Additional Proxy Soliciting Materials (definitive) (defa14a)

19 April 2023 - 10:31PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

|

Filed by the Registrant |

|

Filed by a Party other than the Registrant |

| Check the appropriate box: |

|

Preliminary Proxy Statement |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14A-6(E)(2)) |

|

Definitive Proxy Statement |

|

Definitive Additional Materials |

|

Soliciting Material under §240.14a-12 |

ArcBest Corporation

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if

other than the Registrant)

| Payment of Filing Fee (Check all boxes that apply): |

|

No fee required. |

|

Fee paid previously with preliminary materials. |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

8401 McClure Drive

Fort Smith AR 72916

479-785-6000

arcb.com

April 19, 2023

Dear Fellow ArcBest Stockholder:

On March 17, 2023, ArcBest Corporation filed a definitive proxy statement in connection with our 2023 Annual Meeting of Stockholders, to be held on April 26, 2023. The annual meeting is rapidly approaching, and your vote is critical at this

time.

One of our proposals on the ballot this year is Proposal V, the proposal to approve an amendment and restatement of our restated certificate of incorporation to update the existing exculpation provision to also provide exculpation for

officers. We refer to this proposal as the exculpation amendment in this letter. If approved by stockholders at our

annual meeting, Proposal V would amend the current certificate of incorporation (as amended and restated, the “Second

Amended and Restated Certificate of Incorporation”) to permit exculpation for direct claims brought by stockholders for

breach of an officer’s fiduciary duty of care. We recommend stockholders vote “FOR” Proposal V.

As further set forth below, the board’s principal rationale for recommending this exculpation amendment is to balance stockholders’ interest in accountability with their interest in the company being able to attract and retain quality

officers and avoiding litigation abuse resulting from the current disparity that exists in the treatment of directors,

who oversee and are ultimately accountable for corporate actions, and the officers who execute those actions on behalf

of the board.

To assist our stockholders in their consideration of this important proposal, we are reaching out to provide additional

context.

Background and Purpose of the Exculpation Amendment

Effective August 1, 2022, the Delaware legislature adopted an amendment to Section 102(b)(7) of the Delaware General

Corporation Law (“DGCL”) that permits a Delaware corporation to eliminate or limit the personal liability of certain

officers of the corporation for monetary damages to the corporation or its stockholders for breaches of their fiduciary

duty of care. Prior to this amendment and since its original adoption in 1986, Section 102(b)(7) of the DGCL has

authorized exculpation of directors of Delaware corporations from personal liability for monetary damages in connection

with breaches of their fiduciary duty of care, but it did not permit exculpation of corporate officers. This amendment

is not self-executing – a Delaware corporation must take action to affirmatively adopt such an exculpation provision in

its certificate of incorporation for its officers. In light of the changes to Section 102(b)(7) of the DGCL, the board

of directors of the company, and its Nominating/Corporate Governance Committee, reviewed and considered whether

extending such limitation on liability to officers would be advisable and in the best interest of the company’s

stockholders. The company’s current certificate of incorporation provides for director exculpation.

If the exculpation amendment is adopted, Article VI of the current certificate of incorporation would be amended to

permit exculpation for direct claims brought by stockholders for breach of an officer’s fiduciary duty of care,

including class actions, but would not eliminate officers’ monetary liability for breach of fiduciary duty claims

brought by the company itself or for derivative claims brought by stockholders in the name of the company. Furthermore,

the limitation on liability would not apply to breaches of the duty of loyalty, acts or omissions not in good faith or

that involve intentional misconduct or a knowing violation of law, or any transaction in which the officer derived an

improper personal benefit.

Considerations for Stockholders Regarding the Exculpation Amendment

The board, upon the recommendation of the Nominating/Corporate Governance Committee, has unanimously determined that the

Second Amended and Restated Certificate of Incorporation (including the exculpation amendment) is advisable and in the

best interests of the company and its stockholders and has approved the Second Amended and Restated Certificate of

Incorporation (including the exculpation amendment), subject to stockholder approval.

Key reasons the board considered in approving the exculpation amendment are set forth below:

◼

Frequently, directors and officers of the company must make decisions in response to time-sensitive opportunities and

challenges, which can create substantial risk of investigations, claims, actions, suits or proceedings seeking to impose

liability on the basis of hindsight, especially in the current litigious environment and regardless of merit. Limiting

concern about personal risk would empower our officers to best exercise their business judgment in furtherance of

stockholder interests.

◼

The exculpation amendment would more closely align the existing protection available to our directors to those

available to our officers. In addition, it helps to clarify the application of exculpation provisions to individuals

serving as both a director and an officer.

◼

Adopting the exculpation amendment would better position us to attract talented officer candidates and retain our

current officers, who may otherwise conclude that the potential exposure to liabilities, costs of defense and other

risks of proceedings exceeds the benefits of serving as an officer of the company.

◼

Other companies incorporated in Delaware, including certain of our peers, may adopt exculpation clauses that limit the

personal liability of officers in their certificates of incorporation, and failing to adopt the exculpation amendment

could further impact our recruitment and retention of talented officer candidates.

◼

Adoption of the exculpation amendment may also help prevent frivolous claims that may be brought against officers that

could not be maintained against directors, including those claims brought only to increase the settlement value of such

suits or, if such frivolous claims are brought, may make an earlier dismissal of such claims easier to achieve.

◼

Adoption of the exculpation amendment may reduce the company’s future insurance needs and costs.

◼

Given the narrow class and type of claims for which officers’ liability would be exculpated, the board believes the

Amendment would not negatively impact stockholder rights.

Please Vote Today

On behalf of the board, I want to thank you for your attention to and consideration of this Proposal V. The board strongly believes that approval of the exculpation amendment is in the best interests of the company and its

stockholders and continues to unanimously recommend you cast your vote “FOR” Proposal V. We respectfully urge you to

consider the foregoing context, as well as the reasons articulated in our 2023 Proxy Statement, as you cast your vote.

If you have already returned your proxy or voting instruction form or provided voting instructions, you may change your vote. Should you have any questions or need any assistance in submitting your proxy to vote your shares, please call our

proxy solicitor, Alliance Advisors, at 1-833-670-0698.

Sincerely,

/s/ Michael R. Johns

Michael R. Johns

Chief Legal Officer and Corporate Secretary

ArcBest (NASDAQ:ARCB)

Historical Stock Chart

From Mar 2024 to Apr 2024

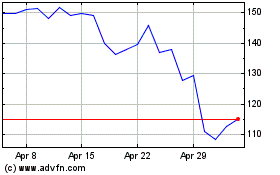

ArcBest (NASDAQ:ARCB)

Historical Stock Chart

From Apr 2023 to Apr 2024