As

filed with the Securities and Exchange Commission on November 2, 2022

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

S-1

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

ANEBULO

PHARMACEUTICALS, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

85-1170950 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(I.R.S.

Employer

Identification

Number) |

1415

Ranch Road 620 South, Suite 201

Lakeway,

Texas 78734

(512)

598-0931

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Simon

Allen

Chief

Executive Officer

Anebulo

Pharmaceuticals, Inc.

1415

Ranch Road 620 South, Suite 201

Lakeway,

Texas 78734

(512)

598-0931

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

Kenneth

J. Rollins, Esq.

Asa

M. Henin, Esq.

Cooley

LLP

10265

Science Center Drive

San

Diego, California 92121

(858)

550-6000

As

soon as practicable after this Registration Statement is declared effective.

(Approximate

date of commencement of proposed sale to the public)

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, as amended, other than securities offered only in connection with dividend or interest reinvestment plans, check

the following box: ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

|

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☒ |

|

Smaller

reporting company |

☒ |

| |

|

|

Emerging

growth company |

☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

The

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the

Registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective

on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. The selling stockholders may not sell these securities or accept an

offer to buy these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus

is not an offer to sell these securities and it is not soliciting offers to buy these securities in any state where such offer or sale

is not permitted.

SUBJECT

TO COMPLETION, DATED NOVEMBER 2, 2022

PROSPECTUS

4,529,300

shares of Common Stock

This

prospectus covers the offer and resale by the selling stockholders identified in this prospectus of up to an aggregate of 4,529,300 shares

of our common stock, which includes 2,264,650 shares of our common stock and 2,264,650 shares of our common stock issuable upon the exercise

of warrants. An aggregate of 2,264,650 shares of our common stock and warrants to purchase 2,264,650 shares of our common stock were

sold to the selling stockholders in a private placement on September 28, 2022 (the “Private Placement”).

We

are not selling any shares of common stock under this prospectus and will not receive any proceeds from the sale by the selling stockholders

of such shares. We will, however, receive the net proceeds of any exercise of the warrants.

Sales

of the shares by the selling stockholders may occur at fixed prices, at market prices prevailing at the time of sale, at prices related

to prevailing market prices or at negotiated prices. The selling stockholders may sell shares to or through underwriters, broker-dealers

or agents, who may receive compensation in the form of discounts, concessions or commissions from the selling stockholders, the purchasers

of the shares, or both.

We

are paying the cost of registering the shares of common stock covered by this prospectus as well as various related expenses. The selling

stockholders are responsible for all selling commissions, transfer taxes and other costs related to the offer and sale of their shares.

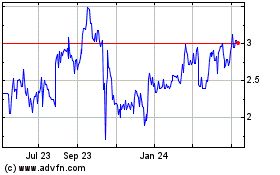

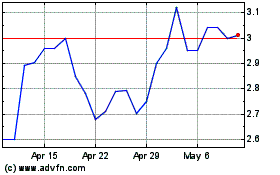

Our

common stock is listed on The Nasdaq Capital Market under the symbol “ANEB.” On November 1, 2022, the last reported sale

price of our common stock was $2.81 per share.

Investing

in our common stock involves a high degree of risk. Before making an investment decision, please read the information under “Risk

Factors” on page 4 of this prospectus and under similar headings in any amendment or supplement to this prospectus or in any filing

with the Securities and Exchange Commission that is incorporated by reference herein.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is ,

2022.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement on Form S-1 that we filed with the Securities and Exchange Commission (the “SEC”).

Under this registration statement, the selling stockholders may sell from time to time in one or more offerings the common stock described

in this prospectus.

We

have not, and the selling stockholders have not, authorized anyone to provide you with information other than the information that we

have provided or incorporated by reference in this prospectus and your reliance on any unauthorized information or representation is

at your own risk. This prospectus may be used only in jurisdictions where offers and sales of these securities are permitted. You should

assume that the information appearing in this prospectus is accurate only as of the date of this prospectus and that any information

we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of

delivery of this prospectus, or any sale of our common stock. Our business, financial condition and results of operations may have changed

since those dates.

Unless

otherwise stated, all references in this prospectus to “we,” “us,” “our,” “Anebulo,”

the “Company” and similar designations refer to Anebulo Pharmaceuticals, Inc. This prospectus contains references to our

trademarks and to trademarks belonging to other entities. Solely for convenience, trademarks and trade names referred to in this prospectus,

including logos, artwork and other visual displays, may appear without the ® or TM symbols, but such references are not intended

to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable

licensor to these trademarks and trade names. We do not intend our use or display of other companies’ trade names or trademarks

to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus and any applicable prospectus supplement or free writing prospectus, including the documents that we incorporate by reference

herein and therein, contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933,

as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”). These statements relate to future events or to our future operating or financial performance and involve known and unknown

risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from

any future results, performances or achievements expressed or implied by the forward-looking statements.

In

some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,”

“could,” “would,” “expects,” “plans,” “anticipates,” “believes,”

“estimates,” “projects,” “predicts,” “potential” and similar expressions (including their

use in the negative) intended to identify forward-looking statements. These statements reflect our current views with respect to future

events and are based on assumptions and are subject to risks and uncertainties. As such, our actual results may differ significantly

from those expressed in any forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking

statements.

We

discuss many of these risks in greater detail under “Risk Factors” in this prospectus, in the “Business” and

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections incorporated by reference

from our most recent Annual Report on Form 10-K and in our Quarterly Reports on Form 10-Q for the quarterly periods ended subsequent

to our filing of such Annual Report on Form 10-K, as well as any amendments thereto reflected in subsequent filings with the SEC.

Also,

these forward-looking statements represent our estimates and assumptions only as of the date of the document containing the applicable

statement. Unless required by law, we undertake no obligation to update or revise any forward-looking statements to reflect new information

or future events or developments. Thus, you should not assume that our silence over time means that actual events are bearing out as

expressed or implied in such forward-looking statements. You should read this prospectus, any applicable prospectus supplement, together

with the documents that we have filed with the SEC that are incorporated by reference and any free writing prospectus we have authorized

for use in connection with this offering, completely and with the understanding that our actual future results may be materially different

from what we expect. We qualify all of the forward-looking statements in the foregoing documents by these cautionary statements.

PROSPECTUS

SUMMARY

This

summary highlights certain information about us, the Private Placement and selected information contained elsewhere in or incorporated

by reference into this prospectus. This summary is not complete and does not contain all of the information that you should consider

before making an investment decision. For a more complete understanding of our company, you should read and consider carefully the more

detailed information included or incorporated by reference in this prospectus and any applicable prospectus supplement, including the

factors described under the heading “Risk Factors” on page 4 of this prospectus, as well as the information incorporated

herein by reference, before making an investment decision.

Overview

We

are a clinical-stage biotechnology company developing novel solutions for people suffering from acute cannabinoid intoxication (“ACI”)

and substance addiction. Our lead product candidate, ANEB-001, is intended to rapidly reverse the negative effects of ACI within one

hour of administration. The signs and symptoms of ACI range from profound sedation to anxiety and panic to psychosis with hallucinations.

There is no approved medical treatment currently available to specifically alleviate the symptoms of ACI. If approved by the U.S. Food

and Drug Administration (“FDA”), we believe ANEB-001 has the potential to be the first FDA approved treatment of its kind

on the market for reversing the effects of THC, the principal psychoactive constituent of cannabis. Clinical trials completed to date

have shown that ANEB-001 is rapidly absorbed, well tolerated and when administered to obese subjects leads to weight loss, an effect

that is consistent with central CB1 antagonism. We initiated a Phase 2 proof-of-concept clinical trial in the Netherlands in December

2021. We received initial topline data from Part A of the study on June 29, 2022 and announced the results on July 5, 2022.

ACI

episodes have become a widespread health issue in the United States, particularly in the increasing number of states that have legalized

cannabis for medical and recreational use. The ingestion of large quantities of THC is a major cause of ACI. Excessive ingestion of THC

via edible products such as candies and brownies, and intoxication from synthetic cannabinoids (also known as “synthetics,”

“K2” or “spice”), are two leading causes of THC-related emergency room visits. Synthetic cannabinoids are analogous

to fentanyl for opioids insofar as they are more potent at the cannabinoid receptor than their natural product congener THC. In recent

years, hospital emergency rooms across the United States have seen a dramatic increase in patient visits with cannabis-related conditions.

Before the legalization of cannabis, an estimated 450,000 patients visited hospital emergency rooms annually for cannabis-related conditions.

In 2014, this number more than doubled to an estimated 1.1 million patients, according to data published in “Trends and Related

Factors of Cannabis-Associated Emergency Department Visits in the United States: 2006-2014,” Journal of Addiction Medicine (May/June

2019), which provided a national estimate analyzing data from The Nationwide Emergency Department Sample (“NEDS”), the largest

database of U.S. hospital-owned emergency department visits. Based on our own analysis of the most recent NEDS data, we believe that

the number of hospitalizations grew to 1.74 million patients in 2018 and was growing at an approximately 15% compounded annual growth

rate between 2012 and 2018. We believe the number of cannabis-related hospitalizations and other health problems associated with ACIs

such as depression, anxiety and mental disorders will continue to increase substantially as more states pass laws legalizing cannabis

for medical and recreational use. Given the consequences, there is an urgent need for a treatment to rapidly reverse the symptoms of

ACI.

Our

objective is to develop new treatment options for patients suffering from ACI and substance addiction. Our lead product candidate is

ANEB-001, a potent, small molecule cannabinoid receptor antagonist, to address the unmet medical need for a specific antidote for ACI.

ANEB-001 is an orally bioavailable, rapidly absorbed treatment that we anticipate will reverse the symptoms of ACI, in most cases within

1 hour of administration. Our proprietary position in the treatment of ACI is protected by rights to two patent applications covering

various methods of use of the compound and delivery systems.

Corporate

Information

We

were incorporated in Delaware in April 2020. Our principal executive offices are located at 1415 Ranch Road 620 South, Suite 201, Lakeway,

Texas 78734, and our telephone number is 512-598-0931. Our

corporate website address is www.anebulo.com. Information contained on or accessible through

our website is not a part of this prospectus, and the inclusion of our website address in this prospectus is an inactive textual reference

only.

Private

Placement

On

September 25, 2022, we entered into a Securities Purchase Agreement (the “Purchase Agreement”) with the selling stockholders

named in this prospectus, pursuant to which we sold and issued to the selling stockholders 2,264,650 units (collectively, the “Units”),

with each Unit consisting of (i) one share of our common stock and (ii) a warrant to purchase one share of our common stock, for an aggregate

purchase price of approximately $6.6 million (or $2.935 per Unit). The closing of the Private Placement occurred on September 28, 2022.

Each warrant has an exercise price of $4.215 per share, which is subject to customary adjustments in the event of any combination or

split of our common stock, and has a five-year term. The warrants contain beneficial ownership limitations which prevent the holder from

exercising the warrant if immediately following such exercise the holder would beneficially own shares of our common stock in excess

of the stated beneficial ownership limitation.

22NW

Fund, LP, a fund affiliated with Aron R. English, a director of the Company and the second largest beneficial owner of common stock,

participated in the Private Placement and purchased 1,703,577 Units at the per Unit purchase price, for an aggregate purchase price of

approximately $5.0 million.

Under

the terms of the Purchase Agreement, we agreed to prepare and file a registration statement with the SEC on or before November 2, 2022

to register the resale of the shares of our common stock issued under the Purchase Agreement, and the shares of our common stock issuable

upon exercise of the warrants issued under the Purchase Agreement, and to cause the registration statement to become effective as promptly

as possible after the filing thereof, but in any event

prior to the date which is five days after the receipt of a notification of no-review in the event of no review by the SEC, or 90 days

after the filing thereof in the event of a review by the SEC.

Implications

of Being and Emerging Growth Company and Smaller Reporting Company

We

qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012. An emerging growth

company may take advantage of specified reduced reporting and other burdens that are otherwise applicable generally to public companies.

These provisions include:

| |

● |

an

exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting pursuant to

the Sarbanes-Oxley Act of 2002; |

| |

● |

an

exemption from implementation of new or revised financial accounting standards until they would apply to private companies and from

compliance with any new requirements adopted by the Public Company Accounting Oversight Board requiring mandatory audit firm rotation; |

| |

● |

reduced

disclosure obligations regarding executive compensation arrangements; and |

| |

● |

no

requirement to seek nonbinding advisory votes on executive compensation or golden parachute arrangements. |

We

may take advantage of some or all these provisions until we are no longer an emerging growth company. We will remain an emerging growth

company until the earlier to occur of (1) (a) June 30, 2026, which is the end of the fiscal year following the fifth anniversary of the

completion of our initial public offering, (b) the last day of the fiscal year in which we have total annual gross revenues of at least

$1.235 billion or (c) the last day of the fiscal year in which we are deemed to be a “large accelerated filer” under the

rules of the SEC, which means the market value of our common stock that is held by non-affiliates exceeds $700 million as of the prior

December 31st, and (2) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period.

Finally,

we are a “smaller reporting company” (and may continue to qualify as such even after we no longer qualify as an emerging

growth company) and accordingly may provide less public disclosure than larger public companies, including the inclusion of only two

years of audited financial statements and only two years of related management’s discussion and analysis of financial condition

and results of operations disclosure. As a result, the information that we provide to our stockholders may be different than you might

receive from other public reporting companies in which you hold equity interests.

The

Offering

| Common

stock offered by the selling stockholders |

4,529,300

shares(1) |

| |

|

| Terms

of the offering |

Each

selling stockholder will determine when and how it will sell the common stock offered in this prospectus, as described in “Plan

of Distribution.” |

| |

|

| Use

of proceeds |

We

will not receive any proceeds from the sale of the shares of common stock covered by this prospectus. |

| |

|

| Risk

Factors |

See

“Risk Factors” on page 4, for a discussion of factors you should carefully consider before deciding to invest in our

common stock. |

| |

|

| Nasdaq

Capital Market symbol |

ANEB |

| (1) |

Includes

2,264,650 shares of common stock held by the selling stockholders named in this prospectus and 2,264,650 shares of common stock issuable

upon exercise of warrants held by the selling stockholders named in this prospectus. |

The

selling stockholders named in this prospectus may offer and sell up to 4,529,300 shares of our common stock. Our common stock is currently

listed on The Nasdaq Capital Market under the symbol “ANEB.” Shares of our common stock that may be offered under this prospectus

will be fully paid and non-assessable. We will not receive any of the proceeds of sales by the selling stockholders of any of the common

stock covered by this prospectus. We will, however, receive the net proceeds of any exercise of the warrants. Throughout this prospectus,

when we refer to the shares of our common stock being registered on behalf of the selling stockholders for offer and resale, we are referring

to the shares of common stock that have been issued to the selling stockholders and the shares of common stock issuable upon exercise

of warrants issued in the Private Placement as described above. When we refer to the selling stockholders in this prospectus, we are

referring to the selling stockholders identified in this prospectus and, as applicable, their permitted transferees or other successors-in-interest

that may be identified in a supplement to this prospectus or, if required, a post-effective amendment to the registration statement of

which this prospectus is a part.

RISK

FACTORS

Investing

in our common stock involves a high degree of risk. Before making an investment decision, you should carefully consider the risks described

in the sections entitled “Risk Factors” in our most recent Annual Report on Form 10-K, as filed with the SEC, which is incorporated

herein by reference, as well any amendment or updates to our risk factors reflected in subsequent filings with the SEC, including any

applicable prospectus supplement. Our business, financial condition, results of operations or prospects could be materially adversely

affected by any of these risks. The trading price of our securities could decline due to any of these risks, and you may lose all or

part of your investment. This prospectus and the documents incorporated herein by reference also contain forward-looking statements that

involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements

as a result of certain factors, including the risks mentioned elsewhere in this prospectus. For more information, see the section entitled

“Where You Can Find Additional Information.” Please also read carefully the section entitled “Special Note Regarding

Forward-Looking Statements.”

USE

OF PROCEEDS

We

will not receive any of the proceeds from the sale or other disposition of shares of our common stock held by the selling stockholders

pursuant to this prospectus. Upon any exercise of any of the warrants, the applicable selling stockholder would pay us the exercise price

set forth in the warrants. The exercise price of the warrants is $4.215 per share, which is subject to customary adjustments in the event

of any combination or split of our common stock. We expect to use any such proceeds to advance

the development of ANEB-001 and for other general corporate purposes.

We

will bear the out-of-pocket costs, expenses and fees incurred in connection with the registration of shares of our common stock to be

sold by the selling stockholders pursuant to this prospectus. Other than registration expenses, the selling stockholders will bear underwriting

discounts, commissions, placement agent fees or other similar expenses payable with respect to sales of shares of our common stock.

SELLING

STOCKHOLDERS

The

common stock being offered by the selling stockholders are those previously issued to the selling stockholders, and those issuable to

the selling stockholders, upon exercise of the warrants. For additional information regarding the issuances of those shares of common

stock and warrants, see “Prospectus Summary—Private Placement” above. We are registering the shares of common stock

in order to permit the selling stockholders to offer the shares for resale from time to time.

The

table below lists the selling stockholders and other information regarding the beneficial ownership of the shares of common stock by

each of the selling stockholders. The second column lists the number of shares of common stock beneficially owned by each selling stockholder,

based on its ownership of the shares of common stock and warrants, as of September 30, 2022, assuming exercise of the warrants held by

the selling stockholders on that date.

The

third column lists the shares of common stock being offered by this prospectus by the selling stockholders.

This

prospectus generally covers the resale of the sum of (i) the number of shares of common stock issued to the selling stockholders and

(ii) the maximum number of shares of common stock issuable upon exercise of the warrants, determined as if the outstanding warrants were

exercised in full as of the trading day immediately preceding the date this registration statement was initially filed with the SEC,

each as of the trading day immediately preceding the applicable date of determination and all subject to adjustment as provided in the

Purchase Agreement, without regard to any limitations on the exercise of the warrants. The fourth column assumes the sale of all of the

shares offered by the selling stockholders pursuant to this prospectus.

Under

the terms of the warrants, a selling stockholder may not exercise the warrants to the extent such exercise would cause such selling stockholder,

together with its Attribution Parties (as defined in the Purchase Agreement), to beneficially own a number of shares of common stock

which would exceed 4.99%, 9.99% or 12,000,000 shares, as applicable, of our then outstanding common stock following such exercise, excluding

for purposes of such determination shares of common stock issuable upon exercise of such warrants which have not been exercised. The

percentage of shares owned prior to and after the offering in the second and fourth columns is based on 25,633,217 shares of our common

stock outstanding on September 30, 2022. The selling stockholders may sell all, some or none of their shares in this offering. See “Plan

of Distribution.”

| Name

of Selling Shareholder | |

Number

of shares

of Common

Stock Owned

Prior to Offering |

| | |

Maximum

Number

of shares of

Common Stock to

be Sold Pursuant

to this Prospectus | | |

Number

of shares

of Common

Stock Owned

After Offering |

| |

| | |

Shares |

| % | |

| | |

Shares |

| % |

| 22NW

Fund, LP(1) | |

| 6,769,867 |

| 24.8 | |

| 3,407,154 | | |

| 3,362,713 |

| 13.1 |

| Nantahala

Capital Partners Limited Partnership(2)(6) | |

| 179,812 |

| * | |

| 179,812 | | |

| — |

| * |

| NCP

RFM LP(3)(6) | |

| 237,018 |

| * | |

| 237,018 | | |

| — |

| * |

| Blackwell

Partners LLC – Series A(4)(6) | |

| 605,316 |

| 2.3 | |

| 605,316 | | |

| — |

| * |

| ADAR1

Partners, LP(5) | |

| 100,000 |

| * | |

| 100,000 | | |

| — |

| * |

| * |

Less

than 1% |

| |

|

| (1) |

Includes

1,703,577 shares issuable pursuant to warrants exercisable within 60 days of September 30, 2022. Aron R. English, as the Manager of 22NW Fund GP, LLC, which is the General Partner of 22NW Fund, LP, may be

deemed to beneficially own the securities owned directly by 22NW Fund, LP. The address for 22NW Fund, LP is 1455 NW Leary Way, Suite

400, Seattle, Washington 98107. |

| (2) |

Includes

89,906 shares issuable pursuant to warrants exercisable within 60 days of September 30, 2022. |

| (3) |

Includes

118,509 shares issuable pursuant to warrants exercisable within 60 days of September 30, 2022. |

| (4) |

Included

302,658 shares issuable pursuant to warrants exercisable within 60 days of September 30, 2022. |

| (5) |

Includes

50,000 shares issuable pursuant to warrants exercisable within 60 days of September 30, 2022. Daniel Schneeberger is the Managing Member of the General Partner of ADAR1 Partners, LP and thereby may be deemed

to beneficially own the securities held by ADAR1 Partners, LP. The address for ADAR1 Partners, LP is 7816 Lynchburg Drive, Austin,

Texas 78738, Attn: Daniel Schneeberger. |

| (6) |

Nantahala Capital Management, LLC is a Registered

Investment Adviser and has been delegated the legal power to vote and/or direct the disposition of such securities on behalf of the

selling stockholder as a General Partner, Investment Manager, or Sub-Advisor and would be considered the beneficial owner of such

securities. The above shall not be deemed to be an admission by the record owners or the selling stockholder that they are

themselves beneficial owners of these securities for purposes of Section 13(d) of the Exchange Act, or any other purpose. Wilmot

Harkey and Daniel Mack are managing members of Nantahala Capital Management, LLC and may be deemed to have voting and dispositive

power over the shares held by the selling stockholder. The address for Nantahala Capital Management, LLC is 130 Main St. 2nd

Floor, New Canaan, CT 06840. |

Relationships

with Selling Stockholders

Board

of Directors and Executive Officers

22NW

Fund, LP is an affiliate of Aron R. English, a member of our board of directors since June 2020. In addition, Nat Calloway, a member

of our board of directors since October 2022, is an employee of 22NW Fund, LP.

ADAR1

Partners, LP is an affiliate of Daniel Schneeberger, who served as our President, Chief Executive Officer and a member of our board of

directors from to July 2020 to February 2022.

June

2020 Private Placement

On

June 18, 2020, we received gross proceeds of $3,000,000 from a private placement of our series A preferred stock (the “2020 Private

Placement”), convertible into 2,047,500 shares of our common stock, pursuant to the terms of a securities purchase agreement (the

“2020 Securities Purchase Agreement”) with 22NW Fund, LP, an institutional accredited investor affiliated with Aron R. English,

who became a director of our Company at such time. The series A preferred stock converted into shares of our common stock, on a one-to-one

basis, automatically upon the closing of our initial public offering.

As

part of the 2020 Private Placement, 22NW Fund, LP and Mr. English, individually, further agreed under the 2020 Securities Purchase Agreement

to purchase, upon the achievement of certain corporate events, milestone warrants for $2,250,000 in the aggregate. The milestone warrants

were exercisable for cash for up to 6,896,406 shares of series A preferred stock at an exercise price of $1.69 per share or on a “net-exercise”

basis into such lesser number of shares of series A preferred stock by surrendering a portion of the underlying warrant shares, based

on the positive difference between the stated milestone warrant exercise price and the initial public offering price per share, to pay

the exercise price. The 2020 Securities Purchase Agreement provided that the milestone warrants must be purchased upon our achievement

of (i) a filing with the U.S. Food and Drug Administration of an investigational new drug application or the making of an analogous regulatory

filing in any foreign jurisdiction, whichever occurred earlier, and (ii) an arrangement by us to produce the active pharmaceutical ingredient

of ANEB-001, the Company’s lead product candidate, in amounts sufficient to facilitate the consummation of a trial pursuant to

such regulatory filing, or otherwise forfeited. On March 8, 2021, 22NW Fund, LP and Mr. English purchased the milestone warrants for

$2,250,000 in cash following acceptance of an open European clinical trial application in the Netherlands, permitting us to utilize ANEB-001

on human subjects in a Phase 2 clinical trial, and exercised the milestone warrants on a net-exercise basis into 5,236,343 shares of

common stock in connection with the closing of our initial public offering.

As

part of the 2020 Private Placement, we entered into an Investors’ Rights Agreement with 22NW Fund, LP. Upon the closing of our

initial public offering, all rights under the Investors’ Rights Agreement terminated, except for the registration rights set forth

therein. Pursuant to the terms of the Investors’ Rights Agreement, if we register any of our securities either for our own account

or for the account of other security holders, 22NW Fund, LP is entitled to certain “piggyback” registration rights allowing

it to include its registrable securities in such registration, subject to specified conditions and limitations. The registration rights

granted under the Investors’ Rights Agreement will terminate with respect to the registrable securities upon the earlier of (i)

the closing of a “Deemed Liquidation Event” (as defined in our amended and restated certificate of incorporation), (ii) such

time after the closing of our initial public offering as Rule 144 promulgated under the Securities Act or another similar exemption under

the Securities Act is available for the sale of all of 22NW Fund, LP’s shares without limitation during a three-month period without

registration and (iii) the third anniversary of our initial public offering. All fees, costs and expenses of registrations under the

Investors’ Rights Agreement will be borne by us and all selling expenses, including underwriting discounts and selling commissions,

if any, will be borne by 22NW Fund, LP.

Initial

Public Offering

22NW

Fund, LP purchased shares of our common stock in our initial public offering in May 2021 in an aggregate amount of $5.0 million. The

shares sold to 22NW Fund, LP were at the same price and on the same terms as the other investors in the initial public offering.

September

2022 Private Placement

The

description set forth above under “Prospectus Summary—Private Placement” is incorporated herein by reference.

PLAN

OF DISTRIBUTION

Each

selling stockholder and any of their pledgees, assignees and successors-in-interest may, from time to time, sell any or all of their

securities covered hereby on the Nasdaq Stock Market or any other stock exchange, market or trading facility on which the securities

are traded or in private transactions. These sales may be at fixed or negotiated prices. A selling stockholder may use any one or more

of the following methods when selling such securities:

| |

● |

ordinary

brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| |

|

|

| |

● |

block

trades in which the broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the block

as principal to facilitate the transaction; |

| |

|

|

| |

● |

purchases

by a broker-dealer as principal and resale by the broker-dealer for its account; |

| |

|

|

| |

● |

an

exchange distribution in accordance with the rules of the applicable exchange; |

| |

|

|

| |

● |

privately

negotiated transactions; |

| |

|

|

| |

● |

settlement

of short sales; |

| |

|

|

| |

● |

in

transactions through broker-dealers that agree with the selling stockholders to sell a specified number of such securities at a stipulated

price per security; |

| |

|

|

| |

● |

through

the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| |

|

|

| |

● |

a

combination of any such methods of sale; or |

| |

|

|

| |

● |

any

other method permitted pursuant to applicable law. |

The

selling stockholders may also sell the securities under Rule 144 or any other exemption from registration under the Securities Act, if

available, rather than under this prospectus.

Broker-dealers

engaged by the selling stockholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions

or discounts from the selling stockholders (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser)

in amounts to be negotiated, but, except as set forth in a supplement to this prospectus, in the case of an agency transaction not in

excess of a customary brokerage commission in compliance with FINRA Rule 2121; and in the case of a principal transaction a markup or

markdown in compliance with FINRA Rule 2121.

In

connection with the sale of the securities or interests therein, the selling stockholders may enter into hedging transactions with broker-dealers

or other financial institutions, which may in turn engage in short sales of the securities in the course of hedging the positions they

assume. The selling stockholders may also sell securities short and deliver these securities to close out their short positions, or loan

or pledge the securities to broker-dealers that in turn may sell these securities. The selling stockholders may also enter into option

or other transactions with broker-dealers or other financial institutions or create one or more derivative securities which require the

delivery to such broker-dealer or other financial institution of securities offered by this prospectus, which securities such broker-dealer

or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The

selling stockholders and any broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters”

within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers

or agents and any profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts

under the Securities Act. Each selling stockholder has informed the Company that it does not have any written or oral agreement or understanding,

directly or indirectly, with any person to distribute the securities.

The

Company is required to pay certain fees and expenses incurred by the Company incident to the registration of the securities. The Company

has agreed to indemnify the selling stockholders against certain losses, claims, damages and liabilities, including liabilities under

the Securities Act.

We

agreed to keep this prospectus effective until the earlier of (i) September 28, 2024 and (ii) the date all of the shares of common stock

issued pursuant to the Purchase Agreement or shares of common stock issuable upon the exercise of warrants issued pursuant to the Purchase

Agreement held by the selling stockholders may be sold under Rule 144 without being subject to any volume, manner of sale or publicly

available information requirements. The securities will be sold only through registered or licensed brokers or dealers if required under

applicable state securities laws. In addition, in certain states, the securities covered hereby may not be sold unless they have been

registered or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available

and is complied with.

Under

applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the securities covered hereby may

not simultaneously engage in market making activities with respect to the common stock for the applicable restricted period, as defined

in Regulation M, prior to the commencement of the distribution. In addition, the selling stockholders will be subject to applicable provisions

of the Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales

of the common stock by the selling stockholders or any other person. We will make copies of this prospectus available to the selling

stockholders and have informed them of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the

sale (including by compliance with Rule 172 under the Securities Act).

LEGAL

MATTERS

Certain

legal matters, including the validity of the shares of common stock offered pursuant to this registration statement, will be passed upon

for us by Cooley LLP, San Diego, California.

EXPERTS

The

balance sheets of Anebulo Pharmaceuticals, Inc. as of June 30, 2022 and 2021 and the related statements of operations, convertible preferred

stock, common stock and stockholders’ equity (deficit), and cash flows for each of the years then ended, have been audited by EisnerAmper

LLP, independent registered public accounting firm, as stated in their report which is incorporated herein by reference. Such financial

statements have been incorporated herein by reference in reliance on the report of such firm given upon their authority as experts in

accounting and auditing.

WHERE

YOU CAN FIND MORE INFORMATION

This

prospectus is part of a registration statement we filed with the SEC. This prospectus does not contain all of the information set forth

in the registration statement and the exhibits to the registration statement. For further information with respect to us and the securities

we are offering under this prospectus, we refer you to the registration statement and the exhibits and schedules filed as a part of the

registration statement. Neither we nor any agent, underwriter or dealer has authorized any person to provide you with information that

is different from that contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available

to you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give

you. We are not making an offer of these securities in any state where the offer is not permitted. You should not assume that the information

in this prospectus is accurate as of any date other than the date on the front page of this prospectus, regardless of the time of delivery

of this prospectus or any sale of the securities offered by this prospectus.

We

file annual, quarterly and current reports, proxy statements and other information with the SEC. The SEC maintains a website that contains

reports, proxy and information statements and other information regarding issuers that file electronically with the SEC, including us.

The address of the SEC website is www.sec.gov.

We

maintain a website at www.anebulo.com. Information contained in or accessible through our

website does not constitute a part of this prospectus.

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

The

SEC allows us to “incorporate by reference” information from other documents that we file with it, which means that we can

disclose important information to you by referring you to those documents. The information incorporated by reference is considered to

be part of this prospectus. Information in this prospectus supersedes information incorporated by reference that we filed with the SEC

prior to the date of this prospectus.

We

incorporate by reference into this prospectus and the registration statement of which this prospectus is a part the information or documents

listed below that we have filed with the SEC (Commission File No. 001-40388):

| |

● |

our

Annual Report on Form 10-K for the fiscal year ended June 30, 2022, filed with the SEC on September

9, 2022; |

| |

|

|

| |

● |

our

Current Reports on Form 8-K filed with the SEC on September

26, 2022, September

29, 2022, October

13, 2022 and October

28, 2022 (other than the portions thereof which are furnished and not filed); |

| |

|

|

| |

● |

the

information specifically incorporated by reference into our Annual Report on Form 10-K for the fiscal year ended June 30, 2022 from

our Definitive Proxy Statement on Schedule 14A, as filed with the SEC on October

17, 2022; and |

| |

|

|

| |

● |

the

description of our common stock, which is registered under Section 12 of the Exchange Act, in our registration statement on Form

8-A, filed with the SEC on May

5, 2021, including any amendments or reports filed for the purpose of updating such description. |

In

addition, all documents subsequently filed by us pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, prior to the termination

of the offering (excluding any information furnished rather than filed) shall be deemed to be incorporated by reference into this prospectus.

We

will furnish without charge to each person, including any beneficial owner, to whom this prospectus is delivered, upon written or oral

request, a copy of any document incorporated by reference. Requests should be addressed to 1415 Ranch Road 620 South, Suite 201, Lakeway,

Texas 78734, Attn: Corporate Secretary or may be made telephonically at (512) 598-0931.

You

also may access these filings on our website at www.anebulo.com. We do not incorporate the information on our website into this prospectus

and you should not consider any information on, or that can be accessed through, our website as part of this prospectus (other than those

filings with the SEC that we specifically incorporate by reference into this prospectus).

In

accordance with Rule 412 of the Securities Act, any statement contained in a document incorporated by reference herein shall be deemed

modified or superseded to the extent that a statement contained herein or in any other subsequently filed document which also is or is

deemed to be incorporated by reference herein modifies or supersedes such statement.

Anebulo

Pharmaceuticals, Inc.

4,529,300

Shares of Common Stock

PROSPECTUS

,

2022

PART

II

INFORMATION

NOT REQUIRED IN THE PROSPECTUS

Item

13. Other Expenses of Issuance and Distribution

The

following table sets forth an estimate of the fees and expenses, other than the underwriting discounts and commissions, payable by Anebulo

Pharmaceuticals, Inc. (the “Registrant,” “we,” “our” or “us”) in connection with the

issuance and distribution of the securities being registered.

| | |

Amount | |

| SEC

registration fee | |

$ | 1,013 | |

| Accounting

fees and expenses | |

| 20,000 | |

| Legal

fees and expenses | |

| 25,000 | |

| Other

miscellaneous fees and expenses | |

| 3,987 | |

| Total | |

$ | 50,000 | |

Item

14. Indemnification of Directors and Officers

We

are incorporated under the laws of the State of Delaware. Section 145 of the Delaware General Corporation Law provides that a Delaware

corporation may indemnify any persons who were, are, or are threatened to be made, parties to any threatened, pending or completed action,

suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of such corporation),

by reason of the fact that such person is or was an officer, director, employee or agent of such corporation, or is or was serving at

the request of such corporation as an officer, director, employee or agent of another corporation or enterprise. The indemnity may include

expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by such

person in connection with such action, suit or proceeding, provided that such person acted in good faith and in a manner he or she reasonably

believed to be in or not opposed to the corporation’s best interests and, with respect to any criminal action or proceeding, had

no reasonable cause to believe that his or her conduct was illegal. A Delaware corporation may indemnify any persons who were, are, or

are threatened to be made, a party to any threatened, pending or completed action or suit by or in the right of the corporation by reason

of the fact that such person is or was a director, officer, employee or agent of such corporation, or is or was serving at the request

of such corporation as a director, officer, employee or agent of another corporation or enterprise. The indemnity may include expenses

(including attorneys’ fees) actually and reasonably incurred by such person in connection with the defense or settlement of such

action or suit provided such person acted in good faith and in a manner he or she reasonably believed to be in or not opposed to the

corporation’s best interests except that no indemnification is permitted without judicial approval if the officer or director is

adjudged to be liable to the corporation. Where an officer or director is successful on the merits or otherwise in the defense of any

action referred to above, the corporation must indemnify him or her against the expenses (including attorneys’ fees) actually and

reasonably incurred.

Our

amended and restated certificate of incorporation and amended and restated bylaws provide for the indemnification of our directors and

officers to the fullest extent permitted under the Delaware General Corporation Law.

Section

102(b)(7) of the Delaware General Corporation Law permits a corporation to provide in its certificate of incorporation that a director

of the corporation shall not be personally liable to the corporation or its stockholders for monetary damages for breach of fiduciary

duties as a director, except for liability for any:

| |

● |

transaction

from which the director derives an improper personal benefit; |

| |

|

|

| |

● |

act

or omission not in good faith or that involves intentional misconduct or a knowing violation of law; |

| |

|

|

| |

● |

unlawful

payment of dividends or redemption of shares; or |

| |

|

|

| |

● |

breach

of a director’s duty of loyalty to the corporation or its stockholders. |

Our

amended and restated certificate of incorporation includes such a provision. Expenses incurred by any officer or director in defending

any such action, suit or proceeding in advance of its final disposition shall be paid by us upon delivery to us of an undertaking, by

or on behalf of such director or officer, to repay all amounts so advanced if it shall ultimately be determined that such director or

officer is not entitled to be indemnified by us.

Section

174 of the Delaware General Corporation Law provides, among other things, that a director who willfully or negligently approves of an

unlawful payment of dividends or an unlawful stock purchase or redemption, may be held liable for such actions. A director who was either

absent when the unlawful actions were approved or dissented at the time may avoid liability by causing his or her dissent to such actions

to be entered in the books containing minutes of the meetings of the board of directors at the time such action occurred or immediately

after such absent director receives notice of the unlawful acts.

As

permitted by the Delaware General Corporation Law, we have entered into indemnity agreements with each of our directors and executive

officers, that require us to indemnify such persons against any and all costs and expenses (including attorneys’, witness or other

professional fees) actually and reasonably incurred by such persons in connection with any action, suit, arbitration, alternate dispute

resolution mechanism, investigation, inquiring, administrative hearing or other actual, threatened or completed proceeding (including

derivative actions) to which any such person is, was or may be made a party by reason of the fact that such person is or was a director,

officer, employee, agent or fiduciary of us or of any other entity or enterprise that such person was serving at the express written

consent of us. Under these agreements, we are not required to provide indemnification for certain matters, including:

| |

● |

indemnification

beyond that permitted by the Delaware General Corporation Law; |

| |

|

|

| |

● |

indemnification

for certain proceedings for which payment has actually been made to or on behalf of such director or officer under any insurance

policy or other indemnity provision, except with respect to any excess beyond the amount paid under any insurance policy or other

indemnity provision; |

| |

|

|

| |

● |

indemnification

for certain proceedings for an accounting of profits made from the purchase and sale (or sale and purchase) by such director or officer

of our securities within the meaning of Section 16(b) of the Securities Exchange Act of 1934, as amended, or similar provisions of

state statutory law or common law; or |

| |

|

|

| |

● |

indemnification

for proceedings brought by an officer or director against us or any of our directors, officers, employees or other indemnitees, unless

(i) our board of directors authorized the proceeding (or any part of any proceeding) prior to its initiation, or (ii) we provide

the indemnification in our sole discretion pursuant to the powers vested in us under applicable law |

The

indemnification agreements also set forth certain procedures that will apply in the event of a claim for indemnification thereunder.

At

present, there is no pending litigation or proceeding involving any of our directors or executive officers as to which indemnification

is required or permitted, and we are not aware of any threatened litigation or proceeding that may result in a claim for indemnification.

We

have an insurance policy in place that covers our officers and directors with respect to certain liabilities, including liabilities arising

under the Securities Act of 1933, as amended (the “Securities Act”) or otherwise.

We

may enter into one or more underwriting agreements which provides that the underwriters are obligated, under some circumstances, to indemnify

our directors, officers and controlling persons against specified liabilities, including liabilities under the Securities Act.

Item

15. Recent Sales of Unregistered Securities

On

June 18, 2020, we received gross proceeds of $3.0 million from a private placement of our series A preferred stock (the “2020 Private

Placement”), convertible into 2,047,500 shares of our common stock, pursuant to the terms of a Securities Purchase Agreement (the

“2020 Securities Purchase Agreement”) with 22NW Fund, LP, an institutional accredited investor affiliated with Aron R. English,

a director of our company. As part of the 2020 Private Placement, 22NW Fund, LP and Mr. English, individually, further agreed under the

2020 Securities Purchase Agreement to purchase, upon the achievement of certain corporate events, “milestone” warrants for

$2,250,000 in the aggregate. The milestone warrants were exercisable for cash for up to 6,896,406 shares of series A preferred stock

at an exercise price of $1.69 per share or on a “net exercise” basis into such lesser number of shares of series A preferred

stock by surrendering a portion of the underlying warrant shares, based on the positive difference between the stated milestone warrant

exercise price and the initial public offering price per share in this offering, to pay the exercise price. On March 8, 2021, following

the achievement of the applicable milestones, 22NW Fund, LP and Mr. English purchased the milestone warrants for $2,250,000 in cash.

On May 11, 2021, in connection with the closing of our initial public offering, and following a six-for-one stock split effected by the

Registrant on April 23, 2021, the milestone warrants were exercised on a net-exercise basis into 5,236,343 shares of our series A preferred

stock and all of the outstanding shares of series A preferred stock were converted into 7,283,843 shares of common stock.

On

September 25, 2022, we entered into a Securities Purchase Agreement (the “2022 Securities Purchase Agreement”) with certain

accredited investors, pursuant to which we sold and issued to such investors 2,264,650 units (collectively, the “Units”),

with each Unit consisting of (i) one share of our common stock and (ii) a warrant to purchase one share of our common stock, for an aggregate

purchase price of approximately $6.6 million (or $2.935 per Unit), in a private placement transaction (the “2022 Private Placement”).

The closing of the 2022 Private Placement occurred on September 28, 2022. Each warrant has an exercise price of $4.215 per share, which

is subject to customary adjustments in the event of any combination or split of our common stock, and has a five-year term. The warrants

contain beneficial ownership limitations which prevent the holder from exercising the warrant if immediately following such exercise

the holder would beneficially own shares of our common stock in excess of the stated beneficial ownership limitation. 22NW

Fund, LP, a fund affiliated with Mr. English, a director of our company and the second largest beneficial owner of common stock, participated

in the 2022 Private Placement and purchased 1,703,577 Units at the per Unit purchase price, for an aggregate purchase price of approximately

$5.0 million. The shares of common stock issued pursuant to the 2022 Securities Purchase Agreement and the shares of common stock issuable

upon exercise of the warrants issued pursuant to the 2022 Securities Purchase Agreement are being registered pursuant to this registration

statement.

The

sales and issuances of securities in the transactions described above were not registered under the Securities Act in reliance upon the

exemption from registration provided by Section 4(a)(2) thereof or Regulation D promulgated thereunder. The recipients of the securities

in each of these transactions represented their intentions to acquire the securities for investment only and not with a view to or for

sale in connection with any distribution thereof, and appropriate legends were placed upon the stock certificates issued in these transactions.

All recipients had adequate access, through their relationships with us, to information about us.

Item

16. Exhibits and Financial Statement Schedules

(a)

Exhibit Index

Exhibit

Number |

|

Description

of Document |

| 3.1 |

|

Second

Amended and Restated Certificate of Incorporation of Anebulo Pharmaceuticals, Inc. (incorporated by reference to Exhibit 3.1 to the

Registrant’s Annual Report on Form 10-K, filed with the SEC on September 9, 2022). |

| |

|

|

| 3.2 |

|

Certificate

of Correction to Second Amended and Restated Certificate of Incorporation of Anebulo Pharmaceuticals, Inc. (incorporated by reference

to Exhibit 3.2 to the Registrant’s Annual Report on Form 10-K, filed with the SEC on September 9, 2022). |

| |

|

|

| 3.3 |

|

Amended

and Restated Bylaws of Anebulo Pharmaceuticals, Inc. (incorporated by reference to Exhibit 3.1 to the Registrant’s Current

Report on Form 8-K, filed with the SEC on October 13, 2022). |

| |

|

|

| 4.1 |

|

Reference

is made to Exhibits 3.1,

3.2 and

3.3. |

| |

|

| 4.2 |

|

Specimen

Stock Certificate for Common Stock (filed as Exhibit 4.1 to the Registrant’s Registration Statement on Form S-1 filed with

the SEC on April 1, 2021 and incorporated herein by reference). |

| |

|

| 4.3 |

|

Investors’

Rights Agreement, dated June 18, 2020, between Anebulo Pharmaceuticals, Inc. and 22NW, LP (filed as Exhibit 10.3 to the Registrant’s

Registration Statement on Form S-1 filed with the SEC on April 1, 2021 and incorporated herein by reference). |

| |

|

| 4.4 |

|

Securities

Purchase Agreement, dated September 25, 2022, by and between Anebulo Pharmaceuticals, Inc. and the purchasers named therein (incorporated

by reference to Exhibit 4.1 to the Registrant’s Current Report on Form 8-K, filed with the SEC on September 29, 2022). |

| |

|

| 4.5 |

|

Form

of Common Stock Purchase Warrant, issued September 28, 2022 (incorporated by reference to Exhibit 4.2 to the Registrant’s Current

Report on Form 8-K, filed with the SEC on September 29, 2022). |

| |

|

| 5.1 |

|

Opinion

of Cooley LLP. |

| |

|

|

| 10.1# |

|

License

Agreement, dated May 26, 2020, between Vernalis (R&D) Limited and Anebulo Pharmaceuticals, Inc. (filed as Exhibit 10.4 to the

Registrant’s Registration Statement on Form S-1 filed with the SEC on April 1, 2021 and incorporated herein by reference). |

| |

|

|

| 10.2† |

|

Anebulo

Pharmaceuticals, Inc. 2020 Stock Incentive Plan, as amended, and Form of Award Agreement thereunder (incorporated by reference to

Exhibit 10.2 of the Registrant’s Annual Report on Form 10-K, filed with the SEC on September 9, 2022). |

| |

|

|

| 10.3† |

|

Form

of Indemnification Agreement between Anebulo Pharmaceuticals, Inc. and each of its directors (filed as Exhibit 10.8 to the Registrant’s

Registration Statement on Form S-1 filed with the SEC on April 1, 2021 and incorporated herein by reference). |

| |

|

|

| 10.4 |

|

Consultancy

Agreement, dated July 15, 2020, between Anebulo Pharmaceuticals, Inc. and Traxeus Pharma Services Limited (filed as Exhibit 10.9

to the Registrant’s Registration Statement on Form S-1 filed with the SEC on April 1, 2021 and incorporated herein by reference). |

| |

|

|

| 10.5† |

|

Employment

Agreement, dated February 1, 2022, between Simon Allen and Anebulo Pharmaceuticals, Inc. (filed as Exhibit 10.1 to the Registrant’s

Current Report on Form 8-K filed with the SEC on January 5, 2022 and incorporated herein by reference). |

| |

|

|

| 10.6† |

|

Employment

Agreement, dated January 1, 2021, between Rex Merchant and Anebulo Pharmaceuticals, Inc. (incorporated by reference to Exhibit 10.6

of the Registrant’s Annual Report on Form 10-K, filed with the SEC on September 9, 2022). |

| |

|

|

| 10.7† |

|

Employment

Agreement, effective as of May 20, 2022, between Anebulo Pharmaceuticals, Inc. and Kenneth Cundy (filed as Exhibit 10.1 to the Registrant’s

Current Report on Form 8-K filed with the SEC on May 24, 2022 and incorporated herein by reference). |

| |

|

|

| 10.8 |

|

Sublease

Agreement, dated August 15, 2020, as amended on August 1, 2022, between Anebulo Pharmaceuticals, Inc. and JFL Capital Management

LLC (incorporated by reference to Exhibit 10.8 of the Registrant’s Annual Report on Form 10-K, filed with the SEC on September

9, 2022). |

| |

|

|

| 10.9† |

|

Non-Employee

Director Compensation Policy (incorporated by reference to Exhibit 10.9 of the Registrant’s Annual Report on Form 10-K, filed

with the SEC on September 9, 2022). |

| |

|

| 23.1 |

|

Consent

of EisnerAmper LLP. |

| |

|

| 23.2 |

|

Consent

of Cooley LLP (included in legal opinion filed as Exhibit 5.1). |

| |

|

| 24.1 |

|

Power

of Attorney (included on signature page). |

| |

|

| 107 |

|

Filing

Fee Table. |

(b)

Financial Statement Schedules

All

financial statement schedules are omitted because the information called for is not required or is shown either in the financial statements

or in the notes thereto incorporated by reference herein.

Item

17. Undertakings

The

undersigned registrant hereby undertakes:

| (a) |

(1)

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement: |

| |

(i) |

To

include any prospectus required by Section 10(a)(3) of the Securities Act; |

| |

|

|

| |

(ii) |

To

reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent

post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set

forth in the registration |

| |

statement.

Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities

offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering

range may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in

volume and price represent no more than 20 percent change in the maximum aggregate offering price set forth in the “Calculation

of Registration Fee” table in the effective registration statement; and |

| |

(iii) |

To

include any material information with respect to the plan of distribution not previously disclosed in the registration statement

or any material change to such information in the registration statement; |

provided,

however, that the undertakings set forth in paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) above do not apply if the information

required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the SEC

by the registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

that are incorporated by reference in this registration statement or are contained in a form of prospectus filed pursuant to Rule 424(b)

that is part of this registration statement.

| |

(2) |

That,

for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a

new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be

deemed to be the initial bona fide offering thereof. |

| |

|

|

| |

(3) |

To

remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering. |

| |

|

|

| |

(4) |

That,

for the purpose of determining liability under the Securities Act to any purchaser: |

| |

(i) |

Each

prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the

date the filed prospectus was deemed part of and included in the registration statement; and |

| |

|

|

| |

(ii) |

Each

prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on

Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information

required by Section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of the

earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities

in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is

at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities

in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed

to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement

or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into

the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract

of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus

that was part of the registration statement or made in any such document immediately prior to such effective date. |

| (b) |

The

registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the registrant’s

annual report pursuant to Section 13(a) or 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s

annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in the registration statement shall

be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that

time shall be deemed to be the initial bona fide offering thereof. |

| |

|

| (c) |

Insofar

as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons

of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the

SEC such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event

that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid

by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted

by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in

the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the

question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the

final adjudication of such issue. |

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, the registrant has duly caused this registration statement to be signed on its behalf

by the undersigned, thereunto duly authorized, in the City of Lakeway, State of Texas, on November 2, 2022.

| |

Anebulo

Pharmaceuticals, INC. |

| |

|

|

| |

By: |

/s/

Simon Allen |

| |

|

Simon

Allen |

| |

|

Chief

Executive Officer |

POWER

OF ATTORNEY

KNOW

ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Simon Allen and Rex Merchant,

and each of them, as his/her true and lawful attorney-in-fact and agent, each acting alone, with

full power of substitution and resubstitution, for him/her and in his/her name, place and stead, in any and all capacities, to sign any

or all amendments (including post-effective amendments) to this Registration Statement, and to file the same, with all exhibits thereto,

and all documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents,

full power and authority to do and perform each and every act and thing requisite and necessary to be done in and about the premises,

as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact

and agents, or his/her substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant

to the requirements of the Securities Act of 1933, as amended, this registration statement has been signed below by the following persons

in the capacities and on the dates indicated.

| Name |

|

Title |

|

Date |

| |

|

|

|

|

| /s/

Simon Allen |

|

Chief

Executive Officer and Director |

|

November

2, 2022 |

| Simon

Allen |

|

(principal

executive officer) |

|

|

| |

|

|

|

|

| /s/

Rex Merchant |

|

Chief

Financial Officer |

|

November

2, 2022 |

| Rex

Merchant |

|

(principal

financial and accounting officer) |

|

|

| |

|

|

|

|

| /s/

Joseph F. Lawler |

|

Chair

of the Board of Directors |

|

November