Current Report Filing (8-k)

08 December 2021 - 1:01AM

Edgar (US Regulatory)

false000138746700013874672020-05-052020-05-05false000138746700013874672021-12-012021-12-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 1, 2021

Alpha and Omega Semiconductor Limited

(Exact name of registrant as specified in its charter)

Bermuda

|

|

001-34717

|

|

77-0553536

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

Clarendon House

2 Church Street

Hamilton HM 11

Bermuda

(Address of principal registered offices)

(408) 830-9742

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Shares

|

AOSL

|

The Nasdaq Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act

of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

Effective as of December 1, 2021 (the “Effective Date”), Alpha & Omega Semiconductor (Shanghai) Ltd. (“AOS SH”) and Agape

Package Manufacturing (Shanghai) Limited (“APM SH” and, together with AOS SH, the “Sellers”), each a wholly-owned subsidiary of Alpha and Omega Semiconductor Limited (the “Company” or “AOS”), entered into a share transfer agreement (the “STA”)

with a third-party investor (the “Investor”), pursuant to which the Sellers sold to the Investor approximately 2.1% of outstanding equity interest held by the Sellers in the joint venture in Chongqing (the “JV Company”) for an aggregate

purchase price of RMB 108 million (or approximately $16.9 million based on the currency exchange rate as of December 1, 2021) (the “Transaction”). The STA contained customary representations, warranties and covenants.

Also on the Effective Date, the Investor and the other shareholders of the JV Company, including AOS and the Sellers, entered into

the Fourth Supplementary Agreement (the “Fourth Amendment”) to the Joint Venture Contract dated as of March 29, 2016 among the parties named thereto (as amended and supplemented from time to time, the “JV Contract”). Pursuant to the Fourth

Amendment, the parties agree that, among other things, (a) AOS’s right to designate directors on the board of the JV Company will be three (3) out of seven (7) directors, instead of four (4) directors as provided under the JV Contract prior to

the Transaction, and (b) the shareholders will facilitate the establishment of an employment stock ownership plan for the JV Company.

The Transaction was closed on December 2, 2021 (the “Closing Date”).

The above disclosure is a summary and qualified in its entirety by the STA and the Fourth Amendment, copies of which will be filed

as exhibits to the Company’s Quarterly Report for the period ending December 31, 2021.

Item 2.01 Completion of Acquisition or Disposition of Assets.

Reference is made to the information disclosed under Item 1.01 above, which information is incorporated herein by reference.

As a result of the Transaction, as of the Closing Date, AOS’s equity interest in the JV Company decreased from 50.9% to 48.8%, and

AOS no longer has a controlling financial interest in the JV Company. Accordingly, AOS has made a preliminary determination that it will deconsolidate the JV Company’s financial statements and results of operations from AOS’s consolidated

financial statements (the “Deconsolidation”), effective as of the Closing Date, in accordance with Accounting Standards Codification, or ASC, 810-10-40-4(c), Consolidation. Following the Deconsolidation, AOS will account for its interest in the JV Company using the equity method of accounting effective beginning on the Closing Date. In connection with the

Deconsolidation, AOS expects to record in the second quarter of fiscal year 2022 ending December 31, 2021 a significant non-cash gain to recognize the difference between the carrying value and estimated fair value of its interest in the JV

Company as of the Closing Date. The assessment as to whether the JV Company will be deconsolidated is ongoing and will be finalized in conjunction with the Company’s financial statement close process for the three months ending December 31,

2021.

We have included as Exhibit 99.1 to this Report the unaudited pro forma consolidated condensed balance sheet as of September 30,

2021, derived from our latest unaudited consolidated condensed balance sheet filed in our Quarterly Report on Form 10-Q, and unaudited pro forma consolidated condensed statements of operations for the three months ended September 30, 2021 and

for the fiscal year ended June 30, 2021 as if the Deconsolidation had occurred on July 1, 2020.

Item 7.01 Regulation FD Disclosure.

On December 7, 2021, the Company issued a press

release announcing the closing of the Transaction and the Deconsolidation. A copy of the press release is furnished as Exhibit 99.2 to this Report and is

incorporated by reference into this Item 7.01.

Item 9.01 Financial Statements and Exhibits.

(b) Pro Forma Financial Information.

Unaudited Pro Forma Consolidated Condensed Financial Information of the Registrant, which reflects the Deconsolidation, is attached

hereto as Exhibit 99.1 and is incorporated herein by reference.

(d) Exhibits.

|

|

|

|

|

|

|

104

|

Cover Page Interactive Data File - the cover page XBRL tags are embedded within Inline XBRL document

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused

this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: December 7, 2021

|

|

Alpha and Omega Semiconductor Limited

|

|

|

|

|

|

|

By:

|

/s/ Yifan Liang

|

|

|

Name:

|

Yifan Liang

|

|

|

Title:

|

Chief Financial Officer and Corporate Secretary

|

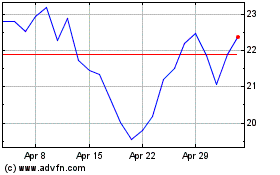

Alpha and Omega Semicond... (NASDAQ:AOSL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alpha and Omega Semicond... (NASDAQ:AOSL)

Historical Stock Chart

From Apr 2023 to Apr 2024