Table of Contents

As filed with the Securities and Exchange Commission on November 18, 2022

Registration Statement No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

ARAVIVE, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

2834

|

|

26-4106690

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Primary Standard Industrial

Classification Code Number)

|

|

(I.R.S. Employer

Identification No.)

|

River Oaks Tower

3730 Kirby Drive, Suite 1200

Houston, Texas 77098

(936) 355-1910

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Gail McIntyre

Chief Executive Officer

River Oaks Tower

3730 Kirby Drive, Suite 1200

Houston, Texas 77098

(936) 355-1910

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Leslie Marlow, Esq.

Patrick J. Egan, Esq.

Hank Gracin, Esq.

Blank Rome LLP

1271 Avenue of the Americas

New York, New York 10020

Telephone: (212) 885-5000

Facsimile: (212) 885-5001

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

Large accelerated filer ☐

|

|

Accelerated filer ☐

|

|

Non-accelerated filer ☒

|

|

Smaller reporting company ☒

Emerging growth company ☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The selling stockholders named in this prospectus may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and the selling stockholders named in this prospectus are not soliciting offers to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

Subject to completion, dated November 18, 2022

PROSPECTUS

90,357,622 Shares of Common Stock

This prospectus relates to the resale from time to time of up to 90,357,622 shares of common stock, par value $0.0001 per share (the “Common Stock”), of Aravive, Inc. by the selling stockholders identified in this prospectus (the “Selling Stockholders”), including their pledgees, assignees, donees, transferees or their respective successors-in-interest, which consist of 29,308,612 outstanding shares of Common Stock held by the Selling Stockholders, 15,870,199 shares of Common Stock issuable upon the exercise of outstanding pre-funded warrants (the “Pre-Funded Warrants”) held by certain of the Selling Stockholders to purchase shares of Common Stock and 45,178,811 shares of Common Stock issuable upon the exercise of outstanding warrants held by the Selling Stockholders to purchase shares of Common Stock (the “Warrants”) (or issuable upon exercise of pre-funded warrants to purchase shares of Common Stock that are issuable to holders of Warrants upon exercise of such Warrants for pre-funded warrants in lieu of Common Stock).

The Selling Stockholders acquired the shares of Common Stock, the Pre-Funded Warrants and the Warrants in a private placement transaction that closed on October 27, 2022 (the “Private Placement”). We are filing the registration statement on Form S-3, of which this prospectus forms a part, to fulfill our contractual obligations with the Selling Stockholders to provide for the resale by the Selling Stockholders of the shares of Common Stock offered hereby. See “Selling Stockholders” beginning on page 8 of this prospectus for more information about the Selling Stockholders. The registration of the shares of Common Stock to which this prospectus relates does not require the Selling Stockholders to sell any of their shares of our Common Stock.

We are not offering any shares of Common Stock under this prospectus and will not receive any proceeds from the sale or other disposition of the shares covered hereby; however, we will receive proceeds from the exercise of the Pre-Funded Warrants and the Warrants. See “Use of Proceeds” beginning on page 7 of this prospectus.

The Selling Stockholders identified in this prospectus, or their pledgees, assignees, donees, transferees or their respective successors-in-interest, from time to time may offer and sell through public or private transactions at prevailing market prices, at prices related to prevailing market prices or at privately negotiated prices the shares held by them directly or through underwriters, agents or broker-dealers on terms to be determined at the time of sale, as described in more detail in this prospectus. See “Plan of Distribution” beginning on page 14 of this prospectus for more information about how the Selling Stockholders may sell their respective shares of Common Stock. For a list of the selling stockholders, see the section entitled “Selling Stockholders” on page 8.

In connection with the Private Placement, we have agreed, pursuant to certain registration rights agreements that we have entered into with the Selling Stockholders, to bear all of the expenses in connection with the registration of the shares of Common Stock pursuant to this prospectus. The Selling Stockholders will pay or assume all commissions, discounts, fees of underwriters, selling brokers or dealer managers and similar expenses, if any, attributable to its sales of the shares of Common Stock.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire prospectus and any amendments or supplements carefully before you make your investment decision.

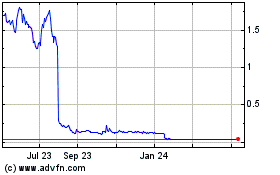

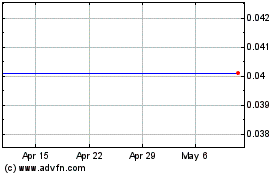

Our Common Stock is listed on the Nasdaq Global Select Market under the symbol “ARAV.” On November 16, 2022, the last reported sale price of our Common Stock on the Nasdaq Global Select Market was $1.49 per share.

An investment in shares of our shares of Common Stock involves risks. See the “Risk Factors” beginning on page 5 and the “Risk Factors” section of our most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission and any updates to those risk factors or new risk factors contained in our subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K filed with the Securities and Exchange Commission, all of which we incorporate by reference herein.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2022.

TABLE OF CONTENTS

i

ABOUT THIS PROSPECTUS

This prospectus provides you with a general description of the shares of Common Stock the Selling Stockholders may offer. A prospectus supplement may also add, update or change information contained in this prospectus. To the extent that any statement made in an accompanying prospectus supplement is inconsistent with statements made in this prospectus, the statements made in this prospectus will be deemed modified or superseded by those made in the accompanying prospectus supplement. You should read both this prospectus and any accompanying prospectus supplement together with the additional information described under the heading “Where You Can Find More Information” beginning on page 15 of this prospectus.

Neither we nor any Selling Stockholder has authorized anyone to provide you with information different from that contained in this prospectus, any accompanying prospectus supplement or in any related free-writing prospectus filed by us with the SEC. Neither we nor any Selling Stockholder takes any responsibility for, or provide any assurance as to the reliability of, any information other than the information in this prospectus, any accompanying prospectus supplement or in any related free-writing prospectus filed by us with the SEC. This prospectus and any accompanying prospectus supplement do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the securities described in this prospectus or any accompanying prospectus supplement or an offer to sell or the solicitation of an offer to buy such securities in any circumstances in which such offer or solicitation is unlawful. You should assume that the information appearing in this prospectus, any prospectus supplement, the documents incorporated by reference and any related free-writing prospectus is accurate only as of their respective dates. Our business, financial condition, results of operations and prospects may have changed materially since those dates.

Except as otherwise indicated herein or as the context otherwise requires, references in this prospectus to “Aravive,” “the company,” “we,” “us,” “our” and similar references refer to Aravive, Inc., an entity incorporated under the laws of the State of Delaware, and where appropriate our consolidated subsidiaries.

This prospectus and the information incorporated herein by reference include trademarks, service marks and trade names owned by us or other companies. All trademarks, service marks and trade names included or incorporated by reference into this prospectus, any applicable prospectus supplement or any related free writing prospectus are the property of their respective owners.

ii

PROSPECTUS SUMMARY

This summary highlights about us and selected information contained elsewhere in this prospectus and in the documents we incorporate by reference. This summary does not contain all of the information you should consider before investing in our Common Stock. You should read this entire prospectus and the documents incorporated by reference carefully, especially the risks of investing in our Common Stock discussed under and incorporated by reference in “Risk Factors” on page 5 of this prospectus, along with our consolidated financial statements and notes to those consolidated financial statements and the other information incorporated by reference in this prospectus, before making an investment decision.

Company Overview

We are a clinical-stage oncology company developing transformative treatments designed to halt the progression of life-threatening diseases, including cancer and fibrosis.

Our lead product candidate, batiraxcept (formerly AVB-500), is an ultrahigh-affinity, decoy protein that targets the GAS6-AXL signaling pathway. By capturing serum GAS6, batiraxcept starves the AXL pathway of its signal, potentially halting the biological programming that promotes disease progression. AXL receptor signaling plays an important role in multiple types of malignancies by promoting metastasis, cancer cell survival, resistance to treatments, and immune suppression.

Our current development program benefits from the availability of a proprietary serum-based biomarker that has accelerated batiraxcept drug development by allowing us to select a pharmacologically active dose and may potentially identify the cancer patients that have the best chance of responding to batiraxcept.

In our completed Phase 1 clinical trial in healthy volunteers with our lead product candidate, batiraxcept, we have demonstrated proof of mechanism for batiraxcept in neutralizing GAS6. Importantly, batiraxcept had a favorable safety profile preclinically and in the first in human trial and Phase 1b clinical trial in cancer patients.

In August 2018, the FDA designated as a Fast Track development program the investigation of our lead development candidate, batiraxcept, for platinum-resistant recurrent ovarian cancer.

In December 2018, we initiated our Phase 1b clinical trial of batiraxcept combined with standard of care therapies in patients with PROC, for which we reported results in July 2020.

In April 2020, we entered into a license and collaboration agreement with WuXi, the objective of which is to identify and develop novel high-affinity bispecific antibodies against CCN2, also known as CTGF, implicated in cancer and fibrosis and identified from a similar target discovery screen that identified the significance of the AXL/GAS6 pathway in cancer.

In November 2020, we entered into the 3D Medicines Agreement, whereby we granted 3D Medicines an exclusive license to develop and commercialize products that contain batiraxcept as the sole drug substance, for the diagnosis, treatment or prevention of human oncological diseases, in in mainland China, Taiwan, Hong Kong and Macau (the “Territory”).

During the fourth quarter of 2020, we initiated our Phase 1b portion of the Phase 1b/2 trial of batiraxcept in ccRCC and we dosed our first patient in the trial in March 2021.

During the first quarter 2021, we initiated our registrational Phase 3 trial of batiraxcept in platinum resistant ovarian cancer (“PROC”) and we dosed our first patient in the trial in April 2021.This global, randomized, double-blind, placebo-controlled adaptive trial is designed to evaluate efficacy and safety of batiraxcept at a dose of 15 mg/kg in combination with PAC versus PAC alone.

In May 2021, we announced expansion of batiraxcept development programs into first line pancreatic adenocarcinoma with the goal of initiating the trial by end of 2021. We dosed our first patient in August 2021.

In June 2021, we announced positive initial safety, pharmacokinetic, and pharmacodynamic results from the batiraxcept Phase 1b portion of the Phase 1b/2 clinical trial in ccRCC.

In October 2021, the EMA granted orphan drug designation for batiraxcept for the treatment of ovarian cancer, following a recommendation from the Committee for Orphan Medicinal Products.

In November 2021, we announced positive preliminary data from our Phase 1b trial evaluating batiraxcept in combination with cabozantinib for treatment of ccRCC.

In January 2022, we announced that we had dosed the first patient in the Phase 2 portion of the Phase 1b/2 study of batiraxcept in combination with cabozantinib for treatment of ccRCC.

In March 2022, we announced updated positive data and new biomarker data from our Phase 1b trial of batiraxcept in ccRCC.

In May 2022, we provided updated data and information at our Key Opinion Leader symposium.

In August 2022, we temporarily halted work on the CTGF program with WuXi in an effort to focus all resources on the clinical programs.

In October 2022, we received a $6 million development milestone payment from 3D Medicines based on the initiation of the global Phase 3 PROC clinical trial in the Territory for the development of batiraxcept.

General Corporate Information

We were incorporated under the laws of the State of Delaware in December 2008 under the name Versartis, Inc. and completed our initial public offering in March 2014. Aravive Biologics, Inc. was incorporated under the laws of the State of Delaware in April 2007, originally under the name of Hypoximed, Inc, which name was changed to Ruga Corporation in July 2009 and changed to Aravive Biologics, Inc. in October 2016. On October 12, 2018, we, then known as Versartis, Inc. and Aravive Biologics, Inc. completed a merger and reorganization (the “Merger”) pursuant to which Aravive Biologics, Inc. survived as our wholly owned subsidiary. In connection with the completion of the Merger, on October 15, 2018, we changed our name from Versartis, Inc. to “Aravive, Inc.” and on October 16, 2018, we effected a reverse split of our Common Stock at a ratio of 1-for-6.

Our principal executive offices are located at River Oaks Tower, 3730 Kirby Drive, Suite 1200, Houston, Texas 77098. Our telephone number is (936) 355-1910, and our website address is www.aravive.com. The information contained on, or that can be accessed through, our website is not part of, and should not be construed as being incorporated by reference into, this prospectus.

October 2022 Private Placement

On October 27, 2022, we closed the Private Placement priced at-the-market under rules of The Nasdaq Stock Market with new investors, existing investors, and certain of the Company’s management and directors (collectively, the “Purchasers”) for the issuance and sale of an aggregate of (i) 29,308,612 shares of our Common Stock, (ii) 15,870,199 shares of our Common Stock issuable upon the exercise of the Pre-Funded Warrants and (iii) 45,178,811 shares of our Common Stock issuable upon the exercise of the Warrants. The purchase price per share of Common Stock and accompanying Warrant was $0.9199 for all investors who participated in the offering (or $0.9198 per Pre-Funded Warrant and accompanying Warrant). Fifty percent of the Warrants (the Series A Warrants) have an exercise price of $0.7949 per share and expire on the date that is the later of: (A) 15 months from the date the Authorized Share Increase (as described below) is effected, or (B) one month after the public announcement of the topline Phase 3 PROC data. The remaining 50% of the Warrants (the Series B Warrants) have an exercise price of $0.7949 per share and will expire 30 months from the date that the Authorized Share Increase is effected. All of the Warrants are exercisable for cash only. The gross proceeds in the Private Placement were approximately $41.5 million before deducting placement agent fees and other expenses and are expected to be used to fund our clinical development programs.

Each Pre-Funded Warrant has an exercise price equal to $0.0001 per share. The Pre-Funded Warrants are exercisable at any time after their original issuance, subject to the Beneficial Ownership Limitation (as defined below), and will not expire until exercised in full. The exercise price and number of shares of Common Stock issuable upon exercise of the Pre-Funded Warrant and Warrants are subject to appropriate adjustment in the event of stock dividends, stock splits, reorganizations or similar events affecting our Common Stock and the exercise price

In the event of a fundamental transaction, as described in the Warrants and generally including any reorganization, recapitalization or reclassification of our Common Stock, the sale, transfer or other disposition of all or substantially all of our properties or assets, our consolidation or merger with or into another person, any holder of the Warrant will be entitled to receive upon exercise of the Warrant the kind and amount of securities, cash or other property that the holder of the Warrant would have received had the such holder exercised the Warrant immediately prior to such fundamental transaction. Upon certain fundamental transactions, the holders can require that we purchase their Warrants at the Black Scholes Value of the unexercised portion of the Warrants.

The Purchasers included several institutional accredited investors (the “Investors”), Eshelman Ventures, LLC (“Eshelman Ventures”) and certain of our directors and officers of the Company (the “Insiders” and together with Eshelman Ventures, the “Insider Investors”). More specifically, the Insider Investors consist of the following: (i) Eshelman Ventures, an entity wholly owned by Dr. Fredric N. Eshelman, the Executive Chairman of our Board of Directors (purchased 16,306,120 shares of Common Stock and Warrants to purchase 16,306,120 shares of Common Stock or pre-funded warrants), (ii) Amato Giaccia, Ph.D., one of our directors, through his IRA (purchased 271,768 shares of Common Stock and Warrants to purchase 271,768 shares of Common Stock or pre-funded warrants), (iii) Peter C. Ho, one of our directors, through a trust he controls (purchased 54,353 shares of Common Stock and Warrants to purchase 54,353 shares of Common Stock or pre-funded warrants), (iv) Rudy Howard, our Chief Financial Officer (purchased 10,870 shares of Common Stock and Warrants to purchase 10,870 shares of Common Stock or pre-funded warrants), (v) Gail McIntyre, Ph.D., our President and Chief Executive Officer and one of our directors (purchased 54,353 shares of Common Stock and Warrants to purchase 54,353 Shares of Common Stock or pre-funded warrants), and (vi) Eric Zhang, one of our directors, through an entity he controls (purchased 543,537 shares of Common Stock and Warrants to purchase 543,537 shares of Common Stock or pre-funded warrants).

In connection with the Private Placement, we agreed to convene a special meeting of our stockholders no later than 120 days following the closing of the Private Placement to seek approval of an increase in the number of our authorized shares of Common Stock to allow for full sufficient authorized shares of Common Stock for the full exercise of the Warrants and the shares of Common Stock issuable upon exercise of the Warrants. The Purchasers in the Private Placement agreed that for a period of one year following the date of the Purchase Agreement, in any vote of the stockholders of the Company with respect to an increase in the number of our authorized shares of Common Stock in an amount not less than the maximum amount of shares of Common Stock issuable upon exercise of the Warrants, the Purchasers would vote, and would cause their respective affiliates to vote, in favor of such proposal. Based upon the number of shares outstanding as of the date of this registration statement, the shares of Common Stock held by the Purchasers that the Purchasers are obligated to vote in favor of an increase in the number of our authorized shares exceeds fifty percent (50%) of our outstanding shares, which is the vote required to approve such an increase.

The shares of Common Stock issued to the Purchasers, and the shares of Common Stock issuable upon exercise of the Pre-Funded Warrants or the Warrants (or issuable upon exercise of pre-funded warrants to purchase shares of Common Stock that are issuable to holders of Warrants upon exercise of such Warrants for pre-funded warrants in lieu of Common Stock), as applicable, were not initially registered under the Securities Act of 1933, as amended (the “Securities Act”) or any state securities laws. We have relied on the exemption from the registration requirements afforded by Regulation D under the Securities Act. In connection with their execution of the Purchase Agreement, each of the Purchasers represented to us that such Purchaser is an “accredited investor” as defined in Regulation D of the Securities Act and that the securities purchased by such Purchaser were being acquired solely for its own account and for investment purposes and not with a view to its future sale or distribution.

Registration Rights Agreement

On October 27, 2022, in connection with the Private Placement, we entered into two different Registration Rights Agreements with the Purchasers (the “Registration Rights Agreement”), pursuant to which we agreed to (i) by no later than November 26, 2022 (the “Effectiveness Deadline”), file a registration statement with the SEC to cover the resale of the shares of Common Stock, including those shares of Common Stock issuable upon exercise of the Pre-Funded Warrants and the Warrants, issued to the Purchasers pursuant to the Purchase Agreement (collectively, the “Shares”), (ii) to use commercially reasonable efforts to cause such registration statement to become effective (the “Effectiveness Deadline”) as soon as practicable (but no later than the 60th calendar following the Filing Deadline or, in the event the Securities and Exchange Commission (the “SEC”) reviews and has written comments to the registration statement, the 120th calendar following the Filing Deadline) to use commercially reasonable efforts to cause such registration statement to become effective as soon as practicable and (iii) to keep such registration statement effective until the date the Shares covered by such registration statement have been sold or may be resold pursuant to Rule 144 without restriction. In the event that such registration statement is not filed or declared effective within the timeframes set forth in the Registration Rights Agreement or, after the registration statement has been declared effective by the SEC, sales cannot be made pursuant to the registration statement for any reason including by reason of a stop order or our failure to update such registration statement, subject to certain limited exceptions, then we have agreed to make pro rata payments to each Purchaser as liquidated damages in an amount equal to 1% of the aggregate amount invested by each such Purchaser in the Shares per 30-day period or pro rata for any portion thereof for each such month during which such event continues, subject to certain caps set forth in the Registration Rights Agreement.

The registration statement of which this prospectus is a part relates to the offer and resale of the Shares issued to the Purchasers pursuant to the Purchase Agreement, including the Shares issuable upon exercise of the Pre-Funded Warrants and the Warrants. When we refer to the Selling Stockholders in this prospectus, we are referring to the Purchasers named in this prospectus as the Selling Stockholders and, as applicable, any donees, pledgees, assignees, transferees or other successors-in-interest selling the Shares received after the date of this prospectus from the Selling Stockholders as a gift, pledge, or other non-sale related transfer.

THE OFFERING

|

Shares of Common Stock offered by the Selling Stockholders

|

90,357,622 shares (consisting of 29,308,612 outstanding shares of our Common Stock, 15,870,199 shares of our Common Stock issuable upon the exercise of the Pre-Funded Warrants and 45,178,811 shares of our Common Stock issuable upon the exercise of the Warrants.

|

| |

|

|

Use of Proceeds

|

The Selling Stockholders will receive all of the proceeds of the sale of shares of Common Stock offered from time to time pursuant to this prospectus. Accordingly, we will not receive any proceeds from the sale of shares of Common Stock that may be sold from time to time pursuant to this prospectus; however, we will receive proceeds from the any cash exercise of the Pre-Funded Warrants and Warrants. See “Use of Proceeds.”

|

| |

|

|

Risk Factors

|

You should read the “Risk Factors” section of this prospectus and in the documents incorporated by reference in this prospectus for a discussion of factors to consider before deciding to purchase shares of our Common Stock.

|

|

Nasdaq Global Select Market symbol

|

Our Common Stock is listed on The Nasdaq Global Select Market under the symbol “ARAV.”

|

RISK FACTORS

Investing in our shares of Common Stock involves a high degree of risk. Before deciding whether to invest in our Common Stock, you should consider carefully the risks and uncertainties described under the section entitled “Risk Factors” contained in our most recent Annual Report on Form 10-K, as may be updated by subsequent annual, quarterly and other reports that are incorporated by reference into this prospectus in their entirety. The risks described in these documents are not the only ones we face, but those that we consider to be material. There may be other unknown or unpredictable economic, business, competitive, regulatory or other factors that could have material adverse effects on our future results. Past financial performance may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results or trends in future periods. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could be seriously harmed. This could cause the trading price of our Common Stock to decline, resulting in a loss of all or part of your investment. For more information, see the section entitled “Where You Can Find More Information.” Please also read carefully the section below entitled “Forward-Looking Statements.”

FORWARD-LOOKING STATEMENTS

This prospectus, including the documents that we incorporate by reference herein, contains, and any applicable prospectus supplement or free writing prospectus including the documents we incorporate by reference therein may contain, forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including statements regarding our future financial condition, business strategy and plans and objectives of management for future operations. Forward-looking statements include all statements that are not historical facts. In some cases, you can identify forward-looking statements by terminology such as “believe,” “will,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “might,” “approximately,” “expect,” “predict,” “could,” “potentially” or the negative of these terms or other similar expressions. Forward-looking statements appear in a number of places throughout this prospectus and include statements regarding our intentions, beliefs, projections, outlook, analyses or current expectations concerning, among other things:

|

|

•

|

|

our plans to develop and commercialize our product candidates;

|

|

|

•

|

|

the timing of our planned clinical trials for our product candidates;

|

|

|

•

|

|

the timing of and our ability to obtain and maintain regulatory approvals for our product candidates;

|

|

|

•

|

|

the degree of clinical utility of our product candidates;

|

|

|

•

|

|

our commercialization, marketing and manufacturing capabilities and strategy;

|

|

|

•

|

|

expectations regarding clinical trial data;

|

|

|

•

|

|

our intellectual property position;

|

| |

•

|

|

our results of operations, cash needs, spending of the proceeds of any offering;

|

|

|

•

|

|

our competitive position and the development of and projections relating to our competitors or our industry;

|

|

|

•

|

|

our ability to identify, recruit and retain key personnel;

|

|

|

•

|

|

the impact of laws and regulations;

|

|

|

•

|

|

our plans to identify additional product candidates with significant commercial potential that are consistent with our commercial objectives;

|

|

|

•

|

|

our estimates regarding future revenue, expenses and needs for additional financing; and

|

| |

•

|

|

the industry in which we operate and the trends that may affect the industry or us.

|

Discussions containing these forward-looking statements may be found, among other places, in the sections entitled “Business,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained in the documents incorporated by reference herein, including our most recent Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q, as well as any amendments thereto.

These statements relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors that could cause our actual results, levels of activity, performance or achievement to differ materially from those expressed or implied by these forward-looking statements. We discuss in greater detail, and incorporate by reference into this prospectus in their entirety, many of these risks and uncertainties under the heading “Risk Factors” contained in the documents incorporated by reference herein. These statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements, except as required by law. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. All forward-looking statements are qualified in their entirety by this cautionary statement.

USE OF PROCEEDS

The Selling Stockholders will receive all of the proceeds of the sale of shares of Common Stock offered from time to time pursuant to this prospectus. Accordingly, we will not receive any proceeds from the sale of shares of Common Stock that may be sold from time to time pursuant to this prospectus; however, we will receive proceeds from the cash exercise of the Pre-Funded Warrants and Warrants.

We will bear the out-of-pocket costs, expenses and fees incurred in connection with the registration of shares of our Common Stock to be sold by the Selling Stockholders pursuant to this prospectus. Other than registration expenses, the Selling Stockholders will bear any underwriting discounts, commissions, placement agent fees or other similar expenses payable with respect to sales of shares of our Common Stock.

SELLING STOCKHOLDERS

We are registering the offer and sale of 29,308,612 shares of our Common Stock, up to an aggregate of 15,870,199 shares of Common Stock issuable upon exercise of the Pre-Funded Warrants, and 45,178,811 shares of Common Stock issuable upon exercise of the Warrants (or issuable upon exercise of pre-funded warrants to purchase shares of our Common Stock that are issuable to holders of Warrants upon exercise of such Warrants) held by the Selling Stockholders identified in the table below, to permit them, or their permitted transferees or other successors-in-interest that may be identified in a post-effective amendment to the registration statement of which this prospectus is a part, to resell or otherwise dispose of these shares in the manner contemplated under the section entitled “Plan of Distribution” in this prospectus (as may be supplemented and amended).

On October 27, 2022, pursuant to the Purchase Agreement, we issued and sold in the Private Placement priced at-the-market consistent with the rules of The Nasdaq Stock Market LLC, an aggregate of (i) 29,308,612 Shares of our Common Stock, (ii) with respect to certain Investors, in lieu of the Shares, Pre-Funded Warrants to purchase up to an aggregate of 15,870,199 shares of Common Stock, and (iii) accompanying Series A Warrants and Series B Warrants to purchase up to an aggregate of 45,178,811 shares of Common Stock or Pre-Funded Warrants. The combined purchase price of each share of Common Stock and accompanying Warrant was $0.9199. The combined purchase price of each Pre-Funded Warrant and accompanying Warrant was $0.9198, which is equal to the Investor’s combined purchase price per share of Common Stock and accompanying Warrants, minus the per share exercise price of each Pre-Funded Warrant of $0.0001. The Pre-Funded Warrants were offered only to the Investors. The per share exercise price of the Warrants is $0.7949. We received aggregate gross proceeds from the Private Placement of approximately $41.5 million, before deducting the placement agent commissions and estimated offering expenses payable by us.

The Pre-Funded Warrants and the Warrants issued in the Private Placement (other than the Warrants issued to Eshelman Ventures) provide that a holder of a Pre-Funded Warrant or Warrant, as applicable, does not have the right to exercise any portion of its Pre-Funded Warrant or Warrant if such holder, together with its affiliates, and any other party whose holdings would be aggregated with those of the holder for purposes of Section 13(d) or Section 16 of the Exchange Act, to the extent it would result in such holder’s beneficial ownership being in excess of the Beneficial Ownership Limitation, which is 4.99%, 9.99% or 19.99% (as selected by the holder of such Warrants or Pre-Funded Warrants) of the number of shares of the Company’s Common Stock outstanding immediately after giving effect to such exercise; provided, however, that each holder with such limitation in the Warrants or Pre-Funded Warrants may increase or decrease the Beneficial Ownership Limitation by giving notice to the Company, but not to any percentage in excess of 19.99%.

This prospectus covers the sale or other disposition by the Selling Stockholders of up to the total number of shares of our Common Stock that were issued to the Investors pursuant to the Purchase Agreement, plus the total number of shares of our Common Stock issuable upon exercise of the Warrants and Pre-Funded Warrants (or issuable upon exercise of pre-funded warrants to purchase shares of our Common Stock that are issuable to holders of Warrants upon exercise of such Warrants for pre-funded warrants in lieu of Common Stock) issued or issuable to the Selling Stockholders, without giving effect to the Beneficial Ownership Limitation described above.

The following table sets forth, to our knowledge, information concerning the beneficial ownership of shares of our Common Stock by the Selling Stockholders as of November 15, 2022. The information in the table below with respect to the Selling Stockholders has been obtained from the respective Selling Stockholders. When we refer to the “Selling Stockholders” in this prospectus, or, if required, a post-effective amendment to the registration statement of which this prospectus is a part, we mean the Selling Stockholders listed in the table below as offering shares, as well as their respective pledgees, assignees, donees, transferees or successors-in-interest. Throughout this prospectus, when we refer to the shares of our Common Stock being registered on behalf of the Selling Stockholders, we are referring to the shares of our Common Stock and the shares of our Common Stock underlying the Pre-Funded Warrants and the Warrants issued to the Selling Stockholders pursuant to the Purchase Agreement (or issuable upon exercise of pre-funded warrants to purchase shares of our Common Stock that are issuable to holders of Warrants upon exercise of such Warrants for pre-funded warrants in lieu of Common Stock), without giving effect to the Beneficial Ownership Limitation described above. The Selling Stockholders may sell all, some or none of the shares of Common Stock subject to this prospectus. See “Plan of Distribution” below as it may be supplemented and amended from time to time.

The number of shares of Common Stock beneficially owned prior to the offering for each Selling Stockholder includes all shares of our Common Stock beneficially held by such Selling Stockholder as of November 15, 2022, which includes (i) all shares of our Common Stock purchased by such selling stockholder in the Private Placement and (ii) all shares of Common Stock issuable upon exercise of the Pre-Funded Warrants and Warrants (or issuable upon exercise of pre-funded warrants to purchase shares of our Common Stock that are issuable to holders of Warrants upon exercise of such Warrants for pre-funded warrants in lieu of Common Stock) purchased by such Selling Stockholder in the Private Placement, subject to the Beneficial Ownership Limitation described above. The shares reported under “Maximum Number of Shares of Common Stock Being Offered for Resale” consist of (i) the shares reported as beneficially owned by Selling Stockholder under “Shares of Common Stock Beneficially Owned Prior to the Offering” and (ii) the shares issuable upon exercise of the Pre-Funded Warrants and Warrants held by the Selling Stockholder, in each case, without giving effect to the Beneficial Ownership Limitation. The percentages of shares owned before and after the offering are based on 59,826,811 shares of Common Stock outstanding as of November 15, 2022, which includes the outstanding shares of Common Stock offered by this prospectus but does not include any shares of Common Stock offered by this prospectus that are issuable pursuant to the Pre-Funded Warrants and Warrants and are deemed outstanding in the table below because they are beneficially owned by a person. The Warrants issued to the Selling Stockholders pursuant to the Purchase Agreement are not exercisable until we obtain stockholders’ approval to increase the number of authorized shares of Common Stock at the special meeting of stockholders which we plan to hold on or about December 21, 2022 and we expect to effect the share increase within 60 days of November 15, 2022. Based upon the number of shares outstanding as of the date of this registration statement, the shares of Common Stock held by the Purchasers that the Purchasers are obligated to vote in favor of an increase in the number of our authorized shares exceeds fifty percent (50%) of our outstanding shares, which is the vote required to effect such an increase.

Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to our Common Stock. Generally, a person “beneficially owns” shares of our Common Stock if the person has or shares with others the right to vote those shares or to dispose of them, or if the person has the right to acquire voting or disposition rights within 60 days. In computing the number of shares of our Common Stock beneficially owned by a person and the percentage ownership of that person, we deemed outstanding shares of Common Stock issuable upon the exercise of Pre-Funded Warrants and/or Warrants, as applicable, held by that Selling Stockholder because we expect they will all be exercisable within 60 days of November 15, 2022. We did not deem these shares outstanding, however, for the purpose of computing the percentage ownership of any other person. The inclusion of any shares in this table does not constitute an admission of beneficial ownership for any Selling Stockholder named below.

|

|

|

Shares of

Common

Stock

Beneficially

Owned Prior

to the Offering (1)

|

|

|

|

|

Maximum

Number of

Shares of

Common

|

|

|

Shares of Common

Stock To Be Beneficially

Owned Immediately

Following the Sale

of Such Shares of

Common Stock

|

|

|

Selling Stockholder

|

|

Number

|

|

Percentage

|

|

|

Stock

Being

Offered for

Resale(1)

|

|

|

Number

|

|

|

Percentage (1)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Eshelman Ventures, LLC (2)

|

|

|

42,684,225

|

|

55.4%

|

|

|

|

32,612,240(2)

|

|

|

|

10,071,985

|

|

|

|

13.2%

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Entities affiliated with Baker Bros. Advisors, L.P.(3)

|

|

|

3,261,224

|

|

5.45%

|

|

|

|

21,741,490(3)

|

|

|

|

-

|

|

|

|

-

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Entities affiliated with BVF Partners L.P. (4)

|

|

|

6,109,058

|

|

9.99%

|

|

|

|

21,741,486(4)

|

|

|

|

-

|

|

|

|

-

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Invus Public Equities, L.P.(5)

|

|

|

6,132,553

|

|

9.99%

|

|

|

|

10,870,746 (5)

|

|

|

|

1,311,291

|

|

|

|

1.9%

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Entities affiliated with Rail-Splitter Fund (6)

|

|

|

1,521,898

|

|

2.5%

|

|

|

|

1,521,898(6)

|

|

|

|

-

|

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amato Giaccia IRA(7)

|

|

|

1,725,244

|

|

2.9%

|

|

|

|

543,536(7)

|

|

|

|

1,181,708

|

|

|

|

2.0%

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Peter Ho and Peter Ho Trust – 2016 U/A 05/27/16(8)

|

|

|

170,603

|

|

*

|

|

|

|

108,706(8)

|

|

|

|

61,897

|

|

|

|

*

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rudy Howard (9)

|

|

|

21,740

|

|

*

|

|

|

|

21,740(9)

|

|

|

|

-

|

|

|

|

-

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gail McIntyre (10)

|

|

|

496,797

|

|

*

|

|

|

|

108,706(10)

|

|

|

|

388,091

|

|

|

|

*

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Elite Vantage Global Limited(11)

|

|

|

1,946,840

|

|

3.22%

|

|

|

|

1,087,074(11)

|

|

|

|

859,766

|

|

|

|

1.4%

|

|

*less than one percent

| |

(1)

|

Based on 59,826,881 shares of our Common Stock issued and outstanding as of November 15, 2022. Unless otherwise indicated, the address for each Selling Stockholder is c/o Aravive, Inc.: River Oaks Tower, 3730 Kirby drive, Suite 1200, Houston, Texas 77098.

|

| |

|

|

| |

(2)

|

The shares reported under “Shares of Common Stock Beneficially Owned Prior to the Offering” includes (i) 25,517,889 shares of Common Stock held by Eshelman Ventures, including 16,306,120 Shares of Common Stock purchased in the Private Placement; (ii) 860,216 shares of Common Stock issuable upon exercise of a Warrant issued in March 2022 and (iii) 16,306,120 shares of Common Stock underlying the Warrants not exercisable until we effect an increase in our number of shares of authorized Common Stock, which we expect to effect within 60 days of November 15, 2022. The address for Eshelman Ventures, LLC is 319 North 3rd Street, Suite 301, Wilmington, North Carolina 28401.

|

| |

|

|

| |

(3)

|

The shares reported under “Shares of Common Stock Beneficially Owned Prior to the Offering” consist of (i) 318,315 shares of Common Stock held by 667, L.P; and (ii) 2,942,909 shares of Common Stock held by Baker Brothers Life Sciences, L.P. (collectively the “BB Investors”). The shares underlying the following warrants, each of which was held by the BB Investors as of November 15, 2022 are not included in the shares reported under “Shares of Common Stock Beneficially Owned Prior to the Offering” because they are subject to limitations on exercisability described below: (i) 742,735 shares of Common Stock issuable upon exercise of a Pre-Funded Warrant held by 667, L.P and 6,866,786 shares of Common Stock issuable upon exercise of a Pre-Funded Warrant held by Baker Brothers Life Sciences, L.P., and (ii) 1,061,050 shares of Common Stock issuable upon exercise of Warrants held by 667, L.P. and 9,809,695 shares of Common Stock issuable upon exercise of Warrants held by Baker Brothers Life Sciences, L.P. The BB Investors are prohibited from exercising such Pre-Funded Warrants and Warrants, if, immediately prior to or as a result of such exercise, the BB Investors and their affiliates would beneficially own more than 4.99% of the total number of shares of Common Stock then issued and outstanding immediately after giving effect to the exercise. The BB Investors and their affiliates disclaim beneficial ownership of any shares of Common Stock the issuance of which would violate such beneficial ownership limitation. Baker Bros. Advisors LP (“Adviser”) is the management company and investment adviser to the BB Investors and has sole voting and investment power with respect to the shares held by the BB Investors. Baker Bros. Advisors (GP) LLC (“Adviser GP”) is the sole general partner of Adviser. Julian C. Baker and Felix J. Baker are managing members of Adviser GP. Adviser GP, Felix J. Baker, Julian C. Baker and Adviser may be deemed to be beneficial owners of the securities directly held by the BB Funds. Julian C. Baker, Felix J. Baker, the Adviser and the Adviser GP disclaim beneficial ownership of all shares held by the BB Funds, except to the extent of their indirect pecuniary interest therein. The address for the above referenced entities and persons is 860 Washington Street, 3rd Floor, New York, New York 10014.

|

| |

|

|

| |

(4)

|

The shares reported under “Shares of Common Stock Beneficially Owned Prior to the Offering” consist of (i) 4,784,214 shares of Common Stock, of which 2,583,476 shares of Common Stock are held by Biotechnology Value Fund, L.P. (“BVF”); 1,961,528 shares of Common Stock are held by Biotechnology Value Fund II, L.P. (“BVF2”); 191,368 shares of Common Stock are held by Biotechnology Value Trading Fund OS, LP (“Trading Fund OS”) and 47,842 shares of Common Stock are held by MSI BVF SPV LLC (“MSI BVF”) and together with BVF, BVF2 and Trading Fund OS, (the “BVF Investors”); and (ii) 1,324,844 shares of Common Stock issuable upon exercise of Pre-Funded Warrants held by BVF. The following warrants, each of which was held by the BVF Investors as of November 15, 2022 are not included in the shares reported under “Shares of Common Stock Beneficially Owned Prior to the Offering” because they are subject to limitations on exercisability described below (i) 4,761,685 shares of Common Stock issuable upon exercise of Pre-Funded Warrants of which 1,961,882 shares of Common Stock issuable upon exercise of Pre-Funded Warrants are held by BVF; 2,495,477 shares of Common Stock issuable upon exercise of Pre-Funded Warrants are held by BVF2; 243,461 shares of Common Stock issuable upon exercise of Pre-Funded Warrants are held by Trading Fund OS and 60,865 shares of Common Stock issuable upon exercise of Pre-Funded Warrants are held by MSI BVF; and (iii) 10,870,743 shares of Common Stock issuable upon exercise of the Warrants held by the BVF Investors that are not exercisable until we effect an increase in our number of shares of authorized Common Stock, which we expect will be effected within 60 days of November 15, 2022; of which 5,870,202 shares of Common Stock issuable upon exercise of Warrants are held by BVF; 4,457,004 shares of Common Stock issuable upon exercise of Warrants are held by BVF2; 434,829 shares of Common Stock issuable upon exercise of Warrants are held by Trading Fund OS and 108,708 shares of Common Stock issuable upon exercise of Warrants are held by MSI BVF. The BVF Investors are prohibited from exercising such Pre-Funded Warrants and Warrants, if, as a result of such exercise, they would beneficially own more than 9.99% of the total number of shares of Common Stock then issued and outstanding immediately after giving effect to the exercise. BVF I GP LLC (“BVF GP”), as the general partner of BVF, may be deemed to beneficially own the shares beneficially owned by BVF. BVF II GP LLC (“BVF2 GP”), as the general partner of BVF2, may be deemed to beneficially own the shares beneficially owned by BVF2. BVF Partners OS Ltd., (“Partners OS”), as the general partner of Trading Fund OS, may be deemed to beneficially own the shares beneficially owned by Trading Fund OS. BVF GP Holdings LLC, (“BVF GPH”), as the sole member of each of BVF GP and BVF2 GP, may be deemed to beneficially own the shares beneficially owned in the aggregate by BVF and BVF2. BVF Partners L.P., as the investment manager of BVF, BVF2, Trading Fund OS and MSI BVF, and the sole member of Partners OS, may be deemed to beneficially own the shares beneficially owned in the aggregate by BVF, BVF2, Trading Fund OS, and MSI BVF. BVF Inc., as the general partner of BVF Partners L.P., may be deemed to beneficially own the shares beneficially owned by BVF Partners L.P. Mark N. Lampert, as a director and officer of BVF Inc., may be deemed to beneficially own the shares beneficially owned by BVF Inc. Each of the entities and individuals listed above expressly disclaims beneficial ownership of the securities listed above except to the extent of any pecuniary interest therein. The address of these entities is 44 Montgomery Street, 40th Floor, San Francisco, California 94104.

|

| |

(5)

|

The shares reported under “Shares of Common Stock Beneficially Owned Prior to the Offering” consist of (i) 4,572,515 shares of Common Stock including 3,261,224 shares of Common Stock purchased in the Private Placement; and (ii) 1,560,038 shares of Common Stock issuable upon exercise of the Pre-Funded Warrants or the Warrants or a combination thereof. An additional aggregate of 6,049,484 shares of Common Stock underlie the Pre-Funded Warrants and the Warrants held by Invus Public Equities, L.P. as of November 15, 2022 and are not included in the shares reported under “Shares of Common Stock Beneficially Owned Prior to the Offering” because they are subject to limitations on exercisability described below. Invus Public Equities, L.P. is prohibited from exercising such Pre-Funded Warrants and Warrants if, as a result of such exercise, Invus Public Equities, L.P. and its affiliates would beneficially own more than 9.99% of the total number of shares of Common Stock then issued and outstanding immediately after giving effect to the exercise. Invus Public Equities, L.P. and its affiliates disclaim beneficial ownership of any shares of Common Stock, the issuance of which would violate such Beneficial Ownership Limitation. The shares reported under “Number of Shares of Common Stock Being Offered” consist of (i) 3,261,224 shares reported as beneficially owned by Invus Public Equities, L.P. under “Shares of Common Stock Beneficially Owned Prior to the Offering”, which were purchased in the Offering, and (ii) all of the shares issuable upon exercise of the Pre-Funded Warrants and Warrants held by Invus Public Equities, L.P. described above, in each case, without giving effect to the Beneficial Ownership Limitation. Invus Public Equities Advisors, LLC (“Invus PE Advisors”) controls Invus PE, as its general partner and accordingly, may be deemed to beneficially own the Shares held by Invus PE. The Geneva branch of Artal International S.C.A. (“Artal International”) controls Invus PE Advisors, as its managing member and accordingly, may be deemed to beneficially own the Shares held by Invus PE. Artal International Management S.A. (“Artal International Management”), as the managing partner of Artal International, controls Artal International and accordingly, may be deemed to beneficially own the Shares that Artal International may be deemed to beneficially own. Artal Group S.A., as the sole stockholder of Artal International Management, controls Artal International Management and accordingly, may be deemed to beneficially own the Shares that Artal International Management may be deemed to beneficially own. Westend S.A. (“Westend”), as the parent company of Artal Group S.A. (“Artal Group”), controls Artal Group and accordingly, may be deemed to beneficially own the shares that Artal Group may be deemed to beneficially own. Stichting Administratiekantoor Westend (the “Stichting”), as majority shareholder of Westend, controls Westend and accordingly, may be deemed to beneficially own the Shares that Westend may be deemed to beneficially own. Mr. Amaury Wittouck, as the sole member of the board of the Stichting, controls the Stichting and accordingly, may be deemed to beneficially own the Shares that the Stichting may be deemed to beneficially own. The address for Invus PE and Invus PE Advisors is 750 Lexington Avenue, 30th Floor, New York, NY 10022. The address for Artal International, Artal International Management, Artal Group, Westend and Mr. Wittouck is Valley Park, 44, Rue de la Vallée, L-2661, Luxembourg. The address for the Stichting is Claude Debussylaan, 46, 1082 MD Amsterdam, The Netherlands.

|

| |

|

|

| |

(6)

|

The shares reported under “Shares of Common Stock Beneficially Owned Prior to the Offering” consist of (i) 423,958 shares of Common Stock held by Rail-Splitter Fund; 52,179 shares of Common Stock held by Micro Cap Opportunities Fund; 254,918 shares of Common Stock held by Iron Road Multi Strat Fund; and 29,894 shares of Common Stock held by Iron Road Multi Strat 2 (the “Iron Road Funds”) and (ii) 423,958 shares of Common Stock issuable upon exercise of the Warrants held by Rail-Splitter Fund; 52,179 shares of Common Stock issuable upon exercise of the Warrants held by Micro Cap Opportunities Fund; 254,918 shares of Common Stock issuable upon exercise of the Warrants held by Iron Road Multi Strat Fund; and 29,894 shares of Common Stock issuable upon exercise of the Warrants held by Iron Road Multi Strat 2. The shares of Common Stock underlying the Warrants are not exercisable until we effect an increase in our number of shares of authorized Common Stock, which we expect will be effected within 60 days of November 15, 2022. The Iron Road Funds are prohibited from exercising Warrants, if, as a result of such exercise, the Funds would beneficially own more than 4.99% of the total number of shares of Common Stock then issued and outstanding immediately after giving effect to the exercise. The Iron Rail Funds and their affiliates disclaim beneficial ownership of any shares of Common Stock the issuance of which would violate such Beneficial Ownership Limitation. John Souter, as the Principal of Rail-Splitter Capital Management, controls Rail-Splitter Capital Management, the management company and investment adviser to the Iron Road Funds and has sole voting and investment power with respect to the shares held by the Iron Road Funds. The address for the above referenced entities and persons is 20 N. Wacker Drive, Suite 2807, Chicago, Illinois 60606.

|

| |

|

|

| |

(7)

|

The shares reported under “Shares of Common Stock Beneficially Owned Prior to the Offering” consist of (i) 1,213,648 shares of Common Stock, including 271,768 Shares of Common Stock acquired by Dr. Giaccia’s IRA in the Private Placement, (ii) 239,828 shares of Common Stock issuable upon exercise of options and (iii) 271,768 shares of Common Stock issuable upon exercise of the Warrants, which are not exercisable until we effect an increase in our number of shares of authorized Common Stock, which we expect to effect within 60 days of November 15, 2022.

|

| |

(8)

|

The shares reported under “Shares of Common Stock Beneficially Owned Prior to the Offering” consist of (i) 55,353 Shares of Common Stock, (ii) 60,897 shares of Common Stock issuable upon exercise of options and (iii) 54,353 shares of Common Stock issuable upon exercise of the Warrants, which are not exercisable until we effect an increase in our number of shares of authorized Common Stock, which we expect to effect within 60 days of November 15, 2022.

|

| |

|

|

| |

(9)

|

The shares reported under “Shares of Common Stock Beneficially Owned Prior to the Offering” consist of (i) 10,870 Shares of Common Stock and (ii) 10,870 shares of Common Stock issuable upon exercise of the Warrants, which are not exercisable until we effect an increase in our number of shares of authorized Common Stock, which we expect to effect within 60 days of November 15, 2022.

|

| |

|

|

| |

(10)

|

The shares reported under “Shares of Common Stock Beneficially Owned Prior to the Offering” consist of (i) 65,490 which include 54,353 shares of Common Stock acquired by Dr. McIntyre in the Private Placement, (ii) 376,954 shares of common Stock underlying options, and (iii) 54,353 shares of Common Stock issuable upon exercise of the Warrants which are not exercisable until we effect an increase in our number of shares of authorized Common Stock, which we expect to effect within 60 days of November 15, 2022.

|

| |

|

|

| |

(11)

|

The shares reported under “Shares of Common Stock Beneficially Owned Prior to the Offering” consist of (i) 1,403,303 shares of Common Stock, including 543,537 shares of Common Stock acquired by Elite Vantage Global Limited in the Private Placement, (ii) 543,537 shares of Common Stock issuable upon exercise of the Warrants which are not exercisable until we effect an increase in our number of shares of authorized Common Stock which we expect to effect within 60 days of November 15, 2022. Eric Zhang is the director of Elite Vantage Global Limited. The address for Elite Vantage Global Limited is Suite 1807, 18F, China Resources Building, 26 Harbor Road, Hong Kong.

|

Relationships with Selling Stockholders

Each of the Selling Stockholders have not had any material relationship with the registrant or any of its predecessors or affiliates, within the past three years, except as hereinafter described. As discussed in greater detail above under the section titled “Prospectus Summary—October 2022 Private Placement,” in October 2022, we entered into the Purchase Agreement with the Selling Stockholders, pursuant to which we sold and issued shares of our Common Stock, Pre-Funded Warrants to purchase our Common Stock and Warrants to purchase our Common Stock or Pre-Funded Warrants. We also entered into the Registration Rights Agreement with the Selling Stockholders, pursuant to which we agreed to file a registration statement with the SEC to cover the resale by the Selling Stockholders of the shares of our Common Stock, including the shares of Common Stock issuable upon exercise of the Pre-Funded Warrants and the Warrants, issued pursuant to the Purchase Agreement.

The Selling Stockholders include several of our officers and directors or affiliates thereof. Eshelman Ventures, LLC is an entity wholly owned by Fredric N. Eshelman, our Executive Chairman of the Board of Directors and purchased in the Private Placement 16,306,120 shares of Common Stock and Warrants to purchase 16,306,120 shares of Common Stock or pre-funded warrant. Gail McIntyre is our President, Chief Executive Officer and Director and purchased in the Private Placement 54,353 shares of Common Stock and Warrants to purchase 54,353 Shares of Common Stock or pre-funded warrants. The Amato Giaccia IRA is for the benefit of Amato Giaccia, one of our directors and purchased in the Private Placement 271,768 shares of Common Stock and Warrants to purchase 271,768 shares of Common Stock or pre-funded warrants. Rudy Howard is our Chief Financial Officer and purchased in the Private Placement 10,870 shares of Common Stock and Warrants to purchase 10,870 shares of Common Stock or pre-funded warrants. The Peter Ho Trust – 2016 U/A 05/27/16, is a trust of which Peter T.C. Ho, one of our directors, is the trustee and beneficiary and purchased in the Private Placement 54,353 shares of Common Stock and Warrants to purchase 54,353 Shares of Common Stock or pre-funded warrants. Elite Vantage Global Limited is an entity owned by Eric Zhang, a director of the Company and purchased in the Private Placement 543,537 shares of Common Stock and Warrants to purchase 543,537 Shares of Common Stock or pre-funded warrants. Each of the forgoing individuals has received cash and equity compensation in their roles as directors and/or officers.

On April 8, 2020 pursuant to the terms of an investment agreement (the “First Investment Agreement”) that we entered into with Eshelman Ventures and, solely for purposes of Article IV and Article V of the First Investment Agreement, Fredric N. Eshelman, Pharm.D. Eshelman Ventures purchased 931,098 shares of Common Stock for an aggregate purchase price of approximately $5,000,000. On February 16, 2021, pursuant to the terms of a Securities Purchase Agreement with Eshelman Ventures we issued and sold to Eshelman Ventures (the “Second Offering”) 2,875,000 shares of Common Stock at a price per share of $7.29 for aggregate gross proceeds to us of approximately $21.0 million. On January 5, 2022, we entered into a Securities Purchase Agreement with Eshelman Ventures relating to the issuance and sale (the “Third Offering”) of a pre-funded warrants to purchase 4,545,455 shares of Common Stock at a price per share of $2.20 for aggregate gross proceeds to us of approximately $10.0 million. The pre-funded warrants were exercised in April 2022 after obtaining certain stockholders’ approval. On March 31, 2022, we raised $10 million when we issued and sold to Eshelman Ventures and one institutional investor, pursuant to the terms of a securities purchase agreement that we entered into, an aggregate of 3,185,216 shares (consisting of 2,325,000 shares for the investor and 860,216 shares for Eshelman Ventures) (ii) pre-funded warrants to purchase up to an aggregate of 1,665,025 shares of Common Stock, and (iii) 4,850,241 shares, consisting of warrants to purchase up to 3,990,025 shares of Common Stock for the investor and warrants to purchase up to 860,216 shares of Common Stock for Eshelman Ventures.

In connection with the Private Placement, we entered into certain side letter agreements as discussed below. Pursuant to the terms of the side letter agreement with the BB Investors, we agreed that at any time during the five-year period following the closing date of the Private Placement that if the BB Investors or their affiliates (i) own at least 90% of their purchase including the Pre-Funded Warrants (or the underlying shares upon exercise) and Common Stock purchased by them and (ii) purchases at least 50% of their pro rata share in any offering in which they are offered the opportunity to participate pursuant to this participation right, (A) and if we propose to offer any new securities in a private placement or registered direct offering (subject to customary exclusions), we will offer them the right to purchase their pro rata share of such new securities (based on percentage ownership of the Company on a fully diluted basis) and (B) if we propose to offer any new securities in an underwritten registered offering we will instruct the underwriter(s) in such offering to contact the BB Investors and to provide to the BB Investors the opportunity to purchase their pro rata share of such new securities (based on percentage ownership of the Company on a fully diluted basis). Pursuant to the terms of a second side letter agreement with BVF Partners L.P, we agreed that at any time during the five-year period following the closing date of the Private Placement that BVF, BVF2, Trading Fund OS, MSI BVF and/or one or more of their respective affiliates (as defined below) (i) own at least 90% of the Pre-Funded Warrants (or the underlying warrant shares upon exercise) and Common Stock purchased by them and (ii) purchase at least 50% of their pro rata share in any offering in which BVF Investors are offered the opportunity to participate pursuant to this participation right, (A) and if we propose to offer any new securities in a private placement or registered direct offering (subject to customary exclusions), we will offer the BVF Investors the right to purchase their pro rata share of such new securities (based on percentage ownership of the Company on a fully diluted basis) and (B) if we propose to offer any new securities in an underwritten registered offering we will instruct the underwriter(s) in such offering to contact the BVF Investors and to provide to the BVF Investors the opportunity to purchase their pro rata share of such new securities (based on percentage ownership of the Company on a fully diluted basis).

Effective only upon full exercise of the Series A Warrants by the BB Investors and for so long as they own at least 1% of our total outstanding Common Stock, and at least 75% of the securities purchased by them in the Private Placement (or as exercised), the BB Investors shall have the right to appoint one individual designated by them (the “Board Designee”) to our board of directors; thereafter, we shall nominate and recommend one Board Designee (if they have exercised their right) in our proxy statement at each applicable annual meeting of our stockholders for such director’s class.

At any time following the closing date of the Private Placement when the BB Investors own at least 50% of the Common Stock and Pre-Funded Warrants (or the underlying warrant shares upon exercise thereof) purchased in the Private Placement they have the right to one (1) non-voting board observer who is acceptable to us who shall have the right to attend and participate in all board and committee meetings, with certain exceptions.

PLAN OF DISTRIBUTION

The Selling Stockholders, which as used herein includes pledgees, assignees, donees, transferees or their respective successors-in-interest selling shares of Common Stock or interests in shares of Common Stock received after the date of this prospectus from a Selling Stockholder as a pledge, assignment, gift, partnership distribution or other transfer, may, from time to time, sell, transfer or otherwise dispose of any or all of their shares of Common Stock or interests in shares of Common Stock on any stock exchange, market or trading facility on which the shares of Common Stock are traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices.

The Selling Stockholders may use any one or more of the following methods when disposing of shares or interests therein:

|

|

•

|

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

|

|

•

|

|

block trades in which the broker-dealer will attempt to sell the shares as agent, but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

•

|

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

|

•

|

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

|

|

•

|

|

privately negotiated transactions;

|

|

|

•

|

|

settlement of short sales;

|

|

|

•

|

|

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

|

|

|

•

|

|

broker-dealers may agree with the Selling Stockholders to sell a specified number of such shares at a stipulated price per share;

|

|

|

•

|

|

a combination of any such methods of sale; and

|

|

|

•

|

|

any other method permitted by applicable law.

|

The Selling Stockholders may, from time to time, pledge or grant a security interest in some or all of the shares of Common Stock owned by them and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the shares of Common Stock, from time to time, under this prospectus, or under an amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act amending the list of Selling Stockholders to include the pledgee, transferee or other successors-in-interest as Selling Stockholders under this prospectus. The Selling Stockholders also may transfer the shares of Common Stock in other circumstances, in which case the transferees, pledgees, donees or other successors-in-interest will be the selling beneficial owners for purposes of this prospectus.

In connection with the sale of Common Stock or interests therein, the Selling Stockholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the Common Stock in the course of hedging the positions they assume. The Selling Stockholders may also sell shares of our Common Stock short and deliver these securities to close out their short positions, or loan or pledge the Common Stock to broker-dealers that in turn may sell these securities. The Selling Stockholders may also enter into option or other transactions with broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery to such broker-dealer or other financial institution of shares offered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The aggregate proceeds to the Selling Stockholders from the sale of the Common Stock offered by them will be the purchase price of the Common Stock less discounts or commissions, if any. Each of the Selling Stockholders reserves the right to accept and, together with their agents from time to time, to reject, in whole or in part, any proposed purchase of Common Stock to be made directly or through agents. We will not receive any of the proceeds from this offering. Upon any exercise of the Pre-Funded Warrants or Warrants by payment of cash, however, we will receive the exercise price of the Pre-Funded Warrants or Warrants.

The Selling Stockholders also may resell all or a portion of the shares in open market transactions in reliance upon Rule 144 under the Securities Act, provided that they meet the criteria and conform to the requirements of that rule.

The Selling Stockholders and any underwriters, broker-dealers or agents that participate in the sale of the Common Stock or interests therein may be “underwriters” within the meaning of Section 2(a)(11) of the Securities Act. Any discounts, commissions, concessions or profit they earn on any resale of the shares may be underwriting discounts and commissions under the Securities Act. Selling Stockholders who are “underwriters” within the meaning of Section 2(a)(11) of the Securities Act will be subject to the prospectus delivery requirements of the Securities Act.