Assertio Holdings, Inc. (Nasdaq: ASRT) (“Assertio”), a specialty

pharmaceutical company offering differentiated products to

patients, and Spectrum Pharmaceuticals, Inc. (Nasdaq: SPPI)

(“Spectrum”), a commercial stage biopharmaceutical company focused

on novel and targeted oncology, today announced that they have

entered into a definitive agreement pursuant to which Assertio will

acquire all outstanding shares of Spectrum in an all-stock and

contingent value rights (“CVR”) transaction.

“The addition of Spectrum’s commercial

capabilities and ROLVEDON, a novel long-acting G-CSF product

recently launched into a blockbuster market in October 2022,

exemplifies Assertio’s attractiveness as an acquirer of new,

accretive assets across diverse therapeutic categories, and ability

to continue their growth and achieve profitable contributions

faster and more efficiently than could be achieved on a standalone

basis. We intend to retain the majority of Spectrum’s commercial

infrastructure, which we believe is synergistic to our digital

non-personal platform, deploying these complementary dual channels

to support clinical messaging, reimbursement education and ROLVEDON

awareness to further aid and accelerate its launch,” said Dan

Peisert, President and Chief Executive Officer of Assertio.

“We are excited to combine with Assertio in a

transaction that will deliver significant value to our stockholders

and the opportunity to share in the future upside of ROLVEDON,”

said Tom Riga, President and Chief Executive Officer of Spectrum

Pharmaceuticals. “Our mission at Spectrum has always been to make a

difference in the lives of patients and with Assertio, we have a

partner that will enable us to deliver on this promise. Our

combined assets and commercial infrastructure will position us to

accelerate ROLVEDON’s launch for the benefit of patients, maximize

its potential and drive further growth. We are proud of the launch

trajectory our team has achieved with ROLVEDON and look forward to

an exciting new chapter.”

Terms of the Agreement

Under the terms of the agreement, at closing,

Spectrum stockholders will receive a fixed exchange ratio of 0.1783

shares of Assertio common stock for each share of Spectrum common

stock they own, implying an upfront value of $1.14 per Spectrum

share (approximately $248 million) based on Assertio’s stock price

on April 24, 2023 and an initial 65% premium to Spectrum’s closing

price on such date. Additionally, Spectrum stockholders will

receive one CVR per Spectrum share entitling them to receive up to

an additional $0.20 per share in total (approximately $43 million),

payable in cash or stock at Assertio's election, for $1.34

(approximately $291 million), a total potential premium of 94%.

Subject to adjustments, each CVR shall represent the right to

receive $0.10 payable upon ROLVEDON net sales (less certain

deductions) achieving $175 million during the calendar year ending

December 31, 2024, and $0.10 payable upon ROLVEDON net sales (less

certain deductions) achieving $225 million during the calendar year

ending December 31, 2025.

Following the close of the transaction, Assertio

stockholders will own approximately 65% of the combined company,

and Spectrum stockholders will own approximately 35%, on a fully

diluted basis.

Transaction Strategic and Financial

Rationale

Strengthened Commercial Infrastructure

and Resources: Assertio’s innovative digital non-personal

sales model complements Spectrum’s in-person commercial

infrastructure, providing greater market access and resources than

either company as a standalone entity.

Expected to Be Accretive to Adjusted EPS

and Operating Cash Flow in 2024: Assertio intends to

retain the majority of Spectrum’s commercial team and add operating

costs of approximately $60 million annually. The remaining cost

synergies are expected to accelerate and enhance the profit

opportunities for the combined company and generate double-digit

accretion to adjusted EPS and increased operating cash flow in

2024.

Enhanced IP Portfolio:

ROLVEDON’s intellectual property protection is anticipated to

extend through 2036, complementing Assertio’s portfolio of

traditional and non-traditional IP protection, including assets

with protection extending beyond 2040 and plans to secure

additional protections on existing assets.

Improved Strategic Profile: The

transaction enables the combined company to have a more scalable

and competitive infrastructure for continuing the development and

acquisition of existing and prospective new commercial- and late

development-stage products suited to Assertio’s unique omni-channel

sales strategy.

Platform Diversification: In

addition to Assertio’s key assets Indocin, Sympazan and Otrexup,

Spectrum’s key asset ROLVEDON will represent meaningful further

asset diversification. ROLVEDON is a long-acting growth factor

(G-CSF) indicated to decrease the incidence of infection, as

manifested by febrile neutropenia, in adult patients with

non-myeloid malignancies receiving myelosuppressive anti-cancer

drugs associated with clinically significant incidence of febrile

neutropenia.

Access to Capital Markets: With

enhanced scale and greater diversification of revenue generating

commercial assets, the combined company is expected to have a more

attractive profile to investors and to benefit from greater access

to the capital markets.

Approvals and Timing to

Close

The transaction, which has been approved by the

boards of directors of both companies, is expected to close in the

third quarter of 2023, subject to approval by Assertio and Spectrum

stockholders and the satisfaction of customary closing

conditions.

Conference Call and Investor

Presentation Information

Assertio and Spectrum will host a conference

call today, at 8:30 am Eastern Time to discuss the transaction.

|

Date: |

April 25, 2023 |

|

Time: |

8:30 a.m. Eastern Time |

|

Webcast (live and archive) and Presentation: |

http://investor.assertiotx.com/overview/default.aspxhttps://investor.sppirx.com/events-and-presentations |

|

Dial-in numbers: |

1-929-201-5912 |

|

Conference number: |

9687947 |

Please connect at least 15 minutes prior to the

live webcast to ensure adequate time for any software download that

may be needed to access the webcast. The replay will be available

approximately two hours after the call on the investor

websites.

Advisors

Guggenheim Securities, LLC is acting as

financial advisor to Spectrum, and Gibson, Dunn & Crutcher LLP

is serving as legal counsel.

SVB Securities and H.C. Wainwright & Co. are

acting as financial advisors to Assertio, and Latham & Watkins

LLP is serving as legal counsel.

About Assertio

Assertio is a specialty pharmaceutical company

offering differentiated products to patients utilizing a

non-personal promotional model. We have built and continue to build

our commercial portfolio by identifying new opportunities within

our existing products as well as acquisitions or licensing of

additional approved products. To learn more about Assertio, visit

www.assertiotx.com.

About Spectrum

Spectrum is a commercial stage biopharmaceutical

company, with a strategy of acquiring, developing, and

commercializing novel and targeted oncology therapies. We have an

in-house clinical development organization with regulatory and data

management capabilities, in addition to commercial infrastructure

and a field based sales force for our marketed product, ROLVEDON™

(eflapegrastim-xnst) Injection. For additional information on

Spectrum please visit www.sppirx.com.

Forward-Looking Statements

The statements in this communication include

forward-looking statements concerning Assertio and Spectrum, the

proposed transactions and other related matters. Forward-looking

statements may discuss goals, intentions and expectations as to

future plans, trends, events, results of operations or financial

condition, or otherwise, based on current beliefs and involve

numerous risks and uncertainties that could cause actual results to

differ materially from expectations. Forward-looking statements

speak only as of the date they are made or as of the dates

indicated in the statements and should not be relied upon as

predictions of future events, as there can be no assurance that the

events or circumstances reflected in these statements will be

achieved or will occur. Forward-looking statements can often, but

not always, be identified by the use of forward-looking terminology

including “believes,” “expects,” “may,” “will,” “should,” “seeks,”

“intends,” “plans,” “pro forma,” “estimates,” “anticipates,”

“designed,” or the negative of these words and phrases, other

variations of these words and phrases or comparable terminology.

These forward-looking statements involve risks and uncertainties

that could cause actual results to differ materially from those

contemplated by the statements, including: failure to obtain

applicable regulatory or stockholder approvals in a timely manner

or otherwise; failure to satisfy other closing conditions to the

proposed transactions; risks that the new businesses will not be

integrated successfully or that the combined company will not

realize estimated cost savings, value of certain tax assets,

synergies and growth, or that such benefits may take longer to

realize than expected; failure to realize anticipated benefits of

the combined operations; risks relating to unanticipated costs of

integration; demand for the combined company’s products; the

growth, change and competitive landscape of the markets in which

the combined company participates; expected industry trends,

including pricing pressures and managed healthcare practices;

variations in revenues obtained from commercialization agreements,

including contingent milestone payments, royalties, license fees

and other contract revenues, including non-recurring revenues, and

the accounting treatment with respect thereto; Assertio’s and

Spectrum’s abilities to obtain and maintain intellectual property

protection for their respective products and operate their

respective businesses without infringing the intellectual property

rights of others; the commercial success and market acceptance of

Assertio’s and Spectrum’s products; the entry and sales of generics

of Assertio’s products including the Indocin products which are not

patent protected and may face generic competition at any time; the

outcome of, and Assertio’s intentions with respect to, any

litigation or investigations, including antitrust litigation,

opioid-related investigations, opioid-related litigation and

related claims for negligence and breach of fiduciary duty against

Assertio’s former insurance broker, and other disputes and

litigation, and the costs and expenses associated therewith; and

the ability of Assertio’s and Spectrum’s third-party manufacturers

to manufacture adequate quantities of commercially salable

inventory and active pharmaceutical ingredients for each of their

respective products, and Assertio’s and Spectrum’s abilities to

maintain their respective supply chains. For a discussion of

additional factors that could cause actual results to differ

materially from those contemplated by forward-looking statements,

see the sections captioned “Risk Factors” in Assertio’s and

Spectrum’s Annual Reports on Form 10-K for the year ended December

31, 2022 and other filings with the Securities and Exchange

Commission (the “SEC”). Many of these risks and uncertainties may

be exacerbated by the COVID-19 pandemic and any worsening of the

global business and economic environment as a result. Assertio and

Spectrum do not assume, and hereby disclaim, any obligation to

update forward-looking statements, except as may be required by

law.

About ROLVEDON™

ROLVEDON™ (eflapegrastim-xnst) injection is a

long-acting granulocyte colony-stimulating factor (G-CSF) with a

novel formulation. Spectrum has received an indication to decrease

the incidence of infection, as manifested by febrile neutropenia,

in adult patients with non-myeloid malignancies receiving

myelosuppressive anti-cancer drugs associated with clinically

significant incidence of febrile neutropenia. ROLVEDON is not

indicated for the mobilization of peripheral blood progenitor cells

for hematopoietic stem cell transplantation. The BLA for ROLVEDON

was supported by data from two identically designed Phase 3,

randomized, open-label, noninferiority clinical trials, ADVANCE and

RECOVER, which evaluated the safety and efficacy of ROLVEDON in 643

early-stage breast cancer patients for the management of

neutropenia due to myelosuppressive chemotherapy. In both studies,

ROLVEDON demonstrated the pre-specified hypothesis of

non-inferiority (NI) in mean duration of severe neutropenia (DSN)

and a similar safety profile to pegfilgrastim. ROLVEDON also

demonstrated non-inferiority to pegfilgrastim in the mean DSN

across all four cycles (all NI p<0.0001) in both trials.

Please see the Important Safety Information

below and the full prescribing information for ROLVEDON at

www.rolvedon.com.

Indications and UsageROLVEDON

is indicated to decrease the incidence of infection, as manifested

by febrile neutropenia, in adult patients with non-myeloid

malignancies receiving myelosuppressive anti-cancer drugs

associated with clinically significant incidence of febrile

neutropenia.

Limitations of UseROLVEDON is not indicated for

the mobilization of peripheral blood progenitor cells for

hematopoietic stem cell transplantation.

Important Safety

InformationContraindications

- ROLVEDON is contraindicated in

patients with a history of serious allergic reactions to

eflapegrastim, pegfilgrastim or filgrastim products. Reactions may

include anaphylaxis.

Warnings and

PrecautionsSplenic Rupture

- Splenic rupture, including fatal

cases, can occur following the administration of recombinant human

granulocyte colony-stimulating factor (rhG-CSF) products. Evaluate

patients who report left upper abdominal or shoulder pain for an

enlarged spleen or splenic rupture.

Acute Respiratory Distress Syndrome

(ARDS)

- ARDS can occur in patients

receiving rhG-CSF products. Evaluate patients who develop fever,

lung infiltrates, or respiratory distress. Discontinue ROLVEDON in

patients with ARDS.

Serious Allergic Reactions

- Serious allergic reactions,

including anaphylaxis, can occur in patients receiving rhG-CSF

products. Permanently discontinue ROLVEDON in patients who

experience serious allergic reactions.

Sickle Cell Crisis in Patients with

Sickle Cell Disorders

- Severe and sometimes fatal sickle

cell crises can occur in patients with sickle cell disorders

receiving rhG-CSF products. Discontinue ROLVEDON if sickle cell

crisis occurs.

Glomerulonephritis

- Glomerulonephritis has occurred in

patients receiving rhG-CSF products. The diagnoses were based upon

azotemia, hematuria (microscopic and macroscopic), proteinuria, and

renal biopsy. Generally, events of glomerulonephritis resolved

after dose-reduction or discontinuation. Evaluate and consider dose

reduction or interruption of ROLVEDON if causality is likely.

Leukocytosis

- White blood cell (WBC) counts of

100 x 109/L or greater have been observed in patients receiving

rhG-CSF products. Monitor complete blood count (CBC) during

ROLVEDON therapy. Discontinue ROLVEDON treatment if WBC count of

100 x 109/L or greater occurs.

Thrombocytopenia

- Thrombocytopenia has been reported

in patients receiving rhG-CSF products. Monitor platelet

counts.

Capillary Leak Syndrome

- Capillary leak syndrome has been

reported after administration of rhG-CSF products and is

characterized by hypotension, hypoalbuminemia, edema and

hemoconcentration. Episodes vary in frequency and severity and may

be life-threatening if treatment is delayed. If symptoms develop,

closely monitor and give standard symptomatic treatment, which may

include a need for intensive care.

Potential for Tumor Growth Stimulatory

Effects on Malignant Cells

- The granulocyte colony-stimulating

factor (G-CSF) receptor through which ROLVEDON acts has been found

on tumor cell lines. The possibility that ROLVEDON acts as a growth

factor for any tumor type, including myeloid malignancies and

myelodysplasia, diseases for which ROLVEDON is not approved, cannot

be excluded.

Myelodysplastic Syndrome (MDS) and Acute

Myeloid Leukemia (AML) in Patients with Breast and Lung

Cancer

- MDS and AML have been associated

with the use of rhG-CSF products in conjunction with chemotherapy

and/or radiotherapy in patients with breast and lung cancer.

Monitor patients for signs and symptoms of MDS/AML in these

settings.

Aortitis

- Aortitis has been reported in

patients receiving rhG-CSF products. It may occur as early as the

first week after start of therapy. Consider aortitis in patients

who develop generalized signs and symptoms such as fever, abdominal

pain, malaise, back pain, and increased inflammatory markers (e.g.,

c-reactive protein and white blood cell count) without known

etiology. Discontinue ROLVEDON if aortitis is suspected.

Nuclear Imaging

- Increased hematopoietic activity of

the bone marrow in response to growth factor therapy has been

associated with transient positive bone imaging changes. This

should be considered when interpreting bone imaging results.

Adverse Reactions

- The most common adverse reactions

(≥20%) were fatigue, nausea, diarrhea, bone pain, headache,

pyrexia, anemia, rash, myalgia, arthralgia, and back pain.

- Permanent discontinuation due to an

adverse reaction occurred in 4% of patients who received ROLVEDON.

The adverse reaction requiring permanent discontinuation in 3

patients who received ROLVEDON was rash.

To report SUSPECTED ADVERSE REACTIONS,

contact Spectrum Pharmaceuticals, Inc. at 1-888-713-0688 or FDA at

1800FDA1088 or www.fda.gov/medwatch

SPECTRUM PHARMACEUTICALS, INC.® is a registered

trademark of Spectrum Pharmaceuticals, Inc. and its

affiliates. REDEFINING CANCER CARE™ and ROLVEDON™ are the Spectrum

Pharmaceuticals’ logos and trademarks owned by Spectrum

Pharmaceuticals, Inc. Any other trademarks are the property of

their respective owners.

No Offer or Solicitation

This communication is not intended to and does

not constitute an offer to sell or the solicitation of an offer to

subscribe for or buy or an invitation to purchase or subscribe for

any securities or the solicitation of any vote in any jurisdiction

pursuant to the proposed transactions or otherwise, nor shall there

be any sale, issuance or transfer of securities in any jurisdiction

in contravention of applicable law. No offer of securities shall be

made except by means of a prospectus meeting the requirements of

Section 10 of the Securities Act of 1933, as amended. Subject to

certain exceptions to be approved by the relevant regulators or

certain facts to be ascertained, the public offer will not be made

directly or indirectly, in or into any jurisdiction where to do so

would constitute a violation of the laws of such jurisdiction, or

by use of the mails or by any means or instrumentality (including

without limitation, facsimile transmission, telephone and the

internet) of interstate or foreign commerce, or any facility of a

national securities exchange, of any such jurisdiction.

Important Additional Information Will be

Filed with the SEC

Assertio will file with the SEC a Registration

Statement on Form S-4, which will include a joint proxy statement

and prospectus of both Assertio and Spectrum (the “joint proxy

statement/prospectus”). INVESTORS AND STOCKHOLDERS ARE

URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS, AND OTHER

RELEVANT DOCUMENTS TO BE FILED WITH THE SEC, IN THEIR ENTIRETY

CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION ABOUT ASSERTIO, SPECTRUM, THE PROPOSED

TRANSACTIONS AND RELATED MATTERS. Investors and

stockholders will be able to obtain free copies of the joint proxy

statement/prospectus and other documents filed with the SEC by

Assertio and Spectrum through the website maintained by the SEC at

www.sec.gov. In addition, investors and stockholders will be able

to obtain free copies of the joint proxy statement/prospectus and

other documents filed with the SEC by Assertio and Spectrum by

contacting Investor Relations at Assertio Holdings, Inc., 100 South

Sanders Rd., Suite 300, Lake Forest, IL 60045 (for documents filed

by Assertio) or Investor Relations at Spectrum Pharmaceuticals,

Inc. by email at ir@sppirx.com or by phone at (949) 788-6700 (for

documents filed by Spectrum).

Participants in the

Solicitation

Assertio and Spectrum and their respective

directors and executive officers may be deemed to be participants

in the solicitation of proxies from their respective stockholders

in respect of the proposed transactions contemplated by the joint

proxy statement/prospectus. Information regarding the persons who

are, under the rules of the SEC, participants in the solicitation

of the stockholders of Assertio and Spectrum in connection with the

proposed transactions, including a description of their direct or

indirect interests, by security holdings or otherwise, will be set

forth in the joint proxy statement/prospectus when it is filed with

the SEC. Information regarding Assertio’s directors and executive

officers is contained in its Annual Report on Form 10-K for the

year ended December 31, 2022 and its Proxy Statement on Schedule

14A, dated April 3, 2023, which are filed with the SEC. Information

regarding Spectrum’s directors and executive officers is contained

in its Annual Report on Form 10-K for the year ended December 31,

2022 and its Proxy Statement on Schedule 14A, dated April 27, 2022,

which are filed with the SEC.

Assertio Investor Contact Matt KrepsDarrow

AssociatesM: 214-597-8200mkreps@darrowir.com

Spectrum Investor ContactsNora Brennan Chief

Financial Officer/Investor Relations

949-788-6700InvestorRelations@sppirx.com

Lisa WilsonIn-Site Communications,

Inc.212-452-2793lwilson@insitecony.com

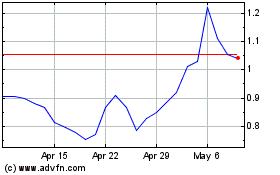

Assertio (NASDAQ:ASRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Assertio (NASDAQ:ASRT)

Historical Stock Chart

From Apr 2023 to Apr 2024