Amazon and Lendistry Fuel Small Business Growth with Expansion of Amazon Community Lending Program

29 September 2022 - 11:00PM

Business Wire

In partnership with Lendistry, this program

supports urban and rural small businesses in socially and

economically distressed communities with financing options to

sustain and grow their businesses

After a successful pilot, both companies will

help even more sellers fund strategic business needs, such as

inventory expansion, brand building, and customer acquisition

A year after its successful pilot launch, Amazon (NASDAQ: AMZN)

announced today that it will roll out the Amazon Community Lending

program as a long-term offering to help even more sellers grow. In

partnership with B.S.D. Capital, Inc. dba Lendistry (“Lendistry”),

this program will continue to support urban and rural small

businesses in socially and economically distressed communities

through short-term loans at competitive and affordable rates. Since

its launch, the program has loaned more than $35 million to over

800 sellers—surpassing the original goal of $10 million during the

pilot. Now, the program plans to loan more than $150 million in the

next three years to small businesses selling in the Amazon US

store.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20220929005255/en/

Amazon sellers and small business owners

Armando Colimodio and Eduardo Rodriguez, co-owners of Colsen in

Miami, FL. (Photo: Amazon)

“At Colsen, we have big ambitions to grow the business but a

need for capital to facilitate it was critical,” explains Armando

Colimodio, co-owner of Colsen, an ecommerce business based in

Miami, FL. “By working with Amazon Community Lending, we’ve been

able to invest in our business and expand our great product

selection through the program’s simple and quick loan acceptance

process. We expect to double our sales this year and remain

committed to growing our product portfolio."

Amazon sellers account for more than half of all units sold in

Amazon’s store. Small businesses approved for a loan from Lendistry

through the Amazon Community Lending program can use these funds to

grow their business in Amazon’s US store and to cover other

strategic business needs, such as staffing and operations costs,

inventory, product development and manufacturing, and marketing

efforts to build their brands and grow their customer base. Loans

provided by Lendistry through this program will range from $10,000

to $250,000 with terms of up to five years.

“Businesses in our communities are often launched with limited

responsible options for funding,” shares Talisha Bekavac, executive

vice president of U.S. Black Chambers, Inc. “The Amazon Community

Lending program has created a model that helps Black-owned

businesses grow and thrive with a minimum loan size of $10,000 and

rates at an affordable and competitive level.”

Since 2011, Amazon has provided loans to small businesses

selling in its stores through Amazon Lending. The company believes

that an infusion of working capital at the right moment can help

sellers succeed. Through its partnership with Lendistry, an

established minority-led Community Development Financial

Institution (CDFI), Amazon can now help reach urban and rural small

businesses in socially and economically distressed communities. The

majority of the funds Lendistry has historically disbursed have

gone to traditionally low-to-moderate income communities,

minority-owned businesses, and other historically disadvantaged

business owners and the communities they serve.

“Amazon believes businesses of all sizes should have access to

financing, payment options, and funds management tools,” explains

Tai Koottatep, director and general manager of Amazon B2B Payments

and Lending. “The Amazon Community Lending program was developed to

help provide sellers in socially and economically distressed

communities with working capital as well as one-on-one coaching,

education programs, webinars, and classes to help them grow now,

and in the future.”

In addition to providing access to critical working capital, the

Amazon Community Lending program provides small businesses access

to supplementary resources from Lendistry, including one-on-one

consulting, webinars, and on-demand educational classes. Small

businesses also have access to Amazon’s Seller University and

Amazon Small Business Academy to help them succeed.

“When Amazon came to us with the idea for the Amazon Community

Lending Program, we knew it would make a significant difference for

small businesses that need responsible capital to grow,” says

Lendistry CEO, Everett K. Sands. “Together, we’ve done impactful

work to expand opportunities for growing businesses and give them a

responsible lending option.”

Each year Amazon invests billions of dollars to help sellers

expand their businesses by improving the infrastructure, tools,

services, and fulfillment solutions to sell in Amazon’s store. In

addition to Amazon Community Lending, Amazon separately offers the

Black Business Accelerator (BBA) program, which provides access to

financial assistance, strategic business education and coaching,

and marketing and advertising support to help Black business owners

succeed as sellers in Amazon’s store. Amazon also provides a number

of other financial tools to help sellers grow—now and in the

future. In the last decade, Amazon has introduced convenient

financing options through Amazon Lending, rewards on Amazon

purchases with the Amazon Business Prime American Express Card, and

automatic proceeds disbursements through the Amazon Currency

Converter for Sellers (ACCS).

Small businesses interested in learning more about this program

can visit sell.amazon.com/programs/amazon-lending.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220929005255/en/

Amazon.com, Inc. Media Hotline Amazon-pr@amazon.com

www.amazon.com/pr

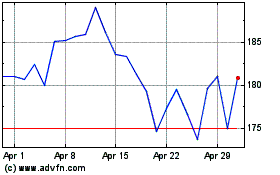

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Mar 2024 to Apr 2024

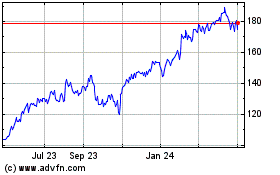

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Apr 2023 to Apr 2024