Statement of Ownership (sc 13g)

15 February 2022 - 8:16AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

13G

(Rule 13d-102)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED

PURSUANT TO RULES 13d-1 (b),

(c) AND (d) AND AMENDMENTS THERETO FILED PURSUANT TO 13d-2

(Amendment No. _____)

Amplitude, Inc.

(Name of Issuer)

Class A Common Stock

(Title of Class of

Securities)

03213A 10 4

(CUSIP Number)

December 31,

2021

(Date of Event Which Requires Filing of This Statement)

Check the appropriate box to designate the rule pursuant to which

this Schedule is filed:

¨ Rule 13d-1(b)

¨ Rule 13d-1(c)

x Rule 13d-1(d)

*The remainder of this cover page shall be

filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent

amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this

cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934

(“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of

the Act (however, see the Notes).

|

CUSIP NO. 03213A 10 4

|

13 G

|

Page 2 of 17 Pages

|

|

1

|

NAMES OF REPORTING PERSONS.

Institutional Venture Partners XV, L.P.

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a) ¨ (b)

x (1)

|

|

3

|

SEC USE ONLY

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH

|

5

|

SOLE VOTING POWER

0 shares

|

|

|

6

|

SHARED VOTING POWER

5,665,403 shares (2)

|

|

|

7

|

SOLE DISPOSITIVE POWER

0 shares

|

|

|

8

|

SHARED DISPOSITIVE POWER

5,665,403 shares (2)

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

5,665,403 shares (2)

|

|

10

|

CHECK BOX

IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES* o

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 9

10.5% of Class A Common Stock (5.2% of Total Common Stock) (3)

|

|

12

|

TYPE OF REPORTING PERSON*

PN

|

|

|

|

|

|

|

|

(1)

|

This Schedule 13G is filed by the Reporting Persons. The Reporting Persons expressly disclaim status as

a “group” for purposes of this Schedule 13G.

|

|

|

(2)

|

Consists of 5,610,449 shares of Class A Common Stock and 54,954 shares

of Class B Common Stock held by IVP XV. Each share of Class B Common Stock is convertible into Class A Common Stock at the option of the

holder on a share-for-share basis. IVM XV serves as the sole general partner of IVP XV and has

shared voting and investment control over the shares owned by IVP XV and may be deemed to own beneficially the shares held by IVP XV.

IVM XV owns no securities of the Issuer directly. Chaffee, Fogelsong, Harrick, Miller, Phelps, Maltz, Dash and Liaw are Managing Directors

of IVM XV and share voting and dispositive power over the shares held by IVP XV, and may be deemed to own beneficially the shares held

by IVP XV.

|

|

|

(3)

|

The percentages are based on 53,879,646 shares of Class A Common Stock and 55,015,748 shares of Class B

Common Stock reported to be outstanding as of November 3, 2021 in the Issuer’s Form 10-Q for the quarterly period ended

September 30, 2021 as filed with the Securities and Exchange Commission on November 9, 2021.

|

|

CUSIP NO. 03213A 10 4

|

13 G

|

Page 3 of 17 Pages

|

|

1

|

NAMES OF REPORTING PERSONS.

Institutional Venture Partners XV Executive Fund, L.P.

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a) ¨ (b)

x (1)

|

|

3

|

SEC USE ONLY

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH

|

5

|

SOLE VOTING POWER

0 shares

|

|

|

6

|

SHARED VOTING POWER

30,128 shares (2)

|

|

|

7

|

SOLE DISPOSITIVE POWER

0 shares

|

|

|

8

|

SHARED DISPOSITIVE POWER

30,128 shares (2)

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

30,128 shares (2)

|

|

10

|

CHECK BOX

IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES* o

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 9

0.1% of Class A Common Stock (0.0% of Total Common Stock) (3)

|

|

12

|

TYPE OF REPORTING PERSON*

PN

|

|

|

|

|

|

|

|

(1)

|

This Schedule 13G is filed by the Reporting Persons. The Reporting Persons expressly disclaim status as

a “group” for purposes of this Schedule 13G.

|

|

|

(2)

|

Consists of 29,837 shares of Class A Common Stock and 291 shares of

Class B Common Stock held by IVP XV EF. Each share of Class B Common Stock is convertible into Class A Common Stock at the option of the

holder on a share-for-share basis. IVM XV serves as the sole general partner of IVP XV

EF and has shared voting and investment control over the shares owned by IVP XV EF and may be deemed to own beneficially the shares held

by IVP XV EF. IVM XV owns no securities of the Issuer directly. Chaffee, Fogelsong, Harrick, Miller, Phelps, Maltz, Dash and Liaw are

Managing Directors of IVM XV and share voting and dispositive power over the shares held by IVP XV EF, and may be deemed to own beneficially

the shares held by IVP XV EF.

|

|

|

(3)

|

The percentages are based on 53,879,646 shares of Class A Common Stock and 55,015,748 shares of Class B

Common Stock reported to be outstanding as of November 3, 2021 in the Issuer’s Form 10-Q for the quarterly period ended

September 30, 2021 as filed with the Securities and Exchange Commission on November 9, 2021.

|

|

CUSIP NO. 03213A 10 4

|

13 G

|

Page 4 of 17 Pages

|

|

1

|

NAMES OF REPORTING PERSONS

Institutional Venture Management XV, LLC

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a) ¨ (b)

x (1)

|

|

3

|

SEC USE ONLY

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH

|

5

|

SOLE VOTING POWER

0 shares

|

|

|

6

|

SHARED VOTING POWER

5,695,531 shares (2)

|

|

|

7

|

SOLE DISPOSITIVE POWER

0 shares

|

|

|

8

|

SHARED DISPOSITIVE POWER

5,695,531 shares (2)

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

5,695,531 shares (2)

|

|

10

|

CHECK BOX

IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES* o

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 9

10.6% of Class A Common Stock (5.2% of Total Common Stock) (3)

|

|

12

|

TYPE OF REPORTING PERSON*

OO

|

|

|

|

|

|

|

|

(1)

|

This Schedule 13G is filed by the Reporting Persons. The Reporting Persons expressly disclaim status as

a “group” for purposes of this Schedule 13G.

|

|

|

(2)

|

Consists of (i) 5,610,449 shares of Class A Common Stock and 54,954

shares of Class B Common Stock held by IVP XV; and (ii) 29,837 shares of Class A Common Stock and 291 shares of Class B Common Stock held

by IVP XV EF. Each share of Class B Common Stock is convertible into Class A Common Stock at the option of the holder on a share-for-share

basis. IVM

XV serves as the sole general partner of IVP XV and IVP XV EF and has shared voting and investment control over the shares owned by IVP

XV and IVP XV EF and may be deemed to own beneficially the shares held by IVP XV and IVP XV EF. IVM XV owns no securities of the Issuer

directly. Chaffee, Fogelsong, Harrick, Miller, Phelps, Maltz, Dash and Liaw are Managing Directors of IVM XV and share voting and dispositive

power over the shares held by IVP XV and IVP XV EF, and may be deemed to own beneficially the shares held by IVP XV and IVP XV EF.

|

|

|

(3)

|

The percentages are based on 53,879,646 shares of Class A Common Stock and 55,015,748 shares of Class B

Common Stock reported to be outstanding as of November 3, 2021 in the Issuer’s Form 10-Q for the quarterly period ended

September 30, 2021 as filed with the Securities and Exchange Commission on November 9, 2021.

|

|

CUSIP NO. 03213A 10 4

|

13 G

|

Page 5 of 17 Pages

|

|

1

|

NAMES OF REPORTING PERSONS

Todd C. Chaffee

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a) ¨ (b)

x (1)

|

|

3

|

SEC USE ONLY

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America

|

NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH

|

5

|

SOLE VOTING POWER

49,672 shares

|

|

|

6

|

SHARED VOTING POWER

5,695,531 shares (2)

|

|

|

7

|

SOLE DISPOSITIVE POWER

49,672 shares

|

|

|

8

|

SHARED DISPOSITIVE POWER

5,695,531 shares (2)

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

5,745,203 shares (2)

|

|

10

|

CHECK BOX

IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES* o

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 9

10.7% of Class A Common Stock (5.3% of Total Common Stock) (3)

|

|

12

|

TYPE OF REPORTING PERSON*

IN

|

|

|

|

|

|

|

|

(1)

|

This Schedule 13G is filed by the Reporting Persons. The Reporting Persons expressly disclaim status as

a “group” for purposes of this Schedule 13G.

|

|

|

(2)

|

Includes (i) 5,610,449 shares of Class A Common Stock and 54,954 shares

of Class B Common Stock held by IVP XV; and (ii) 29,837 shares of Class A Common Stock and 291 shares of Class B Common Stock held by

IVP XV EF. Each share of Class B Common Stock is convertible into Class A Common Stock at the option of the holder on a share-for-share

basis. IVM

XV serves as the sole general partner of IVP XV and IVP XV EF and has shared voting and investment control over the shares owned by IVP

XV and IVP XV EF and may be deemed to own beneficially the shares held by IVP XV and IVP XV EF. IVM XV owns no securities of the Issuer

directly. Chaffee, Fogelsong, Harrick, Miller, Phelps, Maltz, Dash and Liaw are Managing Directors of IVM XV and share voting and dispositive

power over the shares held by IVP XV and IVP XV EF, and may be deemed to own beneficially the shares held by IVP XV and IVP XV EF.

|

|

|

(3)

|

The percentages are based on 53,879,646 shares of Class A Common Stock and 55,015,748 shares of Class B

Common Stock reported to be outstanding as of November 3, 2021 in the Issuer’s Form 10-Q for the quarterly period ended

September 30, 2021 as filed with the Securities and Exchange Commission on November 9, 2021.

|

|

CUSIP NO. 03213A 10 4

|

13 G

|

Page 6 of 17 Pages

|

|

1

|

NAMES OF REPORTING PERSONS

Norman A. Fogelsong

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a) ¨ (b)

x (1)

|

|

3

|

SEC USE ONLY

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America

|

NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH

|

5

|

SOLE VOTING POWER

32,974 shares

|

|

|

6

|

SHARED VOTING POWER

5,695,531 shares (2)

|

|

|

7

|

SOLE

DISPOSITIVE POWER

32,974 shares

|

|

|

8

|

SHARED DISPOSITIVE POWER

5,695,531 shares (2)

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

5,728,505 shares (2)

|

|

10

|

CHECK BOX

IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES* o

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 9

10.6% of Class A Common Stock (5.3% of Total Common Stock) (3)

|

|

12

|

TYPE OF REPORTING PERSON*

IN

|

|

|

|

|

|

|

|

(1)

|

This Schedule 13G is filed by the Reporting Persons. The Reporting Persons expressly disclaim status as

a “group” for purposes of this Schedule 13G.

|

|

|

(2)

|

Includes (i) 5,610,449 shares of Class A Common Stock and 54,954 shares

of Class B Common Stock held by IVP XV; and (ii) 29,837 shares of Class A Common Stock and 291 shares of Class B Common Stock held by

IVP XV EF. Each share of Class B Common Stock is convertible into Class A Common Stock at the option of the holder on a share-for-share

basis. IVM

XV serves as the sole general partner of IVP XV and IVP XV EF and has shared voting and investment control over the shares owned by IVP

XV and IVP XV EF and may be deemed to own beneficially the shares held by IVP XV and IVP XV EF. IVM XV owns no securities of the Issuer

directly. Chaffee, Fogelsong, Harrick, Miller, Phelps, Maltz, Dash and Liaw are Managing Directors of IVM XV and share voting and dispositive

power over the shares held by IVP XV and IVP XV EF, and may be deemed to own beneficially the shares held by IVP XV and IVP XV EF.

|

|

|

(3)

|

The percentages are based on 53,879,646 shares of Class A Common Stock and 55,015,748 shares of Class B

Common Stock reported to be outstanding as of November 3, 2021 in the Issuer’s Form 10-Q for the quarterly period ended

September 30, 2021 as filed with the Securities and Exchange Commission on November 9, 2021.

|

|

CUSIP NO. 03213A 10 4

|

13 G

|

Page 7 of 17 Pages

|

|

1

|

NAMES OF REPORTING PERSONS

Stephen J. Harrick

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a) ¨ (b)

x (1)

|

|

3

|

SEC USE ONLY

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America

|

NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH

|

5

|

SOLE VOTING POWER

94,206 shares

|

|

|

6

|

SHARED VOTING POWER

5,695,531 shares (2)

|

|

|

7

|

SOLE DISPOSITIVE POWER

94,206 shares

|

|

|

8

|

SHARED DISPOSITIVE POWER

5,695,531 shares (2)

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

5,789,737 shares (2)

|

|

10

|

CHECK BOX

IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES* o

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 9

10.7% of Class A Common Stock (5.3% of Total Common Stock) (3)

|

|

12

|

TYPE OF REPORTING PERSON*

IN

|

|

|

|

|

|

|

|

(1)

|

This Schedule 13G is filed by the Reporting Persons. The Reporting Persons expressly disclaim status as

a “group” for purposes of this Schedule 13G.

|

|

|

(2)

|

Includes (i) 5,610,449 shares of Class A Common Stock and 54,954 shares

of Class B Common Stock held by IVP XV; and (ii) 29,837 shares of Class A Common Stock and 291 shares of Class B Common Stock held by

IVP XV EF. Each share of Class B Common Stock is convertible into Class A Common Stock at the option of the holder on a share-for-share

basis. IVM

XV serves as the sole general partner of IVP XV and IVP XV EF and has shared voting and investment control over the shares owned by IVP

XV and IVP XV EF and may be deemed to own beneficially the shares held by IVP XV and IVP XV EF. IVM XV owns no securities of the Issuer

directly. Chaffee, Fogelsong, Harrick, Miller, Phelps, Maltz, Dash and Liaw are Managing Directors of IVM XV and share voting and dispositive

power over the shares held by IVP XV and IVP XV EF, and may be deemed to own beneficially the shares held by IVP XV and IVP XV EF.

|

|

|

(3)

|

The percentages are based on 53,879,646 shares of Class A Common Stock and 55,015,748 shares of Class B

Common Stock reported to be outstanding as of November 3, 2021 in the Issuer’s Form 10-Q for the quarterly period ended

September 30, 2021 as filed with the Securities and Exchange Commission on November 9, 2021.

|

|

CUSIP NO. 03213A 10 4

|

13 G

|

Page 8 of 17 Pages

|

|

1

|

NAMES OF REPORTING PERSONS

J. Sanford Miller

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a) ¨ (b)

x (1)

|

|

3

|

SEC USE ONLY

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America

|

NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH

|

5

|

SOLE VOTING POWER

25,909 shares

|

|

|

6

|

SHARED VOTING POWER

5,695,531 shares (2)

|

|

|

7

|

SOLE DISPOSITIVE POWER

25,909 shares

|

|

|

8

|

SHARED DISPOSITIVE POWER

5,695,531 shares (2)

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

5,721,440 shares (2)

|

|

10

|

CHECK BOX

IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES* o

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 9

10.6% of Class A Common Stock (5.3% of Total Common Stock) (3)

|

|

12

|

TYPE OF REPORTING PERSON*

IN

|

|

|

|

|

|

|

|

(1)

|

This Schedule 13G is filed by the Reporting Persons. The Reporting Persons expressly disclaim status as

a “group” for purposes of this Schedule 13G.

|

|

|

(2)

|

Includes (i) 5,610,449 shares of Class A Common Stock and 54,954 shares

of Class B Common Stock held by IVP XV; and (ii) 29,837 shares of Class A Common Stock and 291 shares of Class B Common Stock held by

IVP XV EF. Each share of Class B Common Stock is convertible into Class A Common Stock at the option of the holder on a share-for-share

basis. IVM

XV serves as the sole general partner of IVP XV and IVP XV EF and has shared voting and investment control over the shares owned by IVP

XV and IVP XV EF and may be deemed to own beneficially the shares held by IVP XV and IVP XV EF. IVM XV owns no securities of the Issuer

directly. Chaffee, Fogelsong, Harrick, Miller, Phelps, Maltz, Dash and Liaw are Managing Directors of IVM XV and share voting and dispositive

power over the shares held by IVP XV and IVP XV EF, and may be deemed to own beneficially the shares held by IVP XV and IVP XV EF.

|

|

|

(3)

|

The percentages are based on 53,879,646 shares of Class A Common Stock and 55,015,748 shares of Class B

Common Stock reported to be outstanding as of November 3, 2021 in the Issuer’s Form 10-Q for the quarterly period ended

September 30, 2021 as filed with the Securities and Exchange Commission on November 9, 2021.

|

|

CUSIP NO. 03213A 10 4

|

13 G

|

Page 9 of 17 Pages

|

|

1

|

NAMES OF REPORTING PERSONS

Dennis B. Phelps

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a) ¨ (b)

x (1)

|

|

3

|

SEC USE ONLY

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America

|

NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH

|

5

|

SOLE VOTING POWER

49,672 shares

|

|

|

6

|

SHARED VOTING POWER

5,695,531 shares (2)

|

|

|

7

|

SOLE DISPOSITIVE POWER

49,672 shares

|

|

|

8

|

SHARED DISPOSITIVE POWER

5,695,531 shares (2)

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

5,745,203 shares (2)

|

|

10

|

CHECK BOX

IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES* o

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 9

10.7% of Class A Common Stock (5.3% of Total Common Stock) (3)

|

|

12

|

TYPE OF REPORTING PERSON*

IN

|

|

|

|

|

|

|

|

(1)

|

This Schedule 13G is filed by the Reporting Persons. The Reporting Persons expressly disclaim status as

a “group” for purposes of this Schedule 13G.

|

|

|

(2)

|

Includes (i) 5,610,449 shares of Class A Common Stock and 54,954 shares

of Class B Common Stock held by IVP XV; and (ii) 29,837 shares of Class A Common Stock and 291 shares of Class B Common Stock held by

IVP XV EF. Each share of Class B Common Stock is convertible into Class A Common Stock at the option of the holder on a share-for-share

basis. IVM

XV serves as the sole general partner of IVP XV and IVP XV EF and has shared voting and investment control over the shares owned by IVP

XV and IVP XV EF and may be deemed to own beneficially the shares held by IVP XV and IVP XV EF. IVM XV owns no securities of the Issuer

directly. Chaffee, Fogelsong, Harrick, Miller, Phelps, Maltz, Dash and Liaw are Managing Directors of IVM XV and share voting and dispositive

power over the shares held by IVP XV and IVP XV EF, and may be deemed to own beneficially the shares held by IVP XV and IVP XV EF.

|

|

|

(3)

|

The percentages are based on 53,879,646 shares of Class A Common Stock and 55,015,748 shares of Class B

Common Stock reported to be outstanding as of November 3, 2021 in the Issuer’s Form 10-Q for the quarterly period ended

September 30, 2021 as filed with the Securities and Exchange Commission on November 9, 2021.

|

|

CUSIP NO. 03213A 10 4

|

13 G

|

Page 10 of 17 Pages

|

|

1

|

NAMES OF REPORTING PERSONS

Jules A. Maltz

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a) ¨ (b)

x (1)

|

|

3

|

SEC USE ONLY

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America

|

NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH

|

5

|

SOLE VOTING POWER

94,206 shares

|

|

|

6

|

SHARED VOTING POWER

5,695,531 shares (2)

|

|

|

7

|

SOLE DISPOSITIVE POWER

94,206 shares

|

|

|

8

|

SHARED DISPOSITIVE POWER

5,695,531 shares (2)

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

5,789,737 shares (2)

|

|

10

|

CHECK BOX

IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES* o

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 9

10.7% of Class A Common Stock (5.3% of Total Common Stock) (3)

|

|

12

|

TYPE OF REPORTING PERSON*

IN

|

|

|

|

|

|

|

|

(1)

|

This Schedule 13G is filed by the Reporting Persons. The Reporting Persons expressly disclaim status as

a “group” for purposes of this Schedule 13G.

|

|

|

(2)

|

Includes (i) 5,610,449 shares of Class A Common Stock and 54,954 shares

of Class B Common Stock held by IVP XV; and (ii) 29,837 shares of Class A Common Stock and 291 shares of Class B Common Stock held by

IVP XV EF. Each share of Class B Common Stock is convertible into Class A Common Stock at the option of the holder on a share-for-share

basis. IVM XV

serves as the sole general partner of IVP XV and IVP XV EF and has shared voting and investment control over the shares owned by IVP XV

and IVP XV EF and may be deemed to own beneficially the shares held by IVP XV and IVP XV EF. IVM XV owns no securities of the Issuer directly.

Chaffee, Fogelsong, Harrick, Miller, Phelps, Maltz, Dash and Liaw are Managing Directors of IVM XV and share voting and dispositive power

over the shares held by IVP XV and IVP XV EF, and may be deemed to own beneficially the shares held by IVP XV and IVP XV EF.

|

|

|

(3)

|

The percentages are based on 53,879,646 shares of Class A Common Stock and 55,015,748 shares of Class B

Common Stock reported to be outstanding as of November 3, 2021 in the Issuer’s Form 10-Q for the quarterly period ended

September 30, 2021 as filed with the Securities and Exchange Commission on November 9, 2021.

|

|

CUSIP NO. 03213A 10 4

|

13 G

|

Page 11 of 17 Pages

|

|

1

|

NAMES OF REPORTING PERSONS

Somesh Dash

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a) ¨ (b)

x (1)

|

|

3

|

SEC USE ONLY

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America

|

NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH

|

5

|

SOLE VOTING POWER

23,551 shares

|

|

|

6

|

SHARED VOTING POWER

5,695,531 shares (2)

|

|

|

7

|

SOLE DISPOSITIVE POWER

23,551 shares

|

|

|

8

|

SHARED DISPOSITIVE POWER

5,695,531 shares (2)

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

5,719,082 shares (2)

|

|

10

|

CHECK BOX

IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES* o

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 9

10.6% of Class A Common Stock (5.3% of Total Common Stock) (3)

|

|

12

|

TYPE OF REPORTING PERSON*

IN

|

|

|

|

|

|

|

|

(1)

|

This Schedule 13G is filed by the Reporting Persons. The Reporting Persons expressly disclaim status as

a “group” for purposes of this Schedule 13G.

|

|

|

(2)

|

Includes (i) 5,610,449 shares of Class A Common Stock and 54,954 shares

of Class B Common Stock held by IVP XV; and (ii) 29,837 shares of Class A Common Stock and 291 shares of Class B Common Stock held by

IVP XV EF. Each share of Class B Common Stock is convertible into Class A Common Stock at the option of the holder on a share-for-share

basis. IVM XV

serves as the sole general partner of IVP XV and IVP XV EF and has shared voting and investment control over the shares owned by IVP XV

and IVP XV EF and may be deemed to own beneficially the shares held by IVP XV and IVP XV EF. IVM XV owns no securities of the Issuer directly.

Chaffee, Fogelsong, Harrick, Miller, Phelps, Maltz, Dash and Liaw are Managing Directors of IVM XV and share voting and dispositive power

over the shares held by IVP XV and IVP XV EF, and may be deemed to own beneficially the shares held by IVP XV and IVP XV EF.

|

|

|

(3)

|

The percentages are based on 53,879,646 shares of Class A Common Stock and 55,015,748 shares of Class B

Common Stock reported to be outstanding as of November 3, 2021 in the Issuer’s Form 10-Q for the quarterly period ended

September 30, 2021 as filed with the Securities and Exchange Commission on November 9, 2021.

|

|

CUSIP NO. 03213A 10 4

|

13 G

|

Page 12 of 17 Pages

|

|

1

|

NAMES OF REPORTING PERSONS

Eric Liaw

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a) ¨ (b)

x (1)

|

|

3

|

SEC USE ONLY

|

|

4

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America

|

NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH

|

5

|

SOLE VOTING POWER

23,551 shares

|

|

|

6

|

SHARED VOTING POWER

5,695,531 shares (2)

|

|

|

7

|

SOLE DISPOSITIVE POWER

23,551 shares

|

|

|

8

|

SHARED DISPOSITIVE POWER

5,695,531 shares (2)

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

5,719,082 shares (2)

|

|

10

|

CHECK BOX

IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES* o

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 9

10.6% of Class A Common Stock (5.3% of Total Common Stock) (3)

|

|

12

|

TYPE OF REPORTING PERSON*

IN

|

|

|

|

|

|

|

|

(1)

|

This Schedule 13G is filed by the Reporting Persons. The Reporting Persons expressly disclaim status as

a “group” for purposes of this Schedule 13G.

|

|

|

(2)

|

Includes (i) 5,610,449 shares of Class A Common Stock and 54,954 shares

of Class B Common Stock held by IVP XV; and (ii) 29,837 shares of Class A Common Stock and 291 shares of Class B Common Stock held by

IVP XV EF. Each share of Class B Common Stock is convertible into Class A Common Stock at the option of the holder on a share-for-share

basis. IVM XV

serves as the sole general partner of IVP XV and IVP XV EF and has shared voting and investment control over the shares owned by IVP XV

and IVP XV EF and may be deemed to own beneficially the shares held by IVP XV and IVP XV EF. IVM XV owns no securities of the Issuer directly.

Chaffee, Fogelsong, Harrick, Miller, Phelps, Maltz, Dash and Liaw are Managing Directors of IVM XV and share voting and dispositive power

over the shares held by IVP XV and IVP XV EF, and may be deemed to own beneficially the shares held by IVP XV and IVP XV EF.

|

|

|

(3)

|

The percentages are based on 53,879,646 shares of Class A Common Stock and 55,015,748 shares of Class B

Common Stock reported to be outstanding as of November 3, 2021 in the Issuer’s Form 10-Q for the quarterly period ended

September 30, 2021 as filed with the Securities and Exchange Commission on November 9, 2021.

|

Introductory Note: This statement on

Schedule 13G is filed by the Reporting Persons with the Commission in respect of shares of Class A Common Stock (“Class A

Common Stock”), of Amplitude, Inc., a Delaware corporation (the “Issuer”).

Item 1

|

|

(a)

|

Name of Issuer:

|

Amplitude, Inc.

|

|

|

(b)

|

Address of Issuer’s Principal Executive Offices:

|

201 Third Street, Suite 200

San Francisco, California 94103

Item 2

|

|

(a)

|

Name of Reporting Persons Filing:

|

|

|

1.

|

Institutional Venture Partners XV, L.P. (“IVP XV”)

|

|

|

2.

|

IVP XV Executive Fund, L.P. (“IVP XV EF”)

|

|

|

3.

|

Institutional Venture Management XV, LLC (“IVM XV”)

|

|

|

4.

|

Todd C. Chaffee (“Chaffee”)

|

|

|

5.

|

Norman A. Fogelsong (“Fogelsong”)

|

|

|

6.

|

Stephen J. Harrick (“Harrick”)

|

|

|

7.

|

J. Sanford Miller (“Miller”)

|

|

|

8.

|

Dennis B. Phelps (“Phelps”)

|

|

|

9.

|

Jules A. Maltz (“Maltz”)

|

|

(b)

|

Address of Principal Business Office:

|

c/o Institutional Venture Partners

|

|

|

|

3000 Sand Hill Road, Building 2, Suite 250

|

|

|

|

Menlo Park, California 94025

|

|

IVP XV

|

Delaware

|

|

IVP XV EF

|

Delaware

|

|

IVM XV

|

Delaware

|

|

Chaffee

|

United States of America

|

|

Fogelsong

|

United States of America

|

|

Harrick

|

United States of America

|

|

Miller

|

United States of America

|

|

Phelps

|

United States of America

|

|

Maltz

|

United States of America

|

|

Dash

|

United States of America

|

|

Liaw

|

United States of America

|

|

|

(d)

|

Title of Class of Securities: Class A Common Stock

|

|

|

(e)

|

CUSIP

Number: 03213A 10 4

|

The following information with respect to the

ownership of the Common Stock by the Reporting Persons filing this statement on Schedule 13G is provided as of December 31, 2021:

|

Reporting Persons

|

|

Class B

Common

Stock Held

Directly (1)

|

|

|

Class A

Common Stock

Held Directly

(1)

|

|

|

Sole Voting/

Dispositive

Power

|

|

|

Shared

Voting/

Dispositive

Power (2)

|

|

|

Beneficial

Ownership

|

|

|

Percentage

of

Class A

Common Stock

(3)

|

|

|

Percentage of

Total Common

Stock (3)

|

|

|

IVP XV

|

|

|

54,954

|

|

|

|

5,610,449

|

|

|

|

0

|

|

|

|

5,695,531

|

|

|

|

5,695,531

|

|

|

|

10.6

|

%

|

|

|

5.2

|

%

|

|

IVP XV EF

|

|

|

291

|

|

|

|

29,837

|

|

|

|

0

|

|

|

|

5,695,531

|

|

|

|

5,695,531

|

|

|

|

10.6

|

%

|

|

|

5.2

|

%

|

|

IVM XV (2)

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

5,695,531

|

|

|

|

5,695,531

|

|

|

|

10.6

|

%

|

|

|

5.2

|

%

|

|

Chaffee (2)

|

|

|

0

|

|

|

|

49,672

|

|

|

|

49,672

|

|

|

|

5,695,531

|

|

|

|

5,745,203

|

|

|

|

10.7

|

%

|

|

|

5.3

|

%

|

|

Fogelsong (2)

|

|

|

0

|

|

|

|

32,974

|

|

|

|

32,974

|

|

|

|

5,695,531

|

|

|

|

5,728,505

|

|

|

|

10.6

|

%

|

|

|

5.3

|

%

|

|

Harrick (2)

|

|

|

0

|

|

|

|

94,206

|

|

|

|

94,206

|

|

|

|

5,695,531

|

|

|

|

5,789,737

|

|

|

|

10.7

|

%

|

|

|

5.3

|

%

|

|

Miller (2)

|

|

|

0

|

|

|

|

25,909

|

|

|

|

25,909

|

|

|

|

5,695,531

|

|

|

|

5,721,440

|

|

|

|

10.6

|

%

|

|

|

5.3

|

%

|

|

Phelps (2)

|

|

|

0

|

|

|

|

49,672

|

|

|

|

49,672

|

|

|

|

5,695,531

|

|

|

|

5,745,203

|

|

|

|

10.7

|

%

|

|

|

5.3

|

%

|

|

Maltz (2)

|

|

|

0

|

|

|

|

94,206

|

|

|

|

94,206

|

|

|

|

5,695,531

|

|

|

|

5,789,737

|

|

|

|

10.7

|

%

|

|

|

5.3

|

%

|

|

Dash (2)

|

|

|

0

|

|

|

|

23,551

|

|

|

|

23,551

|

|

|

|

5,695,531

|

|

|

|

5,719,082

|

|

|

|

10.6

|

%

|

|

|

5.3

|

%

|

|

Liaw (2)

|

|

|

0

|

|

|

|

23,551

|

|

|

|

23,551

|

|

|

|

5,695,531

|

|

|

|

5,719,082

|

|

|

|

10.6

|

%

|

|

|

5.3

|

%

|

|

|

(1)

|

Represents the number of shares of Class A Common Stock and Class B Common Stock as applicable,

held directly.

|

|

|

(2)

|

IVM XV serves as the sole general partner of IVP XV and IVP XV EF and has shared voting and investment

control over the shares owned by IVP XV and IVP XV EF and may be deemed to own beneficially the shares held by IVP XV and IVP XV EF. IVM

XV owns no securities of the Issuer directly. Chaffee, Fogelsong, Harrick, Miller, Phelps, Maltz, Dash and Liaw are Managing Directors

of IVM XV and share voting and dispositive power over the shares held by IVP XV and IVP XV EF, and may be deemed to own beneficially the

shares held by IVP XV and IVP XV EF.

|

|

|

(3)

|

The percentages are based on 53,879,646 shares of Class A Common Stock and 55,015,748 shares of Class B

Common Stock reported to be outstanding as of November 3, 2021 in the Issuer’s Form 10-Q for the quarterly period ended

September 30, 2021 as filed with the Securities and Exchange Commission on November 9, 2021.

|

|

|

Item 5

|

Ownership of Five Percent or Less of a Class.

|

If

this statement is being filed to report the fact that as of the date hereof, the reporting person has ceased to be the beneficial owner

of more than five percent of the class of securities, check the following: ¨

|

|

Item 6

|

Ownership of More Than Five Percent on Behalf of Another Person.

|

Not applicable.

|

|

Item 7

|

Identification and Classification of the Subsidiary which Acquired the Security Being Reported on by the Parent Holding Company.

|

Not applicable.

|

|

Item 8

|

Identification and Classification of Members of the Group.

|

Not applicable.

|

|

Item 9

|

Notice of Dissolution of Group.

|

Not applicable.

Not applicable.

SIGNATURE

After reasonable inquiry and to the best of my

knowledge and belief, I certify that the information set forth in the attached statement on Schedule 13G is true, complete and correct.

Dated: February 14, 2022

INSTITUTIONAL VENTURE PARTNERS XV, L.P.

IVP XV EXECUTIVE FUND, L.P.

By: Institutional Venture Management XV, LLC

Its: General Partner

|

By:

|

/s/ Tracy Hogan

|

|

|

Tracy Hogan, Attorney-in-Fact

|

|

|

|

|

|

INSTITUTIONAL VENTURE MANAGEMENT XV, LLC

|

|

|

|

|

|

By:

|

/s/ Tracy Hogan

|

|

|

Tracy Hogan, Attorney-in-Fact

|

|

|

|

|

|

/s/ Tracy Hogan

|

|

|

Tracy Hogan, Attorney-in-Fact for Todd C. Chaffee

|

|

|

|

|

|

/s/ Tracy Hogan

|

|

|

Tracy Hogan, Attorney-in-Fact for Norman A. Fogelsong

|

|

|

|

|

|

/s/ Tracy Hogan

|

|

|

Tracy Hogan, Attorney-in-Fact for Stephen J. Harrick

|

|

|

|

|

|

/s/ Tracy Hogan

|

|

|

Tracy Hogan, Attorney-in-Fact for J. Sanford Miller

|

|

|

|

|

|

/s/ Tracy Hogan

|

|

|

Tracy Hogan, Attorney-in-Fact for Dennis B. Phelps

|

|

|

|

|

|

/s/ Tracy Hogan

|

|

|

Tracy Hogan, Attorney-in-Fact for Jules A. Maltz

|

|

|

|

|

|

/s/ Tracy Hogan

|

|

|

Tracy Hogan, Attorney-in-Fact for Somesh Dash

|

|

|

|

|

|

/s/ Tracy Hogan

|

|

|

Tracy Hogan, Attorney-in-Fact for Eric Liaw

|

|

Exhibit(s):

A: Joint

Filing Statement

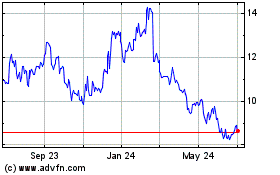

Amplitude (NASDAQ:AMPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

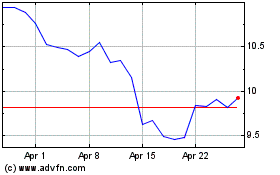

Amplitude (NASDAQ:AMPL)

Historical Stock Chart

From Apr 2023 to Apr 2024