2022 Highlights

- Full year 2022 revenue of $408.5 million, up 20.0%

year-over-year.

- Full year 2022 GAAP net income of $43.9 million, or 10.7% of

sales, up 21.4% year-over-year.

- Full Year 2022 Adjusted Net Income of $63.6 million, or 15.5%

of sales.

- Adjusted EBITDA of $87.4 million or 21.4% of sales for the full

year 2022.

- Flight equipment sales included 12 aircraft, two airframes, and

15 engines during 2022.

- Up to 12 additional aircraft to be converted to freighters by

third parties, of which 9 are scheduled to become available for

sale or lease in 2023.

- Provides 2023 guidance: expects revenue in the range of $460 -

$490 million and adjusted EBITDA in the range of $70 - $80 million,

which excludes any potential AerAware sales1.

AerSale Corporation (Nasdaq: ASLE) (the “Company”) today

reported results for the fourth quarter and full year ended

December 31, 2022.

The Company’s revenue for the fourth quarter of 2022 was $95.1

million compared to $116.8 million in the fourth quarter of 2021.

Revenue for the fourth quarter of 2022 included $51.4 million of

flight equipment sales compared to $73.1 million of flight

equipment sales in the prior year period. Flight equipment sales in

the fourth quarter of 2022 consisted of six engines and three

aircraft, which included one AerSale converted passenger to

freighter (P2F) aircraft versus three aircraft and four engines in

the fourth quarter of 2021. The decline in sales was largely a

result of the pacing of flight equipment sales, which tend to occur

at irregular intervals throughout the year. As a reminder to

investors and as evidenced by the fluctuations that saw record

first and second quarters in 2022, the Company’s revenues will

fluctuate from quarter-to-quarter and year-to-year based on flight

equipment sales and therefore, progress should be monitored based

on asset purchases and related sales.

Asset Management Solutions (“Asset Management") revenue

decreased to $67.9 million during the fourth quarter of 2022

compared to $93.6 million in the fourth quarter of 2021, primarily

due to the pacing of flight equipment sales as mentioned above.

Excluding flight equipment sales, Asset Management revenue would

have been $16.5 million in the fourth quarter of 2022 compared to

$20.5 million in the prior year period. Lower Asset Management

revenue was partially offset by improved results from TechOps,

fueled by better performance from landing gear and aerostructure

maintenance, repair and overhaul (MRO), as well as increased

revenue from AerSale’s Goodyear on-airport MRO facility due to

additional capacity dedicated to customer aircraft.

AerSale continues to benefit from an ongoing recovery in the

commercial aerospace end markets which generated higher revenue

from MRO activities at AerSale’s Goodyear facility, which was

partially offset by lower revenue at the Company’s Roswell facility

due to fewer customer aircraft in storage programs compared to

prior periods. As previously mentioned, the Company sub-contracted

third-party providers at the beginning of the fourth quarter of

2022 to perform 12 757 P2F conversions initially planned to be

completed at AerSale’s Goodyear facility, enabling the Company to

increase capacity for third-party services.

Fourth quarter 2022 GAAP net income was $9.2 million versus

$11.2 million in the prior year period, mainly due to lower flight

equipment sales, which tend to have better margins.

AerSale recognized mark-to-market adjustment income of $1.4

million related to private warrant liability, $4.5 million of

stock-based compensation expenses within payroll expenses, $0.6

million in secondary offering costs, $0.8 million in facility

relocation costs, and a $1.7M gain on an aircraft insurance claim

during the fourth quarter of 2022. In the fourth quarter of 2021,

AerSale recognized an unrealized loss on investment of $5.4

million, a mark-to-market adjustment expense to warrant liability

of $0.2 million, $3.8 million of non-cash stock-based compensation

expense within payroll expenses, and $1.6 million in non-cash

inventory write-down recorded in the cost of products line.

Excluding these non-cash and unusual items adjusted for tax,

Adjusted Net Income was $12.3 million in the fourth quarter of 2022

versus Adjusted Net Income of $22.3 million in the fourth quarter

of 2021.

Diluted earnings per share was $0.17 for the fourth quarter of

2022 and $0.21 for the fourth quarter of 2021. Adjusted for the

non-cash and unusual items noted above, adjusted diluted earnings

per share was $0.23 for the fourth quarter of 2022 compared to

$0.41 for the fourth quarter of 2021. Please see the non-GAAP

reconciliation table at the end of this press release for

additional details on adjusted Net Income and adjusted diluted

earnings per share.

Fourth quarter 2022 adjusted EBITDA was $17.7 million, compared

to $28.6 million in the prior-year period. The drop in adjusted

EBITDA and margins reflected lower flight equipment sales, which

generally have higher margins. Please see the non-GAAP

reconciliation table at the end of this press release for

additional details on these amounts.

Cash used in operating activities was $0.1 million, primarily

due to the application of $18.0 million in customer deposits

associated with the sale of a 747 freighter aircraft that closed

during 2022, for which the sale proceeds are reflected under

investment activities. AerSale continued its investment in the 757

P2F conversion program, which is largely the driver of the $13.3

million increase in advance vendor payments, as well as investing

an additional $37.6 million to increase inventory available for

sale. AerSale ended the year with $147.2 million of cash and has an

undrawn $150 million credit facility.

Nicolas Finazzo, AerSale’s Chief Executive Officer, commented,

“We delivered another year of excellent performance driven by

strong execution and the broad success of our 757 P2F freighter

conversion program. While our results were unevenly distributed

throughout the year, our full-year results came in within our

expected range and marked a record result for the Company. As we

look forward to 2023, we anticipate the 757 P2F program to again be

a strong contributor, and we will continue to benefit from an

improving backdrop in commercial aerospace.”

Finazzo added, “We are also in the final stages of obtaining a

Supplemental Type Certificate (“STC”) from the FAA for our Enhanced

Flight Vision System “AerAware” with FAA certification flight

testing already in progress. This marks a significant milestone in

a multi-year period of product development, and we expect this

technology to become a meaningful contributor to our long-term

performance. AerAware offers substantial safety and efficiency

benefits to airline operators with an attractive ROI, and we

believe these attributes will lead this innovative enhanced flight

vision technology to be broadly adopted over the long-term.”

Update on AerAware Depending on the complexity of the

modification, the FAA requires that it observe flight testing of

new products incorporated into FAA type certificated aircraft. In

the case of AerAware, the FAA has scheduled five different sets of

demonstration flight tests that began in February and will continue

into April. AerSale has successfully completed the first two sets

of flight tests, with the third and fourth sets scheduled in March,

and the fifth set expected in April. All flight tests are subject

to changes due to FAA staffing and weather. Upon successful

completion of flight testing, it is typical to receive an STC

within 30 days.

Fourth Quarter 2022 Results of Operations AerSale

reported revenue of $95.1 million in the fourth quarter of 2022,

which included $51.4 million of flight equipment sales consisting

of six engines and three aircraft, which included one 757 P2F

converted aircraft. The Company’s revenue for the fourth quarter of

2021 was $116.8 million and included $73.1 million of flight

equipment sales consisting of three aircraft and four engines.

Excluding flight equipment sales, revenue would have been $43.7

million in the fourth quarter of 2022 and 2021. The delivery of one

757 P2F AerSale converted aircraft, which was initially forecasted

to close during the third quarter of 2022, was delivered at the

beginning of the fourth quarter. Again, flight equipment sales may

significantly vary quarter-to-quarter, and AerSale believes

full-year analysis, rather than year-over-year quarterly

comparisons is a more appropriate measurement of the Company’s

progress.

Asset Management revenue fell 27.4% to $67.9 million in the

fourth quarter of 2022 on account of lower flight equipment sales.

Leasing revenue for the fourth quarter of 2022 decreased as a

result of expected reductions in the number of aircraft in the

leasing portfolio. Fourth quarter 2022 Used Serviceable Material

(“USM”) parts sales were similar to the year ago quarter levels.

Asset Management revenue would have been $16.5 million in the

fourth quarter of 2022 compared to $20.5 million in the prior year

period excluding flight equipment sales.

Technical Operations (“TechOps”) revenue was $27.1 million in

the fourth quarter of 2022, an improvement of 17.2% compared to the

fourth quarter of 2021, which was largely due to better performance

from our landing gear facility and the AerSale’s Goodyear MRO.

Revenue growth from the Goodyear facility was offset by lower

revenue at the Company’s Roswell facility due to fewer customer

aircraft in storage as compared to prior periods.

Gross margin was 36.0% in the fourth quarter of 2022 compared to

37.8% in the year ago period on account of the sales mix across

both the operating segments of AerSale.

Selling, general and administrative expenses were $25.1 million

in the fourth quarter of 2022 compared to $24.4 million in the

fourth quarter of 2021. Payroll expenses were higher and AerSale

incurred $4.5 million of stock-based compensation expenses in the

fourth quarter of 2022, compared to $3.8 million in the fourth

quarter of 2021.

Income from operations was $9.1 million in the fourth quarter of

2022 and $19.8 million in the fourth quarter of 2021.

Income tax expense was $4.1 million in the fourth quarter of

2022 and $2.9 million in the fourth quarter of 2021.

GAAP net income was $9.2 million in the fourth quarter of 2022

compared to $11.2 million in fourth quarter of 2021.

Adjusted for stock-based compensation, inventory write-down,

mark-to-market adjustment to the private warrant liability, gain an

aircraft insurance claim, secondary offering and facility

relocation costs, Adjusted Net Income was $12.3 million in the

fourth quarter of 2022 versus $22.3 million in the fourth quarter

of 2021. Diluted earnings per share was $0.17 for the fourth

quarter of 2022 and $0.21 in the fourth quarter of 2021. Adjusted

for the above-mentioned non-cash and unusual items, adjusted

diluted earnings per share was $0.23 for the fourth quarter of 2022

and $0.41 for the fourth quarter of 2022.

Adjusted EBITDA in the fourth quarter of 2022 was $17.7 million,

compared to $28.6 million in the fourth quarter of 2021. The

decline in adjusted EBITDA and related margins was mainly on

account of lower flight equipment sales, which generally produce

higher margins. AerSale did not receive Payroll Support Program

proceeds during the fourth quarter of 2021 or 2022.

Full Year 2022 Results of Operations For the full year

2022, AerSale reported consolidated revenue of $408.5 million, an

increase of 20.0% from $340.4 million for full year 2021. Full year

2022 included flight equipment sales of $222.5 million consisting

of 12 aircraft, two airframes, and 15 engines. Flight equipment

sales were $156.9 million in the full year 2021 consisting of nine

aircraft, two airframes, and 10 engines.

AerSale has contracted for 12 additional 757 P2F conversions

from multiple providers, resulting in the 757 P2F program being

extended into 2024.

Asset Management revenue was $277.6 million in full year 2022,

up 19.7% from $232.0 million in full year 2021 largely due to

higher flight equipment sales, partially offset by lower leasing

volume. Asset Management parts business benefitted from growing

demand for airframe and engine parts as airlines expand their USM

parts consumption. AerSale expects USM sales to improve as the

availability of feedstock improves.

Revenue from TechOps was 20.8% higher at $130.9 million in 2022

and was led by the Engineered Solutions’ sale of the AerAware

dedicated 737NG aircraft, which was partially offset by lower heavy

MRO activities due to reduced storage related maintenance activity

in Roswell. The Company expects to benefit from a pickup in MRO

volume due to the ongoing recommissioning of commercial aircraft

and greater demand for USM parts consumption for overhaul

activity.

Gross margin was 37.1% in 2022 compared to 35.1% in 2021, which

was primarily driven by higher flight equipment sales.

Selling, general and administrative expenses were $96.3 million

in 2022 compared to $77.5 million in 2021. While payroll expenses

increased in 2022, selling, general and administrative expenses in

2021 reflects the benefit of $14.8 million in Payroll Support

Program proceeds. There was no such corresponding benefit in 2022.

The Company incurred $16.5 million of non-cash stock-based

compensation within payroll expenses in 2022, compared to $12.7

million in 2021.

Income from operations was $55.0 million in 2022, up from $56.7

million in 2021.

Income tax expense was $14.0 million in 2022 compared to $11.7

million in 2021.

GAAP net income was $43.9 million in 2022 compared to $36.1

million in 2021. Adjusted for stock-based compensation, inventory

write-down, impairment of flight equipment, mark-to-market

adjustment to the private warrant liability, and secondary offering

and facility relocation costs as well as the gain on an aircraft

insurance claim, Adjusted Net Income was $63.6 million in 2022 and

in 2021.

Adjusted EBITDA for 2022 was $87.4 million, or 21.4% of sales,

compared to adjusted EBITDA of $89.3 million, or 26.1% of sales, in

2021. Adjusted EBITDA benefitted from $14.8 million in Payroll

Support Program proceeds during 2021, while there was no such

corresponding benefit in 2022.

Martin Garmendia, AerSale’s Chief Financial Officer, said:

“Aside from the variability in the timing of flight equipment

sales, the business has continued to gain strong traction and the

underlying momentum remains on a robust growth trajectory. With a

strong balance sheet and liquidity, we are well positioned to

capitalize on increasing flight equipment feedstock availability,

as well as other internal and external opportunities in order to

continue generating high returns going forward.”

2023 Guidance AerSale expects revenue of $460 to $490

million and adjusted EBITDA of $70 - $80 million in 2023. This

guidance reflects the Company’s expected whole asset sales during

the year and anticipated volume in its ongoing operations. Guidance

for 2023 does not reflect potential sales of AerAware as the

product is in its final stages of approval and will be updated once

the STC is issued and the Company can assess initial order and

delivery schedules.

Conference Call Information The Company will host a

conference call today, March 6, 2023 at 4:30 pm Eastern Time to

discuss these results. A live webcast will also be available at

https://ir.aersale.com/news-events/events. Participants may access

the call at 1-877-407-3982, international callers may use

1-201-493-6780, and request to join the AerSale Corporation

earnings call.

A telephonic replay will be available shortly after the

conclusion of the call and until March 20, 2023. Participants may

access the replay at 1-844-512-2921, international callers may use

1-412-317-6671, and enter access code 13735594. An archived replay

of the call will also be available on the Investors portion of the

AerSale website at https://ir.aersale.com/.

Non-GAAP Financial Measures This press release includes

non-GAAP financial measures, including adjusted EBITDA, adjusted

Net Income, and adjusted diluted Earnings per Share. AerSale

defines adjusted EBITDA as net income (loss) after giving effect to

interest expense, depreciation and amortization, income tax expense

(benefit), and other non-recurring or unusual items. Adjusted Net

Income is defined as net income (loss) after giving effect to

mark-to-market adjustments relating to our Private Warrants,

stock-based compensation expense and other non-recurring or unusual

items. Adjusted diluted earnings per share also exclude these

material non-recurring or unusual items.

AerSale believes these non-GAAP measures of financial results

provide useful information to management and investors regarding

certain financial and business trends relating to AerSale’s

financial condition and results of operations. AerSale’s management

uses certain of these non-GAAP measures to compare AerSale’s

performance to that of prior periods for trend analyses and for

budgeting and planning purposes. These non- GAAP measures should

not be construed as an alternative to net income or net income

margin as an indicator of operating performance or as an

alternative to cash flow provided by operating activities as a

measure of liquidity (each as determined in accordance with

GAAP).

You should review AerSale’s audited financial statements, and

not rely on any single financial measure to evaluate AerSale’s

business. Other companies may calculate adjusted EBITDA, adjusted

Net Income, or Adjusted diluted earnings per share differently, and

therefore AerSale’s adjusted EBITDA, adjusted Net Income, or

adjusted diluted earnings per share measures may not be directly

comparable to similarly titled measures of other companies.

Reconciliations of Net Income, the Company’s closest GAAP

measure, to adjusted EBITDA, adjusted Net Income, and adjusted

diluted earnings per share, are outlined in the tables below

following the Company’s condensed consolidated financial

statements.

Fourth Quarter and Full Year 2022 Financial Results

AERSALE CORPORATION

CONSOLIDATED BALANCE SHEET

(in thousands, except per share

data)

December 31,

December 31,

2022

2021

Current assets:

Cash and cash equivalents

$

147,188

$

130,188

Accounts receivable, net of allowance for

doubtful accounts of $1,074 and $1,692 as of December 31, 2022 and

December 31, 2021

28,273

29,350

Inventory:

Aircraft, airframes, engines, and parts,

net

117,488

81,759

Advance vendor payments

27,585

14,287

Deposits, prepaid expenses, and other

current assets

13,022

15,945

Total current assets

333,556

271,529

Fixed assets:

Aircraft and engines held for lease,

net

31,288

73,364

Property and equipment, net

12,638

7,350

Inventory:

Aircraft, airframes, engines, and parts,

net

66,042

77,534

Operating lease right-of-use assets

31,624

-

Deferred income taxes

11,287

10,013

Deferred financing costs, net

544

999

Deferred customer incentives and other

assets, net

628

598

Goodwill

19,860

19,860

Other intangible assets, net

24,112

26,238

Total assets

$

531,579

$

487,485

Current liabilities:

Accounts payable

$

21,131

$

19,967

Accrued expenses

8,843

8,424

Income tax payable

-

3,443

Lessee and customer purchase deposits

17,085

33,212

Current operating lease liabilities

4,426

-

Deferred revenue

1,355

2,860

Total current liabilities

52,840

67,906

Long-term lease deposits

152

2,053

Long-term operating lease liabilities

28,283

-

Maintenance deposit payments and other

liabilities

668

3,403

Deferred income taxes, net

-

1,113

Warrant liability

4,656

4,131

Total liabilities

86,599

78,606

Commitments and contingencies

Stockholders’ equity:

Common stock, $0.0001 par value.

Authorized 200,000,000 shares; issued and outstanding 51,189,461

and 51,673,099 shares as of December 31, 2022 and 2021,

respectively

5

5

Additional paid-in capital

306,141

313,901

Retained earnings

138,834

94,973

Total stockholders' equity

444,980

408,879

Total liabilities and stockholders’

equity

$

531,579

$

487,485

AERSALE CORPORATION

CONSOLIDATED STATEMENTS OF

OPERATIONS

(in thousands, except per share

data)

(Unaudited)

Years ended December

31,

2022

2021

2020

Revenue:

Products

$

284,554

$

209,881

$

49,390

Leasing

28,732

30,657

55,649

Services

95,258

99,899

103,899

Total revenue

408,544

340,437

208,938

Cost of sales and operating expenses:

Cost of products

176,074

139,475

49,890

Cost of leasing

6,929

9,804

24,244

Cost of services

74,147

71,766

82,015

Total cost of sales

257,150

221,045

156,149

Gross profit

151,394

119,392

52,789

Selling, general, and administrative

expenses

96,348

77,498

55,635

Payroll support program proceeds

-

(14,768

)

(12,693

)

Transaction costs recovered

-

-

(1,436

)

Income from operations

55,046

56,662

11,283

Other income (expenses):

Interest income (expense), net

1,093

(980

)

(1,645

)

Other income, net

2,268

458

494

Unrealized loss on investment

-

(5,421

)

-

Change in fair value of warrant

liability

(525

)

(2,945

)

(388

)

Total other income (expenses)

2,836

(8,888

)

(1,539

)

Income before income tax provision

57,882

47,774

9,744

Income tax expense

(14,021

)

(11,659

)

(1,650

)

Net income

43,861

36,115

8,094

Earnings per share - basic

$

0.85

$

0.84

$

7.85

Earnings per share - diluted

$

0.83

$

0.76

$

7.39

AERSALE CORPORATION

CONSOLIDATED STATEMENTS OF CASH

FLOWS

(in thousands)

(Unaudited)

Years ended December

31,

2022

2021

2020

Cash flows from operating activities:

Net income

$

43,861

$

36,115

$

8,094

Adjustments to reconcile net income to net

cash (used in) provided by operating activities:

Depreciation and amortization

10,984

12,998

24,223

Amortization of debt issuance costs

455

494

740

Amortization of operating lease assets

873

-

-

Inventory reserve

2,376

6,942

13,651

Impairment of aircraft held for lease

857

-

3,036

Provision for doubtful accounts

(395

)

212

212

Deferred income taxes

(2,387

)

(3,192

)

22

Change in fair value of warrant

liability

525

2,945

388

Share-based compensation

16,498

12,721

1,042

Loss on related party investment

-

5,421

-

Gain on legal settlement

(1,695

)

-

-

Changes in operating assets and

liabilities:

Accounts receivable

(1,029

)

(3,342

)

9,919

Inventory

(37,637

)

(35,672

)

(55,275

)

Deposits, prepaid expenses, and other

current assets

2,923

12,685

(9,132

)

Deferred customer incentives and other

assets

893

(333

)

56

Advance vendor payments

(13,298

)

(8,090

)

(2,958

)

Accounts payable

1,164

3,603

(801

)

Income tax payable

(3,443

)

2,157

1,324

Accrued expenses

417

(1,280

)

(1,697

)

Deferred revenue

(1,505

)

265

(5,894

)

Lessee and customer purchase deposits

(18,027

)

34,690

1,776

Other liabilities

(2,523

)

(260

)

(957

)

Net cash (used in) provided by operating

activities

(113

)

79,079

(12,231

)

Cash flows from investing activities:

Business acquisition

-

-

(16,976

)

Proceeds from sale of assets

52,771

17,095

3,100

Proceeds from legal settlement, net

4,195

-

-

Acquisition of aircraft and engines held

for lease, including capitalized cost

(7,133

)

(2,383

)

(5,128

)

Purchase of property and equipment

(8,462

)

(1,508

)

(2,137

)

Net cash provided by (used in) investing

activities

41,371

13,204

(21,141

)

Cash flows from financing activities:

Repayments of 8% Senior Secured Notes

-

-

(3,424

)

Proceeds from Revolving Credit

Facility

-

-

96,726

Repayments of Revolving Credit

Facility

-

-

(96,726

)

Purchase of treasury stock

(22,204

)

-

-

Cash paid for employee taxes on

withholding shares

-

(694

)

-

Taxes paid related to net share settlement

of equity awards

(2,592

)

-

-

Proceeds from exercise of warrants

-

9,282

-

Proceeds from the issuance of Employee

Stock Purchase Plan shares

538

-

-

Proceeds from Merger

-

-

48,608

Net cash (used in) provided by financing

activities

(24,258

)

8,588

45,184

Increase in cash and cash equivalents

17,000

100,871

11,812

Cash and cash equivalents, beginning of

period

130,188

29,317

17,505

Cash and cash equivalents, end of

period

$

147,188

$

130,188

$

29,317

Supplemental disclosure of cash

activities

Income taxes paid

21,489

8,340

2,650

Interest paid

573

595

855

Supplemental disclosure of noncash

investing activities

Reclassification of aircraft and aircraft

engines inventory (from) to aircraft and engine held for lease,

net

(25,803

)

(7,002

)

6,228

Reclassification of customer purchase

deposits to sale of assets

12,500

-

-

Reclassification of amounts due from

related party to investments

-

5,421

-

AERSALE CORPORATION

Adjusted EBITDA, Net Income and

Diluted EPS Reconciliation Table (In ‘000s)

(Unaudited)

Three months ended December

31,

Twelve months ended December

31,

2022

% of Total Revenue

2021

% of Total Revenue

2022

% of Total Revenue

2021

% of Total Revenue

Reported Net Income

9,193

9.7

%

11,185

9.6

%

43,861

10.7

%

36,115

10.6

%

Addbacks:

Change in FV of Warrant Liability

(1,356

)

(1.4

%)

210

0.2

%

525

0.00

2,945

0.9

%

Stock-based Compensation

4,470

4.7

%

3,822

3.3

%

16,498

0.04

12,721

3.7

%

Payroll taxes related to stock-based

compensation

250

0.3

%

-

0.0

%

250

0.00

-

0.0

%

Inventory Write-down

-

0.0

%

1,640

1.4

%

1,845

0.00

6,416

1.9

%

Unrealized loss on investment

-

0.0

%

5,421

4.6

%

-

-

5,421

1.6

%

Impairment in Flight Equipment

-

0.0

%

-

0.0

%

857

0.00

-

0.0

%

Secondary Offering Costs

579

0.6

%

-

0.0

%

579

0.1

%

-

0.0

%

Relocation Costs

804

0.8

%

-

0.0

%

804

0.2

%

-

0.0

%

Gain on legal settlement

(1,695

)

(1.8

%)

-

0.0

%

(1,695

)

(0.4

%)

-

0.0

%

Income Tax Effect of Adjusting Items

(1)

96

0.1

%

-

0.0

%

76

0.0

%

-

0.0

%

Adjusted Net Income

12,341

12.9

%

22,278

19.1

%

63,600

15.5

%

63,618

18.6

%

Interest Expense

(1,078

)

(1.1

%)

230

0.2

%

(1,093

)

(0.3

%)

980

0.3

%

Income Tax Expense (Benefit)

4,108

4.3

%

2,922

2.5

%

14,021

3.4

%

11,659

3.4

%

Depreciation and Amortization

2,395

2.5

%

3,130

2.7

%

10,984

2.7

%

12,998

3.8

%

Reversal of Income Tax Effect of Adjusting

Items (1)

(96

)

(0.1

%)

-

0.0

%

(76

)

(0.0

%)

-

0.0

%

Adjusted EBITDA

17,670

18.6

%

28,561

24.5

%

87,436

21.4

%

89,255

26.1

%

Reported Basic earnings per

share

0.18

0.24

0.85

0.84

Addbacks:

Change in fair value of warrant

liability

(0.03

)

0.00

0.01

0.07

Stock-based compensation

0.09

0.08

0.32

0.29

Inventory Write-down

-

0.04

0.04

0.15

Unrealized loss on investment

-

0.12

-

0.13

Secondary Offering Costs

0.01

-

0.01

-

Relocation Costs

0.02

-

0.02

-

Gain on legal settlement

(0.03

)

Income Tax Effect of Adjusting Items

0.00

-

0.00

-

Adjusted Basic earnings per

share

0.24

0.49

1.24

1.48

Reported Diluted earnings per

share

0.17

0.21

0.83

0.76

Addbacks:

Change in FV of warrant liability

(0.03

)

0.00

0.01

0.06

Stock-based compensation

0.08

0.07

0.31

0.27

Inventory Write-down

-

0.03

0.03

0.14

Impairment in Flight Equipment

-

0.10

-

0.11

Secondary Offering Costs

0.01

-

0.01

-

Relocation Costs

0.02

-

0.02

-

Gain on legal settlement

(0.03

)

Income Tax Effect of Adjusting Items

0.00

-

0.00

-

Adjusted Diluted earnings per

share

0.23

0.41

1.20

1.34

Forward Looking Statements

This press release includes “forward-looking statements”. We

intend such forward-looking statements to be covered by the safe

harbor provisions for forward-looking statements contained in

Section 27A of the Securities Act of 1933, as amended (the

“Securities Act”), and Section 21E of the Securities Exchange Act

of 1934, as amended (the “Exchange Act”). All statements other than

statements of historical facts contained in this press release may

constitute forward-looking statements, and include, but are not

limited to, statements regarding our anticipated financial

performance, including all statements set forth in the “2023

Guidance” section above such as expectations of revenue in the

range of $460 - $490 million and adjusted EBITDA in the range of

$70 - $80 million; our expectations that up to twelve additional

aircraft will be converted to freighters by third parties; the

anticipation that the 757 P2F conversion program is expected to be

a strong contributor to the Company; anticipations regarding an

increasingly favorable market for feedstock availability within

AerSale’s USM business and greater demand for USM parts;

expectations regarding feedstock, and our belief that we are

extremely well positioned to take advantage of the current market

dynamic; our belief that we are well positioned to take advantage

of asset availability; our growth trajectory; the expected

operating capacity of our MRO facilities and demand for such

services; expectations of increased capacity for third party work

and revenue at our Goodyear, AZ facility; the anticipated receipt

and typical timeline of receipt from the FAA of an STC for our

AerAware product; expectation that AerAware is a technology that

will be broadly adopted and that sales of AerAware will be a

meaningful contributor to long-term performance; and expected

benefits from an improving backdrop in commercial aerospace, and

end markets; AerSale’s actual results may differ from their

expectations, estimates and projections and consequently, you

should not rely on these forward-looking statements as predictions

of future events. Words such as “expect,” “estimate,” “project,”

“budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,”

“will,” “could,” “should,” “believes,” “predicts,” “potential,”

“continue,” or the negative of these or other similar expressions

are intended to identify such forward-looking statements. The

forward-looking statements in this press release are only

predictions. We have based these forward-looking statements largely

on our current expectations and projections about future events and

financial trends that we believe may affect our business, financial

condition and results of operations. You should carefully consider

the foregoing factors and the other risks and uncertainties

described in the Risk Factors, Management’s Discussion and Analysis

of Financial Condition and Results of Operations sections of the

Company's most recent Annual Report on Form 10-K filed with the

Securities and Exchange Commission ("SEC"), and its other filings

with the SEC, including its subsequent quarterly reports on Form

10-Q. These filings identify and address other important risks and

uncertainties that could cause actual events and results to differ

materially from those contained in the forward-looking statements.

Moreover, we operate in an evolving environment. New risk factors

and uncertainties may emerge from time to time, and it is not

possible for management to predict all risk factors and

uncertainties.

Forward-looking statements speak only as of the date they are

made. Readers are cautioned not to put undue reliance on

forward-looking statements and we qualify all of our

forward-looking statements by these cautionary statements. Except

as required by applicable law, we do not plan to publicly update or

revise any forward-looking statements contained herein, whether as

a result of any new information, future events, changed

circumstances or otherwise.

About AerSale AerSale serves airlines operating large

jets manufactured by Boeing, Airbus and McDonnell Douglas and is

dedicated to providing integrated aftermarket services and products

designed to help aircraft owners and operators to realize

significant savings in the operation, maintenance and monetization

of their aircraft, engines, and components. AerSale’s offerings

include: Aircraft & Component MRO, Aircraft and Engine Sales

and Leasing, Used Serviceable Material sales, and internally

developed ‘Engineered Solutions’ to enhance aircraft performance

and operating economics (e.g. AerSafe™, AerTrak™, and now

AerAware™).

For more information about AerSale, please visit our website:

www.AerSale.com. Follow us on: LinkedIn | Twitter | Facebook |

Instagram

____________________________ 1 A reconciliation of non-GAAP

adjusted EBITDA guidance to net (loss) income, the most directly

comparable GAAP (Generally Accepted Accounting Principles) measure,

has not been provided due to the lack of predictability regarding

the various reconciling items such as the provision for income

taxes and depreciation and amortization, which are expected to have

a material impact on these measures and cannot be reasonably

predicted without unreasonable efforts.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230306005749/en/

Media: AerSale: Jackie Carlon (305) 764-3200

media.relations@aersale.com

Investors: AerSale: AersaleIR@icrinc.com

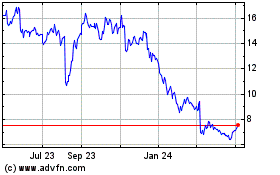

AerSale (NASDAQ:ASLE)

Historical Stock Chart

From Mar 2024 to Apr 2024

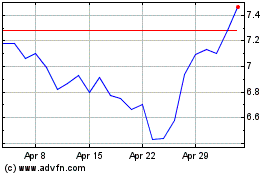

AerSale (NASDAQ:ASLE)

Historical Stock Chart

From Apr 2023 to Apr 2024