UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

PRE-EFFECTIVE AMENDMENT NO. 1 TO

FORM S-3

REGISTRATION STATEMENT

Under

THE SECURITIES ACT OF 1933

| | |

|

| APYX MEDICAL CORPORATION |

| (Exact name of registrant as specified in its charter) |

| | | | | | | | |

| Delaware | | 11-2644611 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

5115 Ulmerton Road

Clearwater, FL 33760

(727) 384-2323

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Charles D. Goodwin, II

Chief Executive Officer

5115 Ulmerton Road

Clearwater, Florida 33760

(727) 384-2323

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

Adam P. Silvers, Esq.

Neil Novikoff, Esq.

Dominick P. Ragno, Esq.

Ruskin Moscou Faltischek, P.C.

1425 RXR Plaza

East Tower, 15th Floor

Uniondale, New York 11556-1425

(516) 663-6519

______________________________

Approximate date of commencement of proposed sale to the public:

From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: o

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or intent reinvestments plans, check the following box: ý

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. o

If this form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. o

If this form is a post-effective amendment to a registration statement filed pursuant General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. o

Indicate by check mark whether registrant is a large accelerated filer, an accelerated filer, a non accelerated filer, or a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | o | | Accelerated filer | o |

| Non-accelerated filer | ý | | Smaller reporting company | ý |

| | | Emerging growth company | o |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | o |

| | | | | | | | | | | | | | |

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933, AS AMENDED, OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE SECURITIES AND EXCHANGE COMMISSION ACTING PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

|

| | | | |

EXPLANATORY NOTE

The sole purpose of this Pre-Effective Amendment No. 1 to the Registration Statement on Form S-3, initially filed on November 22, 2022 (File No. 333-268532) (the “Registration Statement”), is to update the sections entitled “Dilution” and “Risk Factors” in the equity distribution agreement prospectus therein to correct a discrepancy in the dilution per share to investors purchasing our common stock. This figure has been revised from $0.13 to $0.14 per share in the body of the sections entitled “Dilution” and “Risk Factors”. Accordingly, this Pre-Effective Amendment No. 1 consists only of the facing page, this explanatory note, the updated equity distribution agreement prospectus (reflecting only a change to the sections entitled “Dilution” and “Risk Factors”), Part II of the Registration Statement and the signature page of the Registration Statement. This Pre-Effective Amendment is not intended to amend or delete any part of the Registration Statement except as specifically noted herein.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. THESE SECURITIES WILL NOT BE SOLD UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES, AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

SUBJECT TO COMPLETION, DATED November 22, 2022

Up to $40,000,000

Common Stock

We have entered into an equity distribution agreement (the “Equity Distribution Agreement”) with Piper Sandler & Co. (“Piper Sandler”), relating to shares of our common stock offered by this prospectus. In accordance with the terms of the Equity Distribution Agreement, pursuant to this prospectus, we may offer and sell shares of our common stock, $0.001 par value, having an aggregate offering price of up to $40,000,000 from time to time through Piper Sandler acting as our agent.

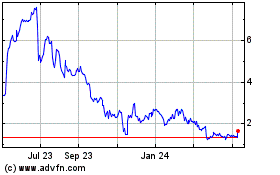

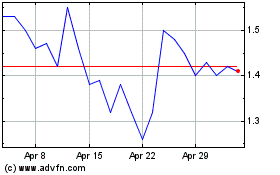

Our common stock is listed on the NASDAQ Stock Market LLC under the symbol “APYX.” On November 21, 2022, the last reported sale price of our common stock was $1.42 per share.

Sales of our common stock, if any, under this prospectus will be made in sales deemed to be “at the market offerings” as defined in Rule 415(a)(4) promulgated under the Securities Act of 1933, as amended, or (the “Securities Act”). Piper Sandler will act as our agent on a best efforts basis and will use commercially reasonable efforts to sell on our behalf all of the shares of common stock requested to be sold by us, consistent with its normal trading and sales practices, on mutually agreed terms between Piper Sandler and us. There is no arrangement for funds to be received in any escrow, trust or similar arrangement.

Piper Sandler will be entitled to compensation at a fixed commission rate of 3.0% of the gross proceeds of any shares of common stock sold pursuant to the Equity Distribution Agreement. See “Plan of Distribution” for additional information regarding compensation to be paid to Piper Sandler. In connection with the sale of the common stock on our behalf, Piper Sandler will be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation of Piper Sandler will be deemed to be underwriting commissions or discounts. We have also agreed to provide indemnification and contribution to Piper Sandler with respect to certain liabilities, including liabilities under the Securities Act and the Exchange Act of 1934, as amended (the “Exchange Act”).

INVESTING IN OUR SECURITIES INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD REVIEW CAREFULLY THE RISKS AND UNCERTAINTIES REFERENCED UNDER THE HEADING “RISK FACTORS” ON PAGE 12 OF THIS PROSPECTUS AS WELL AS THOSE CONTAINED IN THE APPLICABLE PROSPECTUS SUPPLEMENT AND ANY RELATED FREE WRITING PROSPECTUS, AND IN THE OTHER DOCUMENTS THAT ARE INCORPORATED BY REFERENCE INTO THIS PROSPECTUS.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Piper Sandler

THE DATE OF THIS PROSPECTUS IS __________, 2022

| | | | | |

| TABLE OF CONTENTS |

|

| Prospectus |

| Page |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

ABOUT THIS PROSPECTUS

This prospectus relates to the registration statement on Form S-3 that we filed with the Securities and Exchange Commission (the “SEC”) utilizing a “shelf” registration process. Under this shelf registration process, we may from time to time sell shares of our common stock. Under this prospectus, we may from time to time sell shares of our common stock having an aggregate offering price of up to $40,000,000, at prices and on terms to be determined by market conditions at the time of the offering. Before buying any of the common stock that we are offering, we urge you to carefully read this prospectus, any prospectus supplement, and the information incorporated by reference as described under the headings “Where You Can Find More Information” and “Incorporation of Certain Information by Reference” herein and therein. These documents contain important information that you should consider when making your investment decision.

This prospectus describes the terms of this offering of common stock and also adds to and updates information contained in the documents incorporated by reference into this prospectus. To the extent there is a conflict between the information contained in this prospectus, on the one hand, and the information contained in any document incorporated by reference into this prospectus that was filed with the SEC, before the date of this prospectus, on the other hand, you should rely on the information in this prospectus. If any statement in one of these documents is inconsistent with a statement in another document having a later date (for example, a document incorporated by reference into this prospectus) the statement in the document having the later date modifies or supersedes the earlier statement. The information contained in this prospectus or any free writing prospectus, or incorporated by reference herein or therein, is accurate only as of the respective dates thereof, regardless of the time of delivery of this prospectus or of any sale of our shares of common stock. Our business, financial condition, results of operations and prospects may have changed since those dates.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference herein were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

We have not, and Piper Sandler has not, authorized anyone to provide any information other than that contained or incorporated by reference in this prospectus, any prospectus supplement or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus does not constitute an offer to sell, or a solicitation of an offer to purchase, the securities offered by this prospectus in any jurisdiction to or from any person to whom or from whom it is unlawful to make such offer or solicitation of an offer in such jurisdiction.

Unless the context indicates otherwise, references in this prospectus to “Apyx,” “Apyx Medical,” or the “Company,” “we,” “us,” “our” and similar terms refer to Apyx Medical Corporation.

We own or have rights to trademarks, service marks and trade names that we use in connection with the operation of our business, including our corporate name, logos and website names. Other trademarks, service marks and trade names appearing in this prospectus are the property of their respective owners. Solely for convenience, some of the trademarks, service marks and trade names referred to in this prospectus are listed without the ® and ™ symbols, but we will assert, to the fullest extent under applicable law, our rights to our trademarks, service marks and trade names.

PROSPECTUS SUMMARY

The following highlights information about the Registrant and our business contained elsewhere or incorporated by reference in this prospectus. It is not complete and does not contain all of the information that you should consider before investing in any of our securities. You should carefully read this prospectus together with the more detailed information incorporated by reference in this prospectus.

Our Company

Overview

Apyx Medical Corporation (“Company”, “Apyx Medical”, “we”, “us”, or “our”) was incorporated in 1982, under the laws of the State of Delaware and has its principal executive office at 5115 Ulmerton Road, Clearwater, FL 33760.

We are an advanced energy technology company with a passion for elevating people’s lives through innovative products in the cosmetic and surgical markets. Known for our innovative Helium Plasma Technology, Apyx is solely focused on bringing transformative solutions to physicians and their patients. Our Helium Plasma Technology is marketed and sold as Renuvion® in the cosmetic surgery market and J-Plasma® in the hospital surgical market. Our primary focus is on the cosmetic surgery market where Renuvion® offers plastic surgeons, fascial plastic surgeons and cosmetic physicians a unique ability to provide controlled heat to the tissue to achieve their desired results. We also leverage our deep expertise and decades of experience in unique waveforms through original equipment manufacturing (“OEM”) agreements with other medical device manufacturers.

Our objective is to achieve profitable, sustainable growth by increasing our market share in the Advanced Energy category, including the commercialization of products that have the potential to be transformational with respect to the results they produce for surgeons and their patients. In order to achieve this objective, we plan to leverage our long history in the industry, along with a reputation for quality, reliability, and a science-based approach that our brand enjoys within the medical community.

Significant Subsidiaries

Apyx Bulgaria, EOOD is a wholly owned limited liability company incorporated under Bulgarian law, located in Sofia, Bulgaria. It is engaged in the business of development and manufacturing of our advanced energy generators, as well as the manufacturing of our disposable handpieces and OEM generators and accessories. The facility also distributes products directly to customers in certain international markets and provides warranty and repair services.

Industry

The cosmetic surgery market is a special segment of the medical field which is involved in the restoration, reconstruction, or alteration of the human body so as to enhance the body’s appearance. The market for cosmetic surgery includes surgical, minimally invasive, and nonsurgical cosmetic procedures. This market is expected to have steady growth year-over-year and this growth is driven by social and cultural factors such as the influence of social media, peer pressure for appearance and beauty, and increasing disposable income.

We believe that we have sustainable, competitive advantages in the cosmetic surgery market for several reasons: our long history of developing unique energy devices to meet the needs of physicians, our unique Helium Plasma Technology, our outstanding product quality supported by strong engineering and research and development capabilities, and the clinical support that our expanding global medial affairs team provides to our customers. We feel that our products and our strategy as a customer-centric aesthetic medical device manufacturer have, and will continue to improve, the lives of doctors and their patients.

Intellectual Property

We rely on our intellectual property that we have developed or acquired over the years including patents, trade secrets, technical innovations and various licensing agreements to provide our future growth and build our competitive position. We have been issued 40 patents in the United States and 28 foreign patents. We have 22 pending patent applications in the United States and 58 pending foreign applications. We have 9 U.S. registered trademarks, 5 international registered trademarks, and 4 pending international trademark applications. As we continue to expand our intellectual property portfolio, we believe it is critical for us to continue to invest in filing patent applications to protect our technology, inventions and improvements. However, we can give no assurance that competitors will not infringe on our patent rights or otherwise create similar or non-infringing competing products that are technically patentable in their own right.

Manufacturing and Suppliers

We are committed to producing the most technically advanced and highest quality products of their kind available on the market. We manufacture the majority of our products on our premises in Clearwater, Florida and at our facility located in Sofia, Bulgaria, both of which are certified under the ISO international quality standards and are subject to continuing regulation and routine inspections by the U.S. Food and Drug Administration (“FDA”) to ensure compliance with regulations relating to our quality system, medical device complaint reporting, and adherence to FDA restrictions on promotion and advertising. In addition, we are subject to regulations under the Occupational Safety and Health Act, the Environmental Protection Act and other federal, state and local regulations, as well as international laws and regulations.

Apyx Bulgaria, EOOD operates an approximately 25,000 square foot, ISO13485 certified and FDA registered manufacturing facility located in the capital city of Sofia, which houses manufacturing, development and assembly operations.

We work closely with our suppliers to ensure that our raw material inventory (i.e., semiconductors and plastics) needs are met, while maintaining high quality and reliability. To date, we have experienced some delays in locating and obtaining the materials necessary to fulfill our production requirements, but such delays have not caused a meaningful backlog of sales orders. However, it is possible that a prolonged COVID-19 disruption to the global supply chain could cause a backlog of sales orders in the future. We continue to work to find other sources of supply, where feasible, and have expedited the shipments of certain raw material items to adequately maintain our production and safety stock levels, resulting in higher shipping costs. We have also experienced some impact on the purchase prices of our raw materials due to inflation, global inventory shortages. and increased demand across the manufacturing sector.

We maintain collaborative arrangements with three foreign suppliers, including our contract component manufacturer located in Ningbo, China, under which we request the development of certain products which we purchase pursuant to purchase orders. Our purchase order commitments are never more than one year in duration and are supported by our sales forecasts. To our knowledge, none of the products that we source are through entities manufacturing in the Xinjiang province.

During late 2019, we entered into a joint venture with our Chinese supplier to establish a foundation for the manufacturing and sale of our Advanced Energy products into the Chinese market. As of the date of this report, the joint venture has not commenced its principal operations.

Backlog

The value of unshipped factory orders is not material.

Sustainability

We have created a strong environmental, social and governance (“ESG”) structure by introducing a new cross-functional ESG team which has been working with senior management, our board and other stakeholders to develop an ESG framework that is aligned with our corporate mission, vision and values. In the third quarter of 2022, we published our first ESG-focused disclosure under the sector-specific ESG standards published by the Sustainability Accounting Standards Board (“SASB”).

Human Capital Management

At November 21, 2022, we had 282 full-time employees world-wide, of whom 4 were executive officers, 43 were supervisory personnel, 38 were sales personnel and 197 were technical support, administrative and production employees. None of our current employees are covered by a collective bargaining agreement and we have never experienced a work stoppage. During 2021, our voluntary employee turnover rate was approximately 15%.

Diversity, Equity and Inclusion

We have worked to create a culture that fosters employee engagement, where diverse talent is productive and passionate about the work they do. We continuously focus our efforts on cultivating and enhancing our working culture that embraces equality, diversity and inclusion. Currently, over half of our global workforce is represented by women, including half of our executive management team. In addition, in the U.S., approximately 40% of our employees are from minority ethnic\racial groups.

Recruitment, Training and Development

The implementation of our growth strategy largely depends on our ability to hire, train, and retain our workforce. Our recruitment practices include cross-functional departmental interviewing, allowing for the best fit not just for a specific department, but the Company as a whole. We also ensure all of our employees are fully trained and competent for the role for which they were hired. In addition, we train our sales professionals to thoroughly understand our Helium Plasma Technology and the marketplace in which we compete, including how our technologies can increase our customer's revenue and the results they are able to achieve for their patients.

Compensation and Benefits

Our compensation programs are designed to align the compensation of our employees with our performance, and to provide the proper incentives to attract, retain and motivate them to achieve superior results. The structure of our compensation programs balances incentive earnings for both short-term and long-term performance, specifically:

•We offer wages that are competitive and consistent with employee positions, skill levels, experience, knowledge and geographic location;

•Our compensation practices are fair and equitable across all levels of the organization, from our Executive Officers to our hourly employees;

•We work with both local and nationally recognized outside compensation and benefits consulting firms to independently evaluate the effectiveness of our executive and non-executive compensation and benefit programs and to provide benchmarking against our peers within our industry;

•We may provide our non-hourly U.S-based employees long term incentives in the form of stock options to help foster a culture of ownership, and empower individuals to drive continuous improvements to increase stockholder value;

•Annual increases and incentive compensation are based on merit, which is communicated to employees at the time of hiring and documented through our talent management process as part of our annual review procedures and upon internal transfer and/or promotion;

•All employees are eligible for health insurance, paid and unpaid leaves, a retirement plan, and life and disability/accident coverage. We also offer a variety of voluntary benefits that allow employees to select the options that meet their needs.

Culture

We are a solution focused company in the cosmetic surgery market and the broader medical technology sector, and endeavor to provide unique and creative solutions for the ever-changing needs of our physician customers and their patients. Our mission and vision are to be the world’s leading innovator in unique energy solutions that continually reshape what’s possible in cosmetic and medical procedures through innovative solutions.

Our shared values of transforming physicians’ and their patients’ lives, acting with integrity, and driving innovation, form the core of our company's culture. We articulate the qualities associated with these behaviors through our three Core Values:

•Trailblazers: We are passionate about the work we do. We energetically pursue our goals, aim higher, and reach further. When we encounter setbacks, we see opportunities for innovation and improvement. When we clear a business hurdle, we celebrate, and then raise the bar.

•Challengers: We speak up and are not afraid to question, to reimagine, to think differently. We innovate to break the status quo, and create new possibilities, for our customers and for our company.

•Team Players: We respect everyone’s contribution, and are absolutely committed to elevating our fellow team members, and our customers and their patients.

Employee Health and Safety

The health and safety of our employees is our highest priority, and this is consistent with our operating philosophy. We provide a safe and healthy workplace for employees consistent with the requirements of the Occupational Safety and Health Act. We aim to prevent any employee, visitor, customer, or person from being subjected to any health or safety risks. We provide annual training and expect our employees to diligently work towards the maintenance of safe and healthy working conditions, adhere to proper operating practices and procedures designed to prevent injury and illness, and conscientiously observe all safety regulations. Our commitment to the safety and well-being of our employees is shown through safety walkthroughs by our Safety Committee, as well as having an open-door policy, allowing employees to feel comfortable bringing up any safety concerns to management or Human Resources. Identified concerns and potential hazards are addressed immediately, which is evidenced by our low safety incident rate quarter over quarter. In 2021, we had only one lost time accident.

In addition, in our response to the COVID-19 pandemic around the globe, we supported our employees and their families by:

•Adding work from home flexibility;

•Adjusting attendance policies to encourage those who are sick to stay home;

•Increasing cleaning protocols;

•Establishing new physical distancing procedures for employees who need to be onsite;

•Providing additional personal protective equipment and cleaning supplies;

•Implementing protocols to address actual and suspected COVID-19 cases and potential exposure;

•Limiting domestic and international non-essential travel for all employees; and

•Requiring masks to be worn at all locations where allowed by local law.

Our Two Business Segments

We currently have two reportable segments: Advanced Energy and OEM. The Corporate and Other category includes certain unallocated corporate and administrative costs which are not specifically attributed to either reportable segment. Net assets are shared, therefore, not allocated to the reportable segments.

For the year ended December 31, 2021, our OEM segment contributed 11.4% of our consolidated total revenue and our Advanced Energy segment contributed 88.6% of our consolidated total revenue.

Advanced Energy Segment

Our product portfolio consists of our Helium Plasma Technology that is marketed and sold as Renuvion® in the cosmetic surgery market and J-Plasma® in the hospital surgical market. Our primary focus is on the cosmetic surgery market where Renuvion® offers plastic surgeons, fascial plastic surgeons and cosmetic physicians a unique ability to provide controlled heat to the tissue to achieve their desired results. This technology has U.S. FDA clearance, CE mark, and clearance for sale in multiple other countries and is generally indicated for the cutting, coagulation and ablation of soft tissue. The system consists of an electrosurgical generator unit (“ESU”), a handpiece and a supply of helium gas. The proprietary radiofrequency (“RF”) energy is delivered to the handpiece by the ESU and used to energize an electrode. When helium gas passes over the energized electrode, helium plasma is generated which allows for conduction of the RF energy from the electrode to the patient in the form of a precise helium plasma beam. The energy delivered to the patient via the helium plasma beam is unique in that it allows for the application of heat to tissue in a way that is not possible with traditional monopolar or bipolar technologies. This technology has been the subject of forty-two peer-reviewed journal articles, book chapters, abstracts, and posters. It also continues to be the subject of numerous presentations at traditional and cosmetic surgery conferences around the world.

This technology initially received FDA clearance in 2012 and a CE mark in December 2014, which enables us to sell the product in the European Union. In 2014, we created and trained a direct sales force dedicated to sell this technology. In 2015, we continued the commercialization process for our Helium Plasma Technology with a multi-faceted strategy designed to accelerate adoption of the product. This strategy primarily involved deployment of a dedicated sales force, developing product line extensions and expanding the specialties in which this technology can become the “standard of care” for certain procedures.

We continue our full-scale, global, commercialization efforts for Renuvion® in the cosmetic and plastic surgery markets. As of September 30, 2022, we had a direct sales force of 35 field-based selling professionals and utilized 3 independent sales agencies. We also had 4 sales managers. This selling organization is focused on the use of Renuvion® in the cosmetic surgery market, supported by our global medical affairs team. This global team of clinical support specialists focuses on supporting our users to ensure optimal outcomes for their patients. In addition, we have invested in training programs and marketing-related activities to support accelerated adoption of Renuvion® into physicians' practices.

From 2015 through the present, we launched numerous new extensions to our Helium Plasma product lines in an effort to target new surgical procedures, users, and markets. Most notably, throughout 2021, we continued our launch of our Renuvion® Apyx Plasma RF handpieces (“APR”) around the world. These handpieces were designed with improved ergonomics and usability for our Renuvion® customers. As a result of our sales, marketing and product development initiatives, we have significantly increased the number of physicians using our Helium Plasma Technology by expanding usage to include the cosmetic surgery market in the U.S., and the cosmetic surgery market as well as the surgical oncology market outside the U.S.

As part of our plan to accelerate and fully fund the development of our advanced energy business, with a focus in the cosmetic surgery market, we sold our Core business in 2018 for gross proceeds of $97 million. These proceeds were used to launch broad marketing and sales initiatives which resulted in rapid sales growth through December 31, 2021 and into the first quarter of 2022. This planned growth in the business was accompanied by scaled operations, including procurement of components, expanded manufacturing capacity to turn those materials into saleable inventory, additional discretionary expenditures, including increased global participation at trade shows, additional employee trainings, user meetings, increased travel and entertainment expenses, more expansive research and development projects, and additional headcount to support those activities. Additionally, we had and still have, some significant non-recurring discretionary expenditures associated with completing our multi-year marketing initiatives related to our dermal resurfacing and skin laxity clearances.

We continue to make substantial investments in the development and marketing of our Renuvion® technology for the long-term benefit of the Company and its stakeholders, and this may adversely affect our short-term operating performance and cash flows, particularly over the next 12 to 18 months. While we believe that these investments have the potential to generate additional revenues and profits in the future, there can be no assurance that our Helium Plasma Technology will continue to be successful or that such future revenues and profitability will be realized.

In order to assist us in leveraging our Helium Plasma Technology’s precision and effectiveness in multiple surgical specialties, we continue to utilize our Medical Advisory Board which currently consists of 5 members representing the plastic surgery, fascial plastic surgery, and cosmetic procedure specialties.

Our commercial strategy in the U.S. and outside the U.S. is primarily focused on advancing the usage of Renuvion® in the cosmetic surgery market. In some of our international markets, we continue to provide support to our customers who have adopted our J-Plasma® technology for the hospital surgical market. We continue to develop a clinical and regulatory strategy, and corresponding marketing campaigns, to support our market focus. We also continue to expand the reach of our global medical affairs team in order to provide clinical support to our customers in all markets.

On February 18, 2022, we received a request from the FDA for information concerning certain medical device reports which we had filed with the agency. We fully cooperated with the agency and provided the FDA with the requested information. On March 14, 2022, the FDA posted a Medical Device Safety Communication (“Safety Communication”) that warns consumers and health care providers against the use of our Advanced Energy products outside of their FDA-cleared indications for general use in cutting, coagulation, and ablation of soft tissue during open and laparoscopic surgical procedures. Following the Safety Communication, we experienced slowed demand for the adoption of our Helium Plasma Technology.

On May 26, 2022, we announced that we received 510(k) clearance from the FDA for the use of the Renuvion Dermal Handpiece for specific dermal resurfacing procedures. On July 18, 2022, we announced that we received 510(k) clearance from the FDA for the use of the Renuvion® APR Handpiece for certain skin contraction procedures. While we expected that receiving these clearances would materially mitigate the financial effects of the Safety Communication in future periods, we continue to experience reduced demand for the adoption and utilization of our technology and we believe that this may have an adverse effect in future periods.

On June 2, 2022, and July 21, 2022, the FDA updated the Safety Communication to recognize the new 510(k) clearances for the Renuvion® Dermal handpiece, and the expanded indications for the Renuvion® APR handpieces. The 510(k) clearance for the Renuvion® Dermal handpiece allows surgeons to perform dermal resurfacing procedures for the treatment of moderate to severe wrinkles and rhytides, limited to patients with Fitzpatrick Skin Types I, II or III. The 510(k) clearance for the Renuvion® APR handpieces now addresses improving the appearance of lax (loose) skin in the neck and submental region.

Customers

In the U.S., we primarily sell our Renuvion® products through our direct sales force to physicians, cosmetic surgery offices and surgical centers. Outside of the U.S., all of our products are sold primarily through our distributor network.

Products

Our Advanced Energy Products consist of our Helium Plasma Technology lines (Renuvion® and J-Plasma®). These product lines consist of a multifunction generator, a handpiece and a supply of helium gas. RF energy is delivered to the handpiece by the generator and used to energize an electrode. When helium gas passes over the energized electrode, helium plasma is generated which allows for conduction of the RF energy from the electrode to the patient in the form of a precise helium plasma beam. The energy delivered to the patient via the helium plasma beam is unique in that it allows for the application of heat to tissue in a way that is not possible with traditional monopolar or bipolar technologies.

Helium Plasma Generator

Throughout 2021, we continued our launch of the newest generation of our Renuvion® generator, the Renuvion® System 3, to markets outside the U.S. This high frequency electrosurgical generator can be used for delivery of RF energy and/or helium plasma to cut, coagulate and ablate soft tissue during open and laparoscopic surgical procedures. This new generator was built for use with our Renuvion® APR handpieces, and features enhanced capabilities such as a joule counter, capable of displaying energy delivered to the patient, and new Auto-Bipolar functionality, which expands the surgical capabilities of the system. These new product releases continue to expand the procedure base for our Helium Plasma Technology by providing surgeons with the tools they need to access additional anatomic locations and perform specific procedures.

Disposable Portfolio

We offer a variety of different hand pieces for open and laparoscopic procedures. The helium-based plasma generated from these devices has been shown to provide increased precision and control and cause less thermal damage to tissue than CO2 laser, argon plasma and RF energy products currently available on the market. The technology has a general indication and can be used for cutting, coagulating and ablating soft tissue. The advantages of helium plasma continue to be studied throughout the medical and scientific communities. We believe that cosmetic surgery applications are the primary area of opportunity for this technology. In 2020, we completed the launch of our new generation APR handpieces in the U.S. market. During 2021, we began to launch these new

handpieces in our international markets, designed specifically for minimally invasive use, with improved ergonomics and safety features.

Competition

Currently, we are the only company with helium-based plasma and retractable blade products. However, there are RF based competitors, argon plasma competitors, and CO2 laser competitors for our target market. We believe our competitive position has not changed.

Litigation

The medical device industry is characterized by frequent claims and litigation, and the Company may become subject to various claims, lawsuits and proceedings in the ordinary course of our business. Such claims may include claims by current or former employees, distributors and competitors, claims concerning the marketing and promotion of our products and product liability claims.

In addition to a securities class action that was previously disclosed with the SEC, the Company is involved in a number of legal actions relating to the use of our Helium Plasma technology stemming from claims of alleged negligence in marketing, promotion of off-label uses of the Company’s products, product liability claims and/or complaints of alleged medical negligence by physicians employing the Company’s devices. The outcomes of these legal actions are not within the Company’s control and may not be known for prolonged periods of time. It believes that such claims are adequately covered by insurance; however, in the case of one of the Company’s carriers, the Company is in a dispute regarding the total level of coverage available. Notwithstanding the foregoing, in the opinion of management, the Company has meritorious defenses, and such claims are not expected, individually or in the aggregate, to result in a material, adverse effect on its financial condition, results of operations and cash flows. However, in the event that damages exceed the aggregate coverage limits of the Company’s policies or if its insurance carriers disclaim coverage, management believes it is possible that costs associated with these claims could have a material adverse impact on our consolidated financial condition, results of operations and cash flows.

FDA and Other Government Regulations

Our products are medical devices that are subject to extensive regulation by the U.S. FDA, as well as by other regulatory bodies in the United States and abroad. The FDA classifies medical devices into one of three classes based on the risks associated with the medical device and the controls deemed necessary to reasonably ensure the device’s safety and effectiveness. Those three classes are:

•Class I, the lowest risk products, which require compliance with medical device general controls, including labeling, establishment registration, device product listing, adverse event reporting and, for some products, adherence to good manufacturing practices through the FDA’s quality system regulations;

•Class II, comprising moderate-risk devices, which also require compliance with general controls and in some cases, so called special controls that may include performance standards, particular labeling requirements, or post-market surveillance obligations; typically a Class II device also requires pre-market review and clearance by FDA of a pre-market notification (also referred to as a “510(k) application”) as well as adherence to the quality system regulations/good manufacturing practices for devices; and

•Class III, high-risk devices that are often implantable or life-sustaining, which also require compliance with the medical device general controls and quality system regulations, but which generally must be approved by FDA before entering the market, through a more-lengthy pre-market approval (PMA) application. Approved PMAs can include post-approval conditions and post-market surveillance requirements, analogous to some of the special controls that may be imposed on Class II devices.

Before being introduced into the U.S. market, our products must obtain marketing clearance or approval from FDA through the 510(k)-pre-market notification, or premarket approval processes. To date, our products have been classified as Class II, moderate-risk medical devices that are substantially equivalent to a legally marketed device and, thus, have been subject to the 510(k) review and clearance process.

510(k) Pre-Market Notification Process

Class II devices typically require pre-market review and clearance by the FDA, which is accomplished through the submission of a 510(k)-pre-market notification before the device may be marketed. To obtain 510(k) clearance, we must demonstrate that a new device is substantially equivalent to another device with 510(k) clearance or grandfathered status, or to a device that was reclassified from Class III to Class II or Class I - this device to which the new device is compared is called the “predicate device.” In some cases, we may be required to perform clinical trials to support a claim of substantial equivalence. If clinical trials are required, we may be required to submit an application for an investigational device exemption, or IDE, which must be cleared by the FDA prior to the start of a clinical investigation, unless the device and clinical investigation are considered non-significant risk by the FDA or are exempt from the IDE requirements.

Whether or not an IDE is required for a clinical study involving a medical device, an appropriate Institutional Review Board (IRB) must review and approve the study protocol before it is initiated. It generally takes three months from the date of the pre-market notification submission to obtain a final 510(k) clearance decision from the FDA, but it can be significantly longer. After a medical device receives a 510(k)-clearance letter, which authorizes commercial marketing of the new device for one or more specific indications for use, any modification that could significantly affect its safety or effectiveness, or that would constitute a major change in its intended use, requires the submission of a new 510(k) notification or could require de novo classification or a PMA. The FDA allows each company to make this determination, but the FDA can review the decision as part of routine compliance audits of the company. If the FDA disagrees with a company’s decision not to seek prior FDA authorization, the FDA may require the company to seek additional 510(k) clearance or pre-market approval. The FDA also can require the company to cease marketing and/or recall the medical device in question until its regulatory status is resolved.

Post-Marketing Compliance Obligations

Regardless of which pre-market pathway a medical device uses to reach the U.S. market, after a device is placed on the market, numerous regulatory requirements continue to apply. These include:

•the FDA’s Quality System Regulation (“QSR”), which requires manufacturers, including third-party manufacturers, to follow stringent design, testing, control, documentation and other good manufacturing practice and quality assurance procedures during all aspects of the manufacturing process (unless a device category is exempt from this requirement by the FDA, such as in the case of many Class I devices);

•labeling regulations and FDA prohibitions against the promotion of products for uncleared or unapproved uses (known as off-label uses), as well as requirements to provide adequate information on both risks and benefits;

•medical device reporting regulations, which require that manufacturers report to FDA any event that the company learns of in which a device may have caused or contributed to a death or serious injury or malfunctioned in a way that would likely cause or contribute to a death or serious injury if the malfunction were to recur;

•correction and removal reporting regulations, which require that manufacturers report to the FDA field corrections and device recalls or removals if undertaken to reduce a risk to health by the device or to remedy a violation of the U.S. Food Drug and Cosmetic Act caused by the device that may present a risk to health;

•post-market surveillance regulations, which apply to Class II or III devices if the FDA has issued a post-market surveillance order and the failure of the device would be reasonably likely to have serious adverse health consequences, the device is expected to have significant use in the pediatric population, the device is intended to be implanted in the human body for more than one year, or the device is intended to be used to support or sustain life and to be used outside a user facility;

•regular and for-cause inspections by FDA to review a manufacturer’s facility and its compliance with applicable FDA requirements; and

•the FDA’s recall authority, whereby it can ask, or order, device manufacturers to recall from the market a product that is in violation of applicable laws and regulations.

Because our customers are health care providers, our business may also be subject to state, federal, and foreign laws and regulations prohibiting health care fraud, waste, and abuse and requiring pricing and financial relationship transparency.

On February 18, 2022, we received a request from the FDA for information concerning certain medical device reports which we had filed with the agency. We fully cooperated with the agency and provided the FDA with the requested information. On March 14, 2022, the FDA posted a Medical Device Safety Communication that warns consumers and health care providers against the use of our Advanced Energy products outside of their FDA-cleared indications for general use in cutting, coagulation, and ablation of soft tissue during open and laparoscopic surgical procedures. We continue to work with the FDA towards securing 510(k) clearance for additional indications. We are in the process of evaluating what effects, if any, the Safety Communication will have on our results of operations, cash flows and financial position.

On June 2, 2022, and July 21, 2022, FDA updated the Medical Device Safety Communication to recognize the new 510(k) clearances for the Renuvion® Dermal handpiece, and the expanded indications for the Renuvion® APR handpieces. The 510(k) clearance for the Renuvion® Dermal handpiece allows surgeons to perform dermal resurfacing procedures for the treatment of moderate to severe wrinkles and rhytides, limited to patients with Fitzpatrick Skin Types I, II or III. The 510(k) clearance for the Renuvion® APR handpieces now addresses improving the appearance of lax (loose) skin in the neck and submental region.

Medical Device Single Audit Program (“MDSAP”)

The International Medical Device Regulators Forum (the “IMDRF”) recognized that a global approach to auditing and monitoring the manufacturing of medical devices could improve their safety and oversight on an international scale. The IMDRF established a work group that developed specific documents to advance a MDSAP. The Medical Device Single Audit Program allowed MDSAP recognized Auditing Organizations to conduct a single regulatory audit of a medical device manufacturer to satisfy the relevant

requirements of the regulatory authorities participating in the program. Based on its evaluation of the MDSAP Final Pilot Report, the MDSAP Regulatory Authority Council (the international MDSAP governing body) determined that the MDSAP Pilot had satisfactorily demonstrated the viability of the Medical Device Single Audit Program. In October 2021, we underwent a successful annual MDSAP audit our registrar GMED SAS. There were no observations related to safety or efficacy of our products noted during this MDSAP audit. The FDA accepts MDSAP audit reports as a substitute for routine Agency inspections.

OEM Segment

We leverage our expertise in the design, development and manufacturing of electrosurgical equipment by producing generators and related accessories for large, well-known medical device manufacturers through OEM agreements, as well as start-up companies with the need for our energy-based designs. In connection with the Asset Purchase Agreement with Symmetry Surgical in 2018, we entered into a Manufacturing and Supply Agreement for a ten-year term, whereby we will manufacture certain products and sell to them at agreed upon prices. Revenue, costs and expenses resulting from this agreement are reported in our Consolidated Statements of Operations as a component of income or loss from operations of our OEM reporting segment.

THE OFFERING

| | | | | |

| Common Stock Offered By Us | Shares of our common stock having an aggregate offering price of up to $40,000,000. |

| |

Common Stock Outstanding After

This Offering

| Up to 62,757,412 shares, assuming the sale of up to 28,169,014 shares of our common stock at a price of $1.42 per share, which was the closing price of our common stock on the NASDAQ Stock Market on November 21, 2022. The actual number of shares issued will vary depending on the sales price under this offering. |

| |

| Plan of Distribution | “At the market” offering that may be made from time to time through our agent, Piper Sandler. See “Plan of Distribution” on page 17 of this prospectus. |

| |

| Use of Proceeds | We currently intend to use the net proceeds from the sale of securities offered by this prospectus for working capital and other general corporate purposes, including expanding our sales and marketing, capital expenditures, facilities expansion, acquisitions of complementary business or products, technologies or businesses and repaying indebtedness we may incur from time to time. See “Use of Proceeds” on page 14 of this prospectus. |

| |

| Risk Factors | Investing in our common stock involves significant risks. See “Risk Factors” on page 12 of this prospectus, and under similar headings in other documents incorporated by reference into this prospectus. |

| |

| Symbol on the Nasdaq Stock Market | “APYX” |

The number of shares of common stock to be outstanding after this offering is based on 34,588,398 shares of common stock outstanding as of September 30, 2022 and excludes as of September 30, 2022:

•6,635,409 shares of common stock issuable upon the exercise of outstanding stock options having a weighted-average exercise price of approximately $7.13 per share.

In addition, unless we specifically state otherwise, all information in this prospectus assumes no exercise of outstanding stock options subsequent to September 30, 2022.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements within the meaning of Section 27A of the Securities Act regarding our business, financial condition, results of operations and prospects. Words such as “expects,” “anticipates,” “intends,” “plans,” “aims,” “predicts,” “believes,” “seeks,” “estimates,” and similar expressions or variations of such words are intended to identify forward-looking statements. However, these are not the exclusive means of identifying forward-looking statements. Although forward-looking statements contained in this prospectus reflect our good faith judgment, such statements can only be based on facts and factors currently known to us. Consequently, forward-looking statements are inherently subject to risks and uncertainties, and actual outcomes may differ materially from the results and outcomes discussed in the forward-looking statements, including but not limited to risks, uncertainties and assumptions relating to the regulatory environment in which the Company is subject to, including the Company’s ability to gain requisite approvals for its products from the FDA and other governmental and regulatory bodies, both domestically and internationally; the impact of the recent FDA Safety Communication on our business and operations; factors relating to the effects of the COVID-19 pandemic; sudden or extreme volatility in commodity prices and availability, including supply chain disruptions; changes in general economic, business or demographic conditions or trends; changes in and effects of the geopolitical environment;

liabilities and costs which the Company may incur from pending or threatened litigations, claims, disputes or investigations. You should review the risks and uncertainties referred to in this prospectus under the heading “Risk Factors,” as well as those in our other filings made from time to time with the SEC. You should not place undue reliance on forward-looking statements, which speak only as of the date of this prospectus. We undertake no obligation to update publicly any forward-looking statements in order to reflect any event or circumstance occurring after the date of this prospectus or currently unknown facts or conditions or the occurrence of unanticipated events. In addition, our past results are not necessarily indicative of future results, thus, we cannot guarantee future results, levels of activity, performance or achievements. Factors that could cause actual results to differ from those discussed in the forward-looking statements include, but are not limited to:

•changes in general economic, business or demographic conditions or trends in the U.S. or throughout the world or changes in the political environment, including changes in GDP, trade wars, interest rates and inflation;

•our ability to conclude a sufficient number of attractive growth projects, deploy growth capital in amounts consistent with our objectives in the prosecution of those and achieve targeted risk-adjusted returns on any growth project, including the continued commercialization of our Helium Plasma Technology;

•the regulatory environment, including our ability to gain requisite approval from the FDA and other governmental and regulatory bodies, both domestically and internationally, including the effects of the recent FDA Medical Device Safety Communication regarding an emerging safety signal of our products;

•our ability to estimate compliance costs, comply with any changes thereto, rates implemented by regulators, and our relationships and rights under, and contracts with, governmental agencies and authorities;

•disruptions or other extraordinary or force majeure events and the ability to insure against losses resulting from such events or disruptions, including disruptions caused by COVID-19 or other global pandemics;

•sudden or extreme volatility in commodity prices and availability, including supply chain disruptions;

•changes in competitive dynamics affecting our business and the medical device industry as a whole;

•technological innovations leading to increased competition in the medical device industry;

•changes in healthcare policy;

•our ability to make alternate arrangements to account for any disruptions or shutdowns that may affect suppliers’ facilities or the operations upon which our business is dependent;

•continued aggressive EPA state regulation of Ethylene oxide sterilization commercial plants resulting in additional plant closures, leading to a reduced availability of our handpieces, which are commercially sterilized;

•our ability to implement operating and internal growth strategies;

•environmental risks, including the impact of climate change and weather conditions;

•the impact of weather events, including potentially hurricanes, tornadoes and/or seasonal extremes;

•unplanned outages and/or failures of technical and mechanical systems;

•cybersecurity breaches impacting critical systems or data;

•work interruptions or other labor stoppages;

RISK FACTORS

Investing in our securities involves certain risks. You should carefully consider the risk factors contained in Item 1A under the caption “Risk Factors” and elsewhere in our annual report on Form 10-K for the fiscal year ended December 31, 2021 and in our quarterly report on Form 10-Q for the fiscal quarter ended September 30, 2022, which are incorporated into this prospectus by reference, as updated by our annual or quarterly reports for subsequent fiscal years or fiscal quarters that we file with the SEC and that are so incorporated. See “Where You Can Find More Information” for information about how to obtain a copy of these documents. You should also carefully consider the risks and other information that may be contained in, or incorporated by reference into, any prospectus supplement relating to specific offerings of securities. Each of the referenced risks and uncertainties could adversely affect our business, operating results and financial condition, as well as adversely affect the value of an investment in our securities. Additional risks and uncertainties not known to us or that we believe are immaterial may also adversely affect our business, operating results and financial condition and the value of an investment in our securities.

ADDITIONAL RISKS RELATED TO THIS OFFERING

You may experience dilution.

The offering price per share in this offering may exceed the net tangible book value per share of our common stock outstanding prior to this offering. Assuming that an aggregate of 28,169,014 shares of our common stock are sold at a price of $1.42 per share, the last reported sale price of our common stock on the NASDAQ Stock Market on November 21, 2022, for aggregate gross proceeds of $40 million, and after deducting commissions and estimated offering expenses payable by us, you would experience immediate dilution of $0.14 per share, representing the difference between our as adjusted net tangible book value per share as of September 30, 2022 after giving effect to this offering and the assumed offering price. The exercise of outstanding stock options would result in further dilution of your investment. See the section entitled “Dilution” below for a more detailed illustration of the dilution you would incur if you participate in this offering. Because the sales of the shares offered hereby will be made directly into the market or in negotiated transactions, the prices at which we sell these shares will vary and these variations may be significant. Purchasers of the shares we sell,

as well as our existing shareholders, will experience significant dilution if we sell shares at prices significantly below the price at which they invested.

You may experience future dilution as a result of future equity offerings.

In order to raise additional capital, we may in the future offer additional shares of our common stock or other securities convertible into or exchangeable for our common stock. We cannot assure you that we will be able to sell shares or other securities in any other offering at a price per share that is equal to or greater than the price per share paid by investors in this offering, and investors purchasing shares or other securities in the future could have rights superior to existing stockholders. The price per share at which we sell additional shares of our common stock or other securities convertible into or exchangeable for our common stock in future transactions may be higher or lower than the price per share in this offering.

Our management might apply the net proceeds from this offering in ways with which you do not agree and in ways that may impair the value of your investment.

We currently intend to use the net proceeds from the sale of securities offered by this prospectus for working capital and other general corporate purposes, including expanding our sales and marketing, capital expenditures, facilities expansion, acquisitions of complementary business or products, technologies or businesses and repaying indebtedness we may incur from time to time. The timing and amount of our actual expenditures will be based on many factors, including cash flows from operations and the anticipated growth of our business. As a result, our management will have broad discretion to allocate the net proceeds of the offerings. We might apply these proceeds in ways with which you do not agree, or in ways that do not yield a favorable return. If our management applies these proceeds in a manner that does not yield a significant return, if any, on our investment of these net proceeds, it could compromise our ability to pursue our growth strategy and adversely affect the market price of our common stock.

It is not possible to predict the actual number of shares we will sell under the Equity Distribution Agreement or the gross proceeds resulting from those sales.

Subject to certain limitations in the Equity Distribution Agreement and compliance with applicable law, we have the discretion to deliver instructions to Piper Sandler to sell shares of our common stock at any time throughout the term of the Equity Distribution Agreement. The number of shares that are sold through Piper Sandler after our instructions will fluctuate based on a number of factors, including the market price of our common stock during the sales period, the limits we set with Piper Sandler in any instructions to sell shares, and the demand for our common stock during the sales period. Because the price per share of each share sold will fluctuate during this offering, it is not currently possible to predict the number of shares that will be sold or the gross proceeds to be raised in connection with those sales.

The common stock offered hereby will be sold in “at the market offerings,” and investors who buy shares at different times will likely pay different prices.

Investors who purchase shares in this offering at different times will likely pay different prices, and so may experience different levels of dilution and different outcomes in their investment results. We will have discretion, subject to market demand, to vary the timing, prices, and numbers of shares sold in this offering. In addition, subject to the final determination by our board of directors, there is no minimum or maximum sales price for shares to be sold in this offering. Investors may experience a decline in the value of the shares they purchase in this offering as a result of sales made at prices lower than the prices they paid.

Sales of a significant number of shares of our common stock in the public markets, or the perception that such sales could occur, could depress the market price of our common stock.

Sales of a significant number of shares of our common stock in the public markets, or the perception that such sales could occur as a result of our utilization of our shelf registration statement, the Equity Distribution Agreement or otherwise could depress the market price of our common stock and impair our ability to raise capital through the sale of additional equity securities. We cannot predict the effect that future sales of our common stock or the market perception that we are permitted to sell a significant number of our securities would have on the market price of our common stock.

USE OF PROCEEDS

We may issue and sell shares of our common stock having aggregate sales proceeds of up to $40 million from time to time. Because there is no minimum offering price for the shares that we may offer from time to time, the actual total public offering amount, commissions to Piper Sandler and proceeds to us, if any, are not determinable at this time. There can be no assurance that we will sell any shares under or fully utilize the Equity Distribution Agreement with Piper Sandler as a source of financing.

We currently intend to use the net proceeds from the sale of securities offered by this prospectus for working capital and other general corporate purposes, including expanding our sales and marketing, capital expenditures, facilities expansion, acquisitions of complementary business or products, technologies or businesses and repaying indebtedness we may incur from time to time. The timing and amount of our actual expenditures will be based on many factors, including cash flows from operations and the anticipated growth of our business. As a result, our management will have broad discretion to allocate the net proceeds of the offerings.

DILUTION

If you invest in our common stock in this offering, your ownership interest will be diluted to the extent of the difference between the public offering price per share of our common stock and the as adjusted net tangible book value per share of our common stock immediately after this offering.

Our net tangible book value as of September 30, 2022 was approximately $42.0 million or $1.22 per share. Net tangible book value per share is determined by dividing our total tangible assets, less total liabilities, by the number of shares of our common stock outstanding as of September 30, 2022. Dilution with respect to net tangible book value per share represents the difference between the amount per share paid by purchasers of shares of common stock in this offering and the net tangible book value per share of our common stock immediately after this offering.

After giving effect to the sale of 28,169,014 shares of our common stock in this offering at an assumed offering price of $1.42 per share, the last reported sale price of our common stock on the NASDAQ Stock Market on November 21, 2022, for aggregate gross proceeds of $40 million, and after deducting commissions and offering expenses payable by us, our as adjusted net tangible book value as of September 30, 2022 would have been approximately $80.6 million, or $1.28 per share. This represents an immediate increase in net tangible book value of $0.06 per share to existing stockholders and immediate dilution of $0.14 per share to investors purchasing our common stock in this offering at the assumed public offering price. The following table illustrates this dilution on a per share basis:

| | | | | | | | |

| Assumed public offering price per share | | $ | 1.42 | |

| Net tangible book value per share of as of September 30, 2022 | $ | 1.22 | | |

| Increase in net tangible book value per share attributable to this offering | $ | 0.06 | | |

| As adjusted net tangible book value per share as of September 30, 2022, after giving effect to this offering | | $ | 1.28 | |

| Dilution per share to investors purchasing our common stock in this offering | | $ | 0.14 | |

The above discussion and table are based on 34,588,398 shares of common stock outstanding as of September 30, 2022 and exclude as of September 30, 2022:

•6,635,409 shares of common stock issuable upon the exercise of outstanding stock options having a weighted-average exercise price of approximately $7.13 per share.

In addition, unless we specifically state otherwise, all information in this prospectus assumes no exercise of outstanding stock options subsequent to September 30, 2022.

The table above assumes for illustrative purposes that an aggregate of 28,169,014 shares of our common stock are offered during the term of the Equity Distribution Agreement with Piper Sandler at a price of $1.42 per share, the last reported sale price of our common stock on the NASDAQ Stock Market on November 21, 2022, for aggregate gross proceeds of $40 million. The shares subject to the Equity Distribution Agreement with Piper Sandler are being sold from time to time at various prices.

An increase of $0.35 per share in the price at which the shares are sold from the assumed offering price of $1.42 per share shown in the table above, assuming all of our common stock in the aggregate amount of $40 million during the term of the Equity Distribution Agreement with Piper Sandler is sold at that price, would increase our as adjusted net tangible book value per share after the offering to $1.41 per share and would increase the dilution in net tangible book value per share to new investors in this offering to $0.36 per share, after deducting commissions and estimated aggregate offering expenses payable by us.

A decrease of $0.35 per share in the price at which the shares are sold from the assumed offering price of $1.42 per share shown in the table above, assuming all of our common stock in the aggregate amount of $40 million during the term of the Equity Distribution Agreement with Piper Sandler is sold at that price, would decrease our as adjusted net tangible book value per share after the offering

to $1.12 per share and would result in an increase in net tangible book value per share to new investors in this offering of $0.05 per share, after deducting commissions and estimated aggregate offering expenses payable by us. This information is supplied for illustrative purposes only.

To the extent that outstanding stock options outstanding as of September 30, 2022 have been or may be exercised or other shares issued, investors purchasing our common stock in this offering may experience further dilution. In addition, we may choose to raise additional capital due to market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plans. To the extent that additional capital is raised through the sale of equity, convertible debt securities or other securities exchangeable for common stock, the issuance of these securities could result in further dilution to our stockholders.

DESCRIPTION OF CAPITAL STOCK

The following is only a summary of the material terms of our common stock and preferred stock, together with the additional information we may include in any applicable prospectus supplements. Because it is only a summary, it does not contain all the information that may be important to you. Accordingly, you should carefully read the more detailed provisions of our certificate of incorporation, as amended, and our by-laws, each of which has been filed with the SEC, as well as applicable provisions of Delaware law.

Authorized Capitalization

Our authorized capital stock consists of 75,000,000 shares of Common Stock, par value $0.001 per share, and 10,000,000 shares of “blank check” Preferred Stock, par value $.001 per share. As of November 21, 2022, there were 34,597,822 shares of common stock issued and outstanding, held by approximately 600 stockholders of record. Since many stockholders choose to hold their shares under the name of their brokerage firm, we estimate that the actual number of stockholders was over 3,500.

Common Stock

Holders of shares of common stock are entitled to one vote for each share on all matters to be voted on by the stockholders, and do not have cumulative voting rights, subject to the preferences that may be applicable to any then outstanding shares of preferred stock. Holders of shares of common stock are entitled to share ratably in dividends, if any, as may be declared from time to time by the Board of Directors in its discretion, from funds legally available therefore. In the event of our liquidation, dissolution or winding up, holders of our common stock will be entitled to share ratably in the net assets legally available for distribution to shareholders after the payment of all of our debts and other liabilities. Holders of common stock have no preemptive or other subscription rights, and there are no conversion rights or redemption with respect to such shares.

Preferred Stock

Our certificate of incorporation, as amended, provides that our Board of Directors has the authority, without further action by the stockholders, to issue up to a specified number of shares of preferred stock in one or more series and to fix the rights, preferences, privileges and restrictions of this preferred stock, including dividend rights, conversion rights, voting rights, terms of redemption, liquidation preferences, sinking fund terms and the number of shares constituting any series or the designation of a series, without further vote or action by the stockholders.

If we issue preferred stock, our Board of Directors would fix the rights, preferences, privileges and restrictions of the preferred stock of each series in a Certificate of Designations relating to that series. We will incorporate by reference as an exhibit to the registration statement that includes this prospectus or as an exhibit to a current report on Form 8-K, the form of any Certificate of Designations that describes the terms of the series of preferred stock we are offering before the issuance of the related series of preferred stock. This description will include:

•the title and stated value;

•the number of shares we are offering;

•the liquidation preference per share;

•the purchase price;

•the dividend rate, period and payment date and method of calculation for dividends;

•whether dividends will be cumulative or non-cumulative and, if cumulative, the date from which dividends will accumulate;

•the procedures for any auction and remarketing, if any;

•the provisions for a sinking fund, if any;

•the provisions for redemption or repurchase, if applicable, and any restrictions on our ability to exercise those redemption and repurchase rights;

•any listing of the preferred stock on any securities exchange or market;

•whether the preferred stock will be convertible into our common stock, and, if applicable, the conversion price, or how it will be calculated, and the conversion period;

•voting rights, if any, of the preferred stock;

•preemption rights, if any;

•restrictions on transfer, sale or other assignment, if any;

•a discussion of any material or special United States federal income tax considerations applicable to the preferred stock;

•the relative ranking and preferences of the preferred stock as to dividend rights and rights if we liquidate, dissolve or wind up our affairs;

•any limitations on issuance of any class or series of preferred stock ranking senior to or on a parity with the series of preferred stock as to dividend rights and rights if we liquidate, dissolve or wind up our affairs; and

•any other specific terms, preferences, rights or limitations of, or restrictions on, the preferred stock.

The issuance of preferred stock, whether pursuant to this offering or otherwise, could adversely affect the voting power, conversion or other rights of holders of our common stock. Preferred stock could be issued quickly with terms designed to delay or prevent a change in control of our company or make removal of management more difficult. Additionally, the issuance of preferred stock may have the effect of decreasing the market price of our common stock.

Transfer Agent and Registrar

The transfer agent and registrar for our common stock is Manhattan Transfer Registrar Company. Its telephone number is 877-645-8691.

Listing

Our common stock trades on the NASDAQ Stock Market LLC under the symbol “APYX.”

Delaware General Corporation Law Section 203

As a corporation organized under the laws of the State of Delaware, we are subject to Section 203 of the Delaware General Corporation Law (the “DGCL”) which restricts certain business combinations between us and an “interested stockholder” (in general, a stockholder owning 15% or more of our outstanding voting stock) or its affiliates or associates for a period of three years following the date on which the stockholder becomes an “interested stockholder.” The restrictions do not apply if (i) prior to an interested stockholder becoming such, the board of directors approves either the business combination or the transaction in which the stockholder becomes an interested stockholder, (ii) upon consummation of the transaction in which any person becomes an interested stockholder, such interested stockholder owns at least 85% of our voting stock outstanding at the time the transaction commences (excluding shares owned by certain employee stock ownership plans and persons who are both directors and officers of us) or (iii) on or subsequent to the date an interested stockholder becomes such, the business combination is both approved by the board of directors and authorized at an annual or special meeting of our stockholders, not by written consent, by the affirmative vote of at least 66-2/3% of the outstanding voting stock not owned by the interested stockholder.