UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 2)*

ARCO PLATFORM

LIMITED

(Name of Issuer)

Class A common shares, par value $0.00005 per share

(Title of Class of Securities)

G04553106

(CUSIP Number)

Michael Dimitruk

Dragoneer Investment Group, LLC

One Letterman Drive, Building D, Suite M500

San Francisco, CA 94129

(415) 539-3097

with copies to:

Thomas

Holden

Ropes & Gray LLP

Three Embarcadero Center

San Francisco, CA 94111

(415) 315-2355

(Name, Address and Telephone Number of Person Authorized to Receive Notices and

Communications)

January 2, 2023

(Date of Event Which Requires Filing of This Statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box. ☒

Note: Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are to be sent.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form

with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

|

|

| CUSIP No. G04553106 |

|

Page

2

of 6 |

|

|

|

|

|

|

|

| (1) |

|

Names of reporting persons

Marc Stad |

| (2) |

|

Check the appropriate box

if a member of a group (see instructions) (a) ☐ (b) ☒

|

| (3) |

|

SEC use only

|

| (4) |

|

Source of funds (see

instructions) OO |

| (5) |

|

Check if disclosure of

legal proceedings is required pursuant to Items 2(d) or 2(e) |

| (6) |

|

Citizenship or place or

organization United States of

America |

|

|

|

|

|

|

|

| Number of

shares beneficially

owned by each

reporting person

with: |

|

(7) |

|

Sole voting power

|

| |

(8) |

|

Shared voting power

5,013,675(1) |

| |

(9) |

|

Sole dispositive power

|

| |

(10) |

|

Shared dispositive power

5,013,675(1) |

|

|

|

|

|

|

|

| (11) |

|

Aggregate amount beneficially owned by each reporting person

5,013,675(1) |

| (12) |

|

Check if the aggregate

amount in Row (11) excludes certain shares (see instructions) |

| (13) |

|

Percent of class

represented by amount in Row (11) 11.6%(2) |

| (14) |

|

Type of reporting person

(see instructions) IN |

| (1) |

Includes (i) 1,565,395 Class A common shares, par value $0.00005 per share (the

“Class A Common Shares”) of Arco Platform Limited (the “Company”) and (ii) 3,448,280 Class A Common Shares issuable upon conversion of the Company’s 8.00% Senior Convertible Notes due

2028 (the “2028 Convertible Notes”). |

| (2) |

Based on (i) 29,450,551 Class A Common Shares reported outstanding as of April 8, 2022 in the

Company’s Form 6-K filed with the U.S. Securities and Exchange Commission on April 13, 2022 (the “Form 6-K”), (ii) 10,436,202 Class A

Common Shares issued by the Company in connection with the Company’s acquisition of isaac, as announced by the Company in its press release dated January 3, 2023 (the “January 3 Press Release”) and (iii)

3,448,280 Class A Common Shares issuable upon conversion of the 2028 Convertible Notes. |

|

|

|

| CUSIP No. G04553106 |

|

Page

3

of 6 |

|

|

|

|

|

|

|

| (1) |

|

Names of reporting persons

Dragoneer Investment Group, LLC |

| (2) |

|

Check the appropriate box

if a member of a group (see instructions) (a) ☐ (b) ☒

|

| (3) |

|

SEC use only

|

| (4) |

|

Source of funds (see

instructions) OO |

| (5) |

|

Check if disclosure of

legal proceedings is required pursuant to Items 2(d) or 2(e) |

| (6) |

|

Citizenship or place or

organization

Delaware |

|

|

|

|

|

|

|

| Number of

shares beneficially

owned by each

reporting person

with: |

|

(7) |

|

Sole voting power

|

| |

(8) |

|

Shared voting power

5,013,675(1) |

| |

(9) |

|

Sole dispositive power

|

| |

(10) |

|

Shared dispositive power

5,013,675(1) |

|

|

|

|

|

|

|

| (11) |

|

Aggregate amount beneficially owned by each reporting person

5,013,675(1) |

| (12) |

|

Check if the aggregate

amount in Row (11) excludes certain shares (see instructions) |

| (13) |

|

Percent of class

represented by amount in Row (11) 11.6%(2) |

| (14) |

|

Type of reporting person

(see instructions) IA, OO |

| (1) |

Includes (i) 1,565,395 Class A Common Shares and (ii) 3,448,280 Class A Common Shares issuable upon

conversion of the 2028 Convertible Notes. |

| (2) |

Based on (i) 29,450,551 Class A Common Shares reported outstanding as of April 8, 2022 in the Form 6-K, (ii) 10,436,202 Class A Common Shares issued by the Company in connection with the Company’s acquisition of isaac, as announced by the Company in the January 3 Press Release and (iii) 3,448,280

Class A Common Shares issuable upon conversion of the 2028 Convertible Notes. |

|

|

|

| CUSIP No. G04553106 |

|

Page

4

of 6 |

This Amendment No. 2 (the “Amendment”) amends and supplements the

Schedule 13D filed by the Reporting Persons on December 1, 2022, as amended and supplemented by Amendment No. 1 on January 6, 2023 (collectively, the “Original Schedule 13D” and, as amended and supplemented by this

Amendment, the “Statement”), with respect to the Class A Common Shares. Capitalized terms used in this Amendment and not otherwise defined shall have the same meanings ascribed to them in the Original Schedule 13D.

On January 6, 2023 and January 11, 2023, General Atlantic, together with certain affiliated entities, filed amendments to their

Schedule 13D with respect to the Company (the “GA Schedule 13D Amendments”). This Amendment updates Item 5 of the Statement to reflect certain information disclosed in the GA Schedule 13D Amendments and to reflect an increase in the

number of Class A Common Shares outstanding and a corresponding decrease in the percentage of that class of securities beneficially owned by the Reporting Persons and other persons identified in Item 5.

Item 5. Interest in Securities of the Issuer.

Item 5 of the Schedule 13D is hereby amended and restated in its entirety.

The information contained in rows 7, 8, 9, 10, 11 and 13 on each of the cover pages of this Statement is incorporated by reference in its

entirety into this Item 5.

Arcade OF V Holdings, LLC is the direct holder of $80,000,000 in principal amount of the Company’s 2028

Convertible Notes, which are convertible into 2,758,624 Class A Common Shares at the option of the holder. Dragoneer Adviser is the investment adviser to Dragoneer Opportunities Fund V, L.P., which is the sole member of Arcade OF V Holdings,

LLC.

Arcade GF II Holdings, LLC is the direct holder of $20,000,000 in principal amount of the Company’s 2028 Convertible Notes,

which are convertible into 689,656 Class A Common Shares at the option of the holder. Dragoneer Global Fund II, L.P. (“DGF II”) is the sole member of Arcade GF II Holdings, LLC and directly holds 1,565,395 Class A Common

Shares. Dragoneer Adviser is the investment adviser to Dragoneer Global Fund II, L.P.

As the managing member of Dragoneer Adviser,

Cardinal DIG CC, LLC may also be deemed to share voting and dispositive power with respect to the Class A Common Shares (including the Class A Common Shares issuable upon conversion of 2028 Convertible Notes). Marc Stad is the sole member

of Cardinal DIG CC, LLC. By virtue of these relationships, each of the Reporting Persons may be deemed to share beneficial ownership of the Class A Common Shares of the Company (including the Class A Common Shares issuable upon conversion

of 2028 Convertible Notes).

None of the Reporting Persons nor, to the best knowledge of the Reporting Persons, without independent

verification, any person named in Item 2 hereof, has effected any transaction in Class A Common Shares during the past 60 days.

To the best knowledge of the Reporting Persons, no person other than the Reporting

Persons has the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, the securities

beneficially owned by the Reporting Persons identified above in this Item 5.

By virtue of

submitting the Proposal, the Reporting Persons may be deemed to be members of a “group” with General Atlantic and the Founders that own Class A Common Shares and Class B Common Shares pursuant to Section 13(d) of the

Exchange Act as a result of jointly submitting the proposal. However, each Reporting Person expressly disclaims beneficial ownership of the Class A Common Shares beneficially owned by any other person(s), General Atlantic or the Founders.

Neither the filing of this Statement nor any of its contents shall be deemed to constitute an admission that any of the Reporting Persons beneficially owns any Class A Common Shares or Class B Common Shares of the Company that are

beneficially owned by any other person(s), General Atlantic or the Founders. The Reporting Persons are only responsible for the information contained in this Statement and assume no responsibility for information contained in any other Schedules 13D

filed by any other reporting person(s), General Atlantic or the Founders.

|

|

|

| CUSIP No. G04553106 |

|

Page

5

of 6 |

Based on the GA Schedule 13D Amendments, General Atlantic, together with its affiliated

funds, beneficially owns 5,827,504 Class A Common Shares including 1,724,138 Class A Common Shares issuable upon conversion of all of the 2028 Convertible Notes beneficially owned by General Atlantic and 4,103,366 Class A Common

Shares. Based on (i) 29,450,551 Class A Common Shares reported outstanding as of April 8, 2022 in the Company’s Form 6-K filed with the SEC on April 13, 2022 (the “Form 6-K”), (ii) 10,436,202 Class A Common Shares issued by the Company in connection with the Company’s acquisition of isaac, as announced by the Company in its press release dated January 3,

2023 (the “January 3 Press Release”) and (iii) 1,724,138 Class A Common Shares issuable upon conversion of all of the 2028 Convertible Notes beneficially owned by General Atlantic, General Atlantic

beneficially owns approximately 14% of the outstanding Class A Common Shares, as calculated in accordance with Rule 13d-3(d)(1)(i). The GA Schedule 13D Amendments state that a fund affiliated with General

Atlantic, as a shareholder of isaac, acquired 2,919,432 Class A Common Shares in connection with the Company’s acquisition of isaac, which closed on January 2, 2023, in consideration for the shares of isaac owned by that fund. The GA

Schedule 13D Amendments further state that such fund may be entitled to receive up to an additional 121,644 Class A Common Shares that are subject to holdback provisions for a period of eighteen months in connection with the acquisition of

isaac by the Company.

Based on Amendment No. 1 to Schedule 13D filed by Oto Brasil de Sá Cavalcante and the other reporting

person therein with the SEC on January 11, 2023, Oto Brasil de Sá Cavalcante and the other reporting person beneficially own 19,103,363 Class B Common Shares, which represents approximately 32.4% of the Class A Common Shares

reported to be outstanding based on (i) 29,450,551 Class A Common Shares reported outstanding as of April 8, 2022 in the Form 6-K, (ii) 10,436,202 Class A Common Shares issued by the Company in

connection with the Company’s acquisition of isaac, as announced by the Company in the January 3 Press Release and (iii) 19,103,363 Class A Common Shares issuable upon conversion of the Class B Common Shares, approximately 69.7%

of the total number of outstanding Class B Common Shares and voting power of approximately 60.9%. The percentage of total voting power represents voting power with respect to all Class A Common Shares and Class B Common Shares, as a

single class. Each Class B Common Share may be converted into one Class A Common Share at the option of the holder.

Based on

Amendment No. 1 to Schedule 13D filed by Ari de Sá Cavalcante Neto and the other reporting person therein with the SEC on January 11, 2023, Ari de Sá Cavalcante Neto and the other reporting person beneficially own 344,182

Class A Common Shares and 8,297,485 Class B Common Shares, which represent approximately 17.9% of the total number of Class A Common Shares based on (i) 29,450,551 Class A Common Shares reported outstanding as of April 8,

2022 in the Form 6-K, (ii) 10,436,202 Class A Common Shares issued by the Company in connection with the Company’s acquisition of isaac, as announced by the Company in the January 3 Press

Release and (iii) 8,297,485 Class A Common Shares issuable upon conversion of the Class B Common Shares, approximately 30.3% of Class B Common Shares outstanding and voting power of approximately 26.5%. The percentage of total voting

power represents voting power with respect to all Class A Common Shares and Class B Common Shares, as a single class. Each Class B Common Share may be converted into one Class A Common Share at the option of the holder.

Accordingly, in the aggregate, the Reporting Persons, General Atlantic and the Founders may be deemed to beneficially own 38,586,209

Class A Common Shares, comprised of an aggregate of 6,012,943 Class A Common Shares, 5,172,418 Class A Common Shares issuable upon conversion of the 2028 Convertible Notes and 27,400,848 Class A Common Shares issuable upon

conversion of Class B Common Shares, which, as calculated in accordance with Rule 13d-3(d)(1)(i), represents approximately 53.3% of the total number of Class A Common Shares based on (i) 29,450,551

Class A Common Shares reported outstanding as of April 8, 2022 in the Form 6-K, (ii) 10,436,202 Class A Common Shares issued by the Company in connection with the Company’s acquisition of

isaac, as announced by the Company in the January 3 Press Release and (iii) an aggregate of 32,573,266 Class A Common Shares issuable upon conversion of all of the 2028 Convertible Notes and Class B Common Shares beneficially

owned by the Reporting Persons, General Atlantic and the Founders.

|

|

|

| CUSIP No. G04553106 |

|

Page

6

of 6 |

Signatures

After reasonable inquiry and to the best knowledge and belief of the undersigned, such person certifies that the information set forth in this Statement with

respect to such person is true, complete and correct.

Date: January 11, 2023

|

|

|

| /s/ Marc Stad |

| Marc Stad |

|

| DRAGONEER INVESTMENT GROUP, LLC |

|

|

| By: |

|

Cardinal DIG CC, LLC |

| Its: |

|

Managing Member |

|

|

| By: |

|

/s/ Marc Stad |

|

|

Name: Marc Stad Title: Sole

Member |

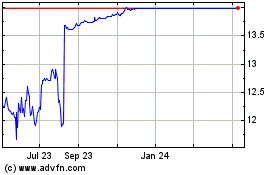

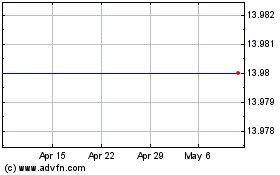

Arco Platform (NASDAQ:ARCE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Arco Platform (NASDAQ:ARCE)

Historical Stock Chart

From Apr 2023 to Apr 2024