Amended Statement of Beneficial Ownership (sc 13d/a)

21 November 2022 - 10:01PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 4 to

SCHEDULE 13D

Under the Securities Exchange Act of 1934

AerSale Corporation

(formerly known as Monocle Acquisition Corporation)

(Name of Issuer)

Common Stock

(Title of Class of Securities)

00810F106

(CUSIP Number)

Mitchell Lampert, Esq.

Robinson & Cole, LLP

1055 Washington Blvd.

Stamford, Ct. 06901

(203) 462-7559

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

November 16, 2022

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G

to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f)

or 240.13d-1(g), check the following box. ☐

Note: Schedules filed in paper format shall include a signed

original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are to be sent.

| * | The

remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover

page. |

The information required on the remainder of this cover page shall

not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise

subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

| CUSIP No. 00810F106 |

13D |

Page 2 of 6 Pages |

| 1. |

NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

George P. Bauer Revocable Trust, dated 7/20/1990, a Connecticut trust |

|

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see instructions)

(a) ☐

(b) ☐ |

|

| 3. |

SEC USE ONLY

|

|

| 4. |

SOURCE OF FUNDS (see instructions)

PF |

|

| 5. |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEMS 2(d) or 2(e)

|

☐ |

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7. |

SOLE VOTING POWER *

3,392,344 shares |

| 8. |

SHARED VOTING POWER

0 shares |

| 9. |

SOLE DISPOSITIVE POWER *

3,392,344 shares |

| 10. |

SHARED DISPOSITIVE POWER

0 shares |

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

3,392,344* |

|

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

(see instructions)

|

☐ |

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

6.7% ** |

|

| 14. |

TYPE OF REPORTING PERSON (see instructions)

OO |

|

| * | The

number of shares over which the Reporting Person has sole voting and dispositive power includes (i) 2,125,000 shares of Common Stock

owned by the Reporting Person; (ii) 733,202 shares of Common Stock owned by the Reporting Person following the exercise of 1,972,566

warrants, on a cashless basis, at a warrant exercise price of $11.50 per share (the “Warrants”) by the Reporting Person;

(iii) 200,000 shares of Common Stock owned by the Reporting Person following acquisition in a secondary offering by certain AerSale stockholders;

and (iv) 334,142 shares of Common Stock owned by the Reporting Person following acquisition via a combination of purchases with personal

funds in the open market. |

| ** | Calculated

based on 50,274,665 shares of the common stock, $.0001 par value, of AerSale Corporation (“AerSale”) (formerly “Monocle

Acquisition Corporation”) outstanding, which assumes the closing of that certain repurchase of 1,500,000 shares of Common Stock

by AerSale (the “Repurchase Transaction”) announced on November 16, 2022, which Repurchase Transaction is expected to close

shortly thereafter. In the event the closing of the Repurchase Transaction does not occur, the percentage decreases to 6.6%,

which is calculated based on 51,774,665 shares of common stock, $.0001 par value, of AerSale outstanding as of November 8, 2022, as reported

in AerSale’s Quarterly Report on Form 10-Q filed with the SEC on November 9, 2022. |

|

CUSIP No. 00810F106 |

13D |

Page 3 of 6 Pages |

| 1. |

NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

George P. Bauer |

|

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see instructions)

(a) ☐

(b) ☐ |

|

| 3. |

SEC USE ONLY

|

|

| 4. |

SOURCE OF FUNDS (see instructions)

PF |

|

| 5. |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEMS 2(d) or 2(e)

|

☐ |

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7. |

SOLE VOTING POWER *

3,392,344 shares |

| 8. |

SHARED VOTING POWER

0 shares |

| 9. |

SOLE DISPOSITIVE POWER *

3,392,344 shares |

| 10. |

SHARED DISPOSITIVE POWER

0 shares |

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

3,392,344* |

|

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

(see instructions)

|

☐ |

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

6.7% ** |

|

| 14. |

TYPE OF REPORTING PERSON (see instructions)

IN |

|

| * | The

number of shares over which the Reporting Person has sole voting and dispositive power includes (i) 2,125,000 shares of Common Stock

owned by the Reporting Person; and (ii) 733,202 shares of Common Stock owned by the Reporting Person following the exercise of the Warrants,

on a cashless basis, at a warrant exercise price of $11.50 per share by the Reporting Person; (iii) 200,000 shares of Common Stock owned

by the Reporting Person following acquisition in a secondary offering by certain AerSale stockholders; and (iv) 334,142 shares of Common

Stock owned by the Reporting Person following acquisition via a combination of purchases with personal funds in the open market. |

| ** | Calculated

based on 50,274,665 shares of the common stock, $.0001 par value, of AerSale outstanding, which assumes the closing of the Repurchase

Transaction announced on November 16, 2022, which Repurchase Transaction is expected to close shortly thereafter. In the event

the closing of the Repurchase Transaction does not occur, the percentage decreases to 6.6%, which is calculated based on 51,774,665 shares

of common stock, $.0001 par value, of AerSale outstanding as of November 8, 2022, as reported in AerSale’s Quarterly Report on

Form 10-Q filed with the SEC on November 9, 2022. |

| CUSIP No. 00810F106 |

13D |

Page 4 of 6 Pages |

| Item 1. | Security

and Issuer. |

The securities to which this Amendment No. 4 to

Schedule 13D relates are shares of common stock, $.0001 par value per share (“Common Stock”), of AerSale Corporation (formerly

“Monocle Acquisition Corporation”), a Delaware corporation (the “Company”), and amends

and supplements the Schedule 13D filed with the Securities and Exchange Commission (the “SEC”) on December 22, 2020,

as amended by the Amendment No. 1 to Schedule 13D previously filed on September 29, 2021, and as further amended by the Amendment No.

2 to Schedule 13D previously filed on October 7, 2021, and as further amended by the Amendment No. 3 to Schedule 13D previously filed

on December 28, 2021. The Company’s Common Stock is listed on The NASDAQ Stock Market under the symbol “ASLE”

(formerly “MNCL”).

The address of the Company’s principal executive

office is 255 Alhambra Circle, Suite 435, Coral Gables, Florida 33134 (formerly 121 Alhambra Plaza, Suite 1700, Coral Gables, Florida

33134).

| Item 2. | Identity

and Background. |

(a)This

Schedule 13D is being filed by each of the following persons (collectively, the “Reporting Persons” and, individually, a “Reporting

Person”):

George P. Bauer Revocable Trust, dated 7/20/1990, a Connecticut

trust (the “Trust”); and

George P. Bauer (“Mr. Bauer”). Mr. Bauer is the

trustee and a beneficiary of the Trust.

| |

(b) |

The address of each Reporting Person is as follows: |

| |

For the Trust: |

George P. Bauer Revocable Trust, dated 7/20/1990 |

| |

|

c/o George P. Bauer, Trustee |

| |

|

499 Silvermine Road |

| |

|

New Canaan, CT 06840 |

| |

For Mr. Bauer: |

George P. Bauer |

| |

|

499 Silvermine Road |

| |

|

New Canaan, CT 06840 |

| |

(c) |

Present Principal Occupation or Employment: |

For the Trust: Not applicable

For Mr. Bauer: Investor

(d) The

Reporting Persons each have not, during the last five years, been convicted in a criminal proceeding (excluding traffic violations and

similar misdemeanors).

| CUSIP No. 00810F106 |

13D |

Page 5 of 6 Pages |

| |

(e) |

The Reporting Persons each have not, during the last five years, been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such a proceeding, been subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws. |

| |

(f) |

Citizenship/Place of Organization: |

For the Trust: Connecticut

For Mr. Bauer: United States

| Item 3. | Source

or Amount of Funds or Other Consideration. |

All shares of the Company’s Common Stock

and Warrants acquired by the Reporting Persons were acquired with personal funds.

| Item 4. | Purpose

of Transaction. |

The Reporting Persons acquired the shares of the

Company’s Common Stock and Warrants and currently hold the shares of the Company’s Common Stock, as described herein, for

investment purposes. The Reporting Persons believed that the shares of Common Stock and Warrants, when purchased, represented an attractive

investment opportunity.

The Reporting Persons do not have any plans or

proposals that relate to or would result in any of the actions specified in clauses (a) through (j) of Item 4 to Schedule 13D.

| Item 5. | Interest

in Securities of the Issuer. |

| |

(a) |

The Trust beneficially owns 3,392,344 shares of Common Stock of the Company, or approximately 6.7% of the total issued and outstanding shares of Common Stock of the Company. This total includes: (i) 2,125,000 shares of Common Stock owned by the Reporting Person; (ii) 733,202 shares of Common Stock owned by the Reporting Person following the exercise of the Warrants, on a cashless basis, by the Reporting Person; (iii) 200,000 shares of Common Stock owned by the Reporting Person following acquisition in a secondary offering by certain AerSale stockholders; and (iv) 334,142 shares of Common Stock owned by the Reporting Person following acquisition via a combination of purchases with personal funds in the open market. |

| |

(b) |

Mr. Bauer, as Trustee of the Trust, has the sole power to vote or direct the vote, and to dispose or direct the disposition, of 3,392,344 shares of the Company’s Common Stock owned by the Trust. |

| |

(c) |

Between February 3, 2022 and November 16, 2022, the Trust acquired 334,142 shares of Common Stock via a combination of purchases on the open market (the “Open Market Purchase”). The Open Market Purchase transactions by the Trust are set forth in Schedule A and are incorporated herein by reference. On August 29, 2022, the Trust acquired 200,000 shares of Common Stock in a secondary offering by certain AerSale stockholders at a price of $17.25 per share. On December 6, 2021, the Trust exercised 1,972,566 Warrants, on a cashless basis, at the warrant exercise price of $11.50. On September 29, September 30, October 1, October 4, and October 6, 2021, the Trust sold 10,764 Warrants, 143,256 Warrants, 87,619 Warrants, 560,109 Warrants and 348,110 Warrants on the open market at an average price of $6.15, $6.20, $6.25, $6.30 and $6.45 per warrant, respectively. On September 27 and September 28, 2021, the Trust sold 420,000 Warrants and 257,576 Warrants on the open market at an average price of $6.10 and $6.18 per warrant, respectively. There have been no other transactions in the shares of Common Stock effected by the Reporting Persons during the past 60 days. |

| |

(d) |

No person other than the Reporting Persons has the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, the shares of the Issuer’s Common Stock reported as being beneficially owned (or which may be deemed to be beneficially owned) by the Reporting Persons. |

| Item 6. | Contracts,

Arrangements, Understandings or Relationships with Respect to Securities of the Issuer. |

The Reporting Persons have no contracts, arrangements,

understandings or relationships with any other person with respect to any securities of the Issuer, other than as disclosed in the Subscription

Agreement.

| CUSIP No. 00810F106 |

|

13D |

|

Page 6 of 6 Pages |

SIGNATURE

After reasonable inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: November 18, 2022

George P. Bauer Revocable Trust,

dated 7/20/1990, a Connecticut

trust

| By: |

/s/ George P. Bauer |

|

| Name |

George P. Bauer |

|

| Title: |

Trustee |

|

| By: |

/s/ George P. Bauer |

|

| |

George P. Bauer |

|

CUSIP

No. 00810F106

SCHEDULE A

Transactions in the shares

of Common Stock

| Shares of Common Stock Purchased | | |

Price Per Share ($)(1) | | |

Date of Purchase |

| | 10,013 | | |

$ | 13.50 | (2) | |

02/03/2022 |

| | 16,575 | | |

$ | 14.32 | (3) | |

03/14/2022 |

| | 58,538 | | |

$ | 13.76 | (4) | |

05/10/2022 |

| | 57,363 | | |

$ | 13.55 | (5) | |

05/11/2022 |

| | 20,144 | | |

$ | 13.15 | (6) | |

06/16/2022 |

| | 5,800 | | |

$ | 17.50 | | |

07/15/2022 |

| | 34,200 | | |

$ | 16.04 | (7) | |

07/18/2022 |

| | 131,509 | | |

$ | 15.47 | (8) | |

11/16/2022 |

| 1 | The prices reported in this column are weighted average prices. |

| 2 | The shares were purchased in multiple transactions at prices

ranging from $13.45 to $13.50, inclusive. |

| 3 | The shares were purchased in multiple transactions at prices

ranging from $14.32 to $14.35, inclusive. |

| 4 | The shares were purchased in multiple transactions at prices

ranging from $13.45 to $14.00, inclusive. |

| 5 | The shares were purchased in multiple transactions at prices

ranging from $13.40 to $13.70, inclusive. |

| 6 | The shares were purchased in multiple transactions at prices

ranging from $13.02 to $13.15, inclusive. |

| 7 | The shares were purchased in multiple transactions at prices

ranging from $15.00 to $17.50, inclusive. |

| 8 | The shares were purchased in multiple transactions at prices

ranging from $15.40 to $15.53, inclusive. |

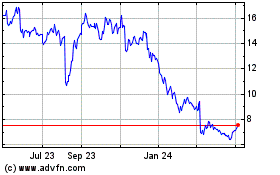

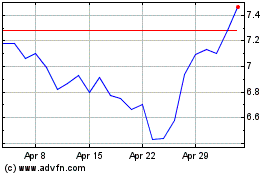

AerSale (NASDAQ:ASLE)

Historical Stock Chart

From Mar 2024 to Apr 2024

AerSale (NASDAQ:ASLE)

Historical Stock Chart

From Apr 2023 to Apr 2024