Altimmune Announces Fourth Quarter and Full Year 2024 Financial Results and Provides a Business Update

27 February 2025 - 11:00PM

Altimmune, Inc. (Nasdaq: ALT), a clinical-stage biopharmaceutical

company, today announced financial results for the fourth quarter

and full year ended December 31, 2024, and provided a business

update.

"2024 was a year of important progress for

Altimmune as we continued to advance pemvidutide in multiple

indications," said Vipin K. Garg, Ph.D., President and Chief

Executive Officer of Altimmune. "As announced previously, we

completed enrollment of the IMPACT Phase 2b trial of pemvidutide in

MASH and are on track to report top-line data in the second quarter

of 2025. IMPACT was one of the fastest enrolling biopsy-driven

Phase 2b MASH trials, which we believe reflects the attractiveness

of pemvidutide to patients and providers, specifically the

compound's potent reduction of both liver fat and body weight.

Based on the totality of the data generated to date, including

multiple non-invasive biomarkers of liver inflammation and

fibrosis, we are confident that pemvidutide will achieve

statistically significant improvements in biopsy endpoints, both

MASH resolution and fibrosis improvement, at trial readout. We

anticipate holding an end-of-Phase 2 meeting with FDA by the end of

2025 to gain alignment on the registrational Phase 3 program."

Dr. Garg continued, "In-line with our previously

stated plan, we submitted INDs for two additional indications in Q4

2024, and I am excited to report that both have received FDA

clearance, and we are on track to initiate Phase 2 efficacy studies

mid-2025. We look forward to providing information on these

additional indications and our development plans during the

upcoming virtual R&D Day on March 13. We believe that these

indications reinforce our vision for the broad therapeutic utility

of pemvidutide."

Recent Highlights and Anticipated

Milestones

Metabolic Dysfunction-Associated

Steatohepatitis (MASH)

- IMPACT, the Company's biopsy-driven Phase 2b trial of

pemvidutide in MASH, is on track for top-line data readout in Q2

2025

- IMPACT is evaluating the efficacy and safety of pemvidutide in

approximately 190 subjects with biopsy-confirmed MASH.

- With a successful readout from IMPACT, pemvidutide would be the

first incretin to achieve statistical significance on MASH

resolution and fibrosis improvement at only 24 weeks of treatment,

and the first therapy in any class to achieve these endpoints along

with meaningful weight loss at this timepoint.

Additional Indications for

Pemvidutide

- The Company submitted IND applications for pemvidutide in two

additional indications at the end of 2024, both of which have been

cleared by FDA

- Phase 2 trials in additional indications are expected to

initiate in mid-2025.

R&D Day March 13,

2025

- Altimmune will hold a virtual R&D Day on Thursday, March

13, 2025 at 12:00pm Eastern Time

- The program will feature presentations on pemvidutide

development from Company management and key opinion leaders in

obesity, MASH and the two additional indications which will be

disclosed during the event.

- Details of the R&D Day, including registration information,

are available at https://investorday.altimmune.com. Additional

information related to the event will be posted to this site.

Corporate Update

- The Company strengthened its Board of Directors with the

appointments of pharmaceutical industry veterans Teri Lawver and

Jerry Durso

- Ms. Lawver has nearly 30 years of experience spanning

pharmaceuticals, medical devices and consumer health technology.

She most recently served as Executive Vice President and Chief

Commercial Officer of Dexcom. Previously she served for over 20

years at Johnson & Johnson in various leadership roles,

including as Global Vice President for the Cardiovascular &

Metabolism therapeutic area and Worldwide Vice President for the

Immunology business at Janssen Pharmaceuticals.

- Mr. Durso brings more than 30 years of leadership experience in

the life sciences industry, most recently serving as Chief

Executive Officer at Intercept Pharmaceuticals where he built a

successful rare liver disease franchise and ultimately led the

Company through its acquisition by Alfasigma. Prior to Intercept,

he spent over two decades in a variety of leadership roles at

Sanofi, including Chief Commercial Officer for its U.S.

Pharmaceuticals business.

Financial Results for the Three Months

Ended December 31, 2024

- Altimmune reported cash, cash equivalents and short-term

investments totaling $131.9 million on December 31, 2024.

- Research and development expenses were $19.8 million for the

three months ended December 31, 2024, compared to $16.9 million in

the same period in 2023. The expenses for the quarter ended

December 31, 2024, included $13.6 million in direct costs related

to development activities for pemvidutide.

- General and administrative expenses were $5.1 million for the

three months ended December 31, 2024, compared to $4.3 million in

the same period in 2023. The increase was primarily due to a $0.5

million increase in stock compensation.

- Interest income was $1.6 million for the three months ended

December 31, 2024, compared to $2.0 million for the same period in

2023.

- Net loss for the three months ended December 31, 2024, was

$23.2 million, or $0.33 net loss per share, compared to a net loss

of $31.6 million, or $0.54 net loss per share, in the same period

in 2023. The net loss for 2023 included the $12.4 million noncash

impairment charge related to the discontinuation of development of

HepTcell.

Financial Results for the Year Ended

December 31, 2024

- Research and development expenses were $82.2 million for the

year ended December 31, 2024, compared to $65.8 million in the same

period in 2023. The expenses for the year ended December 31, 2024,

included $53.3 million in direct costs related to development

activities for pemvidutide and $1.3 million in initial costs for

additional research and discovery projects.

- General and administrative expenses were $21.0 million for the

year ended December 31, 2024, compared to $18.1 million in the same

period in 2023. The increase was primarily due to a $2.7 million

increase in stock compensation and other labor-related expenses,

including the $1.0 million increase in stock compensation expense

caused by modifications of stock awards.

- Interest income was $8.1 million for the year ended December

31, 2024, compared to $7.4 million for the same period in

2023.

- Net loss for the year ended December 31, 2024, was $95.1

million, or $1.34 net loss per share, compared to a net loss of

$88.4 million, or $1.66 net loss per share, in the same period in

2023. The net loss for 2023 included the $12.4 million noncash

impairment charge related to the discontinuation of development of

HepTcell.

| Conference

Call Information: |

|

Date: |

|

February 27, 2025 |

| Time: |

|

8:30 a.m. Eastern Time |

| Webcast: |

|

To listen, the conference call

will be webcast live on Altimmune's Investor Relations website at

https://ir.altimmune.com/investors. |

| Dial-in: |

|

To participate or dial-in,

register here to receive the dial-in numbers and unique PIN to

access the call. |

| |

|

|

Following the conclusion of the call, the

webcast will be available for replay on the Investor Relations (IR)

page of the Company's website at www.altimmune.com. The Company has

used, and intends to continue to use, the IR portion of its website

as a means of disclosing material non-public information and for

complying with disclosure obligations under Regulation FD.

About Pemvidutide

Pemvidutide is a novel, investigational,

peptide-based GLP-1/glucagon dual receptor agonist in development

for the treatment of obesity and MASH. Activation of the GLP-1 and

glucagon receptors is believed to mimic the complementary effects

of diet and exercise on weight loss, with GLP-1 suppressing

appetite and glucagon increasing energy expenditure. Glucagon is

also recognized as having direct effects on hepatic fat metabolism,

which is believed to lead to rapid reductions in levels of liver

fat and serum lipids. In clinical trials to date, once-weekly

pemvidutide has demonstrated compelling weight loss with

class-leading lean mass preservation, and robust reductions in

triglycerides, LDL cholesterol, liver fat content and blood

pressure. The U.S. FDA has granted Fast Track designation

to pemvidutide for the treatment of MASH. Pemvidutide recently

completed the MOMENTUM Phase 2 obesity trial and is being studied

in the ongoing IMPACT Phase 2b MASH trial.

About Altimmune

Altimmune is a clinical-stage biopharmaceutical

company focused on developing innovative next-generation

peptide-based therapeutics. The Company is developing pemvidutide,

a GLP-1/glucagon dual receptor agonist for the treatment of

obesity, MASH and other indications. For more information,

please visit www.altimmune.com.

Follow @Altimmune, Inc. on

LinkedIn Follow @AltimmuneInc on

Twitter

Forward-Looking Statement

Any statements made in this press release

related to the development or commercialization of product

candidates and other business matters, including without

limitation, trial results and data, the timing of key milestones

for our clinical assets, and the prospects for the utility of,

regulatory approval, commercializing or selling any product or drug

candidates, are forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995. In addition,

when or if used in this press release, the words "may," "could,"

"should," "anticipate," "believe," "estimate," "expect," "intend,"

"plan," "predict" and similar expressions and their variants, as

they relate to Altimmune, Inc. may identify forward-looking

statements. The Company cautions that these forward-looking

statements are subject to numerous assumptions, risks, and

uncertainties, which change over time. Important factors that may

cause actual results to differ materially from the results

discussed in the forward looking statements or historical

experience include risks and uncertainties, including risks

relating to: delays in regulatory review, manufacturing and supply

chain interruptions, access to clinical sites, enrollment, adverse

effects on healthcare systems and disruption of the global economy;

the reliability of the results of studies relating to human

safety and possible adverse effects resulting from the

administration of the Company's product candidates; the Company's

ability to manufacture clinical trial materials on the timelines

anticipated; and the success of future product advancements,

including the success of future clinical trials. Further

information on the factors and risks that could affect the

Company's business, financial conditions and results of operations

are contained in the Company's filings with the U.S. Securities and

Exchange Commission, including under the heading "Risk Factors" in

the Company's most recent annual report on Form 10-K and our other

filings with the SEC, which are available at www.sec.gov.

Company Contact:Greg WeaverChief Financial

OfficerPhone: 240-654-1450ir@altimmune.com

Investor Contact:Lee RothBurns McClellanPhone:

646-382-3403lroth@burnsmc.com

Media Contact:Danielle CanteyInizio Evoke,

BiotechPhone: 619-826-4657Danielle.cantey@inizioevoke.com

|

ALTIMMUNE, INC. |

|

CONSOLIDATED BALANCE SHEETS |

|

(In thousands, except share and per-share

amounts) |

| |

| |

|

December 31, |

| |

|

2024 |

|

2023 |

| ASSETS |

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

36,926 |

|

|

$ |

135,117 |

|

|

Restricted cash |

|

|

42 |

|

|

|

41 |

|

|

Total cash, cash equivalents and restricted cash |

|

|

36,968 |

|

|

|

135,158 |

|

|

Short-term investments |

|

|

94,965 |

|

|

|

62,698 |

|

|

Accounts and other receivables |

|

|

544 |

|

|

|

1,111 |

|

|

Income tax and R&D incentive receivables |

|

|

2,573 |

|

|

|

3,742 |

|

|

Prepaid expenses and other current assets |

|

|

2,204 |

|

|

|

6,917 |

|

|

Total current assets |

|

|

137,254 |

|

|

|

209,626 |

|

| Property and equipment,

net |

|

|

413 |

|

|

|

651 |

|

| Other assets |

|

|

1,639 |

|

|

|

363 |

|

|

Total assets |

|

$ |

139,306 |

|

|

$ |

210,640 |

|

| LIABILITIES AND

STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

211 |

|

|

$ |

2,070 |

|

|

Accrued expenses and other current liabilities |

|

|

10,257 |

|

|

|

10,073 |

|

|

Total current liabilities |

|

|

10,468 |

|

|

|

12,143 |

|

| Other noncurrent

liabilities |

|

|

5,330 |

|

|

|

4,398 |

|

|

Total liabilities |

|

|

15,798 |

|

|

|

16,541 |

|

|

Commitments and contingencies |

|

|

|

|

|

|

| Stockholders' equity: |

|

|

|

|

|

|

|

Common stock, $0.0001 par value; 200,000,000 shares authorized;

72,352,701 and 70,677,400 shares issued and outstanding as of

December 31, 2024 and 2023, respectively |

|

|

7 |

|

|

|

7 |

|

|

Additional paid-in capital |

|

|

689,864 |

|

|

|

665,427 |

|

|

Accumulated deficit |

|

|

(561,390 |

) |

|

|

(466,331 |

) |

|

Accumulated other comprehensive loss, net |

|

|

(4,973 |

) |

|

|

(5,004 |

) |

|

Total stockholders' equity |

|

|

123,508 |

|

|

|

194,099 |

|

|

Total liabilities and stockholders' equity |

|

$ |

139,306 |

|

|

$ |

210,640 |

|

|

|

|

ALTIMMUNE, INC. |

|

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE

LOSS |

|

(In thousands, except share and per-share

amounts) |

| |

| |

|

Three Months Ended |

|

Year Ended |

| |

|

December 31, |

|

December 31, |

| |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Revenues |

|

$ |

5 |

|

|

$ |

37 |

|

|

$ |

20 |

|

|

$ |

426 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

19,781 |

|

|

|

16,909 |

|

|

|

82,226 |

|

|

|

65,799 |

|

|

General and administrative |

|

|

5,090 |

|

|

|

4,332 |

|

|

|

20,966 |

|

|

|

18,137 |

|

|

Impairment loss on intangible asset |

|

|

— |

|

|

|

12,419 |

|

|

|

— |

|

|

|

12,419 |

|

|

Total operating expenses |

|

|

24,871 |

|

|

|

33,660 |

|

|

|

103,192 |

|

|

|

96,355 |

|

| Loss from operations |

|

|

(24,866 |

) |

|

|

(33,623 |

) |

|

|

(103,172 |

) |

|

|

(95,929 |

) |

| Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(1 |

) |

|

|

(2 |

) |

|

|

(9 |

) |

|

|

(35 |

) |

|

Interest income |

|

|

1,569 |

|

|

|

1,964 |

|

|

|

8,074 |

|

|

|

7,351 |

|

|

Other income (expense), net |

|

|

118 |

|

|

|

20 |

|

|

|

48 |

|

|

|

166 |

|

|

Total other income (expense), net |

|

|

1,686 |

|

|

|

1,982 |

|

|

|

8,113 |

|

|

|

7,482 |

|

| Net loss |

|

|

(23,180 |

) |

|

|

(31,641 |

) |

|

|

(95,059 |

) |

|

|

(88,447 |

) |

| Other comprehensive income Ñ

unrealized gain on short-term investments |

|

|

(128 |

) |

|

|

120 |

|

|

|

31 |

|

|

|

223 |

|

| Comprehensive loss |

|

$ |

(23,308 |

) |

|

$ |

(31,521 |

) |

|

$ |

(95,028 |

) |

|

$ |

(88,224 |

) |

| Net loss per share, basic and

diluted |

|

$ |

(0.33 |

) |

|

$ |

(0.54 |

) |

|

$ |

(1.34 |

) |

|

$ |

(1.66 |

) |

| Weighted-average common shares

outstanding, basic and diluted |

|

|

71,260,875 |

|

|

|

58,442,779 |

|

|

|

71,003,399 |

|

|

|

53,246,937 |

|

| |

This press release was published by a CLEAR® Verified

individual.

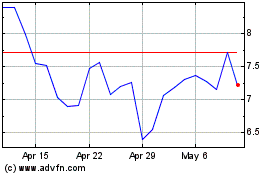

Altimmune (NASDAQ:ALT)

Historical Stock Chart

From Jan 2025 to Feb 2025

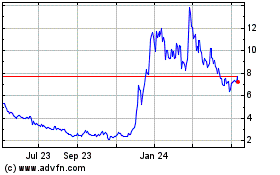

Altimmune (NASDAQ:ALT)

Historical Stock Chart

From Feb 2024 to Feb 2025