Reports Net Combined Ratio of 80.1%

AMERISAFE, Inc. (Nasdaq: AMSF), a specialty provider of

workers’ compensation insurance focused on high hazard industries,

today announced results for the first quarter ended March 31,

2022.

Three Months Ended

March 31,

2022

2021

% Change

(in thousands, except per

share data)

Net premiums earned

$

67,556

$

70,746

-4.5%

Net investment income

6,113

6,583

-7.1%

Net realized gains on investments (pretax)

738

319

NM

Net unrealized gains on equity securities (pretax)

1,040

5,511

NM

Net income

17,331

19,312

-10.3%

Diluted earnings per share

$

0.89

$

0.99

-10.1%

Operating net income

15,926

14,706

8.3%

Operating earnings per share

$

0.82

$

0.76

7.9%

Book value per share

$

20.46

$

23.16

-11.7%

Net combined ratio

80.1%

84.6%

Return on average equity

17.4%

17.4%

G. Janelle Frost, President and Chief Executive Officer, noted,

“Providing protection for small to mid-sized businesses and care

for their injured workers, while returning value to our

shareholders is fundamental to our strategy. This quarter our

capital management approach included our regular quarterly dividend

and share repurchases. I believe the share repurchases, along with

our strong operating results, reinforces the confidence we have in

our long-term plans and underlying earnings power of our niche

business.”

INSURANCE RESULTS

Three Months Ended

March 31,

2022

2021

% Change

(in thousands) Gross premiums written

$

77,791

$

81,514

-4.6

%

Net premiums earned

67,556

70,746

-4.5

%

Loss and loss adjustment expenses incurred

37,741

39,517

-4.5

%

Underwriting and certain other operating costs, commissions,

salaries and benefits

15,113

18,967

-20.3

%

Policyholder dividends

1,189

1,350

-11.9

%

Underwriting profit (pre-tax)

$

13,513

$

10,912

23.8

%

Insurance Ratios: Current accident year loss ratio

71.0

%

72.0

%

Prior accident year loss ratio

-15.1

%

-16.1

%

Net loss ratio

55.9

%

55.9

%

Net underwriting expense ratio

22.4

%

26.8

%

Net dividend ratio

1.8

%

1.9

%

Net combined ratio

80.1

%

84.6

%

- Gross written premiums in the quarter were lower by $3.7

million, or 4.6%, compared with the first quarter of 2021.

Voluntary premiums were down 7.6% compared to the first quarter of

2021, driven by loss cost declines in state filings with the

average loss cost decline in the first quarter being 8.2%.

- Payroll audits and related premium adjustments were $2.5

million higher than the first quarter of 2021. Audits and other

adjustments increased premiums written by $2.8 million in the first

quarter of 2022, compared to an increase in premiums written of

$0.3 million in the first quarter of 2021.

- The current accident year loss ratio for the first quarter was

71.0%, one point lower than the 72.0% ratio initially set for

accident year 2021. During the quarter, the Company experienced

favorable net loss development for prior accident years, which

reduced loss and loss adjustment expenses by $10.2 million,

primarily from accident years 2019 through 2017. There was no

change to the reserve estimate on the catastrophic claim the

company experienced in the fourth quarter of 2021.

- For the quarter ended March 31, 2022, the underwriting expense

ratio was 22.4% compared with 26.8% in the same quarter in 2021.

The decrease was due to lower insurance assessments compared with

the first quarter of 2021, primarily due to a $3.8 million return

of assessments from the Minnesota Workers Compensation Reinsurance

Association.

- The effective tax rate for the quarter ended March 31, 2022 was

19.1%, higher than 18.3% in the first quarter of 2021 due to higher

underwriting pre-tax profits.

INVESTMENT RESULTS

Three Months Ended

March 31,

2022

2021

% Change

(in thousands) Net investment income

$

6,113

$

6,583

-7.1

%

Net realized gains on investments (pre-tax)

738

319

NM

Net unrealized gains on equity securities (pre-tax)

1,040

5,511

NM

Pre-tax investment yield

2.3

%

2.3

%

Tax-equivalent yield (1)

2.7

%

2.8

%

________________________________

(1) The tax equivalent yield is calculated using the effective

interest rate and the appropriate marginal tax rate.

- Net investment income for the quarter ended March 31, 2022,

decreased 7.1% to $6.1 million from $6.6 million in the first

quarter of 2021, primarily due to lower investment yields on

fixed-income securities.

- As of March 31, 2022, the carrying value of AMERISAFE’s

investment portfolio, including cash and cash equivalents, was $1.1

billion.

CAPITAL MANAGEMENT

During the first quarter of 2022, the Company repurchased 43,893

shares at an average cost of $46.90 per share for a total of $2.1

million. The remaining outstanding share repurchase authorization

is $22.9 million. No additional shares were repurchased from March

31, 2022 through April 25, 2022.

During the first quarter of 2022, the Company paid a regular

quarterly cash dividend of $0.31 per share on March 25, 2022 which

represented a 6.9% increase in the quarterly dividend compared with

2021. On April 26, 2022 the Company’s Board of Directors declared a

quarterly cash dividend of $0.31 per share, payable on June 24,

2022 to shareholders of record as of June 17, 2022.

Book value per share at March 31, 2022 was $20.46, a decrease of

0.8% from $20.62 at December 31, 2021.

SUPPLEMENTAL INFORMATION

Three Months Ended

March 31,

2022

2021

Net income

$

17,331

$

19,312

Less: Net realized gains on investments

738

319

Net unrealized gains on equity securities

1,040

5,511

Tax effect (1)

(373

)

(1,224

)

Operating net income (2)

$

15,926

$

14,706

Average shareholders’ equity (3)

$

397,298

$

443,221

Less: Average accumulated other comprehensive income

6,797

18,495

Average adjusted shareholders’ equity (2)

$

390,501

$

424,726

Diluted weighted average common shares

19,430,824

19,408,804

Return on average equity (4)

17.4

%

17.4

%

Operating return on average adjusted equity (2)

16.3

%

13.9

%

Diluted earnings per share

$

0.89

$

0.99

Operating earnings per share (2)

$

0.82

$

0.76

________________________________

(1)

The tax effect of net realized losses on

investments and net unrealized gains (losses) on equity securities

is calculated with an effective tax rate of 21%.

(2)

Operating net income, operating return on

average adjusted equity and operating earnings per share are

non-GAAP financial measures. Management believes that investors’

understanding of core operating performance is enhanced by

AMERISAFE’s disclosure of these financial measures.

(3)

Average shareholders’ equity is calculated

by taking the average of the beginning and ending shareholders’

equity.

(4)

Return on average equity is calculated by

dividing the annualized net income by the average shareholders’

equity.

CONFERENCE CALL INFORMATION

AMERISAFE has scheduled a conference call for April 28, 2022, at

10:30 a.m. Eastern Time to discuss the results for the quarter and

comment on future periods. To participate in the conference call,

dial 323-794-2551 (Conference Code 9718445) at least ten minutes

before the call begins.

Investors, analysts and the general public will also have the

opportunity to listen to the conference call over the Internet by

visiting http://www.amerisafe.com. To listen to the live call on

the web, please visit the website at least fifteen minutes before

the call begins to register, download and install any necessary

audio software. For those who cannot listen to the live webcast, an

archive will be available shortly after the call at

http://www.amerisafe.com.

ABOUT AMERISAFE

AMERISAFE, Inc. is a specialty provider of workers’ compensation

insurance focused on small to mid-sized employers engaged in

hazardous industries, principally construction, trucking, logging

and lumber, agriculture, and manufacturing. AMERISAFE actively

markets workers’ compensation insurance in 27 states.

FORWARD LOOKING STATEMENTS

Statements made in this press release that are not historical

facts, including statements accompanied by words such as “will,”

“believe,” “anticipate,” “expect,” “estimate,” or similar words are

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995 regarding AMERISAFE’s

plans and performance. These statements are based on management’s

estimates, assumptions and projections as of the date of this

release and are not guarantees of future performance and include

statements regarding management’s views and expectations of the

workers’ compensation market, the Company’s growth opportunities,

underwriting margins and actions by competitors. Actual results may

differ materially from the results expressed or implied in these

statements if the underlying assumptions prove to be incorrect or

as the results of risks, uncertainties and other factors. Other

factors that may affect our results are set forth in the Company’s

filings with the Securities and Exchange Commission, including

AMERISAFE’s Annual Report on Form 10-K for the year ended December

31, 2021. AMERISAFE cautions you not to place undue reliance on the

forward-looking statements contained in this release. AMERISAFE

does not undertake any obligation to publicly update or revise any

forward-looking statements to reflect future events, information or

circumstances that arise after the date of this release.

- Tables to Follow -

AMERISAFE, INC. AND

SUBSIDIARIES Consolidated Statements of Income (in

thousands)

Three Months Ended

March 31,

2022

2021

(unaudited) Revenues: Gross premiums written

$

77,791

$

81,514

Ceded premiums written

(2,559

)

(2,517

)

Net premiums written

$

75,232

$

78,997

Net premiums earned

$

67,556

$

70,746

Net investment income

6,113

6,583

Net realized gains on investments

738

319

Net unrealized gains on equity securities

1,040

5,511

Fee and other income

113

192

Total revenues

75,560

83,351

Expenses: Loss and loss adjustment expenses incurred

37,741

39,517

Underwriting and other operating costs

15,113

18,967

Policyholder dividends

1,189

1,350

Provision for investment related credit loss expense (benefit)

95

(108

)

Total expenses

54,138

59,726

Income before taxes

21,422

23,625

Income tax expense

4,091

4,313

Net income

$

17,331

$

19,312

AMERISAFE, INC. AND

SUBSIDIARIES Consolidated Statements of Income (cont.) (in

thousands, except per share amounts)

Three Months Ended

March 31,

2022

2021

(unaudited) Basic EPS: Net

income

$

17,331

$

19,312

Basic weighted average common shares

19,332,006

19,311,710

Basic earnings per share

$

0.90

$

1.00

Diluted EPS: Net income

$

17,331

$

19,312

Diluted weighted average common shares: Weighted average

common shares

19,332,006

19,311,710

Restricted stock

98,818

97,094

Diluted weighted average common shares

19,430,824

19,408,804

Diluted earnings per share

$

0.89

$

0.99

AMERISAFE, INC. AND

SUBSIDIARIES Consolidated Balance Sheets (in thousands)

March 31,

December 31,

2022

2021

(unaudited) Assets Investments

$

1,030,320

$

1,012,571

Cash and cash equivalents

30,741

70,722

Amounts recoverable from reinsurers

116,233

120,561

Premiums receivable, net

140,601

135,100

Deferred income taxes

17,602

14,384

Deferred policy acquisition costs

17,877

17,059

Other assets

38,007

32,327

$

1,391,381

$

1,402,724

Liabilities and Shareholders’ Equity Liabilities:

Reserves for loss and loss adjustment expenses

$

728,558

$

745,278

Unearned premiums

128,768

121,092

Insurance-related assessments

17,622

16,850

Other liabilities

121,160

120,181

Shareholders’ equity

395,273

399,323

Total liabilities and shareholders’ equity

$

1,391,381

$

1,402,724

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220427005756/en/

Neal A. Fuller, EVP & CFO AMERISAFE 337.463.9052

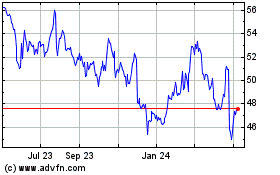

AMERISAFE (NASDAQ:AMSF)

Historical Stock Chart

From Mar 2024 to Apr 2024

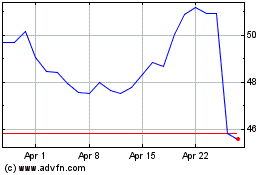

AMERISAFE (NASDAQ:AMSF)

Historical Stock Chart

From Apr 2023 to Apr 2024