Current Report Filing (8-k)

29 December 2022 - 8:32AM

Edgar (US Regulatory)

0001201792

false

--12-31

0001201792

2022-12-28

2022-12-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 28, 2022

American Public Education, Inc.

(Exact name of registrant as specified

in its charter)

| Delaware |

|

001-33810 |

|

01-0724376 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

111 W. Congress Street

Charles Town, West Virginia |

|

25414 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: 304-724-3700

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, $0.01 par value per share |

APEI |

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

| Item 1.01. |

Entry Into a Material Definitive Agreement. |

On December 28, 2022 (the “Closing

Date”), American Public Education, Inc. (the “Company”) announced that it had sold $40 million of its

newly designated Series A Senior Preferred Stock, $0.01 par value per share (the “Preferred Stock”), to affiliates of Redwood Capital Management, LLC and MSD Partners, L.P., affiliates of each of which are

existing common stockholders of the Company (the “Investors”). The sale of the Preferred Stock was consummated on the

Closing Date pursuant to a purchase agreement (the “Purchase Agreement”) among the Company and the Investors.

The

Company intends to use a portion of the net proceeds from the sale of the Preferred Stock, along with available cash, to repay approximately $65

million (the “Repayment”) of the outstanding principal balance of the Company’s outstanding Term Loans (as defined

in that certain Credit Agreement, dated as of September 1, 2021, among the Company, as borrower, the lenders and issuing banks from

time to time party thereto, Macquarie Capital Funding LLC, as administrative agent and collateral agent, and Macquarie Capital (USA) Inc.

and Truist Securities, Inc., as joint lead arrangers and joint bookrunners (as in effect on the Closing Date, the “Credit

Agreement”)). After giving effect to the Repayment, the aggregate amount of the Term Loans outstanding will not exceed

$100 million. The remaining net proceeds will be used by the Company solely for general corporate

purposes.

The Purchase Agreement contains customary representations

and warranties from the Company, on the one hand, and the Investors, on the other. The Purchase

Agreement also contains affirmative and negative covenants applicable to the Company, including limitations on the Company’s and

its subsidiaries’ abilities, among other things, to incur additional debt, issue equity securities senior to or pari passu with

the Preferred Stock, pay dividends and distributions on the Company’s capital stock (other than the Preferred Stock), repurchase

or redeem the Company’s or any of its subsidiaries’ equity securities junior to the Preferred Stock, enter into affiliate

transactions, make a material change to the Company’s business and amend or modify the Credit Agreement or the Company’s certificate

of incorporation or bylaws in a manner that would have an adverse effect on the holders of the Preferred Stock, in each case, subject

to certain exceptions. In addition, the Purchase Agreement requires the Company to comply with certain affirmative and negative covenants

set forth in the Credit Agreement.

The foregoing description of the Purchase Agreement

is a summary and is qualified in its entirety by the terms of Purchase Agreement, which is attached hereto as Exhibit 10.1 and is

incorporated herein by reference.

| Item 3.02. |

Unregistered Sales of Equity Securities. |

The sale of the Preferred Stock pursuant to the

Purchase Agreement has not been registered under the Securities Act of 1933, as amended (the “Securities Act”), in

reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act and certain rules and regulations

promulgated thereunder.

The information contained in Items 1.01 and 5.03

of this Current Report on Form 8-K regarding the sale of the Preferred Stock, the Purchase Agreement and the terms of the Preferred

Stock is hereby incorporated by reference into this Item 3.02.

| Item 3.03. |

Material Modification to Rights of Security Holders |

The information contained in Item 5.03 of this

Current Report on Form 8-K regarding the Certificate of Designation (as defined below) is hereby incorporated by reference into this

Item 3.03.

| Item 5.03. |

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

On December 28, 2022, the Company filed the

Certificate of Designation of Series A Senior Preferred Stock (the “Certificate of Designation”) to the Company’s

Fifth Amended and Restated Certificate of Incorporation with the Secretary of State of the State of Delaware, effective as of such date,

designating 400 Shares of Preferred Stock out of the authorized but unissued shares of Preferred Stock as “Series A Senior

Preferred Stock,” and designating the dividend, preferences, rights, voting power, restrictions, limitations as to dividends and

other distributions, qualifications and terms and conditions of redemption of such Shares. A description of the material terms of the

Preferred Stock, as contained within the Certificate of Designation, is set forth below:

| Issue: |

|

Series A Senior Preferred Stock |

| |

|

|

| Number of Shares Designated |

|

400 |

| |

|

|

| Ranking, with respect to dividend rights and distribution rights upon the liquidation, winding-up or dissolution of the Company: |

|

The Preferred Stock will rank senior to all of the common stock and any other equity security of the Company. |

| |

|

|

| Maturity: |

|

Perpetual |

| |

|

|

| Issue Price per Share: |

|

$100,000 |

| |

|

|

| Dividend Rate: |

|

Dividends will accrue daily on the Issue Price at an annual rate equal to Term SOFR (as defined in the Certificate of Designation) plus 10.00% (the “Initial Dividend Rate”). On the 30-month anniversary of the Closing Date (the “First Increase Date”), the Initial Dividend Rate shall increase by 2.00% per annum, and shall thereafter increase by 0.50% per annum at the beginning of each full fiscal quarter occurring after the Initial Increase Date (the Initial Dividend Rate, as increased pursuant to this sentence and as otherwise provided in the Certificate of Designation, the “Dividend Rate”). The Dividend Rate is subject to further adjustment as provided below. Other than pursuant to an increase in the Dividend Rate described under the “Events of Default” heading below, in no event will the Dividend Rate exceed Term SOFR plus 25.00%. |

| |

|

|

| Liquidation Preference: |

|

The sum of (i) the Issue Price per Share, plus (ii) all accrued and unpaid dividends (whether or not declared) on each Share to the date of any redemption; payment in connection with a liquidation, dissolution or winding up of the Company; or payment as a result of a Default (as defined in the Certificate of Designation) or other event triggering the payment of the Early Premium (the “Liquidation Preference”). |

| |

|

|

| Optional Redemption: |

|

The Company has the right to redeem the Preferred Stock pro rata in whole or in part at the price per Share equal to the Liquidation Preference on the date of such redemption, plus any applicable Early Premium Amount (as defined below). |

| Early Premium Amount: |

|

A premium per Share (the “Early Premium

Amount”) is applicable in the event of any redemption of a Share by the Company or any Default, in each case, with such Early

Premium Amount determined as of the date of the applicable redemption or Default, as follows:

|

| |

· |

At any time prior to the First Increase Date, an amount equal to (i) a customary 30-month no-call “make-whole” plus (ii) (A) 50% of the Initial Dividend Rate multiplied by (B) the Liquidation Preference amount calculated at the time of such redemption or Default. |

| |

|

|

| |

· |

At any time on or after the First Increase Date but prior to June 28, 2026, an amount equal to (i) 50% of the Initial Dividend Rate multiplied by (ii) the Liquidation Preference amount calculated at the time of such redemption or Default. |

| |

|

|

| |

· |

At any time on or after June 28, 2026 but prior to June 28, 2027, an amount equal to (i) 25% of the Initial Dividend Rate multiplied by (ii) the Liquidation Preference amount calculated at the time of such redemption or Default. |

| |

|

|

| |

· |

At any time on or after June 28, 2027: $0. |

| Events of Default: |

|

Default means (i) the Company’s failure

to make a full dividend payment (based on the then-current Dividend Rate) to the holders of the Preferred Stock on each dividend payment

date, (ii) any breach by the Company or a failure to perform or observe by the Company any of the material terms, privileges, powers,

preferences or other rights of the Series A Preferred Stock as set forth in the Certificate of Designation or the Purchase Agreement,

(iii) certain change of control transactions, (iv) certain insolvency events, (v) the acceleration of payments under the

Company’s credit facilities or (vi) the liquidation, dissolution or winding up of the Company, whether voluntary or involuntary.

Upon the occurrence of a Default, the Dividend

Rate will immediately increase by 6.00% per annum. Such increase will continue until such time as there is no longer any Default in existence

and continuing, in each case, subject to reinstatement upon the occurrence of a subsequent Default. In addition, upon the occurrence

of a Default, a special dividend equal to the applicable Early Premium Amount will immediately become due and payable. |

| |

|

|

| Conversion: |

|

The Preferred Stock is not convertible into any other securities of the Issuer. |

| |

|

|

| Voting: |

|

The Preferred Stock has no voting rights for directors or otherwise, except as required by law or as contemplated in the Certificate of Designation with respect to protective provisions. |

The foregoing description of the Certificate of

Designation is a summary and is qualified in its entirety by the Certificate of Designation, which is attached hereto as Exhibit 3.1

and is incorporated herein by reference. In addition, the information set forth above under Item 1.01 is hereby incorporated by reference

into this Item 5.03.

Forward-Looking Statements

Certain matters discussed in this Current Report

on Form 8-K and other company communications constitute forward-looking statements within the meaning of the federal securities laws.

Generally, the use of words such as “expect,” “intend,” “estimate,” “believe,” “anticipate,”

“will,” “forecast,” “plan,” “project,” or similar words identify forward-looking statements

that we intend to be included within the safe harbor protections provided by the federal securities laws. Forward-looking statements are

subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements.

Such risks and uncertainties include, among others, risks related to: the Company’s use of proceeds from the sale of the Preferred

Stock, including debt repayment; the impacts of inflation, increases in labor costs, and enrollment trends, including on the Company’s

operating margins; the Company’s dependence on the effectiveness of its ability to attract students who persist in its institutions’

programs; changing market demands; the Company’s inability to effectively market its institutions’ programs; the Company’s

inability to maintain strong relationships with the military and maintain course registrations and enrollments from military students;

the Company’s loss of its ability to receive funds under tuition assistance programs or the reduction, elimination, or suspension

of tuition assistance; the effects, duration, and severity of and the Company’s response to the COVID-19 pandemic; adverse effects

on demand as the pandemic abates; adverse effects of changes the Company makes to improve the student experience and enhance the ability

to identify and enroll students who are likely to succeed; the Company’s need to successfully adjust to future market demands by

updating existing programs and developing new programs; the Company’s failure to comply with regulatory and accrediting agency requirements

and to maintain institutional accreditation; the Company’s loss of eligibility to participate in Title IV programs or ability to

process Title IV financial aid; business combinations and acquisitions, including the integration of RU and GSUSA and the Company’s

inability to realize the expected benefits of their acquisition; incurring substantial debt, the cost of servicing that debt, and the

Company’s inability in the future to service that debt; the Company’s compliance with debt covenants; the Company’s

dependence on and the need to continue to invest in its technology infrastructure; the Company’s financial flexibility and financial

condition; and the various risks described in the “Risk Factors” section and elsewhere in the Company’s Quarterly Report

on Form 10-Q for the period ended September 30, 2022 and Annual Report on Form 10-K for the year ended December 31,

2021, and in other filings with the SEC. Such statements are not guarantees of future performance and involve certain risks, uncertainties

and assumptions, which are difficult to predict and many of which are beyond our control. Therefore, actual outcomes and results may differ

materially from those matters expressed or implied in such forward-looking statements. You should not place undue reliance on any forward-looking

statements. The Company undertakes no obligation to update publicly any forward-looking statements for any reason, unless required by

law, even if new information becomes available or other events occur in the future.

| Item 9.01. |

Financial Statements and Exhibits. |

EXHIBIT INDEX

| Exhibit No. |

|

Description |

| 3.1 |

|

Certificate of Designation of Series A Senior Preferred Stock |

| 10.1 |

|

Purchase Agreement, dated December 28, 2022, by and between American Public Education, Inc. and Redwood Master Fund, Ltd., Redwood Drawdown Master Fund III, L.P., MSD SIF Holdings II, L.P. and MSD Special Investments Fund II, L.P.* |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| * |

In accordance with Item 601(a)(5) of Regulation S-K, certain schedules (or similar attachments) to this exhibit have been omitted from this filing. The registrant will provide a copy of any omitted schedule to the Securities and Exchange Commission or its staff upon request. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

American Public Education, Inc. |

| |

|

| |

|

|

By: |

/s/ Richard W. Sunderland, Jr. |

| |

|

Richard W. Sunderland, Jr.

Executive Vice President and Chief Financial Officer |

Date: December 28, 2022

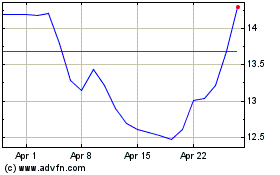

American Public Education (NASDAQ:APEI)

Historical Stock Chart

From Mar 2024 to Apr 2024

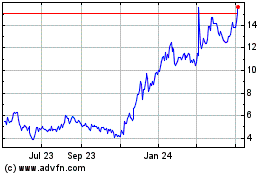

American Public Education (NASDAQ:APEI)

Historical Stock Chart

From Apr 2023 to Apr 2024