Current Report Filing (8-k)

26 November 2022 - 4:33AM

Edgar (US Regulatory)

0001606698FALSE00016066982022-07-112022-07-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________

FORM 8-K

___________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED) November 22, 2022

Alpine 4 Holdings, Inc.

(EXACT NAME OF REGISTRANT AS SPECIFIED IN CHARTER)

| | | | | | | | | | | | | | |

| | | | | |

| Delaware | | 001-40913 | | 46-5482689 |

(STATE OR OTHER JURISDICTION OF INCORPORATION OR ORGANIZATION) | | (COMMISSION FILE NO.) | | (IRS EMPLOYEE IDENTIFICATION NO.) |

2525 E Arizona Biltmore Circle, Suite 237

Phoenix, AZ 85016

(ADDRESS OF PRINCIPAL EXECUTIVE OFFICES)

480-702-2431

(ISSUER TELEPHONE NUMBER)

(FORMER NAME OR FORMER ADDRESS, IF CHANGED SINCE LAST REPORT)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock | ALPP | The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Item 3.01. Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On November 22, 2022, the Company received a notice (the “November Notice”) from The Nasdaq Stock Market LLC (“Nasdaq”) indicating that, as a result of not having timely filed the Form 10-Q with the SEC, the Company is not in compliance with Nasdaq Listing Rule 5250(c)(1) (the “Listing Rule”), which requires timely filing of all required periodic financial reports with the SEC.

The November Notice indicated that under Nasdaq Listing Rules, the Company has 60 calendar days to submit a plan to regain compliance with the Listing Rule. If Nasdaq accepts the Company’s plan, Nasdaq can grant an exception of up to 180 calendar days from the filing date for the Form 10-Q to regain compliance. The Company currently plans to file the Form 10-Q as soon as practicable and to submit a plan to Nasdaq detailing the Company’s plan to regain compliance with the Listing Rule.

The November Notice has no immediate impact on the listing of the Company’s Common Stock, which will continue to be listed and traded on The Nasdaq Capital Market under the symbol “ALPP,” subject to the Company’s compliance with the requirements outlined above.

This report contains forward-looking statements that involve risks and uncertainties. For example, forward-looking statements include statements regarding the timing of the filing of the Form 10-Q, the submission of a plan to regain compliance with the Listing Rule and Nasdaq’s potential acceptance of such a plan. Actual results could differ materially from the results projected in or implied by the forward-looking statements made in this report. Factors that might cause these differences include, but are not limited to: the possibility of unanticipated delays that will prevent the filing of the Form 10-Q within the allotted 60-day period, the risk that the work necessary to complete the Form 10-Q is greater than anticipated or may involve the resolution of additional issues identified during the review process, the potential inability to file a plan to regain compliance in a timely manner, the risk of potential additional violations of Listing Rule 5250(c)(1), the risk that the Company may not respond adequately to further inquiries from Nasdaq, and the risk that Nasdaq will not accept any plan to regain compliance and will delist the Company's Class A common stock. Other risk factors that may impact these forward-looking statements are discussed in more detail in the Company’s Quarterly Report on Form 10-Q filed with the SEC on August 12, 2022. Copies are available through the Company's Investor Relations department and website, alpine4.com. The Company expressly disclaims any obligation or intention to update these forward-looking statements to reflect new information and developments.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

Exhibit Number | | Description |

99 | | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

Alpine 4 Holdings, Inc.

By: /s/ Kent B. Wilson

Kent B. Wilson

Chief Executive Officer, President

(Principal Executive Officer)

Date: November 25, 2022

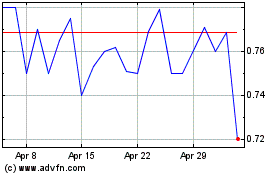

Alpine 4 (NASDAQ:ALPP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alpine 4 (NASDAQ:ALPP)

Historical Stock Chart

From Apr 2023 to Apr 2024