As filed with the Securities and Exchange

Commission on March 28, 2023.

Registration No. 333-270514

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

Allarity Therapeutics, Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

2834 |

|

87-2147982 |

(State or other jurisdiction of

incorporation or organization) |

|

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S. Employer

Identification No.) |

24 School Street, 2nd Floor

Boston, MA 02108

Telephone: (401) 426-4664

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

James G. Cullem

c/o Allarity Therapeutics, Inc.

24 School Street, 2nd Floor

Boston, MA 02108

Telephone: (401) 426-4664

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

Scott E. Bartel

Daniel B. Eng

Lewis Brisbois Bisgaard & Smith LLP

633 West 5th Street, Suite 4000

Los Angeles, CA 90071

(213) 358-6174 |

|

David E. Danovitch

Aaron M. Schleicher

Sullivan & Worcester LLP

1633 Broadway

New York, NY 10019

212-660-3060 |

Approximate date of commencement of proposed

sale to the public: As soon as practicable after this Registration Statement is declared effective.

If any of the securities being

registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check

the following box. ☒

If this Form is filed to register

additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective

amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective

amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether

the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging

growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting

company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

Accelerated filer |

☐ |

| Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

| |

|

Emerging growth company |

☒ |

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends

this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further

amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a)

of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant

to said Section 8(a), may determine.

The information in

this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed

with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities nor does

it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| Preliminary

Prospectus |

Subject

To Completion |

Dated

March 28, 2023 |

Up to 3,891,050 Shares of Common Stock

Up to 3,891,050 Warrants to purchase

up to 3,891,050 Shares of Common Stock

Up to 3,891,050 Pre-Funded Warrants to

purchase up to 3,891,050 Shares of Common Stock

Up to 3,891,050 Shares of Common Stock Issuable

Upon Exercise of Common Warrants

We are offering on a

best-efforts basis up to 3,891,050 shares of our common stock, par value $0.0001 per share (“common stock”) and

common stock purchase warrants (the “common warrants”) to purchase an aggregate of up to 3,891,050 shares of our

common stock at an assumed combined public offering price of $2.57 (equal to the last sale price of our common stock as reported by

The Nasdaq Global Market on March 27, 2023). Each common warrant is assumed to have an exercise price of $2.57 per share (100% of

the assumed public offering price per share and accompanying common warrant), will be exercisable upon issuance and will expire five

(5) years from the date of issuance. The common stock and common warrants are immediately separable and will be issued separately in

this offering.

We are also offering to those

purchasers, if any, whose purchase of common stock in this offering would otherwise result in any such purchaser, together with its affiliates,

beneficially owning more than 4.99% (or, at the election of such purchaser, 9.99%) of our outstanding common stock immediately following

the consummation of this offering, the opportunity to purchase pre-funded warrants in lieu of shares of our common stock that would otherwise

result in such purchaser’s beneficial ownership exceeding 4.99% (or, at the election of such purchaser, 9.99%) of our outstanding

common stock. The purchase price for each pre-funded warrant and common warrant will equal the combined public offering price for the

common stock and accompanying common warrant in this offering less the $0.001 per share exercise price of each such pre-funded warrant.

Each pre-funded warrant will be exercisable upon issuance and will not expire prior to exercise. The pre-funded warrants and common warrants

are immediately separable and will be issued separately in this offering. For each pre-funded warrant we sell, the number of shares of

common stock we are offering will be decreased on a one-for-one basis.

For purposes of clarity,

each share of common stock or pre-funded warrant to purchase one share of common stock is being sold together with one common warrant

to purchase one share of common stock. The common stock or pre-funded warrant to purchase one share of common stock, together with one

common warrant to purchase one share of common stock is being offered on a best-efforts basis as described in this prospectus for a maximum

aggregate offering amount of $10,000,000. This prospectus also relates to the offering of the shares of our common stock issuable upon

the exercise of such pre-funded warrants and common warrants sold in this offering.

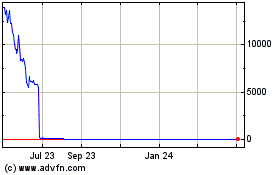

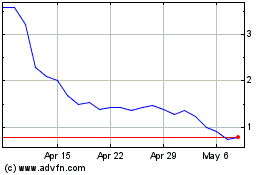

Our shares of common stock

are listed on The Nasdaq Global Market under the symbol “ALLR.” On March 27, 2023, the last reported sale price of our common

stock on The Nasdaq Global Market was $2.57 per share. There is no established trading market for the pre-funded warrants or common warrants

and we do not expect a market to develop. In addition, we do not intend to list the pre-funded warrants or common warrants on The Nasdaq

Global Market, any other national securities exchange or any other trading system. Without an active trading market, the liquidity of

the pre-funded warrants and common warrants may be limited. Except as otherwise indicated herein, all information in this prospectus,

including the number of shares of common stock that will be outstanding after this offering, gives effect to the Share Consolidation

(as defined below) effected on March 24, 2023.

We have retained A.G.P./Alliance

Global Partners to act as our sole placement agent in connection with the securities offered by this prospectus. The placement

agent is not purchasing or selling any of these securities nor is it required to sell any specific number or dollar amount of securities,

but has agreed to use its reasonable best efforts to solicit offers to purchase the securities offered by this prospectus. We may not

sell all of the securities in this offering. We have agreed to pay the placement agent the placement agent fees set

forth in the table below. The actual combined public offering price of the common stock and common warrants, and pre-funded warrants

and common warrants we are offering, and the exercise price of the common warrants that we are offering, were negotiated between us,

the placement agent and the investors in the offering based on a negotiated discount to the trading price of our common stock prior to

the offering.

There

is no minimum number of securities or minimum aggregate amount of proceeds for this offering to close. We expect this offering to be completed

not later than two business days following the commencement of this offering and we will deliver all securities to be issued in connection

with this offering delivery versus payment (“DVP”)/receipt versus payment (“RVP”) upon receipt of investor funds

received by the Company. Accordingly, neither we nor the placement agent have made any arrangements to place investor funds in an escrow

account or trust account since the placement agent will not receive investor funds in connection with the sale of the securities offered

hereunder.

We

are an “emerging growth company” and a “smaller reporting company” under applicable Securities and Exchange Commission

rules and, as such, have elected to comply with certain reduced public company disclosure requirements for this prospectus and future

filings. See the discussions in the section titled “Summary - Implications of Being an Emerging Growth Company and a Smaller

Reporting Company.”

Investing in our securities

involves a high degree of risk. See section titled “Risk Factors” beginning on page 10.

| | |

Per

Share of Common Stock and

Common Warrant | |

Per Pre-Funded Warrant and Common

Warrant | |

Total Offering |

| Public offering price | |

$ | | | |

$ | | | |

$ | | |

| Placement Agent Fees(1) | |

$ | | | |

$ | | | |

$ | | |

| Proceeds to us (before expenses)(2) | |

$ | | | |

$ | | | |

$ | | |

| (1) | We have agreed to pay the placement agent a cash fee equal to 7.00% of the gross proceeds that are sold

in the offering and to reimburse the placement agent for certain expenses. See section titled “Plan of Distribution”

for additional information. |

| (2) | The amount of offering proceeds to us presented in this table does not give effect to any exercise of

the common warrants or pre-funded warrants. |

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy

or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

Delivery of the shares of

our common stock and pre-funded warrants together with accompanying common warrants, to certain of the investors is expected to be made

on or about , 2023, subject to customary closing conditions.

Sole Placement Agent

A.G.P.

The date of this prospectus

is , 2023.

TABLE OF CONTENTS

Neither we nor the placement agent has authorized

anyone to provide you with information other than that contained in this prospectus or any free writing prospectus prepared by or on behalf

of us or to which we have referred you. We and the placement agent take no responsibility for, and can provide no assurance as to the

reliability of, any other information that others may give you. We are offering to sell, and seeking offers to buy, the securities only

in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date on

the front cover page of this prospectus, or other earlier date stated in this prospectus, regardless of the time of delivery of this prospectus

or of any sale of our securities.

No action is being taken in any jurisdiction outside

the United States to permit a public offering of our securities or possession or distribution of this prospectus in that jurisdiction.

Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about

and to observe any restrictions as to this offering and the distribution of this prospectus applicable to that jurisdiction.

When used herein, unless the context requires

otherwise, references to the “Company,” “we,” “our” and “us” refer to Allarity Therapeutics,

Inc., a Delaware corporation.

MARKET AND INDUSTRY DATA

This prospectus contains estimates, projections

and other information concerning our industry, our business and the markets for our therapeutic candidates, including data regarding the

estimated size of such markets and the incidence of certain medical conditions. We obtained the industry, market and similar data set

forth in this prospectus from our internal estimates and research and from academic and industry research, publications, surveys and studies

conducted by third parties, including governmental agencies. In some cases, we do not expressly refer to the sources from which this data

is derived. Information that is based on estimates, forecasts, projections, market research or similar methodologies is inherently subject

to uncertainties and actual events or circumstances may differ materially from events and circumstances that are assumed in this information.

While we believe our internal research is reliable, such research has not been verified by any third party.

PROSPECTUS SUMMARY

This summary highlights

information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your

investment decision. Before investing in our securities, you should carefully read this entire prospectus, including our consolidated

financial statements and the related notes thereto and the information set forth in the sections titled “Risk Factors” and

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained in our Annual Report

on Form 10-K for the year ended December 31, 2022, which is incorporated herein by reference.

Overview

We

are a clinical-stage, precision medicine biopharmaceutical company actively

advancing a pipeline of in-licensed oncology therapeutics for patients with difficult-to-treat cancers. Our clinical program includes

three anti-cancer assets in mid- to late-stage clinical development and one anti-cancer asset in early stage clinical development. Our

programs and partnerships leverage our proprietary, highly accurate Drug Response Predictor (DRP®) technology to refine patient selection

and improve clinical outcomes. Our DRP® technology has been broadly validated across an extensive array of therapies and tumor types

with a high degree of accuracy for matching the right patient to the right drug. By identifying those patients who will and who will not

respond, the DRP® companion diagnostics have the potential to transform cancer therapeutic development across many indications by

increasing clinical success rates with trials involving a fewer number of patients, and improve patient outcomes by matching them to the

right drug.

Our pipeline currently consists

of three mid-to-late stage clinical candidates for cancer and one anti-cancer asset in early stage clinical development. We are focused

on the clinical development of three priority programs: dovitinib in combination with stenoparib for the second-line or later treatment

of metastatic ovarian cancer, stenoparib as a monotherapy for ovarian cancer, and Ixempra® as a monotherapy for metastatic breast

cancer. In addition, Allarity is supporting the development of one additional clinical asset through business development activities which

are considered at mid-stage development. Each Allarity pipeline program is being co-developed with a drug specific DRP® companion

diagnostic to select and treat patients most likely to benefit from treatment.

While we have not yet successfully

received regulatory or marketing approval for any of our therapeutic candidates or companion diagnostics, and while we believe that our

approach has the potential to reduce the cost and time of drug development through the identification and selection of patient populations

more likely to respond to therapy, our strategy involves risks and uncertainties that differ from other biotechnology companies that focus

solely on new therapeutic candidates that do not have a history of failed clinical development. By utilizing our DRP® platform

to generate a drug-specific companion diagnostic for each of our therapeutic candidates, if approved by the FDA, we believe our therapeutic

candidates have the potential to advance the goal of personalized medicine by selecting the patients most likely to benefit from each

of our therapeutic candidates and avoid the treatment of non-responder patients. All of our therapeutic candidates are clinical stage

assets and the FDA has not yet approved any of our therapeutic candidates or any of our DRP® companion diagnostics. As

used in this prospectus, statements regarding the use of our proprietary DRP® companion diagnostics or our proprietary

DRP® platform or our observations that a therapeutic candidate may have anti-cancer or anti-tumor activity or is observed

to be well tolerated in a patient population should not be construed to mean that we have resolved all issues of safety and/or efficacy

for any of our therapeutic candidates or DRP® companion diagnostic. Issues of safety and efficacy for any therapeutic candidate

or companion diagnostic may only be determined by the U.S. FDA or other applicable regulatory authorities in jurisdictions outside

the United States.

Our clinical and commercial

development team is advancing our pipeline of targeted oncology therapeutic candidates, all of which have previously succeeded at least

through Phase 1 clinical trials demonstrating that the therapeutic candidate is well tolerated. Our three priority assets, dovitinib,

stenoparib, and IXEMPRA® (ixabepilone) are all former drug candidates of large pharmaceutical companies.

Our most advanced therapeutic

candidate, dovitinib, is a selective inhibitor of several classes of tyrosine kinases, including FGFR and VEGFR, and was formerly developed

by Novartis Pharmaceuticals through Phase 3 clinical trials in numerous indications. We submitted a New Drug Application (“NDA”)

with the FDA on December 21, 2021, for the third line treatment of metastatic renal cell carcinoma (mRCC or kidney cancer) in patients

selected by our Dovitinib-DRP® companion diagnostic. Prior to submission of the NDA, we submitted a Pre-Market Approval

(PMA) application to the FDA for approval of our dovitinib-specific DRP® companion diagnostic for use to select and treat

patients likely to respond to dovitinib. On February 15, 2022, we received Refusal to File (RTF) letters for both our dovitinib NDA and

our DRP®-Dovitinib companion diagnostic PMA. The FDA has asserted that neither our NDA or PMA meets the regulatory requirements

to warrant a complete agency review. The primary grounds of rejection asserted by the FDA relates to our use of prior Phase 3 clinical

trial data, generated by Novartis in a “superiority” endpoint study against sorafenib (Bayer), to support a “non-inferiority”

endpoint in connection with the DRP®-Dovitinib companion diagnostic. Based upon the reasons given in the RTF letters and

a subsequent Type C meeting with the FDA on May 31, 2022, we anticipate that the FDA will require a prospective Phase 3 clinical trial

as well as additional dose optimization studies before regulatory approval of Dovitinib as a monotherapy and its companion diagnostic

Dovitinib-DRP for the treatment of third-line mRCC can be obtained. While we have decided that the costs, risks and potential benefits

of conducting these studies for dovitinib as a monotherapy for mRCC are no longer the best path toward commercial success, we continue

to evaluate other potential Phase 1b/2 clinical trials for dovitinib combined with other approved drugs in the mRCC space and in other

indications. On March 20, 2023, we announced that we had dosed our first patient in a Phase 1b clinical study to evaluate the combination

of stenoparib and dovitnib for the treatment of advanced solid tumors, including ovarian cancer. The completion of this offering will

provide us with financing to dose additional patients and our ability to continue these clinical trials will be dependent upon additional

financing. Our decision to advance dovitinib as a combination therapy and not as a monotherapy is based on our belief that both the science

and the market for oncology therapies has shifted towards combination therapies and away from monotherapies for multiple indications

of cancer. We further believe that our DRP®-Dovitinib companion diagnostic is indication agnostic and our retrospective

analysis of the clinical data generated in the Novartis clinical studies for mRCC will also support a companion diagnostic for dovitinib

in second-line or later treatment of metastatic ovarian cancer, as well as other indications.

Our second priority therapeutic

candidate is stenoparib (formerly E7449), a novel inhibitor of the key DNA damage repair enzyme poly-ADP-ribose polymerase (PARP), which

also has an observed inhibitory action against Tankyrases, another important group of DNA damage repair enzymes. Stenoparib was formerly

developed by Eisai, Inc. (Eisai) through Phase 1 clinical trials, and we are currently advancing a Phase 2 clinical trial of this therapeutic

candidate for the treatment of ovarian cancer at trial sites in the U.S. and Europe together with its stenoparib-specific DRP®

companion diagnostic, for which the FDA has previously approved an Investigational Device Exemption (IDE) application. In addition, upon

completion of this offering, we anticipate commencing a stenoparib in combination with dovitinib Phase 1b/2 Clinical Trial for second-line

or later treatment of metastatic ovarian cancer.

Our third priority therapeutic

candidate is IXEMPRA® (ixabepilone), a selective microtubule inhibitor, which has been shown to interfere with cancer cell

division, leading to cell death. IXEMPRA® (ixabepilone) was formerly developed and brought to market by Bristol-Myers Squibb,

is currently marketed and sold in the U.S. by R-PHARM US LLC, for the treatment of metastatic breast cancer treated with two or more prior

chemotherapies. We are currently advancing IXEMPRA®, together with its drug-specific DRP® companion diagnostic,

in a Phase 2 European clinical trial for the same indication, with the goal of eventually submitting an application for Marketing Authorization

(MA) with the European Medicine Agency (EMA) to market IXEMPRA®, together with its drug-specific DRP® companion

diagnostic, in the European market.

We have in-licensed the intellectual

property rights to develop, use and market our two most advanced therapeutic candidates, dovitinib and stenoparib. Consequently, we must

perform all of the obligations under these license agreements, including the payment of substantial development milestones payments and

royalty payments on future sales in the event we receive marketing approval for dovitinib or stenoparib in the future. If we fail to perform

our obligations under our license agreements, we may lose the intellectual property rights to these therapeutic candidates which will

have a material adverse effect on our business.

Our focused approach to address

major unmet needs in oncology leverages our management’s expertise in discovery, medicinal chemistry, manufacturing, clinical development,

and commercialization. As a result, we have created substantial intellectual property around the composition of matter for our new chemical

entities. The foundations of our approach include:

| |

● |

The pursuit of clinical-stage assets: We strive to identify and pursue novel oncology therapeutic candidates that have advanced beyond Phase 1 clinical trials and are preferably Phase 2 to Phase 3 clinical stage assets. Accordingly, the assets we have acquired, and intend to acquire, have undergone prior clinical trials by other pharmaceutical companies with clinical data that helps us evaluate whether these candidates will be well tolerated in the tested patient population, and in some cases, have observed anti-cancer or anti-tumor activity that would support additional clinical trials using our DRP® platform. We often focus our acquisition efforts on therapeutic candidates that have been the subject of clinical trials conducted by large pharmaceutical companies. Further we intend to select therapeutic candidates for which we believe we can develop a drug-specific DRP® to advance together with the therapeutic candidate in further clinical trials as a companion diagnostic to select and treat the patients most likely to respond to the therapeutic candidate. We further consider whether the licensor or assignor can provide us substantial clinical grade active pharmaceutical ingredients (API) for the therapeutic candidate, at low-to-no cost, for our use in future clinical trials. The availability of API at low-to-no cost reduces both our future clinical trial costs and the lead time it takes us to start a new clinical trial for the therapeutic candidate. As an example, our therapeutic candidate, dovitinib, was developed by Novartis through Phase 2 clinical trials in numerous indications and in Phase 3 clinical trials for RCC before we acquired the therapeutic candidate, and it came with a substantial API. |

| |

● |

Our proprietary DRP® companion diagnostics: We believe our proprietary and patented Drug Response Predictor (DRP®) platform provides us with a substantial clinical and commercial competitive advantage for each of the therapeutic candidates in our pipeline. Our DRP® companion diagnostic platform is a proprietary, predictive biomarker technology that employs complex systems biology, bio-analytics with a proprietary clinical relevance filter to bridge the gap between in vitro cancer cell responsiveness to a given therapeutic candidate and in vivo likelihood of actual patient response to that therapeutic candidate. The DRP® companion diagnostic platform has been retrospectively validated by us using retrospective observational studies in 35 clinical trials that were conducted or sponsored by other companies. We intend to develop and validate a drug-specific DRP® biomarker for each and every therapeutic candidate in our therapeutic candidate pipeline to serve as a companion diagnostic to select and treat patients most likely to respond to that therapeutic candidate. Although we are in the early stages of our companion diagnostic development and have not yet received a PMA from the FDA, our DRP® technology has been peer-reviewed by numerous publications and we have patented our DRP® platform for more than 70 anti-cancer drugs. While retrospective studies guide our clinical development of our companion diagnostics, prospective clinical trials may be required in order to receive a PMA from the FDA. |

| |

● |

A precision oncology approach: Our focused strategy is to advance our pipeline of therapeutic candidates, together with DRP® companion diagnostics, to bring these therapeutic candidates, once approved, to market and to patients through a precision oncology approach. Our DRP® companion diagnostic platform provides a gene expression fingerprint that we believe reveals whether a specific tumor in a specific patient is likely to respond to one of our therapeutic candidates and therefore can be used to identify those patients who are most likely to respond to a particular therapeutic treatment in order to guide therapy decisions and lead to better treatment outcomes. We believe our DRP® companion diagnostic platform may be used both to identify a susceptible patient population for inclusion in clinical trials during the drug development process (and to exclude the non-susceptible patient population), and further to select the optimal anti-cancer drug for individual patients in the treatment setting once an anti-cancer drug is approved and marketed. By including only patients that have tumors that we believe may respond to our therapeutic candidate in our clinical trials, we believe our proprietary DRP® companion diagnostics platform has the potential to improve the overall treatment response in our clinical trials and thereby improving our chances for regulatory approval to market our therapeutic candidate, while potentially reducing the time, cost, and risk of clinical development. |

The following chart summarizes

our therapeutic candidate pipeline:

Implications of Being an Emerging Growth Company

and a Smaller Reporting Company

We are an “emerging

growth company,” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and we intend to take advantage

of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth

companies” including not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley

Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from

the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments

not previously approved. In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take

advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act, for complying with new or revised accounting

standards.

Additionally, we are a “smaller

reporting company” as defined in Item 10(f)(1) of Regulation S-K. Even after we no longer qualify as an emerging growth company,

we may still qualify as a “smaller reporting company,” which would allow us to continue to take advantage of many of the same

exemptions from disclosure requirements, including presenting only the two most recent fiscal years of audited financial statements and

reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements. We may continue to be a

smaller reporting company after the close of this offering if either (i) the market value of our stock held by non-affiliates is less

than $250 million or (ii) our annual revenue was less than $100 million during the most recently completed fiscal year and the market

value of our stock held by non-affiliates is less than $700 million. To the extent we take advantage of such reduced disclosure obligations,

it may also make comparison of our financial statements with other public companies difficult or impossible.

Corporate Information

Our former parent, Allarity Therapeutics A/S, was founded in Denmark

in 2004 by our chief scientific officer, Steen Knudsen, Ph.D., and our Director and Senior Vice President of Investor Relations, Thomas

Jensen, both of whom were formerly academic researchers at the Technical University of Denmark working to advance novel bioinformatic

and diagnostic approaches to improving cancer patient response to therapeutics. On May 20, 2021, we entered a Plan of Reorganization and

Asset Purchase Agreement (the “Recapitalization Share Exchange”), between us, Allarity Acquisition Subsidiary, our wholly

owned Delaware subsidiary (“Acquisition Sub”), and Allarity Therapeutics A/S, an Aktieselskab organized under the laws of

Denmark. Pursuant to the terms of the Recapitalization Share Exchange, our Acquisition Sub acquired substantially all of the assets and

liabilities of Allarity Therapeutics A/S in exchange for shares of our common stock on December 20, 2021, and our common stock began trading

on the Nasdaq Global Market on that same day.

Our principal executive offices

are located at 24 School Street, 2nd Floor, Boston, MA 02108 and our telephone number is (401) 426-4664. Our corporate website

address is www.allarity.com. Information contained on or accessible through our website is not a part of this prospectus, and the

inclusion of our website address in this prospectus is an inactive textual reference only.

Allarity and its subsidiaries

own or have rights to trademarks, trade names and service marks that they use in connection with the operation of their business. In addition,

their names, logos and website names and addresses are their trademarks or service marks. Other trademarks, trade names and service marks

appearing in this prospectus are the property of their respective owners. Solely for convenience, in some cases, the trademarks, trade

names and service marks referred to in this prospectus are listed without the applicable ®, ™ and

SM symbols, but they will assert, to the fullest extent under applicable law, their rights to these trademarks, trade names and service

marks.

Recent Events

Subsequent to year ended

December 31, 2022, we entered into a series of transactions or events or received notifications as follows. The transactions or events

or notifications discussed below, are discussed in more detail in the Current Reports on Form 8-K filed by us with the SEC and incorporated

by reference. See section titled “Incorporation of Certain Information By Reference.”

Redemption of Series B Preferred Stock

Upon conclusion of the 2023

Annual Meeting of Stockholders on February 3, 2023, all of the 190,786 shares of Series B Preferred Stock outstanding were automatically

redeemed, with the holders of the Series B Preferred Stock only having a right to receive the purchase price for the redemption, which

was $0.01 per share of Series B Preferred Stock.

Series A Preferred Stock Conversions

Subsequent to December

31, 2022, pursuant to the exercise of conversion by the 3i, LP, we issued 525,622 shares of common stock to the 3i, LP upon the conversion

of 3,361 shares of Series A Convertible Preferred Stock (“Series A Preferred Stock”) based on a conversion price ranging

from $3.68 to $9.10. No proceeds were received by the Company upon such conversion. As of March 27, 2023, we had 10,225 shares of Series

A Preferred Stock issued and outstanding.

Amendment to Certain Employment Contracts

On January 12, 2023, we

entered into new employment agreements with James G. Cullem, our chief executive officer, and Joan Brown, our chief financial officer,

regarding salary, bonuses, stock options and change of control provisions.

SEC Request

In January 2023, we received

a request to produce documents from the SEC that stated that the staff of the SEC is conducting an investigation known as “In the

Matter of Allarity Therapeutics, Inc.” to determine if violations of the federal securities laws have occurred. The documents requested

appear to focus on submissions, communications and meetings with the FDA regarding our NDA for Dovitinib or Dovitinib-DRP. The SEC letter

also stated that investigation is a fact-finding inquiry and does not mean that that the SEC has concluded that we or anyone else has

violated the laws. As a result of the disclosure of the SEC request, The Nasdaq Stock Market LLC (“Nasdaq”) staff has requested

us to provide them with the information requested by the SEC in which we are complying.

Change in Board of Directors; Nasdaq Non-Compliance

On January 19, 2023, three

members of the board indicated that they resigned, or will resign with an effective date, from the board. Currently, the board consists

of four members. On February 8, 2023, we received a notice from Nasdaq notifying us that we no longer comply with Nasdaq’s independent

director and audit committee requirements. We have a cure period to regain compliance as follows: (i) until the earlier our next annual

shareholders’ meeting or February 4, 2024; or (ii) if our next annual shareholders’ meeting is held before August 3, 2023,

then we must evidence compliance no later than August 3, 2023.

Modification to Conversion Price of Series

A Preferred Stock

On January 23, 2023, we and 3i, LP amended the letter agreement entered

into on December 8, 2022, to provide that the modification of the term Series A Preferred Stock Conversion Price (“Series A Preferred

Stock Conversion Price”) to mean the lower of: (i) the Closing Sale Price (as defined in the Certificate of Designations of Series

A Convertible Preferred Stock (“Series A Certificate of Designations”)) on the trading date immediately preceding the Conversion

Date (as defined in the Series A Certificate of Designations and (ii) the average Closing Sale Price of the common stock for the five

trading days immediately preceding the Conversion Date, for the Trading Days (as defined in the Series A Certificate of Designations)

will be in effect until terminated by us and 3i, LP.

Establishment and sale of Series C Convertible Redeemable Preferred

Stock

On February 24, 2023, we filed

a Certificate of Designation of Preferences, Rights and Limitations of Series C Convertible Redeemable Preferred Stock (“Series

C Preferred Stock Certificate of Designations”) with the Delaware Secretary of State designating 50,000 shares of our authorized

and unissued preferred stock as Series C Convertible Redeemable Preferred Stock (“Series C Preferred Stock”) with a stated

value of $27.00 per share. On February 28, 2023, we filed a Certificate of Amendment to the Series C Preferred Stock Certificate of Designations

to clarify the terms of conversion price and floor price based on definitions provided in the original Series C Preferred Stock Certificate

of Designations (the original and amended Series C Preferred Stock Certificate of Designations collectively “the Series C Certificate

of Designations”). Each share of Series C Preferred Stock has 620 votes and is subject to certain redemption rights and voting limitations.

On February 28, 2023,

we entered into a securities purchase agreement with 3i, LP for the purchase and sale of 50,000 shares of Series C Preferred Stock at

a purchase price of $24.00 per share, for a subscription receivable in the aggregate amount equal to the total purchase price of $1.2

million. The 50,000 shares of Series C Preferred Stock are convertible into shares of our common stock, subject to the terms of the Series

C Certificate of Designations. The conversion price for the Series C Preferred Stock is initially equal the lower of: (i) $6.37, which

is the official closing price of the common stock on the Nasdaq Global Market (as reflected on Nasdaq.com) on the Trading Day (as defined

in the Series C Certificate of Designations) immediately preceding the Original Issuance Date (as defined in the Series C Certificate

of Designations); and (ii) the lower of: (x) the official closing price of the common stock on the Nasdaq Global Market (as reflected

on Nasdaq.com) on the Trading Day immediately preceding the Conversion Date or such other date of determination; and (y) the average

of the official closing prices of the common stock on the Nasdaq Global Market (as reflected on Nasdaq.com) for the five Trading Days

immediately preceding the Conversion Date (as defined in the Series C Certificate of Designations) or such other date of determination,

subject to adjustment (the “Series C Preferred Stock Conversion Price”). In no event will the Series C Preferred Stock Conversion

Price be less than $1.295 (the “Series C Preferred Stock Floor Price”). In the event that the Series C Preferred Stock Conversion

Price on a Conversion Date would have been less than the applicable Series C Preferred Stock Floor Price if not for the immediately preceding

sentence, then on any such Conversion Date we will pay the holder an amount in cash equal to the product obtained by multiplying (A)

the higher of (I) the highest price that the common stock trades at on the Trading Day immediately preceding such Series C Preferred

Stock Conversion Date and (II) the applicable Series C Preferred Stock Conversion Price and (B) the difference obtained by subtracting

(I) the number of shares of common stock delivered to the holder of Series C Preferred Stock on the applicable Share Delivery Date with

respect to such conversion of Series C Preferred Stock from (II) the quotient obtained by dividing (x) the applicable Series C Preferred

Stock Conversion Amount that the holder of Series C Preferred Stock has elected to be the subject of the applicable conversion of Series

C Preferred Stock, by (y) the applicable Series C Preferred Stock Conversion Price without giving effect to clause (x) of such definition.

In connection with the Series

C Preferred Stock securities purchase agreement, we entered into a registration rights agreement with 3i, LP (the “Series C RRA”)

pursuant to which we are required to file a registration statement with the SEC to register for resale the shares of Common Stock that

are issued upon the potential conversion of the shares of Series C Preferred Stock. Under the terms of the Series C RRA, if we fail to

file an Initial Registration Statement (as defined in the Series C RRA) on or prior to its Filing Date (as defined in the Series C RRA),

or fail to maintain the effectiveness of the registration statement beyond defined allowable grace periods set forth in the Series C RRA,

we will incur certain registration delay payments, in cash and as partial liquidated damages and not as a penalty, equal to 2.0% of 3i,

LP’s subscription amount of the Series C Preferred Stock pursuant to the securities purchase agreement. In addition, if we fail

to pay any partial liquidated damages in full within seven days after the date payment, we will have to pay interest at a rate of 18.0%

per annum, accruing daily from the date such partial liquidated damages are due until such amounts, plus all such interest thereon, are

paid in full. We have also agreed to pay all fees and expenses incident to the performance of the Series C RRA, except for any broker

or similar commissions. In connection with the sale and purchase of Series C Preferred Stock, we and 3i entered into a limited waiver

agreement pursuant to which 3i confirmed that the sale and issuance of the Series C Preferred Stock will not give rise to any, or trigger

any, rights of termination, defaults, amendment, anti-dilution or similar adjustments, acceleration or cancellation under agreements with

3i.

Annual Stockholder Meeting

On February 3, 2023, we held

our annual meeting of stockholders (the “Annual Meeting”). Nine proposals were submitted to our stockholders for a vote at

the Annual Meeting including a proposal to increase the number of authorized shares and a proposal to effect a reverse stock split. The

proposals to increase the number of authorized shares and proposal to effect a reverse stock split did not received the requisite votes.

Special Meeting of Stockholders; Share

Consolidation and Share Increase

On March 20, 2023, we

held a Special Meeting of Stockholders (the “Special Meeting”) for our stockholders of record of our outstanding shares of

Common Stock and Series C Preferred Stock. At the Special Meeting, the stockholders of Common Stock and Series C Preferred Stock approved

: (1) an amendment to our Certificate of Incorporation, as amended (“Certificate of Incorporation”), to increase the number

of authorized shares from 30,500,000 to 750,500,000, and to increase the number of our common stock from 30,000,000 to 750,000,000 (the

“Share Increase Proposal”); and (2) an amendment to our Certificate of Incorporation, to, at the discretion of the board,

effect a reverse stock split with respect to our issued and outstanding common stock at a ratio between 1-for-20 and 1-for-35 (the “Reverse

Stock Split Proposal”). Upon stockholder approval, the Board of Directors determined a ratio of 1-for-35 for the reverse stock

split. In addition, the Company filed a Second Certificate of Amendment of the Certificate of Incorporation to effect the share increase

approved by the stockholders.

We effected a 1-for-35

share consolidation of our common stock on March 24, 2023 (“Share Consolidation”). No fractional shares were issued in connection

with the Share Consolidation. If, as a result of the Share Consolidation, a stockholder would otherwise have been entitled to a fractional

share, each fractional share was rounded up to the next whole number. The Share Consolidation resulted in a reduction of our outstanding

shares of common stock from 34,294,582 to 979,846. As a result of the Second Certificate of Amendment of our Certificate of Incorporation

as discussed above, the number of our authorized shares is 750,500,000 which consist of 750,000,000 authorized shares of Common Stock

and 500,000 authorized shares of preferred stock. The par value of our authorized stock remained unchanged at $0.0001.

THE OFFERING

| Common Stock offered by us

|

Up to 3,891,050 shares.

|

| |

|

| Common Warrants offered by us |

Common warrants to

purchase up to 3,891,050 shares of our common stock, which will be exercisable during the period commencing on the date of

their issuance and ending five years from such date at an exercise price of

$ per share of common stock. The common warrants will be sold together

with the common stock but issued separately from the common stock and may be transferred separately immediately thereafter. A common

warrant to purchase one share of our common stock will be issued for every share of common stock purchased in this

offering. |

| |

|

| Pre-Funded Warrants offered by us |

We are also offering to certain purchasers whose purchase of our common stock in this offering would otherwise result in the purchaser, together with its affiliates, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding shares of common stock immediately following the consummation of this offering, the opportunity to purchase pre-funded warrants (together with the common warrants, the “Warrants”) in lieu of common stock that would otherwise result in any such purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding shares of common stock. Each pre-funded warrant will be exercisable for one share of common stock. The purchase price of each pre-funded warrant and the accompanying common warrant will equal the price at which the common stock and the accompanying common warrant are being sold to the public in this offering, minus $0.001, and the exercise price of each pre-funded warrant will be $0.001 per share. The pre-funded warrants will be exercisable immediately and may be exercised at any time until exercised in full. For each pre-funded warrant we sell, the number of shares of common stock we are offering will be decreased on a one-for-one basis. Because we will issue one common warrant for each share of common stock and for each pre-funded warrant to purchase one share of common stock sold in this offering, the number of common warrants sold in this offering will not change as a result of a change in the mix of the shares of our common stock and pre-funded warrants sold. |

| |

|

| Public Offering Price |

$__ per share of common

stock and accompanying common warrant or $__ per pre-funded warrant and accompanying common warrant, as applicable. |

| |

|

| Best Efforts |

We have agreed to issue and sell the securities offered hereby to the purchasers through the placement agent. The placement agent is not required to buy or sell any specific number or dollar amount of the securities offered hereby, but it will use its reasonable best efforts to solicit offers to purchase the securities offered by this prospectus. See “Plan of Distribution” on page 39 of this prospectus. |

| Shares of Common Stock to

be Outstanding Immediately After this Offering (1) |

Up to

4,870,896 shares of common stock (assuming the sale of the maximum number of shares of common stock in this offering, at the

assumed combined public offering price of $2.57, the closing sale price of our common stock on the Nasdaq Global Market on March 27,

2023, and no sale of any pre-funded warrants but excluding the number of shares of common stock issuable upon exercise of common

warrants sold in this offering). |

| |

|

| Use of Proceeds |

We expect to use the

net proceeds from this offering of $10,000,000 (assuming a combined public offering price of $2.57, based on the closing sale price

of our common stock on the Nasdaq Global Market on March 27, 2023) to initiate our clinical trial, and for working capital and general

corporate purposes. Notwithstanding the forgoing, in the event we raise more than $5 million in this offering, and 3i, LP exercises

its demand redemption rights under the terms of secured promissory notes issued to 3i, LP in the aggregate principal amount of $2,666,640

(“3i, LP Promissory Notes”), we will be required to use up to 35% of the gross proceeds from this offering to redeem

the 3i, LP Promissory Notes. See section titled “Use of Proceeds” on page 23 of this prospectus. |

| Risk Factors |

You should read the “Risk Factors” section beginning on

page 10 of this prospectus and in Item 1A “Risk Factors” of our Annual Report on Form 10-K for the year ended December 31,

2022, which is incorporated herein by reference for a discussion of factors that you should consider before investing in our securities. |

| |

|

| Trading Symbol |

Our shares of common stock are listed on The Nasdaq Global Market under the symbol “ALLR.”

There is no established public trading market for the common warrants and pre-funded warrants to be sold in this offering and we

do not expect a market to develop. In addition, we do not intend to apply for listing of the common warrants or pre-funded warrants

on The Nasdaq Global Market, any other national securities exchange or any other trading system. |

| |

|

| Transfer Agent |

The transfer agent and registrar for our common stock is Computershare Trust Company, N.A. |

| (1) |

The number of shares of common stock

that will be outstanding after this offering as shown above is based on 979,846 shares of common stock outstanding as of March

27, 2023, and excludes the following: |

| |

● |

19,332 shares common

stock issuable pursuant to options outstanding as of March 27, 2023, with a weighted-average exercise price of $213.76; |

| |

|

|

| |

● |

56,007 shares of common

stock available under our 2021 Equity Incentive Plan (“2021 Plan”) as of March 27, 2023; |

| |

● |

57,685 shares of common

stock issuable upon the exercise of warrants outstanding as of March 27, 2023, at an unweighted exercise price of $346.71 per

share, subject to adjustment; |

| |

● |

shares of common stock

issuable upon conversion of 10,225 shares of Series A Preferred Stock outstanding held by 3i, LP at the Series A Preferred

Stock Conversion Price equal to the lower of: (i) the closing sale price (as defined in the Series A Certificate of Designations)

on the trading date immediately preceding the Conversion Date (as defined in the Series A Certificate of Designations

and (ii) the average closing sale price of the common stock for the five trading days immediately preceding the Conversion Date excluding

any subsequent adjustments; |

| |

|

|

| |

● |

shares of common stock

issuable upon conversion of 50,000 shares of Series C Preferred Stock at a conversion price equal to the lower of: (i) $6.37, which

is the official closing price of the Common Stock on the Nasdaq Global Market (as reflected on Nasdaq.com) on the Trading Day (as

defined in the Series C Certificate of Designation) immediately preceding the Original Issuance Date (as defined in the Series C

Certificate of Designation); and (ii) the lower of: (x) the official closing price of the Common Stock on the Nasdaq Global Market

on the Trading Day immediately preceding the Conversion Date or such other date of determination; and (y) the average of the official

closing prices of the Common Stock on the Nasdaq Global Market (as reflected on Nasdaq.com) for the five (5) Trading Days immediately

preceding the Conversion Date (as defined in the Series C Certificate of Designation) or such other date of determination, subject

to adjustment herein (the “Conversion Price”), with the Conversion Price being no less than $1.295. |

| |

● |

up

to 3,891,050 shares of common stock issuable upon the exercise of the common warrants to be issued in connection with this offering. |

Unless otherwise indicated, all information in

this prospectus assumes:

| |

● |

no exercise of the outstanding options or warrants described above; |

| |

|

|

| |

● |

no conversion of outstanding shares of Series A Preferred Stock

described above; no conversion of outstanding shares of Series C Convertible Preferred Stock; |

| |

|

|

| |

● |

no exchange of outstanding 3i, LP Promissory Notes into shares of common stock; and |

| |

|

|

| |

● |

no exercise of the common warrants or pre-funded warrants sold in this offering. |

SUMMARY HISTORICAL FINANCIAL INFORMATION

The following summary historical financial information of Allarity

set forth below should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results

of Operations” and our historical financial statements and the related notes thereto incorporated by reference in this prospectus.

The summary consolidated

balance sheet data as of December 31, 2021 and 2022 and summary consolidated statements of operations and comprehensive loss data for

the years ended December 31, 2021 and 2022 are derived from our audited consolidated financial statements incorporated by reference in

this prospectus. The historical results are not necessarily indicative of the results to be expected in the future. Dollar amounts are

in thousands. Share and per share calculations gives effect to the Share Consolidation effected on March 24, 2023.

| | |

As of December 31, |

| | |

2021 | |

2022 |

| Consolidated Balance Sheet Data: | |

| | | |

| | |

| Total assets | |

$ | 49,633 | | |

$ | 14,544 | |

| Total liabilities | |

$ | 30,849 | | |

$ | 12,654 | |

| Total mezzanine equity | |

$ | 632 | | |

$ | 2,003 | |

| Total stockholders’ equity (deficit) | |

$ | 18,152 | | |

$ | (113 | ) |

| | |

Year Ended December 31, | |

| | |

2021 | | |

2022 | |

| Consolidated Statements of Operations and Comprehensive Loss Data | |

| | |

| |

| Revenue | |

$ | — | | |

$ | — | |

| | |

| | | |

| | |

| Operating expenses | |

| | | |

| | |

| Research and development | |

| 14,196 | | |

| 6,930 | |

| Impairment of intangible assets | |

| - | | |

| 17,571 | |

| General and administrative | |

| 12,360 | | |

| 9,962 | |

| Total operating expenses | |

| 26,556 | | |

| 34,463 | |

| Loss from operations | |

| (26,556 | ) | |

| (34,463 | ) |

| | |

| | | |

| | |

| Other income (expense) | |

| | | |

| | |

| Gain from the sale of IP | |

| 1,005 | | |

| 1,780 | |

| Interest Income | |

| — | | |

| 30 | |

| Interest expense | |

| (499 | ) | |

| (223 | ) |

| Finance costs | |

| (1,347 | ) | |

| - | |

| Loss on investment | |

| (495 | ) | |

| (115 | ) |

| Foreign currency transaction losses, net | |

| (95 | ) | |

| (913 | ) |

| Change in fair value adjustment of derivative and warrant liabilities | |

| 2,087 | | |

| 17,579 | |

| | |

| | | |

| | |

| Penalty on Series A Preferred stock liability | |

| — | | |

| (800 | ) |

| Non-cash interest expense related to Beneficial conversion feature of convertible

debt | |

| (141 | ) | |

| - | |

| Change in fair value of convertible debt | |

| (474 | ) | |

| - | |

| Total other income, net | |

| 41 | | |

| 16,884 | |

| Net loss before tax expense (recovery) | |

| (26,515 | ) | |

| (17,579 | ) |

| Income tax recovery (expense) | |

| (133 | ) | |

| 1,521 | |

| Net loss | |

| (26,648 | ) | |

| (16,058 | ) |

| Deemed dividend of 8% on Preferred stock | |

| - | | |

| (1,572 | ) |

| Cash obligations on converted Series A Preferred stock | |

| - | | |

| (3,421 | ) |

| Net loss attributable to common stockholders | |

$ | (26,648 | ) | |

$ | (21,051 | ) |

| | |

| | | |

| | |

| Basis and diluted net loss per share applicable to common stockholders | |

$ | (146.67 | ) | |

$ | (77.36 | ) |

Basic and

Diluted weighted average common shares outstanding | |

| 181,686 | | |

| 272,204 | |

| | |

| | | |

| | |

| Net loss | |

$ | (26,648 | ) | |

$ | (16,058 | ) |

| Other comprehensive loss, net of tax: | |

| | | |

| | |

| Change in cumulative translation adjustment | |

| (1,966 | ) | |

| (121 | ) |

| Change in fair value attributable to instrument specific

credit risk | |

| (9 | ) | |

| - | |

| Total comprehensive loss attributable to common stockholders | |

$ | (28,623 | ) | |

$ | (16,179 | ) |

RISK FACTORS

An investment in our securities is subject to a number of risks, including

risks related to this offering, our business and industry, as well as risks related to our shares of common stock. You should carefully

consider all of the information in this prospectus and the documents incorporated by reference into this prospectus, including our financial

statements and related notes, before making an investment in our securities The occurrence of any of the adverse developments described

in the following risk factors and risk factors incorporated by reference could materially and adversely harm our business, financial condition,

results of operations or prospects. In that case, the trading price of our common stock could decline, and you may lose all or part of

your investment. In addition, please read the information in the section entitled “Risk Factors” on page 10 of this prospectus

and in Item 1A “Risk Factors” of our Annual Report on Form 10-K for the year ended December 31, 2022, which is incorporated

herein by reference, for a more thorough description of these and other risks.

Risks Related to Owning our Securities and

this Offering

We currently do not satisfy The Nasdaq Global

Market continued listing requirements and if we fail to regain compliance our Common Stock will be delisted.

The listing of our common

stock on The Nasdaq Global Market is contingent on our compliance with The Nasdaq Global Market’s conditions for continued listing.

On April 20, 2022, we received notice from the Nasdaq Listing Qualifications stating that because we had not yet filed our Annual Report

on Form 10-K for the year ended December 31, 2021 (the “Form 10-K”) by its due date, we were no longer in compliance with

the listing requirement which requires listed companies to timely file all required periodic financial reports with the SEC. On May 17,

2022, we filed our Form 10-K with the SEC. Subsequent to the filing of the Form 10-K, we were late in filing our Form 10-Q for the quarterly

periods ended March 31, 2022, and June 30, 2022.

On October 12, 2022, we received

a letter from Nasdaq Listing Qualifications notifying us that the Company’s stockholders’ equity as reported in its Quarterly

Report on Form 10-Q for the period ended June 30, 2022 (the “Form 10-Q”), did not satisfy the continued listing requirement

under Nasdaq Listing Rule 5450(b)(1)(A) for The Nasdaq Global Market, which requires that a listed company’s stockholders’

equity be at least $10.0 million. As reported on the Form 10-Q, the Company’s stockholders’ equity as of June 30, 2022 was

approximately $8.0 million. Pursuant to the letter, we were required to submit a plan to regain compliance with Nasdaq Listing Rule 5450(b)(1)(A)

by November 26, 2022. After discussions with the Nasdaq Listing Qualifications staff, on December 12, 2022, we filed a plan to regain

and demonstrate long-term Nasdaq Listing Qualifications compliance including seeking to phase-down to The Nasdaq Capital Market. On December

21, 2022, we received notification from the Nasdaq Listing Qualifications staff that they have granted us an extension of time until April

10, 2023, to regain and evidence compliance with the Nasdaq Listing Rule 5450(b)(1)(A).

On November 21, 2022,

the Company received written notice from Nasdaq Listing Qualifications indicating that the Company is not in compliance with the minimum

bid price requirement of $1.00 per share under the Nasdaq Listing Rules. Based on the closing bid price of the Company’s listed

securities for the last 30 consecutive business days from October 10, 2022 to November 18, 2022, the Company no longer met the minimum

bid price requirement set forth in Listing Rule 5550(a)(2). Under Nasdaq Listing Rules, we are provided with a compliance period of 180

calendar days, or until May 22, 2023, to regain compliance under the Nasdaq Listing Rules. In the event we do not regain compliance by

May 22, 2023, we may be eligible for additional time to regain compliance. On March 24, 2023, we effected the 1-for-35 Share Consolidation

of our common stock in order to attempt to meet the minimum bid requirement of $1.00 per share.

On December 20, 2022, we received

a written notice from Nasdaq Listing Qualifications indicating that we are not in compliance with the minimum Market Value of Publicly

Held Shares (“MVPHS”) of $5,000,000 requirement under the Nasdaq Listing Rules Based on our MVPHS for the thirty-one (31)

consecutive business days from November 4, 2022 to December 19, 2022, we no longer meets the minimum MVPHS requirement set forth in Listing

Rule 5450(b)(1)(C). Under Nasdaq Listing Rules, we are provided with a compliance period of 180 calendar days, or until June 19, 2023

to regain compliance. To regain compliance under Nasdaq Listing Rules, our MVPHS must close at $5,000,000 for a minimum of ten (10) consecutive

business days. In the event we do not regain compliance by June 19, 2023, we may face delisting.

On February 8, 2023, we received notice from Nasdaq Listing Qualifications

stating that due to the resignation of Soren G. Jensen from the Company’s board and audit committee, effective on February 4, 2023,

the Company no longer complies with Nasdaq’s Listing Rules’ independent director and audit committee requirements as set forth

in Nasdaq Listing Rules 5605(b)(1)(A) and 5605(c)(4) which requires a majority of the board of directors to be comprised of independent

directors and an audit committee of at least three independent directors. The February 8, 2023 Nasdaq Listing Qualification notice has

no immediate effect on the listing or trading of the Company’s common stock on the Nasdaq Global Market. In accordance with Nasdaq

Listing Rules, we have a cure period to regain compliance as follows: (i) until the earlier of the Company’s next annual shareholders’

meeting or February 4, 2024; or (ii) if the next annual shareholders’ meeting is held before August 3, 2023, then the Company must

evidence compliance no later than August 3, 2023. The Company’s board is currently seeking to appoint a new independent director

who will also qualify under the Nasdaq Listing Rules to serve as a member of the audit committee, and intends to regain compliance with

the Nasdaq Listing Rules as soon as practicable.

If we fail to meet the

Nasdaq listing requirements and do not regain compliance, we will be subject to delisting by Nasdaq. If the Nasdaq staff determines

to seek the delisting our common stock on the Nasdaq, we intend to appeal such determination before the Nasdaq Hearing Panel. In the

event our common stock is no longer listed for trading on The Nasdaq Global Market and we are unable to transfer to The Nasdaq

Capital Market, our trading volume and share price may decrease and you may have a difficult time selling your shares of common

stock. In addition, we may experience difficulties in raising capital which could materially adversely affect our operations and

financial results. Further, delisting from Nasdaq markets could also have other negative effects, including potential loss of

confidence by partners, lenders, suppliers and employees. Finally, delisting could make it harder for you and the Company to sell

the securities and hard for us to raise capital.

If we raise more than $5 million in this

offering and because we will have broad discretion in how we use the proceeds from this offering, we may not apply the proceeds in ways

that increase the value of your investment.

Pursuant to a loan agreement

with 3i, LP, in the event we raise more than $5 million in this offering, and 3i, LP exercises its demand redemption rights under the

terms of 3i, LP Promissory Notes issued to 3i, LP, we will be required to use up to 35% of the gross proceeds from this offering to redeem

the 3i, LP Promissory Notes.

In addition, our management will have broad discretion to use the net

proceeds from this offering, including for any of the purposes described in “Use of Proceeds,” and you will be relying on

the judgment of our management regarding the application of these proceeds. Because a certain percentage of the gross proceeds will be

used to redeem the 3i, LP Promissory Notes and you will not have the opportunity to influence our decisions on how to use the remaining

proceeds, and the net proceeds from this offering may not be used in ways that increase the value of your investment. Because of the number

and variability of factors that will determine our use of the net proceeds from this offering, their ultimate use may vary substantially

from their currently intended use. The failure by our management to apply these funds effectively could harm our business. Pending their

use, we intend to invest the net proceeds from this offering in marketable securities, which may not yield a favorable return to our stockholders.

If we do not invest or apply the net proceeds from this offering in ways that enhance stockholder value, we may fail to achieve expected

financial results, which could cause our stock price to decline.

There is no public market for the pre-funded

warrants and common warrants to purchase common stock in this offering.

There is no established public

trading market for the pre-funded warrants and common warrants that are being offered in this offering, and we do not expect a market

to develop. In addition, we do not intend to apply to list the pre-funded warrants and common warrants on any national securities exchange

or other trading market. Without an active market, the liquidity of the pre-funded warrants and common warrants will be limited.

The holders of the pre-funded warrants and

common warrants will have no rights as common stockholders until such holders exercise their pre-funded warrants or common warrants and

acquire shares of our common stock.

Except by virtue of such holder’s

ownership of shares of our common stock, the holder of a pre-funded warrant and common warrant will not have the rights or privileges

of a holder of our common stock, including any voting rights, until such holder exercises the pre-funded warrant and common warrant. Upon

exercise of the pre-funded warrant or common warrant, the holders will be entitled to exercise the rights of a common stockholder only

as to matters for which the record date occurs after the exercise date.

Because the public offering price of our

securities will be substantially higher than the pro forma as adjusted net tangible book value per share of our outstanding common stock

following this offering, new investors will experience immediate and substantial dilution.

The assumed combined public

offering price of the common stock and pre-funded warrants are substantially higher than the pro forma as adjusted net tangible book

value per share of our common stock immediately following this offering based on the total value of our tangible assets less our total

liabilities. Therefore, assuming the sale of all shares of common stock offered hereby and no sale of any pre-funded warrants in this

offering, you will suffer immediate and substantial dilution of $2.62 in the pro forma as adjusted net tangible book value per share

of common stock as of December 31, 2022, based on the assumed combined public offering price of $2.57, which is the last

reported sale price of our common stock on The Nasdaq Global Market on March 27, 2023. Therefore, if you purchase shares of our common

stock and pre-funded warrants in this offering, you will pay a price per share that substantially exceeds our pro forma as adjusted net

tangible book value per share after this offering. See the section titled “Dilution” below for a more detailed discussion

of the dilution you will incur if you participate in this offering.

We received a request for documents

from the SEC in the investigation known as “In the Matter of Allarity Therapeutics, Inc.,” and, separately, a letter from

Nasdaq, regarding the same matter, the consequences of which are unknown.

In January 2023, we received

a request to produce documents from the SEC that stated that the staff of the SEC is conducting an investigation known as “In the

Matter of Allarity Therapeutics, Inc.” to determine if violations of the federal securities laws have occurred. The documents requested

appear to focus on submissions, communications and meetings with the FDA regarding our NDA for Dovitinib or Dovitinib-DRP. The SEC letter

also stated that investigation is a fact-finding inquiry and does not mean that that the SEC has concluded that the Company or anyone

else has violated the laws. As a result of the disclosure of the SEC request, the Nasdaq staff has requested us to provide them with

the information requested by the SEC in which we are complying.

We do not know when the

SEC’s or Nasdaq’s investigation will be concluded or what action, if any, might be taken in the future by the SEC, Nasdaq

or their staff as a result of the matters that are the subject to its investigation or what impact, if any, the cost of continuing to

respond to inquiries might have on our financial position or results of operations. We have not established any provision for losses

in respect of this matter. In addition, complying with any such future requests by the SEC or Nasdaq for documents or testimony would

distract the time and attention of our officers and directors or divert our resources away from ongoing business matters. This investigation

may result in significant legal expenses, the diversion of management’s attention from our business, could cause damage to our

business and reputation, and could subject us to a wide range of remedies, including enforcement actions by the SEC or delisting proceedings

by Nasdaq. There can be no assurance that any final resolution of this or any similar matters will not have a material adverse effect

on our financial condition or results of operations.

If our business developments and achievements

do not meet the expectations of investors or securities analysts or for other reasons the expected benefits do not occur, the market price

of our common stock traded on Nasdaq may decline.

If our business developments

and achievements do not meet the expectations of investors or securities analysts, the market price of common stock traded on Nasdaq may

decline. The trading price of our common stock could be volatile and subject to wide fluctuations in response to various factors, some

of which are beyond our control. Any of the factors listed below could have a negative impact on your investment in our securities and

our securities may trade at prices significantly below the price you paid for them. In such circumstances, the trading price of our securities

may not recover and may experience a further decline.

Factors affecting the trading

price of our securities may include:

| ● | adverse regulatory decisions; |

| ● | any delay in our regulatory filings for our therapeutic candidates and any adverse development or perceived

adverse development with respect to the applicable regulatory authority’s review of such filings, including without limitation the

FDA’s issuance of a “refusal to file” letter or a request for additional information; |

| ● | the impacts of the ongoing COVID-19 pandemic and related restrictions as they may related to

our clinical trials; |

| ● | the commencement, enrollment or results of any future clinical trials we may conduct, or changes in the

development status of our therapeutic candidates; |

| ● | adverse results from, delays in or termination of clinical trials; |

| ● | unanticipated serious safety concerns related to the use of our therapeutic candidates; |

| ● | lower than expected market acceptance of our therapeutic candidates following approval for commercialization,

if approved; |

| ● | changes in financial estimates by us or by any securities analysts who might cover our securities; |

| ● | conditions or trends in our industry; |

| ● | changes in the market valuations of similar companies; |

| ● | stock market price and volume fluctuations of comparable companies and, in particular, those that operate

in the biopharmaceutical industry; |

| ● | publication of research reports about us or our industry or positive or negative recommendations or withdrawal

of research coverage by securities analysts; |

| ● | announcements by us or our competitors of significant acquisitions, strategic partnerships or divestitures; |

| ● | announcements of investigations or regulatory scrutiny of our operations or lawsuits filed against us; |

| ● | investors’ general perception of our business prospects or management; |

| ● | recruitment or departure of key personnel; |

| ● | overall performance of the equity markets; |

| ● | trading volume of our common stock; |

| ● | disputes or other developments relating to intellectual property rights, including patents, litigation

matters and our ability to obtain, maintain, defend, protect and enforce patent and other intellectual property rights for our technologies; |

| ● | significant lawsuits, including patent or stockholder litigation; |

| ● | proposed changes to healthcare laws in the U.S. or foreign jurisdictions, or speculation regarding such

changes; |

| ● | general political and economic conditions; and |

| ● | other events or factors, many of which are beyond our control. |

In addition, in the past,

stockholders have initiated class action lawsuits against biopharmaceutical and biotechnology companies following periods of volatility