AppFolio, Inc. Announces Third Quarter 2021 Financial Results

09 November 2021 - 8:10AM

AppFolio, Inc. (NASDAQ: APPF) ("AppFolio" or the "Company"), a

leading provider of cloud-based business software solutions,

services, and data analytics to the real estate industry, today

announced its financial results for the third quarter ended

September 30, 2021.

AppFolio's operating results for the third

quarter of 2021 are summarized in the tables accompanying this

press release. The Company nevertheless urges investors to read its

Annual Report on Form 10-K, which was filed with the Securities and

Exchange Commission (the "SEC") on March 1, 2021, as well as its

more detailed third quarter 2021 results that will be included in

the Company's Quarterly Report on Form 10-Q, which will be filed

with the SEC today. These periodic report filings, together with

other documents the Company files with the SEC from time to time,

will be accessible on AppFolio's website,

http://ir.appfolioinc.com. The limited information that follows in

this press release is not adequate for making an informed

investment judgment.

Financial Outlook

Based on information available as of

November 8, 2021, AppFolio's outlook for fiscal year 2021

follows:

- Full year revenue is expected to be in the range of $355

million to $357 million.

- Diluted weighted average shares are expected to be

approximately 36 million for the full year.

Conference Call InformationAs

previously announced, the Company will host a conference call

today, November 8, 2021, at 1:30 p.m. Pacific Time, 4:30 p.m.

Eastern Time, to discuss its financial results. Participants who

wish to dial into the conference call, please register in advance

at

https://www.incommglobalevents.com/registration/q4inc/9012/appfolio-inc-announces-third-quarter-2021-financial-results.

After registering, a confirmation email will be sent, including

dial-in details and a unique code for entry. Registration will be

open through the start of the live call.

Following the conference call, a replay will be

available at 866.813.9403 (domestic) or 929.458.6194

(international). The passcode is 367726. To access the webcast

during the live call, participants may access

https://events.q4inc.com/attendee/783445260 and use passcode

367726. An archived webcast of this conference call will also be

available on AppFolio’s Investor Relations website at

http://ir.appfolioinc.com.

About AppFolio, Inc.AppFolio

provides innovative software, services and data analytics to the

real estate industry. Our cloud-based business management solutions

are designed to enable our customers to digitally transform their

businesses, address critical business operations and enable

exceptional customer service. Today our core solutions include

AppFolio Property Manager, AppFolio Property Manager PLUS, and

AppFolio Investment Management. In addition, the Company offers a

variety of Value+ services that are designed to enhance, automate

and streamline essential processes and workflows for our customers.

AppFolio was founded in 2006 and is headquartered in Santa Barbara,

CA. Learn more at www.appfolioinc.com.

Investor Relations Contact:

ir@appfolio.com

Forward-Looking Statements

This press release contains “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended, which statements are subject to considerable

risks and uncertainties. Forward-looking statements include all

statements that are not statements of historical fact contained in

this press release, and can be identified by words such as

“anticipates,” “believes,” “could,” “estimates,” “expects,”

“intends,” “may,” “plans,” “potential,” “predicts," “projects,”

“seeks,” “should,” “will,” “would” or similar expressions and the

negatives of those expressions. In particular, forward-looking

statements contained in this press release relate to the Company's

future or assumed revenues and weighted-average outstanding shares,

as well as its future growth and success.

Forward-looking statements represent AppFolio's

current beliefs and assumptions based on information currently

available. Forward-looking statements involve numerous known and

unknown risks, uncertainties and other factors that may cause the

Company's actual results, performance or achievements to be

materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements. Some of the risks and uncertainties that may cause the

Company's actual results to materially differ from those expressed

or implied by these forward-looking statements are described in the

section entitled “Risk Factors” in AppFolio's Quarterly Report on

Form 10-Q for the quarter ended September 30, 2021, which will

be filed with the SEC today, as well as in the Company's other

filings with the SEC. You should read this press release with the

understanding that the Company's actual future results may be

materially different from the results expressed or implied by these

forward looking statements.

Except as required by applicable law or the

rules of the NASDAQ Global Market, AppFolio assumes no obligation

to update any forward-looking statements publicly, or to update the

reasons actual results could differ materially from those

anticipated in these forward-looking statements, even if new

information becomes available in the future.

CONDENSED CONSOLIDATED BALANCE

SHEETS(UNAUDITED)(in thousands, except

par values)

| |

September 30,2021 |

|

December 31,2020 |

| Assets |

|

|

|

| Current assets |

|

|

|

|

Cash and cash equivalents |

$ |

84,444 |

|

|

$ |

140,263 |

|

|

Investment securities—current |

76,034 |

|

|

28,256 |

|

|

Accounts receivable, net |

12,184 |

|

|

10,057 |

|

|

Prepaid expenses and other current assets |

24,714 |

|

|

20,777 |

|

|

Total current assets |

197,376 |

|

|

199,353 |

|

| Investment

securities—noncurrent |

9,287 |

|

|

6,770 |

|

| Property and equipment, net |

28,177 |

|

|

26,439 |

|

| Operating lease right-of-use

assets |

42,597 |

|

|

30,561 |

|

| Capitalized software development

costs, net |

40,711 |

|

|

35,459 |

|

| Goodwill |

56,147 |

|

|

56,147 |

|

| Intangible assets, net |

12,864 |

|

|

16,357 |

|

| Deferred income

taxes—noncurrent |

12,834 |

|

|

12,181 |

|

| Other long-term assets |

7,394 |

|

|

6,213 |

|

|

Total assets |

$ |

407,387 |

|

|

$ |

389,480 |

|

| Liabilities and

Stockholders’ Equity |

|

|

|

| Current liabilities |

|

|

|

|

Accounts payable |

$ |

2,493 |

|

|

$ |

1,040 |

|

|

Accrued employee expenses—current |

25,785 |

|

|

18,888 |

|

|

Accrued expenses |

13,090 |

|

|

14,069 |

|

|

Deferred revenue |

2,738 |

|

|

2,262 |

|

|

Income tax payable |

186 |

|

|

9,095 |

|

|

Other current liabilities |

4,910 |

|

|

4,451 |

|

|

Total current liabilities |

49,202 |

|

|

49,805 |

|

| Accrued employee

expenses—noncurrent |

2,059 |

|

|

— |

|

| Operating lease liabilities |

56,559 |

|

|

40,146 |

|

| Deferred income

taxes—noncurrent |

7,868 |

|

|

13,609 |

|

|

Total liabilities |

115,688 |

|

|

103,560 |

|

| Stockholders’ equity: |

|

|

|

| Preferred stock, $0.0001 par

value, 25,000 shares authorized and no shares issued and

outstanding as of September 30, 2021 and December 31, 2020 |

— |

|

|

— |

|

| Class A common stock, $0.0001 par

value, 250,000 shares authorized as of September 30, 2021 and

December 31, 2020; 19,610 and 19,148 shares issued as of September

30, 2021 and December 31, 2020, respectively; 19,191 and 18,729

shares outstanding as of September 30, 2020 and December 31, 2020,

respectively |

2 |

|

|

2 |

|

| Class B common stock, $0.0001 par

value, 50,000 shares authorized as of September 30, 2021 and

December 31, 2020; 15,453 and 15,659 shares issued and outstanding

as of September 30, 2021 and December 31, 2020, respectively |

2 |

|

|

2 |

|

| Additional paid-in capital |

164,740 |

|

|

161,247 |

|

| Accumulated other comprehensive

(loss) income |

(17 |

) |

|

56 |

|

| Treasury stock, at cost, 419

shares of Class A common stock as of September 30, 2021 and

December 31, 2020 |

(25,756 |

) |

|

(25,756 |

) |

| Retained earnings |

152,728 |

|

|

150,369 |

|

|

Total stockholders’ equity |

291,699 |

|

|

285,920 |

|

|

Total liabilities and stockholders’ equity |

$ |

407,387 |

|

|

$ |

389,480 |

|

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS(UNAUDITED)(in thousands,

except per share amounts)

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

| |

|

|

|

|

|

|

|

|

Revenue |

$ |

95,809 |

|

|

$ |

84,086 |

|

|

$ |

263,770 |

|

|

$ |

237,624 |

|

| Costs and operating

expenses: |

|

|

|

|

|

|

|

|

Cost of revenue (exclusive of depreciation and amortization) |

38,730 |

|

|

32,752 |

|

|

104,847 |

|

|

89,124 |

|

|

Sales and marketing |

19,362 |

|

|

14,894 |

|

|

53,255 |

|

|

43,117 |

|

|

Research and product development |

16,500 |

|

|

13,454 |

|

|

46,389 |

|

|

36,794 |

|

|

General and administrative |

13,404 |

|

|

12,946 |

|

|

40,971 |

|

|

36,303 |

|

|

Depreciation and amortization |

7,826 |

|

|

6,680 |

|

|

22,844 |

|

|

19,751 |

|

|

Total costs and operating expenses |

95,822 |

|

|

80,726 |

|

|

268,306 |

|

|

225,089 |

|

| (Loss) income from

operations |

(13 |

) |

|

3,360 |

|

|

(4,536 |

) |

|

12,535 |

|

| Other (loss) income, net |

(353 |

) |

|

187,747 |

|

|

705 |

|

|

187,759 |

|

| Interest income (expense),

net |

65 |

|

|

(853 |

) |

|

173 |

|

|

(1,909 |

) |

| (Loss) income before (benefit

from) provision for income taxes |

(301 |

) |

|

190,254 |

|

|

(3,658 |

) |

|

198,385 |

|

| (Benefit from) provision for

income taxes |

(160 |

) |

|

52,578 |

|

|

(6,017 |

) |

|

39,469 |

|

| Net (loss) income |

$ |

(141 |

) |

|

$ |

137,676 |

|

|

$ |

2,359 |

|

|

$ |

158,916 |

|

| |

|

|

|

|

|

|

|

| Net (loss) income per common

share: |

|

|

|

|

|

|

|

|

Basic |

$ |

— |

|

|

$ |

4.01 |

|

|

$ |

0.07 |

|

|

$ |

4.64 |

|

|

Diluted |

$ |

— |

|

|

$ |

3.86 |

|

|

$ |

0.07 |

|

|

$ |

4.46 |

|

| Weighted average common shares

outstanding: |

|

|

|

|

|

|

|

|

Basic |

34,614 |

|

|

34,296 |

|

|

34,525 |

|

|

34,241 |

|

|

Diluted |

34,614 |

|

|

35,665 |

|

|

35,695 |

|

|

35,662 |

|

Stock-Based Compensation Expense(in

thousands)

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

| |

2021 |

|

2020 |

|

2021 |

|

2020 |

| Costs and operating

expenses: |

|

|

|

|

|

|

|

|

Cost of revenue (exclusive of depreciation and amortization) |

$ |

575 |

|

|

$ |

452 |

|

|

$ |

1,509 |

|

|

$ |

1,098 |

|

|

Sales and marketing |

738 |

|

|

367 |

|

|

1,587 |

|

|

1,069 |

|

|

Research and product development |

1,451 |

|

|

474 |

|

|

3,522 |

|

|

1,348 |

|

|

General and administrative |

1,299 |

|

|

1,803 |

|

|

3,435 |

|

|

3,293 |

|

| Total stock-based compensation

expense |

$ |

4,063 |

|

|

$ |

3,096 |

|

|

$ |

10,053 |

|

|

$ |

6,808 |

|

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS(UNAUDITED)(in thousands) |

|

|

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

| |

2021 |

|

2020 |

|

2021 |

|

2020 |

| Cash from operating

activities |

|

|

|

|

|

|

|

|

Net income |

$ |

(141 |

) |

|

$ |

137,676 |

|

|

$ |

2,359 |

|

|

$ |

158,916 |

|

| Adjustments to reconcile net

income to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

7,826 |

|

|

6,680 |

|

|

22,844 |

|

|

19,751 |

|

|

Amortization of operating lease right-of-use assets |

913 |

|

|

902 |

|

|

2,312 |

|

|

2,973 |

|

|

Deferred income taxes |

(308 |

) |

|

36,015 |

|

|

(6,394 |

) |

|

22,878 |

|

|

Stock-based compensation |

4,063 |

|

|

3,096 |

|

|

10,053 |

|

|

6,808 |

|

|

Gain on sale of business |

(21 |

) |

|

(187,636 |

) |

|

(380 |

) |

|

(187,636 |

) |

|

Other |

309 |

|

|

200 |

|

|

89 |

|

|

170 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

Accounts receivable |

2,657 |

|

|

2,907 |

|

|

(1,350 |

) |

|

(2,229 |

) |

|

Prepaid expenses and other current assets |

(1,387 |

) |

|

(567 |

) |

|

(3,558 |

) |

|

(859 |

) |

|

Other assets |

(199 |

) |

|

(213 |

) |

|

(1,181 |

) |

|

(320 |

) |

|

Accounts payable |

83 |

|

|

502 |

|

|

1,384 |

|

|

695 |

|

|

Accrued employee expenses—current |

(1,303 |

) |

|

1,202 |

|

|

6,335 |

|

|

1,919 |

|

|

Accrued expenses |

1,621 |

|

|

1,397 |

|

|

(1,426 |

) |

|

5,931 |

|

|

Deferred revenue |

(335 |

) |

|

283 |

|

|

(302 |

) |

|

815 |

|

|

Income tax payable |

120 |

|

|

— |

|

|

(8,909 |

) |

|

— |

|

|

Accrued employee expenses—noncurrent |

1,091 |

|

|

— |

|

|

2,059 |

|

|

— |

|

|

Operating lease liabilities |

310 |

|

|

(1,043 |

) |

|

1,995 |

|

|

(1,135 |

) |

|

Other liabilities |

499 |

|

|

16,439 |

|

|

529 |

|

|

16,539 |

|

|

Net cash provided by operating activities |

15,798 |

|

|

17,840 |

|

|

26,459 |

|

|

45,216 |

|

| Cash from investing

activities |

|

|

|

|

|

|

|

| Purchases of

available-for-sale investments |

(18,748 |

) |

|

(16,490 |

) |

|

(167,041 |

) |

|

(29,879 |

) |

| Proceeds from sales of

available-for-sale investments |

1,000 |

|

|

— |

|

|

43,198 |

|

|

13,942 |

|

| Proceeds from maturities of

available-for-sale investments |

47,004 |

|

|

5,550 |

|

|

73,754 |

|

|

13,300 |

|

| Purchases of property,

equipment and intangible assets |

(2,362 |

) |

|

(2,245 |

) |

|

(5,166 |

) |

|

(16,551 |

) |

| Capitalization of software

development costs |

(6,600 |

) |

|

(6,988 |

) |

|

(18,511 |

) |

|

(19,697 |

) |

| Proceeds from sale of

business, net of cash divested |

— |

|

|

191,427 |

|

|

— |

|

|

191,427 |

|

|

Net cash provided by (used in) investing

activities |

20,294 |

|

|

171,254 |

|

|

(73,766 |

) |

|

152,542 |

|

| Cash from financing

activities |

|

|

|

|

|

|

|

| Proceeds from stock option

exercises |

145 |

|

|

73 |

|

|

791 |

|

|

402 |

|

| Tax withholding for net share

settlement |

(403 |

) |

|

(1,269 |

) |

|

(9,303 |

) |

|

(10,959 |

) |

| Payment of contingent

consideration |

— |

|

|

— |

|

|

— |

|

|

(5,977 |

) |

| Proceeds from issuance of

debt |

— |

|

|

562 |

|

|

— |

|

|

50,752 |

|

| Principal payments on

debt |

— |

|

|

(97,747 |

) |

|

— |

|

|

(99,565 |

) |

| Purchase of treasury

stock |

— |

|

|

— |

|

|

— |

|

|

(4,194 |

) |

|

Net cash used in financing activities |

(258 |

) |

|

(98,381 |

) |

|

(8,512 |

) |

|

(69,541 |

) |

|

Net increase (decrease) in cash and cash

equivalents and restricted cash |

35,834 |

|

|

90,713 |

|

|

(55,819 |

) |

|

128,217 |

|

| Cash, cash equivalents

and restricted cash |

|

|

|

|

|

|

|

| Beginning of period |

49,046 |

|

|

53,751 |

|

|

140,699 |

|

|

16,247 |

|

| End of period |

$ |

84,880 |

|

|

$ |

144,464 |

|

|

$ |

84,880 |

|

|

$ |

144,464 |

|

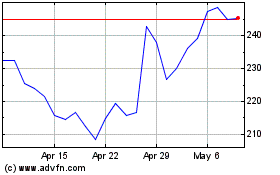

AppFolio (NASDAQ:APPF)

Historical Stock Chart

From Mar 2024 to Apr 2024

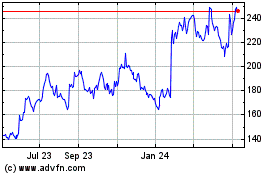

AppFolio (NASDAQ:APPF)

Historical Stock Chart

From Apr 2023 to Apr 2024