Filed by: Abri SPAC I, Inc.

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Companies:

Abri SPAC I, Inc.

(Commission File No.: 333-268133)

November 21, 2022

Logiq Signs LOI

to Acquire Privately Held Operating Company

As contemplated:

| · | The

preliminary confidential target valuation is between $220M and $250M. |

| · | The

transaction would be executed simultaneously with Logiq’s pending Abri de-SPAC deal

whereby the confidential target would be acquired to become a wholly owned subsidiary of

Logiq. |

| · | Properly

structured, post-transaction the combined entity is expected apply for Nasdaq or NYSE up-listing

and complete a significant capital raise by the end of next year |

NEW YORK, Nov. 18, 2022 -- Logiq,

Inc. (OTCQX: LGIQ) (“the Company”), a provider of digital consumer acquisition solutions, today announced that it has

signed a non-binding letter of intent (“LOI”) with a privately held operating company (“PrivCo”) in which –

effectively simultaneous with Logiq’s pending de-SPAC transaction with Abri SPAC I– Logiq will acquire PrivCo in a share

exchange of newly issued Logiq shares for 100% of the shareholder interests of PrivCo. PrivCo will become a wholly-owned subsidiary of

the Company and is expected to place executives in senior management positions.

The recent announcement

of the Abri SPAC I (special purpose acquisition company) transaction for Logiq opens a possibility for Logiq to acquire PrivCo simultaneous

with the DataLogiq business being acquired by Abri. Properly structured, the combined entity post transaction anticipates:

| 1. | Closing a significant capital raise in

connection with the transaction, as well as |

| 2. | Meeting listing qualifications to apply

for an up-listing from Logiq’s current OTCQX listing to Nasdaq or NYSE by the end of

2023 |

PrivCo attributes

include:

1.

A preliminarily agreed gross valuation for transaction purposes of between $220 million and $250 million

2.

Operates in the financial technology industry, specializing in wealth management, offering above-market secular growth potential

3.

Large institutional shareholders including a U.S. fund management company, a European bank and an Asian conglomerate

Logiq Chief Executive Officer, Brent

Suen, commented, “We are excited about the late-stage discussions underway with this privately held operating company to complete

a transaction that is win-win for both companies’ shareholders. Our next step is to execute a definitive merger agreement, which

we will communicate to our shareholders as soon as we are able to do so, along with further details about the identity and attributes

of the target acquisition.”

The closing of the intended transaction

with PrivCo is expected to occur not later than March 31, 2023 but may well be considerably sooner depending on the timing of a definitive

merger agreement and the timing of Logiq’s de-SPAC transaction with Abri SPAC I.

About Logiq

Logiq Inc. is a U.S.-based provider of e-commerce and digital customer acquisition solutions by simplifying digital advertising.

It provides a data-driven, end-to-end marketing through its results solution or providing software to access data by activating campaigns

across multiple channels.

Connect with Logiq: Website | LinkedIn | Twitter | Facebook

The Company’s Digital Marketing

business includes a holistic, self-serve ad tech platform. Its proprietary data-driven, AI-powered solutions allows brands and agencies

to advertise across thousands of the world’s leading digital and connected TV publishers.

Important Cautions Regarding Forward

Looking Statements

This press release contains certain forward-looking statements and information, as defined within the meaning of Section 27A of the Securities

Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and is subject to the Safe Harbor created

by those sections. This press release also contains forward-looking statements and forward-looking information within the meaning of

Canadian securities legislation that relate to Logiq’s current expectations and views of future events. Any statements that express,

or involve discussions as to, expectations, beliefs, plans, objectives, assumptions or future events or performance (often, but not always,

through the use of words or phrases such as “will likely result”, “are expected to”, “expects”, “will

continue”, “is anticipated”, “anticipates”, “believes”, “estimated”, “intends”,

“plans”, “forecast”, “projection”, “strategy”, “objective” and “outlook”)

are not historical facts and may be forward-looking statements and may involve estimates, assumptions and uncertainties which could cause

actual results or outcomes to differ materially from those expressed in such forward-looking statements. No assurance can be given that

these expectations will prove to be correct and such forward-looking statements included in this press release should not be unduly relied

upon.

These statements speak only as of the

date of this press release. Forward-looking statements are based on a number of assumptions and are subject to a number of risks and

uncertainties, many of which are beyond Logiq’s control, which could cause actual results and events to differ materially from

those that are disclosed in or implied by such forward-looking statements. In particular and without limitation, this press release contains

forward-looking statements regarding our ability to consummate the SPAC transaction with Abri, our ability to consummate a transaction

with PrivCo and subsequent ability to meet the listing requirements on either Nasdaq or NYSE, our ability to raise sufficient operating

capital to adequately operate, our products and services, the use and/or ongoing demand for our products and services, expectations regarding

our revenue and the revenue generation potential of our products and services, our partnerships and strategic alliances, potential strategic

transactions, the impact of global pandemics (including COVID-19) on the demand for our products and services, industry trends, overall

market growth rates, our growth strategies, the continued growth of the addressable markets for our products and solutions, our business

plans and strategies, and the valuation and success of the businesses after completion of the transaction, if any, and other risks described

in the Company’s prior press releases and in its filings with the Securities and Exchange Commission (SEC) including its Annual

Report on Form 10-K and any subsequent public filings.

Logiq undertakes no obligation to update

or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required

by law. New factors emerge from time to time, and it is not possible for Logiq to predict all of them, or assess the impact of each such

factor or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any

forward-looking statement. Any forward-looking statements contained in this press release are expressly qualified in their entirety by

this cautionary statement.

Media & Investor Contact

ir@logiq.com

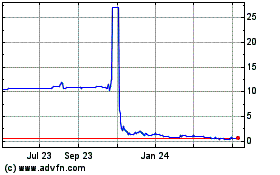

Collective Audience (NASDAQ:CAUD)

Historical Stock Chart

From Mar 2024 to Apr 2024

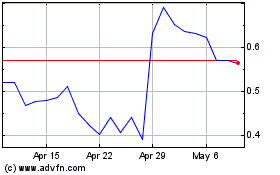

Collective Audience (NASDAQ:CAUD)

Historical Stock Chart

From Apr 2023 to Apr 2024