Why Ford Stock Can Outpace the S&P 500 in the Upcoming Decade?

09 December 2021 - 9:34PM

Finscreener.org

The last two years have been

extremely fruitful for electric vehicle investors. For example,

since the start of 2020, Tesla (NASDAQ: TSLA)

stock has surged over 1,000%, easily outpacing broader market

gains.

Companies part of the EV sector

are expected to gain pace in the upcoming decade given the global

shift towards the adoption of clean energy solutions. So, it’s

quite evident that the highly disruptive sector will attract both

new and established players.

One legacy auto manufacturer that

has the potential to gain traction in the EV market is

Ford (NYSE:

F). Shares of the Ford

Motor Company have more than doubled in 2021, easily beating

the

S&P

500. However, while the

S&P 500 has returned 350% since December 2011, Ford stock is

up just 167% in dividend-adjusted gains in the last 10

years.

Let’s see why Ford stock is

poised to keep beating the market over the long term.

Ford has a 12% stake in Rivian

Ford invested $500 million

in Rivian (NASDAQ:

RIVN) for a 12% stake in

the electric vehicle start-up which is still pre-revenue.

Rivian is also backed by Amazon

(NASDAQ:

AMZN) and the tech giant has pre-ordered 100,000

delivery vans from the company.

Ford and Rivian were also

collaborating to develop a vehicle but this partnership has now

come to an end. In an interview with Automotive News, Ford’s CEO

Jim Farley explained, “We have growing confidence in our ability to

win in the electric space……So much has changed: about our ability,

about the brandU+02019s direction in both cases, and now itU+02019s

more certain to us what we have to do.”

The reservations for Ford’s

battery-powered pick-up truck called the F-150 Lightning surpassed

150,000 units by the end of Q3. The base model of the Lightning is

priced at $39,974 and can be considered a “workhorse

vehicle”.

We can see why Ford is optimistic

about its long-term prospects in the EV segment and decided to end

its collaboration with Rivian while still maintaining a 12% equity

stake in the latter.

Ford announced a joint venture with SK

Innovation

In September 2021, Ford also

announced a joint venture valued at $11.4 billion with South

Korea-based SK Innovation which is a battery manufacturer. The two

companies will build a six-square-mile factory complex to

manufacture EVs as well as batteries in the state of

Kentucky.

The initial battery production at

the facility is estimated at 129 gigawatt-hours which is more than

two times the capacity compared to Tesla’s Gigafactory in

Berlin.

In the near future, Ford will

launch three electric vehicles that include the F-150 Lightning. By

the end of this decade, the automobile heavyweight expects 40% of

its vehicle deliveries to be battery-powered, on the back of its

rising capital expenditure and aggressive expansion

plans.

What next for investors?

Deloitte estimates

global EV sales

to rise at an annual rate of 29%

through 2030. So, total EV sales will touch 31.1 million units and

account for a third of vehicle deliveries by 2030. Ford aims to $30

billion in this period which will allow the company to increase

market share at a steady pace and take on leaders such as

Tesla.

While Tesla and other players

including General Motors (NYSE:

GM) will expand their

lineup of battery-powered sedans, Ford aims to dominate the pick-up

truck and transit van verticals with its vehicles.

Investment bank

Morgan Analyst (NYSE: MS) detailed

that the F-150 accounted for 90% of Ford’s global net income in the

trailing 12-month period. Ford has a razor-focused strategy that

will help the company leverage its expertise to benefit from

economies of scale and widening profit margins.

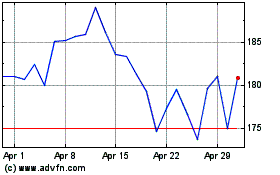

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Mar 2024 to Apr 2024

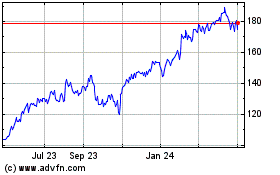

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Apr 2023 to Apr 2024