UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. 1)

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Under § 240.14a-12 |

| AMERISERV FINANCIAL, INC. |

(Name of Registrant as Specified In Its Charter)

|

| |

DRIVER MANAGEMENT

COMPANY LLC

DRIVER OPPORTUNITY

PARTNERS I LP

J. ABBOTT R.

COOPER

Julius D. Rudolph

Brandon L. Simmons

|

(Name of Persons(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

PRELIMINARY PROXY STATEMENT

SUBJECT TO COMPLETION

DATED MARCH 17, 2023

DRIVER MANAGEMENT COMPANY LLC

•, 2023

PLEASE VOTE THE ENCLOSED WHITE UNIVERSAL

PROXY CARD TODAY—

BY PHONE, BY INTERNET OR BY SIGNING, DATING AND RETURNING IT IN THE

POSTAGE-PAID ENVELOPE PROVIDED

To Our Fellow Shareholders:

Driver

Management Company LLC and the other participants in this solicitation (collectively, “Driver”, “we” or “our”)

are the beneficial owners of an aggregate of 1,477,919 shares of common stock, par value $0.01 per share (the “ASRV Common Stock”),

of AmeriServ Financial, Inc., a Pennsylvania corporation (“ASRV” or the “Company”). We have nominated three (3)

highly-qualified individuals for election to the Company’s board of directors (the “Board”) because we believe that

substantial change in the composition of the Board is needed to protect and increase shareholder value. We are seeking your support at

the Company’s 2023 annual meeting of shareholders scheduled to be held on [April 25, 2023 at 1:30 p.m., Eastern Time] (including

any adjournments or postponements thereof and any meeting which may be called in lieu thereof, the “Annual Meeting”).

On March 15, 2023,

the Company notified Driver by letter that it had determined that Driver’s notice of nomination submitted on January 17, 2023 was

invalid and one of Driver’s nominees was ineligible for election to the Board. The Company has filed the letter as Exhibit 99.2

to its Current Report on Form 8-K filed on March 15, 2023 with the U.S. Securities and Exchange Commission. Driver believes that there

is no justification for the conclusions reached in the Company’s letter and will challenge the Company’s determination.

The Company has a classified

Board, which is currently divided into three (3) classes. The terms of three (3) Class I directors expire at the Annual Meeting. We are

seeking your support at the Annual Meeting to elect our three (3) nominees. Your vote to elect our nominees will have the legal effect

of replacing three incumbent directors with our nominees.

We urge you to carefully

consider the information contained in the attached proxy statement and then support our efforts by signing, dating and returning the enclosed

WHITE universal proxy card today. The attached proxy statement and the enclosed WHITE universal proxy card are first being

mailed to shareholders on or about •, 2023.

If you have already voted

for the incumbent management slate, you have every right to change your vote by signing, dating and returning a later dated WHITE universal

proxy card or by voting in person at the Annual Meeting.

If you have any questions

or require any assistance with your vote, please contact Saratoga Proxy Consulting LLC, who is assisting us, at its address and toll-free

numbers listed below.

Thank you for your support,

/s/ J. Abbott R. Cooper

J. Abbott R. Cooper

Driver Management Company LLC

|

If you have any questions, require assistance in

voting your WHITE universal proxy card,

or need additional copies of Driver’s proxy

materials,

please contact Saratoga at the phone numbers listed

below.

Shareholders call toll free at (888) 368-0379

Email: info@saratogaproxy.com

|

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED MARCH 17, 2023

2023 ANNUAL MEETING OF SHAREHOLDERS

OF

AMERISERV FINANCIAL, INC.

_________________________

PROXY STATEMENT

OF

DRIVER MANAGEMENT COMPANY LLC

•, 2023

_________________________

PLEASE SIGN, DATE AND MAIL THE ENCLOSED WHITE UNIVERSAL PROXY CARD TODAY

Driver Management Company

LLC, a Delaware limited liability company, (“Driver Management”) and the other participants in this solicitation (collectively,

“Driver”, “we” or “our”) are the beneficial owners of an aggregate of 1,477,919 shares of common stock,

par value $0.01 per share (the “ASRV Common Stock”), of AmeriServ Financial, Inc., a Pennsylvania corporation (“ASRV”

or the “Company”). We believe change in the composition of the Company’s board of directors (the “Board”)

is required to ensure that the Company is being run in manner that is consistent with shareholders’ best interests and have nominated

three (3) highly-qualified director candidates who will work to preserve and increase shareholder value. We are seeking your support at

the Company’s 2023 annual meeting of shareholders scheduled to be held on [April 25, 2023 at 1:30 p.m., Eastern Time] (including

any adjournments or postponements thereof and any meeting which may be called in lieu thereof, the “Annual Meeting”), for

the following:

| 1. | To elect Driver’s three (3) director nominees, J. Abbott R. Cooper, Julius D. Rudolph and Brandon

L. Simmons (each a “Driver Nominee” and, collectively, the “Driver Nominees”), to the Board as Class I directors

to serve until the 2026 annual meeting of shareholders (the “2026 Annual Meeting”) or until their respective successors are

duly elected and qualified (“Proposal 1”); |

| 2. | To ratify the appointment of S.R. Snodgrass P.C as the Company’s independent registered public accounting

firm to audit the Company’s books and financial records for the fiscal year ending December 31, 2023 (“Proposal 2”); |

| 3. | To vote to approve the compensation of the named executive officers of the Company (“Proposal 3”);

and |

| 4. | To transact such other business as may properly come before the Annual Meeting or any adjournment(s) thereof. |

This Proxy Statement and

the enclosed WHITE universal proxy card are first being mailed to shareholders on or about •, 2023.

The Company has a classified

Board, which is currently divided into three classes. The terms of three Class I directors expire at the Annual Meeting. Through the attached

Proxy Statement and enclosed WHITE universal proxy card, we are soliciting proxies to elect the Driver Nominees. Driver and ASRV

will each be using a universal proxy card for voting on the election of directors at the Annual Meeting, which will include the names

of all nominees for election to the Board. Shareholders will have the ability to vote for up to three nominees on Driver’s enclosed

WHITE universal proxy card. There is no need to use the Company’s [•] proxy card or voting instruction form, regardless

of how you wish to vote.

Your vote to elect the

Driver Nominees will have the legal effect of replacing three incumbent directors. If elected, the Driver Nominees, subject to their fiduciary

duties as directors, will seek to work with the other members of the Board to increase shareholder value through (i) more efficient and

shareholder friendly capital allocation, (ii) better alignment of the interests of the Board and the Company’s management, on the

one hand, and shareholders, on the other hand, and (iii) increased focus on total shareholder return However, the Driver Nominees will

constitute a minority on the Board and there can be no guarantee that they will be able to implement the actions that they believe are

necessary to accomplish those objectives. There is no assurance that any of the Company’s nominees will serve as directors if all

or some of the Driver Nominees are elected. The names, background and qualifications of the Company’s nominees, and other information

about them, can be found in the Company’s proxy statement.

On March 15, 2023,

the Company notified Driver by letter that it had determined that Driver’s notice of nomination submitted on January 17, 2023 was

invalid and one of Driver’s nominees was ineligible for election to the Board. The Company has filed the letter as Exhibit 99.2

to its Current Report on Form 8-K filed on March 15, 2023 with the U.S. Securities and Exchange Commission (the “SEC”). Driver

believes that there is no justification for the conclusions reached in the Company’s letter and will challenge the Company’s

determination.

Shareholders are permitted

to vote for less than three nominees or for any combination (up to three total) of the Driver Nominees and the Company’s nominees

on the WHITE universal proxy card. We believe the best opportunity for the Driver Nominees to be elected is by voting on the WHITE

universal proxy card. Driver therefore urges shareholders using our WHITE universal proxy card to vote “FOR”

all three of the Driver Nominees. IMPORTANTLY, IF YOU MARK MORE THAN THREE “FOR” BOXES WITH RESPECT TO THE ELECTION OF

DIRECTORS, ALL OF YOUR VOTES FOR THE ELECTION OF DIRECTORS WILL BE DEEMED INVALID.

Driver Management, Driver

Opportunity Partners I LP, a Delaware limited partnership (“Partners”), J. Abbott R. Cooper, Julius D. Rudolph and Brandon

L. Simmons are members of a group (the “Group”) formed in connection with this proxy solicitation and are deemed participants

in this proxy solicitation.

As of the date hereof,

the participants in this solicitation collectively own 1,477,919 shares of ASRV Common Stock (the “Driver Group Shares”).

We intend to vote such shares FOR the election of the Driver Nominees, FOR Proposal 2 and [•] Proposal 3.

The Company has set the

close of business on •, 2023 as the record date for determining shareholders entitled to notice of and to vote at the Annual Meeting

(the “Record Date”). The mailing address of the principal executive offices of the Company is P.O. Box 430, Johnstown, Pennsylvania

15907-0430. Shareholders of record at the close of business on the Record Date will be entitled to vote at the Annual Meeting. According

to the Company’s proxy statement, as of the Record Date, there were • shares of ASRV Common Stock outstanding.

We urge you to carefully

consider the information contained in the Proxy Statement and then support our efforts by signing, dating and returning the enclosed WHITE

universal proxy card today.

THIS SOLICITATION IS BEING

MADE BY DRIVER AND NOT ON BEHALF OF THE BOARD OR MANAGEMENT OF THE COMPANY. DRIVER IS NOT AWARE OF ANY OTHER MATTERS TO BE BROUGHT BEFORE

THE ANNUAL MEETING OTHER THAN AS SET FORTH IN THIS PROXY STATEMENT. SHOULD OTHER MATTERS, WHICH DRIVER IS NOT AWARE OF A REASONABLE TIME

BEFORE THIS SOLICITATION, BE BROUGHT BEFORE THE ANNUAL MEETING, THE PERSONS NAMED AS PROXIES IN THE ENCLOSED WHITE UNIVERSAL PROXY

CARD WILL VOTE ON SUCH MATTERS IN THEIR DISCRETION.

DRIVER URGES YOU TO VOTE

“FOR” THE DRIVER NOMINEES BY FOLLOWING THE INSTRUCTIONS ON THE ENCLOSED WHITE UNIVERSAL PROXY CARD TODAY. PLEASE

SIGN, DATE AND RETURN THE WHITE UNIVERSAL PROXY CARD VOTING “FOR” THE ELECTION OF THE DRIVER NOMINEES.

IF YOU HAVE ALREADY SENT

A PROXY CARD FURNISHED BY COMPANY MANAGEMENT OR THE BOARD, YOU MAY REVOKE THAT PROXY AND VOTE ON EACH OF THE PROPOSALS DESCRIBED IN THIS

PROXY STATEMENT BY SIGNING, DATING AND RETURNING THE ENCLOSED WHITE UNIVERSAL PROXY CARD. THE LATEST DATED PROXY IS THE ONLY ONE

THAT COUNTS. ANY PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE ANNUAL MEETING BY DELIVERING A WRITTEN NOTICE OF REVOCATION OR A LATER

DATED PROXY FOR THE ANNUAL MEETING OR BY VOTING IN PERSON AT THE ANNUAL MEETING.

Important Notice Regarding the Availability

of Proxy Materials for the Annual Meeting—This Proxy Statement and our WHITE universal proxy card are available at

•

______________________________

IMPORTANT

Your vote is important,

no matter how many shares of ASRV Common Stock you own. Driver urges you to sign, date, and return the enclosed WHITE universal proxy

card today to vote FOR the election of the Driver Nominees and in accordance with Driver’s recommendations on the other proposals

on the agenda for the Annual Meeting.

| · | If your shares of ASRV Common Stock are registered in your own name, please sign and date the enclosed

WHITE universal proxy card and return it to Driver c/o Saratoga Proxy Consulting LLC (“Saratoga”) in the enclosed envelope

today. |

| · | If your shares of ASRV Common Stock are held in a brokerage account, you are considered the beneficial

owner of the shares of ASRV Common Stock, and these proxy materials, together with a WHITE voting form, are being forwarded to

you by your broker. As a beneficial owner, if you wish to vote, you must instruct your broker how to vote. Your broker cannot vote your

shares of ASRV Common Stock on your behalf without your instructions. |

| · | Depending upon your broker, you may be able to vote either by toll-free telephone or by the Internet.

Please refer to the enclosed voting form for instructions on how to vote electronically. You may also vote by signing, dating and returning

the enclosed voting form. |

As Driver is using a “universal”

proxy card containing the Driver Nominees as well as the Company’s nominees, there is no need to use any other proxy card regardless

of how you intend to vote. Driver strongly urges you NOT to sign or return any [•] proxy cards or voting instruction forms

that you may receive from ASRV. Even if you return the [•] management proxy card marked “withhold” as a protest against

the incumbent directors, it will revoke any proxy card you may have previously sent to us.

|

If you have any questions, require assistance in

voting your WHITE universal proxy card,

or need additional copies of Driver’s proxy

materials,

please contact Saratoga at the phone numbers listed

below.

Shareholders call toll free at (888) 368-0379

Email: info@saratogaproxy.com

|

QUESTIONS AND ANSWERS

Q: Who is making this

solicitation?

A: This solicitation is being made by

Driver Opportunity Partners I LP, Driver Management Company LLC, J. Abbott R. Cooper, Julius “Izzy” D. Rudolph, and Brandon

Simmons

Q: Why

are you making this solicitation?

A: To be blunt, Driver believes that

the Board and the Company’s executive management team have demonstrated that they just are not very good at running a business and

that meaningful change, starting with the composition of the Board, is necessary to preserve and enhance shareholder value. Since 2000

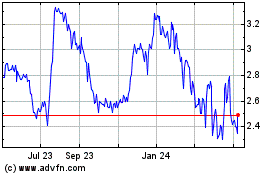

(and indeed well before then), ASRV has created a legacy of underperformance, as illustrated by the chart below, which presents ASRV’s

return on assets (“ROA”), a standard measure of bank profitability, for the years 2000 to 2022 compared to the ROA for the

Dow Jones U.S. Micro Cap Banks Index (the “Micro Cap Banks Index”) for the years 2004 (the first year for which index financial

data is available) to 2022:1

In Driver’s opinion, there is no

adequate explanation for the underperformance illustrated above—underperformance that has lasted decades and across a wide range

of market, financial, economic, political, and regulatory conditions—other than poor management by the executive team and abysmal

leadership and oversight by the Board.

Driver believes that sweeping changes are

needed to end this legacy of underperformance, starting with the composition of the Board, which is why Driver has nominated three highly

qualified individuals, Mr. Cooper, Mr. Rudolph, and Mr. Simmons for election to director at the 2023 Annual Meeting. As a corporation,

ASRV is managed by its board of directors, who have the power to hire and fire executives and to make other significant decisions affecting

how ASRV is managed and operated. As a matter of corporate law, the only way that ASRV shareholders can change the way ASRV is run is

by electing new directors, which is why your vote is so important.

1

Unless otherwise noted, all market and financial data is per S&P Capital IQ.

Q: How

do I know that Driver’s views regarding ASRV are nothing more than the opinion of one unhappy shareholder?

A: Fair point. Let’s consider

how the public market views ASRV.

Q: How

would I do that?

A: Well,

to begin with, start by thinking about what tangible book value per share represents, which is the theoretical dollar amount that an

ASRV shareholder would receive per share of ASRV Common Stock if ASRV were liquidated.2

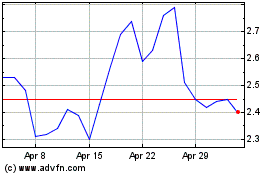

It follows, then, that if a bank’s common stock consistently trades at a discount to tangible book value per share,

then the public market believes that the bank is worth less as an operating business than what it might be liquidated for. As illustrated

by the below chart, ASRV Common Stock has traded less than 100% of tangible book value per share for every single trading day since January

1, 2010:

In other words, based on every single day

that the stock market has been open since January 1, 2010, public market investors have implicitly placed negative value on ASRV operating

as a going concern. While Driver understands that banks may, from time to time trade at a discount to tangible book value per share (in

Driver’s experience, generally during periods of economic turmoil and amid questions regarding credit quality), Driver believes

the fact that ASRV hasn’t traded at tangible book value per share since before January 1, 2010—and never during Jeff Stopko’s

tenure as CEO—suggests that the public market believes there is something fundamentally wrong with how ASRV is being run.

2 See, https://www.travilliannext.com/2022/07/21/tangible-book-value-hits-are-an-underappreciated-headwind-to-bank-stock-performance-but-are-we-approaching-an-inflection-point-written-by-joe-fenech/.

Q: Couldn’t

there be reasons why ASRV isn’t as profitable or as valuable as peers that don’t have to do with the Board? Is there something

about having a union that might make ASRV less profitable or less valuable than other banks that don’t have a union?

A: To begin with, Driver believes that

it is important to be specific when talking about ASRV and unions, since Driver believes that the Board and ASRV management may have,

from time to time, intentionally or unintentionally, allowed investors and others to conflate a number of different concepts regarding

ASRV’s relationship with any unions, many of which are inaccurate.

Q: Ok—now

I am even more confused—what exactly do you mean?

A: Let’s start with what ASRV

has publicly disclosed in filings made with the Securities and Exchange Commission or SEC. In their Annual Report on Form 10-K for the

year ended December 31, 2021 (the “2021 10-K”), ASRV states:

The Company employed 319 people as

of December 31, 2021 in full- and part-time positions. Approximately 150 non-supervisory employees of the Company are represented by the

United Steelworkers AFL-CIO-CLC, Local Union 2635-06. The Company negotiated a new four-year labor contract this year, which will expire

on October 15, 2025. The contract calls for annual wage increases of 2% over the next four years. The Company has not experienced a work

stoppage since 1979. Unionization in financial institutions remains low with less than 1% of banks nationwide being covered by a collective

bargaining agreement.3

In other words, less than half of ASRV’s

employees are represented by a union and covered by a collective bargaining agreement, and that is basically the extent of ASRV’s

disclosures regarding or relating to any union.

Q: But what does that mean for investors?

A: That is a really good question and

one that we have tried to get ASRV’s management and the Board to answer. Based on Driver’s review of ASRV’s filings

with the SEC and other public statements, we have yet to find any disclosure that details the impact of union representation of Company

employees on ASRV’s financial performance. Based on our experience, if the fact that less than half of the Company’s employees

are represented by a union had, is having, or might in the future have a material impact on the Company’s past, present or expected

financial performance, we would expect to see a detailed explanation of that impact in reports filed by ASRV with the SEC. In the absence

of that type of detailed explanation, however, Driver can only assume that the impact of union representation of Company employees has

not been, is not, nor is not expected to be material to ASRV’s financial performance.

Q: Is ASRV owned by a union? Could

a union block a sale of ASRV?

A: Based

on Driver’s review of publicly available information, it does not appear that any union owns a significant percentage of the outstanding

Common Stock. Moreover, Driver believes that if any union could block a sale of ASRV that would constitute material information that

ASRV would need to disclose to investors. Driver is unaware of any such disclosure.

3

https://www.sec.gov/Archives/edgar/data/707605/000155837022003530/tmb-20211231x10k.htm

Q: If

“less than 1% of banks nationwide [are] covered by a collective bargaining agreement,” does that somehow put ASRV at a disadvantage

relative to its peers?

A: Driver does not believe that union

representation of employees puts ASRV at a disadvantage relative to peers. In fact, Driver believes that ASRV’s relationship with

organized labor may offer distinct business advantages that might not be available to peer institutions.

Also, while Driver is only aware of one

other publicly traded banking institution whose employees are represented by a union, Amalgamated Financial Corp. (“Amalgamated”),

it has handily outperformed ASRV, as measured by one, three and five year total return, as illustrated by the below table:4

| |

Total Return |

| |

One Year |

Three Years |

Five Years |

| ASRV |

-7.28% |

5.88% |

-1.47% |

| Amalgamated |

7.57% |

73.71% |

57.75% |

Q: So, Driver doesn’t view

the union negatively?

A: No—to the contrary, Driver

believes that ASRV should be doing far more than it currently is to embrace organized labor generally. Driver believes that ASRV’s

relationship with organized labor is a unique attribute that should be celebrated and made a focal point of ASRV’s business strategy.

Q: Well, if the union isn’t

responsible for ASRV’s underperformance relative to peers, then what is?

A: While there are specific metrics

that Driver believes point directly towards ASRV’s marked underperformance, Driver believes that the ultimate problem is the Board’s

failure to implement appropriate incentives (by way of its executive compensation practices) that might lead to better performance coupled

with the Board’s failure to hold the executive team accountable for underperformance. In Driver’s opinion, the bonuses paid

to ASRV’s executive officers who were named in ASRV’s 2022 proxy statement, who we refer to as “NEOs” and includes

Jeffery Stopko, as part of their compensation for 2021 is a perfect example of this problem.

In order to for the NEO’s to receive

payments under ASRV’s Executive At-Risk Incentive Compensation Plan for 2021, ASRV’s ROA for 2021 needed to be at least 65%

of the ROA of a peer group selected by the compensation/human resources committee (the “Compensation Committee”) of the Board.

To begin with, Driver believes that the performance target of 65% of peer ROA is a low bar and one that merely creates an incentive for

underperformance. However, ASRV was unable to clear this low bar, as disclosed in ASRV’s proxy statement (the “2022 Proxy

Statement”) for its 2022 annual meeting of shareholders, “so there was no payout for any of the named executive officers under

the Executive At-Risk Incentive Compensation Plan.”5

4

Periods ended March 15, 2023

5

https://www.sec.gov/Archives/edgar/data/707605/000114036122010557/ny20002418x1_def14a.htm

Despite the fact that the NEOs failed to

earn a bonus by meeting the (in Driver’s opinion, exceedingly modest) performance targets set by the Compensation Committee, the

Compensation Committee nevertheless “did approve discretionary bonus payments” for the NEOs, allegedly “to ensure that

[ASRV] retain[s] good employees by appropriately compensating them in this extremely competitive job market.” In other words, in

Driver’s opinion, rather than hold the NEO’s accountable for poor financial performance, the Compensation Committee and the

Board determined to reward the NEOs with “discretionary bonus payments.”

Driver also believes that there is a double

standard at work that benefits NEOs to shareholders’ detriment: specifically, that the Board is willing to provide the NEOs with

“competitive” compensation despite resoundingly uncompetitive performance.

Q: So, does Driver think that management

should be paid less?

A: First and foremost, Driver believes

that incentives work and that executive compensation is an extremely effective form of incentive. Unfortunately, Driver believes that,

as currently structured, ASRV’s executive compensation practices create an incentive for underperformance. If elected, the Driver

Nominees will urge the Board to adopt compensation practices that better align the interests of the Board and management, on the one hand,

and shareholders, on the other, to create meaningful incentives to spur better financial performance.

As far as Driver is concerned, it is not

so much a matter of paying ASRV’s executive management more or less but to better link compensation with performance to ensure that

the interests of management are aligned (rather than in conflict) with those of shareholders.

Q: What are some of the “specific

metrics” that you mentioned?

A: Perhaps the primary metric is efficiency

ratio, which is non-interest expense divided by net income and a common metric for measuring a bank management team’s ability to

control costs. Below is a chart showing ASRV’s efficiency ratio for the years 2000 to 2022 compared to the efficiency ratio for

the Micro Cap Banks Index for the years 2004 (the earliest year for which index financial information is available) to 2022.

Effectively, a bank’s efficiency

ratio measures how many dollars of revenue are produced by each dollar of expense. The lower the efficiency ratio, the greater the operating

leverage.6 What is striking about the above chart isn’t

just the magnitude of ASRV’s underperformance (as measured by efficiency ratio) relative to peers, but its consistency. In Driver’s

opinion, the Board and ASRV’s management team have conclusively demonstrated, over an extended period of time, their inability to

achieve what Driver considers to be acceptable levels of operating leverage, which, in turn, in Driver’s opinion, necessitates change,

beginning with the composition of the Board.

Q: I know we already covered this

but what about the union? I know that you said that if the fact that some of ASRV’s employees were covered by a collective bargaining

agreement has had, is having, or is expected to have a material impact on ASRV’s financial performance, you would expect that to

be described in ASRV’s public disclosure but aren’t union employees more expensive than non-union employees?

A: First, to the extent that ASRV’s

compensation and benefits expenses are materially higher than peers due to union representation of employees, you are right in that Driver

would expect that to be described in detail in ASRV’s public disclosures and Driver has yet to see that type of detail if it exists.

What is interesting, however, is that, to the extent that union employees somehow come with a greater cost, Driver would expect to see

that reflected in ASRV’s compensation and benefits expense.

The below chart compares ASRV’s compensation

and benefits expense as percentage of average assets to that of a peer group comprised of publicly traded banking organizations with $1

to $10 billion in assets:

6 See, https://www.bankdirector.com/issues/strategy/secret-low-efficiency-ratio/.

While ASRV’s compensation and benefits as a percentage

of average assets is clearly higher than peers, compared to peer median, ASRV’s compensation and benefits as a percentage of average

assets is 1.4 to 1.6 times peer median for the period 2010 to 2022, which, to Driver’s eye, doesn’t seem to fully explain

why ASRV’s efficiency ratio is so much worse than that of the Micro Cap Banks Index.

However, in reviewing other components of ASRV’s non-interest

expense, one line item stood out: professional fees. The below chart shows ASRV’s professional fee expense for the years 2010 to

2022, during which period ASRV’s professional fees averaged $4.8 million per year:

As a percentage of average assets, ASRV’s

professional fees are significantly greater (between 2.7 and 3.8 times the peer average) than the average and median for the same peer

group of publicly traded banking organizations with assets between $1 and $10 billion:

When professional fees are measured as

a percentage of market capitalization, the issue appears even more vividly: In Driver’s opinion, compared it its market capitalization,

ASRV is spending way too much on professional fees:

What exactly these professional fees are

and what is causing them to appear so much higher than peer institutions is entirely unclear, and ASRV’s disclosure does little

to shed light on the matter. For example, the only commentary relating to professional fees in ASRV’s press release regarding earnings

for the quarter and year ended December 31, 2022 is:

Professional fees were $521,000, or

9.5%, higher for the full year of 2022 due to higher legal costs, outsourced professional services and other professional fees.7

Driver believes the above statement can

be paraphrased as “professional fees were higher because professional fees were higher.” Since Driver believes that a 9.5%

increase in anything might be material, it warrants greater explanation. Regardless of the reasons for ASRV’s elevated (compared

to peers) professional fees, Driver believes that the magnitude of those expenses, particularly relative to ASRV’s market capitalization,

is evidence of poor management.

Q: Ok—so Driver is in favor

of ASRV embracing organized labor, linking pay to performance for the Company’s executive management team, better aligning the interests

of the Board and the Company’s management, on the one hand, and shareholders, on the other hand, and improving operating leverage

by, among other things controlling costs, particularly professional fees—does Driver have other priorities as well?

A: Absolutely. If elected, Driver Nominees

would focus on numerous additional priorities, such as increasing trust and wealth management assets and increasing commercial loans.

Given ASRV’s proximity to Pittsburgh, Driver believes that expanding ASRV’s business represents a tremendous opportunity for

growth. Driver also believes that, if elected, Mr. Rudolph would be invaluable in growing ASRV’s business in Pittsburgh, given his

extensive relationships in that market.

Q: Those all sound like good ideas.

Why doesn’t Driver just ask the current Board to consider Driver’s suggestions? Is it really necessary to change the composition

of the Board?

A: The average tenure of a member of

the Board is twenty years. Jeff Stopko has been CEO (and a director) since 2015. Driver believes that the current Board (i) is invested

in maintaining the status quo, (ii) is not willing to consider the types of meaningful change Driver believes is necessary to end ASRV’s

legacy of underperformance, and (iii) has had ample time and opportunity to remedy ASRV’s underperformance with no noticeable success.

7 https://www.sec.gov/Archives/edgar/data/707605/000155837023000442/tmb-20230124xex99d1.htm.

Q: Has

the Board interviewed the Driver Nominees? If not, why?

A: As an

ASRV shareholder, Driver has the right to nominated candidates for election to the board, which it has done. Nothing in ASRV’s

certificate of incorporation or bylaws requires the Board to interview the Driver Nominees, nor does any applicable law or regulation.

As noted above, Driver believes that the current Board has an interest in maintaining the status quo and has no interest in nominating

candidates for election to director who are likely to support the type of significant change that is needed at ASRV. Driver believes

that it is somewhat absurd for the Board to request to interview the Driver Nominees when the Board is neither required to nor likely

to nominate any of them for election to the Board.

Q: Is Driver an “activist investor?”

A: Driver and Mr. Cooper are often referred

to as activist investors.

Q: Aren’t activist investors

bad?

A: I guess it depends on your perspective.

Driver invests in publicly traded banking organizations where it believes that the status quo needs to change to increase shareholder

value, so directors and officers interested in maintaining the status quo at ASRV might have a negative view about Driver. On the other

hand, if you are unhappy with the long-term performance of ASRV Common Stock, you might consider Driver a welcome agent of change.

Q: Is

Driver just out to make a quick buck at ASRV’s expense?

A: Now who is being blunt? Driver’s

primary goal is to increase the value of its investment in ASRV Common Stock and any increase in the value of ASRV Common Stock will benefit

all ASRV shareholders to exactly the same extent that it will benefit Driver. All things being equal, Driver would rather increase the

value of its investment in ASRV faster rather than slower, which Driver believes is likely a sentiment shared by all ASRV shareholders.

However, Driver considers ASRV to be a long-term investment and intends to remain an ASRV shareholder as long as the possibility exists

for meaningfully increasing shareholder value.

Q: What about a sale? Is Driver pushing

for ASRV to sell itself?

A: As a general matter, Driver believes

that the board of directors of a publicly traded corporation should always consider all opportunities for increasing shareholder value,

including a sale. However, based on information currently available to Driver, Driver does not believe that a sale represents the best

opportunity to increase value for all ASRV shareholders. Driver has not suggested, nor does it have any current intentions to suggest,

that ASRV explore selling itself. None of the Driver Nominees have any current intention, if elected, to push for a sale.

Q: Is shareholder value the only

thing Driver cares about?

A: Driver invests on behalf of its limited

partners and others, and its mandate is to increase the value of investor capital, which, with respect to its investment in ASRV, means

increasing shareholder value. However, Driver believes that a bank that is able to increase shareholder value through profitable growth

is also a bank that can offer better employment opportunities, be a source of credit and other banking products and services to more business

and individuals, and generally better serve the communities in which it operates. Driver does not believe that increasing shareholder

value can only come at the expense of other stakeholders—rather Driver believes that increasing shareholder value through profitable

and prudent growth will create additional benefits for all of ASRV’s stakeholders. In Driver’s opinion, one of the unfortunate

byproducts of ASRV’s legacy of underperformance is what Driver considers to be underinvestment in ASRV’s employees and the

communities in which it operates.

Q: What

are Mr. Rudolph’s and Mr. Simmons’s relationships to Driver and Mr. Cooper?

A: Other than indemnity and other customary

agreements commonly entered into with a nominating shareholder, neither Mr. Rudolph nor Mr. Simmons have any relationship—business

or otherwise—with Driver or Mr. Cooper. Simply put, Driver believes that both Mr. Rudolph, including by virtue of his family’s

historic roots in Johnstown, Pennsylvania and his extensive business relationships in Pittsburgh, and Mr. Simmons, including by virtue

of his extensive experience in leadership roles at a variety of business, civic, and charitable enterprises (as well as his experience

growing up with two parents who were union members), will better represent the interests of all ASRV shareholders than the Company’s

nominees.

REASONS FOR THE SOLICITATION

Driver believes that ASRV’s profitability

(as measured by ROA) and public market valuation (as measured by price to tangible book value) reflects the hard truth that it is a company

with challenges that need to be addressed. Driver further believes that the current Board and management team have had ample opportunity

to improve ASRV’s performance relative to peers and have resolutely failed to do so in any material way. Finally, Driver believes

that significant change in the composition of the Board needs to occur before shareholders might have any reasonable expectation of better

future performance.

Driver has nominated three highly-qualified

and highly motivated individuals for election as directors who, if elected, will work to preserve and increase value for all ASRV shareholders.

Driver believes that preserving and increasing value for ASRV shareholders will result in a more profitable and dynamic financial institution

that will be better equipped and have more resources to benefit all its stakeholders.

PROPOSAL 1

ELECTION OF DIRECTORS

The Company currently has

a classified Board, which is divided into three (3) classes. The directors in each class are elected for staggered terms such that the

term of office of one (1) class of directors expires at each annual meeting of shareholders. We believe that the terms of three (3) Class

I directors expire at the Annual Meeting. We are seeking your support at the Annual Meeting to elect our three (3) Driver Nominees, J.

Abbott R. Cooper, Julius D. Rudolph and Brandon L. Simmons, each of whom is independent of the Company, for terms ending at the 2026 Annual

Meeting. Your vote to elect the Driver Nominees will have the legal effect of replacing three incumbent directors of the Company with

the Driver Nominees. If elected, the Driver Nominees will represent a minority of the members of the Board, and therefore it is not guaranteed

that they will be able to implement any actions that they may believe are necessary to enhance shareholder value. However, we believe

the election of the Driver Nominees is an important step in the right direction for enhancing long-term value at the Company. There is

no assurance that any incumbent director will serve as a director if our Driver Nominees are elected to the Board. You should refer to

the Company’s proxy statement for the names, background, qualifications and other information concerning the Company’s nominees.

This Proxy Statement is

soliciting proxies to elect the Driver Nominees. We have provided the required notice to the Company pursuant to the Universal Proxy Rules,

including Rule 14a-19(a)(1) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and intend to solicit

the holders of ASRV Common Stock representing at least 67% of the voting power of ASRV Common Stock entitled to vote on the election of

directors in support of director nominees other than the Company’s nominees.

THE NOMINEES

The following information

sets forth the name, age, business address, present principal occupation, and employment and material occupations, positions, or offices

for the past five (5) years of each of the Driver Nominees. The specific experience, qualifications, attributes and skills that led us

to conclude that the Driver Nominees should serve as directors of the Company are set forth below. This information has been furnished

to us by the Driver Nominees. Each of the Driver Nominees are citizens of the United States of America.

J. Abbott R. Cooper,

age 55, is the Founder and Managing Member of Driver Management, a value-oriented investment firm, since August 2018. Prior to founding

Driver Management, Mr. Cooper founded and was Senior Portfolio Manager of Financial Opportunity Strategy at Hilton Capital Management,

LLC, an investment management firm, from 2015 to July 2018. Prior to that, Mr. Cooper was a senior investment banker covering depository

institutions at Jefferies Financial Group Inc. (NYSE: JEF), a financial services company, and Bank of America Corporation (NYSE: BAC),

a multinational investment bank and financial services company. Mr. Cooper began his career as a corporate lawyer, focusing on public

and private company mergers and acquisitions, corporate governance, contests for corporate control and capital markets. Mr. Cooper earned

a B.A. in History from the University of Virginia and a J.D. from the University of Montana School of Law.

Driver believes that Mr.

Cooper’s extensive financial, investment banking and capital markets experience, coupled with his legal expertise, would make him

a valuable addition to the Board.

Julius (“Izzy”)

D. Rudolph, age 35, is the Chief Executive Officer of McKnight Realty Partners, LLC (“McKnight”), a private commercial

real estate investment, development and operating company, since December 2022. Concurrent to serving as Chief Executive Officer of McKnight,

Mr. Rudolph is the President of Development and Acquisitions at McKnight, since November 2016. Mr. Rudolph is on the board of directors

of VisitPittsburgh, the official tourism promotion organization for Pittsburgh, Pennsylvania, since 2022, Pittsburgh Film Office, a non-profit

economic-development agency, since 2017, the Senator John Heinz History Center, an affiliate of the Smithsonian Institution, since 2016,

and Pittsburgh Downtown Partnership, a non-profit urban planning initiative, since 2013. Mr. Rudolph is the Vice President of the board

of directors of the Yeshiva Schools of Pittsburgh, the largest Jewish day school in Pennsylvania, since 2021. Mr. Rudolph served on the

board of directors of the National Association of Industrial and Office Properties (NAIOP), a commercial real estate trade association,

from 2016 to 2019. Mr. Rudolph studied at the Rabbinical College of America.

Driver believes Mr. Rudolph’s

experience in real estate and development expertise from his executive roles would make him a valuable addition to the Board.

Brandon L. Simmons,

age 40, is President and Chairman of Let Our Vision Evolve Inc., a non-profit organization educating underrepresented professionals about

private sector opportunities, since he founded the organization in April 2022. Mr. Simmons has also been an investor and advisor of GameOn

Technology, a software development company, since 2014. Until recently, Mr. Simmons was a General Partner at Prime Movers Lab, a venture

capital investment firm, from September 2019 to April 2022. Prior to that, Mr. Simmons held various executive roles at Tachyus Corporation,

a software company servicing the oil and gas industry, including Chief Executive Officer from June 2020 to October 2020, Chief Operating

Officer and General Counsel from 2017 to June 2020, Executive-Vice President and General Counsel from 2015 to November 2017. Earlier

in his career, Mr. Simmons was a Corporate Lawyer for Hogan Lovells LLP, an international law firm, from 2010 to 2015, a Legal Associate

at the Cato Institute, a public policy think tank located in Washington, D.C., from 2009 to 2010, and a Judicial Clerk for Chief Judge

J.L. Edmondson of the U.S. Court of Appeals of the Eleventh Circuit, from 2008 to 2009. Mr. Simmons has served on the boards of directors

of Space Perspective, a commercial space travel service provider, since August 2021, Venus Aerospace, an aerospace company, since January

2021, and polySpectra, an innovative advanced 3D printing technology developer, since June 2020. Mr. Simmons previously served on the

boards of directors of Carbon Capture, a developer of modular CO2 direct air capture machines, from September 2021 to September 2022,

Elevian Therapeutics, a novel therapeutics service provider, from August 2021 to September 2022, Unlimited Tomorrow, a personalized prosthetics

developer, from December 2020 to September 2022, NobleAI, an artificial intelligence research and development company, from March 2020

to June 2022, and Pyka, an electric aircraft developer, from February 2020 to April 2022. Mr. Simmons also serves on the boards of directors

of various non-profit organizations, including the Institute for Responsible Citizenship, a 20-year old leadership development program

for minority students, since January 2022, and the Teneo Network, a non-profit civic education organization, of which he served as Board

Chairman from 2018 to 2021. Mr. Simmons is also an advisory board member of the Urban League, a civil rights and urban advocacy organization,

since 2016. In February 2023, Mr. Simmons was appointed to serve on the Texas Southern University, Board of Regents, the board that governs

Texas Southern University, for a term expiring in February 2029. Mr. Simmons received a J.D. from Stanford University School of Law and

B.A. in Political Science from the University of California at Berkeley. Mr. Simmons is a licensed attorney in California and the District

of Columbia.

Driver believes Mr. Simmons’

extensive investment and executive leadership experience, coupled with his board service, would make him a valuable addition to the Board.

The principal business

address of Mr. Cooper is c/o Driver Management Company LLC, 1266 E. Main Street, Suite 700R, Stamford, CT 06902. The principal business

address of Mr. Rudolph is c/o McKnight Realty Partners, LLC, 310 Grant Street, Suite 2500, Pittsburgh, PA 15219. The principal business

address of Mr. Simmons is c/o Let Our Vision Evolve Inc., 5340 Weslayan St., Unit 6556, Houston, TX 77005.

As of the date hereof,

none of the Nominees, except Mr. Cooper, own beneficially or of record any securities of the Company and none of the Nominees, except

Mr. Rudolph, have entered into any transactions in the securities of the Company during the past two years. For information regarding

transactions in the shares of ASRV Common Stock during the past two years by Mr. Rudolph, please see Schedule I attached hereto.

Additionally, neither

McKnight, nor any of its principals or affiliates (other than Mr. Rudolph), have entered into any transactions in the securities of the

Company during the past two years.

Mr. Cooper, as the managing

member of Driver Management, may be deemed to beneficially own the 1,477,919 shares of ASRV Common Stock beneficially owned in the aggregate

by Driver as further explained elsewhere in this Proxy Statement. For information regarding transactions in the shares of ASRV Common

Stock during the past two years by certain of the Driver entities, please see Schedule I attached hereto.

Partners has signed a letter

agreement (the “Indemnification Agreement”) with each of Messrs. Rudolph and Simmons pursuant to which it and its affiliates

have agreed to indemnify such Driver Nominees against certain claims arising from the solicitation of proxies from the Company’s

shareholders in connection with the Annual Meeting and any related transactions. For the avoidance of doubt, such indemnification does

not apply to any claims made against such Driver Nominee in his capacity as a director of the Company, if so elected.

Each of the Driver

Nominees, except Mr. Cooper, has granted Mr. Cooper a power of attorney to execute certain filings with the SEC and other documents in

connection with the solicitation of proxies from the Company’s shareholders in connection with the Annual Meeting and any related

transactions.

On January 17, 2023, Driver

and the Driver Nominees entered into a Joint Filing and Solicitation Agreement in connection with the Annual Meeting, pursuant to which,

among other things, the parties agreed (a) to solicit proxies for the election of the Driver Nominees at the Annual Meeting, (b) that

Messrs. Rudolph and Simmons would not enter into any transactions in the securities of the Company without the prior written consent of

Driver and (c) that Driver would bear all expenses incurred in connection with the participants’ activities, including approved

expenses incurred by any of the parties in connection with the solicitation, subject to certain limitations.

Certain of Mr. Rudolph’s

immediate family members have been a party to a transaction with the Company in the ordinary course of business since its last fiscal

year in an amount that exceeds $120,000. Mr. Rudolph's father, William C. Rudolph, has a personal line of credit with the Company in

the amount of $4 million that is being upsized to $5 million. Mr. Rudolph's brother-in-law, Benyamin Dere, has several commercial mortgage

loans from the Company in connection with the purchase of rental units, which total, in the aggregate, approximately $8 million. Neither

Driver nor Mr. Rudolph has any reason to believe that either the line of credit nor the commercial mortgage loans were not (i) made in

the ordinary course of business nor (ii) made on substantially the same terms, including interest rates and collateral, as those prevailing

at the time for comparable loans with persons not related to the Company. In addition, neither Driver nor Mr. Rudolph has any reason

to believe that either the line of credit nor the commercial mortgage loans involved more than the normal risk of collectability or presented

other unfavorable features.

Other than as stated herein,

there are no arrangements or understandings among the members of Driver or any other person or persons pursuant to which the nomination

of the Driver Nominees described herein is to be made, other than the consent by each of the Driver Nominees to be named as a nominee

of Partnership in any proxy statement relating to the Annual Meeting and serving as a director of the Company if elected as such at the

Annual Meeting. Other than as stated herein, the Driver Nominees are not a party adverse to the Company or any of its subsidiaries nor

do the Driver Nominees have a material interest adverse to the Company or any of its subsidiaries in any material pending legal proceeding.

Except as disclosed

herein, we believe that each Driver Nominee presently is, and if elected as a director of the Company, each of the Driver Nominees would

qualify as, an “independent director” within the meaning of (i) applicable NASDAQ listing standards applicable to board composition,

including NASDAQ Listing Rule 5605(a)(2), and (ii) Section 301 of the Sarbanes-Oxley Act of 2002. Notwithstanding the foregoing, we acknowledge

that no director of a NASDAQ listed company qualifies as “independent” under the NASDAQ listing standards unless the board

of directors affirmatively determines that such director is independent under such standards. Accordingly, we acknowledge that if any

of the Driver Nominees are elected, the determination of the Driver Nominee’s independence under the NASDAQ listing standards ultimately

rests with the judgment and discretion of the Board. No Driver Nominee is a member of the Company’s compensation, nominating or

audit committee that is not independent under any such committee’s applicable independence standards.

Except as set forth

in this Proxy Statement (including the Schedules hereto), (i) during the past 10 years, no Driver Nominee has been convicted in a criminal

proceeding (excluding traffic violations or similar misdemeanors); (ii) no Driver Nominee directly or indirectly beneficially owns any

securities of the Company; (iii) no Driver Nominee owns any securities of the Company which are owned of record but not beneficially;

(iv) no Driver Nominee has purchased or sold any securities of the Company during the past two years; (v) no part of the purchase price

or market value of the securities of the Company owned by any Driver Nominee is represented by funds borrowed or otherwise obtained for

the purpose of acquiring or holding such securities; (vi) no Driver Nominee is, or within the past year was, a party to any contract,

arrangements or understandings with any person with respect to any securities of the Company, including, but not limited to, joint ventures,

loan or option arrangements, puts or calls, guarantees against loss or guarantees of profit, division of losses or profits, or the giving

or withholding of proxies; (vii) no associate of any Driver Nominee owns beneficially, directly or indirectly, any securities of the

Company; (viii) no Driver Nominee owns beneficially, directly or indirectly, any securities of any parent or subsidiary of the Company;

(ix) no Driver Nominee or any of his associates or immediate family members was a party to any transaction, or series of similar transactions,

since the beginning of the Company’s last fiscal year, or is a party to any currently proposed transaction, or series of similar

transactions, to which the Company or any of its subsidiaries was or is to be a party, in which the amount involved exceeds $120,000;

(x) no Driver Nominee or any of his associates has any arrangement or understanding with any person with respect to any future employment

by the Company or its affiliates, or with respect to any future transactions to which the Company or any of its affiliates will or may

be a party; (xi) no Driver Nominee has a substantial interest, direct or indirect, by securities holdings or otherwise in any matter

to be acted on at the Annual Meeting; (xii) no Driver holds any positions or offices with the Company; (xiii) no Driver Nominee has a

family relationship with any director, executive officer, or person nominated or chosen by the Company to become a director or executive

officer; and (xiv) no companies or organizations, with which any of the Driver Nominees has been employed in the past five years, is

a parent, subsidiary or other affiliate of the Company. There are no material proceedings to which any Driver Nominee or any of his associates

is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries.

Except as disclosed herein, with respect to each of the Driver Nominees, none of the events enumerated in Item 401(f)(1)-(8) of Regulation

S-K of the Exchange Act (“Regulation S-K”) occurred during the past 10 years.

Except as disclosed herein,

none of the Driver Nominees nor any of their associates has received any fees earned or paid in cash, stock awards, option awards, non-equity

incentive plan compensation, changes in pension value or nonqualified deferred compensation earnings or any other compensation from the

Company during the Company’s last completed fiscal year, or was subject to any other compensation arrangement described in Item

402 of Regulation S-K.

We do not expect that the

Driver Nominees will be unable to stand for election, but, in the event any Driver Nominee is unable to serve or for good cause will not

serve, the shares of ASRV Common Stock represented by the enclosed WHITE universal proxy card will be voted for substitute nominee(s),

to the extent this is not prohibited under the Company’s Amended and Restated Bylaws (the “Bylaws”) and applicable law.

In addition, we reserve the right to nominate substitute person(s) if the Company makes or announces any changes to the Bylaws or takes

or announces any other action that has, or if consummated would have, the effect of disqualifying any Driver Nominee, to the extent this

is not prohibited under the Bylaws and applicable law. In any such case, we would identify and properly nominate such substitute nominee(s)

in accordance with the Bylaws and the shares of ASRV Common Stock represented by the enclosed WHITE universal proxy card will be

voted for such substitute nominee(s). We reserve the right to nominate additional person(s), to the extent this is not prohibited under

the Bylaws and applicable law, if the Company increases the size of the Board above its existing size or increases the number of directors

whose terms expire at the Annual Meeting.

Certain information about

the Company’s nominees are set forth in the Company’s proxy statement. Driver is not responsible for the accuracy of any information

provided by or relating to ASRV or its nominees contained in any proxy solicitation materials filed or disseminated by, or on behalf of,

ASRV or any other statements that ASRV or its representatives have made or may otherwise make.

Shareholders are permitted to

vote for less than three nominees or for any combination (up to three total) of the Driver Nominees and the Company’s nominees on

the WHITE universal proxy card. IMPORTANTLY, IF YOU MARK MORE THAN THREE “FOR” BOXES WITH RESPECT TO THE ELECTION

OF DIRECTORS, ALL OF YOUR VOTES FOR THE ELECTION OF DIRECTORS WILL BE DEEMED INVALID.

WE URGE YOU TO VOTE “FOR” THE

ELECTION OF THE DRIVER NOMINEES ON THE ENCLOSED WHITE UNIVERSAL PROXY CARD.

PROPOSAL 2

RATIFICATION

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

As discussed in further

detail in the Company’s proxy statement, the Audit Committee of the Board has appointed S.R. Snodgrass P.C., (“S.R. Snodgrass”)

as the independent registered public accounting firm for the fiscal year ending December 31, 2023, and the Board is requesting that shareholders

ratify such selection. Additional information regarding this proposal is contained in the Company’s proxy statement.

WE MAKE NO RECOMMENDATION

WITH RESPECT TO THIS PROPOSAL AND INTEND TO VOTE OUR SHARES “FOR” THIS PROPOSAL.

PROPOSAL 3

ADVISORY (NON-BINDING) VOTE ON THE COMPENSATION

OF THE COMPANY’S NAMED EXECUTIVE OFFICERS

As discussed in further

detail in the Company’s proxy statement, the Company is submitting a non-binding proposal allowing shareholders to cast an advisory

vote on the Company’s compensation program at the Annual Meeting. This proposal, commonly known as a “say-on-pay” vote,

gives shareholders of ASRV an opportunity to endorse or not endorse the Company’s executive compensation programs and policies through

the following resolution:

“RESOLVED, that the

compensation paid to the company’s named executive officers, as disclosed pursuant to the compensation disclosure rules of the Securities

and Exchange Commission, including the narrative disclosure regarding executive compensation, the compensation tables and any related

material disclosed in this proxy statement, is hereby APPROVED.”

WE URGE YOU TO VOTE “[•]”

THE ADVISORY (NON-BINDING) PROPOSAL ON THE COMPENSATION OF THE COMPANY’S NAMED EXECUTIVE OFFICERS

VOTING AND PROXY PROCEDURES

Except with respect to

the election of directors, each shareholder is entitled to one vote for each share held. Only shareholders of record on the Record Date

will be entitled to vote at the Annual Meeting or at any adjournments. Shareholders who sell their shares of ASRV Common Stock before

the Record Date (or acquire them without voting rights after the Record Date) may not vote such shares. Shareholders of record on the

Record Date will retain their voting rights in connection with the Annual Meeting even if they sell such shares after the Record Date.

Based on publicly available information, Driver believes that the only outstanding class of securities of the Company entitled to vote

at the Annual Meeting is the ASRV Common Stock.

Shares of ASRV Common Stock

represented by properly executed WHITE universal proxy cards will be voted at the Annual Meeting as marked and, in the absence

of specific instructions, will be voted FOR the election of the Driver Nominees to the Board, FOR Proposal 2, and [•]

Proposal 3, and in the discretion of the persons named as proxies on all other matters as may properly come before the Annual Meeting,

as described herein.

Driver and ASRV will each

be using a universal proxy card for voting on the election of directors at the Annual Meeting, which will include the names of all nominees

for election to the Board. Shareholders will have the ability to vote for up to three nominees on Driver’s enclosed WHITE

universal proxy card. There is no need to use the Company’s [•] proxy card or voting instruction form, regardless

of how you wish to vote.

The Company has a classified

Board, which is currently divided into three classes. The terms of three Class I directors expire at the Annual Meeting. Through the

attached Proxy Statement and enclosed WHITE universal proxy card, we are soliciting proxies to elect the Driver Nominees.

Shareholders are permitted

to vote for less than three nominees or for any combination (up to three total) of the Driver Nominees and the Company’s nominees

on the WHITE universal proxy card. We believe the best opportunity for the Driver Nominees to be elected is by voting on the WHITE

universal proxy card. Driver therefore urges shareholders using our WHITE universal proxy card to vote “FOR”

the Driver Nominees.

IMPORTANTLY, IF YOU

MARK MORE THAN THREE “FOR” BOXES WITH RESPECT TO THE ELECTION OF DIRECTORS, ALL OF YOUR VOTES FOR THE ELECTION OF DIRECTORS

WILL BE DEEMED INVALID.

QUORUM; BROKER NON-VOTES; DISCRETIONARY VOTING

A quorum is the minimum

number of shares of ASRV Common Stock that must be represented at a duly called meeting in person or by proxy in order to legally conduct

business at the meeting. The presence, in person or by proxy, of shareholders entitled to cast at least a majority of the votes that all

shareholders are entitled to cast constitutes a quorum for the transaction of business at the Annual Meeting. Abstentions and broker non-votes

will not constitute or be counted as “votes” cast for purposes of the Annual Meeting, but will be counted for purposes of

determining the presence of a quorum.

If you hold your shares

in street name and do not provide voting instructions to your broker, bank or other nominee on how to vote, your shares will not be voted

on any proposal on which your broker does not have discretionary authority to vote (a “broker non-vote”). Under applicable

rules, your broker will not have discretionary authority to vote your shares at the Annual Meeting on Proposal 1 and Proposal 3.

VOTES REQUIRED FOR APPROVAL

Proposal 1: Election

of Directors – According to the information contained in the Company’s proxy statement, directors will be elected by

a plurality of votes cast by shares entitled to vote at the Annual Meeting. As a result, the three director nominees receiving the highest

number of “FOR” votes will be elected as directors. If you vote “FOR” less than three (3) nominees in Proposal

1, your shares will only be voted “FOR” those nominees you have so marked. If you vote “FOR” more than three

(3) nominees, all of your votes on Proposal 1 will be invalid and will not be counted. The Company has indicated that abstentions and

any broker non-votes will have no direct effect on the outcome of the election of directors.

Furthermore, according

to the information contained in the Company’s proxy statement, holders of ASRV Common Stock are entitled to cumulate their vote

in the election of directors (meaning, pursuant to the Bylaws, a holder can give one candidate as many votes as the number of directors

multiplied by the number of his or her shares shall equal, or to distribute them on the same principle among as many candidates as he

or she shall think fit).

Proposal 2: Ratification

of Independent Registered Public Accounting Firm – According to the information contained in the Company’s proxy statement,

the affirmative vote of a majority of the votes cast at the Annual Meeting is required to approve the ratification of the appointment

of S.R. Snodgrass. The Company has indicated abstentions and any broker non-votes will not be included in determining the number of votes

cast.

Proposal 3: Advisory

(Non-Binding) Vote On the Compensation of the Company’s Named Executive Officers– According to the information contained

in the Company’s proxy statement, the affirmative vote of a majority of the votes cast at the Annual Meeting is required to approve

the advisory (non-binding) vote on the compensation of its named executive officers. The Company has indicated abstentions and any broker

non-votes will not be included in determining the number of votes cast.

INFORMATION ON THE MECHANICS OF CUMULATIVE VOTING

All stockholders will

have the right to cumulate their votes in the election of directors. Cumulative voting means that each stockholder may aggregate and

combine their voting power for the election of directors by distributing a number of votes, determined by multiplying the number of shares

held by the stockholder as of the Record Date by three (3) (the number of directors to be elected at the Annual Meeting). Such stockholder

may distribute all of the votes to one individual director nominee, or distribute such votes among any two or more director nominees,

as the stockholder chooses.

Discretionary authority

is being sought to cumulate votes at the Annual Meeting and, unless you specifically instruct otherwise, the WHITE universal proxy

confers discretionary authority to cumulate votes for any or all of our Driver Nominees for which authority to vote has not been withheld,

at the discretion of the individuals named as proxies on the enclosed WHITE universal proxy card. If you do not specifically instruct

otherwise, the WHITE universal proxy will confer such proxy holders with the authority to cumulate votes at their discretion so

as to provide for the election of the maximum number of Driver Nominees (for whom authority is not otherwise specifically withheld) including,

but not limited to, the prioritization of such Driver Nominees to whom such votes may be allocated. If it is necessary for us to prioritize

among the Driver Nominees and allocate votes, we intend to provide for the election of the maximum number of our Driver Nominees, and

will provide instructions as to the order of priority of such Driver Nominees.

If you elect to grant

us your proxy and do not specifically instruct otherwise, you are authorizing the individuals named as proxies on the enclosed WHITE

universal proxy card to vote your shares in their discretion, including to cumulate your votes in favor of the Driver Nominees and

to determine the specific allocation of votes to individual Driver Nominees in order to elect as many of the Driver Nominees as possible.

You may withhold your authority to vote for one or more Driver Nominees by voting “FOR ALL EXCEPT” and writing in such Driver

Nominee(s), in which case the proxy holders will retain discretion to allocate your votes among our other Driver Nominees unless you

specifically instruct otherwise. If you do not wish to grant the proxy holders authority to cumulate your votes in the election of directors,

you must state this objection on your proxy card. Under no circumstances may the proxy holders cast your votes for any Driver Nominee

for whom you have withheld authority to vote by noting “FOR ALL EXCEPT” and named such Driver Nominee.

For example, a proxy

marked “FOR ALL EXCEPT” may only be voted for our director Driver Nominees for whom you have not otherwise specifically withheld

authority to vote. In exercising their discretion with respect to cumulating votes, the proxy holders may cumulate and cast the votes

represented by your proxy for any of our director Driver Nominees for whom you have not otherwise withheld authority by voting “FOR

ALL EXCEPT” and naming such Driver Nominee. For example, if you grant a proxy with respect to shares representing 800 cumulative

votes, and mark “FOR ALL EXCEPT” and list one of our Driver Nominees, the proxy holders may cast the 800 votes for any of

our Driver Nominees, other than the Driver Nominee you listed.

Assuming cumulative

voting applies, unless you specifically instruct otherwise, you are authorizing the individuals named as proxies on the enclosed WHITE

universal proxy card to cast the votes as to which voting authority has been granted so as to provide for the election of the maximum

number of our director Driver Nominees, and will provide instructions as to the order of priority of the Driver Nominees in the event

that fewer than all of our Driver Nominees are elected. No determination has been made as to the order of priority of candidates to which

votes will be allocated, and any determination will be made, if necessary, at the Annual Meeting. Accordingly, if you grant a proxy to

the individuals named as proxies on the enclosed WHITE universal proxy card and have not specifically instructed otherwise, your

shares will be voted for our director Driver Nominees at the discretion of the individuals named as proxies on the enclosed WHITE

universal proxy card with respect to all of your shares (except that the individuals named as proxies on the enclosed WHITE

universal proxy card will not be able to vote your shares for a candidate from whom you have withheld authority to vote). If you wish

to exercise your own discretion as to allocation of votes among the Driver Nominees, and you are a record holder of shares, you will

be able to do so by attending the Annual Meeting and voting in person, by appointing another person as your representative to vote on

your behalf at the Annual Meeting, or by providing us with specific instructions as to how to allocate your votes.

A holder of record

who wishes to provide vote allocation instructions must submit a proxy card by mail and should handwrite the number of votes such holder

wishes to allocate to each Driver Nominee as specified on the enclosed WHITE universal proxy card. You may provide vote allocation

instructions for all or a portion of the votes you are entitled to cast. If you provide vote allocation instructions for all of the votes

you are entitled to cast, the proxy holders will vote in accordance with your instructions. If you provide vote allocation instructions

for less than all of the votes that you are entitled to cast, the proxy holders will retain discretionary authority to cast your remaining

votes, except for any Driver Nominee for whom you have withheld authority by marking the “FOR ALL EXCEPT” box and specifically

naming that Driver Nominee. The individuals named as proxies on the enclosed WHITE universal proxy card will retain discretionary

authority to allocate votes among all our Driver Nominees except where you provide a specific instruction stating your objection to the

proxy holder cumulating your votes, by hand marking the number of votes to be allocated to one or more Driver Nominees, or by voting

“FOR ALL EXCEPT” and naming one or more Driver Nominees.

Any stockholder who

holds shares in street name and desires to allocate votes among specific Driver Nominees may do so by either informing the stockholder’s

broker, banker or other custodian of the stockholder’s desire to attend the Annual Meeting, and requesting a legal proxy to attend

the Annual Meeting, or by providing the broker, banker or other custodian with instructions as to how to allocate votes among Driver

Nominees, which can then be delivered to us. Because each broker, banker or custodian has its own procedures and requirements, a stockholder

holding shares in street name who wishes to allocate votes to specific Driver Nominees should contact its broker, banker or other custodian

for specific instructions on how to obtain a legal proxy or provide vote allocation instructions.

Stockholders with any

questions about how to cumulate their votes should please contact Saratoga at the phone number or address set forth herein.

REVOCATION OF PROXIES

Shareholders of the Company may

revoke their proxies at any time prior to exercise by attending the Annual Meeting and voting in person (although, attendance at the Annual

Meeting will not in and of itself constitute revocation of a proxy), by delivering a written notice of revocation or by signing and delivering

a subsequently dated proxy which is properly completed. The revocation may be delivered either to Driver in care of Saratoga at the address

set forth on the back cover of this Proxy Statement or to the Company’s Corporate Secretary at P.O. Box 430, Johnstown, Pennsylvania

15907-0430 or any other address provided by the Company. Although a revocation is effective if delivered to the Company, Driver requests

that either the original or photostatic copies of all revocations be mailed to Driver in care of Saratoga at the address set forth on

the back cover of this Proxy Statement so that we will be aware of all revocations and can more accurately determine if and when proxies

have been received from the holders of record on the Record Date of a majority of the votes that all shareholders are entitled to cast

at the Annual Meeting. Additionally, Saratoga may use this information to contact shareholders who have revoked their proxies in order

to solicit later dated proxies for the election of the Driver Nominees.

IF YOU WISH TO VOTE FOR THE ELECTION OF THE

DRIVER NOMINEES, PLEASE SIGN, DATE AND RETURN THE ENCLOSED WHITE UNIVERSAL PROXY CARD TODAY IN THE POSTAGE-PAID ENVELOPE PROVIDED.

SOLICITATION OF PROXIES

The solicitation of proxies

pursuant to this Proxy Statement is being made by Driver. Proxies may be solicited by mail, facsimile, telephone, Internet, in person

and by advertisements. Solicitations may be made by certain of the respective directors, officers, members and employees of Driver, none

of whom will, except as described elsewhere in this Proxy Statement, receive additional compensation for such solicitation. The Driver

Nominees may make solicitations of proxies but, except as described herein, will not receive compensation for acting as director nominees.

Members of Driver have

entered into an agreement with Saratoga for solicitation and advisory services in connection with this solicitation, for which Saratoga

will receive a fee not to exceed $•, together with reimbursement for its reasonable out-of-pocket expenses, and will be indemnified

against certain liabilities and expenses, including certain liabilities under the federal securities laws. Saratoga will solicit proxies

from individuals, brokers, banks, bank nominees and other institutional holders. Driver has requested banks, brokerage houses and other

custodians, nominees and fiduciaries to forward all solicitation materials to the beneficial owners of the shares of ASRV Common Stock

they hold of record. Driver will reimburse these record holders for their reasonable out-of-pocket expenses in so doing. It is anticipated

that Saratoga will employ approximately • persons to solicit shareholders for the Annual Meeting.

The entire expense of soliciting

proxies is being borne by Driver. Costs of this solicitation of proxies are currently estimated to be approximately $• (including,