Filed Pursuant to Rule 424(b)(5)

Registration No. 333-258322

AMENDMENT NO. 1 DATED NOVEMBER 30, 2021

To Prospectus Supplement Dated August 18, 2021

(To Prospectus dated July 30, 2021)

$300,000,000

Aemetis, Inc.

Common Stock

_________

This

Amendment No. 1 to Prospectus Supplement, or this amendment, amends

our prospectus supplement dated August 18, 2021 (as amended by the

amendment, the prospectus supplement). This amendment should be

read in conjunction with the prospectus supplement and the

prospectus dated July 30, 2021, each of which are to be delivered

with this amendment. This amendment amends and/or supplements only

those sections of the prospectus supplement listed in this

amendment; all other sections of the prospectus supplement remain

as is.

We have

entered into an At Market Issuance Sales Agreement, or the sales

agreement, with H.C. Wainwright & Co., LLC, or the distribution

agent, dated January 26, 2021, as amended by that certain amendment

agreement, dated as of August 18, 2021, relating to the sale of our

common stock offered by the prospectus supplement, as amended by

this amendment. In accordance with the terms of the sales

agreement, under the prospectus supplement we may offer and sell

shares of our common stock, $0.001 par value per share, having an

aggregate offering price of up to $300,000,000 from time to time

through the distribution agent, acting as our agent. Sales of our

common stock, if any, under the prospectus supplement will be made

by any method permitted that is deemed an “at the market

offering” as defined in Rule 415 under the Securities Act of

1933, as amended, or the Securities Act. The distribution agent is

not required to sell any specific amount, but will act as our

distribution agent using commercially reasonable efforts consistent

with its normal trading and sales practices.

The

distribution agent will be entitled to compensation at a commission

rate of up to 3.0% of the gross sales price per share sold under

the sales agreement. The

net proceeds, if any, that we receive from the sales of our common

stock will depend on the number of shares actually sold and the

offering price for such shares. See “Plan of

Distribution” beginning on page S-12 for additional

information regarding the compensation to be paid to the

distribution agent. In connection with the sale of the common stock

on our behalf, the distribution agent will be deemed to be an

“underwriter” within the meaning of the Securities Act

and the compensation of the distribution agent will be deemed to be

underwriting commissions or discounts. We have also agreed to

provide indemnification and contribution to the distribution agent

with respect to certain liabilities, including liabilities under

the Securities Act.

You

should read the prospectus supplement in conjunction with the

accompanying base prospectus, including any supplements and

amendments thereto. The prospectus supplement is qualified by

reference to the accompanying base prospectus except to the extent

that the information in the prospectus supplement supersedes and

updates the information contained in the accompanying base

prospectus. The prospectus supplement is not complete without, and

may not be delivered or utilized except in connection with, the

accompanying base prospectus, including any supplements and

amendments thereto.

Our

common stock is listed on The Nasdaq Stock Market under the symbol

“AMTX.” On November 24, 2021, the last reported sale

price of our common stock on The Nasdaq Stock Market was $18.51 per

share.

________________________________________

Investing in our securities involves a high

degree of risk. See the “Risk

Factors” section

beginning on page S-7 of the prospectus supplement and the

corresponding sections in the accompanying base prospectus and in

our Annual Report on Form 10-K for the year ended December 31,

2020, as well as our subsequent filings with the Securities and

Exchange Commission under the Securities Exchange Act of 1934,

which are incorporated by reference into the prospectus

supplement.

Neither

the Securities and Exchange Commission nor any state securities

commission has approved or disapproved of these securities or

determined if this amendment, the prospectus supplement or the

accompanying base prospectus is truthful or complete. Any

representation to the contrary is a criminal

offense.

________________________________________

H.C. Wainwright & Co.

The date of this Amendment No. 1 to prospectus supplement is

November 30, 2021

Table of Contents

|

AMENDMENT NO. 1 TO PROSPECTUS SUPPLEMENT

|

Page

|

|

ABOUT THIS AMENDMENT TO PROSPECTUS SUPPLEMENT

|

ii

|

|

PROSPECTUS SUPPLEMENT SUMMARY

|

3

|

|

RISK FACTORS

|

4

|

|

DILUTION

|

5

|

|

CAPITALIZATION

|

6

|

|

LEGAL MATTERS

|

8

|

ABOUT THIS AMENDMENT TO PROSPECTUS SUPPLEMENT

You should carefully read this entire prospectus supplement and the

accompanying base prospectus, including the information included

and referred to under “Risk Factors” below, the

information incorporated by reference in the prospectus supplement

and in the accompanying base prospectus, and the financial

statements and the other information incorporated by reference in

the accompanying base prospectus, before making an investment

decision.

We are

filing this amendment in connection with our reincorporation from

Nevada to Delaware in connection with a plan of conversion. Unless

the context otherwise requires, the terms “Aemetis,

Inc.,” “Company,” “our company,”

“we,” “us,” or “our” refer to

Aemetis, Inc., a Delaware corporation, and its subsidiaries. When

we refer to “you” we mean the purchaser or potential

purchaser of the shares of common stock offered

hereby.

The

prospectus supplement and the accompanying base prospectus form

part of a registration statement on Form S-3 that we filed with the

Securities and Exchange Commission, or SEC, using a

“shelf” registration process. This document contains

two parts. The first part consists of the prospectus supplement,

which provides you with specific information about this offering.

The second part, the accompanying base prospectus, provides more

general information, some of which may not apply to this offering.

Generally, when we refer only to the “prospectus,” we

are referring to both parts combined. The prospectus supplement may

add, update, or change information contained in the accompanying

base prospectus. To the extent that any statement we make in the

prospectus supplement is inconsistent with statements made in the

accompanying base prospectus or any documents incorporated by

reference herein or therein, the statements made in the prospectus

supplement will be deemed to modify or supersede those made in the

accompanying base prospectus and such documents incorporated by

reference herein and therein.

The

prospectus supplement and the accompanying base prospectus relate

to the offering of common stock. Before buying any securities

offered hereby, we urge you to carefully read the prospectus

supplement and the accompanying base prospectus, together with the

information incorporated herein and therein by reference as

described under the headings “Where You Can Find More

Information” and “Incorporation of Certain Information

by Reference.” These documents contain important information

that you should consider when making your investment decision. The

prospectus supplement may add, update, or change information in the

accompanying base prospectus.

You

should rely only on the information contained in or incorporated by

reference in the prospectus supplement, the accompanying base

prospectus and any free writing prospectus that we may authorize

for use in connection with this offering. We have not, and the

distribution agent has not, authorized anyone to provide you with

different information. If anyone provides you with different or

inconsistent information, you should not rely on it. We are not,

and the distribution agent is not, making an offer to sell these

securities in any jurisdiction where the offer or sale is not

permitted or in which the person making that offer or solicitation

is not qualified to do so or to anyone to whom it is unlawful to

make an offer or solicitation. You should assume that the

information appearing in the prospectus supplement, the

accompanying base prospectus, the documents incorporated by

reference herein and therein and any free writing prospectus that

we have authorized for use in connection with this offering is

accurate only as of the date of those respective documents. Our

business, financial condition, results of operations and prospects

may have changed since those dates. You should carefully read this

entire prospectus supplement and the accompanying base prospectus,

including the information included and referred to under

“Risk Factors” below, the information incorporated by

reference in the prospectus supplement and in the accompanying base

prospectus, and the financial statements and the other information

incorporated by reference in the accompanying base prospectus,

before making an investment decision. You should also read and

consider the information in the documents to which we have referred

you in the section of the prospectus supplement entitled

“Incorporation of Certain Information by

Reference.”

The

prospectus supplement and the accompanying base prospectus contain

summaries of certain provisions contained in some of the documents

described herein, but reference is made to the actual documents for

complete information. All of the summaries are qualified in their

entirety by the actual documents. Copies of some of the documents

referred to herein have been or will be filed as exhibits to the

registration statement of which the prospectus supplement is a part

or as exhibits to documents incorporated by reference herein, and

you may obtain copies of those documents as described below under

the headings “Where You Can Find More Information” and

“Incorporation of Certain Information by Reference.” We

note that the representations, warranties and covenants made by us

in any agreement that is filed as an exhibit to any document that

is incorporated by reference herein were made solely for the

benefit of the parties to such agreement, including, in some cases,

for the purpose of allocating risk among the parties to such

agreement, and should not be deemed to be a representation,

warranty or covenant to you. Moreover, such representations,

warranties or covenants were accurate only as of the date when

made. Accordingly, such representations, warranties and covenants

should not be relied on as accurately representing the current

state of our affairs.

The industry and market data and

other statistical information contained in the documents we

incorporate by reference are based on our own estimates,

independent publications, government publications, reports by

market research firms or other published independent sources, and,

in each case, are believed by us to be reasonable estimates.

Although we believe these sources are reliable, we have not

independently verified the information.

Securities offered pursuant to the registration

statement to which the prospectus supplement relates may only be

offered and sold if not more than three years have elapsed since

the initial effective date of the registration statement, subject

to the extension of this period in compliance with applicable SEC

rules.

|

PROSPECTUS SUPPLEMENT SUMMARY

The following summary of our business

highlights some of the information contained elsewhere in or

incorporated by reference into the prospectus supplement or the

accompanying base prospectus. Because this is only a summary,

however, it does not contain all of the information that may be

important to you. You should carefully read the prospectus

supplement and the accompanying base prospectus, including the

documents incorporated by reference, which are described under

“Incorporation of Certain Information by Reference” in

the prospectus supplement and the accompanying base prospectus. You

should also carefully consider the matters discussed in the section

in the prospectus supplement entitled “Risk Factors”

and in the accompanying base prospectus and in other documents

incorporated herein by reference. Moreover, the information

contained in the prospectus supplement includes

“forward-looking statements,” which are based on

current expectations and beliefs concerning future developments and

their potential effects on us. There can be no assurance that

future developments actually affecting us will be those

anticipated. See the prospectus supplement for cautionary

information regarding forward-looking

statements.

|

|

Our History

We were

incorporated in Nevada in 2006 under the name American Ethanol,

Inc. We completed a reverse merger of American Ethanol, Inc. with

Marwich II, Ltd., a public shell company, on December 7, 2007. For

accounting purposes, the reverse merger was treated as a reverse

acquisition with American Ethanol as the acquirer and Marwich as

the acquired party. After consummation of the reverse merger, we

changed our name to AE Biofuels, Inc.

In

2011, we acquired Zymetis, Inc., a biotechnology company with a

patented organism that enables the production of renewable advanced

biofuels and biochemicals. As a part of the acquisition, we changed

our name to Aemetis, Inc. In 2012, we acquired all of the

outstanding shares of Cilion, Inc., and thereby acquired the Keyes

plant.

In

2021, we entered into a plan of conversion, pursuant to which we

reincorporated from Nevada to Delaware. Following the

reincorporation, we continued our existence as Aemetis, Inc., a

Delaware corporation. Other than the jurisdiction of incorporation,

we remained the same entity following the reincorporation, and the

reincorporation did not effect any change in our business,

management or operations or the location of our principal executive

offices.

|

An investment in our securities involves a

high degree of risk. Before deciding whether to invest in our

securities, you should carefully consider the risks described

below, together with the other information in the prospectus

supplement and the accompanying base prospectus and the information

contained in our other filings with the SEC as well as any

amendment or update to our risk factors reflected in subsequent

filings with the SEC, which are incorporated by reference in the

prospectus supplement and the accompanying base prospectus in their

entirety, together with other information in the prospectus

supplement, the accompanying base prospectus, the information and

documents incorporated by reference herein and therein, and in any

free writing prospectus that we have authorized for use in

connection with this offering. If any of these risks actually

occurs, our business, financial condition, results of operations,

or cash flow could be seriously harmed. This could cause the

trading price of our securities to decline, resulting in a loss of

all or part of your investment.

Risks Related to This Offering

You may experience immediate and substantial

dilution.

The

offering price per share in this offering may exceed the net

tangible book value per share of our common stock. Assuming that an

aggregate of 16,207,455 shares of our common stock are sold at a

price of $18.51 per share pursuant to the prospectus supplement

which was the last reported sale price of our common stock on

Nasdaq on November 24, 2021, for aggregate net proceeds of

approximately $291.0 million after deducting commissions and

estimated aggregate offering expenses payable by us, you would

experience immediate dilution of approximately $15.25 per share.

See the section entitled “Dilution” on page 6 of this

amendment for a more detailed illustration of the dilution you

would incur if you participate in this offering.

If you

invest in our common stock, your interest will be diluted to the

extent of the difference between the price per share you pay in

this offering and the net tangible book value or deficit per share

of our common stock immediately after this offering. Our historical

net tangible book deficit of our common stock as of September 30,

2021 was approximately $132.1 million, or $4.06 per share of our

common stock based upon 32,564,085 shares outstanding. Historical

net tangible book value or deficit per share is equal to our total

tangible assets, less our total liabilities, divided by the total

number of shares of our common stock outstanding as of September

30, 2021.

Dilution per share

to new investors represents the difference between the amount per

share paid by purchasers for our common stock in this offering and

the as adjusted net tangible book value per share of our common

stock immediately following the completion of this

offering.

After

giving effect to the sale of our common stock in the aggregate

amount of $300.0 million at an assumed offering price of $18.51 per

share, being the last reported sale price of our common stock on

The Nasdaq Stock Market on November 24, 2021 and after deducting

commissions and estimated offering expenses payable by us, our as

adjusted net tangible book value as of September 30, 2021 would

have been approximately $158.9 million, or $3.26 per share of

common stock. This represents an increase in net tangible book

value compared to the net tangible book deficit as of September 30,

2021 of $7.32 per share to our existing stockholders and an

immediate dilution of $15.25 per share to new investors in this

offering.

The

following table illustrates this calculation on a per share basis.

The as adjusted information is illustrative only and will adjust

based on the actual price to the public, the actual number of

shares sold and other terms of the offering determined at the time

shares of our common stock are sold pursuant to the prospectus

supplement. The as adjusted information assumes that all of our

common stock in the aggregate amount of $300.0 million is sold at

the assumed offering price of $18.51 per share, being the last

reported sale price of our common stock on The Nasdaq Stock Market

on November 24, 2021. The shares sold in this offering, if any,

will be sold from time to time at various prices.

|

Assumed public

offering price per share

|

|

$18.51

|

|

Historical net

tangible book value (deficit) per share as of September 30,

2021

|

$(4.06)

|

|

|

Increase in net

tangible book value (deficit) per share attributable to new

investors in this offering

|

7.32

|

|

|

|

|

|

|

As adjusted net

tangible book value (deficit) per share immediately after this

offering

|

|

3.26

|

|

|

|

|

|

Dilution per share

to new investors in this offering

|

|

$15.25

|

|

|

|

|

The foregoing

table is based upon 32,564,085 shares outstanding, which excludes

663,500 shares of common stock issued pursuant to our existing

at-the-market program from August 19, 2021 through November 24,

2021, and does not give effect to the exercise of any outstanding

options or warrants. To the extent options and warrants are

exercised, there may be further dilution to new

investors.

The

shares subject to the sales agreement with the distribution agent

are being sold from time to time at various prices. An increase of $1.00 per share in the

price at which the shares are sold from the assumed offering price

of $18.51 per share shown in the table above, assuming an adjusted

15,376,730 aggregate number of shares sold pursuant to this

offering, would increase our adjusted net tangible book value per

share after the offering to $3.31 per share and would increase the

dilution per share to new investors in this offering to

$16.20 per share,

after deducting commissions and estimated aggregate offering

expenses payable by us. A decrease of $1.00 per share in the price

at which the shares are sold from the assumed offering price of

$17.51 per share shown in the table above, assuming an adjusted

17,133,067 aggregate number of shares sold pursuant to this

offering, would decrease our adjusted net tangible book value per

share after the offering to $3.20 per share and would decrease the

dilution per share to new investors in this offering to $14.31 per

share, after deducting commissions and estimated aggregate offering

expenses payable by us. This information is supplied for

illustrative purposes only.

In addition, we may choose to raise additional capital due to

market conditions or strategic considerations even if we believe we

have sufficient funds for our current or future operating plans. To

the extent that additional capital is raised through the sale of

equity or convertible debt securities, the issuance of these

securities could result in further dilution to our

stockholders.

The

following table sets forth our cash and cash equivalents and

capitalization as of September 30, 2021 on an actual basis, and on

an adjusted basis to give effect to the sale of shares of common

stock in this offering, the effect of sales of common stock

pursuant to our existing at-the-market program between August 18,

2021 through November 24, 2021, and the use of funds for the

capital expenditures. You should read this table in conjunction

with our consolidated financial statements and the related notes

thereto, “Management’s Discussion and Analysis of

Financial Condition and Results of Operations,” and the other

financial information incorporated by reference into this

prospectus supplement and the accompanying base

prospectus.

|

|

|

|

In thousands,

except for par value

|

|

|

|

Cash and cash

equivalents

|

6,389

|

154,697

|

|

Long-term

debt:

|

|

|

|

Current portion of

long-term debt

|

23,863

|

9,786

|

|

Long-term

|

204,467

|

75,852

|

|

Total long-term

debt

|

228,330

|

85,638

|

|

Shareholders’

equity:

|

|

|

|

Series B

convertible preferred stock, $0.001 par value; 7,235 authorized;

1,323 shares issued and outstanding (aggregate liquidation

preference of $3,969)

|

1

|

1

|

|

Common stock,

$0.001 par value; 40,000 authorized; 32,564 and 22,830 shares

issued and outstanding, respectively

|

33

|

50

|

|

Additional paid-in

capital

|

192,520

|

483,504

|

|

Accumulated

deficit

|

(320,346)

|

(320,346)

|

|

Accumulated other

comprehensive loss

|

(4,301)

|

(4,301)

|

|

Total

stockholders’ equity (deficit) attributable to Aemetis,

Inc.

|

(132,093)

|

158,908

|

|

Total

capitalization

|

96,237

|

244,546

|

DESCRIPTION OF CAPITAL STOCK

General

The

following summary of the material features of our capital stock

does not purport to be complete and is subject to, and qualified in

its entirety by, the provisions of our certificate of incorporation

(“Certificate of Incorporation”), the Certificate of

Designation of Series B Preferred Stock, our bylaws

(“Bylaws”) and other applicable law.

Authorized and Outstanding Capital Stock

Our

authorized capital stock consists of 80,000,000 shares of common

stock, $0.001 par value per share, and 65,000,000 shares of

preferred stock, $0.001 par value per share, of which 1,323,394

shares are designated as Series B Preferred Stock. As of November

24, 2021, there were 33,289,689 shares of common stock and

1,323,394 shares of

Series B Preferred Stock issued and outstanding. The following

description of our capital stock does not purport to be complete

and should be reviewed in conjunction with our Certificate of

Incorporation, including our Certificate of Designation of Series B

Preferred, and our Bylaws.

Common Stock

The

holders of our common stock are entitled to one vote for each share

held on all matters submitted to a vote of the stockholders. The

holders of our common stock do not have any cumulative voting

rights. Holders of our common stock are entitled to receive ratably

any dividends declared by the board of directors out of funds

legally available for that purpose, subject to any preferential

dividend rights of any outstanding preferred stock. Our common

stock has no preemptive rights, conversion rights or other

subscription rights or redemption or sinking fund

provisions.

In the

event of our liquidation, dissolution or winding up, holders of our

common stock will be entitled to share ratably in all assets

remaining after payment of all debts and other liabilities and any

liquidation preference of any outstanding preferred

stock.

Anti-Takeover Provisions

Certain

provisions of Delaware law, our Certificate of Incorporation and

our Bylaws may have the effect of delaying, deferring or

discouraging another person from acquiring control of the

Company.

Issuance of undesignated preferred stock

Our

board of directors has the ability to designate and issue preferred

stock with voting or other rights or preferences that could deter

hostile takeovers or delay changes in our control or

management.

Classified Board

Our

Certificate of Incorporation provides for a classified board of

directors consisting of three classes of directors. Directors of

each class are chosen for three-year terms upon the expiration of

their current terms and each year one class of our directors will

be elected by our stockholders. Additionally, there is no

cumulative voting in the election of directors. This classified

board provision could have the effect of making the replacement of

incumbent directors more time consuming and difficult. At least two

annual meetings of stockholders, instead of one, will generally be

required to effect a change in a majority of our board of

directors. Thus, the classified board provision could increase the

likelihood that incumbent directors will retain their positions.

The staggered terms of directors may delay, defer or prevent a

tender offer or an attempt to change control of us, even though a

stockholder might consider a tender offer or change in control to

be in its best interests.

In

addition, our Certificate of Incorporation and Bylaws provide that,

subject to the terms of any series of preferred stock, directors

may be removed only for cause and only by the affirmative vote of

the holders of at least a majority of the voting power of the

outstanding shares of capital stock of the Company entitled to vote

at an election of directors. Our Certificate of Incorporation and

Bylaws also provide that subject to the terms of any series of

preferred stock, any vacancy or newly created directorship in our

board of directors, however occurring, shall be filled only by vote

of a majority of the directors then in office, although less than a

quorum, and shall not be filled by the stockholders.

Ability of our Stockholders to Act

Our

Certificate of Incorporation and Bylaws do not permit our

stockholders to call special stockholders meetings; special

stockholders meetings may only be called by the board of directors,

the chairperson of the board of directors or the Chief Executive

Officer of the Company. Written notice of any special meeting so

called shall be given to each stockholder of record entitled to

vote at such meeting not less than 10 or more than 60 days before

the date of such meeting, unless otherwise required by law. No

action shall be taken by the stockholders of the Company except at

an annual or special meeting of stockholders called in accordance

with our Certificate of Incorporation or Bylaws, and no action

shall be taken by the stockholders by written consent; provided,

however, that any action required or permitted to be taken by the

holders of preferred stock, voting separately as a series or

separately as a class with one or more other such series, may be

taken without a meeting, without prior notice and without a vote,

to the extent expressly so provided by the applicable certificate

of designation relating to such series of preferred

stock.

Rights Plan

We have

a stockholder rights plan (the “Rights Plan”) designed

to preserve the value of certain tax assets primarily associated

with our net operating losses (“NOLs”) and built in

losses under Section 382. The use of such losses to offset

federal income tax would be limited if we experience an

“ownership change” under Section 382. This would

occur if stockholders owning (or deemed under Section 382 to

own) 5% or more of our stock by value increase their collective

ownership of the aggregate amount of our stock by more than 50

percentage points over a defined period of time. While the Rights

Plan is intended to protect our NOLs and built-in losses under

Section 382, it may also have an “anti-takeover”

effect of delaying or preventing beneficial takeover bids by third

parties.

The

validity of the shares of common stock offered hereby have been

passed upon for us by Shearman & Sterling LLP. Ellenoff

Grossman & Schole LLP is counsel for the distribution agent in

connection with this offering.

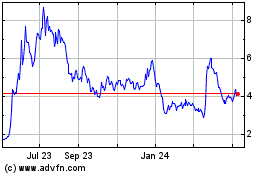

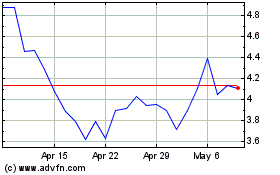

Aemetis (NASDAQ:AMTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Aemetis (NASDAQ:AMTX)

Historical Stock Chart

From Apr 2023 to Apr 2024