AppTech Payments Reports Third Quarter 2024 Results and Provides Business Update

16 November 2024 - 8:14AM

AppTech Payments Corp. (NASDAQ: APCX), a pioneering Fintech company

powering frictionless commerce, announced its financial results for

the third quarter ended September 30, 2024.

Strategic HighlightsIn Q3 2024,

AppTech continued its strategic focus on platform innovation,

operational efficiency, and expanding partnerships within

high-growth sectors such as credit unions, Independent Sales

Organizations (ISOs), and airports, addressing the increasing

demand for seamless, secure, and customized payment solutions.

Utilizing its Payments-as-a-Service (PaaS) and Banking-as-a-Service

(BaaS) models, AppTech is working to provide ISOs, credit unions,

and travel hubs with foundational digital payment capabilities.

These ongoing developments are intended to help AppTech’s clients

address the operational challenges of digital payments while

adapting to changing market demands.

Key growth drivers for AppTech in the upcoming

quarters and year include the continued expansion of its BaaS

program and white-label solutions, which are the primary drivers

for ISOs to transition their portfolios to the FinZeo platform. The

rollout of FinZeo is expected to continue, with new airports coming

on board by the end of 2024, and plans for nationwide availability

to credit unions. Additionally, the anticipated launch of InstaCash

is poised to transform the specialty payments space. Another

significant growth factor is the onboarding of a new strategic

partner with a portfolio of 40,000 clients, which will further

expand AppTech's reach and market presence.

CEO Statement

“Our Q3 results reflect our focused approach to

refining digital payment solutions and advancing strategic platform

development to serve key sectors better,” said Luke D’Angelo,

Chairman and CEO of AppTech. “As we continue enhancing our

platform, we remain committed to delivering adaptable payment

solutions to Independent Sales Organizations, credit unions, and

airports. These efforts demonstrate our dedication to operational

efficiency and sustainable growth while building long-term

shareholder value.”

Operational Efficiency and Investment in

Growth

In Q3 2024, AppTech reported revenues of

$43,000, compared to $140,000 in Q3 2023, reflecting a strategic

adjustment in the Company’s focus, prioritizing long-term platform

development over short-term merchant processing revenue. AppTech

aims to support sustainable growth and scalability across key

sectors by shifting resources toward enhancing its proprietary

digital financial services.

Total operating expenses for the quarter were

$1.9 million, a decrease from $3.0 million in Q3 2023, due to

disciplined cost management and expense reductions. As a result,

net loss narrowed to $2.0 million for Q3 2024, compared to a net

loss of $2.9 million in Q3 2023. This improvement underscores the

Company’s commitment to efficient resource allocation, ensuring

that investments align with strategic goals for long-term value

creation.

Capital and Equity

StrategyAppTech raised $0.9 million through a convertible

note to support its growth initiatives and $1.0 million from

warrant exercises during the quarter. The Company’s financial

resources continue to drive shareholder value and advance ongoing

technological developments as we invest in the future.

About AppTech Payments Corp.

AppTech Payments Corp. (NASDAQ: APCX) provides

digital financial services for financial institutions,

corporations, small and midsized enterprises (“SMEs”), and

consumers through the Company’s scalable cloud-based platform

architecture and infrastructure, coupled with our Specialty

Payments development and delivery model. AppTech maintains

exclusive licensing and partnership agreements in addition to a

full suite of patented technology capabilities. For more

information, please visit apptechcorp.com.

Forward-Looking Statements

This press release contains forward-looking

statements that are inherently subject to risks and uncertainties.

Any statements contained in this document that are not historical

facts are forward-looking statements as defined in the U.S. Private

Securities Litigation Reform Act of 1995. Words such as

“anticipate, believe, estimate, expect, forecast, intend, may,

plan, project, predict, should, will” and similar expressions as

they relate to AppTech are intended to identify such

forward-looking statements. These risks and uncertainties include,

but are not limited to, general economic and business conditions,

effects of continued geopolitical unrest and regional conflicts,

competition, changes in methods of marketing, delays in

manufacturing or distribution, changes in customer order patterns,

changes in customer offering mix, and various other factors beyond

the Company’s control. Actual events or results may differ

materially from those described in this press release due to any of

these factors. AppTech is under no obligation to update or alter

its forward-looking statements, whether as a result of new

information, future events, or otherwise.

AppTech Payments

Corp.760-707-5959info@apptechcorp.com

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1933 is available at the link

below:

https://www.sec.gov/ix?doc=/Archives/edgar/data/1070050/000168316824008000/apptech_i10q-093024.htm

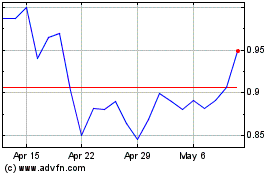

AppTech Payments (NASDAQ:APCX)

Historical Stock Chart

From Oct 2024 to Nov 2024

AppTech Payments (NASDAQ:APCX)

Historical Stock Chart

From Nov 2023 to Nov 2024