Another Volatile Week Is On the Cards for the S&P 500 Index

07 November 2022 - 7:41AM

Finscreener.org

The U.S. equity markets ticked

higher on Friday despite a stronger-than-expected jobs report. But

it was down for the week that ended on November 4, 2022, after the

Federal Reserve increased interest rates for the sixth time this

year. Treasury yields are at their highest levels since

2008.

In the last week, the

Dow Jones index

fell 1.4%, while the

S&P 500 index and

the Nasdaq Composite index were down by 3.3% and 5.6%,

respectively.

The 10-year Treasury yield stood

at 4.2% while the two-year yield was higher at 4.7%, indicating the

inversion of the yield curve has deepened. Crude oil prices rose

and the West Texas Intermediate (WTI) crude priced at more than

$92/barrel on Friday, the highest level since August, on the news

that China could ease pandemic restrictions.

Around 80% of the companies part

of the S&P 500 have already reported Q3 earnings, so the

earnings season will cool off in the upcoming week. However,

heavyweights, including The Walt Disney

Company (NYSE:

DIS),

Activision Blizzard (NASDAQ:

ATVI), and Dupont (NYSE:

DD),

are scheduled to report Q3 earnings

in the next few days.

Will tech sell-offs accelerate?

Big tech companies

are under pressure. After more than

a decade of marginal interest rates, these companies are wrestling

with higher debt costs and red-hot inflation in 2022, which is

impacting both revenue and profit margins.

Amazon (NASDAQ:

AMZN)

disclosed it would pause hiring while Lyft

(NASDAQ: LYFT)

reduced its employee count by 13%, and its estimated Twitter just

fired 50% of its total employees. Meta (NASDAQ: META)

is also looking to lower costs across various business segments, as

it reported two consecutive quarters of revenue decline in

Q3.

Fintech start-up Stripe, which

was valued at $95 billion last March, announced it would lower its

workforce by 14%, and this trend is likely to continue in the near

term.

Soon after COVID-19 reared its

ugly head, e-commerce and fintech companies experienced a massive

uptick in sales as several retailers moved online, accelerating the

demand for payments processing and web development services.

Companies and management overestimated the shift towards online and

expanded their employee base significantly.

But an extremely challenging

macro-environment has meant operating costs have surged amid a

slowdown in sales. The management at Shopify

(NYSE:

SHOP) and Stripe have stated they were too optimistic about

top-line growth and “overhired for the world we’re in.”

All eyes on inflation and consumer spending

Right now, the Federal Reserve is

willing to risk the possibility of a recession to tame inflation.

In fact, the better-than-expected jobs report on Friday was frowned

upon as the labor market added 261,000 jobs in October, compared to

estimates of less than 210,000 job additions.

The Fed has emphasized interest

rates will remain elevated if inflation is not brought under

control, indicating further hikes are on the cards.

The Bureau Labor of Statistics

will release its CPI (consumer price index) report for October on

Thursday. Economists expect prices to rise 8% year over year, a tad

lower than the 8.2% gain in September. Core inflation which

excludes food and fuel costs, is expected to rise by 6.7%, higher

than the 6.6% figure for September. Any deviation from these

figures could trigger another round of sell-offs on the equity

markets.

Consumer sentiment touched an

all-time low of 50 in June as the macro environment remains

uncertain. The University of Michigan will release data for the

Consumer Sentiment Index on Friday, which is expected to touch 60,

just higher than last monthU+02019s reading of 59.9.

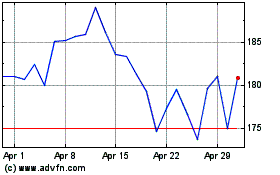

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Mar 2024 to Apr 2024

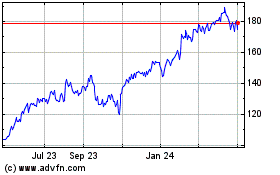

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Apr 2023 to Apr 2024