As filed with the Securities and Exchange Commission

on March 14, 2023

Registration No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

S-1

REGISTRATION

STATEMENT

UNDER

THE SECURITIES ACT OF 1933

AMESITE

INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

7372 |

|

82-3431718 |

(State or other jurisdiction of

incorporation or organization) |

|

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S. Employer

Identification Number) |

607 Shelby Street

Suite 700 PMB 214

Detroit, MI

(734) 876-8130

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Ann Marie Sastry

Chief Executive Officer

Amesite Inc.

607 Shelby Street, Suite 700 PMB 214

Detroit, MI 48226

(734) 876-8130

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies to:

Richard A. Friedman, Esq.

Sean F. Reid, Esq.

Sheppard, Mullin, Richter & Hampton LLP

30 Rockefeller Plaza

New York, NY 10112

Tel: (212) 653-8700

Fax: (212) 653-8701

Approximate date of commencement

of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933 check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

Accelerated filer |

☐ |

| |

|

|

|

| Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

| |

|

|

|

| |

|

Emerging growth company |

☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

THE REGISTRANT HEREBY

AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE

A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION

8(a) OF THE SECURITIES ACT OF 1933, AS AMENDED, OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE SECURITIES

AND EXCHANGE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

THE INFORMATION IN

THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. THE SELLING STOCKHOLDERS MAY NOT RESELL THESE SECURITIES UNTIL THE REGISTRATION STATEMENT

FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS DECLARED EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND

IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

SUBJECT TO COMPLETION, DATED MARCH

14, 2023

PROSPECTUS

Amesite Inc.

366,665 Shares of Common Stock

The selling stockholders

of Amesite Inc. (“Amesite,” “we,” “us” or the “Company”) listed beginning on page 12

of this prospectus may offer and resell under this prospectus up to (i) 349,240 shares of our common stock, par value $0.0001 per share

(the “common stock”), issuable upon exercise of warrants (the “warrants”) acquired by certain of the selling

stockholders under the Purchase Agreements (defined below), (ii) up to 17,425 shares of our common stock issuable upon exercise of placement

agent warrants (the “placement agent warrants” and, together with the warrants, the “warrants”) acquired by certain

of the selling stockholders under the Placement Agent Agreement (defined below). The selling stockholders acquired the warrants from

us pursuant to securities purchase agreements (the “Purchase Agreements”), dated August 30, 2022, by and between the Company

and each of the purchasers named therein and placement agency agreement, dated August 30, 2022, by and among the Company and Laidlaw

& Company (UK) Ltd. (the “Placement Agent Agreement”).

We are registering the resale

of the shares of common stock covered by this prospectus as required by the Purchase Agreements. The selling stockholders will receive

all of the proceeds from any sales of the shares of common stock offered hereby. We will not receive any of the proceeds, but we will

incur expenses in connection with the offering. To the extent the warrants are exercised for cash, if at all, we will receive the exercise

price of the warrants.

The selling stockholders

may sell these shares through public or private transactions at market prices prevailing at the time of sale or at negotiated prices.

The timing and amount of any sale are within the sole discretion of the selling stockholders. Our registration of the shares of common

Stock covered by this prospectus does not mean that the selling stockholders will offer or sell any of the shares. For further information

regarding the possible methods by which the shares may be distributed, see “Plan of Distribution” beginning on page 13 of

this prospectus.

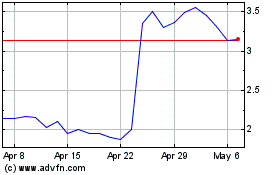

Our common stock is listed

on The Nasdaq Capital Market under the symbol “AMST.” The last reported sale price of our common stock on March 10, 2023 was

$2.80 per share.

We are an “emerging

growth company” under applicable Securities and Exchange Commission rules and, as such, we are subject to reduced public company

reporting requirements.

Investing in our common

stock is highly speculative and involves a significant degree of risk. Please consider carefully the specific factors set forth under

“Risk Factors” beginning on page 6 of this prospectus and in our filings with the Securities and Exchange Commission.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2023.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

The registration statement

we filed with the Securities and Exchange Commission (the “SEC”) includes exhibits that provide more detail of the matters

discussed in this prospectus. You should read this prospectus, the related exhibits filed with the SEC, and the documents incorporated

by reference herein before making your investment decision. You should rely only on the information provided in this prospectus and the

documents incorporated by reference herein or any amendment thereto. In addition, this prospectus contains summaries of certain provisions

contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the

summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed,

will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you

may obtain copies of those documents as described below under the heading “Where You Can Find More Information.”

The

selling stockholders named in this prospectus may sell up to 366,665 shares of our common

stock previously issued and issuable upon exercise of warrants to purchase shares of our common stock from time to time. This prospectus

also covers any shares of common stock that may become issuable as a result of share splits, share dividends, or similar transactions.

We have agreed to pay the expenses incurred in registering these shares, including legal and accounting fees.

We have not, and the selling

stockholders have not, authorized anyone to provide any information or to make any representations other than those contained in this

prospectus, the documents incorporated by reference herein or in any free writing prospectuses prepared by or on behalf of us or to which

we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that

others may give you. The information contained in this prospectus, the documents incorporated by reference herein or in any applicable

free writing prospectus is current only as of its date, regardless of its time of delivery or any sale of our securities. Our business,

financial condition, results of operations and prospects may have changed since that date.

The selling stockholders

are offering to sell, and seeking offers to buy, shares of our common stock only under circumstances and in jurisdictions where it is

lawful to do so. The selling stockholders are not making an offer to sell these securities in any state or jurisdiction where the offer

or sale is not permitted.

Unless the context otherwise

requires, “Amesite,” “AMST,” “the Company,” “we,” “us,” “our”

and similar terms refer to Amesite Inc.

Industry and Market Data

This prospectus or

the documents incorporated by reference herein includes statistical and other industry and market data that we obtained from industry

publications and research, surveys and studies conducted by third parties. Industry publications and third-party research, surveys and

studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee

the accuracy or completeness of such information.

PROSPECTUS SUMMARY

The following is a summary

of what we believe to be the most important aspects of our business and the offering of our securities under this prospectus. We urge

you to read this entire prospectus, including the more detailed consolidated financial statements, notes to the consolidated financial

statements and other information incorporated by reference from our other filings with the SEC or included in any applicable prospectus

supplement. Investing in our securities involves risks. Therefore, carefully consider the risk factors set forth in any prospectus supplements

and in our most recent annual and quarterly filings with the SEC, as well as other information in this prospectus and any prospectus supplements

and the documents incorporated by reference herein or therein, before purchasing our securities. Each of the risk factors could adversely

affect our business, operating results and financial condition, as well as adversely affect the value of an investment in our securities.

Overview

Amesite’s smart, intuitive

learning environments help organizations thrive. Amesite is a high tech artificial intelligence software company offering a cloud-based

platform and content creation services for business and university-delivered education and upskilling. Amesite-offered courses and programs

are branded to our part. Amesite uses artificial intelligence technologies to provide customized environments for learners, easy-to-manage

interfaces for instructors, and greater accessibility for learners in the US education market and beyond. We leverage existing institutional

infrastructures, adding mass customization and cutting-edge technology to provide cost-effective, scalable and engaging experiences for

learners anywhere.

We are passionate about improving

the learner experience and learner outcomes in online learning products, and improving our Customers’ ability to create and deliver

both. We are focused on creating the best possible technology solutions and have been awarded an innovation award for our product. We

are committed to our team, and have been recognized with 10 workplace excellence awards, 4 of them national.

Amesite offers our white label

platform to our customers: universities, museums, businesses and government agencies. Our customers offer learning to their users, who

are students, professional learners and / or their own employees. Amesite derives revenue from the licensing of our platform, and user

fees associated with its use by our customers for their users. Some of our customers generate revenue using our systems, including universities

and museums.

Recent Developments

Reverse Stock Split

On February 15, 2023, the Company held

a special meeting of stockholders (the “Special Meeting”).

At the Special Meeting,

the stockholders approved a proposal to amend the Company’s certificate of incorporation to effect a reverse split of the Company’s

outstanding shares of common stock, par value $0.0001 at a specific ratio within a range of one-for five (1-for-5) to a maximum of one-for-fifty

(1-for-50) to be determined by the Company’s board of directors in its sole discretion.

Following the Special

Meeting, the board of directors approved a one-for-twelve (1-for-12) reverse split of the Company’s issued and outstanding shares

of common stock (the “Reverse Stock Split”). On February 21, 2023, the Company filed with the Secretary of State of the State

of Delaware a certificate of amendment to its certificate of incorporation (the “Certificate of Amendment”) to effect the

Reverse Stock Split. The Reverse Stock Split became effective as of 4:01 p.m. Eastern Time on February 21, 2023, and the Company’s

common stock is expected to begin trading on a split-adjusted basis when the Nasdaq Stock Market opens on February 22, 2023.

When the Reverse Stock

Split became effective, every twelve (12) shares of the Company’s issued and outstanding common stock were automatically combined,

converted and changed into one (1) share the Company’s common stock, without any change in the number of authorized shares or the

par value per share. In addition, a proportionate adjustment was made to the per share exercise price and the number of shares issuable

upon the exercise of all outstanding stock options, restricted stock units and warrants to purchase shares of common stock and the number

of shares reserved for issuance pursuant to the company’s equity incentive compensation plans. Any fraction of a share of common

stock that would be created as a result of the Reverse Stock Split was rounded up to the next whole share.

All share and per share

information in this prospectus (other than the historical financial statements incorporated by reference herein) has been adjusted to

reflect the reverse stock split.

Implication of Being an Emerging Growth Company

We are an “emerging

growth company” as defined in the Jumpstart Our Business Startups Act of 2012, as amended (the “JOBS Act”). We will

remain an emerging growth company until the earlier of (1) the last day of the fiscal year following the fifth anniversary of the completion

of our initial public offering, (2) the last day of the fiscal year in which we have total annual gross revenues of at least $1.07 billion,

(3) the date on which we are deemed to be a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), which would occur if the market value of our common stock held by non-affiliates

exceeded $700.0 million as of the last business day of our most recently completed second fiscal quarter or (4) the date on which we have

issued more than $1.0 billion in non-convertible debt securities during the prior three-year period. An emerging growth company may take

advantage of specified reduced reporting requirements and is relieved of certain other significant requirements that are otherwise generally

applicable to public companies. As an emerging growth company,

| ● | we may reduce our executive

compensation disclosure; |

| ● | we may present only two years

of audited financial statements, plus unaudited condensed financial statements for any interim period, and related Management’s

Discussion and Analysis of Financial Condition and Results of Operations in this Prospectus; |

| ● | we may avail ourselves of the

exemption from the requirement to obtain an attestation and report from our auditors on the assessment of our internal control over financial

reporting pursuant to the Sarbanes-Oxley Act of 2002; and |

| ● | we may not require stockholder

non-binding advisory votes on executive compensation or golden parachute arrangements. |

We have availed ourselves

in this Prospectus of the reduced reporting requirements described above with respect to compensation disclosure requirements and selected

financial data. As a result, the information that we provide stockholders may be less comprehensive than what you might receive from other

public companies. When we are no longer deemed to be an emerging growth company, we will not be entitled to the exemptions provided in

the JOBS Act discussed above. We have not elected to avail ourselves of the exemption that allows emerging growth companies to extend

the transition period for complying with new or revised financial accounting standards. This election is irrevocable.

As a company with less than

$1.0 billion in revenue during our last fiscal year, we qualify as an “emerging growth company.”

Smaller Reporting Company

We are also currently a “smaller

reporting company,” meaning that we are not an investment company, an asset-backed issuer, or a majority-owned subsidiary of a parent

company that is not a smaller reporting company, and have a public float of less than $250 million or annual revenues of less than $100

million during the most recently completed fiscal year. In the event that we are still considered a “smaller reporting company,”

at such time as we cease being an “emerging growth company,” the disclosure we will be required to provide in our SEC filings

will increase, but will still be less than it would be if we were not considered either an “emerging growth company” or a

“smaller reporting company.” Specifically, similar to “emerging growth companies,” “smaller reporting companies”

are able to provide simplified executive compensation disclosures in their filings; are exempt from the provisions of Section 404(b) of

the Sarbanes-Oxley Act requiring that independent registered public accounting firms provide an attestation report on the effectiveness

of internal control over financial reporting; and have certain other decreased disclosure obligations in their SEC filings, including,

among other things, only being required to provide two years of audited financial statements in annual reports. Decreased disclosures

in our SEC filings due to our status as an “emerging growth company” or “smaller reporting company” may make it

harder for investors to analyze our results of operations and financial prospects.

Risks Associated with Our Business

Our business and our ability

to implement our business strategy are subject to numerous risks, as more fully described in the section entitled “Risk Factors”

in this prospectus and in our Annual Report on Form 10-K for the fiscal year ended June 30, 2022, incorporated herein by reference. You

should read these risks before you invest in our securities. We may be unable, for many reasons, including those that are beyond our control,

to implement our business strategy.

Corporate Information and History

The Company was incorporated

in November 2017. The Company is an artificial intelligence driven platform and course designer, that provides customized, high performance

and scalable online products for schools and businesses. The Company uses machine learning to provide a novel, mass customized experience

to learners. The Company’s customers are businesses, universities and colleges, and K-12 schools. The Company’s activities

are subject to significant risks and uncertainties. The Company’s operations are in one segment.

On September 18, 2020, we

consummated a reorganizational merger (the “Reorganization”), pursuant to an Agreement and Plan of Merger (the “Merger

Agreement”), dated July 14, 2020, whereby Amesite Inc. (“Amesite Parent”), our former parent corporation, merged with

and into us, with our Company resulting as the surviving entity. In connection with the same, we filed a Certificate of Ownership and

Merger with the Secretary of State of the State of Delaware, and changed our name from “Amesite Operating Company” to “Amesite

Inc.” The stockholders of Amesite Parent approved the Merger Agreement on August 4, 2020. The directors and officers of Amesite

Parent became our directors and officers.

Pursuant to the Merger Agreement,

on the Effective Date, each share of Amesite Parent’s common stock, $0.0001 par value per share, issued and outstanding immediately

before the Effective Date, was converted, on a one-for-one basis, into shares of our common stock. Additionally, each option or warrant

to acquire shares of Amesite Parent outstanding immediately before the Effective Date was converted into and became an equivalent option

to acquire shares of our common stock, upon the same terms and conditions.

Our corporate headquarters

are located at 607 Shelby Street, Suite 700 PMB 214, Detroit, Michigan 48226, and our telephone number is (734) 876-8130. We maintain

a website at www.amesite.com. The contents of, or information accessible through, our website are not part of this Annual Report on Form

10-K, and our website address is included in this document as an inactive textual reference only. We make our filings with the SEC, including

our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports, available

free of charge on our website as soon as reasonably practicable after we file such reports with, or furnish such reports to, the SEC.

The public may read and copy the materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington,

D.C. 20549. The public may also obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

Additionally, the SEC maintains an internet site that contains reports, proxy and information statements and other information. The address

of the SEC’s website is www.sec.gov. The information contained in the SEC’s website is not intended to be a part of this filing.

THE OFFERING

| Shares of Common Stock that May be Offered by the Selling Stockholders |

|

Up to 366,665 shares of common stock. |

| |

|

|

| Use of Proceeds |

|

We will not receive any proceeds from the sale of the common stock by the selling stockholders. However, if all of the warrants were exercised for cash, we would receive gross proceeds of approximately $3.6 million. See the section entitled “Use of Proceeds” in this prospectus. |

| |

|

|

| Offering Price |

|

The selling stockholders may sell all or a portion of their shares through public or private transactions at prevailing market prices or at privately negotiated prices. |

| |

|

|

| Nasdaq Capital Market Symbol |

|

AMST |

| |

|

|

| Risk Factors |

|

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 6 of this prospectus, and any other risk factors described in the documents incorporated by reference herein, for a discussion of certain factors to consider carefully before deciding to invest in our common stock. |

Throughout this prospectus,

when we refer to the shares of our common stock being registered on behalf of the selling stockholders for offer and sale, we are referring

to the shares of common stock issuable upon exercise of the warrants, each as described under “The Private Placement” and

“Selling Stockholders.” When we refer to the selling stockholders in this prospectus, we are referring to the selling stockholders

identified in this prospectus and, as applicable, their donees, pledgees, transferees or other successors-in-interest selling shares of

common stock or interests in shares of common stock received after the date of this prospectus from a selling stockholder as a gift, pledge,

partnership distribution or other transfer.

RISK FACTORS

Investing in our securities

involves a high degree of risk. You should carefully consider and evaluate all of the information contained in this prospectus and in

the documents we incorporate by reference into this prospectus before you decide to purchase our securities. In particular, you should

carefully consider and evaluate the risks and uncertainties described under the heading “Risk Factors” in our Annual Report

on Form 10-K for the year ended June 30, 2022. Any of the risks and uncertainties set forth below and in the Annual Report, as updated

by annual, quarterly and other reports and documents that we file with the SEC and incorporate by reference into this prospectus, or any

prospectus, could materially and adversely affect our business, results of operations and financial condition, which in turn could materially

and adversely affect the value of any securities offered by this prospectus. As a result, you could lose all or part of your investment.

THE PRIVATE PLACEMENT

On

August 30, 2022 (the “Effective Date”), we entered into a Securities Purchase Agreement (the “Purchase Agreement”)

with certain investors (the “Investors”) for the purpose of raising approximately $2.3 million in gross proceeds for the Company

(the “Offering”). Pursuant to the terms of the Purchase Agreement, we agreed to sell, in a registered direct offering, an

aggregate of 348,485 shares (the “Shares”) of our common stock, par value $0.0001 per share (the “Common Stock”),

and in a concurrent private placement, warrants to purchase an aggregate of 348,485 shares (the “Warrant Shares”) of Common

Stock (the “Warrants” and together with the Shares and the Warrant Shares, the “Securities”), for a combined purchase

price per Share and Warrant of $6.60 (the “Purchase Price”). The Warrants will be exercisable commencing six months after

the date of their issuance, have an exercise price of $9.84 per share and will expire five and one-half years from the date of issuance.

Laidlaw &

Company (UK) Ltd. acted as the exclusive placement agent (the “Placement Agent”) for the Company, on a “reasonable best

efforts” basis, in connection with the Offering. Pursuant to that certain Placement Agency Agreement, dated as of August 30, 2022,

by and between us and the Placement Agent (the “Placement Agency Agreement”), the Placement Agent will be entitled to a cash

fee equal to 8.0% of the gross proceeds from the placement of the total amount of Securities sold by the Placement Agent and a cash management

fee equal to 1% of the gross proceeds from the placement of the total amount of Securities sold in the Offering. In addition, the Placement

Agent will be issued a warrant (the “Placement Agent Warrant”) to purchase up to 17,425 shares (the “Placement Agent

Warrant Shares”) of Common Stock, substantially the same form as the Warrants, at an exercise price of $12.30 per share (125% of

the Purchase Price).

The

net proceeds to us from the registered direct offering and concurrent private placement, after deducting the Placement Agent’s fees

and expenses but before paying the Company’s estimated offering expenses, and excluding the proceeds, if any, from the exercise

of the Warrants and the Placement Agent Warrant, are expected to be approximately $2 million. The Company intends to use the net proceeds

from the Offering for working capital and for other general corporate purposes.

Pursuant

to the terms of the Purchase Agreement and subject to certain exceptions as set forth in the Purchase Agreement, from the Effective Date

until the 75th day after the Effective Date, we, may not, without the prior written consent of the Placement Agent and

Investors which purchased at least 67.0% in interest of the Shares offered in the Offering, (i) offer, pledge, sell, contract to sell,

sell any option or contract to purchase, purchase any option or contract to sell, grant any option, right or warrant to purchase, lend,

or otherwise transfer or dispose of, directly or indirectly, any shares of capital stock or any Common Stock Equivalents (as defined in

the Purchase Agreement); (ii) except in limited circumstances, file or cause to be filed any registration statement with the Securities

and Exchange Commission relating to the offering of any shares of capital stock of the Company or any securities convertible into or exercisable

or exchangeable for shares of capital stock of the Company, (iii) complete any offering of debt securities, other than entering into a

line of credit with a traditional bank or (iv) enter into any swap or other arrangement that transfers to another, in whole or in part,

any of the economic consequences of ownership of capital stock of the Company or any of its subsidiaries, whether any such transaction

described in clause (i), (ii), (iii) or (iv) above is to be settled by delivery of shares of capital stock or such other securities, in

cash or otherwise.

In

connection with the Purchase Agreement and Placement Agency Agreement, our directors, officers, entered into lock-up agreements for a

90-day period (the “Lock-Up Agreements”).

The

Shares (but not the Warrants or the Warrant Shares) were offered and sold by us pursuant to effective registration

statements on Form S-3 (File Nos. 333-260666), as well as a prospectus supplement in connection

the Offering filed with the SEC.

The foregoing description of the material terms

of the Purchase Agreement, the Warrant, the Placement Agent Warrant, the Placement Agency Agreement and the Lock-Up Agreements does not

purport to be complete and is qualified in its entirety by reference to the full text of the form of Purchase Agreement, form of Warrant,

form of Placement Agent Warrant, form of Placement Agency Agreement and form of Lock-Up Agreement, copies of which are filed as Exhibits

10.1, 4.1, 4.2, 10.2 and 10.3, respectively, to the Current Report on Form 8-K dated September 1, 2022, and are incorporated herein by

reference.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents

incorporated by reference in this prospectus contain “forward-looking statements,” which include information relating to future

events, future financial performance, financial projections, strategies, expectations, competitive environment and regulation. Words such

as “may,” “should,” “could,” “would,” “predicts,” “potential,”

“continue,” “expects,” “anticipates,” “future,” “intends,” “plans,”

“believes,” “estimates,” and similar expressions, as well as statements in future tense, identify forward-looking

statements. Forward-looking statements should not be read as a guarantee of future performance or results and may not be accurate indications

of when such performance or results will be achieved. Forward-looking statements are based on information we have when those statements

are made or management’s good faith belief as of that time with respect to future events, and are subject to a number of risks,

and uncertainties and assumptions that could cause actual performance or results to differ materially from those expressed in or suggested

by the forward-looking statements. These risks are more fully described in the “Risk Factors” section of this prospectus.

The following is a summary of such risks:

| ● | our ability to continue as a going concern; |

| ● | our planned online machine learning platform’s ability

to enable universities and other clients to offer timely, improved popular courses and certification programs, without becoming software

tech companies; |

| ● | our planned online machine learning platform’s ability

to result in opportunistic incremental revenue for colleges, universities and other clients, and improved ability to garner state funds

due to increased retention and graduation rates through use of machine learning and natural language processing; |

| ● | our ability to obtain additional funds for our operations; |

| ● | our ability to obtain and maintain intellectual property

protection for our technologies and our ability to operate our business without infringing the intellectual property rights of others; |

| ● | our reliance on third parties to conduct our business and

studies; |

| ● | our reliance on third party designers, suppliers, and Partners

to provide and maintain our learning platform; |

| ● | our ability to attract and retain qualified key management

and technical personnel; |

| ● | our expectations regarding the time during which we will

be an emerging growth company under the Jumpstart Our Business Startups Act, or JOBS Act; |

| ● | our financial performance; |

| ● | the impact of government regulation and developments relating

to our competitors or our industry; and |

| ● | other risks and uncertainties, including those listed under

the caption “Risk Factors.” |

These statements relate to

future events or our future operational or financial performance, and involve known and unknown risks, uncertainties and other factors

that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements

expressed or implied by these forward-looking statements. Factors that may cause actual results to differ materially from current expectations

include, among other things, those listed under the section titled “Risk Factors” and elsewhere in this prospectus.

Any forward-looking statement

in this prospectus reflects our current view with respect to future events and is subject to these and other risks, uncertainties and

assumptions relating to our business, results of operations, industry and future growth. Given these uncertainties, you should not place

undue reliance on these forward-looking statements. No forward-looking statement is a guarantee of future performance. You should read

this prospectus, and the documents that we reference herein and have filed as exhibits hereto completely and with the understanding that

our actual future results may be materially different from any future results expressed or implied by these forward-looking statements.

Except as required by law, we assume no obligation to update or revise these forward-looking statements for any reason, even if new information

becomes available in the future

This prospectus also contains,

or may contain, estimates, projections and other information concerning our industry, our business and the markets for our products, including

data regarding the estimated size of those markets and their projected growth rates. Information that is based on estimates, forecasts,

projections or similar methodologies is inherently subject to uncertainties and actual events or circumstances may differ materially from

events and circumstances reflected in this information. Unless otherwise expressly stated, we obtained these industry, business, market

and other data from reports, research surveys, studies and similar data prepared by third parties, industry and general publications,

government data and similar sources. In some cases, we do not expressly refer to the sources from which these data are derived.

USE OF PROCEEDS

We are not selling any shares

of our common stock in this offering and we will not receive any of the proceeds from the sale of shares of our common stock by the selling

stockholders. The selling stockholders will receive all of the proceeds from any sales of the shares of our common stock offered hereby.

However, we will incur expenses in connection with the registration of the shares of our common stock offered hereby.

We will receive the exercise

price upon any exercise of the warrants, to the extent exercised on a cash basis. If all the warrants were exercised for cash, we would

receive gross proceeds of approximately $3.6 million. However, the holders of the warrants are not obligated to exercise the warrants,

and we cannot predict whether or when, if ever, the holders of the warrants will choose to exercise the warrants, in whole or in part.

Accordingly, any proceeds from such exercise will be used for general corporate purposes and working capital.

MARKET FOR COMMON STOCK AND DIVIDEND POLICY

Our common stock is traded

on the Nasdaq Capital Market under the symbol “AMST.” The last reported sale price of our common stock on March 10, 2023 on

the Nasdaq Capital Market was $2.80 per share. As of March 10, 2023, there were 39 stockholders of record of our common stock.

We have never declared or

paid any cash dividend on our common stock. We intend to retain any future earnings and do not expect to pay dividends in the foreseeable

future.

SECURITY OWNERSHIP OF BENEFICIAL OWNERS AND

MANAGEMENT

The following table sets

forth certain information regarding beneficial ownership of shares of our common stock as of March 10, 2023, based on 2,533,359 shares

of common stock and 100,000 shares of Series A preferred stock issued and outstanding by (i) each person known to beneficially own more

than 5% of our outstanding common stock, (ii) each of our directors and director nominees, (iii) our named executive officers and (iv)

all directors and executive officers as a group. Shares are beneficially owned when an individual has voting and/or investment power over

the shares or could obtain voting and/or investment power over the shares within 60 days of the March 10, 2023. Except as otherwise indicated,

the persons named in the table have sole voting and investment power with respect to all shares beneficially owned, subject to community

property laws, where applicable. Unless otherwise indicated, the address of each beneficial owner listed below is c/o Amesite Inc., 607

Shelby Street, Suite 700 PMB 214, Detroit, Michigan 48226.

| Name of Beneficial Owner and Title of Officers and Directors | |

Shares of Common Stock Beneficially Owned | | |

Percentage | |

| | |

| | |

| |

| Ann Marie Sastry, Ph.D., President, Chief Executive Officer, and Chairman of the Board (1) | |

| 575,848 | | |

| 22.3 | % |

| Sherlyn W. Farrell, Chief Financial Officer | |

| - | | |

| * | |

| J. Michael Losh, Director (2) | |

| 37,587 | | |

| 1.5 | % |

| Gilbert S. Omenn, M.D., Ph.D., Director (3) | |

| 21,510 | | |

| * | % |

| Richard T. Ogawa, Director (4) | |

| 57,726 | | |

| 2.2 | % |

| Anthony M. Barkett, Director (5) | |

| 31,493 | | |

| 1.2 | % |

| Barbie Brewer, Director (6) | |

| 27,083 | | |

| 1.1 | % |

| George Parmer, Director | |

| 84,167 | | |

| 3.3 | % |

| All Officers and Directors as a Group (8 persons) (7) | |

| 835,414 | | |

| 30.6 | % |

| | |

| | | |

| | |

| Beneficial Owner Greater than 5% Stockholders | |

| | | |

| | |

| Mark Tompkins (8) | |

| 170,259 | | |

| 6.7 | % |

| (1) |

Includes (i) 532,098 shares of common stock held by Dr. Sastry and (ii)

43,750 shares of common stock underlying options that are presently exercisable or exercisable within 60 days of March 10, 2023 held by

Dr. Sastry. |

| |

|

| (2) |

Includes (i) 3,472 shares of common stock held by Mr. Losh and (ii) 34,115 shares of common stock underlying options that are presently exercisable or exercisable within 60 days of March 10, 2023 held by Mr. Losh. |

| |

|

| (3) |

Includes (i) 3,472 shares of common stock held by Dr. Omenn and (ii) 18,038 shares of common stock underlying options that are presently exercisable or exercisable within 60 days of March 10, 2023 held by Dr. Omenn. |

| |

|

| (4) |

Includes (i) 5,556 shares of common stock held by Mr. Ogawa and (ii) 52,170 shares of common stock underlying options that are presently exercisable or exercisable within 60 days of March 10, 2023 held by Mr. Ogawa. |

| |

|

| (5) |

Includes (i) 4,167 shares of common stock held by Mr. Barkett and (ii) 27,326 shares of common stock underlying options that are presently exercisable or exercisable within 60 days of March 10, 2023 held by Mr. Barkett. |

| (6) |

Includes (i) 2,083 shares of common stock held by Ms. Brewer and (ii) 27,083 shares of common stock underlying options that are presently exercisable or exercisable within 60 days of March 10, 2023 held by Ms. Brewer. |

| (7) |

Includes 200,399 shares of common stock underlying options that are either presently exercisable or exercisable within 60 days of March 10, 2023 held by all directors and officers as a group. |

| |

|

| (8) |

Mr. Tompkins’s address is Apt 1, via Guidino 23, 6900 Lugano, Paradiso, Switzerland. Mr. Tompkins has voting and dispositive authority over the shares. |

SELLING STOCKHOLDERS

The common stock being offered

by the selling stockholders are those issuable to the selling stockholders upon exercise of the warrants. For additional information regarding

the issuance of the warrants, see “The Private Placement” above. We are registering the shares of common stock in order to

permit the selling stockholders to offer the shares for resale from time to time. Except as described below, to our knowledge, none of

the selling stockholders has been an officer or director of ours or of our affiliates within the past three years or has any material

relationship with us or our affiliates within the past three years. Our knowledge is based on information provided by the selling stockholders

in connection with the filing of this prospectus.

The table below lists the

selling stockholders and other information regarding the beneficial ownership of the shares of common stock by each of the selling stockholders.

The second column lists the number of shares of common stock beneficially owned by each selling stockholder, based on its ownership of

the shares of common stock, options to purchase common stock, and warrants, as of March 10, 2023, assuming exercise of the warrants held

by the selling stockholders on that date, without regard to any limitations on exercises. The third column lists the maximum number of

shares of common stock that may be sold or otherwise disposed of by the selling stockholders pursuant to the registration statement of

which this prospectus forms a part. The selling stockholders may sell or otherwise dispose of some, all or none of their shares. Pursuant

to Rules 13d-3 and 13d-5 of the Exchange Act, beneficial ownership includes any shares of our common stock as to which a stockholders

has sole or shared voting power or investment power, and also any shares of our common stock which the stockholder has the right to acquire

within 60 days of March 10, 2023. The percentage of beneficial ownership for the selling stockholders is based on 2,533,359 shares of our

common stock outstanding as of March 10, 2023 and the number of shares of our common stock issuable upon exercise or conversion of convertible

securities that are currently exercisable or convertible or are exercisable or convertible within 60 days of March 10, 2023 beneficially

owned by the applicable selling stockholder. The fourth column assumes the sale of all of the shares of common stock offered by the selling

stockholders pursuant to this prospectus.

Under the terms of the warrants,

a selling stockholder may not exercise the warrants to the extent such exercise would cause such selling stockholder, together with its

affiliates and attribution parties, to beneficially own a number of shares of common stock which would exceed 4.99% (or for certain holders,

9.99%) of our then outstanding common stock following such exercise, excluding for purposes of such determination shares of common stock

issuable upon exercise of the warrants which have not been exercised. The number of shares in the second column does not reflect this

limitation. The selling stockholders may sell all, some or none of their shares in this offering. See “Plan of Distribution.”

Information about the selling

stockholders may change over time. Any changed information will be set forth in an amendment to the registration statement or supplement

to this prospectus, to the extent required by law. Unless otherwise noted below, the address of each selling stockholder listed on the

table is c/o Amesite Inc., 607 Shelby Street, Suite 700 PMB 214, Detroit, MI 48226.

| | |

Beneficial Ownership Prior to the Offering(1) | | |

Maximum | | |

Beneficial Ownership After the Offering(2) | |

| Name of Selling Stockholder | |

Number of

Shares of

Common

Stock

Beneficially

Owned Prior

to the

Offering | | |

Percentage

of

Outstanding

Common

Stock(2) | | |

Number of

Shares of

Common

Stock

To Be Sold

Pursuant

to this

Prospectus | | |

Number of

Shares of

Common

Stock

Beneficially

Owned

After the

Offering | | |

Percentage of

Outstanding

Common

Stock(2) | |

| Donald Garlikov | |

| 181,819 | | |

| 7.2 | % | |

| 91,660 | | |

| 90,159 | | |

| 3.6 | % |

| CVI Investment, Inc. | |

| 90,910 | | |

| 3.6 | % | |

| 45,455 | | |

| 45,455 | | |

| 1.8 | % |

| 3I, LP | |

| 75,758 | | |

| 3.0 | % | |

| 37,879 | | |

| 37,879 | | |

| 1.5 | % |

| Lincoln Park Capital, LLC | |

| 75,758 | | |

| 3.0 | % | |

| 37,879 | | |

| 37,879 | | |

| 1.5 | % |

| Warberg WFX LP | |

| 75,758 | | |

| 3.0 | % | |

| 37,879 | | |

| 37,879 | | |

| 1.5 | % |

| Iroquois Capital Investment Group | |

| 54,538 | | |

| 2.2 | % | |

| 27,273 | | |

| 27,265 | | |

| 1.1 | % |

| Iroquois Master Fund Ltd. | |

| 36,364 | | |

| 1.4 | % | |

| 18,182 | | |

| 18,182 | | |

| * | |

| Evergreen Capital Management | |

| 30,303 | | |

| 1.2 | % | |

| 15,152 | | |

| 15,151 | | |

| * | |

| Akita Partners, LLC | |

| 22,728 | | |

| * | | |

| 11,364 | | |

| 11,364 | | |

| * | |

| KBB Asset Management | |

| 22,728 | | |

| * | | |

| 11,364 | | |

| 11,364 | | |

| * | |

| Boothbay Diversified Alpha Master Fund LP | |

| 20,073 | | |

| * | | |

| 10,037 | | |

| 10,036 | | |

| * | |

| Laidlaw & Co (UK) Ltd. | |

| 17,425 | | |

| * | | |

| 17,425 | | |

| - | | |

| * | |

| Boothbay Absolute Return Strategies, LP | |

| 10,231 | | |

| * | | |

| 5,116 | | |

| 5,115 | | |

| * | |

| * | Represents less than 1%. |

| (1) |

Assumes all warrants are exercised. |

| (2) |

Assumes that (i) all of the shares of common stock to be registered by the registration statement of which this prospectus is a part are sold in this offering and (ii) the selling stockholders do not acquire additional shares of our common stock after the date of this prospectus and prior to completion of this offering. The percentage of beneficial ownership after the offering is based on 2,900,024 shares of common stock, consisting of (a) 2,533,359 shares of our common stock outstanding on March 10, 2023, and (b) the 366,665 shares of our common stock underlying the warrants offered under this prospectus. The number of shares listed do not take into account any limitations on exercise of the warrants. |

PLAN OF DISTRIBUTION

Each selling stockholder

of the securities and any of their pledgees, assignees and successors-in-interest may, from time to time, sell any or all of their securities

covered hereby on The Nasdaq Capital Market or any other stock exchange, market or trading facility on which the securities are traded

or in private transactions. These sales may be at fixed or negotiated prices. A selling stockholder may use any one or more of the following

methods when selling securities:

| |

● |

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| |

● |

block trades in which the broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| |

● |

purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

| |

● |

an exchange distribution in accordance with the rules of the applicable exchange; |

| |

● |

privately negotiated transactions; |

| |

● |

settlement of short sales; |

| |

● |

in transactions through broker-dealers that agree with the selling stockholders to sell a specified number of such securities at a stipulated price per security; |

| |

● |

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| |

● |

a combination of any such methods of sale; or |

| |

● |

any other method permitted pursuant to applicable law. |

The selling stockholders

may also sell securities under Rule 144 or any other exemption from registration under the Securities Act of 1933, as amended (the “Securities

Act”), if available, rather than under this prospectus.

Broker-dealers engaged by

the selling stockholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts

from the selling stockholders (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser) in amounts

to be negotiated, but, except as set forth in a supplement to this Prospectus, in the case of an agency transaction not in excess of a

customary brokerage commission in compliance with FINRA Rule 2121; and in the case of a principal transaction a markup or markdown in

compliance with FINRA Rule 2121.

In connection with the sale

of the securities or interests therein, the selling stockholders may enter into hedging transactions with broker-dealers or other financial

institutions, which may in turn engage in short sales of the securities in the course of hedging the positions they assume. The selling

stockholders may also sell securities short and deliver these securities to close out their short positions, or loan or pledge the securities

to broker-dealers that in turn may sell these securities. The selling stockholders may also enter into option or other transactions with

broker-dealers or other financial institutions or create one or more derivative securities which require the delivery to such broker-dealer

or other financial institution of securities offered by this prospectus, which securities such broker-dealer or other financial institution

may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The selling stockholders

and any broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters” within the

meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents

and any profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts under the Securities

Act. Each selling stockholder has informed the Company that it does not have any written or oral agreement or understanding, directly

or indirectly, with any person to distribute the securities.

The Company is required to

pay certain fees and expenses incurred by the Company incident to the registration of the securities. The Company has agreed to indemnify

the selling stockholders against certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

We agreed to use commercially

reasonable efforts to keep this registration statement effective at all times until the selling stockholders no longer own any Warrants

or shares of Common Stock issuable upon the exercise of the Warrants.

Under applicable rules and

regulations under the Exchange Act, any person engaged in the distribution of the resale securities may not simultaneously engage in market

making activities with respect to the Common Stock for the applicable restricted period, as defined in Regulation M, prior to the commencement

of the distribution. In addition, the selling stockholders will be subject to applicable provisions of the Exchange Act and the rules

and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of the Common Stock by the selling

stockholders or any other person. We will make copies of this prospectus available to the selling stockholders and have informed them

of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale (including by compliance with Rule

172 under the Securities Act).

DESCRIPTION OF OUR SECURITIES TO BE REGISTERED

The securities to be registered

on this registration statement on Form S-1 include up to an aggregate amount of 366,665 shares of common stock, consisting of (i) up to

349,240 shares of our common stock issuable upon exercise of the warrants acquired by certain of the selling stockholders under the Purchase

Agreements, and (ii) up to 17,425 shares of our common stock issuable upon exercise of placement agent warrants acquired by certain of

the selling stockholders under the Placement Agent Agreement.

General

The following is a summary

of material characteristics of our capital stock as set forth in our certificate of incorporation and bylaws, and certain provisions of

Delaware law. The following description does not purport to be complete and is subject to and qualified in its entirety by, and should

be read in conjuncture with, our certificate of incorporation and bylaws, each of which are filed as exhibits to this Registration Statement

and are incorporated herein by reference. The summaries and descriptions below do not purport to be complete statements of the Delaware

General Corporation Law (“DGCL”).

The Company is authorized

to issue 105,000,000 shares of capital stock, par value $0.0001 per share, of which 100,000,000 are shares of common stock and 5,000,000

are shares of “blank check” preferred stock.

As of the date of this prospectus,

there were 2,533,359 shares of our common stock issued and outstanding and no shares of preferred stock issued and outstanding.

Common Stock

Voting

The holders of our common

stock are entitled to one vote for each share held on all matters to be voted on by the Company’s stockholders. There shall be no

cumulative voting.

Dividends

The holders of shares of our

common stock are entitled to dividends when and as declared by the Board from funds legally available therefor if, as and when determined

by the Board of Directors of the Company in their sole discretion, subject to provisions of law, and any provision of the Company’s

Certificate of Incorporation, as amended from time to time. There are no preemptive, conversion or redemption privileges, nor sinking

fund provisions with respect to the common stock.

Liquidation

In the event of any voluntary

or involuntary liquidation, dissolution or winding up of our affairs, the holders of our common stock will be entitled to share ratably

in the net assets legally available for distribution to stockholders after the payment of or provision for all of our debts and other

liabilities.

Fully Paid and Non-assessable

All outstanding shares of

common stock are duly authorized, validly issued, fully paid and non-assessable.

Preferred Stock

We are authorized to issue

up to 5,000,000 shares of preferred stock. This preferred stock may be issued in one or more series, the terms of which may be determined

at the time of issuance by our board of directors without further action by stockholders. The terms of any series of preferred stock may

include voting rights (including the right to vote as a series on particular matters), preferences as to dividend, liquidation, conversion

and redemption rights and sinking fund provisions. No preferred stock is currently outstanding. The issuance of any preferred stock could

materially adversely affect the rights of the holders of our common stock, and therefore, reduce the value of our common stock and the

Notes. In particular, specific rights granted to future holders of preferred stock could be used to restrict our ability to merge with,

or sell our assets to, a third party and thereby preserve control by the present management.

Series A Preferred Stock

On

January 23, 2023, we filed a Certificate of Designation of the Series A Preferred Stock (the “Certificate of Designation”)

with the Secretary of State of the State of Delaware to create a new class of Series A Preferred Stock, par value $0.0001 per share.

The Certificate of Designation designates 100,000 shares of authorized preferred stock as Series A Preferred Stock. The Series A Preferred

Stock are not entitled to receive dividends or any other distributions. The Series A Preferred Stock are entitled to one thousand votes

per share and shall vote together with the issued and outstanding shares of our common stock as a single class exclusively with respect

to the Reverse Stock Split (as defined in the Certificate of Designation). The Series A Preferred Stock have no rights as to any distribution

or assets of the Company upon a liquidation, bankruptcy, reorganization, merger, acquisition, sale, dissolution or winding up

of the Company. The outstanding shares of Series A Preferred Stock shall be redeemed in whole, but not in part for an aggregate price

of $1,000 (i) if such redemption is ordered by our board of directors, in its sole discretion, or (ii) automatically and effective immediately

after the effectiveness of the Reverse Stock Split.

Exclusive Forum

Our Certificate of Incorporation

provides that unless the Company consents in writing to the selection of an alternative forum, the State of Delaware is the sole

and exclusive forum for: (i) any derivative action or proceeding brought on behalf of the Company, (ii) any action asserting a claim of

breach of a fiduciary duty owed by any director, officer or other employee of the Company to the Company or the Company’s stockholders,

(iii) any action asserting a claim against the Company, its directors, officers or employees arising pursuant to any provision of the

DGCL or our Certificate of Incorporation or the Bylaws, or (iv) any action asserting a claim against the Company, its directors, officers,

employees or agents governed by the internal affairs doctrine, except for, as to each of (i) through (iv) above, any claim as to which

the Court of Chancery determines that there is an indispensable party not subject to the jurisdiction of the Court of Chancery (and the

indispensable party does not consent to the personal jurisdiction of the Court of Chancery within ten days following such determination),

which is vested in the exclusive jurisdiction of a court or forum other than the Court of Chancery, or for which the Court of Chancery

does not have subject matter jurisdiction.

Additionally, our Certificate

of Incorporation provide that unless the Company consents in writing to the selection of an alternative forum, the federal district courts

of the United States of America will be the exclusive forum for the resolution of any complaint asserting a cause of action arising under

the Securities Act. Any person or entity purchasing or otherwise acquiring any interest in shares of capital stock of the Corporation

are deemed to have notice of and consented to this provision. The Supreme Court of Delaware has held that this type of exclusive federal

forum provision is enforceable. There may be uncertainty, however, as to whether courts of other jurisdictions would enforce such a provision,

if applicable.

Transfer Agent

The transfer agent and registrar

for our common stock is Continental Stock Transfer & Trust Company.

Changes in Authorized Number

The Board of Directors is

expressly authorized to increase or decrease the number of shares of any series subsequent to the issuance of shares of that series, but

not below the number of shares of such series then outstanding. The number of authorized shares of Preferred Stock may be increased or

decreased (but not below the number of shares thereof then outstanding) by the affirmative vote of the holders of a majority of the voting

power of the stock of the Company entitled to vote thereon, without a separate vote of the holders of the Preferred Stock, or of any series

thereof, unless a vote of any such holders is required pursuant to the terms of any Certificate of Designation filed with respect to any

series of Preferred Stock.

Delaware Anti-Takeover Statute

We may become subject to Section

203 of the Delaware General Corporation Law, which prohibits persons deemed to be “interested stockholders” from engaging

in a “business combination” with a publicly held Delaware corporation for three years following the date these persons become

interested stockholders unless the business combination is, or the transaction in which the person became an interested stockholder was,

approved in a prescribed manner or another prescribed exception applies. Generally, an “interested stockholder” is a person

who, together with affiliates and associates, owns, or within three years prior to the determination of interested stockholder status

did own, 15% or more of a corporation’s voting stock. Generally, a “business combination” includes a merger, asset or

stock sale, or other transaction resulting in a financial benefit to the interested stockholder. The existence of this provision may have

an anti-takeover effect with respect to transactions not approved in advance by the Board of Directors. A Delaware corporation may “opt

out” of these provisions with an express provision in its original certificate of incorporation or an express provision in its certificate

of incorporation or bylaws resulting from a stockholders’ amendment approved by at least a majority of the outstanding voting shares.

We have not opted out of these provisions. As a result, mergers or other takeover or change in control attempts of us may be discouraged

or prevented.

The Bylaws establish an advance

notice procedure for stockholder proposals to be brought before an annual meeting of our stockholders, including proposed nominations

of persons for election to our board of directors. At an annual meeting, stockholders may only consider proposals or nominations specified

in the notice of meeting or brought before the meeting by or at the direction of our board of directors. Stockholders may also consider

a proposal or nomination by a person who was a stockholder at the time of giving notice and at the time of the meeting, who is entitled

to vote at the meeting and who has complied with the notice requirements of the Bylaws in all respects. The Bylaws do not give our board

of directors the power to approve or disapprove stockholder nominations of candidates or proposals regarding other business to be conducted

at a special or annual meeting of our stockholders. However, the Bylaws may have the effect of precluding the conduct of certain business

at a meeting if the proper procedures are not followed. These provisions may also discourage or deter a potential acquirer from conducting

a solicitation of proxies to elect the acquirer’s own slate of directors or otherwise attempting to obtain control of our company.

The Bylaws provide that a

special meeting of our stockholders may be called only by our Secretary at the direction of the Board or by resolution adopted by a majority

of our board of directors. Because our stockholders do not have the right to call a special meeting, a stockholder could not force stockholder

consideration of a proposal over the opposition of our board of directors by calling a special meeting of stockholders prior to such time

as a majority of our board of directors or the Secretary believe the matter should be considered or until the next annual meeting provided that

the requestor met the notice requirements. The restriction on the ability of stockholders to call a special meeting means that a proposal

to replace our board of directors also could be delayed until the next annual meeting.

Limitations on Liability and Indemnification

of Officers and Directors

We intend to enter into separate

indemnification agreements with each of our directors and executive officers. Each indemnification agreement will provide, among other

things, for indemnification to the fullest extent permitted by law and our Certificate of Incorporation and Bylaws against any and all

expenses, judgments, fines, penalties and amounts paid in settlement of any claim. The indemnification agreements will provide for the

advancement or payment of all expenses to the indemnitee and for the reimbursement to us if it is found that such indemnitee is not entitled

to such indemnification under applicable law and our Certificate of Incorporation and Bylaws.

We maintain a general liability

insurance policy that covers certain liabilities of directors and officers of our corporation arising out of claims based on acts or omissions

in their capacities as directors or officers.

Section 203 of the Delaware General Corporation

Law

We may become subject to Section

203 of the Delaware General Corporation Law, which prohibits persons deemed to be “interested stockholders” from engaging

in a “business combination” with a publicly held Delaware corporation for three years following the date these persons become

interested stockholders unless the business combination is, or the transaction in which the person became an interested stockholder was,

approved in a prescribed manner or another prescribed exception applies. Generally, an “interested stockholder” is a person

who, together with affiliates and associates, owns, or within three years prior to the determination of interested stockholder status

did own, 15% or more of a corporation’s voting stock. Generally, a “business combination” includes a merger, asset or

stock sale, or other transaction resulting in a financial benefit to the interested stockholder. The existence of this provision may have

an anti-takeover effect with respect to transactions not approved in advance by the Board of Directors. A Delaware corporation may “opt

out” of these provisions with an express provision in its original certificate of incorporation or an express provision in its certificate

of incorporation or bylaws resulting from a stockholders’ amendment approved by at least a majority of the outstanding voting shares.

We have not opted out of these provisions. As a result, mergers or other takeover or change in control attempts of us may be discouraged

or prevented.

The Bylaws establish an advance

notice procedure for stockholder proposals to be brought before an annual meeting of our stockholders, including proposed nominations

of persons for election to our board of directors. At an annual meeting, stockholders may only consider proposals or nominations specified

in the notice of meeting or brought before the meeting by or at the direction of our board of directors. Stockholders may also consider

a proposal or nomination by a person who was a stockholder at the time of giving notice and at the time of the meeting, who is entitled

to vote at the meeting and who has complied with the notice requirements of the Bylaws in all respects. The Bylaws do not give our board

of directors the power to approve or disapprove stockholder nominations of candidates or proposals regarding other business to be conducted

at a special or annual meeting of our stockholders. However, the Bylaws may have the effect of precluding the conduct of certain business

at a meeting if the proper procedures are not followed. These provisions may also discourage or deter a potential acquirer from conducting

a solicitation of proxies to elect the acquirer’s own slate of directors or otherwise attempting to obtain control of our company.

The Bylaws provide that a

special meeting of our stockholders may be called only by our Secretary at the direction of the Board or by resolution adopted by a majority

of our board of directors. Because our stockholders do not have the right to call a special meeting, a stockholder could not force stockholder

consideration of a proposal over the opposition of our board of directors by calling a special meeting of stockholders prior to such time

as a majority of our board of directors or the Secretary believe the matter should be considered or until the next annual meeting provided that

the requestor met the notice requirements. The restriction on the ability of stockholders to call a special meeting means that a proposal

to replace our board of directors also could be delayed until the next annual meeting.

Listing

Our common stock is listed

on The Nasdaq Capital Market under the symbol “AMST.”

LEGAL MATTERS

Sheppard, Mullin, Richter

& Hampton LLP, New York, New York, will pass upon the validity of the issuance of the securities to be offered by this prospectus.

EXPERTS

The

financial statements of Amesite Inc. as of June 30, 2022 and 2021, and for each of the two years in the period ended June 30, 2022, incorporated

by reference in this Prospectus, have been audited by Deloitte & Touche LLP, an independent registered public accounting firm, as

stated in their report. Such financial statements are incorporated by reference in reliance upon the report of such firm given their authority

as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We have filed a registration

statement on Form S-1 with respect to the shares of common stock offered by this prospectus with the SEC in accordance with the Securities

Act and the rules and regulations enacted under its authority. This prospectus, which constitutes a part of the registration statement,

does not contain all of the information included in the registration statement and its exhibits and schedules. Any statement made in this

prospectus concerning the contents of any contract, agreement or other document is only a summary of the actual contract, agreement or

other document. If we have filed or incorporated by reference any contract, agreement or other document as an exhibit to the registration

statement, you should read the exhibit for a more complete understanding of the document or matter involved. Each statement regarding

a contract, agreement or other document is qualified by reference to the actual document. For further information regarding us and the

shares of common stock offered by this prospectus, we refer you to the full registration statement, including its exhibits and schedules,

filed under the Securities Act.

The SEC maintains a website

at http://www.sec.gov that contains reports, proxy and information statements and other information regarding issuers that file electronically

with the SEC. Our registration statement, of which this prospectus constitutes a part, can be downloaded from the SEC’s website.

We also file annual, quarterly

and current reports, proxy statements and other information with the SEC. You can read our SEC filings on the SEC’s website at http://www.sec.gov.

Our website address is https://amesite.com/.

There we make available free of charge, on or through the investor relations section of our website, annual reports on Form 10-K, quarterly

reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed pursuant to Section 13(a) or 15(d) of the Exchange

Act as soon as reasonably practicable after we electronically file such material with the SEC. The information contained on, or that can

be accessed through, our website is not a part of this prospectus, and our reference to the address for our website is intended to be

an inactive textual reference only.

INCORPORATION OF DOCUMENTS BY REFERENCE

The rules of the SEC allow

us to incorporate by reference into this prospectus the information we file with the SEC. This means that we are disclosing important

information to you by referring to other documents. The information incorporated by reference is considered to be part of this prospectus,

except for any information superseded by information contained directly in this prospectus. We incorporate by reference the documents

listed below (other than any portions thereof, which under the Exchange Act, and applicable SEC rules, are not deemed “filed”

under the Exchange Act):

| |

● |

our Annual Report on Form 10-K for the fiscal year ended June 30, 2022, filed with the SEC on September 28, 2022; |

| |

● |

our Quarterly Report on Form 10-Q for the fiscal quarter ended September 30, 2022, filed with the SEC on November 10, 2022; |

| |

● |

our Quarterly Report on Form 10-Q for the fiscal quarter ended December 31, 2022, filed with the SEC on February 17, 2023; |

| |

● |

our Proxy Statement on Schedule 14A filed on October 28, 2022; and |

| |

● |

the description of our common stock contained in our Registration Statement on September 23, 2020, including any amendment or report filed for the purpose of updating such description. |

The SEC file number for each

of the documents listed above is 001-39553.

In addition, all documents

subsequently filed by us with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, prior to the termination of

the offering, shall be deemed to be incorporated by reference into this prospectus; provided, however, that all reports, exhibits and

other information that we “furnish” to the SEC will not be considered incorporated by reference into this prospectus. If we

have incorporated by reference any statement or information in this prospectus and we subsequently modify that statement or information

with information contained in this prospectus, the statement or information previously incorporated in this prospectus is also modified

or superseded in the same manner.

You may request, orally or

in writing, a copy of any or all of the documents incorporated herein by reference. These documents will be provided to you at no cost,

by contacting:

Amesite Inc.

607 Shelby Street

Suite 700 PMB 214

Detroit, MI

(734) 876-8130

You