Current Report Filing (8-k)

05 May 2021 - 6:39AM

Edgar (US Regulatory)

United States

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

April 29, 2021

Date of

Report (Date of earliest event reported)

American Acquisition Opportunity Inc.

(Exact

Name of Registrant as Specified in its Charter)

|

Delaware

|

|

001-40233

|

|

86-1599759

|

|

(State

or other jurisdiction of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S.

Employer Identification No.)

|

|

12115 Visionary Way

Fishers, Indiana

|

|

46038

|

|

(Address

of Principal Executive Offices)

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: (317) 855-9926

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

☐ Written

communications pursuant to Rule 425 under the Securities

Act

☐ Soliciting material

pursuant to Rule 14a-12 under the Exchange Act

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange

Act

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange

Act

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol

|

|

Name of

each exchange on which registered

|

|

Units,

each consisting of one share of Common Stock and one-half of one

Redeemable Warrant

|

|

AMAOU

|

|

The

Nasdaq Capital Market LLC

|

|

Common

Stock, par value $0.0001 per share

|

|

AMAO

|

|

The

Nasdaq Capital Market LLC

|

|

Redeemable

Warrants, each whole warrant exercisable for one share of Common

Stock at an exercise price of $11.50

|

|

AMAOW

|

|

The

Nasdaq Capital Market LLC

|

Indicate

by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (17 CFR

§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934

(17 CFR §240.12b-2).

Emerging

growth company ☒

If an

emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act. ☐

Item 4.01. Changes in Registrant’s Certifying

Accountant

(a)

Dismissal of Independent Registered Public Accounting

Firm

On

April 29, 2021, the Audit Committee of the Board of Directors of

American Acquisition Opportunity Inc. (or the

“Company”) approved the dismissal of Marcum LLP

(“Marcum”) as the Company’s independent

registered public accounting firm.

The

reports of Marcum on the Company’s financial statements as of

January 22, 2021 and for the period January 20, 2021 through

January 22, 2021 and the Company’s balance sheet as of March

22, 2021 did not contain an adverse opinion or a disclaimer of

opinion, and were not qualified or modified as to uncertainty,

audit scope or accounting principles other than an explanatory

paragraph relating to the Company’s ability to continue as a

going concern.

During

the period January 20, 2021 through January 22, 2021 through the

date of termination, April 29, 2021, there were no

“disagreements” with Marcum on any matter of accounting

principles or practices, financial statement disclosure or auditing

scope or procedure, which disagreements if not resolved to the

satisfaction of Marcum would have caused Marcum to make reference

thereto in its reports on the consolidated financial statement for

such years. During the period January 20, 2021 through January 22,

2021 and through April 29, 2021, there have been no

“reportable events” (as defined in Item 304(a)(1)(iv)

and Item 304(a)(1)(v) of Registration S-K).

The

Company provided Marcum with a copy of the disclosure it is making

herein in response to Item 304(a) of Regulation S-K, and requested

Marcum furnish the Company with a copy of its letter addressed to

the Securities and Exchange Commission (the “SEC”),

pursuant to Item 304(a)(3) of Regulation S-K, stating whether or

not Marcum agrees with the statements related to them made by the

Company in this report. A copy of Marcum’s letter dated May

4, 2021 is attached as Exhibit 16.1 to this report.

(b)

Newly Engaged Independent Registered Public Accounting

Firm

On

April 29, 2021, the Audit Committee approved the appointment of BF

Borgers CPA, PC (“BF Borgers”) as the Company’s

new independent public accounting firm, effective immediately.

Prior to engaging BF Borgers, neither the Company, nor anyone on

its behalf, consulted BF Borgers regarding either (i) the

application of accounting principles to a specified transaction,

either completed or proposed, or the type of audit opinion that

might be rendered with respect to the consolidated financial

statements of the Company, and no written report or oral advice was

provided to the Company by BF Borgers that was an important factor

considered by the Company in reaching a decision as to any

accounting, auditing or financial reporting issue; or (ii) any

matter that was the subject of a "disagreement" (as defined in Item

304(a)(1)(iv) of Regulation S-K and the related instructions) or a

“reportable event” (as that term is defined in Item

304(a)(1)(v) of Regulation S-K).

Item 4.02. Non-Reliance on Previously Issued Financial Statements

or a Related Audit Report or Completed Interim Review.

(b) On

May 1, 2021, Marcum informed management of its conclusion that the

Company’s (i) audited balance sheet dated March 22, 2021,

that was filed with the SEC as an Exhibit to a Current Report on

Form 8-K filed on March 29, 2021, (ii) the unaudited pro forma

balance sheet dated March 22, 2021 that was filed on April 6, 2021

reflecting the partial exercise of over-allotment option by the

underwriters (“Underwriters”) of the Company’s

initial public offering, (collectively the “Affected Period

Financial Statements”) should no longer be relied upon due to

the continued research regarding how the Company accounted for its

outstanding warrants to purchase shares of Class A common stock,

par value $0.0001 per share of the Company (“Class A Common

Stock”). The Company has issued 5,253,001 warrants to

purchase shares of its Class A Common Stock at $11.50 per share,

which were included in the units sold in the Company’s

initial public offering (the “Public Warrants”) and

3,701,621 warrants to purchase shares of Class A Common Stock at

$11.50 per share, which were sold in a private placement (the

“Private Placement Warrants”). In each case, the total

number of warrants includes those issued due to the partial

exercise of the underwriters’ over-allotment option. The

Company had been accounting for the Warrants as components of

equity instead of as liabilities.

On

April 12, 2021, the Staff at the U.S. Securities and Exchange

Commission (the “SEC”) issued a statement (the

“Statement”) discussing the accounting implications of

certain terms that are common in warrants issued by special purpose

acquisition companies (“SPACs”). In light of the

Statement, the Company’s management evaluated the terms of

the Warrant Agreement entered into in connection with the

Company’s initial public offering and concluded that the

Company’s Public Warrants and Private Placement Warrants

(together, the “Warrants”) include provisions (the

“Extraordinary Transaction Provisions”) that, based on

the Statement, preclude the Warrants from being classified as

components of equity. As a result, the Company is required to

classify the Warrants as liabilities in the Affected Period

Financial Statements. Under this accounting treatment, the Company

is required to measure the fair value of the Warrants at the end of

each reporting period and recognize changes in the fair value from

the prior period in the Company’s operating results for the

current period.

While

the Company is still in the process of obtaining a valuation of the

Warrants, in connection with its termination as independent

auditor, Marcum stated that it was its belief the impact will be

material thereby requiring a restatement of the previously-issued

financial statements. As such, Marcum stated that the

previously-issued financial statements should no longer be relied

upon.

The

Company has provided Marcum with a copy of this disclosure.

Attached as Exhibit 16.2 is a letter dated May 4, 2021 from Marcum

regarding the disclosure.

Item 9.01. Financial Statements and Exhibits.

|

Exhibit

No.

|

|

Description

|

|

|

|

|

|

|

|

Letter Dated

May 4, 2021 from Marcum LLP

|

|

|

|

Letter

Dated May 4, 2021 from Marcum LLP

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

Registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

Dated:

May 4, 2021

|

AMERICAN

ACQUISITION OPPORTUNITY INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:_/s/

Mark C. Jensen_________________

|

|

|

Name:

Mark C. Jensen

|

|

|

Title:

Chief Executive Officer

|

American Acquisition Opp... (NASDAQ:AMAO)

Historical Stock Chart

From Mar 2024 to Apr 2024

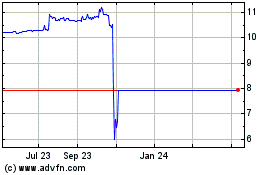

American Acquisition Opp... (NASDAQ:AMAO)

Historical Stock Chart

From Apr 2023 to Apr 2024