Current Report Filing (8-k)

23 February 2023 - 11:06PM

Edgar (US Regulatory)

0001808665

false

0001808665

2023-02-23

2023-02-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

February 23, 2023

ASSERTIO HOLDINGS, INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-39294 |

|

85-0598378 |

(State or other jurisdiction of

incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

100

South Sanders Rd., Suite

300,

Lake Forest, IL 60045

(Address of principal executive

offices, including zip code)

(224) 419-7106

(Registrant’s

telephone number, including area code)

Not Applicable

(Former name or former address, if changed

since last report)

Securities registered pursuant

to Section 12(b) of the Act:

| Title

of each class: |

|

Trading

Symbol(s): |

|

Name

of each exchange on which registered: |

| Common Stock, $0.0001 par value |

|

ASRT |

|

The Nasdaq Stock Market LLC |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2 below):

¨ Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth Company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 | Entry into a Material Agreement. |

Exchange Agreement

On February 23, 2023,

Assertio Holdings, Inc. (the “Company”) announced it has entered into separate, privately negotiated exchange

agreements (the “Exchange Agreements”) with a limited number of holders of the Company’s currently outstanding

6.50% Convertible Senior Notes due 2027 (the “Exchanged Notes”). Pursuant to the Exchange Agreements, the Company will

exchange $30.0 million aggregate principal amount of Exchanged Notes for a combination of (a) a cash payment and (b) an agreed

number of shares of the Company’s common stock, $0.0001 par value (the “Common Stock”). The transactions are

subject to customary closing conditions and are expected to close on February 27, 2023. The shares of the Company’s Common

Stock will be issued in private placements exempt from registration in reliance on Section 4(a)(2) of the Securities Act of

1933, as amended (the “Securities Act”). The Company will pay an aggregate of $10.5 million in cash and issue an aggregate

of approximately 7.0 million shares of its common stock in the transactions. The Company will not receive any cash proceeds from the issuance

of the shares of its common stock.

A copy of the Form of

Exchange Agreement is attached hereto as Exhibit 10.1 and is incorporated by reference herein.

| Item 3.02 | Unregistered Sales of Equity Securities. |

The information set forth

under Item 1.01 of this Current Report on Form 8-K regarding the exchange of the Exchanged Notes is incorporated herein by reference.

| Item 7.01 | Regulation FD Disclosure. |

The information set forth

under Item 1.01 of this Current Report on Form 8-K regarding the exchange of the Exchanged Notes is incorporated herein by reference.

A copy of the Company’s

press release is attached hereto as Exhibit 99.1 and is incorporated by reference in this Item 7.01. Exhibit 99.1 to this Current

Report on Form 8-K is furnished only under this Item 7.01 and not any other Item of this Current Report.

This Current Report on Form 8-K

does not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall it constitute an offer to sell,

solicitation or sale in any jurisdiction in which such offer, solicitation or sale would be unlawful. These securities have not been registered

under the Securities Act or any state securities laws and, unless so registered, may not be offered or sold in the United States or to

U.S. persons except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities

Act and applicable state laws.

Forward Looking Statements

Statements in this communication that are not

historical facts are forward-looking statements that reflect the Company’s current expectations, assumptions and estimates of future

performance and economic conditions. These forward-looking statements are made in reliance on the safe harbor provisions of Section 27A

of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking

statements relate to, among other things, the completion of the transactions contemplated by the Exchange Agreements. All statements other than historical facts may be forward-looking

statements and can be identified by words such as “anticipate,” “believe,” “could,” “design,”

“estimate,” “expect,” “forecast,” “goal,” “guidance,” “imply,”

“intend,” “may”, “objective,” “opportunity,” “outlook,” “plan,”

“position,” “potential,” “predict,” “project,” “prospective,” “pursue,”

“seek,” “should,” “strategy,” “target,” “would,” “will,” “aim”

or other similar expressions that convey the uncertainty of future events or outcomes and are used to identify forward-looking statements.

Such forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some

of which are beyond the control of the Company, including the risks described in the Company’s Annual Report on Form 10-K

and Quarterly Reports on Form 10-Q filed with the U.S. Securities and Exchange Commission (“SEC”)

and in other filings the Company makes with the SEC from time to time.

Investors and potential investors are urged not

to place undue reliance on forward-looking statements in this communication, which speak only as of this date. While the Company may elect

to update these forward-looking statements at some point in the future, it specifically disclaims any obligation to update or revise any

forward-looking-statements contained in this communication whether as a result of new information or future events, except as may be required

by applicable law. Nothing contained herein constitutes or will be deemed to constitute a forecast, projection or estimate of the future

financial performance or expected results of the Company.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: February 23, 2023

| |

ASSERTIO

HOLDINGS, INC. |

| |

|

| |

/s/

Daniel A. Peisert |

| |

Daniel

A. Peisert |

| |

President

and Chief Executive Officer |

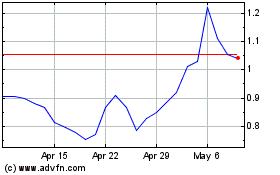

Assertio (NASDAQ:ASRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Assertio (NASDAQ:ASRT)

Historical Stock Chart

From Apr 2023 to Apr 2024