Apyx Medical Corporation (NASDAQ:APYX) (the “Company”),

the manufacturer of a proprietary helium plasma and radiofrequency

technology marketed and sold as Renuvion®, today reported financial

results for its second quarter ended June 30, 2022, and updated

financial expectations for the full year ending December 31,

2022.

Second Quarter 2022 Financial

Summary:

- Total revenue of $10.3 million, down 8% year-over-year.

- Advanced Energy revenue of $8.4 million, down 16%

year-over-year.

- OEM revenue of $1.9 million, up 55% year-over-year.

- Net loss attributable to stockholders of $5.4 million, compared

to $4.0 million for the second quarter of 2021.

- Adjusted EBITDA loss of $3.4 million, compared to adjusted

EBITDA loss of $2.4 million for the second quarter of 2021.

Second Quarter 2022 Operating

Summary:

- On April 4, 2022, the Company announced the submission of a

510(k) premarket notification (“510(k) submission”) to the U.S.

Food and Drug Administration (“FDA”). The 510(k) submission was

intended to expand the Company’s general indication to include a

specific indication for the use of the Renuvion APR Handpiece in

subcutaneous dermatological and aesthetic procedures to improve the

appearance of lax (loose) skin in the neck and submental

region.

- On May 26, 2022, the Company announced it received 510(k)

clearance from the FDA for the use of the Renuvion Dermal Handpiece

for specific dermal resurfacing procedures. The Renuvion Dermal

Handpiece is indicated for dermatological procedures for the

treatment of moderate to severe wrinkles and rhytides, limited to

patients with Fitzpatrick skin types I, II or III.

- On June 2, 2022, the FDA updated the Medical Device Safety

Communication (“MDSC”) related to the Company’s Advanced Energy

products to recognize this new 510(k) clearance.

Highlights & Developments

Subsequent to Quarter End:

- On July 8, 2022, the Company announced that the results of the

pivotal Phase II of its Investigational Device Exemption (“IDE”)

study evaluating the safety and effectiveness of the Renuvion

device to improve the appearance of lax skin in the neck and

submental region are now available on ClinicalTrials.gov.

- On July 18, 2022, the Company announced it received 510(k)

clearance from the FDA for the use of the Renuvion APR Handpieces

for certain skin contraction procedures. The Renuvion APR

Handpieces are now indicated for use in subcutaneous dermatological

and aesthetic procedures to improve the appearance of lax (loose)

skin in the neck and submental region.

- On July 21, 2022, the FDA updated the MDSC related to the

Company’s Advanced Energy products to recognize this new 510(k)

clearance.

- On July 27, 2022, the Company announced its first reporting of

environmental, social and governance (“ESG”) data via a newly

released tear sheet. This data provides context to the Company’s

ESG goals and priorities important to its business and

stakeholders.

Management Comments:

“Our total revenue in the second quarter decreased 8%

year-over-year, due to the impact of the Medical Device Safety

Communication on global sales of our Advanced Energy products,”

said Charlie Goodwin, President and Chief Executive Officer.

“Internationally, we saw softer-than-expected Advanced Energy

generator and handpiece demand from distributors in select

countries, which represented the largest contributor to the 16%

year-over-year decrease in global Advanced Energy sales during the

quarter. Specifically, Advanced Energy international generator and

handpiece sales decreased more than 45% and 30% year-over-year,

respectively. In the U.S., we were pleased by our performance

during the quarter, which exceeded our expectations. While we

continued to experience slower U.S. sales of our Advanced Energy

products as anticipated, we saw material improvement in our

business trends during each month of the quarter.”

Mr. Goodwin continued: “We are updating our guidance today to

reflect the domestic and international performance in our Advanced

Energy business during the second quarter, and revised expectations

for the second half of 2022. Our team has made strong progress in

recent months, securing 510(k) clearances for specific indications

related to the use of our Renuvion technology in dermal resurfacing

procedures and to improve the appearance of lax, or loose, skin.

These clearances provide important validation for the safety and

effectiveness of our Renuvion technology and expand our addressable

market opportunity to include approximately 200,000 wrinkle

reduction procedures and 200,000 neck contouring procedures

performed in the U.S. annually. We are also pleased that the FDA

updated the Medical Device Safety Communication to reflect our

receipt of these new 510(k) clearances. We look forward to entering

full commercialization for these new indications by the end of

2022, and continue to believe that the headwinds experienced during

the second quarter will ultimately prove to be transitory.”

The following tables present revenue by reportable segment and

geography:

Three Months Ended

June 30,

Increase/Decrease

Six Months Ended June

30,

Increase/Decrease

(In thousands)

2022

2021

$ Change

% Change

2022

2021

$ Change

% Change

Advanced Energy

$

8,364

$

9,978

$

(1,614

)

(16.2

) %

$

19,178

$

17,638

$

1,540

8.7

%

OEM

1,928

1,246

682

54.7

%

3,607

2,224

1,383

62.2

%

Total

$

10,292

$

11,224

$

(932

)

(8.3

) %

$

22,785

$

19,862

$

2,923

14.7

%

Three Months Ended June

30,

Increase/Decrease

Six Months Ended June

30,

Increase/Decrease

(In thousands)

2022

2021

$ Change

% Change

2022

2021

$ Change

% Change

Domestic

$

7,947

$

7,383

$

564

7.6

%

$

15,495

$

12,949

$

2,546

19.7

%

International

2,345

3,841

(1,496

)

(38.9

) %

7,290

6,913

377

5.5

%

Total

$

10,292

$

11,224

$

(932

)

(8.3

) %

$

22,785

$

19,862

$

2,923

14.7

%

Second Quarter 2022 Results:

Total revenue for the three months ended June 30, 2022 decreased

$0.9 million, or 8% year-over-year, to $10.3 million, compared to

$11.2 million in the prior year period. Advanced Energy segment

sales decreased $1.6 million, or 16% year-over-year, to $8.4

million, compared to $10.0 million in the prior year period. OEM

segment sales increased $0.7 million, or 55% year-over-year to $1.9

million, compared to $1.2 million in the prior year period. For the

second quarter of 2022, revenue in the United States increased $0.6

million, or 8% year-over-year, to $7.9 million, and international

revenue decreased $1.5 million, or 39% year-over-year, to $2.3

million. The year-over-year decrease in Advanced Energy revenue was

due to decreased global demand for the Company’s handpieces and

generators following the FDA Safety Communication on March 14,

2022. The year-over-year increase in OEM revenue was driven by

higher sales to existing customers, including Symmetry Surgical, as

well as sales related to the completion of the development portion

of some of the Company’s OEM development agreements.

Gross profit for the three months ended June 30, 2022, decreased

$0.6 million, or 8% year-over-year, to $6.9 million, compared to

$7.5 million in the prior year period. Gross margin for the three

months ended June 30, 2022, was 67.2%, compared to 67.1% in the

prior year period. The increase in gross profit margins for the

three months ended June 30, 2022 from the prior year period was

primarily attributable to geographic mix within the Company’s

Advanced Energy segment, with domestic sales comprising a higher

percentage of total sales and the mix of newer product models as

the Company obtains registrations allowing these products to be

introduced into the markets it serves.

Operating expenses for the three months ended June 30, 2022

increased $1.3 million, or 11% year-over-year, to $12.9 million,

compared to $11.6 million in the prior year period. The

year-over-year change in operating expenses was driven by a $0.5

million increase in salaries and related costs, a $0.5 million

increase in professional services and a $0.3 million increase in

selling, general and administrative expenses.

Income tax expense for the three months ended June 30, 2022 and

2021 was $0.1 million.

Net loss attributable to stockholders for the three months ended

June 30, 2022 was $5.4 million, or $0.16 per share, compared to a

net loss of $4.0 million, or $0.12 per share, in the prior year

period.

Adjusted EBITDA loss for the three months ended June 30, 2022

was $3.4 million, compared to adjusted EBITDA loss of $2.4 million

in the prior year period.

First Six Months of 2022 Results:

Total revenue for the six months ended June 30, 2022, increased

$2.9 million, or 15%, to $22.8 million, compared to $19.9 million

in the prior year period. Advanced Energy segment sales increased

$1.5 million, or 9% year-over-year, to $19.2 million, compared to

$17.6 million in the prior year period. OEM segment sales increased

$1.4 million, or 62% year-over-year, to $3.6 million, compared to

$2.2 million in the prior year period. For the first half of 2022,

revenue in the United States increased $2.5 million, or 20%

year-over-year, to $15.5 million, and international revenue

increased $0.4 million, or 6% year-over-year, to $7.3 million.

Net loss attributable to stockholders for the six months ended

June 30, 2022 was $11.4 million, or $0.33 per share, compared to a

net loss of $8.9 million, or $0.26 per share, in the prior year

period.

Full Year 2022 Financial

Outlook:

The Company is updating financial guidance for the year ending

December 31, 2022 to:

- Total revenue in the range of $51.0 million to $56.4 million,

representing growth of approximately 5% to 16% year-over-year,

compared to total revenue of $48.5 million for the year ended

December 31, 2021. The Company’s prior guidance range for total

revenue was $52.5 million to $59.0 million, representing growth of

8% to 22% year-over-year.

- Total revenue guidance assumes:

- Advanced Energy revenue in the range of $44.5 million to $49.4

million, representing growth of approximately 4% to 15%

year-over-year, compared to Advanced Energy revenue of $43.0

million for the year ended December 31, 2021. The Company’s prior

guidance range for Advanced Energy revenue was $46.0 million to

$52.0 million, representing growth of 7% to 21% year-over-year.

- The Advanced Energy revenue range reflects potential negative

impacts on global new customer adoption, and on procedure-related

demand for handpieces, as a result of the FDA Medical Device Safety

Communication on March 14, 2022.

- The Advanced Energy revenue range continues to assume

contributions from the initial commercial launches for new specific

clinical indications for dermal resurfacing procedures and

procedures to improve the appearance of lax skin.

- The Advanced Energy revenue range continues to assume that

international growth is driven by demand in existing international

markets.

- OEM revenue in the range of $6.5 million to $7.0 million, which

is unchanged from the Company's prior guidance, representing growth

of 18% to 27% year-over-year, compared to $5.5 million for the year

ended December 31, 2021.

- Net loss attributable to stockholders in the range of $20.1

million to $16.6 million, compared to net loss attributable to

stockholders of $15.2 million for the year ended December 31, 2021.

The Company’s prior guidance range for net loss attributable to

stockholders was $19.0 million to $14.7 million.

- Adjusted EBITDA loss in the range of $11.8 million to $8.2

million, compared to adjusted EBITDA loss of $8.8 million for the

year ended December 31, 2021. The Company’s prior guidance range

for Adjusted EBITDA loss was $10.1 million to $6.4 million.

Conference Call Details:

Management will host a conference call at 5:00 p.m. Eastern Time

on August 11, 2022 to discuss the results of the quarter and to

host a question and answer session. To listen to the call by phone,

interested parties may dial 877-407-8289 (or 201-689-8341 for

international callers) and provide access code 13731067.

Participants should ask for the Apyx Medical Corporation Call. A

live webcast of the call will be accessible via the Investor

Relations section of the Company’s website and at:

https://event.choruscall.com/mediaframe/webcast.html?webcastid=4ztO7TPi

A telephonic replay will be available approximately two hours

after the end of the call through the following two weeks. The

replay can be accessed by dialing 877-660-6853 for U.S. callers or

201-612-7415 for international callers and using the replay access

code: 13731067. The webcast will be archived on the Investor

Relations section of the Company’s website.

About Apyx Medical

Corporation:

Apyx Medical Corporation is an advanced energy technology

company with a passion for elevating people’s lives through

innovative products, including its Helium Plasma Technology

products marketed and sold as Renuvion® in the cosmetic surgery

market and J-Plasma® in the hospital surgical market. Renuvion® and

J-Plasma® offer surgeons a unique ability to provide controlled

heat to tissue to achieve their desired results. The Company also

leverages its deep expertise and decades of experience in unique

waveforms through OEM agreements with other medical device

manufacturers. For further information about the Company and its

products, please refer to the Apyx Medical Corporation website at

www.ApyxMedical.com.

Cautionary Statement on Forward-Looking

Statements:

Certain matters discussed in this release and oral statements

made from time to time by representatives of the Company may

constitute forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995 and the Federal

securities laws. Although the Company believes that the

expectations reflected in such forward-looking statements are based

upon reasonable assumptions, it can give no assurance that its

expectations will be achieved.

All statements other than statements of historical fact are

statements that could be deemed forward-looking statements,

including but not limited to, any statements regarding the

potential impact of the COVID-19 pandemic and the actions by

governments, businesses and individuals in response to the

situation; projections of net revenue, margins, expenses, net

earnings, net earnings per share, or other financial items;

projections or assumptions concerning the possible receipt by the

Company of any regulatory approvals from any government agency or

instrumentality including but not limited to the U.S. Food and Drug

Administration, supply chain disruptions, component shortages,

manufacturing disruptions or logistics challenges; or macroeconomic

or geopolitical matters and the impact of those matters on the

Company’s financial performance.

Forward-looking statements and information are subject to

certain risks, trends and uncertainties that could cause actual

results to differ materially from those projected. Many of these

factors are beyond the Company’s ability to control or predict.

Important factors that may cause the Company’s actual results to

differ materially and that could impact the Company and the

statements contained in this release include but are not limited to

risks, uncertainties and assumptions relating to the regulatory

environment in which the Company is subject to, including the

Company’s ability to gain requisite approvals for its products from

the U.S. Food and Drug Administration and other governmental and

regulatory bodies, both domestically and internationally; the

impact of the recent FDA Safety Communication on our business and

operations; factors relating to the effects of the COVID-19

pandemic; sudden or extreme volatility in commodity prices and

availability, including supply chain disruptions; changes in

general economic, business or demographic conditions or trends;

changes in and effects of the geopolitical environment; liabilities

and costs which the Company may incur from pending or threatened

litigations, claims, disputes or investigations; and other risks

that are described in the Company’s Annual Report on Form 10-K for

the fiscal year ended December 31, 2021 and the Company’s other

filings with the Securities and Exchange Commission. For

forward-looking statements in this release, the Company claims the

protection of the safe harbor for forward-looking statements

contained in the Private Securities Litigation Reform Act of 1995.

The Company assumes no obligation to update or supplement any

forward-looking statements whether as a result of new information,

future events or otherwise.

APYX MEDICAL

CORPORATION

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(In thousands, except per

share data)

(Unaudited)

Three Months Ended

June 30,

Six Months Ended

June 30,

2022

2021

2022

2021

Sales

$

10,292

$

11,224

$

22,785

$

19,862

Cost of sales

3,378

3,690

7,652

6,468

Gross profit

6,914

7,534

15,133

13,394

Other costs and expenses:

Research and development

1,070

1,084

2,228

2,199

Professional services

2,389

1,889

4,675

3,410

Salaries and related costs

4,892

4,343

10,073

8,588

Selling, general and administrative

4,539

4,261

10,004

7,985

Total other costs and expenses

12,890

11,577

26,980

22,182

Loss from operations

(5,976

)

(4,043

)

(11,847

)

(8,788

)

Interest income

18

4

20

7

Interest expense

(3

)

(2

)

(11

)

(6

)

Other loss, net

607

97

586

4

Total other loss, net

622

99

595

5

Loss before income taxes

(5,354

)

(3,944

)

(11,252

)

(8,783

)

Income tax expense

96

107

166

173

Net loss

(5,450

)

(4,051

)

(11,418

)

(8,956

)

Net loss attributable to

non-controlling interest

(24

)

(5

)

(47

)

(9

)

Net loss attributable to

stockholders

$

(5,426

)

$

(4,046

)

$

(11,371

)

$

(8,947

)

Loss per share

Basic and Diluted

$

(0.16

)

$

(0.12

)

$

(0.33

)

$

(0.26

)

Weighted average number of shares

outstanding - basic and diluted

34,464

34,321

34,447

34,312

APYX MEDICAL

CORPORATION

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands, except share

and per share data)

June 30,

2022

(Unaudited)

December 31,

2021

ASSETS

Current assets:

Cash and cash equivalents

$

20,063

$

30,870

Trade accounts receivable, net of

allowance of $629 and $430

10,340

13,038

Income tax receivables

7,642

7,642

Other receivables

33

483

Inventories, net of provision for

obsolescence of $360 and $263

9,677

6,778

Prepaid expenses and other current

assets

2,770

1,926

Total current assets

50,525

60,737

Property and equipment, net

6,842

6,575

Operating lease right-of-use assets

659

121

Finance lease right-of-use assets

176

178

Other assets

1,269

1,110

Total assets

$

59,471

$

68,721

LIABILITIES AND EQUITY

Current liabilities:

Accounts payable

$

2,587

$

2,631

Accrued expenses and other liabilities

8,570

10,287

Current portion of operating lease

liabilities

110

122

Current portion of finance lease

liabilities

85

165

Total current liabilities

11,352

13,205

Long-term operating lease liabilities

514

—

Long-term finance lease liabilities

93

18

Long-term contract liabilities

1,207

1,323

Other liabilities

142

166

Total liabilities

13,308

14,712

EQUITY

Common stock, $0.001 par value; 75,000,000

shares authorized; 34,493,085 issued and outstanding as of June 30,

2022, and 34,409,912 issued and outstanding as of December 31,

2021

34

34

Additional paid-in capital

69,793

66,221

Accumulated deficit

(23,922

)

(12,551

)

Total stockholders' equity

45,905

53,704

Non-controlling interest

258

305

Total equity

46,163

54,009

Total liabilities and equity

$

59,471

$

68,721

APYX MEDICAL CORPORATION

RECONCILIATION OF GAAP NET LOSS RESULTS TO NON-GAAP ADJUSTED

EBITDA (Unaudited)

Use of Non-GAAP Financial Measure

We present the following non-GAAP measure because we believe

such measure is a useful indicator of our operating performance.

Our management uses this non-GAAP measure principally as a measure

of our operating performance and believes that this measure is

useful to investors because it is frequently used by analysts,

investors and other interested parties to evaluate companies in our

industry. We also believe that this measure is useful to our

management and investors as a measure of comparative operating

performance from period to period. The non-GAAP financial measure

presented in this release should not be considered as a substitute

for, or preferable to, the measures of financial performance

prepared in accordance with GAAP.

The Company has presented the following non-GAAP financial

measure in this press release: adjusted EBITDA. The Company defines

adjusted EBITDA as its reported net income (loss) attributable to

stockholders (GAAP) plus income tax expense (benefit), interest,

depreciation and amortization, and stock-based compensation

expense.

(In thousands)

Three Months Ended

June 30,

Six Months Ended

June 30,

2022

2021

2022

2021

Net loss attributable to stockholders

$

(5,426

)

$

(4,046

)

$

(11,371

)

$

(8,947

)

Interest income

(18

)

(4

)

(20

)

(7

)

Interest expense

3

2

11

6

Income tax expense

96

107

166

173

Depreciation and amortization

247

213

472

440

Stock based compensation

1,714

1,369

3,364

2,563

Adjusted EBITDA

$

(3,384

)

$

(2,359

)

$

(7,378

)

$

(5,772

)

The following unaudited table presents a reconciliation of net

loss attributable to stockholders to Adjusted EBITDA loss for the

year ending December 31, 2022. The reconciliation assumes the

mid-point of the Adjusted EBITDA loss range and the midpoint of

each component of the reconciliation, corresponding to guidance for

GAAP net loss attributable to stockholders of $20.1 million to

$16.6 million for the year ending December 31, 2022.

(In millions)

Year Ending December 31,

2022

Net loss attributable to stockholders

$

(18.4

)

Interest income

—

Interest expense

—

Income tax expense

0.4

Depreciation and amortization

1.0

Stock based compensation

7.0

Adjusted EBITDA

$

(10.0

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220811005510/en/

Investor Relations

Contact:

ICR Westwicke on behalf of Apyx Medical Corporation Mike

Piccinino, CFA investor.relations@apyxmedical.com

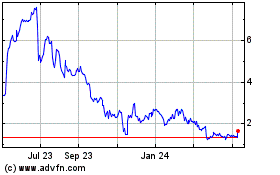

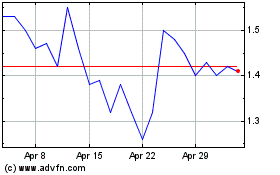

Apyx Medical (NASDAQ:APYX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Apyx Medical (NASDAQ:APYX)

Historical Stock Chart

From Apr 2023 to Apr 2024