SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For November 14, 2024

Commission File Number 001-33463

______________________

ASML Holding N.V.

De Run 6501

5504 DR Veldhoven

The Netherlands

(Address of principal executive offices)

______________________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K on paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K on paper as permitted by Regulation S-T Rule 101(b)(7): ¨

EXHIBIT 99.1 TO THIS REPORT ON FORM 6-K IS INCORPORATED BY REFERENCE IN THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-116337), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-126340), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-136362), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-141125), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-142254), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-144356), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-147128), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-153277), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-162439), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-170034), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-188938), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-190023), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-192951), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-203390), THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-219442) AND THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-227464) OF ASML HOLDING N.V. AND IN THE OUTSTANDING PROSPECTUSES CONTAINED IN SUCH REGISTRATION STATEMENTS.

Exhibits

99.1 “ASML provides updated view on market opportunities at 2024 Investor Day meeting", press release dated November 14, 2024

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

ASML HOLDING N.V. (Registrant)

By: /s/ Christophe D. Fouquet

Christophe D. Fouquet

Chief Executive Officer

ASML provides updated view on market opportunities at 2024 Investor Day meeting

Positioned for significant growth in revenue and profitability in this decade

VELDHOVEN, the Netherlands, November 14, 2024 – At its 2024 Investor Day today, ASML Holding N.V. (ASML) provides an update on its long-term strategy as well as global market and technology trends, confirming potential 2030 scenarios for annual revenue between approximately €44 billion and €60 billion with a gross margin of between approximately 56% and 60%.

“We expect that our ability to scale EUV technology into the next decade and extend our versatile holistic lithography portfolio, positions ASML well to contribute to, and leverage the Artificial Intelligence (AI) opportunity, and allows ASML to deliver significant revenue and profitability growth,” says President and CEO Christophe Fouquet.

The long-term outlook for the semiconductor industry remains promising, given the role of semiconductors as mission-critical enablers of multiple megatrends across society.

In addition to the growth potential of several important end-markets, ASML believes that the emergence of AI creates a significant opportunity for the semiconductor industry, thanks to the potential that AI brings as the next big driver of productivity and innovation across wider society.

These developments are expected to help fuel global semiconductor sales to over $1 trillion by 2030, which translates into an annual semiconductor market growth rate of approximately 9% in the period 2025-2030.

Further, ASML sees an opportunity to increase the number of EUV exposures through the remainder of this decade. The continued cost-effective scalability of EUV technology is expected to allow customers to further transfer multi-patterning layers to single-patterning EUV 0.33 NA and EUV 0.55 NA, for both advanced Logic and DRAM. As a result, ASML expects a double-digit EUV lithography spending CAGR between 2025 and 2030 for both advanced Logic and DRAM.

“The expected growth in semiconductor end-markets and increasing lithography spending on future nodes, give us confidence in strong demand for our products and services,” says Executive Vice President and CFO Roger Dassen. “Based on our assessment of different market and technology scenarios, we expect annual revenue between approximately €44 billion and €60 billion with gross margin between approximately 56% and 60% by 2030. We confirm our capital allocation strategy, and expect to continue to return significant amounts of cash to our shareholders through a combination of growing dividends and share buybacks.”

ASML's strong industry partnerships are essential to our overall success, and we continue to work together with industry and the community to maintain a leadership position in ESG sustainability.

Webcast and presentations

The Investor Day program on November 14 runs from 13:00 to 17:30 CET. The link to the live webcast can be found on our website (no pre-registration required). The presentations and a recording will be made available afterwards on asml.com.

| | | | | |

Media Relations contacts | Investor Relations contacts |

| Monique Mols +31 6 5284 4418 | Skip Miller +1 480 235 0934 |

| Sarah de Crescenzo +1 925 899 8985 | Marcel Kemp +31 40 268 6494 |

| Karen Lo +886 939788635 | Peter Cheang +886 3 659 6771 |

About ASML

ASML is a leading supplier to the semiconductor industry. The company provides chipmakers with hardware, software and services to mass produce the patterns of integrated circuits (microchips). Together with its partners, ASML drives the advancement of more affordable, more powerful, more energy-efficient microchips. ASML enables groundbreaking technology to solve some of humanity's toughest challenges, such as in healthcare, energy use and conservation, mobility and agriculture. ASML is a multinational company headquartered in Veldhoven, the Netherlands, with offices across EMEA, the US and Asia. Every day, ASML’s more than 43,700 employees (FTE) challenge the status quo and push technology to new limits. ASML is traded on Euronext Amsterdam and NASDAQ under the symbol ASML. Discover ASML – our products, technology and career opportunities – at www.asml.com.

Regulated information

This press release contains inside information within the meaning of Article 7(1) of the EU Market Abuse Regulation.

Forward Looking Statements

This document and related discussions contain statements that are forward-looking within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, including statements with respect to our strategy, plans and expected trends, including trends in end markets and the technology industry and business environment trends, including the emergence of AI and its potential opportunities and expectations for the semiconductor industry, including computing power, advanced logic nodes and DRAM memory, statements with respect to Moore’s law and expected transistor growth and aspirations by 2030, global market trends and technology, product and customer roadmaps, long term outlook and expected lithography and semiconductor industry growth and trends and expected growth in semiconductor sales and semiconductor market opportunity through to 2030 and beyond, expected growth in wafer demand and capacity and additional wafer capacity requirements, expected investments by our customers, including investments in our technology and in wafer capacity, plans to increase capacity, expected growth in lithography spend, growth opportunities including opportunities for growth in service and upgrades and opportunities for growth in Installed Base Management sales, expected growth and gross margins in the holistic lithography business and expected addressable market for Applications products, expectations and benefits of a growing installed base, ASML’s and its supplier’s capacity, expected production of systems, model scenarios and the updated model for 2030, including annual revenue and gross margin opportunity and development potential for 2030, outlook and expected, modelled or potential financial results, including revenue opportunity, gross margin, R&D costs, SG&A costs, capital expenditure, cash conversion cycle and annualized effective tax rate for 2030 and assumptions and drivers underlying such expected, modelled or potential amounts, and other assumptions underlying our business and financial models, expected trends, outlook and growth in semiconductor end markets and long term growth opportunities, demand and demand drivers, expected opportunities and growth drivers for and technological innovation of our products including DUV EUV, High NA, Hyper NA, Applications, and other products impacting productivity and costs, transistor dimensions, logic and DRAM shrink, foundry competition, statements with respect to dividends and share buybacks and our capital return policy, including expectation to return significant amounts of cash to shareholders through growing dividends and buybacks and statements with respect to energy generation and consumption trends and the drive toward energy efficiency, emissions reduction and greenhouse gas neutrality goals and target dates to achieve greenhouse gas neutrality, zero waste from operations and other ESG targets and ambitions and plans to maintain a leadership position in ESG, increasing technological sovereignty across the world and the expected impact on semiconductor sales, including specific goals of countries across the world, increasing competition in the foundry business, estimates for 2024 and other non-historical statements. You can generally identify these statements by the use of words like "may", "will", "could", "should", "project", "believe", "anticipate", "expect", "plan", "estimate", "forecast", "potential", “opportunity”, “scenario”, “guidance,” "intend", "continue", "target", "future", "progress", "goal" and variations of these words or comparable words. These statements are not historical facts, but rather are based on current expectations, estimates, assumptions, models, opportunities and projections about our business and our future and potential financial results and readers should not place undue reliance on them. Forward-looking statements do not guarantee future performance and involve a number of substantial known and unknown risks and uncertainties. These risks and uncertainties include, without limitation, customer demand, semiconductor equipment industry capacity, worldwide demand for semiconductors and semiconductor manufacturing capacity, lithography tool utilization and semiconductor inventory levels, general trends and consumer confidence in the semiconductor industry and end markets, the impact of general economic conditions, including the impact of the current macroeconomic environment on the semiconductor industry, uncertainty around a market recovery including the timing thereof, the impact of inflation, interest rates, wars and geopolitical developments, the impact of pandemics, the performance of our systems, the success of technology advances and the pace of new product development and customer acceptance of and demand for new products, our production capacity and ability to adjust capacity to meet demand, supply chain capacity, timely availability of parts and components, raw materials, critical manufacturing equipment and qualified employees, our ability to produce systems to meet demand, the number and timing of systems ordered, shipped and recognized in revenue, risks relating to fluctuations in net bookings and our ability to convert bookings into sales, the risk of order cancellation or push outs and restrictions on shipments of ordered systems under export controls, risks relating to technology, product and customer roadmaps and Moore’s law, risks relating to the trade environment, import/export and national security regulations and orders and their impact on us, including the impact of changes in export regulations and the impact of such regulations on our ability to obtain necessary licenses and to sell our systems and provide services to certain customers, exchange rate fluctuations, changes in tax rates, available liquidity and free cash flow and liquidity requirements, our ability to refinance our indebtedness, available cash and distributable reserves for, and other factors impacting, dividend payments and share repurchases, the number of shares that we repurchase under our share repurchase programs, our ability to enforce patents and protect intellectual property rights and the outcome of intellectual property disputes and litigation, our ability to meet ESG goals and execute our ESG strategy, other factors that may impact ASML’s business or financial results including the risk that actual results may differ materially from the models, potential and opportunity we present for 2030 and other future periods, and other risks indicated in the risk factors included in ASML’s Annual Report on Form 20-F for the year ended December 31, 2023 and other filings with and submissions to the US Securities and Exchange Commission. These forward-looking statements are made only as of the date of this document. We undertake no obligation to update any forward-looking statements after the date of this report or to conform such statements to actual results or revised expectations, except as required by law.

This document and related discussions contain statements relating to our approach to and interim progress on achieving certain energy efficiency and greenhouse gas emissions reduction targets, including our ambition to achieve greenhouse gas neutrality. References to “greenhouse gas neutral” means remaining emissions, after ASML’s efforts to reach its GHG emission reduction targets, compensated by the same amount of metric tons of carbon credits that are verified against recognised quality standards.

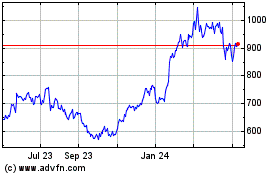

ASML Holding NV (NASDAQ:ASML)

Historical Stock Chart

From Oct 2024 to Nov 2024

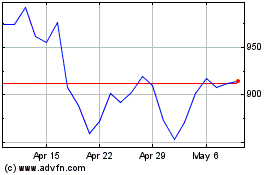

ASML Holding NV (NASDAQ:ASML)

Historical Stock Chart

From Nov 2023 to Nov 2024