AerSale Announces Secondary Offering of Common Stock and Concurrent Share Repurchase

16 November 2022 - 9:22AM

Business Wire

AerSale Corporation (“AerSale”) (NASDAQ: ASLE), a leading

provider of aviation products and services, today announced that

certain of its stockholders, including affiliates of Leonard Green

& Partners, L.P. (the “Selling Stockholders”) intend to offer

for sale in an underwritten secondary offering (the “Offering”)

4,000,000 shares of common stock of AerSale pursuant to a shelf

registration statement on Form S-3 filed by AerSale with the U.S.

Securities and Exchange Commission (the “SEC”). The Selling

Stockholders expect to grant the underwriters a 30-day option to

purchase up to an additional 600,000 shares of common stock on the

same terms and conditions. No shares are being issued or sold by

AerSale. The Selling Stockholders will receive all of the proceeds

from the Offering.

Cowen, RBC Capital Markets, and Stifel are acting as joint

book-running managers and representatives of the underwriters for

the Offering. Truist Securities is also acting as joint

book-running manager for the Offering.

The Offering will be made only by means of a prospectus. Copies

of the preliminary prospectus may be obtained from: Cowen and

Company, LLC, Attn: Cowen and Company, LLC, c/o Broadridge

Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717,

Attn: Prospectus Department, by telephone: (833) 297-2926 or by

email: PostSaleManualRequests@broadridge.com; RBC Capital Markets,

LLC, Attention: Equity Capital Markets, 200 Vesey Street, New York,

NY 10281, by telephone at 877-822-4089 or by email at

equityprospectus@rbccm.com; or Stifel, Nicolaus & Company,

Incorporated, One South Street, 15th Floor, Baltimore, MD 21202,

Attention: Syndicate Department, email:

Syndprospectus@stifel.com.

In addition, the Company announced that it has entered into a

share repurchase agreement with the Selling Stockholders pursuant

to which it intends to purchase an aggregate of 1,500,000 shares of

Common Stock directly from the Selling Stockholders (the “Share

Repurchase”). The price per share to be paid by the Company will be

equal to the price per Share paid by the underwriters for the

Shares in the Offering. The Share Repurchase is expected to be

consummated concurrently with the closing of the Offering. Although

the Share Repurchase will be conditioned upon, among other things,

the closing of the Offering, the closing of the Offering will not

be conditioned upon the closing of the Share Repurchase.

A registration statement, including a prospectus, relating to

these securities has been declared effective by the SEC. This press

release does not constitute an offer to sell, or a solicitation of

an offer to buy, any securities, nor shall there be any sale of

securities in any state or jurisdiction in which such an offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

About AerSale AerSale serves a diverse customer base

operating large jets manufactured by Boeing, Airbus and McDonnell

Douglas and is dedicated to providing integrated aftermarket

services and products designed to help aircraft owners and

operators to realize significant savings in the operation,

maintenance and monetization of their aircraft, engines, and

components. AerSale’s offerings include: Aircraft & Component

MRO, Aircraft and Engine Sales and Leasing, Used Serviceable

Material sales, and internally developed ‘Engineered Solutions’ to

enhance aircraft performance, operating economics and satisfy FAA

mandates (e.g. AerSafe™, AerTrak™, and now AerAware™).

Forward Looking Statements This press release contains

forward-looking statements within the meaning of Section 27A of the

Securities Act and Section 21E of the Securities Exchange Act of

1934, as amended. These forward-looking statements are based on

AerSale’s current expectations and are not guarantees of future

performance. You can identify these forward-looking statements by

the use of words such as “believes,” “expects,” “potential,”

“continues,” “may,” “will,” “should,” “could,” “seeks,” “projects,”

“predicts,” “intends,” “plans,” “estimates,” “anticipates” or the

negative version of these words or other comparable words. The

forward-looking statements are subject to various risks,

uncertainties, assumptions or changes in circumstances that are

difficult to predict or quantify. Actual results may differ

materially from these expectations due to changes in global,

regional or local economic, business, competitive, market,

regulatory and other factors, many of which are beyond AerSale’s

control. Important factors that could cause actual results to

differ materially from those in the forward-looking statements are

set forth in AerSale’s filings with the SEC, its Annual Report on

Form 10-K for the fiscal year ended December 31, 2021, under the

caption “Risk Factors,” as may be updated from time to time in our

periodic filings with the SEC. Any forward-looking statement in

this press release speaks only as of the date of this release.

AerSale undertakes no obligation to publicly update or review any

forward-looking statement, whether as a result of new information,

future developments or otherwise, except as may be required by any

applicable securities laws.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221115006513/en/

Media inquiries: Jackie Carlon Telephone: (305) 764-3200

Email: media.relations@aersale.com

Investor inquiries: AersaleIR@icrinc.com

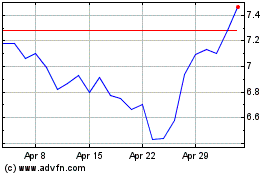

AerSale (NASDAQ:ASLE)

Historical Stock Chart

From Mar 2024 to Apr 2024

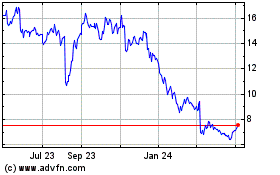

AerSale (NASDAQ:ASLE)

Historical Stock Chart

From Apr 2023 to Apr 2024