Academy Sports and Outdoors, Inc. (Nasdaq: ASO) ("Academy" or the

"Company") today announced its financial results for the third

quarter ended October 30, 2021. Unless otherwise indicated,

comparisons are to the same period in the prior fiscal year.

Third Quarter 2021 ResultsFor

the third quarter, net sales increased 18.1% to a third quarter

record of $1.59 billion. When compared to the third quarter of

2019, sales increased 39.1%. Comparable sales were 17.9% on top of

16.5% last year, making it the 9th consecutive quarter of positive

comparable sales. The Company continued to benefit from the

strategic initiatives implemented to improve merchandise planning

and allocation, operations, customer service and supply chain. As a

result of these actions and the continued strong consumer demand

for sports and outdoors products, all four product divisions saw

significant growth. E-commerce sales grew 25.9% compared to the

prior year quarter and 146.6% compared to the third quarter of

2019.

Gross margin increased 27.3% to $560.8 million.

The gross margin rate improved by 250 basis points to 35.2%. This

growth was primarily driven by higher merchandise margins resulting

from effective pricing and promotions management, a favorable

product mix shift and fewer clearance sales.

Selling, general and administrative ("SG&A")

expenses were 21.6% of sales, a 500 basis point decrease. Compared

to the third quarter of 2020 adjusted SG&A, which excludes

certain initial public offering costs, SG&A leveraged 230 basis

points, primarily attributable to workforce management, marketing

cost efficiencies and leveraging expenses from the growth of

comparable sales.

Pre-tax income increased 251.6% to $205.3

million compared to $58.4 million.

GAAP net income was $161.3 million compared to

$59.6 million. Diluted earnings per share increased 132.4% to $1.72

compared to $0.74 per share last year. Pro forma adjusted net

income, which excludes the impact of certain non-cash and

extraordinary items, increased 122.6% to $164.1 million. Pro forma

diluted earnings per share increased 92.3% to $1.75 compared to

$0.91 per share.

"The Academy Sports + Outdoors team did a great

job again delivering our 9th consecutive quarterly sales and profit

increase," said Ken Hicks, Chairman, President and Chief Executive

Officer. "We are confident that our strong assortment and value

offering, coupled with our great store service, enhanced

omnichannel capabilities, and resilient supply chain will enable

Academy to continue to achieve excellent results through this

holiday season and beyond."

Year-to-Date 2021

ResultsYear-to-date, net sales increased 21.3% to $4.96

billion, while comparable sales increased 21.2%. Year-to-date sales

grew 43.5% compared to 2019. E-commerce sales declined 1.5% versus

2020 and increased 203.9% compared to 2019.

Gross margin increased 43.1% to $1.77 billion.

The gross margin rate improved by 540 basis points to 35.6%. This

growth was primarily driven by higher merchandise margins resulting

from effective pricing and promotions management, strong inventory

productivity, greater product localization, fewer clearance sales

and a favorable product mix shift.

The growth in gross profit and 210 basis points

of expense leverage, resulted in a 208.5% increase in pre-tax

income to $671.1 million compared to $217.6 million.

GAAP net income increased 143.8% to $529.6

million compared to $217.2 million. Diluted earnings per share were

$5.55 compared to $2.82 per share in the prior year to date. Pro

forma adjusted net income, which excludes the impact of certain

non-cash and extraordinary items, increased 173.8% to $571.2

million. Pro forma diluted earnings per share were $5.98 compared

to $2.70 per share in the prior year to date.

Balance Sheet UpdateAs of the

end of the third quarter, the Company’s cash and cash equivalents

totaled $401.3 million and the credit facility had no outstanding

balance. Adjusted free cash flow was $84.4 million. Merchandise

inventories were $1.3 billion, an increase of 22.4% compared to the

prior year quarter and 18.9% higher than the second quarter of

2021.

As previously reported, on September 14, 2021,

Academy's largest shareholder ("KKR") sold its remaining ownership

of the Company. As part of this event, Academy purchased 4.5

million shares for approximately $200 million. Additionally, during

the quarter, the Company made open market purchases of 1.2 million

shares for $50 million. Year-to-date, the Company has repurchased

and retired 8.9 million shares of its common stock for

approximately $350 million. As of October 31, 2021, the Company had

approximately $254 million remaining under its share repurchase

program.

2021 OutlookMichael Mullican,

Executive Vice President and Chief Financial Officer said, “The

ongoing successful execution of our strategic priorities has

allowed us to achieve yet another period of record-setting sales

and profitability. In addition, the strength of the entire Academy

team was apparent as we were able to grow our inventory position in

a challenging environment. As our initiatives continue to mature,

we believe the best days at Academy are still to come. In light of

these exceptional results and expectations, we are raising our

annual guidance."

The Company is raising its fiscal 2021 guidance

based on the strong third quarter performance, dynamic consumer

trends and current visibility. The new guidance is as follows:

|

|

|

|

|

|

% change(at mid-point) |

|

|

Updated Fiscal 2021(e) Guidance |

2020 |

2019 |

vs. 2020 |

vs. 2019 |

|

(in millions, except per share amounts) |

Low end |

High end |

|

|

|

|

|

Net Sales |

$6,675 |

$6,740 |

$5,689 |

$4,830 |

18% |

39% |

|

|

|

|

|

|

|

|

|

Comparable sales |

17.0% |

18.0% |

16.1% |

(0.7)% |

|

|

|

|

|

|

|

|

|

|

| Income

before taxes |

$814 |

$827 |

$339 |

$123 |

142% |

567% |

|

|

|

|

|

|

|

|

| Net

income * |

$638 |

$647 |

$309 |

$120 |

108% |

435% |

|

|

|

|

|

|

|

|

| GAAP

earnings per share-diluted |

$6.75 |

$6.85 |

$3.79 |

$1.60 |

79% |

325% |

|

|

|

|

|

|

|

|

| Non-GAAP

earnings per share-diluted |

$7.21 |

$7.31 |

$3.83 |

$1.02 |

90% |

612% |

|

|

|

|

|

|

|

|

|

Diluted weighted average shares outstanding |

94,500 |

94,500 |

81,431 |

74,795 |

|

|

*Prior to October 1, 2020, the Company was

treated as a flow through entity for U.S. income tax purposes and

no federal income tax was recorded.

The earnings per share estimate reflects a tax

rate of 22.0% and does not include any potential future share

repurchases.

Conference Call InfoAcademy

will host a conference call today at 11:00 a.m. Eastern Time to

discuss its financial results. Listeners may access the call by

dialing 1-877-407-3982 (U.S.) or 1-201-493-6780 (International).

The passcode is 13725072. A webcast of the call can be accessed at

investors.academy.com.

A telephonic replay of the conference call will

be available for approximately 30 days, by dialing 1-844-512-2921

(U.S.) or 1-412-317-6671 (International) and entering passcode

13725072. An archive of the webcast will be available at

investors.academy.com for 30 days.

About Academy Sports +

OutdoorsAcademy is a leading full-line sporting goods and

outdoor recreation retailer in the United States. Originally

founded in 1938 as a family business in Texas, Academy has grown to

259 stores across 16 contiguous states. Academy’s mission is to

provide “Fun for All” and Academy fulfills this mission with a

localized merchandising strategy and value proposition that

strongly connects with a broad range of consumers. Academy’s

product assortment focuses on key categories of outdoor, apparel,

footwear and sports & recreation through both leading national

brands and a portfolio of 20 private label brands, which go well

beyond traditional sporting goods and apparel offerings.

All references to "Academy," "Academy Sports +

Outdoors," "we," "us," "our" or the "Company" in this press release

refer to (1) prior to October 1, 2020 (the "IPO pricing date"), New

Academy Holding Company, LLC, a Delaware limited liability company

("NAHC") and the prior parent holding company for our operations,

and its consolidated subsidiaries; and (2) on and after the IPO

pricing date, Academy Sports and Outdoors, Inc., a Delaware

corporation ("ASO, Inc.") and the current parent holding company of

our operations, and its consolidated subsidiaries.

On the IPO pricing date, we completed a series

of reorganization transactions (the "Reorganization Transactions")

that resulted in NAHC being contributed to ASO, Inc. by its members

and becoming a wholly owned subsidiary of ASO, Inc. and one share

of common stock of ASO, Inc. issued to then-existing members of

NAHC for every 3.15 membership units of NAHC contributed to ASO,

Inc. (the "Contribution Ratio"). Unless indicated otherwise, the

information in this press release has been adjusted to give

retrospective effect to the Contribution Ratio.

Non-GAAP MeasuresAdjusted

EBITDA, Adjusted EBIT, Adjusted Net Income (Loss), Pro Forma

Adjusted Net Income (Loss), Pro Forma Adjusted Earnings Per Share,

Adjusted Selling, General and Administrative Expenses and Adjusted

Free Cash Flow have been presented in this press release as

supplemental measures of financial performance that are not

required by, or presented in accordance with, generally accepted

accounting principles (“GAAP”). These non-GAAP measures have

limitations as analytical tools. For information on these

limitations, as well as information on why management believes

these non-GAAP measures are useful, please see our Annual Report

for fiscal year 2020 filed on April 7, 2021 (the “Annual Report”),

as such limitations and information may be updated from time to

time in our periodic filings with the Securities and Exchange

commission (the "SEC"), which are accessible on the SEC's website

at www.sec.gov.

We compensate for these limitations by primarily

relying on our GAAP results in addition to using these non-GAAP

measures supplementally.

See “Reconciliations of Non-GAAP to GAAP

Financial Measures” below for reconciliations of non-GAAP financial

measures used in this press release to their most directly

comparable GAAP financial measures.

Forward Looking StatementsThis

press release contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended.

These forward-looking statements are based on Academy's current

expectations and are not guarantees of future performance. You can

identify these forward-looking statements by the use of words such

as “outlook,” “guidance,” “believes,” “expects,” “potential,”

“continues,” “may,” “will,” “should,” “could,” “seeks,” “projects,”

“predicts,” “intends,” “plans,” “estimates,” “anticipates” or the

negative version of these words or other comparable words. The

forward-looking statements are subject to various risks,

uncertainties, assumptions or changes in circumstances that are

difficult to predict or quantify. Actual results may differ

materially from these expectations due to changes in global,

regional or local economic, business, competitive, market,

regulatory and other factors, many of which are beyond Academy's

control. Important factors that could cause actual results to

differ materially from those in the forward-looking statements are

set forth in Academy's filings with the SEC, including the Annual

Report, under the caption "Risk Factors," as may be updated from

time to time in our periodic filings with the SEC. Any

forward-looking statement in this press release speaks only as of

the date of this release. Academy undertakes no obligation to

publicly update or review any forward-looking statement, whether as

a result of new information, future developments or otherwise,

except as may be required by any applicable securities laws.

|

Investor Contact |

|

Media

Contact |

| Matt Hodges |

|

Elise Hasbrook |

| VP, Investor Relations |

|

VP, Communications |

| 281-646-5362 |

|

281-944-6041 |

| Matt.hodges@academy.com |

|

Elise.hasbrook@academy.com |

ACADEMY SPORTS AND OUTDOORS,

INC.CONSOLIDATED STATEMENTS OF

INCOME(Unaudited)(Amounts in

thousands, except per share data)

| |

Thirteen Weeks Ended |

| |

October 30, 2021 |

|

Percentage of Sales (1) |

|

October 31, 2020 |

|

Percentage of Sales (1) |

|

Net sales |

$ |

1,592,795 |

|

|

|

100.0 |

|

% |

|

$ |

1,349,076 |

|

|

|

100.0 |

|

% |

| Cost of goods sold |

1,031,957 |

|

|

|

64.8 |

|

% |

|

|

908,565 |

|

|

|

67.3 |

|

% |

|

Gross margin |

560,838 |

|

|

|

35.2 |

|

% |

|

|

440,511 |

|

|

|

32.7 |

|

% |

| Selling, general and

administrative expenses |

344,725 |

|

|

|

21.6 |

|

% |

|

|

358,955 |

|

|

|

26.6 |

|

% |

|

Operating income |

216,113 |

|

|

|

13.6 |

|

% |

|

81,556 |

|

|

|

6.0 |

|

% |

| Interest expense, net |

11,424 |

|

|

|

0.7 |

|

% |

|

22,399 |

|

|

|

1.7 |

|

% |

| Other (income) expense,

net |

(614 |

) |

|

|

0.0 |

|

% |

|

764 |

|

|

|

0.1 |

|

% |

|

Income before income taxes |

205,303 |

|

|

|

12.9 |

|

% |

|

58,393 |

|

|

|

4.3 |

|

% |

| Income tax (benefit)

expense |

43,998 |

|

|

|

2.8 |

|

% |

|

(1,193 |

) |

|

|

(0.1 |

) |

% |

|

Net income |

$ |

161,305 |

|

|

|

10.1 |

|

% |

|

$ |

59,586 |

|

|

|

4.4 |

|

% |

| |

|

|

|

|

|

|

|

| Earnings Per Common

Share: |

|

|

|

|

|

|

|

|

Basic |

$ |

1.77 |

|

|

|

|

|

$ |

0.78 |

|

|

|

|

|

Diluted |

$ |

1.72 |

|

|

|

|

|

$ |

0.74 |

|

|

|

|

| |

|

|

|

|

|

|

|

| Weighted Average Common Shares

Outstanding: |

|

|

|

|

|

|

|

|

Basic |

91,140 |

|

|

|

|

|

76,771 |

|

|

|

|

|

Diluted |

93,844 |

|

|

|

|

|

80,714 |

|

|

|

|

(1) Column may not add due to rounding

ACADEMY SPORTS AND OUTDOORS,

INC.CONSOLIDATED STATEMENTS OF

INCOME(Unaudited)(Amounts in

thousands, except per share data)

| |

Thirty-Nine Weeks Ended |

| |

October 30, 2021 |

|

Percentage of Sales (1) |

|

October 31, 2020 |

|

Percentage of Sales (1) |

|

Net sales |

$ |

4,964,658 |

|

|

|

100.0 |

|

% |

|

$ |

4,091,797 |

|

|

|

100.0 |

|

% |

| Cost of goods sold |

3,197,623 |

|

|

|

64.4 |

|

% |

|

2,856,840 |

|

|

|

69.8 |

|

% |

|

Gross margin |

1,767,035 |

|

|

|

35.6 |

|

% |

|

1,234,957 |

|

|

|

30.2 |

|

% |

| Selling, general and

administrative expenses |

1,057,290 |

|

|

|

21.3 |

|

% |

|

955,591 |

|

|

|

23.4 |

|

% |

|

Operating income |

709,745 |

|

|

|

14.3 |

|

% |

|

279,366 |

|

|

|

6.8 |

|

% |

| Interest expense, net |

38,130 |

|

|

|

0.8 |

|

% |

|

70,487 |

|

|

|

1.7 |

|

% |

| (Gain) loss on early

retirement of debt, net |

2,239 |

|

|

|

0.0 |

|

% |

|

(7,831 |

) |

|

|

(0.2 |

) |

% |

| Other (income), net |

(1,746 |

) |

|

|

0.0 |

|

% |

|

(857 |

) |

|

|

0.0 |

|

% |

|

Income before income taxes |

671,122 |

|

|

|

13.5 |

|

% |

|

217,567 |

|

|

|

5.3 |

|

% |

| Income tax expense |

141,511 |

|

|

|

2.9 |

|

% |

|

325 |

|

|

|

0.0 |

|

% |

|

Net income |

$ |

529,611 |

|

|

|

10.7 |

|

% |

|

$ |

217,242 |

|

|

|

5.3 |

|

% |

| |

|

|

|

|

|

|

|

| Earnings Per Common

Share: |

|

|

|

|

|

|

|

|

Basic |

$ |

5.76 |

|

|

|

|

|

$ |

2.94 |

|

|

|

|

|

Diluted |

$ |

5.55 |

|

|

|

|

|

$ |

2.82 |

|

|

|

|

| |

|

|

|

|

|

|

|

| Weighted Average Common Shares

Outstanding: |

|

|

|

|

|

|

|

|

Basic |

91,951 |

|

|

|

|

|

73,908 |

|

|

|

|

|

Diluted |

95,504 |

|

|

|

|

|

77,171 |

|

|

|

|

(1) Column may not add due to rounding

ACADEMY SPORTS AND OUTDOORS,

INC.CONSOLIDATED BALANCE

SHEETS(Unaudited)(Dollar amounts

in thousands, except per share data)

| |

|

October 30, 2021 |

|

January 30, 2021 |

|

October 31, 2020 |

|

ASSETS |

|

|

|

|

|

|

| CURRENT

ASSETS: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

401,297 |

|

|

|

$ |

377,604 |

|

|

|

$ |

869,725 |

|

|

|

Accounts receivable - less allowance for doubtful accounts of

$1,139, $1,172 and $1,286, respectively |

|

12,368 |

|

|

|

17,306 |

|

|

|

11,908 |

|

|

|

Merchandise inventories, net |

|

1,325,979 |

|

|

|

990,034 |

|

|

|

1,082,907 |

|

|

|

Prepaid expenses and other current assets |

|

44,491 |

|

|

|

28,313 |

|

|

|

25,789 |

|

|

|

Assets held for sale |

|

1,763 |

|

|

|

1,763 |

|

|

|

1,763 |

|

|

|

Total current assets |

|

1,785,898 |

|

|

|

1,415,020 |

|

|

|

1,992,092 |

|

|

| |

|

|

|

|

|

|

| PROPERTY AND

EQUIPMENT, NET |

|

358,110 |

|

|

|

378,260 |

|

|

|

382,620 |

|

|

| RIGHT-OF-USE

ASSETS |

|

1,087,407 |

|

|

|

1,143,699 |

|

|

|

1,163,361 |

|

|

| TRADE

NAME |

|

577,144 |

|

|

|

577,000 |

|

|

|

577,000 |

|

|

| GOODWILL |

|

861,920 |

|

|

|

861,920 |

|

|

|

861,920 |

|

|

| OTHER NONCURRENT

ASSETS |

|

5,516 |

|

|

|

8,583 |

|

|

|

4,923 |

|

|

|

Total assets |

|

$ |

4,675,995 |

|

|

|

$ |

4,384,482 |

|

|

|

$ |

4,981,916 |

|

|

| |

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' / PARTNERS'

EQUITY |

|

|

|

|

|

|

| CURRENT

LIABILITIES: |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

919,196 |

|

|

|

$ |

791,404 |

|

|

|

$ |

868,879 |

|

|

|

Accrued expenses and other current liabilities |

|

304,488 |

|

|

|

291,351 |

|

|

|

274,612 |

|

|

|

Current lease liabilities |

|

86,701 |

|

|

|

80,338 |

|

|

|

79,361 |

|

|

|

Current maturities of long-term debt |

|

3,000 |

|

|

|

4,000 |

|

|

|

18,250 |

|

|

|

Total current liabilities |

|

1,313,385 |

|

|

|

1,167,093 |

|

|

|

1,241,102 |

|

|

| |

|

|

|

|

|

|

| LONG-TERM DEBT,

NET |

|

683,845 |

|

|

|

781,489 |

|

|

|

1,408,885 |

|

|

| LONG-TERM LEASE

LIABILITIES |

|

1,088,142 |

|

|

|

1,150,088 |

|

|

|

1,171,420 |

|

|

| DEFERRED TAX

LIABILITIES, NET |

|

188,243 |

|

|

|

138,703 |

|

|

|

132,701 |

|

|

| OTHER LONG-TERM

LIABILITIES |

|

26,386 |

|

|

|

35,126 |

|

|

|

43,244 |

|

|

|

Total liabilities |

|

3,300,001 |

|

|

|

3,272,499 |

|

|

|

3,997,352 |

|

|

| |

|

|

|

|

|

|

| COMMITMENTS AND

CONTINGENCIES |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| REDEEMABLE MEMBERSHIP

UNITS |

|

— |

|

|

|

— |

|

|

|

— |

|

|

| |

|

|

|

|

|

|

| STOCKHOLDERS' /

PARTNERS' EQUITY : |

|

|

|

|

|

|

|

Preferred stock, $0.01 par value, authorized 50,000,000 shares;

none issued and outstanding |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

Common stock, $0.01 par value, authorized 300,000,000 shares;

88,164,878; 91,114,475; and 88,103,975 issued and outstanding as of

October 30, 2021, January 30, 2021, and October 31, 2020,

respectively. |

|

882 |

|

|

|

911 |

|

|

|

881 |

|

|

|

Additional paid-in capital |

|

188,329 |

|

|

|

127,228 |

|

|

|

93,064 |

|

|

|

Retained earnings |

|

1,188,271 |

|

|

|

987,168 |

|

|

|

895,646 |

|

|

|

Accumulated other comprehensive loss |

|

(1,488 |

) |

|

|

(3,324 |

) |

|

|

(5,027 |

) |

|

|

Stockholders' / partners' equity |

|

1,375,994 |

|

|

|

1,111,983 |

|

|

|

984,564 |

|

|

|

Total liabilities and stockholders' / partners'

equity |

|

$ |

4,675,995 |

|

|

|

$ |

4,384,482 |

|

|

|

$ |

4,981,916 |

|

|

ACADEMY SPORTS AND OUTDOORS,

INC.CONSOLIDATED STATEMENTS OF CASH

FLOWS(Unaudited)(Amounts in

thousands)

| |

|

Thirty-Nine Weeks Ended |

| |

|

October 30, 2021 |

|

October 31, 2020 |

| CASH FLOWS FROM OPERATING

ACTIVITIES: |

|

|

|

|

|

Net income |

|

$ |

529,611 |

|

|

|

$ |

217,242 |

|

|

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

|

Depreciation and amortization |

|

77,767 |

|

|

|

79,718 |

|

|

|

Non-cash lease expense |

|

708 |

|

|

|

14,870 |

|

|

|

Equity compensation |

|

36,126 |

|

|

|

27,049 |

|

|

|

Amortization of terminated interest rate swaps, deferred loan and

other costs |

|

4,787 |

|

|

|

2,734 |

|

|

|

Loss on swaps from debt refinancing |

|

— |

|

|

|

1,330 |

|

|

|

Deferred income taxes |

|

48,991 |

|

|

|

(11,739 |

) |

|

|

Non-cash (gain) loss on early retirement of debt, net |

|

2,239 |

|

|

|

(7,831 |

) |

|

|

Casualty loss |

|

— |

|

|

|

114 |

|

|

|

Changes in assets and liabilities: |

|

|

|

|

|

Accounts receivable, net |

|

4,938 |

|

|

|

2,121 |

|

|

|

Merchandise inventories, net |

|

(335,945 |

) |

|

|

16,727 |

|

|

|

Prepaid expenses and other current assets |

|

(16,177 |

) |

|

|

(1,151 |

) |

|

|

Other noncurrent assets |

|

2,207 |

|

|

|

245 |

|

|

|

Accounts payable |

|

128,743 |

|

|

|

439,682 |

|

|

|

Accrued expenses and other current liabilities |

|

34,683 |

|

|

|

44,733 |

|

|

|

Income taxes payable |

|

(1,830 |

) |

|

|

9,590 |

|

|

|

Other long-term liabilities |

|

(1,785 |

) |

|

|

21,784 |

|

|

|

Net cash provided by operating activities |

|

515,063 |

|

|

|

857,218 |

|

|

| |

|

|

|

|

| CASH FLOWS FROM INVESTING

ACTIVITIES: |

|

|

|

|

|

Capital expenditures |

|

(58,567 |

) |

|

|

(21,915 |

) |

|

|

Purchases of intangible assets |

|

(144 |

) |

|

|

— |

|

|

|

Notes receivable from member |

|

— |

|

|

|

8,125 |

|

|

|

Net cash used in investing activities |

|

(58,711 |

) |

|

|

(13,790 |

) |

|

| |

|

|

|

|

| CASH FLOWS FROM FINANCING

ACTIVITIES: |

|

|

|

|

|

Proceeds from ABL Facility |

|

— |

|

|

|

500,000 |

|

|

|

Repayment of ABL Facility |

|

— |

|

|

|

(500,000 |

) |

|

|

Repayment of Term Loan |

|

(101,500 |

) |

|

|

(29,653 |

) |

|

|

Debt issuance fees |

|

(927 |

) |

|

|

(556 |

) |

|

|

Share-Based Award Payments |

|

(11,214 |

) |

|

|

(20,724 |

) |

|

|

Distribution |

|

— |

|

|

|

(257,000 |

) |

|

|

Proceeds from issuance of common stock, net of Offering Costs |

|

— |

|

|

|

184,882 |

|

|

|

Proceeds from exercise of stock options |

|

41,292 |

|

|

|

— |

|

|

|

Proceeds from issuance of common stock under employee stock

purchase program |

|

945 |

|

|

|

— |

|

|

|

Taxes paid related to net share settlement of equity awards |

|

(15,418 |

) |

|

|

— |

|

|

|

Repurchase of common stock for retirement |

|

(345,837 |

) |

|

|

— |

|

|

|

Repurchase of Redeemable Membership Units |

|

— |

|

|

|

(37 |

) |

|

|

Net cash used in financing activities |

|

(432,659 |

) |

|

|

(123,088 |

) |

|

| |

|

|

|

|

| NET INCREASE IN CASH AND CASH

EQUIVALENTS |

|

23,693 |

|

|

|

720,340 |

|

|

| CASH AND CASH EQUIVALENTS AT

BEGINNING OF PERIOD |

|

377,604 |

|

|

|

149,385 |

|

|

| CASH AND CASH EQUIVALENTS AT

END OF PERIOD |

|

$ |

401,297 |

|

|

|

$ |

869,725 |

|

|

ACADEMY SPORTS AND OUTDOORS,

INC.RECONCILIATIONS OF NON-GAAP TO GAAP FINANCIAL

MEASURES(Unaudited)(Dollar

amounts in thousands)

Adjusted EBITDA and Adjusted

EBIT

We define “Adjusted EBITDA” as net income (loss)

before interest expense, net, income tax expense and depreciation

and amortization, further adjusted to exclude consulting fees,

private equity sponsor monitoring fees, equity compensation

expense, (gain) loss on early retirement of debt, net, severance

and executive transition costs, costs related to the COVID-19

pandemic, payroll taxes associated with a vesting event, as a

result of a secondary offering, of certain time and

performance-based equity awards, both of which occurred in May 2021

(the “2021 Vesting Event”) and other adjustments. We define

“Adjusted EBIT” as net income (loss) before interest expense, net,

and income tax expense, further adjusted to exclude consulting

fees, private equity sponsor monitoring fees, equity compensation

expense, (gain) loss on early retirement of debt, net,

severance and executive transition costs, costs related to the

COVID-19 pandemic, payroll taxes associated with the 2021 Vesting

Event and other adjustments. We describe these adjustments

reconciling net income (loss) to Adjusted EBITDA and Adjusted EBIT

in the following table.

| |

Thirteen Weeks Ended |

|

Thirty-Nine Weeks Ended |

| |

October 30, 2021 |

|

October 31, 2020 |

|

October 30, 2021 |

|

October 31, 2020 |

|

Net income |

$ |

161,305 |

|

|

|

$ |

59,586 |

|

|

|

$ |

529,611 |

|

|

|

$ |

217,242 |

|

|

| Interest expense, net |

11,424 |

|

|

|

22,399 |

|

|

|

38,130 |

|

|

|

70,487 |

|

|

| Income tax expense |

43,998 |

|

|

|

(1,193 |

) |

|

|

141,511 |

|

|

|

325 |

|

|

| Depreciation and

amortization |

26,459 |

|

|

|

25,567 |

|

|

|

77,767 |

|

|

|

79,718 |

|

|

| Consulting fees (a) |

— |

|

|

|

102 |

|

|

|

— |

|

|

|

194 |

|

|

| Private equity sponsor

monitoring fee (b) |

— |

|

|

|

12,953 |

|

|

|

— |

|

|

|

14,793 |

|

|

| Equity compensation (c) |

2,921 |

|

|

|

23,359 |

|

|

|

36,126 |

|

|

|

27,049 |

|

|

| (Gain) loss on early

retirement of debt, net |

— |

|

|

|

— |

|

|

|

2,239 |

|

|

|

(7,831 |

) |

|

| Severance and executive

transition costs (d) |

— |

|

|

|

— |

|

|

|

— |

|

|

|

4,137 |

|

|

| Costs related to the COVID-19

pandemic (e) |

— |

|

|

|

— |

|

|

|

— |

|

|

|

17,632 |

|

|

| Payroll taxes associated with

the 2021 Vesting Event (f) |

— |

|

|

|

— |

|

|

|

15,418 |

|

|

|

— |

|

|

| Other (g) |

595 |

|

|

|

2,965 |

|

|

|

1,309 |

|

|

|

4,894 |

|

|

|

Adjusted EBITDA |

$ |

246,702 |

|

|

|

$ |

145,738 |

|

|

|

$ |

842,111 |

|

|

|

$ |

428,640 |

|

|

| Less: Depreciation and

amortization |

(26,459 |

) |

|

|

(25,567 |

) |

|

|

(77,767 |

) |

|

|

(79,718 |

) |

|

|

Adjusted EBIT |

$ |

220,243 |

|

|

|

$ |

120,171 |

|

|

|

$ |

764,344 |

|

|

|

$ |

348,922 |

|

|

|

(a) |

|

Represents outside consulting fees associated with our strategic

cost savings and business optimization initiatives. |

| (b) |

|

Represents our contractual

payments under a monitoring agreement ("Monitoring Agreement") with

our former private equity sponsor Kohlberg Kravis Roberts & Co.

L.P. |

| (c) |

|

Represents non-cash charges

related to equity based compensation, which vary from period to

period depending on certain factors such as the 2021 Vesting Event,

timing and valuation of awards, achievement of performance targets

and equity award forfeitures. |

| (d) |

|

Represents severance costs

associated with executive leadership changes and enterprise-wide

organizational changes. |

| (e) |

|

Represents costs incurred during

the thirty-nine weeks ended October 31, 2020, as a result of the

COVID-19 pandemic, including temporary wage premiums, additional

sick time, costs of additional cleaning supplies and third party

cleaning services for the stores, corporate office and distribution

centers, accelerated freight costs associated with shifting our

inventory purchase earlier in the year to maintain stock, and legal

fees associated with consulting in local jurisdictions. These costs

were no longer added back beginning in the third quarter of

2020. |

| (f) |

|

Represents cash expenses related

to taxes on equity-based compensation resulting from the 2021

Vesting Event. |

| (g) |

|

Other adjustments include

(representing deductions or additions to Adjusted EBITDA and

Adjusted EBIT) amounts that management believes are not

representative of our operating performance, including investment

income, installation costs for energy savings associated with our

profitability initiatives, legal fees associated with our

distribution to NAHC's members and our omnibus incentive plan,

store exit costs and other costs associated with strategic cost

savings and business optimization initiatives. |

Adjusted Net Income, Pro Forma Adjusted

Net Income and Pro Forma Adjusted Earnings Per Share

We define “Adjusted Net Income (Loss)” as net

income (loss), plus consulting fees, private equity sponsor

monitoring fees, equity compensation expense, (gain) loss on early

retirement of debt, net, severance and executive transition costs,

costs related to the COVID-19 pandemic, payroll taxes associated

with the 2021 Vesting Event and other adjustments, less the tax

effect of these adjustments. We define “Pro Forma Adjusted Net

Income (Loss)” as Adjusted Net Income (Loss) less the retroactive

tax effect of Adjusted Net Income at our estimated effective tax

rate of approximately 25% for periods prior to October 1, 2020, the

effective date of our conversion to a C-Corporation. We define “Pro

Forma Adjusted Earnings per Common Share, Basic” as Pro Forma

Adjusted Net Income divided by the basic weighted average common

shares outstanding during the period and “Pro Forma Adjusted

Earnings per Common Share, Diluted” as Pro Forma Adjusted Net

Income divided by the diluted weighted average common shares

outstanding during the period. We describe these adjustments

reconciling net income (loss) to Adjusted Net Income (Loss), Pro

Forma Adjusted Net Income (Loss), and Pro Forma Adjusted Earnings

Per Share in the following table.

| |

Thirteen Weeks Ended |

|

Thirty-Nine Weeks Ended |

| |

October 30, 2021 |

|

October 31, 2020 |

|

October 30, 2021 |

|

October 31, 2020 |

|

Net income |

$ |

161,305 |

|

|

|

$ |

59,586 |

|

|

|

$ |

529,611 |

|

|

|

$ |

217,242 |

|

|

| Consulting fees (a) |

— |

|

|

|

102 |

|

|

|

— |

|

|

|

194 |

|

|

| Private equity sponsor

monitoring fee (b) |

— |

|

|

|

12,953 |

|

|

|

— |

|

|

|

14,793 |

|

|

| Equity compensation (c) |

2,921 |

|

|

|

23,359 |

|

|

|

36,126 |

|

|

|

27,049 |

|

|

| (Gain) loss on early

retirement of debt, net |

— |

|

|

|

— |

|

|

|

2,239 |

|

|

|

(7,831 |

) |

|

| Severance and executive

transition costs (d) |

— |

|

|

|

— |

|

|

|

— |

|

|

|

4,137 |

|

|

| Costs related to the COVID-19

pandemic (e) |

— |

|

|

|

— |

|

|

|

— |

|

|

|

17,632 |

|

|

| Payroll taxes associated with

the 2021 Vesting Event (f) |

— |

|

|

|

— |

|

|

|

15,418 |

|

|

|

— |

|

|

| Other (g) |

595 |

|

|

|

2,965 |

|

|

|

1,309 |

|

|

|

4,894 |

|

|

| Tax effects of these

adjustments (h) |

(686 |

) |

|

|

(71 |

) |

|

|

(13,487 |

) |

|

|

(109 |

) |

|

|

Adjusted Net Income |

164,135 |

|

|

|

98,894 |

|

|

|

571,216 |

|

|

|

278,001 |

|

|

| Estimated tax effect of change

to C-Corporation status (i) |

— |

|

|

|

(25,147 |

) |

|

|

— |

|

|

|

(69,410 |

) |

|

|

Pro Forma Adjusted Net Income |

$ |

164,135 |

|

|

|

$ |

73,747 |

|

|

|

$ |

571,216 |

|

|

|

$ |

208,591 |

|

|

| |

|

|

|

|

|

|

|

| Pro Forma Adjusted Earnings

per Share |

|

|

|

|

|

|

|

|

Basic |

$ |

1.80 |

|

|

|

$ |

0.96 |

|

|

|

$ |

6.21 |

|

|

|

$ |

2.82 |

|

|

|

Diluted |

$ |

1.75 |

|

|

|

$ |

0.91 |

|

|

|

$ |

5.98 |

|

|

|

$ |

2.70 |

|

|

| Weighted average common shares

outstanding |

|

|

|

|

|

|

|

|

Basic |

91,140 |

|

|

|

76,771 |

|

|

|

91,951 |

|

|

|

73,908 |

|

|

|

Diluted |

93,844 |

|

|

|

80,714 |

|

|

|

95,504 |

|

|

|

77,171 |

|

|

|

(a) |

|

Represents outside consulting fees associated with our strategic

cost savings and business optimization

initiatives. |

| (b) |

|

Represents our contractual

payments under our Monitoring Agreement with our former private

equity sponsor Kohlberg Kravis Roberts & Co.

L.P. |

| (c) |

|

Represents non-cash charges

related to equity based compensation, which vary from period to

period depending on certain factors such as the 2021 Vesting Event,

timing and valuation of awards, achievement of performance targets

and equity award forfeitures. |

| (d) |

|

Represents severance costs

associated with executive leadership changes and enterprise-wide

organizational changes. |

| (e) |

|

Represents costs incurred during

the thirteen and thirty-nine weeks ended October 31, 2020, as a

result of the COVID-19 pandemic, including temporary wage premiums,

additional sick time, costs of additional cleaning supplies and

third party cleaning services for the stores, corporate office and

distribution centers, accelerated freight costs associated with

shifting our inventory purchase earlier in the year to maintain

stock, and legal fees associated with consulting in local

jurisdictions. These costs were no longer added back beginning in

the third quarter of 2020. |

| (f) |

|

Represents cash expenses related

to taxes on equity-based compensation resulting from the 2021

Vesting Event. |

| (g) |

|

Other adjustments include

(representing deductions or additions to Adjusted Net Income)

amounts that management believes are not representative of our

operating performance, including investment income, installation

costs for energy savings associated with our profitability

initiatives, legal fees associated with a distribution to NAHC's

members and our omnibus incentive plan, store exit costs and other

costs associated with strategic cost savings and business

optimization initiatives. |

| (h) |

|

For the thirteen and thirty-nine

weeks ended October 30, 2021, this represents the tax effect of the

total adjustments made to arrive at Adjusted Net Income at the

estimated effective tax rate for the fiscal year ended January 31,

2022. For thirteen and thirty-nine weeks ended October 31, 2020,

this represents the tax effect of the total adjustments made to

arrive at Adjusted Net Income at our historical tax

rate. |

| (i) |

|

Represents the retrospective tax

effect of Adjusted Net Income at our estimated effective tax rate

of approximately 25% for periods prior to October 1, 2020, the

effective date of our conversion to a C-Corporation, upon which we

became subject to federal income taxes. |

Adjusted Selling, General and

Administrative Expenses

We define “Adjusted Selling, General and

Administrative Expenses” as selling, general and administrative

expenses, less consulting fees, private equity sponsor monitoring

fees, equity compensation expense, severance and executive

transition costs, costs related to the COVID-19 pandemic, payroll

taxes associated with the 2021 Vesting Event and other adjustments.

We describe these adjustments reconciling selling, general and

administrative expenses to Adjusted Selling, General and

Administrative Expenses in the following table.

| |

Thirteen Weeks Ended |

|

Thirty-Nine Weeks Ended |

| |

October 30, 2021 |

|

October 31, 2020 |

|

October 30, 2021 |

|

October 31, 2020 |

|

Selling, General and Administrative Expenses |

$ |

344,725 |

|

|

|

$ |

358,955 |

|

|

|

$ |

1,057,290 |

|

|

|

$ |

955,591 |

|

|

| Less: |

|

|

|

|

|

|

|

|

Consulting fees (a) |

— |

|

|

|

(102 |

) |

|

|

— |

|

|

|

(194 |

) |

|

|

Private equity sponsor monitoring fee (b) |

— |

|

|

|

(12,953 |

) |

|

|

— |

|

|

|

(14,793 |

) |

|

|

Equity compensation (c) |

(2,921 |

) |

|

|

(23,359 |

) |

|

|

(36,126 |

) |

|

|

(27,049 |

) |

|

|

Severance and executive transition costs (d) |

— |

|

|

|

— |

|

|

|

— |

|

|

|

(4,137 |

) |

|

|

Costs related to the COVID-19 pandemic (e) |

— |

|

|

|

— |

|

|

|

— |

|

|

|

(17,632 |

) |

|

|

Payroll taxes associated with the 2021 Vesting Event (f) |

— |

|

|

|

— |

|

|

|

(15,418 |

) |

|

|

— |

|

|

|

Other (g) |

(595 |

) |

|

|

(2,965 |

) |

|

|

(1,309 |

) |

|

|

(4,894 |

) |

|

|

Adjusted Selling, General and Administrative Expenses |

$ |

341,209 |

|

|

|

$ |

319,576 |

|

|

|

$ |

1,004,437 |

|

|

|

$ |

886,892 |

|

|

| |

|

|

|

|

|

|

|

| Adjusted Selling, General and

Administrative Expenses as a percentage of Net Sales |

21.4 |

|

% |

|

23.7 |

|

% |

|

20.2 |

|

% |

|

21.7 |

|

% |

|

(a) |

|

Represents outside consulting fees associated with our strategic

cost savings and business optimization initiatives. |

| (b) |

|

Represents our contractual

payments under our Monitoring Agreement with our former private

equity sponsor Kohlberg Kravis Roberts & Co. L.P. |

| (c) |

|

Represents non-cash charges

related to equity based compensation, which vary from period to

period depending on certain factors such as the 2021 Vesting Event,

timing and valuation of awards, achievement of performance targets

and equity award forfeitures. |

| (d) |

|

Represents severance costs

associated with executive leadership changes and enterprise-wide

organizational changes. |

| (e) |

|

Represents costs incurred during

the thirteen and thirty-nine weeks ended October 31, 2020, as a

result of the COVID-19 pandemic, including temporary wage premiums,

additional sick time, costs of additional cleaning supplies and

third party cleaning services for the stores, corporate office and

distribution centers, accelerated freight costs associated with

shifting our inventory purchase earlier in the year to maintain

stock, and legal fees associated with consulting in local

jurisdictions. These costs were no longer added back beginning in

the third quarter of 2020. |

| (f) |

|

Represents cash expenses related

to taxes on equity-based compensation resulting from the 2021

Vesting Event. |

| (g) |

|

Other adjustments include

(representing deductions or additions to Adjusted Selling, General

and Administrative Expenses) amounts that management believes are

not representative of our operating performance, including

investment income, installation costs for energy savings associated

with our profitability initiatives, legal fees associated with a

distribution to NAHC's members and our omnibus incentive plan,

store exit costs and other costs associated with strategic cost

savings and business optimization initiatives. |

Adjusted Free Cash Flow

We define “Adjusted Free Cash Flow” as net cash

provided by (used in) operating activities less net cash provided

by (used in) investing activities. We describe these adjustments

reconciling net cash provided by operating activities to Adjusted

Free Cash Flow in the following table.

| |

Thirteen Weeks Ended |

|

Thirty-Nine Weeks Ended |

| |

October 30, 2021 |

|

October 31, 2020 |

|

October 30, 2021 |

|

October 31, 2020 |

|

Net cash provided by operating activities |

$ |

109,389 |

|

|

|

$ |

83,597 |

|

|

|

$ |

515,063 |

|

|

|

$ |

857,218 |

|

|

| Net cash used in investing

activities |

(24,944 |

) |

|

|

60 |

|

|

|

(58,711 |

) |

|

|

(13,790 |

) |

|

|

Adjusted Free Cash Flow |

$ |

84,445 |

|

|

|

$ |

83,657 |

|

|

|

$ |

456,352 |

|

|

|

$ |

843,428 |

|

|

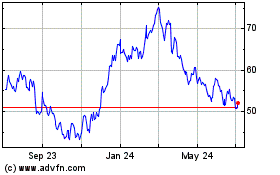

Academy Sports and Outdo... (NASDAQ:ASO)

Historical Stock Chart

From Mar 2024 to Apr 2024

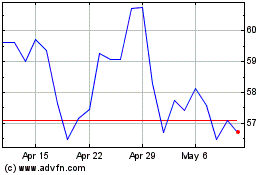

Academy Sports and Outdo... (NASDAQ:ASO)

Historical Stock Chart

From Apr 2023 to Apr 2024