UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant o

Check the appropriate box:

o Preliminary Proxy Statement

o Confidential, for use of the Commission only (as permitted by Rule 14a-6 (e)(2))

þ Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material under Rule 14a-12

ARK RESTAURANTS CORP.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

þ No fee required.

o Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

o Fee previously paid with the preliminary materials:

o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

| | |

ARK RESTAURANTS CORP. |

| 85 Fifth Avenue |

| New York, New York 10003 |

|

| NOTICE OF ANNUAL MEETING OF SHAREHOLDERS |

|

| To Be Held on March 14, 2023 |

|

| To the Shareholders of |

| ARK RESTAURANTS CORP. |

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders of Ark Restaurants Corp. (the “Company”) will be held on March 14, 2023 at 10:00 A.M., New York City time, at Bryant Park Grill, located at 25 West 40th Street, New York, New York. At the Annual Meeting, you will be asked to consider and vote upon:

| | | | | | | | |

| (1) | To elect a board of eight directors; |

| | |

| (2) | To ratify the appointment of CohnReznick LLP ("Cohn"), as independent auditors for the 2023 fiscal year; and |

| | |

| (3) | To transact such other business as may properly come before the meeting or any adjournments thereof. |

The Board of Directors has fixed the close of business on January 17, 2023, as the record date for the determination of shareholders entitled to notice of, and to vote at, the meeting. All shareholders are cordially invited to attend.

YOU ARE REQUESTED, WHETHER OR NOT YOU PLAN TO BE PRESENT AT THE MEETING, TO DATE, SIGN AND RETURN PROMPTLY THE ACCOMPANYING PROXY IN THE ENCLOSED ENVELOPE TO WHICH NO POSTAGE NEED BE AFFIXED IF MAILED IN THE UNITED STATES. IF YOU ATTEND THE MEETING IN PERSON, YOU MAY WITHDRAW A PREVIOUSLY SUBMITTED PROXY AND VOTE YOUR OWN SHARES AT THE MEETING.

| | | | | |

| By Order of the Board of Directors, |

| |

| Anthony J. Sirica |

| President and Chief Financial Officer |

| |

| New York, New York | |

| February 3, 2023 | |

ARK RESTAURANTS CORP.

PROXY STATEMENT

ANNUAL MEETING INFORMATION

This proxy statement contains information related to the annual meeting of shareholders of Ark Restaurants Corp., a New York corporation (“Ark” or the “Company”) to be held at Bryant Park Grill, located at 25 West 40th Street, New York, New York, at 10:00 A.M., New York City time, on March 14, 2023 and at any adjournment or adjournments thereof (the “Meeting”). This proxy statement was prepared under the direction of our Board of Directors (the “Board of Directors” or the “Board”) to solicit your proxy for use at the Meeting. This proxy statement and proxy are being first mailed to shareholders on or about February 7, 2023.

Throughout this Proxy Statement, the terms “we,” “us,” “our” and the “Company” refer to Ark Restaurants Corp. and, unless the context indicates otherwise, our subsidiaries on a consolidated basis; and “you” and “your” refers to the shareholders of the Company.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be Held on March 14, 2023.

This Proxy Statement, the form of proxy and the Company’s Annual Report are available at www.proxyvote.com.

Who may vote?

You may vote if you owned our common stock as of the close of business on January 17, 2023 (the "Record Date"). Each share of your common stock is entitled to one vote on each of the proposals scheduled for vote at the Meeting. As of the Record Date, there were 3,600,407 shares of common stock outstanding and entitled to vote at the Meeting. Shares of common stock that are present during the Meeting constitute shares of common stock represented "in person."

Who may attend the annual meeting?

All shareholders of record at the close of business on the Record Date, or their duly appointed proxies, and our invited guests may attend the Meeting.

If your shares are held in an account at a brokerage firm, bank, broker-dealer or other similar organization, then you are the beneficial owner of shares held in “street name,” and the Notice of Internet Availability was forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Meeting. As a beneficial owner, you have the right to direct that organization on how to vote the shares held in your account.

Shares of common stock held in a stockholder’s name as the stockholder of record may be voted in person at the Meeting. Shares of common stock held beneficially in street name may be voted in person only if you obtain a legal proxy from the broker, trustee or nominee that holds your shares giving you the right to vote the shares.

Whether you hold shares directly as the stockholder of record or beneficially in street name, you may direct how your shares are voted without attending the Meeting. If you are a stockholder of record, you may vote by submitting a proxy electronically via the Internet, by telephone or if you have requested a paper copy of these proxy materials, by returning the proxy or voting instruction card. If you hold shares beneficially in street name, you may vote by submitting voting instructions to your broker, trustee or nominee.

What will I be voting on?

You will be voting on the following proposals:

•The election of eight (8) directors for a term to expire at the next annual meeting of shareholders; and

•The ratification of the selection of CohnReznick LLP ("Cohn") as our independent registered public accounting firm for fiscal 2023.

What are the voting recommendations of the Board of Directors?

The Board of Directors recommends that you vote your shares “FOR” each of the nominees named in this proxy statement for election to the Board; “FOR” the ratification of the selection of Cohn as our independent registered public accounting firm for fiscal 2023, and in accordance with the proxy holders best judgment as to any other matters raised at the annual meeting.

How do I vote?

By Mail: You may vote by completing, signing and returning the enclosed proxy card in the postage-paid envelope provided with this proxy statement. The proxy holders will vote your shares according to your directions. If you sign and return your proxy card without specifying choices, your shares will be voted by the persons named in the proxy in accordance with the recommendations of the Board of Directors as set forth in this proxy statement.

At the Meeting. You may cast your vote in person at the Meeting. Written ballots will be passed out to anyone who wants to vote in person at the Meeting.

Via the Internet: You may vote by proxy via the Internet at www.proxyvote.com by following the instructions provided on the Notice of Internet Availability or proxy card. You must have the control number that is on the Notice of Internet Availability or proxy card when voting.

By Telephone: If you live in the United States or Canada, you may vote by proxy via the telephone by calling 1 (800) 690-6903. You must have the control number that is on the Notice of Internet Availability or proxy card when voting.

Even if you plan to attend the Meeting, you are encouraged to vote your shares by proxy. You may still vote your shares in person at the Meeting even if you have previously voted by proxy. If you are present at the Meeting and desire to vote in person, your vote by proxy will not be used.

What if I hold my shares in “street name”?

You should follow the voting directions provided by your broker or nominee. You may complete and mail a voting instruction card to your broker or nominee or, in most cases, submit voting instructions by telephone or the Internet to your broker or nominee. If you provide specific voting instructions by mail, telephone or the Internet, your broker or nominee will vote your shares as you have directed.

Can I change my mind after I vote?

Yes. If you are a shareholder of record, you may change your vote or revoke your proxy at any time before it is voted at the Meeting by:

•signing another proxy card with a later date and returning it to us prior to the Meeting;

•giving written notice of revocation to Ark Restaurants Corp., Attention: Secretary, 85 Fifth Avenue, New York, NY 10003; or

•attending the Meeting and voting in person.

If you hold your shares in street name, you may submit new voting instructions by contacting your broker, bank or other nominee. You may also vote in person at the Meeting if you obtain a legal proxy from your broker, bank or other nominee.

Who will count the votes?

A representative of our Transfer Agent will count the votes and will serve as the independent inspector of elections.

Will my shares be voted if I do not provide my proxy?

If you are the shareholder of record and you do not vote or provide a proxy, your shares will not be voted.

Under the rules of various national and regional securities exchanges, brokers may generally vote on certain, limited “routine” matters, but cannot vote on non-routine matters, such as the non-contested election of directors or an amendment to the Articles of Incorporation or the adoption or amendment of a stock option plan, unless they have received voting instructions from the person for whom they are holding shares. If your broker does not receive instructions from you on how to vote particular shares on matters on which your broker does not have discretionary authority to vote, your broker will return the proxy form to us, indicating that he or she does not have the authority to vote on these matters. This is generally referred to as a “broker non-vote” and will affect the outcome of the voting as described below, under “What vote is required to approve each proposal?” Therefore, we encourage you to provide directions to your broker as to how you want your shares voted on all matters to be brought before the meeting. You should do this by carefully following the instructions your broker gives you concerning its procedures. This ensures that your shares will be voted at the meeting.

How many votes must be present to hold the meeting?

A majority of the outstanding shares entitled to vote at the Meeting, represented in person or by proxy, will constitute a quorum. Shares of common stock represented in person or by proxy, including shares which abstain or do not vote with respect to one or more of the matters presented for shareholder approval, will be counted for purposes of determining whether a quorum is present.

What vote is required to approve each proposal?

In accordance with our bylaws, the nominees for director receiving the highest number of votes cast in person or by proxy at the Meeting (also referred to as a plurality of the votes cast) will be elected. Broker non-votes will not be counted as entitled to vote, but will count for purposes of determining whether or not a quorum is present on the matter. The affirmative vote of a majority of the shares represented in person or by proxy at the annual meeting is required for the approval of the proposal to ratify the appointment of Cohn for fiscal 2023. If you mark your proxy to withhold your vote for a particular nominee on your proxy card, your vote will not count either “for” or “against” the nominee. Therefore, a broker non-vote has no effect on the proposals provided herein to be voted on at the Meeting. Shares that abstain from voting as to a particular matter will not be counted as votes in favor of such matter, and also will not be counted as votes cast or shares voting on such matter. Accordingly, abstentions will not be included in vote totals and will not affect the outcome of the voting for any of the proposals.

Our directors, director-nominees and executive officers own, directly or indirectly, approximately 37.4% of the voting power entitled to be cast at the Meeting. We anticipate that these directors and executive officers will cast all of their votes in favor of each of the proposals being considered at the Meeting. Shareholders are not entitled to dissenter’s rights of appraisal with respect to any of the proposals.

Who will pay for this proxy solicitation?

We will bear the cost of preparing, assembling and mailing the proxy material and of reimbursing brokers, nominees, fiduciaries and other custodians for out-of-pocket and clerical expenses of transmitting copies of the proxy material to the beneficial owners of our shares. A few of our officers and employees may participate in the solicitation of proxies without additional compensation.

Will any other matters be voted on at the Meeting?

As of the date of this proxy statement, our management knows of no other matter that will be presented for consideration at the Meeting other than those matters discussed in this proxy statement. If any other matters properly come before the Meeting and call for a vote of shareholders, validly executed proxies in the enclosed form returned to us will be voted in accordance with the recommendation of the Board of Directors, or, in the absence of such a recommendation, in accordance with the judgment of the proxy holders.

What are the deadlines for stockholder proposals for next year’s Meeting?

Stockholders may submit proposals on matters appropriate for stockholder action at future annual meetings by following the rules of the Securities and Exchange Commission. Proposals intended for inclusion in next year’s proxy statement and proxy card must be received by not later than October 15, 2023. All proposals and notifications should be addressed to Ark Restaurants Corp., Attention: Secretary, 85 Fifth Avenue, New York, NY 10003. Any such shareholder proposal must comply with the requirements of Rule 14a-8 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Where can I find the voting results?

The preliminary voting results will be announced at the Meeting. The final results will be published in a current report on Form 8-K filed within four (4) business days after the Meeting.

What is the Company’s website address?

Our website address is www.arkrestaurants.com. We make this proxy statement, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act available on our website in the Investors section, as soon as reasonably practicable after electronically filing such material with the United States Securities and Exchange Commission (“SEC”).

This information is also available free of charge at the SEC’s website located at www.sec.gov. Shareholders may also read and copy any reports, statements and other information filed by us with the SEC at the SEC public reference room at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 or visit the SEC’s website for further information on its public reference room.

The references to our website address and the SEC’s website address do not constitute incorporation by reference of the information contained in these websites and should not be considered part of this document.

CORPORATE GOVERNANCE; DIRECTOR AND COMMITTEE INFORMATION

Corporate Governance

We seek to follow best practices in corporate governance in a manner that is in the best interests of our business and stockholders. Our current corporate governance principles, including the Code of Ethics and the charters of each of the Audit Committee and Nominating and Governance Committee are all available under Investors – Corporate Governance on our website at www.arkrestaurants.com. We are in compliance with the corporate governance requirements imposed by the Sarbanes-Oxley Act, the Securities and Exchange Commission and the NASDAQ Marketplace Rules. We will continue to modify our policies and practices to meet ongoing developments in this area. Aspects of our corporate governance principles are discussed throughout this Proxy Statement.

Director Independence

The Board has determined that each of the following directors is an “independent director” as such term is defined in NASDAQ Marketplace Rule 4200(a)(15): Bruce R. Lewin, Marcia Allen, Steven Shulman, Jessica Kates and Stephen Novick. The Company does not utilize any other definition or criteria for determining the independence of a director or nominee, and no other transactions, relationships, or other arrangements exist to the Board’s knowledge or were considered by the Board, other than as may be discussed herein, in determining any such director’s or nominee’s independence.

Board Leadership Structure

Our Board does not have a policy as to whether the roles of Chairman of the Board and Chief Executive Officer should be separate or combined. Currently, the office of Chairman of the Board and Chief Executive Officer are held by Michael Weinstein. The Company does not have a lead independent director. Our Board has determined that its current structure, with combined Chairman and CEO roles is in the best interests of the Company and its stockholders at this time. A number of factors support the leadership structure chosen by the Board, including, among others:

•Mr. Weinstein has extensive knowledge of all aspects of the Company and its business and risks, its industry and its customers;

•Mr. Weinstein is intimately involved in the day-to-day operations of the Company and is best positioned to elevate the most critical business issues for consideration by the Board of Directors;

•The Board believes having Mr. Weinstein serve in both capacities allows him to more effectively execute the Company’s strategic initiatives and business plans and confront its challenges;

•A combined Chairman and CEO structure provides the Company with decisive and effective leadership with clearer accountability to our stockholders and customers; and

•In our view, splitting the roles would potentially make our management and governance processes less effective through undesirable duplication of work and possibly lead to a blurring of clear lines of accountability and responsibility.

Board’s Role in Risk Oversight

Our Board believes that open communication between management and the Board is essential for effective risk management and oversight. The Board meets with our Chief Executive Officer and other members of senior management at Board meetings, where, among other topics, they discuss strategy and risks in the context of reports from the management team and evaluate the risks inherent in significant transactions.

One of the key functions of our Board of Directors is informed oversight of our risk management process. It administers this oversight function directly through the Board of Directors as a whole, as well as through its standing committees that address risks inherent in their respective areas of oversight. Areas of focus include economic, operational, financial (accounting, credit, investment, liquidity and tax), competitive, legal, technical, regulatory, compliance and reputational risks, and more recently, risk exposures related to COVID-19. The risk oversight responsibility of our Board of Directors and its committees is supported by our management reporting processes, which are designed to provide visibility to our Board of Directors and to our personnel who are responsible for risk

assessment and information about the identification, assessment and management of critical risks, and our management’s risk mitigation strategies.

While our Board is ultimately responsible for risk oversight, our Board committees assist the Board in fulfilling its oversight responsibilities in certain areas of risk. For more information about our Board committees, please see the sections titled “Compensation Committee,” “Audit Committee” and “Nominating and Corporate Governance Committee” below. We believe this division of responsibilities is an effective approach for addressing the risks we face and that our board leadership structure supports this approach.

Board and Committee Meeting Attendance

During the past fiscal year, the Board held five meetings. Each member of the Board attended at least 75% of the meetings of the Board and committees on which he or she served. Independent directors met twice last year in executive session without management present.

Board Committees

The Board has delegated various responsibilities and authority to different Board committees. The Board has three standing committees: the Compensation Committee, the Audit Committee and the Nominating and Corporate Governance Committee. The Board has appointed only independent directors to such committees. The members of each committee are appointed by the Board and serve one-year terms. Committees regularly report on their activities and actions to the full Board of Directors. Each committee has a written charter adopted by the Board of Directors under which it operates.

Compensation Committee

Mr. Novick (Chairperson), Mr. Shulman and Ms. Allen currently serve as members of the Compensation Committee of the Board. The Compensation Committee (i) oversees and sets the compensation and benefits arrangements of our Chief Executive Officer and certain other executives; (ii) provides a general review of, and makes recommendations to, the Board of Directors or to our shareholders with respect to our cash-based and equity-based compensation plans; and (iii) implements, administers, operates and interprets our equity-based and similar compensation plans to the extent provided under the terms of such plans. The Compensation Committee has the authority to make decisions respecting CEO and executive officer compensation matters, including employment and severance contracts, salary, compensation awards and bonuses, among other things, and has the right to retain and terminate compensation consultants, legal counsel and other advisors to assist the committee with its functions. The Committee may delegate authority to subcommittees of the Compensation Committee or to executive officers (with respect to compensation determinations for non-executive officers), as well as delegate authority to the Company’s CEO to approve options to employees (who are not directors or executive officers) of the Company or of any subsidiary of the Company, subject to certain quantity, time and price limitations.

The Board of Directors adopted a written charter under which the Compensation Committee operates. The Board of Directors reviews and assesses the adequacy of the charter of the Compensation Committee on an annual basis. The Board of Directors has determined that all of the members of the Compensation Committee meet the independence criteria for compensation committees and have the qualifications set forth in the listing standards of NASDAQ.

The Compensation Committee held one meeting in fiscal 2022.

Audit Committee

Mr. Lewin (Chairperson), Ms. Kates and Ms. Allen currently serve as members of the Audit Committee of the Board of Directors. The Audit Committee is responsible for, among other things, engaging the independent auditors, receiving and reviewing the recommendations of the independent auditors, reviewing consolidated financial statements of the Company, meeting periodically with the independent auditors and Company personnel with respect to the adequacy of internal accounting controls, resolving potential conflicts of interest and reviewing the Company’s accounting policies.

The Board of Directors has determined that all of the members of the Audit Committee meet the independence criteria for audit committees and have the qualifications set forth in the listing standards of NASDAQ and Rule 10A-3 under the Exchange Act.

The Board of Directors has also designated Ms. Allen as an audit committee financial expert within the meaning of Item 401(h) of Regulation S-K under the Exchange Act and the Board of Directors has determined that she has the financial sophistication required under the listing standards of NASDAQ.

The Board of Directors adopted a written charter under which the Audit Committee operates. The Board of Directors reviews and assesses the adequacy of the charter of the Audit Committee on an annual basis.

The Audit Committee held four meetings during fiscal 2022.

Nominating and Corporate Governance Committee

Messrs. Novick (Chairperson) and Lewin and Ms. Allen currently serve as members of the Nominating and Corporate Governance Committee of the Board. The Board of Directors adopted a written charter under which the Nominating and Corporate Governance Committee operates. The Nominating and Corporate Governance Committee approved the nomination of the candidates reflected in Proposal One, which candidates were approved by the Board of Directors.

The duties of the Nominating and Corporate Governance Committee are to recommend to the Board nominees to the Board of Directors and its standing committees. Although the Nominating and Corporate Governance Committee has not established minimum qualifications for director candidates, it will consider, among other factors:

•Judgment

•Skill

•Diversity

•Experience with businesses and other organizations of comparable size

•The interplay of the candidate's experience with the experience of other Board members

•The extent to which the candidate would be a desirable addition to the Board and any committee of the Board

The Nominating and Corporate Governance Committee will consider all director candidates recommended by stockholders. Any stockholder who desires to recommend a director candidate may do so in writing, giving each recommended candidate’s name, biographical data and qualifications, by mail addressed to the Chairman of the Nominating and Corporate Governance Committee, in care of Ark Restaurants Corp., 85 Fifth Avenue, New York, New York 10003. Members of the Nominating and Corporate Governance Committee will assess potential candidates on a regular basis.

The Company does not have a formal policy with regard to the consideration of diversity in identifying director nominees, but the Nominating and Corporate Governance Committee strives to nominate directors with a variety of complementary skills so that, as a group, the Board will possess the appropriate talent, skills, and expertise to oversee the Company’s businesses. In addition to considering a candidate’s background and accomplishments, candidates are reviewed in the context of the current composition of the Board and the evolving needs of our businesses. The Company’s policy is to have at least a majority of directors qualify as “independent” under the listing requirements of NASDAQ.

The Nominating and Corporate Governance Committee held one meeting fiscal 2022.

There are no family relationships among any of the directors or executive officers (or any nominee therefor) of the Company, and no arrangements or understandings exist between any director or nominee and any other person pursuant to which such director or nominee was or is to be selected with respect to the election of directors. No director or executive officer (or any nominee therefor or any associate thereof) has any substantial interest, direct or indirect, by security holdings or otherwise, in any proposal or matter to be acted upon at the Meeting (other than the election of directors). There are no events or legal proceedings material to an evaluation of the ability or integrity of any director or executive officer, or any nominee therefor, of the Company. Moreover, no director or executive officer of the Company, nor any nominee, is a party adverse to the Company or has a material interest adverse to the Company in any legal proceeding.

Stockholder Communications

The Board welcomes communications from stockholders, which may be sent to the entire Board at the principal business address of the Company, Ark Restaurants Corp., 85 Fifth Avenue, New York, New York 10003, Attn: Secretary. Security holder communications are initially screened to determine whether they will be relayed to Board members. Once the decision has been made to relay such communications to Board members, the Secretary will release the communication to the Board on the next business day. Communications that are clearly of a marketing nature, or which are unduly hostile, threatening, illegal or similarly inappropriate will be discarded and, if warranted, subject to appropriate legal action.

Recognizing that director attendance at the Company’s annual meetings of stockholders can provide stockholders with an opportunity to communicate with members of the Board of Directors, it is the policy of the Board of Directors to encourage, but not require, the members of the Board to attend such meetings. Seven board members attended our 2022 annual meeting.

PROPOSAL 1: ELECTION OF DIRECTORS

Our Amended and Restated Certificate of Incorporation provides that the number of directors constituting the Board of Directors shall not be fewer than three nor more than 15, with the exact number to be fixed by a resolution adopted by the affirmative vote of a majority of the Board. The Board of Directors has fixed the number of directors at eight. The term of office of each director is one year, commencing at this annual meeting and ending at the annual meeting of shareholders to be held in 2024. Each director elected will continue in office until he resigns or until a successor has been elected and qualified. Stockholders cannot vote or submit proxies for a greater number of persons than the eight nominees named in this Proposal One.

Each of the nominees named below is at present a director of the Company and has consented to serve if elected. If any nominee should be unable to serve or will not serve for any reason, the persons designated on the accompanying form of proxy will vote in accordance with their judgment. We know of no reason why the nominees would not be able to serve if elected.

The following is a brief account of the business experience during the past five years of each of the Company’s directors and executive officers, including principal occupations and employment during that period and the name and principal business of any corporation or other organization in which such occupation and employment was carried on.

| | | | | | | | | | | | | | | | | | | | |

| Name | | Age | | Position | | Director

Since |

| | | | | | |

| Michael Weinstein | | 79 | | Chairman of the Board and Chief Executive Officer | | 1983 |

| Anthony J. Sirica | | 59 | | Director, President and Chief Financial Officer | | 2018 |

| Vincent Pascal | | 79 | | Director and Chief Operating Officer and Senior Vice President | | 1985 |

| Marcia Allen | | 72 | | Director | | 2003 |

| Jessica Kates | | 44 | | Director | | 2022 |

| Bruce R. Lewin | | 75 | | Director | | 2000 |

| Stephen Novick | | 82 | | Director | | 2005 |

| Steven Shulman | | 81 | | Director | | 2003 |

Biographical Information

Michael Weinstein has been our Chief Executive Officer and a director since our inception in January 1983, was elected Chairman in 2004 and was President of the Company from January 1983 to September 2007. Mr. Weinstein is also an executive officer of each of our subsidiaries. Mr. Weinstein is an officer, director and 29.67% shareholder of RSWB Corp. and a director and 28% owner of BSWR Corp. (since 1998). Collectively, these companies operate two restaurants in New York City, and none of these companies is a parent, subsidiary or other affiliate of us. Mr. Weinstein spends substantially all of his business time on Company-related matters.

Anthony J. Sirica has been employed by us since September 2018 as Chief Financial Officer and was appointed to fill a vacancy on the Board of Directors as of such date. Prior to his appointment, Mr. Sirica served as the Managing Member of Forum Consulting, LLC (“Forum”), since February 2006. Forum was a New York-based management advisory services firm that provided accounting and financial consulting services and corporate governance support primarily to issuers registered with the Securities and Exchange Commission (“SEC”) in the Tri-State area, including Ark Restaurants Corp. Prior to his tenure at Forum, Mr. Sirica served in various capacities with the international accounting firm of BDO Seidman, LLP, including the National Business Line Leader of their risk consulting division and Audit Partner. Mr. Sirica is a certified public accountant.

Vincent Pascal has been employed by us since 1983 and was elected Vice President, Assistant Secretary and a director in 1985. Mr. Pascal became a Senior Vice President in 2001 and Chief Operating Officer in 2011.

Marcia Allen was elected a director of the Company in 2003. Since 2008, Ms. Allen has been the Chief Executive Officer of Allen & Associates Inc., a business and acquisition consulting firm. Currently, Ms. Allen also serves on the Board of Directors of INmune Bio, Inc. (NASDAQ - INMB) and is a director of several private companies.

Jessica Kates was elected a director of the Company in 2022. Since 2019, Ms. Kates has been the Co-Founder and Managing Partner of Rellevant Partners LLC, a female-founded growth equity firm focused on the restaurant, restaurant technology, and food & beverage industries. Currently, Ms. Kates also serves as the Interim Chief Financial Officer of Allonnia, LLC, and Liberation Labs

Holdings Inc. Ms. Kates also serves on the Board of Directors of The Good Dog Foundation and RASA. Prior to 2019, Ms. Kates was a Partner in Trispan's restaurant-focused private equity fund, where she served on the Board of Yardbird, Rosa Mexicano and Stacked.

Since 2019, Ms. Kates has been the Co-Founder and Managing Partner of Rellevant Partners LLC, a female-founded growth equity firm focused on the restaurant, restaurant technology, and food & beverage industries. Currently, Ms. Kates also serves as the Interim Chief Financial Officer of Allonnia, LLC, and Liberation Labs Holdings Inc. Ms. Kates also serves on the Board of Directors of The Good Dog Foundation and RASA.

Bruce R. Lewin was elected a director of the Company in February 2000. Mr. Lewin was the President and a director of Continental Hosts, Ltd from August 2001 until its sale in 2018. He was also a founder and board member of Fuze Beverage, LLC. Mr. Lewin was formerly a director of the Bank of Great Neck (in New York), and a former director of the New York City Chapter of the New York State Restaurant Association. He has been owner and President of Bruce R. Lewin Fine Art since 1985.

Stephen Novick was elected a director of the Company in 2005. Mr. Novick serves as Senior Advisor for the Andrea and Charles Bronfman Philanthropies, a private family foundation. From 1990 to 2004, Mr. Novick served as Chief Creative Officer of Grey Global Group, an advertising agency. Mr. Novick continues to serve as a consultant for Grey Global Group. Mr. Novick formerly a directors of Toll Brothers, Inc.

Steven Shulman was elected a director of the Company in December 2003. During the past five years, Mr. Shulman has been the managing director of Hampton Group, a company engaged in the business of making private investments. Mr. Shulman also serves as a director of various private companies and as a strategic advisor to Ancoris Capital Partners.

Director Diversity Matrix

| | | | | | | | | | | | | | |

| Total Number of Directors | 8 |

| Female | Male | Non-Binary | Did Not

Disclose

Gender |

| Part I: Gender Identity | | | | |

| Directors | 2 | 6 | — | — |

| Part II: Demographic Background | | | | |

| African American or Black | — | — | — | — |

| Alaskan Native or Native American | — | — | — | — |

| Asian | — | — | — | — |

| Hispanic or Latinx | — | — | — | — |

| Native Hawaiian or Pacific Islander | — | — | — | — |

| White | 2 | 5 | — | — |

| Two or more Races or Ethnicities | — | — | — | — |

| LGBTQ+ | 1 |

| Did not disclose demographic background | 1 |

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH NAMED NOMINEE.

PROPOSAL 2:

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

The Audit Committee has recommended, and the Board of Directors has approved, the appointment of Cohn, an independent registered public accounting firm, to audit our financial statements for the 2023 fiscal year. A representative of Cohn is expected to attend the Meeting and will have an opportunity to make a statement if he or she so desires. He or she will also be available to respond to appropriate questions from our shareholders. For additional information regarding our relationship with Cohn, please see the “Audit Committee Report” below.

Although it is not required to submit this proposal to the shareholders for approval, the Board believes it is desirable that an expression of shareholder opinion be solicited and presents the selection of the independent registered public accounting firm to the shareholders for ratification. If the selection of Cohn is not ratified by shareholders, the Board of Directors will take that into consideration but does not intend to engage another firm. Even if the selection of Cohn is ratified by the shareholders, the Audit Committee in its discretion could decide to terminate the engagement of Cohn and engage another firm if the committee determines that this is necessary or desirable.

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” RATIFICATION OF THE APPOINTMENT OF COHNREZNICK LLP AS INDEPENDENT AUDITORS FOR THE COMPANY.

AUDIT COMMITTEE REPORT

The following report is not deemed to be “soliciting material” or to be “filed” with the SEC or subject to the SEC’s proxy rules or to the liabilities of Section 18 of the Exchange Act and the report shall not be deemed to be incorporated by reference into any prior or subsequent filing by the Company under the Securities Act of 1933 or the Exchange Act.

The Audit Committee evidenced its completion of and compliance with the duties and responsibilities set forth in the adopted Audit Committee Charter through a formal written report dated and executed as of December 20, 2022. A copy of that report is set forth below.

December 20, 2022

The Board of Directors

Ark Restaurants Corp.

Fellow Directors:

The primary purpose of the Audit Committee is to assist the Board of Directors in its general oversight of the Corporation’s financial reporting process. The Audit Committee conducted its oversight activities for Ark Restaurants Corp. and subsidiaries (“Ark”) in accordance with the duties and responsibilities outlined in the Audit Committee charter. The Audit Committee annually reviews the NASDAQ standard of independence for audit committees and its most recent review determined that the committee meets that standard.

Ark management is responsible for the preparation, consistency, integrity and fair presentation of the financial statements, accounting and financial reporting principles, systems of internal control, and procedures designed to ensure compliance with accounting standards, applicable laws, and regulations. The Corporation’s independent auditors, CohnReznick LLP, are responsible for performing an independent audit of the financial statements and expressing an opinion on the conformity of those financial statements with accounting principles generally accepted in the Unites States of America.

The Audit Committee, with the assistance and support of the Chief Financial Officer of Ark, has fulfilled its objectives, duties and responsibilities as stipulated in the audit committee charter and has provided adequate and appropriate independent oversight and monitoring of Ark’s systems of internal control for the fiscal year ended October 1, 2022.

These activities included, but were not limited to, the following significant accomplishments during the fiscal year ended October 1, 2022:

•Reviewed and discussed the audited financial statements with management and the external auditors.

•Received written disclosures and letter from the external auditors required by Independence Standards Board Standard No. 1, and discussed with the auditors their independence.

In reliance on the Committee’s review and discussions of the matters referred to above, the Audit Committee recommends the audited financial statements be included in Ark’s Annual Report on Form 10-K for the fiscal year ended October 1, 2022, for filing with the Securities and Exchange Commission.

Respectfully submitted,

Ark Restaurants Corp. Audit Committee

Bruce R. Lewin, Marcia Allen and Jessica Kates

AUDIT FEES AND SERVICES

During fiscal 2021 and 2022, Cohn served as our independent auditors. The following table presents fees for professional audit services rendered by Cohn for the audit of our annual financial statements for the years ended October 2, 2021 and October 1, 2022, and fees for other services rendered by Cohn during those periods.

| | | | | | | | | | | | | | | | | | | | | | | |

| | 2021 | | | 2022 |

| | | | | | | |

| Audit Fees | | $ | 295,500 | | | $ | 320,250 |

| Audit Related Fees | | | 26,250 | | | | 36,226 |

| Tax Fees | | | - | | | | - |

All Other Fees | | | - | | | | - |

Total | | $ | 321,750 | | | $ | 356,476 |

Audit Fees. Annual audit fees relate to services rendered in connection with the audit of our consolidated annual financial statements included in our Form 10-K and the quarterly reviews of financial statements included in our Forms 10-Q.

Audit Related Fees. Audit related services include fees for benefit plan audits and lease compliance audits.

Tax Fees. Tax services include fees for tax compliance, tax advice and tax planning.

All Other Fees: Includes other fees or expenses billed for other services not described above rendered to the Company by Cohn.

The Audit Committee considers whether the provision of these services is compatible with maintaining the auditor’s independence, and has determined such services for fiscal 2021 and 2022 were compatible.

We have been advised by Cohn that neither the firm, nor any member of the firm, has any financial interest, direct or indirect, in any capacity in the Company or its subsidiaries.

Policy on Audit Committee Pre-Approval of Audit and Non-Audit Services of Independent Auditor

The Audit Committee is responsible for appointing, setting compensation and overseeing the work of the independent auditor. The Audit Committee has established a policy regarding pre-approval of all audit and non-audit services provided by the independent auditor, as follows: on an ongoing basis, management communicates specific projects and categories of service for which the advance approval of the Audit Committee is requested, and the Audit Committee reviews these requests and advises management if the Committee approves the engagement of the independent auditor. On a periodic basis, management reports to the Audit Committee regarding the actual spending for such projects and services compared to the approved amounts. All audit-related fees, tax fees and all other fees were approved by the Audit Committee. The projects and categories of service are as follows:

Audit—Annual audit fees relate to services rendered in connection with the audit of our consolidated financial statements included in our Form 10-K and the quarterly reviews of financial statements included in our Forms 10-Q as well as fees for SEC registration services.

Audit Related Services—Audit related services include fees for benefit plan audits and lease compliance audits.

Tax—Tax services include fees for tax compliance, tax advice and tax planning.

All Other—Fees for all other services provided by Cohn.

EXECUTIVE COMPENSATION

The following table shows information concerning all compensation paid for services to the Company in all capacities during the fiscal years ended October 2, 2021 and October 1, 2022, as to the Chief Executive Officer (its “principal executive officer” or “PEO”)

and each of the other two most highly compensated executive officers of the Company who served in such capacity at the end of the last two fiscal years (the “Named Executive Officers” or “NEOs”):

SUMMARY COMPENSATION TABLE

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name and Principal

Position(s) | | Year | | Salary

($) | | Bonus

($) | | Option

Award

($) | | All Other

Compensation

($) | | Total

($) |

| | | | | | | | | | | | | | | | | | | | | | |

| Michael Weinstein | | 2022 | | $ | 1,054,156 | | | $ | 125,000 | | | $ | - | | | $ | - | | | $ | 1,179,156 | |

Chief Executive Officer | | 2021 | | $ | 818,998 | | | $ | 50,000 | | | $ | - | | | $ | - | | | $ | 868,998 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Vincent Pascal | | | | | | | | | | | | | | | | | | | | | | |

Senior Vice President and | | 2022 | | $ | 482,857 | | | $ | 100,000 | | | $ | - | | | $ | - | | | $ | 582,857 | |

| Chief Operating Officer | | 2021 | | $ | 390,927 | | | $ | 50,000 | | | $ | - | | | $ | - | | | $ | 440,927 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Anthony J. Sirica | | | | | | | | | | | | | | | | | | | | | | |

| President and Chief | | 2022 | | $ | 482,218 | | | $ | 100,000 | | | $ | - | | | $ | - | | | $ | 582,218 | |

| Financial Officer | | 2021 | | $ | 401,106 | | | $ | 100,000 | | | $ | 16,656 | | | $ | - | | | $ | 517,762 | |

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END

The following table provides information on the holdings of stock options by the CEO and NEOs as of October 1, 2022:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Option Awards |

| (a) | | | (b) | | | | (c) | | | | (e) | | | (f) |

| Name | | Number of

Securities

Underlying

Unexercised

Options (#)

Exercisable | | Number of

Securities

Underlying

Unexercised

Options (#)

Unexercisable | | Option

Exercise Price

($) | | Option

Expiration

Date |

| | | | | | | | | | | | | | |

| Michael Weinstein | | | 21,375 | | | | - | | | $ | 22.50 | | | 06/09/24 |

| Chief Executive Officer | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Vincent Pascal | | | 21,375 | | | | - | | | $ | 22.50 | | | 06/09/24 |

| Senior Vice President and | | | | | | | | | | | | | | |

| Chief Operating Officer | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Anthony J. Sirica | | | 20,000 | | | | - | | | $ | 22.30 | | | 09/04/28 |

| President and Chief Financial Officer | | | 7,500 | | | 7,500 | (1) | $ | 21.90 | | | 02/03/30 |

| | | 3,750 | | | 3,750 | (2) | $ | 10.65 | | | 11/19/30 |

__________________________________

| | | | | |

| (1) | These options vest as follows: (i) 50% on February 3, 2022 and (ii) 50% on February 3, 2024. |

| (2) | These options vest as follows: (i) 50% of November 19, 2022 and (ii) 50% on November 19, 2024. |

DIRECTOR COMPENSATION

Compensation Paid to Directors in 2022

In fiscal 2022, the Company paid a fee of $32,500 to each director who was not an officer of the Company; each director who was a full-time employee of the Company did not receive any director fees. In addition, in fiscal 2022, the independent director who served as chairman of the Audit Committee of the Board received an annual retainer fee of $10,000, the independent directors who served on the Audit, Compensation and Nominating and Corporate Governance Committees, respectively, including the chairman of the Audit Committee, received $1,500 for each meeting that they attended, and each member of the Board received an additional $1,500 for each Board meeting that they attended, plus an additional $1,500 if such additional Board meeting attended exceeded four hours. The Company reimburses directors for out-of-pocket expenses incurred in connection with attending Board of Director and committee meetings.

Short-Selling, Hedging and Pledging Prohibitions

We do not permit our directors or executive officers to speculate in our common stock which includes, without limitation, "short-selling" and/or buying publicly traded options. We also do not permit our directors or executive officers to enter into hedging transactions with respect to their ownership of our common stock or to pledge any of our common stock.

Director Compensation Table

The following table summarizes the compensation earned by or paid to the Company’s non-employee directors from the Company for the year ended October 1, 2022.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Fees Earned

or Paid in

Cash

($) | | Option

Awards

($) | | Total |

| | | | | | | | | | | | |

Marcia Allen (1) | | $ | 44,500 | | | $ | 0 | | | $ | 44,500 | |

Jessica Kates (2) | | $ | 22,250 | | | $ | 22,662 | | | $ | 44,912 | |

Bruce Lewin (1) | | $ | 61,000 | | | $ | 0 | | | $ | 61,000 | |

Stephen Novick (1) | | $ | 41,500 | | | $ | 0 | | | $ | 41,500 | |

Steven Shulman (1) | | $ | 41,500 | | | $ | 0 | | | $ | 41,500 | |

Arthur Stainman (3) | | $ | 12,625 | | | $ | 0 | | | $ | 12,625 | |

______________

| | | | | |

| (1) | Director has 5,000 currently exercisable options at an exercise price of $22.50 per share, 2,000 currently exercisable options at an exercise price of $21.90 per share and 1,000 currently exercisable options at an exercise price of $10.65 per share. In addition, Director has 2,000 currently unexercisable options at an exercise price of $21.90 per share and 1,000 currently unexercisable options at an exercise price of $10.65 per share. |

| (2) | Director has 5,000 currently unexercisable options at an exercise price of $17.80 per share. |

| (3) | Mr. Stainman was elected to serve as a director of the Company at the 2022 annual meeting of shareholders and tendered his resignation from the Board effective as of May 17, 2022. |

STOCK OWNERSHIP INFORMATION

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information as of January 17, 2023, with respect to the beneficial ownership of shares of our common stock owned by:

•Each of our directors, our CEO and the other NEOs;

•All directors and executive officers as a group; and

•Each person or entity who is known to us to be the beneficial owner of more than 5% of our common stock.

As of January 17, 2023, our outstanding equity securities consisted of 3,600,407 shares of common stock. The number of shares beneficially owned by each stockholder is determined under rules promulgated by the SEC and generally includes voting or investment power over the shares. The information does not necessarily indicate beneficial ownership for any other purpose. Under Securities and Exchange Commission (the “SEC”) rules, the number of shares of common stock deemed outstanding includes shares issuable upon the conversion of other securities, as well as the exercise of options or the settlement of restricted stock units held by the respective person or group that may be exercised or settled on or within 60 days of January 17, 2023. For purposes of calculating each person’s or group’s percentage ownership, shares of common stock issuable pursuant to stock options and restricted stock units that may be exercised or settled on or within 60 days of January 17, 2023 are included as outstanding and beneficially owned by that person or group but are not treated as outstanding for the purpose of computing the percentage ownership of any other person or group. | | | | | | | | | | | | | | | | | | | | |

Name and Address

of Beneficial Owner (1) | | Amount and Nature

of

Beneficial Ownership (2) | | | Percent of Class |

| | | | | | |

| Michael Weinstein | | 964,103 | | (3) | | 26.62 | % |

| Bruce R. Lewin | | 300,681 | | (4) (8) | | 8.33 | % |

| Vincent Pascal | | 48,333 | | (5) | | 1.33 | % |

| Steven Shulman | | 19,800 | | (6) | | Less than 1% |

| Marcia Allen | | 13,000 | | (6) | | Less than 1% |

| Anthony J. Sirica | | 31,250 | | (7) | | Less than 1% |

| Stephen Novick | | 13,000 | | (6) | | Less than 1% |

| Jessica Kates | | 0 | | | | |

| All directors and officers as a group (eight persons) | | 1,390,167 | | (9) | | 37.36 | % |

| | | | | | | | | | | | | | | | | | | | |

Name and Address

of Beneficial Owner (1) | | Amount and Nature

of

Beneficial Ownership (2) | | | Percent of Class |

| | | | | | |

| Five (5%) Shareholders | | | | | | |

| | | | | | |

| Thomas A. Satterfield, Jr. | | 550,557 | | (10) | | 15.29 | % |

| 15 Colley Cove Drive | | | | | | |

| Gulf Breeze, Florida 32561 | | | | | | |

| | | | | | |

_____________________________________________

| | | | | |

| (1) | Unless otherwise indicated, the address for each person is c/o Ark Restaurants Corp., 85 Fifth Avenue, New York, NY 10003. |

| |

| (2) | Except to the extent otherwise indicated, to the best of the Company’s knowledge, each of the indicated persons exercises sole voting and investment power with respect to all shares beneficially owned by him, her or it. |

| |

| (3) | Includes: a 50% interest (113,500 shares) held by Michael Weinstein in a limited liability company account maintained by his adult children; 3,700 shares held by The Weinstein Foundation for which Mr. Weinstein acts as trustee and has shared investment and voting power; and 21,375 shares issuable to Mr. Weinstein pursuant to stock options, all of which options are currently exercisable. |

| |

| (4) | Includes 1,500 shares owned by Mr. Lewin in his Individual Retirement Account (“IRA”). |

| |

| (5) | Includes 21,375 shares issuable pursuant to stock options exercisable within 60 days after the date of this Proxy Statement. |

| |

| (6) | Includes 13,000 shares issuable pursuant to stock options exercisable within 60 days after the date of this Proxy Statement. |

| |

| (7) | Includes 31,250 shares issuable pursuant to stock options exercisable within 60 days after the date of this Proxy Statement. |

| |

| (8) | Includes 8,000 shares issuable pursuant to stock options exercisable within 60 days after the date of this Proxy Statement. |

| |

| (9) | Includes 121,000 shares issuable pursuant to stock options exercisable within 60 days after the date of this Proxy Statement. |

| |

| (10) | Based upon information set forth on Form 4 filed by Thomas A. Satterfield, Jr. (“Mr. Satterfield”) with the SEC on or about December 21, 2022 with respect to the beneficial ownership reported for Thomas A. Satterfield, Jr., 7,500 shares are held jointly with Mr. Satterfield’s spouse; 1,000 shares are held individually by Mr. Satterfield’s spouse in her individual capacity; 50,000 shares are held by Tomsat Investment & Trading Co., Inc., a corporation wholly owned by Mr. Satterfield and of which he serves as President; and 184,607 shares are held by Caldwell Mill Opportunity Fund, a fund managed by an entity of which Mr. Satterfield owns a 50% interest and serves as Chief Investment Manager. Additionally, Mr. Satterfield has been granted limited powers of attorney to exercise voting and dispositive power with respect to the securities held by the following parties: the reporting person's father (32,000 shares); the reporting person's brother (15,000 shares); the reporting person's sister (27,000 shares); the reporting person's brother-in-law (11,000 shares); Rita Phifer (10,000 shares); the reporting person's second brother-in-law (6,000 shares); the reporting person's nephew (2,000 shares); a trust for the reporting person's granddaughter (1,450 shares); a trust for the reporting person's second granddaughter (500 shares); the reporting person's step-sister (2,500 shares); the reporting person's second step-sister (2,000 shares); the reporting person's third step-sister and spouse (7,000 shares); the reporting person's fourth step-sister and spouse (4,000 shares); and the reporting person's fifth step-sister and spouse (3,000 shares). These individuals and entities have the right to receive or the power to direct the receipt of the proceeds from the sale of their respective shares. |

DELINQUENT SECTION 16(a) REPORTS

Section 16(a) of the Exchange Act requires the Company’s officers and directors, and persons who own more than ten percent of a registered class of the Company’s equity securities to file reports of ownership and changes in ownership on Forms 3, 4 and 5 with the SEC and the NASDAQ Capital Market. Officers, directors and greater than ten percent shareholders are required by the Commission’s regulations to furnish the Company with copies of all Forms 3, 4 and 5 they file.

Based solely on the Company’s review of the copies of such forms it has received, and in reliance upon written representations by or on behalf of our directors and officers, the Company believes that all of its officers, directors and greater than ten percent beneficial owners complied with all filing requirements applicable to them with respect to transactions during fiscal 2022, except that in fiscal 2022 Jessica Kates failed to file a Form 4 to report options granted to her on September 2, 2022.

CERTAIN RELATIONSHIPS AND RELATED PERSON TRANSACTIONS

The following section sets forth certain required information regarding transactions or proposed transactions between the Company and certain related persons for the last two completed fiscal years.

For information on the compensation received by our directors and executive officers of the Company during the 2022 fiscal year, and the beneficial ownership of equity securities of the Company of such individuals, see the “Security Ownership of Certain Beneficial Owners and Management” and “Executive Compensation” sections.

ADDITIONAL INFORMATION

“Householding” of Proxy Materials

The SEC has adopted rules that permit companies and intermediaries such as brokers to satisfy delivery requirements for proxy statements and annual reports with respect to two or more shareholders sharing the same address by delivering a single proxy statement and annual report addressed to those shareholders. This process, which is commonly referred to as “householding,” potentially provides extra convenience for shareholders and cost savings for companies. The Company and some brokers household proxy materials, delivering a single proxy statement and annual report to multiple shareholders sharing an address unless contrary instructions have been received from the affected shareholders.

Once you have received notice from your broker or us that each of us will be householding materials to your address, householding will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in householding and would prefer to receive a separate proxy statement and annual report, or if you are receiving multiple copies of the proxy statement and annual report and wish to receive only one, please notify your broker if your shares are held in a brokerage account or the Company if you hold registered shares. You can notify us by sending a written request to Ark Restaurants Corp., Attention: Secretary, 85 Fifth Avenue, New York, NY 10003 or call us at (212) 206-8800

Other Matters

The Board is not aware of any business to be presented at the Meeting, other than the matters set forth in the notice of Meeting and described in this Proxy Statement. If any other business does lawfully come before the Meeting, it is the intention of the persons named as proxies or agents in the enclosed proxy card to vote on such other business in accordance with their judgment.

Annual Report

This proxy solicitation material has been mailed with the annual report to shareholders for the fiscal year ended October 1, 2022; however, it is not intended that the annual report for fiscal year 2022 be a part of the proxy statement or this solicitation of proxies.

Shareholders are respectfully urged to complete, sign, date and return the accompanying form of proxy in the enclosed envelope.

| | | | | |

| ARK RESTAURANTS CORP. |

| |

| By Order of the Board of Directors, |

| |

| Anthony J. Sirica |

| President and Chief Financial Officer |

| |

| New York, New York | |

| February 3, 2023 | |

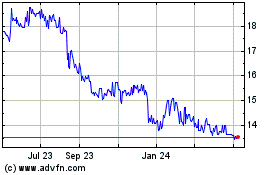

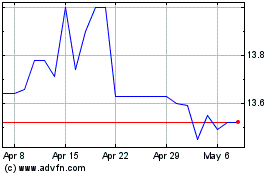

Ark Restaurants (NASDAQ:ARKR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ark Restaurants (NASDAQ:ARKR)

Historical Stock Chart

From Apr 2023 to Apr 2024