Assembly Biosciences Reports Third Quarter 2021 Financial Results and Recent Highlights

05 November 2021 - 7:05AM

Assembly Biosciences, Inc. (Nasdaq: ASMB), a clinical-stage

biotechnology company developing innovative therapeutics targeting

hepatitis B virus (HBV), today reported financial results and

recent highlights for the third quarter ended September 30, 2021.

John McHutchison, AO, MD, chief executive officer and president

of Assembly Bio, said, “We are excited to advance our latest

core inhibitor ABI-4334, with a potential best-in-class profile,

and we are working quickly and diligently to move this candidate

into clinical development as soon as possible next year. In

parallel, we have expanded evaluation of triple combination

regimens to treat HBV, which include the potential backbone therapy

of our lead investigational core inhibitor candidate vebicorvir

(VBR) plus standard-of-care nucleos(t)ide reverse transcriptase

inhibitor (Nrtl) therapy together with an additional complementary

mechanism. Our two ongoing Phase 2 studies include interferon

(peg-IFNα) and Arbutus’ RNAi therapeutic candidate, and we look

forward to initiating a third Phase 2, all-oral triple combination

cohort with Antios’ ASPIN, ATI-2173. We anticipate initial data

from all three of these studies during 2022. Meanwhile, we are

pleased to feature our science and portfolio at scientific and

clinical meetings, demonstrating our commitment to pursuing finite

and curative therapies for the more than a quarter of a billion

individuals living with chronic HBV infection worldwide.”

Recent Updates

- ABI-4334, a next-generation core inhibitor candidate that has

been optimized for potency against the formation of cccDNA, was

selected for advancement into clinical development. The company is

conducting preclinical work, with the aim of completing regulatory

filings and initiating a clinical study as soon as possible in

2022.

- Enrollment and dosing continue in two Phase 2 triple

combination studies evaluating Assembly Bio’s lead core inhibitor

candidate, VBR + Nrtl therapy along with Arbutus Biopharma’s RNAi

therapeutic candidate, AB-729, and separately with peg-IFNα.

- A clinical collaboration agreement was announced with Antios

Therapeutics to evaluate a triple combination of VBR + NrtI and

ATI-2173, Antios’ investigational proprietary active site

polymerase inhibitor nucleotide (ASPIN) in a ten patient

cohort.

- Further development of ABI-H2158 (2158) was discontinued

following the observation of elevated alanine aminotransferase

(ALT) levels consistent with drug-induced hepatotoxicity in a Phase

2 trial. The decision reflects the company’s strategy of advancing

the candidates that exhibit the strongest safety and efficacy

profiles for later-stage clinical studies.

- William Delaney, PhD, chief scientific officer, highlighted

Assembly Bio’s approach and core inhibitor portfolio during recent

scientific conferences focused on HBV.

- Participated in a round-table discussion during ICE-HBV: HBV

Cure: The Mechanisms Behind Combination Therapies

- Presented on the “Discovery and Development of Novel Inhibitors

of HBV Core Protein for the Treatment for Chronic Hepatitis B”

during The Science of HBV Cure Meeting 2021

Anticipated Milestones and Events

- Interim on-treatment data from triple combination studies with

VBR + NrtI, and complementary mechanisms RNAi and peg-IFNα

anticipated during 2022

- Initiate triple combination cohort with VBR + NrtI and ATI-2173

in H1 2022 with 12-week on-treatment data expected by year-end

2022

- Initiate Phase 1b study in ABI-H3733 in 2022

- Complete regulatory filings for ABI-4334 and initiate clinical

development during 2022

Upcoming Conferences

- Three abstracts, including one late-breaking submission, will

be presented at the annual meeting of the American Association for

the Study of Liver Diseases (AASLD), The Liver Meeting Digital

Experience™ (TLMdX), being hosted virtually November 12-15,

2021

- Luisa Stamm, MD, PhD, chief medical officer, will present

during the International Workshop on HBV Cure 2021, November 10,

2021 at 11 am ET

- Jefferies London Healthcare Conference. A webcast of the

fireside chat will be available in the “Events and Presentations”

page in the “Investors” section of the company’s website at

www.assemblybio.com on November 18, 2021 at 8:00 am GMT

- William Delaney, PhD, chief scientific officer, will present

“Development of HBV Core Inhibitors for the treatment of Chronic

Hepatitis B Infection” during HEP DART 2021, December 7, 2021

at 5:45 - 7:30 pm MST

Third Quarter 2021 Financial Results

- Cash, cash equivalents and marketable

securities were $190.1 million as of September 30,

2021, compared to $199.1 million as of June 30, 2021. This result

includes the $10.1 million of net proceeds from the issuance of

common shares under Assembly Bio’s at-the-market (ATM) program. The

company’s cash position is projected to fund operations into the

second half of 2023.

- Revenues from collaborative research were

$6.3 million for the three months ended September 30, 2021,

compared to $34.6 million for the same period in 2020. Revenue for

the three months ended September 30, 2021, consists of deferred

revenue allocated to 2158 under the collaboration agreement with

BeiGene following the announcement that Assembly Bio discontinued

development of the candidate. The decrease year-over-year is due to

the recognition of the amount allocated to VBR as revenue in Q3

2020 upon entering into the BeiGene agreement as well as the

termination of the microbiome collaboration agreement with Allergan

following AbbVie Inc.’s acquisition of Allergan. In Q1 2021

Assembly Bio completed the wind-down of its microbiome

program.

- Research and development expenses were

$18.5 million for the three months ended September 30, 2021,

compared to $26.9 million for the same period in 2020. The decrease

is primarily due to a decrease of $8.3 million related to the

wind-down of the microbiome program. Research and development

expenses include non-cash stock-based compensation expenses of $1.1

million for the three months ended September 30, 2021, and $2.8

million for the same period in 2020. The decrease is primarily due

to a decrease in the fair value of equity grants as well as a

decrease in headcount and outstanding awards resulting from the

wind-down of the microbiome program.

- General and administrative expenses were

$6.7 million for the three months ended September 30, 2021,

compared to $11.7 million for the same period in 2020. General and

administrative expenses include non-cash stock-based compensation

expenses of $0.5 million for the three months ended September 30,

2021, and $3.3 million for the same period in 2020. The decrease is

due to a decrease in the fair value of equity grants as well as a

reversal of previously recognized expenses related to the forfeited

awards to a former officer.

- Net loss attributable to common

stockholders was $18.8 million, or $0.41 per basic

and diluted share, for the three months ended September 30, 2021,

compared to $3.3 million, or $0.09 per basic and diluted share, for

the same period in 2020. The increase was due to less revenue being

recognized under the company’s collaboration agreements to offset

expenses in 2021.

About Assembly BiosciencesAssembly Bio is

a clinical-stage biotechnology company committed to bringing finite

and curative therapies to the 270 million people living with

hepatitis B virus (HBV) worldwide. A pioneer in the development of

a new class of potent, oral core inhibitor drug candidates,

Assembly Bio’s approach aims to break the complex viral replication

cycle of HBV to free patients from a lifetime of therapy. Assembly

Bio’s strategy toward cure includes a leading portfolio of more

potent, next-generation core inhibitors, proof-of-concept

combination studies and a research program focused on the discovery

of novel HBV targets. For more information,

visit assemblybio.com.

Forward-Looking StatementsThe information in

this press release contains forward-looking statements that are

subject to certain risks and uncertainties that could cause actual

results to materially differ. These risks and uncertainties

include: Assembly Bio’s ability to initiate and complete

clinical studies involving its HBV therapeutic product candidates,

including studies contemplated by Assembly Bio’s clinical

collaboration agreements, in the currently anticipated timeframes;

safety and efficacy data from clinical studies may not warrant

further development of Assembly Bio’s product candidates; clinical

and nonclinical data presented at conferences may not differentiate

Assembly Bio’s product candidates from other companies’ candidates;

results of nonclinical studies may not be representative of disease

behavior in a clinical setting and may not be predictive of the

outcomes of clinical studies; continued development and

commercialization of Assembly Bio’s HBV product candidates, if

successful, in the China territory will be dependent on, and

subject to, Assembly Bio’s collaboration agreement governing its

activity in the China territory; Assembly Bio’s ability to maintain

financial resources necessary to continue its clinical studies and

fund business operations; any impact that the COVID-19 pandemic may

have on Assembly Bio’s business and operations, including

initiation and continuation of its clinical studies or timing of

discussions with regulatory authorities; and other risks identified

from time to time in Assembly Bio’s reports filed with

the U.S. Securities and Exchange

Commission (the SEC). You are urged to consider

statements that include the words may, will, would, could, should,

might, believes, hopes, estimates, projects, potential, expects,

plans, anticipates, intends, continues, forecast, designed, goal or

the negative of those words or other comparable words to be

uncertain and forward-looking. Assembly Bio intends such

forward-looking statements to be covered by the safe harbor

provisions contained in Section 27A of the Securities Act of 1933,

as amended, and Section 21E of the Securities Exchange Act of 1934,

as amended. More information about Assembly Bio’s risks and

uncertainties are more fully detailed under the heading “Risk

Factors” in Assembly Bio’s filings with the SEC, including its

most recent Annual Report on Form 10-K, Quarterly Reports on Form

10-Q and Current Reports on Form 8-K. Except as required by law,

Assembly Bio assumes no obligation to update publicly any

forward-looking statements, whether as a result of new information,

future events or otherwise.

ContactsInvestor and Corporate:Lauren

GlaserSenior Vice President, Investor Relations and Corporate

Affairs(415) 521-3828lglaser@assemblybio.com

Media:Sam Brown Inc. Audra Friis (917)

519-9577 ASMBMedia@sambrown.com

|

|

|

|

|

ASSEMBLY BIOSCIENCES, INC. |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(In thousands except for share amounts and par value) |

|

|

|

|

|

|

|

|

|

September 30, |

|

December 31, |

|

|

|

|

2021 |

|

|

|

2020 |

|

|

|

|

(Unaudited) |

|

|

|

ASSETS |

|

|

|

|

|

Current assets |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

70,760 |

|

|

$ |

59,444 |

|

|

Marketable securities - short-term |

|

|

110,142 |

|

|

|

156,969 |

|

|

Accounts receivable from collaborations |

|

|

769 |

|

|

|

1,230 |

|

|

Prepaid expenses and other current assets |

|

|

6,548 |

|

|

|

6,850 |

|

|

Total current assets |

|

|

188,219 |

|

|

|

224,493 |

|

|

|

|

|

|

|

|

Marketable securities - long-term |

|

|

9,180 |

|

|

|

— |

|

|

Property and equipment, net |

|

|

1,241 |

|

|

|

1,600 |

|

|

Operating lease right-of-use (ROU) assets |

|

|

6,773 |

|

|

|

9,131 |

|

|

Other assets |

|

|

1,922 |

|

|

|

6,392 |

|

|

Indefinite-lived intangible asset |

|

|

29,000 |

|

|

|

29,000 |

|

|

Goodwill |

|

|

12,638 |

|

|

|

12,638 |

|

|

Total assets |

|

$ |

248,973 |

|

|

$ |

283,254 |

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

Current liabilities |

|

|

|

|

|

Accounts payable |

|

$ |

2,628 |

|

|

$ |

4,598 |

|

|

Accrued clinical expenses |

|

|

3,744 |

|

|

|

4,444 |

|

|

Other accrued expenses |

|

|

5,457 |

|

|

|

11,987 |

|

|

Operating lease liabilities - short-term |

|

|

3,099 |

|

|

|

3,404 |

|

|

Total current liabilities |

|

|

14,928 |

|

|

|

24,433 |

|

|

|

|

|

|

|

|

Deferred tax liabilities |

|

|

2,531 |

|

|

|

2,531 |

|

|

Deferred revenue |

|

|

2,733 |

|

|

|

8,987 |

|

|

Operating lease liabilities - long-term |

|

|

4,136 |

|

|

|

6,725 |

|

|

Total liabilities |

|

|

24,328 |

|

|

|

42,676 |

|

|

|

|

|

|

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

|

|

|

Stockholders' equity |

|

|

|

|

|

Preferred stock, $0.001 par value; 5,000,000 shares authorized; no

shares issued or outstanding |

|

|

— |

|

|

|

— |

|

|

Common stock, $0.001 par value; 100,000,000 shares authorized as of

September 30, 2021 and December 31, 2020; 47,077,052 and

34,026,680 shares issued and outstanding as of September 30,

2021 and December 31, 2020, respectively |

|

|

47 |

|

|

|

34 |

|

|

Additional paid-in capital |

|

|

796,057 |

|

|

|

742,387 |

|

|

Accumulated other comprehensive loss |

|

|

(288 |

) |

|

|

(270 |

) |

|

Accumulated deficit |

|

|

(571,171 |

) |

|

|

(501,573 |

) |

|

Total stockholders' equity |

|

|

224,645 |

|

|

|

240,578 |

|

|

Total liabilities and stockholders' equity |

|

$ |

248,973 |

|

|

$ |

283,254 |

|

| |

|

|

|

|

|

ASSEMBLY BIOSCIENCES, INC. |

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE LOSS |

|

(In thousands except for share and per share amounts) |

|

(Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

Three Months EndedSeptember 30, |

|

Nine Months EndedSeptember 30, |

|

|

|

|

2021 |

|

|

|

2020 |

|

|

|

2021 |

|

|

|

2020 |

|

|

Collaboration revenue |

|

$ |

6,254 |

|

|

$ |

34,611 |

|

|

$ |

6,254 |

|

|

$ |

78,068 |

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

Research and development |

|

|

18,474 |

|

|

|

26,941 |

|

|

|

53,777 |

|

|

|

73,314 |

|

|

General and administrative |

|

|

6,655 |

|

|

|

11,689 |

|

|

|

22,276 |

|

|

|

29,888 |

|

|

Total operating expenses |

|

|

25,129 |

|

|

|

38,630 |

|

|

|

76,053 |

|

|

|

103,202 |

|

|

Loss from operations |

|

|

(18,875 |

) |

|

|

(4,019 |

) |

|

|

(69,799 |

) |

|

|

(25,134 |

) |

|

|

|

|

|

|

|

|

|

|

|

Other income: |

|

|

|

|

|

|

|

|

|

Interest and other income, net |

|

|

72 |

|

|

|

670 |

|

|

|

201 |

|

|

|

2,400 |

|

|

Total other income |

|

|

72 |

|

|

|

670 |

|

|

|

201 |

|

|

|

2,400 |

|

|

Net loss |

|

$ |

(18,803 |

) |

|

$ |

(3,349 |

) |

|

$ |

(69,598 |

) |

|

$ |

(22,734 |

) |

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive (loss) income |

|

|

|

|

|

|

|

|

|

Unrealized (loss) gain on marketable securities |

|

|

(15 |

) |

|

|

(262 |

) |

|

|

(18 |

) |

|

|

43 |

|

|

Comprehensive loss |

|

$ |

(18,818 |

) |

|

$ |

(3,611 |

) |

|

$ |

(69,616 |

) |

|

$ |

(22,691 |

) |

|

|

|

|

|

|

|

|

|

|

|

Net loss per share, basic and diluted |

|

$ |

(0.41 |

) |

|

$ |

(0.09 |

) |

|

$ |

(1.63 |

) |

|

$ |

(0.64 |

) |

|

Weighted average common shares outstanding, basic and diluted |

|

|

45,569,276 |

|

|

|

35,506,042 |

|

|

|

42,725,109 |

|

|

|

35,321,393 |

|

| |

|

|

|

|

|

|

|

|

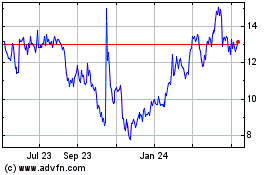

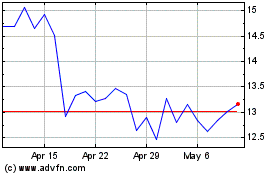

Assembly Biosciences (NASDAQ:ASMB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Assembly Biosciences (NASDAQ:ASMB)

Historical Stock Chart

From Apr 2023 to Apr 2024