Additional Proxy Soliciting Materials - Non-management (definitive) (dfan14a)

18 March 2023 - 7:17AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material Under § 240.14a-12 |

| AmeriServ Financial, Inc. |

(Name of Registrant as Specified In Its Charter)

|

| |

DRIVER MANAGEMENT

COMPANY LLC

Driver Opportunity

Partners I LP

J. Abbott R.

Cooper

JULIUS D. RUDOLPH

brandon l.

simmons

|

(Name of Persons(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Driver Management Company

LLC (“Driver Management”), together with the other participants named herein (collectively, “Driver”), has filed

a preliminary proxy statement and accompanying WHITE universal proxy card with the Securities and Exchange Commission to be used to solicit

votes for the election of its slate of highly-qualified director nominees at the 2023 annual meeting of shareholders of AmeriServ Financial,

Inc., a Pennsylvania corporation (the “Company”).

On March 17, 2023, J. Abbot

R. Cooper, Managing Member of Driver Management, was quoted in the following article published by biznewsPA:

Board fight heats up at AmeriServ

A Johnstown bank is ratcheting up its fight with an activist investor

over the composition of the bank's board.

| · | In a press release this week, AmeriServ Financial declared the investor's nominees were invalid based on alleged problems with how

they were nominated. |

| · | The investor -- Abbott Cooper of New York hedge fund Driver Management -- said he plans to push back against the bank's claims. |

| · | The bank is slated to elect three members to its board this year at its annual meeting, which has not yet been scheduled. |

| · | Driver and AmeriServ have each nominated three candidates. |

What's the issue: There are a couple.

| · | In a letter from its lawyers, AmeriServ says Driver failed to make adequate disclosures about ties between the bank and family

members of one of its nominees, Pittsburgh real estate developer Julius "Izzy" Rudolph. |

| · | Rudolph's father and brother-in-law have both done business with AmeriServ, according to the letter. |

| · | It cites as an example lines of credit totaling more than $4 million taken out by Rudoph's father, William Rudolph. |

| · | The letter also seeks to disqualify Cooper himself from joining the AmeriServ board, citing a bylaw barring directors from serving

as directors for other banks. |

| · | Cooper has been nominated to be a director of First of Long Island Corp., parent of the First National Bank of Long Island in New

York. |

| · | The letter, which was filed with securities regulators, asks Driver to withdraw its candidates. |

| · | A bank spokesperson declined to comment beyond the press release issued earlier this week. |

Who's nominated: In addition to Cooper and Rudolph, Driver has nominated Brandon Simmons, president and chairman of a nonprofit

called Let Our Vision Evolve, which educates under-represented professionals about private-sector opportunities.

| · | Rudolph is CEO of McKnight Realty Partners, which was founded by his father. |

| · | Cooper holds an ownership stake of about 8% in AmeriServ. |

| · | The bank -- which has assets of about $1.4 billion -- has nominated its own candidates: |

| · | Retired AFL-CIO president Richard "Rick" Bloomingdale |

| · | David Hickton, a former U.S. attorney and cyber security expert in western Pennsylvania. |

| · | Daniel Onorato, an existing director who is former chief executive of Allegheny County and a one-time gubernatorial candidate.

He is now chief corporate affairs officer for Highmark Health. |

| · | Bloomingdale and Hickton would be new additions to the board. |

| · | Two existing directors -- Allan Dennison and Sara Sargent -- are not standing for re-election. |

What's the response: In a phone interview, Cooper said he plans to contest the claims and ask the bank to declare Driver's candidates

are valid.

| · | If not, he said, he would file a lawsuit to compel the bank to do so. |

| · | The lawsuit also would ask that the bank's annual meeting be delayed until the matter is resolved, he added. |

What are the arguments: Chief among them is a claim by Cooper that the bank is citing bylaws that were not properly adopted.

| · | Cooper also noted that restrictions from serving on multiple bank boards -- called interlocks provisions -- already exist in federal

law, but that they apply only to banks in the same market. |

| · | "First of Long Island's closest bank branch is 500 miles away," he said. "There's no interlock that would violate federal

law." |

Why is this happening: Cooper has criticized AmeriServ as underperforming and argued that shareholders deserve a change at the

board level.

| · | Cooper tangled previously with Codorus Valley Bancorp., the York-based parent of PeoplesBank. |

| · | Codorus Valley ultimately reached a settlement and added some Driver-nominated candidates to its board |

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Driver Management Company LLC (“Driver Management”),

together with the other participants named herein (collectively, “Driver”), has filed a preliminary proxy statement and accompanying

WHITE universal proxy card with the Securities and Exchange Commission (“SEC”) to be used to solicit votes for the election

of its slate of highly-qualified director nominees at the 2023 annual meeting of shareholders of AmeriServ Financial, Inc., a Pennsylvania

corporation (the “Company”).

DRIVER STRONGLY ADVISES ALL SHAREHOLDERS OF THE COMPANY

TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY

MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT HTTP://WWW.SEC.GOV.

IN ADDITION, THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE, UPON

REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO THE PARTICIPANTS’ PROXY SOLICITOR.

The participants in the proxy solicitation are anticipated

to be Driver Management, Driver Opportunity Partners I LP (“Driver Opportunity”), J. Abbott R. Cooper, Julius D. Rudolph and

Brandon L. Simmons.

As of the date hereof, the participants in the proxy

solicitation beneficially own in the aggregate 1,477,919 shares of Common Stock, par value $0.01 per share, of the Company (the “Common

Stock”). As of the date hereof, Driver Opportunity directly beneficially owns 201,000 shares of Common Stock, including 1,000 shares

held in record name. Driver Management, as the general partner of Driver Opportunity and investment manager to certain separately managed

accounts (the “SMAs”), may be deemed to beneficially own the (i) 201,000 shares of Common Stock directly beneficially owned

by Driver Opportunity and (ii) 1,276,919 shares of Common Stock held in the SMAs. Mr. Cooper, as the managing member of Driver Management,

may be deemed to beneficially own the (i) 201,000 shares of Common Stock directly beneficially owned by Driver Opportunity and (ii) 1,276,919

shares of Common Stock held in the SMAs. Neither of Messrs. Rudolph or Simmons beneficially own any securities of the Company.

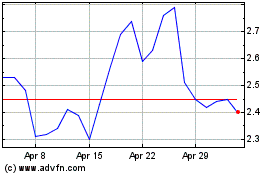

AmeriServ Financial (NASDAQ:ASRV)

Historical Stock Chart

From Mar 2024 to Apr 2024

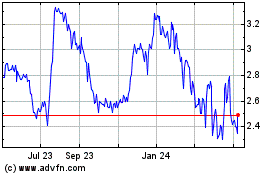

AmeriServ Financial (NASDAQ:ASRV)

Historical Stock Chart

From Apr 2023 to Apr 2024