AMEDISYS INC0000896262false00008962622025-02-262025-02-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED): February 26, 2025

Commission File Number: 0-24260

AMEDISYS, INC.

(Exact Name of Registrant as specified in its Charter)

| | | | | | | | |

| | |

Delaware | | 11-3131700 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

3854 American Way, Suite A, Baton Rouge, LA 70816

(Address of principal executive offices, including zip code)

(225) 292-2031 or (800) 467-2662

(Registrant’s telephone number, including area code) Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | | AMED | | The NASDAQ Global Select Market |

| | | | | | | | | | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

Emerging growth company | ☐ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨ |

SECTION 2 — FINANCIAL INFORMATION

ITEM 2.02. RESULTS OF OPERATIONS AND FINANCIAL CONDITION

On February 26, 2025, Amedisys, Inc. ("we," "us," "our," or "the Company") issued a press release (the “Press Release”) announcing its financial results for the fourth quarter and year ended December 31, 2024. A copy of the Press Release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information presented in Item 2.02 of this Current Report on Form 8-K and Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, unless we specifically state that the information is to be considered “filed” under the Exchange Act or specifically incorporate it by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act.

SECTION 7 – REGULATION FD

ITEM 7.01. REGULATION FD DISCLOSURE

Item 2.02 of this Current Report on Form 8-K is incorporated herein by reference.

In addition, a copy of the Company's fourth quarter supplemental slides are attached to this report as Exhibit 99.2 and incorporated herein by reference.

The information included in this Current Report on Form 8-K under this Item 7.01 (including Exhibits 99.1 and 99.2 hereto) is being “furnished” and shall not be deemed to be “filed” for the purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of Section 18, nor shall it be incorporated by reference into a filing under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such filing. The information included in this Current Report on Form 8-K under this Item 7.01 (including Exhibits 99.1 and 99.2 hereto) will not be deemed an admission as to the materiality of any information required to be disclosed solely to satisfy the requirements of Regulation FD.

SECTION 9 – FINANCIAL STATEMENTS AND EXHIBITS

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits. | | | | | | | | | | | | | | |

| | | | |

| | 99.1 | | |

| | 99.2 | | |

| | 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

AMEDISYS, INC.

(Registrant)

By: /s/ Scott G. Ginn

Scott G. Ginn

Chief Operating Officer, Executive Vice President and Chief Financial Officer

(Principal Financial Officer)

DATE: February 26, 2025

Exhibit 99.1

AMEDISYS REPORTS FOURTH QUARTER AND YEAR END 2024 FINANCIAL RESULTS

BATON ROUGE, Louisiana (February 26, 2025) — Amedisys, Inc. (NASDAQ: AMED) today reported its financial results for the three-month period and year ended December 31, 2024.

Three-Month Periods Ended December 31, 2024 and 2023

•Net service revenue increased $27.3 million to $598.1 million compared to $570.8 million in 2023.

•Net loss attributable to Amedisys, Inc. of $20.4 million, which is inclusive of merger-related expenses totaling $17.4 million ($15.9 million, net of tax) and a non-cash goodwill and other intangibles impairment charge totaling $48.4 million ($38.4 million, net of noncontrolling interest and tax) compared to net income attributable to Amedisys, Inc. of $19.3 million, which is inclusive of merger-related expenses totaling $11.5 million ($9.6 million, net of tax) in 2023.

•Net loss attributable to Amedisys, Inc. per diluted share of $0.62 compared to net income attributable to Amedisys, Inc. per diluted share of $0.59 in 2023.

Adjusted Quarterly Results*

•Adjusted EBITDA of $54.6 million compared to $56.7 million in 2023.

•Adjusted net income attributable to Amedisys, Inc. of $32.0 million compared to $30.8 million in 2023.

•Adjusted net income attributable to Amedisys, Inc. per diluted share of $0.96 compared to $0.94 in 2023.

Years Ended December 31, 2024 and 2023

•Net service revenue increased $111.9 million to $2,348.3 million compared to $2,236.4 million in 2023.

•Net income attributable to Amedisys, Inc. of $43.2 million, which is inclusive of merger-related expenses totaling $66.6 million ($64.0 million, net of tax) and a non-cash goodwill and other intangibles impairment charge totaling $48.4 million ($38.4 million, net of noncontrolling interest and tax) compared to net loss attributable to Amedisys, Inc. of $9.7 million, which is inclusive of merger-related expenses totaling $142.7 million ($140.5 million, net of tax) in 2023.

•Net income attributable to Amedisys, Inc. per diluted share of $1.31 compared to net loss attributable to Amedisys, Inc. per diluted share of $0.30 in 2023.

Adjusted Year End Results*

•Adjusted EBITDA of $245.8 million compared to $247.0 million in 2023.

•Adjusted net income attributable to Amedisys, Inc. of $142.7 million compared to $140.6 million in 2023.

•Adjusted net income attributable to Amedisys, Inc. per diluted share of $4.32 compared to $4.30 in 2023.

* See pages 2 and 13 - 14 for the definition and reconciliations of non-GAAP financial measures to GAAP measures.

The supplemental slides provided in connection with the fourth quarter and year end 2024 earnings release can be found on the Investor Relations page of our website. In light of the pending merger of the Company with UnitedHealth Group Incorporated, Amedisys will not conduct a quarterly earnings call to discuss the fourth quarter and year end results.

Non-GAAP Financial Measures

This press release includes reconciliations of the most comparable financial measures calculated and presented in accordance with accounting principles generally accepted in the U.S. (“GAAP”) to non-GAAP financial measures. The non-GAAP financial measures as defined under SEC rules are as follows: (1) adjusted EBITDA, defined as net (loss) income attributable to Amedisys, Inc. before net interest expense, provision for income taxes and depreciation and amortization, excluding certain items; (2) adjusted net income attributable to Amedisys, Inc., defined as net (loss) income attributable to Amedisys, Inc. calculated in accordance with GAAP excluding certain items; and (3) adjusted net income attributable to Amedisys, Inc. per diluted share, defined as net (loss) income attributable to Amedisys, Inc. common stockholders per diluted share calculated in accordance with GAAP excluding certain items. Certain items include merger-related expenses, impairment charges, acquisition and integration costs, unusual or non-recurring expenses and certain non-operational items. Management believes that these non-GAAP financial measures, when reviewed in conjunction with GAAP financial measures, are useful gauges of our current performance and are also included in internal management reporting. These non-GAAP financial measures should be considered in addition to, and not more meaningful than or as an alternative to, the GAAP financial measures presented in this earnings release and the company’s financial statements. Non-GAAP measures as presented herein may not be comparable to similarly titled measures reported by other companies since not all companies calculate these non-GAAP measures consistently.

Additional Information

Amedisys, Inc. (the “Company”) is a leading healthcare services company, delivering personalized home health, hospice and high acuity care services in the home. Amedisys is focused on delivering the care that is best for our patients, whether that is home-based recovery and rehabilitation after an operation or injury, care focused on empowering our patients to manage a chronic disease, hospice care at the end of life or in-patient hospital, palliative and skilled nursing facility ("SNF") care in their homes. More than 3,300 hospitals and 114,000 physicians nationwide have chosen Amedisys as a partner in post-acute care. Founded in 1982, headquartered in Baton Rouge, LA with an executive office in Nashville, TN, Amedisys is a publicly held company. With approximately 19,000 employees in 519 care centers within 38 states and the District of Columbia, Amedisys is dedicated to delivering the highest quality of care to the doorsteps of more than 499,000 patients every year. For more information about the Company, please visit: www.amedisys.com.

We use our website as a channel of distribution for important company information. Important information, including press releases, investor presentations and financial information regarding our company, is routinely posted on and accessible on the Investor Relations subpage of our website, which is accessible by clicking on the tab labeled “Investors” on our website home page. Visitors to our website can also register to receive automatic e-mail and other notifications alerting them when new information is made available on the Investor Relations subpage of our website.

Forward-Looking Statements

When included in this press release, words like “believes,” “belief,” “expects,” “strategy,” “plans,” “anticipates,” “intends,” “projects,” “estimates,” “may,” “might,” “will,” “could,” “would,” “should” and similar expressions are intended to identify forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve a variety of risks and uncertainties that could cause actual results to differ materially from those described therein. These risks and uncertainties include, but are not limited to, the following: disruption from the proposed merger with UnitedHealth Group with patient, payor, provider, referral source, supplier or management and employee relationships; the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement with UnitedHealth Group or the inability to complete the proposed transaction on the anticipated terms or by the outside date under the merger agreement; the risk that necessary regulatory approvals for the proposed merger with UnitedHealth Group are delayed, are not obtained or are obtained subject to conditions that are not anticipated; the failure of the conditions to the proposed merger to be satisfied; the costs related to the proposed transaction; the diversion of management time on merger-related issues; the risk that termination fees may be payable by the Company in the event that the merger agreement is terminated under certain circumstances; reputational risk related to the proposed merger; the risk of litigation or regulatory action related to the proposed merger, including among other things, the action by the Department of Justice to block the merger; changes in Medicare and other medical payment levels; changes in payments and covered services by federal and state governments; future cost containment initiatives undertaken by third-party payors; changes in the episodic versus non-episodic mix of our payors, the case mix of our patients and payment methodologies; staffing shortages driven by the competitive labor market; our ability to attract and retain qualified personnel; competition in the healthcare industry; our ability to maintain or establish new patient referral sources; changes in or our failure to comply with existing federal and state laws or regulations or the inability to comply with new government regulations on a timely basis; changes in estimates and judgments associated with critical accounting policies; our ability to consistently provide high-quality care; our ability to keep our patients and employees safe; our access to financing; our ability to meet debt service requirements and comply with covenants in debt agreements; business disruptions due to natural or man-made disasters, climate change or acts of terrorism, widespread protests or civil unrest; our ability to open care centers, acquire additional care centers and integrate and operate these care centers effectively; our ability to realize the anticipated benefits of acquisitions, investments and joint ventures; our ability to integrate, manage and keep our information systems secure; the impact of inflation; the impact of new or increased tariffs; uncertainty around, and disruption from, new and emerging technologies, including the adoption and utilization of artificial intelligence ("AI") and generative AI and changes in laws or developments with respect to any litigation relating to the Company, including various other matters, many of which are beyond our control.

Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you should not rely on any forward-looking statement as a prediction of future events. We expressly disclaim any obligation or undertaking, and we do not intend to release publicly any updates or changes in our expectations concerning the forward-looking statements or any changes in events, conditions or circumstances upon which any forward-looking statement may be based, except as required by law.

Contact: Investor Contact: Media Contact:

Amedisys, Inc. Amedisys, Inc.

Nick Muscato Kendra Kimmons

Chief Strategy Officer Vice President, Marketing & Communications

(615) 928- 5452 (225) 299-3720

IR@amedisys.com kendra.kimmons@amedisys.com

AMEDISYS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Amounts in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| | For the Three-Month

Periods Ended December 31, | | For the Years Ended December 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Net service revenue | $ | 598,052 | | | $ | 570,788 | | | $ | 2,348,324 | | | $ | 2,236,382 | |

| Operating expenses: | | | | | | | |

| Cost of service, inclusive of depreciation | 344,614 | | | 321,416 | | | 1,330,647 | | | 1,245,509 | |

| General and administrative expenses: | | | | | | | |

| Salaries and benefits | 137,646 | | | 135,123 | | | 529,748 | | | 516,049 | |

| Non-cash compensation | 7,041 | | | 7,114 | | | 29,028 | | | 26,082 | |

| Merger-related expenses | 17,401 | | | 11,521 | | | 66,638 | | | 36,672 | |

| Depreciation and amortization | 4,566 | | | 4,143 | | | 17,997 | | | 17,747 | |

| Impairment | 48,391 | | | — | | | 48,391 | | | — | |

| Other | 58,017 | | | 57,462 | | | 231,337 | | | 237,929 | |

| Total operating expenses | 617,676 | | | 536,779 | | | 2,253,786 | | | 2,079,988 | |

| Operating (loss) income | (19,624) | | | 34,009 | | | 94,538 | | | 156,394 | |

| Other income (expense): | | | | | | | |

| Interest income | 2,749 | | | 818 | | | 8,110 | | | 3,270 | |

| Interest expense | (6,978) | | | (8,234) | | | (30,764) | | | (31,274) | |

| Equity in earnings from equity method investments | 1,951 | | | 1,394 | | | 6,267 | | | 10,760 | |

| Merger termination fee | — | | | — | | | — | | | (106,000) | |

| Miscellaneous, net | 2,674 | | | 1,211 | | | 8,065 | | | 6,473 | |

| Total other income (expense), net | 396 | | | (4,811) | | | (8,322) | | | (116,771) | |

| (Loss) income before income taxes | (19,228) | | | 29,198 | | | 86,216 | | | 39,623 | |

| Income tax expense | (6,291) | | | (10,178) | | | (48,054) | | | (50,559) | |

| Net (loss) income | (25,519) | | | 19,020 | | | 38,162 | | | (10,936) | |

| Net loss attributable to noncontrolling interests | 5,138 | | | 302 | | | 5,069 | | | 1,189 | |

| Net (loss) income attributable to Amedisys, Inc. | $ | (20,381) | | | $ | 19,322 | | | $ | 43,231 | | | $ | (9,747) | |

| Basic earnings per common share: | | | | | | | |

| Net (loss) income attributable to Amedisys, Inc. common stockholders | $ | (0.62) | | | $ | 0.59 | | | $ | 1.32 | | | $ | (0.30) | |

| Weighted average shares outstanding | 32,751 | | | 32,635 | | | 32,718 | | | 32,599 | |

| Diluted earnings per common share: | | | | | | | |

| Net (loss) income attributable to Amedisys, Inc. common stockholders | $ | (0.62) | | | $ | 0.59 | | | $ | 1.31 | | | $ | (0.30) | |

| Weighted average shares outstanding | 32,751 | | | 32,913 | | | 33,051 | | | 32,599 | |

AMEDISYS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(Amounts in thousands, except share data) | | | | | | | | | | | |

| As of December 31, |

| 2024 | | 2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 303,242 | | | $ | 126,450 | |

| Restricted cash | — | | | 12,413 | |

| Patient accounts receivable | 296,075 | | | 313,373 | |

| Prepaid expenses | 13,072 | | | 14,639 | |

| Other current assets | 19,694 | | | 30,060 | |

| Total current assets | 632,083 | | | 496,935 | |

| Property and equipment, net of accumulated depreciation of $100,890 and $92,422 | 42,108 | | | 41,845 | |

| Operating lease right of use assets | 81,500 | | | 88,939 | |

| Goodwill | 1,213,888 | | | 1,244,679 | |

| Intangible assets, net of accumulated amortization of $18,787 and $14,008 | 81,155 | | | 102,675 | |

| Other assets | 87,980 | | | 85,097 | |

| Total assets | $ | 2,138,714 | | | $ | 2,060,170 | |

| LIABILITIES AND EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 39,956 | | | $ | 28,237 | |

| Payroll and employee benefits | 151,995 | | | 136,835 | |

| Accrued expenses | 152,564 | | | 140,049 | |

| Termination fee paid by UnitedHealth Group | 106,000 | | | 106,000 | |

| Current portion of long-term obligations | 37,968 | | | 36,314 | |

| Current portion of operating lease liabilities | 25,909 | | | 26,286 | |

| Total current liabilities | 514,392 | | | 473,721 | |

| Long-term obligations, less current portion | 339,313 | | | 361,862 | |

| Operating lease liabilities, less current portion | 56,111 | | | 62,751 | |

| Deferred income tax liabilities | 48,051 | | | 40,635 | |

| Other long-term obligations | 882 | | | 1,418 | |

| Total liabilities | 958,749 | | | 940,387 | |

| Equity: | | | |

Preferred stock, $0.001 par value, 5,000,000 shares authorized; none issued or outstanding | — | | | — | |

Common stock, $0.001 par value, 60,000,000 shares authorized; 38,307,521 and 38,131,478 shares issued; and 32,776,148 and 32,667,631 shares outstanding | 38 | | | 38 | |

| Additional paid-in capital | 818,201 | | | 787,177 | |

Treasury stock at cost, 5,531,373 and 5,463,847 shares of common stock | (474,854) | | | (468,626) | |

| | | |

| Retained earnings | 791,156 | | | 747,925 | |

| Total Amedisys, Inc. stockholders’ equity | 1,134,541 | | | 1,066,514 | |

| Noncontrolling interests | 45,424 | | | 53,269 | |

| Total equity | 1,179,965 | | | 1,119,783 | |

| Total liabilities and equity | $ | 2,138,714 | | | $ | 2,060,170 | |

AMEDISYS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS AND DAYS REVENUE OUTSTANDING

(Amounts in thousands, except statistical information)

| | | | | | | | | | | | | | | | | | | | | | | |

| | For the Three-Month

Periods Ended December 31, | | For the Years Ended December 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Cash Flows from Operating Activities: | | | | | | | |

| Net (loss) income | $ | (25,519) | | | $ | 19,020 | | | $ | 38,162 | | | $ | (10,936) | |

| Adjustments to reconcile net (loss) income to net cash provided by operating activities: | | | | | | | |

| Depreciation and amortization (inclusive of depreciation included in cost of service) | 6,708 | | | 5,891 | | | 26,039 | | | 23,847 | |

| Non-cash compensation | 8,249 | | | 9,400 | | | 30,639 | | | 29,024 | |

| Amortization and impairment of operating lease right of use assets | 8,702 | | | 8,569 | | | 34,422 | | | 33,996 | |

| (Gain) loss on disposal of property and equipment | (6) | | | (27) | | | (28) | | | 319 | |

| Gain on deconsolidation of joint venture | (1,626) | | | — | | | (1,626) | | | — | |

| Deferred income taxes | 34 | | | 5,238 | | | 7,416 | | | 20,655 | |

| Loss on personal care divestiture | — | | | — | | | — | | | 2,186 | |

| Merger termination fee | — | | | — | | | — | | | 106,000 | |

| Equity in earnings from equity method investments | (1,951) | | | (1,394) | | | (6,267) | | | (10,760) | |

| Amortization of deferred debt issuance costs | 248 | | | 248 | | | 991 | | | 991 | |

| Return on equity method investments | 1,471 | | | 764 | | | 3,631 | | | 5,073 | |

| Impairment | 48,391 | | | — | | | 48,391 | | | — | |

| Changes in operating assets and liabilities, net of impact of acquisitions: | | | | | | | |

| Patient accounts receivable | 4,974 | | | 6,207 | | | 16,477 | | | (26,727) | |

| Other current assets | 458 | | | 8,796 | | | 11,700 | | | (6,638) | |

| Operating lease right of use assets | (1,061) | | | (983) | | | (4,196) | | | (3,786) | |

| Other assets | 146 | | | (84) | | | 744 | | | 189 | |

| Accounts payable | 8,043 | | | (6,977) | | | 12,210 | | | (15,816) | |

| Accrued expenses | 20,571 | | | 13,354 | | | 33,066 | | | 23,694 | |

| Other long-term obligations | (4) | | | (234) | | | (536) | | | (3,390) | |

| Operating lease liabilities | (7,551) | | | (7,477) | | | (29,570) | | | (30,733) | |

| Net cash provided by operating activities | 70,277 | | | 60,311 | | | 221,665 | | | 137,188 | |

| Cash Flows from Investing Activities: | | | | | | | |

| Proceeds from the sale of deferred compensation plan assets | 34 | | | 29 | | | 55 | | | 54 | |

| Proceeds from the sale of property and equipment | — | | | 36 | | | — | | | 136 | |

| Purchases of property and equipment | (1,110) | | | (1,892) | | | (6,550) | | | (5,620) | |

| Investments in technology assets | (204) | | | (212) | | | (823) | | | (7,093) | |

| Investments in equity method investees | — | | | — | | | (1,046) | | | — | |

| Return of investment | — | | | — | | | — | | | 150 | |

| Proceeds from personal care divestiture | — | | | — | | | — | | | 47,787 | |

| Acquisitions of businesses, net of cash acquired | — | | | — | | | — | | | (350) | |

| Net cash (used in) provided by investing activities | (1,280) | | | (2,039) | | | (8,364) | | | 35,064 | |

| Cash Flows from Financing Activities: | | | | | | | |

| Proceeds from issuance of stock upon exercise of stock options | 221 | | | — | | | 309 | | | 100 | |

| Proceeds from issuance of stock under employee stock purchase plan | — | | | — | | | — | | | 2,602 | |

| Shares withheld to pay taxes on non-cash compensation | (1,312) | | | (2,116) | | | (6,152) | | | (6,529) | |

| Noncontrolling interest contributions | 301 | | | 220 | | | 2,212 | | | 1,452 | |

| Noncontrolling interest distributions | (788) | | | (259) | | | (3,362) | | | (1,873) | |

| Purchase of noncontrolling interest | — | | | — | | | — | | | (800) | |

| Proceeds from borrowings under revolving line of credit | — | | | — | | | — | | | 23,000 | |

| Repayments of borrowings under revolving line of credit | — | | | — | | | — | | | (23,000) | |

| Principal payments of long-term obligations | (9,627) | | | (8,900) | | | (37,357) | | | (76,013) | |

| Payment of accrued contingent consideration | — | | | (2,370) | | | (4,572) | | | (6,461) | |

| Net cash used in financing activities | (11,205) | | | (13,425) | | | (48,922) | | | (87,522) | |

| Net increase in cash, cash equivalents and restricted cash | 57,792 | | | 44,847 | | | 164,379 | | | 84,730 | |

| Cash, cash equivalents and restricted cash at beginning of period | 245,450 | | | 94,016 | | | 138,863 | | | 54,133 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 303,242 | | | $ | 138,863 | | | $ | 303,242 | | | $ | 138,863 | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| For the Three-Month

Periods Ended December 31, | | For the Years Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Supplemental Disclosures of Cash Flow Information: | | | | | | | |

| Cash paid for interest | $ | 6,769 | | | $ | 7,888 | | | $ | 29,989 | | | $ | 29,766 | |

| Cash paid for income taxes, net of refunds received | $ | 12,102 | | | $ | 4,809 | | | $ | 40,095 | | | $ | 29,127 | |

| Days revenue outstanding (1) | 43.0 | | | 47.7 | | | 43.0 | | | 47.7 | |

(1) Our calculation of days revenue outstanding at December 31, 2024 and 2023 is derived by dividing our ending patient accounts receivable by our average daily patient revenue for the three-month periods ended December 31, 2024 and 2023, respectively.

AMEDISYS, INC. AND SUBSIDIARIES

SEGMENT INFORMATION

(Amounts in millions, except statistical information)

(Unaudited)

Segment Information - Home Health

| | | | | | | | | | | |

| | For the Three-Month Periods

Ended December 31, |

| | 2024 | | 2023 |

Financial Information (in millions): | | | |

| Medicare | $ | 212.4 | | | $ | 221.1 | |

| Non-Medicare | 164.6 | | | 137.8 | |

| Net service revenue | 377.0 | | | 358.9 | |

| Cost of service, inclusive of depreciation | 226.3 | | | 208.0 | |

| Gross margin | 150.7 | | | 150.9 | |

| General and administrative expenses | 95.5 | | | 92.8 | |

| Depreciation and amortization | 2.0 | | | 1.9 | |

| Operating income | $ | 53.2 | | | $ | 56.2 | |

Same Store Growth(1): | | | |

| Medicare revenue | (4 | %) | | (1 | %) |

| Non-Medicare revenue | 19 | % | | 15 | % |

| Total admissions | 8 | % | | 7 | % |

Total volume(2) | 7 | % | | 5 | % |

| | | |

| | | |

Key Statistical Data - Total(3): | | | |

| Admissions | 109,686 | | | 101,809 | |

| Recertifications | 47,051 | | | 44,893 | |

| Total volume | 156,737 | | | 146,702 | |

| | | |

| Medicare completed episodes | 72,173 | | | 73,892 | |

Average Medicare revenue per completed episode(4) | $ | 3,030 | | | $ | 2,997 | |

Medicare visits per completed episode(5) | 12.0 | | | 12.2 | |

| | | |

| Visiting clinician cost per visit | $ | 111.75 | | | $ | 108.64 | |

| Clinical manager cost per visit | 13.13 | | | 12.12 | |

| Total cost per visit | $ | 124.88 | | | $ | 120.76 | |

| Visits | 1,812,048 | | | 1,721,985 | |

| | | | | | | | | | | |

| | For the Years

Ended December 31, |

| | 2024 | | 2023 |

Financial Information (in millions): | | | |

| Medicare | $ | 856.4 | | | $ | 874.2 | |

| Non-Medicare | 634.1 | | | 529.4 | |

| Net service revenue | 1,490.5 | | | 1,403.6 | |

| Cost of service, inclusive of depreciation | 874.9 | | | 801.1 | |

| Gross margin | 615.6 | | | 602.5 | |

| General and administrative expenses | 372.2 | | | 363.5 | |

| Depreciation and amortization | 7.8 | | | 6.0 | |

| Operating income | $ | 235.6 | | | $ | 233.0 | |

Same Store Growth(1): | | | |

| Medicare revenue | (2 | %) | | (3 | %) |

| Non-Medicare revenue | 20 | % | | 13 | % |

| Total admissions | 11 | % | | 6 | % |

Total volume(2) | 8 | % | | 4 | % |

| | | |

| | | |

Key Statistical Data - Total(3): | | | |

| Admissions | 441,945 | | | 399,752 | |

| Recertifications | 184,613 | | | 179,719 | |

| Total volume | 626,558 | | | 579,471 | |

| | | |

| Medicare completed episodes | 289,289 | | | 295,017 | |

Average Medicare revenue per completed episode(4) | $ | 3,021 | | | $ | 2,998 | |

Medicare visits per completed episode(5) | 12.0 | | | 12.4 | |

| | | |

| Visiting clinician cost per visit | $ | 108.01 | | | $ | 103.31 | |

| Clinical manager cost per visit | 12.41 | | | 11.58 | |

| Total cost per visit | $ | 120.42 | | | $ | 114.89 | |

| Visits | 7,265,742 | | | 6,972,929 | |

(1)Same store information represents the percent change in our Medicare, Non-Medicare and Total revenue, admissions or volume for the period as a percent of the Medicare, Non-Medicare and Total revenue, admissions or volume of the prior period. Same store is defined as care centers that we have operated for at least the last twelve months and startups that are an expansion of a same store care center.

(2)Total volume includes all admissions and recertifications.

(3)Total includes acquisitions, start-ups and de novos.

(4)Average Medicare revenue per completed episode is the average Medicare revenue earned for each Medicare completed episode of care.

(5)Medicare visits per completed episode are the home health Medicare visits on completed episodes divided by the home health Medicare episodes completed during the period.

Segment Information - Hospice

| | | | | | | | | | | |

| | For the Three-Month Periods

Ended December 31, |

| | 2024 | | 2023 |

Financial Information (in millions): | | | |

| Medicare | $ | 202.4 | | | $ | 194.2 | |

| Non-Medicare | 10.5 | | | 11.8 | |

| Net service revenue | 212.9 | | | 206.0 | |

| Cost of service, inclusive of depreciation | 112.2 | | | 107.8 | |

| Gross margin | 100.7 | | | 98.2 | |

| General and administrative expenses | 50.6 | | | 48.9 | |

| Depreciation and amortization | 0.8 | | | 0.9 | |

| Operating income | $ | 49.3 | | | $ | 48.4 | |

Same Store Growth(1): | | | |

| Medicare revenue | 4 | % | | 4 | % |

| Hospice admissions | (1 | %) | | (3 | %) |

| Average daily census | 1 | % | | — | % |

Key Statistical Data - Total(2): | | | |

| Hospice admissions | 12,157 | | | 12,226 | |

| Average daily census | 12,925 | | | 12,859 | |

| Revenue per day, net | $ | 179.02 | | | $ | 174.10 | |

| Cost of service per day | $ | 94.38 | | | $ | 91.18 | |

| Average discharge length of stay | 95 | | | 97 | |

| | | | | | | | | | | |

| | For the Years

Ended December 31, |

| | 2024 | | 2023 |

Financial Information (in millions): | | | |

| Medicare | $ | 783.9 | | | $ | 754.0 | |

| Non-Medicare | 41.9 | | | 44.8 | |

| Net service revenue | 825.8 | | | 798.8 | |

| Cost of service, inclusive of depreciation | 429.7 | | | 412.2 | |

| Gross margin | 396.1 | | | 386.6 | |

| General and administrative expenses | 197.1 | | | 193.1 | |

| Depreciation and amortization | 3.1 | | | 3.0 | |

| Operating income | $ | 195.9 | | | $ | 190.5 | |

Same Store Growth(1): | | | |

| Medicare revenue | 4 | % | | 1 | % |

| Hospice admissions | (2 | %) | | (5 | %) |

| Average daily census | — | % | | (1 | %) |

Key Statistical Data - Total(2): | | | |

| Hospice admissions | 48,426 | | | 49,587 | |

| Average daily census | 12,916 | | | 12,863 | |

| Revenue per day, net | $ | 174.68 | | | $ | 170.14 | |

| Cost of service per day | $ | 90.90 | | | $ | 87.80 | |

| Average discharge length of stay | 94 | | | 93 | |

(1)Same store information represents the percent change in our Medicare revenue, Hospice admissions or average daily census for the period as a percent of the Medicare revenue, Hospice admissions or average daily census of the prior period. Same store is defined as care centers that we have operated for at least the last twelve months and startups that are an expansion of a same store care center.

(2)Total includes acquisitions and de novos.

Segment Information - High Acuity Care

| | | | | | | | | | | |

| | For the Three-Month Periods

Ended December 31, |

| | 2024 | | 2023 |

Financial Information (in millions): | | | |

| Medicare | $ | — | | | $ | — | |

| Non-Medicare | 8.1 | | | 5.9 | |

| Net service revenue | 8.1 | | | 5.9 | |

| Cost of service, inclusive of depreciation | 6.1 | | | 5.6 | |

| Gross margin | 2.0 | | | 0.3 | |

| General and administrative expenses | 5.7 | | | 5.4 | |

| Depreciation and amortization | 0.9 | | | 0.8 | |

| Impairment | 48.4 | | | — | |

| Operating loss | $ | (53.0) | | | $ | (5.9) | |

| Key Statistical Data - Total: | | | |

| Full risk admissions | 248 | | | 105 | |

| Limited risk admissions | 659 | | | 600 | |

| Total admissions | 907 | | | 705 | |

| | | |

| Full risk revenue per episode | $ | 11,327 | | | $ | 10,919 | |

| Limited risk revenue per episode | $ | 6,525 | | | $ | 6,901 | |

| | | |

| Number of admitting joint ventures | 8 | | | 10 | |

| | | | | | | | | | | |

| | For the Years

Ended December 31, |

| | 2024 | | 2023 |

Financial Information (in millions): | | | |

| Medicare | $ | — | | | $ | — | |

| Non-Medicare | 32.0 | | | 19.0 | |

| Net service revenue | 32.0 | | | 19.0 | |

| Cost of service, inclusive of depreciation | 26.0 | | | 21.1 | |

| Gross margin | 6.0 | | | (2.1) | |

| General and administrative expenses | 22.7 | | | 20.4 | |

| Depreciation and amortization | 3.4 | | | 3.1 | |

| Impairment | 48.4 | | | — | |

| Operating loss | $ | (68.5) | | | $ | (25.6) | |

| Key Statistical Data - Total: | | | |

| Full risk admissions | 761 | | | 648 | |

| Limited risk admissions | 2,612 | | | 1,804 | |

| Total admissions | 3,373 | | | 2,452 | |

| | | |

| Full risk revenue per episode | $ | 10,470 | | | $ | 10,565 | |

| Limited risk revenue per episode | $ | 6,685 | | | $ | 6,187 | |

| | | |

| Number of admitting joint ventures | 8 | | | 10 | |

Segment Information - Personal Care (1)

| | | | | | | | | | | |

| | For the Years

Ended December 31, |

| | 2024 | | 2023 |

Financial Information (in millions): | | | |

| Medicare | $ | — | | | $ | — | |

| Non-Medicare | — | | | 15.0 | |

| Net service revenue | — | | | 15.0 | |

| Cost of service, inclusive of depreciation | — | | | 11.1 | |

| Gross margin | — | | | 3.9 | |

| General and administrative expenses | — | | | 2.3 | |

| Depreciation and amortization | — | | | — | |

| Operating income | $ | — | | | $ | 1.6 | |

| Key Statistical Data - Total: | | | |

| Billable hours | — | | | 440,464 | |

| Clients served | — | | | 7,892 | |

| Shifts | — | | | 191,379 | |

| Revenue per hour | $ | — | | | $ | 33.97 | |

| Revenue per shift | $ | — | | | $ | 78.19 | |

| Hours per shift | — | | | 2.3 | |

(1) We completed the sale of our personal care business on March 31, 2023.

Segment Information - Corporate

| | | | | | | | | | | |

| | For the Three-Month Periods

Ended December 31, |

| | 2024 | | 2023 |

Financial Information (in millions): | | | |

| General and administrative expenses | $ | 68.2 | | | $ | 64.1 | |

| Depreciation and amortization | 0.9 | | | 0.6 | |

| Total operating expenses | $ | 69.1 | | | $ | 64.7 | |

| | | | | | | | | | | |

| | For the Years

Ended December 31, |

| | 2024 | | 2023 |

Financial Information (in millions): | | | |

| General and administrative expenses | $ | 264.8 | | | $ | 237.5 | |

| Depreciation and amortization | 3.7 | | | 5.6 | |

| Total operating expenses | $ | 268.5 | | | $ | 243.1 | |

AMEDISYS, INC. AND SUBSIDIARIES

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES TO GAAP MEASURES

(Amounts in thousands)

(Unaudited)

Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization ("Adjusted EBITDA") Reconciliation: | | | | | | | | | | | | | | | | | | | | | | | |

| For the Three-Month Periods

Ended December 31, | | For the Years

Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net (loss) income attributable to Amedisys, Inc. | $ | (20,381) | | | $ | 19,322 | | | $ | 43,231 | | | $ | (9,747) | |

| Add: | | | | | | | |

| Income tax expense | 6,291 | | | 10,178 | | | 48,054 | | | 50,559 | |

| Interest expense, net | 4,229 | | | 7,416 | | | 22,654 | | | 28,004 | |

| Depreciation and amortization | 6,708 | | | 5,891 | | | 26,039 | | | 23,847 | |

Certain items(1) | 57,802 | | | 13,846 | | | 105,795 | | | 154,344 | |

Adjusted EBITDA(2)(5) | $ | 54,649 | | | $ | 56,653 | | | $ | 245,773 | | | $ | 247,007 | |

Adjusted Net Income Attributable to Amedisys, Inc Reconciliation: | | | | | | | | | | | | | | | | | | | | | | | |

| For the Three-Month Periods

Ended December 31, | | For the Years

Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net (loss) income attributable to Amedisys, Inc. | $ | (20,381) | | | $ | 19,322 | | | $ | 43,231 | | | $ | (9,747) | |

| Add: | | | | | | | |

Certain items(1) | 52,337 | | | 11,500 | | | 99,458 | | | 150,384 | |

Adjusted net income attributable to Amedisys, Inc.(3)(5) | $ | 31,956 | | | $ | 30,822 | | | $ | 142,689 | | | $ | 140,637 | |

Adjusted Net Income Attributable to Amedisys, Inc. per Diluted Share Reconciliation: | | | | | | | | | | | | | | | | | | | | | | | |

| For the Three-Month Periods

Ended December 31, | | For the Years

Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net (loss) income attributable to Amedisys, Inc. common stockholders per diluted share | $ | (0.62) | | | $ | 0.59 | | | $ | 1.31 | | | $ | (0.30) | |

| Add: | | | | | | | |

Certain items(1) | 1.58 | | | 0.35 | | | 3.01 | | | 4.60 | |

Adjusted net income attributable to Amedisys, Inc. common stockholders per diluted share(4)(5) | $ | 0.96 | | | $ | 0.94 | | | $ | 4.32 | | | $ | 4.30 | |

(1) The following details the certain items for the three-month periods and years ended December 31, 2024 and 2023:

Certain Items (in thousands):

| | | | | | | | | | | |

| For the Three-Month Period

Ended December 31, 2024 | | For the Year Ended

December 31, 2024 |

| (Income) Expense | | (Income) Expense |

| Certain Items Impacting General and Administrative Expenses: | | | |

| Merger-related expenses | $ | 17,401 | | | $ | 66,638 | |

| Impairment | 48,391 | | | 48,391 | |

| Certain Items Impacting Other Income (Expense): | | | |

| Other (income) expense, net | (2,123) | | | (3,367) | |

| Certain Items Impacting Net Loss Attributable to Noncontrolling Interests: | | | |

| Impairment | (5,867) | | | (5,867) | |

| Total | $ | 57,802 | | | $ | 105,795 | |

| Net of tax | $ | 52,337 | | | $ | 99,458 | |

| Diluted EPS | $ | 1.58 | | | $ | 3.01 | |

| | | | | | | | | | | |

| For the Three-Month Period

Ended December 31, 2023 | | For the Year Ended

December 31, 2023 |

| (Income) Expense | | (Income) Expense |

| Certain Items Impacting Cost of Service, Inclusive of Depreciation: | | | |

| Clinical optimization and reorganization costs | $ | 199 | | | $ | 595 | |

| Certain Items Impacting General and Administrative Expenses: | | | |

| Acquisition and integration costs | 180 | | | 3,286 | |

| CEO transition | 661 | | | 5,940 | |

| Merger-related expenses | 11,521 | | | 36,672 | |

| Clinical optimization and reorganization costs | 1,819 | | | 6,022 | |

| Personal care divestiture | — | | | 525 | |

| Certain Items Impacting Other Income (Expense): | | | |

| Other (income) expense, net* | (534) | | | 101,304 | |

| Total | $ | 13,846 | | | $ | 154,344 | |

| Net of tax | $ | 11,500 | | | $ | 150,384 | |

| Diluted EPS | $ | 0.35 | | | $ | 4.60 | |

*Includes $106,000 merger termination fee recorded during the year ended December 31, 2023

(2) Adjusted EBITDA is defined as net (loss) income attributable to Amedisys, Inc. before net interest expense, provision for income taxes and depreciation and amortization, excluding certain items as described in footnote 1.

(3) Adjusted net income attributable to Amedisys, Inc. is defined as net (loss) income attributable to Amedisys, Inc. calculated in accordance with GAAP excluding certain items as described in footnote 1.

(4) Adjusted net income attributable to Amedisys, Inc. common stockholders per diluted share is defined as diluted (loss) income per share calculated in accordance with GAAP excluding the earnings per share effect of certain items as described in footnote 1.

(5) Adjusted EBITDA, adjusted net income attributable to Amedisys, Inc. and adjusted net income attributable to Amedisys, Inc. common stockholders per diluted share should not be considered as an alternative to, or more meaningful than, income before income taxes or other measures calculated in accordance with GAAP. These calculations may not be comparable to a similarly titled measure reported by other companies, since not all companies calculate these non-GAAP financial measures in the same manner.

1 Amedisys Fourth Quarter 2024 Earnings Release Supplemental Slides February 26th, 2025 Exhibit 99.2

2 This presentation may include forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based upon current expectations and assumptions about our business that are subject to a variety of risks and uncertainties that could cause actual results to differ materially from those described in this presentation. You should not rely on forward-looking statements as a prediction of future events. Additional information regarding factors that could cause actual results to differ materially from those discussed in any forward-looking statements are described in reports and registration statements we file with the SEC, including our Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, copies of which are available on the Amedisys internet website http://www.amedisys.com or by contacting the Amedisys Investor Relations department at (225) 292-2031. We disclaim any obligation to update any forward-looking statements or any changes in events, conditions or circumstances upon which any forward-looking statement may be based except as required by law. www.amedisys.com NASDAQ: AMED We encourage everyone to visit the Investors Section of our website at www.amedisys.com, where we have posted additional important information such as press releases, profiles concerning our business, clinical operations and control processes and SEC filings. FORWARD-LOOKING STATEMENTS Exhibit 99.2

3 OUR KEY AREAS OF FOCUS Strategic areas of focus and progress made during 4Q’24. • Home Health: Total same store admissions +8% • Hospice: Total same store ADC +0.5% • High Acuity Care: Admissions +29% 1 Organic Growth • Quality: Amedisys Jan’25 STARS score of 4.18 • 88% of care centers at 4+ Stars based on Jan’25 final release • 11 Amedisys care centers rated at 5 Stars in the Jan’25 final release • Hospice quality – outperforming industry average in all hospice item set (HIS) categories 3 Clinical Initiatives • Focusing on optimizing RN / LPN & PT / PTA staffing ratios. • Current LPN Ratio: 47.2% • Current PTA Ratio: 54.4% 4 Capacity and Productivity • Pending merger with UnitedHealth Group Inc. 5 M&A 2 Recruiting / Retention • Targeting industry leading employee retention amongst all employee categories • 4Q’24 Voluntary Turnover 16.8% 2025 Reimbursement • Final Hospice industry rule – industry estimated impact +2.9% increase (effective 10/1/24) • Final Home Health industry rule – industry estimated impact +0.5% increase (effective 1/1/25) 6 Regulatory Exhibit 99.2

4 HIGHLIGHTS AND SUMMARY FINANCIAL RESULTS (ADJUSTED): 4Q’24(1) 1. The financial results for the three-month periods and years ended December 31, 2023 and December 31, 2024 are adjusted for certain items and should be considered a non-GAAP financial measure. A reconciliation of these non-GAAP financial measures is included in the corresponding 8-K detailing quarterly results for each respective reporting period. 2. Same Store volume – Includes admissions and recertifications. 3. Same Store is defined as care centers that we have operated for at least the last 12 months and startups that are an expansion of a same store care center. 4. Free cash flow is defined as cash flow from operations less routine capital expenditures and required debt repayments. Growth Metrics: • Total Admissions: 907 (+29%) • Number of admitting JVs: 8 Other Statistics: • Patient Satisfaction: 86% High Acuity Care Adjusted Financial Results Same Store (3): • Admissions: -0.5% • ADC: +0.5% Other Statistics: • Revenue per Day: $179.02 (+2.8%) • Cost per day: $93.82 (+3.4%) HospiceHome Health Same Store(3) : • Admissions: +8% • Volume(2): +7% Other Statistics: • Medicare Revenue per Episode: $3,030 (+1.1%) • Visiting Clinician Cost per Visit: $110.93 (+2.9%) Amedisys Consolidated • Revenue: +5% • EBITDA: $55M • EBITDA Margin: 9.1% • EPS: $0.96 Amedisys Consolidated Amedisys Consolidated Balance Sheet & Cash Flow • Net debt: $75.7M • Net Leverage ratio: 0.3x • Revolver availability: $511.2M • CFFO: $70.3M • Free cash flow (4): $59.8M • DSO: 43.0 (vs. Q3’24 of 44.4 and down 4.7 days vs prior year) $ in Millions, except EPS 4Q23 4Q24 FY 2023 FY 2024 Home Health 358.9$ 377.0$ 1,403.6$ 1,490.5$ Hospice 206.0 212.9 798.8 825.8 High Acuity Care 5.9 8.1 19.0 32.0 Personal Care - - 15.0 - Total Revenue 570.8$ 598.1$ 2,236.4$ 2,348.3$ Gross Margin % 44.0% 42.7% 44.6% 43.7% Adjusted EBITDA 56.7$ 54.6$ 247.0$ 245.8$ 9.9% 9.1% 11.0% 10.5% Adjusted EPS 0.94$ 0.96$ 4.30$ 4.32$ Free cash flow(4) 50.5$ 59.8$ 107.9$ 180.7$ Exhibit 99.2

5 56.3% 12.9% 30.8% Home Health Revenue Medicare FFS Private Episodic Per Visit & Case Rate 63.0% 35.6% 1.4% Amedisys Consolidated Revenue Home Health Hospice High Acuity Care • Medicare FFS: Reimbursed for a 30-day period of care • Private Episodic: MA and Commercial plans who reimburse us for a 30-day period of care or 60-day episode of care, majority of which range from 90% - 100% of Medicare rates • Per Visit & Case Rate: Managed care, Medicaid and private payors who reimburse us per visit performed or per admission 95.1% 4.9% Hospice Revenue Medicare FFS Private Hospice Per Day Reimbursement: • Routine Care: Patient at home with symptoms controlled, ~97% of the Hospice care provided • Continuous Care: Patient at home with uncontrolled symptoms • Inpatient Care: Patient in facility with uncontrolled symptoms • Respite Care: Patient at facility with symptoms controlled • Home Health: 347 care centers; 34 states & D.C. • Hospice: 164 care centers; 31 states • High Acuity Care: 8 admitting joint ventures; 7 states; 32 referring hospitals • Total: 519 care centers/joint ventures; 38 states and D.C. OUR REVENUE SOURCES: 4Q’24 Exhibit 99.2

6 HOME HEALTH AND HOSPICE SEGMENT (ADJUSTED) – 4Q’24(1) • Medicare revenue per episode up 1.1% primarily due to the rate increase effective 1/1/2024. • Y/Y Total CPV up $4.12 (+3.4%) primarily due to raises, wage inflation and higher health insurance costs. • EBITDA margin decreased 160 basis points driven by the growth in lower margin payors and wage inflation. Home Health Highlights • Net revenue per day +2.8% primarily due to the +2.9% Hospice rate update effective 10/1/2024. • Cost per day up $3.09 (+3.4%) primarily due to raises, wage inflation, an increase in RN hires and higher health insurance. • EBITDA margin down 40 basis points primarily due to higher labor costs partially offset by the 2025 rate increase (effective 10/1/2024). Hospice Highlights 1. The financial results for the three-month periods and years ended December 31, 2023 and December 31, 2024 are adjusted for certain items and should be considered a non-GAAP financial measure. A reconciliation of these non-GAAP financial measures is included in the corresponding 8-K detailing quarterly results for each respective reporting period. 2. Pre-Corporate EBITDA does not include any corporate G&A expenses. 3. Same Store information represents the percent change in volume, admissions or ADC for the period as a percent of the volume, admissions or ADC of the prior period. 4. Same Store is defined as care centers that we have operated for at least the last 12 months and startups that are an expansion of a same store care center. $ in Millions 4Q23 4Q24 2023 2024 Medicare 221.1$ 212.4$ 874.2$ 856.4$ Non-Medicare 137.8 164.6 529.4 634.1 Home Health Revenue $358.9 $377.0 $1,403.6 $1,490.5 Gross Margin % 42.5% 40.4% 43.3% 41.7% Pre-Corporate EBITDA(2) $59.9 $56.9 $245.6 $250.2 16.7% 15.1% 17.5% 16.8% Operating Statistics Same Store Growth(3)(4) Admissions 7% 8% 6% 11% Volume 5% 7% 4% 8% Medicare revenue per episode $2,997 $3,030 $2,998 $3,021 Medicare recert rate 32.0% 32.2% 32.8% 32.1% Total cost per visit $119.94 $124.06 $114.19 $119.65 Year Ended HOME HEALTH $ in Millions 4Q23 4Q24 2023 2024 Medicare 194.2$ 202.4$ 754.0$ 783.9$ Non-Medicare 11.8 10.5 44.8 41.9 Hospice Revenue $206.0 $212.9 $798.8 $825.8 Gross Margin % 47.9% 47.6% 48.6% 48.3% Pre-Corporate EBITDA(2) $50.9 $51.7 $198.3 $204.3 24.7% 24.3% 24.8% 24.7% Operating Statistics Admit growth - same store(3)(4) -3% -0.5% -5% -2% ADC growth - same store(3)(4) -0.2% 0.5% -1% 0.4% ADC 12,859 12,925 12,863 12,916 Avg. discharge length of stay 97 95 93 94 Revenue per day (net) $174.10 $179.02 $170.14 $174.68 Cost per day $90.73 $93.82 $87.41 $90.38 Year Ended HOSPICE Exhibit 99.2

7 GENERAL & ADMINISTRATIVE EXPENSES – ADJUSTED (1,2) Notes: • Year over year total G&A as a percentage of revenue decreased 60 basis points • $5.7 million increase in total G&A is primarily due to planned wage increases, higher incentive compensation costs and travel/training spend. • Total G&A increased ~$4 million sequentially primarily due to planned wage increases and a seasonality driven increase in health insurance costs. 1. The financial results for the three-month periods ended December 31, 2023, March 31, 2024, June 30, 2024, September 30, 2024 and December 31, 2024 are adjusted for certain items and should be considered a non-GAAP financial measure. A reconciliation of these non-GAAP financial measures is included in the corresponding 8-K detailing quarterly results for each respective reporting period. 2. Adjusted G&A expenses do not include depreciation and amortization. Impacted by raises and incentive compensation costs. 34.5% 33.8% 33.1% 33.7% 33.9% 32.0% 34.0% 36.0% 4Q23 1Q24 2Q24 3Q24 4Q24 Total G&A as a Percent of Revenue G&A as a Percent of Revenue $ in Millions 4Q23 1Q24 2Q24 3Q24 4Q24 Home Health Segment - Total 92.7$ 91.0$ 92.4$ 93.3$ 95.5$ % of HH Revenue 25.8% 25.0% 24.5% 25.0% 25.3% Hospice Segment - Total 48.6 48.0 48.7 49.7 50.6 % of HSP Revenue 23.6% 23.9% 23.9% 23.9% 23.8% High Acuity Care Segment - Total 5.4 5.9 5.4 5.7 5.7 % of HAC Revenue 91.4% 92.5% 55.1% 74.2% 70.4% Total Corporate Expenses 50.3 48.4 49.2 49.6 50.8 % of Total Revenue 8.8% 8.5% 8.3% 8.4% 8.5% Total 197.0$ 193.3$ 195.7$ 198.3$ 202.7$ % of Total Revenue 34.5% 33.8% 33.1% 33.7% 33.9% 4Q23 1Q24 2Q24 3Q24 4Q24 Salary and Benefits 29.4$ 27.6$ 27.4$ 29.9$ 30.3$ Other 16.9 16.6 17.4 15.6 16.3 Corp. G&A Subtotal 46.3 44.2 44.8 45.5 46.6 Non-cash comp 4.0 4.2 4.4 4.1 4.2 Adjusted Corporate G&A 50.3$ 48.4$ 49.2$ 49.6$ 50.8$ Exhibit 99.2

8 $25.00 $50.00 $75.00 $100.00 $125.00 4Q23 3Q24 4Q24 Cost Per Visit (CPV) Salaries Contractors Benefits Transportation OPERATIONAL EXCELLENCE: HOME HEALTH COST PER VISIT (CPV)-ADJUSTED YOY Total CPV impacted by higher labor costs and health insurance costs. *Note: Direct comparison with industry competitors’ CPV calculation $107.82 $108.09 $110.93 Components 4Q’23 3Q’24 4Q’24 YoY Variance Detail Initiatives Salaries $77.48 $79.20 $79.93 $2.45 YoY and Sequential increases due to planned wage increases, wage inflation and visit mix Staffing mix optimization, productivity and scheduling improvement initiatives in place to help overcome salary increases Contractors $5.88 $5.64 $5.65 $(0.23) YoY decrease due to lower rates Focused efforts on filling positions with full-time clinicians Benefits $16.85 $15.70 $17.76 $0.91 YoY increase due to higher payroll taxes on the salary increases described above and higher health insurance costs Sequential increase due to higher health insurance costs due to the seasonality of claims Focus on cost containment and spend optimization with specific focus on high-cost claims Transportation & Supplies $7.61 $7.55 $7.59 $(0.02) *Visiting Clinician CPV $107.82 $108.09 $110.93 $3.11 Clinical Managers $12.12 $12.65 $13.13 $1.01 Fixed cost associated with non-visiting clinicians YoY and Sequential variances due to planned wage increases and additional staff Unit cost reduced as volume increases Total CPV $119.94 $120.74 $124.06 $4.12 Exhibit 99.2

9 DRIVING TOP LINE GROWTH 5% 8% 9% 9% 7% 7% 10% 13% 12% 8% 0.0% 4.0% 8.0% 12.0% 16.0% 120,000 130,000 140,000 150,000 160,000 4Q23 1Q24 2Q24 3Q24 4Q24 Volume SS Volume Growth SS Admit Growth Home Health Growth Hospice Growth -0.2% 0.3% 0.4% 0.5% 0.5% -2.0% -1.0% 0.0% 1.0% 12,700 12,800 12,900 13,000 13,100 4Q23 1Q24 2Q24 3Q24 4Q24 ADC SS ADC Growth Exhibit 99.2

10 INDUSTRY LEADING QUALITY SCORES Quality of Patient Care (QPC) Patient Satisfaction (PS) • Amedisys maintains a 4-Star average in the Jan 2025 HHC Final release with 88% of our providers (representing 88% of care centers) at 4+ Stars and 46% of our providers (representing 42% of care centers) at 4.5+ Stars. •7 Amedisys providers (representing 11 care centers) rated at 5 Stars. Notes: (1) Jan 2025 QPC Star Final performance period = Apr 2023 – Mar 2024. (2) Jan 2025 PS Final performance period = Jul 2023 – Jun 2024. (3) QPC Star and PS Results for Amedisys Legacy providers only. (4) Only currently active care centers included in care center results. Metric Apr 24 Final Jul 24 Final Oct 24 Final Jan 25 Final Quality of Patient Care 4.35 4.32 4.24 4.18 Entities at 4+ Stars 95% 93% 89% 88% Metric Apr 24 Final July 24 Final Oct 24 Final Jan 25 Final Patient Satisfaction Star 3.72 3.77 3.78 4.02 Performance Over Industry +2% +3% +3% +4% 3.00 3.50 4.00 4.50 Apr 2022 Jul 2022 Oct 2022 Jan 2023 Apr 2023 Jul 2023 Oct 2023 Jan 2024 Apr 2024 Jul 2024 Oct 2024 Jan 2025 QPC Industry Performance Amedisys QPC Industry Avg QPC Top Competitor 3.00 3.50 4.00 4.50 Apr 2022 Jul 2022 Oct 2022 Jan 2023 Apr 2023 Jul 2023 Oct 2023 Jan 2024 Apr 2024 Jul 2024 Oct 2024 Jan 2025 PS Industry Performance Amedisys PS Industry Avg PS Top Competitor Exhibit 99.2

11 HOSPICE QUALITY: AMEDISYS HOSPICE CONTINUES TO MOVE TOWARDS BEST-IN-CLASS Hospice Quality Notes: Included in the above analysis are only active providers. CMS Nat is an average of all providers nationally, excluding active AMED providers. Exhibit 99.2

12 DEBT AND LIQUIDITY METRICS Net leverage ~0.3x 1. Net debt defined as total debt outstanding ($378.9M) less cash and cash equivalents ($303.2M). 2. Leverage ratio (net) is defined as net debt divided by last twelve months adjusted EBITDA ($245.8M). 3. Liquidity defined as the sum of cash balance and available revolving line of credit. Outstanding Term Loan 349.4$ Outstanding Revolver - Finance Leases 29.5 Total Debt Outstanding 378.9 Less: Deferred Debt Issuance Costs (1.6) Total Debt - Balance Sheet 377.3 Total Debt Outstanding 378.9 Less Cash & Cash Equivalents (Excludes Restricted Cash) (303.2) Net Debt (1) 75.7$ Leverage Ratio (net) (2) 0.3 Term Loan 450.0$ Revolver Size 550.0 Borrowing Capacity 1,000.0 Revolver Size 550.0 Outstanding Revolver - Letters of Credit (38.8) Available Revolver 511.2 Plus Cash & Cash Equivalents (Excludes Restricted Cash) 303.2 Total Liquidity (3) 814.4$ As of: 12/31/24 Credit Facility Outstanding Debt As of: 12/31/24 Exhibit 99.2

13 CASH FLOW STATEMENT HIGHLIGHTS (1) Total cash flow from operations for 4Q’24 positively impacted by the timing of the payment of accounts payable and accrued expenses. 1. Free cash flow defined as cash flow from operations less routine capital expenditures and required debt repayments. $ in Millions 4Q23 1Q24 2Q24 3Q24 4Q24 GAAP net income (loss) 1 9.0$ 1 4.6$ 32.6$ 1 6.5$ (25.5)$ Changes in working capital 21 .4 (36.8) 1 .0 7 5.2 34.0 Depreciation and amortization 5.9 6.1 6.4 6.8 6.7 Non-cash compensation 9.4 7 .9 8.3 6.2 8.2 Deferred income taxes 5.2 2 .6 4.0 0.8 - Impairment - - - - 48.4 Other (0.6) (0.9) - 0.1 (1 .5) Cash flow from operations 60.3 (6.5) 52.3 105.6 70.3 Capital expenditures - routine (0.9) (1 .2) (0.6) (1 .1 ) (0.9) Required debt repay ments (8.9) (8.9) (9.4) (9.3) (9.6) Free cash flow 50.5$ (16.6)$ 42.3$ 95.2$ 59.8$ Exhibit 99.2

14 INCOME STATEMENT ADJUSTMENTS (1) 1. The financial results for the three-month periods ended December 31, 2023, March 31, 2024, June 30, 2024, September 30, 2024 and December 31, 2024 are adjusted for certain items and should be considered a non-GAAP financial measure. A reconciliation of these non-GAAP financial measures is included in the corresponding 8-K detailing quarterly results for each respective reporting period. 4Q’24 adjustments primarily related to costs associated with pending merger and goodwill and intangibles impairment. $000s Income Statement Line Item 4Q23 1Q24 2Q24 3Q24 4Q24 Cost of Service Clinical optimization and reorganization costs Cost of Serv ice, Inclusiv e of Depreciation 1 99$ -$ -$ -$ -$ G&A Acquisition and integration costs General and Administrativ e Expenses 1 80 - - - - Clinical optimization and reorganization costs General and Administrativ e Expenses 1 ,81 9 - - - - Merger-related expenses General and Administrativ e Expenses 1 1 ,521 20,667 1 1 ,901 1 6,669 1 7 ,401 CEO transition General and Administrativ e Expenses 661 - - - - Impairment General and Administrativ e Expenses - - - - 48,391 Other Items Other (income) expense, net Other Income (Expense) (534) (37 1 ) (335) (538) (2,1 23) Impairment Net Loss Attributable to Noncontrolling Interests - - - - (5,867 ) Total 13,846$ 20,296$ 11,566$ 16,131$ 57,802$ EPS Impact 0.35$ 0.59$ 0.34$ 0.49$ 1.58$ EBITDA Impact 13,846$ 20,296$ 11,566$ 16,131$ 57,802$ Exhibit 99.2

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

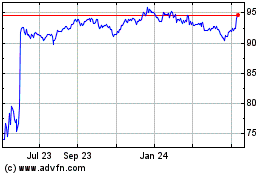

Amedisys (NASDAQ:AMED)

Historical Stock Chart

From Jan 2025 to Feb 2025

Amedisys (NASDAQ:AMED)

Historical Stock Chart

From Feb 2024 to Feb 2025