Current Report Filing (8-k)

13 December 2022 - 8:07AM

Edgar (US Regulatory)

--12-31false000142680000014268002022-12-062022-12-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 6, 2022

Assembly Biosciences, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

Delaware |

001-35005 |

20-8729264 |

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

331 Oyster Point Blvd., Fourth Floor, South San Francisco, California |

|

94080 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (833) 509-4583

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, par value $0.001 |

|

ASMB |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

In October 2022, Assembly Biosciences, Inc. (the "Company") reported that John G. McHutchison, A.O., M.D. would retire from his role as Chief Executive Officer effective December 31, 2022 and that Jason A. Okazaki, the Company's President and Chief Operating Officer, would succeed Dr. McHutchison as Chief Executive Officer, effective January 1, 2023 (the "Effective Date"). The Company also reported that following the Effective Date, Dr. McHutchison would remain a member of the Company's Board of Directors (the "Board") and would assume the role of Chairman of the Board's Science and Technology Committee as of the Effective Date.

On December 6, 2022, the Board's Compensation Committee approved an Amended and Restated Employment Agreement with Mr. Okazaki, to be effective as of the Effective Date (the "Amended Employment Agreement"). The Amended Employment Agreement provides for an initial annual base salary of $600,000 and an annual performance-based incentive cash bonus in an amount initially targeted to 60% of Mr. Okazaki’s then-current annualized base salary.

If Mr. Okazaki’s employment is terminated by the Company for disability or without cause or by Mr. Okazaki for good reason or as a result of his death within one month prior to or within 12 months following, a change of control (each as defined in the Amended Employment Agreement), and subject to Mr. Okazaki’s execution and non-revocation of a general release of claims, the Company will provide Mr. Okazaki the following benefits: (1) a lump sum payment equal to 18 months of his then-current base salary; (2) an amount equal to 1.5 times his full target annual bonus for the year in which the termination occurred; (3) immediate vesting in full of all equity awards (including equity awards that vest based on performance but only if and to the extent accelerated vesting is provided in agreements governing such equity awards); provided, however that (a) in the event that such termination occurs during the one month prior to a change of control, any equity-based compensation outstanding as of the termination will not accelerate but will remain outstanding and eligible to vest immediately prior to the consummation of the change of control and (b) in the event that such termination occurs prior to a change of control and such change of control is not consummated on or prior to the date one month after such termination, no vesting will occur and any equity awards outstanding as of the termination will vest, if at all, and terminate in accordance with, and to the extent provided in the non-change of control separation provisions and the equity award agreements; (4) extension of the exercise period for all vested stock options held by Mr. Okazaki until the earlier of the first anniversary of the employment termination date and the termination date of the vested stock options; and (5) up to 18 months of COBRA following termination.

If Mr. Okazaki’s employment is terminated by the Company as a result of his disability, by the Company without cause or by Mr. Okazaki for good reason, and such termination does not occur during the one month prior to or within 12 months following, a change of control, and subject to Mr. Okazaki’s execution and non-revocation of a general release of claims, the Company will provide him the following benefits: (1) continued payment of his then-current base salary for 12 months following the date of termination of employment; (2) his annual performance bonus, if any, for the year in which termination occurs in an amount equal to the amount Mr. Okazaki would have earned based on Company’s performance if he was employed for the full year, pro-rated based on the number of days employed for the year of termination; (3) all equity awards that would have time vested during the 12 months following the termination date shall accelerate and vest; (4) extension of the exercise period for all vested stock options held by Mr. Okazaki until the earlier of the first anniversary of the employment termination date and the termination date of the vested stock options; and (5) up to 12 months of COBRA following termination. The benefits described in this paragraph are in lieu of, and not in addition to, the benefits described in the prior preceding paragraph.

The Compensation Committee expects to approve an award of equity-based compensation related to Mr. Okazaki's promotion in conjunction with the Company's regularly scheduled annual grants in March 2023; however, the terms and conditions of any such awards have not been determined.

The foregoing description of the terms of the Amended Employment Agreement does not purport to be complete and is qualified in its entirety by reference to the complete text of the Amended Employment Agreement, which will be filed as an exhibit to the Company’s Annual Report on Form 10-K for the year ended December 31, 2022.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On December 7, 2022, the Board approved an amendment and restatement of the Company's Amended and Restated Bylaws (the "Amended and Restated Bylaws"). The following sections were amended in connection with the amendment and restatement:

1

•Section 2.6 - Quorum; Action at Meeting. The quorum required for meetings of stockholders was reduced from a majority to one-third (1/3) of the outstanding shares of stock entitled to vote at any given meeting, present in person or represented by proxy except as otherwise required by statute or provided by the Company's certificate of incorporation. In addition, in situations in which a separate vote by a class or classes or series is required, the quorum requirement was reduced from a majority to one third (1/3) of the outstanding shares of any such class or classes or series entitled to vote on a given matter, present in person or represented by proxy.

•Section 2.13 - List of Stockholders Entitled to Vote. The requirement to make a list of stockholders entitled to vote available at meetings of the Company's stockholders was deleted, as making the list of stockholders available at stockholders' meetings is no longer required under the Delaware General Corporation Law.

•Section 2.14 - Stockholder Proposals Outside of Proxy Access and Other Proposals by Stockholders at Annual Meeting. The advance notice provisions were amended to provide that if a stockholder nominating a director candidate does not comply with the universal proxy rules adopted by the Securities and Exchange Commission, the nomination is invalidated. In addition to the amendments made to Section 2.14, conforming changes were made to Section 3.15 and Section 3.16(d)(i)(D) of the Amended and Restated Bylaws.

The Company reduced the quorum requirement from a majority to one-third of the outstanding shares of stock entitled to vote in response to difficulties that the Company experienced in reaching quorum for both the 2021 and 2022 annual meetings of stockholders. In 2021, a quorum was not reached until three days prior to the annual meeting date, and in 2022, a quorum was not reached until the afternoon of the day prior to the annual meeting date. A failure to meet the quorum requirement in the future would negatively impact the Company's ability to transact necessary business requiring a vote of the Company's stockholders and could require the incurrence of significant expense to adjourn or postpone an annual meeting and solicit additional proxies in order to meet the

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

Assembly Biosciences, Inc. |

|

|

|

|

Date: December 12, 2022 |

|

By: |

/s/ John O. Gunderson |

|

|

|

John O. Gunderson |

|

|

|

Vice President, General Counsel and Corporate Secretary |

3

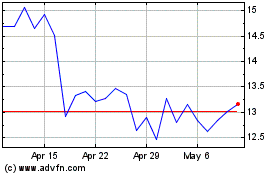

Assembly Biosciences (NASDAQ:ASMB)

Historical Stock Chart

From Mar 2024 to Apr 2024

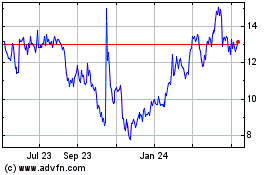

Assembly Biosciences (NASDAQ:ASMB)

Historical Stock Chart

From Apr 2023 to Apr 2024