Correction Notice to Press Release: Amesite Announces $2.3 Million Registered Direct Offering

31 August 2022 - 7:30AM

The press release dated August 30, 2022, contained a clerical

error: the expiration date of the warrants purchased under the

securities purchase agreement should have been five and one-half

years from the date of issuance. Complete corrected text follows:

Amesite, Inc. (NASDAQ: AMST), (“Amesite” or the

“Company”) a leading artificial intelligence software company

offering a cloud-based learning platform for business and education

markets, announces today that it has entered into securities

purchase agreements with institutional investors for the purchase

and sale of (i) 4,181,821 shares of common stock and (ii) warrants

to purchase 4,181,821 shares of common stock at a combined purchase

price of $0.55. The gross proceeds to Amesite from this offering

are expected to be approximately $2.3 million before deducting

placement agent fees and other estimated offering expenses. The

warrants will be exercisable commencing six months after the date

of their issuance, have an exercise price of $0.82 per share and

will expire five and one-half years from the date of issuance. The

offering is expected to close on or about September 1, 2022,

subject to customary closing conditions.

Laidlaw & Company (UK) Ltd. is acting as

sole placement agent for the offering.

This offering is being made pursuant to an

effective shelf registration statement on Form S-3 (No. 333-260666)

previously filed with the U.S. Securities and Exchange Commission

(the “SEC”) that was declared effective by the SEC on November 5,

2021. A prospectus supplement and accompanying prospectus

describing the terms of the proposed offering will be filed with

the SEC and will be available on the SEC’s website located at

http://www.sec.gov. Electronic copies of the prospectus supplement

may be obtained, when available, from Laidlaw & Company (UK)

Ltd., 521 Fifth Ave., 12th Floor, New York, NY 10175, Attention:

Syndicate Dept.; email: syndicate@laidlawltd.com. Before investing

in this offering, interested parties should read, in their

entirety, the prospectus supplement and the accompanying prospectus

and the other documents that Amesite. has filed with the SEC that

are incorporated by reference in such prospectus supplement and the

accompanying prospectus, which provide more information about

Amesite and such offering.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy these securities,

nor shall there be any sale of these securities in any state or

other jurisdiction in which such offer, solicitation or sale would

be unlawful prior to registration or qualification under the

securities laws of any such state or other jurisdiction. Any offer,

if at all, will be made only by means of the prospectus supplement

and accompanying prospectus forming a part of the effective

registration statement.

About Amesite Inc.

Amesite delivers its scalable, customizable,

white-labeled online learning platform to universities, businesses,

museums, and government agencies, enabling them to deliver

outstanding digital learning. Amesite provides a single system that

combines eCommerce, instruction, engagement, analytics, and

administration using best-in-class infrastructure to serve

multi-billion-dollar online learning markets. For more information,

visit www.amesite.io.

Forward Looking Statements

This press release contains certain

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, and Private Securities

Litigation Reform Act, as amended, including those relating to the

timing and completion of the proposed offering and other statement

that are predictive in nature. These statements may be identified

by the use of forward-looking expressions, including, but not

limited to, “expect,” “anticipate,” “intend,” “plan,” “believe,”

“estimate,” “potential,” “predict,” “project,” “should,” “would”

and similar expressions and the negatives of those terms. These

statements relate to future events and involve known and unknown

risks, uncertainties and other factors which may cause actual

results, performance or achievements to be materially different

from any results, performance or achievements expressed or implied

by the forward-looking statements. Such factors include the risk

factors set forth in the Company’s filings with the SEC, including,

without limitation, its Annual Report on Form 10-K for the year

ended June 30, 2021, its Quarterly Reports Form 10-Q, and its

Current Reports on Form 8-K, as well as the risks identified in the

shelf registration statement and the prospectus supplement relating

to the offering. Prospective investors are cautioned not to place

undue reliance on such forward-looking statements, which speak only

as of the date of this press release. Except as required by law,

Amesite undertakes no obligation to publicly update any

forward-looking statement, whether as a result of new information,

future events or otherwise.

Investor Relations Contact:

Christine PetragliaTraDigital IR(917)

633-8980christine@tradigitalir.com

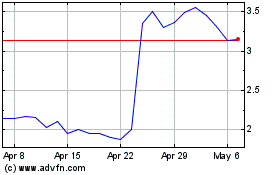

Amesite (NASDAQ:AMST)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amesite (NASDAQ:AMST)

Historical Stock Chart

From Apr 2023 to Apr 2024