Asure Software, Inc. (Nasdaq: ASUR), a leading

provider of cloud-based Human Capital Management (HCM) software

solutions, reported results for the third quarter ended

September 30, 2022.

Third Quarter 2022 Financial

Highlights

- Revenue of $21.9 million, up 22%

year-over-year

- Net loss of $4.5 million, compared

to net income of $5.3 million in the prior year period, which also

included a $10.5 million tax credit; non-GAAP net loss of $0.1

million versus a non-GAAP net loss of $0.4 million in the prior

year’s quarter

- EBITDA of $1.3 million, compared to

$9.9 million in the prior year period, which included a $10.5

million tax credit; Adjusted EBITDA was $2.1 million, from $1.2

million in the prior year period

- Total bookings were up 91%

year-over-year

Management Commentary

“Our strong third quarter results reflect the

strategic investments that we have made throughout 2022, including

increasing our sales force, enhancing our product suite, and

developing improved technology,” said Asure Chairman and CEO Pat

Goepel. “We believe that clients are increasingly recognizing the

value of our solutions, which have continued to improve in

functionality as our strategy to enhance automation and user

experience takes shape. In addition, our focus on areas of

differentiation, such as HR Compliance, our best-in-class tax

platform, and our newly introduced Integration Marketplace, is

anticipated to account for an increasing share of our revenue

moving forward. These efforts have resulted in reduced churn and

higher revenue from our current customer base over the prior year

period, and are expected to generate high-margin revenue streams

during the remainder of 2022 and into 2023.

“Client demand for our solutions has been

robust, as evidenced by the 91% year-over-year increase in new

sales bookings in the third quarter. Accordingly, we are raising

our fourth quarter revenue guidance, which now calls for

year-over-year growth of 11% to 14%, virtually all of which is

organic. We are also introducing preliminary 2023 financial

guidance for revenues of $98 to $102 million and adjusted EBITDA

margins of 14% to 16%. While we intend to continue to evaluate

potential acquisition targets in 2023, our guidance reflects our

expectation for performance on an organic basis at this time.

Looking ahead, we remain focused on our commitments to helping

small and mid-sized businesses get the most from their human

capital.”

| |

Three Months Ended |

|

Nine Months Ended |

| in thousands, except per share

data(unaudited) |

September 30, 2022 |

|

September 30, 2021 |

|

Variance |

|

September 30, 2022 |

|

September 30, 2021 |

|

Variance |

|

REVENUE |

$ |

21,903 |

|

|

$ |

17,981 |

|

|

21.8 |

% |

|

$ |

66,536 |

|

|

$ |

54,951 |

|

|

21.1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| GROSS

PROFIT |

|

|

|

|

|

|

|

|

|

|

|

|

Gross Profit |

$ |

13,647 |

|

|

$ |

10,868 |

|

|

25.6 |

% |

|

$ |

41,372 |

|

|

$ |

33,305 |

|

|

24.2 |

% |

|

Gross Margin |

|

62.3 |

% |

|

|

60.4 |

% |

|

n/a |

|

|

62.0 |

% |

|

|

60.6 |

% |

|

n/a |

|

Non-GAAP Gross Profit |

$ |

14,841 |

|

|

$ |

12,002 |

|

|

23.7 |

% |

|

$ |

44,901 |

|

|

$ |

36,993 |

|

|

21.4 |

% |

|

Non-GAAP Gross Margin |

|

67.8 |

% |

|

|

66.7 |

% |

|

n/a |

|

|

67.5 |

% |

|

|

67.3 |

% |

|

n/a |

| |

|

|

|

|

|

|

|

|

|

|

|

| EARNINGS |

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

$ |

(4,533 |

) |

|

$ |

5,328 |

|

|

NM |

|

$ |

(13,410 |

) |

|

$ |

7,494 |

|

|

NM |

|

Net income (loss) Margin |

|

(20.7 |

)% |

|

|

29.6 |

% |

|

n/a |

|

|

(20.2 |

)% |

|

|

13.6 |

% |

|

n/a |

|

Net income (loss) per share |

$ |

(0.22 |

) |

|

$ |

0.28 |

|

|

NM |

|

$ |

(0.67 |

) |

|

$ |

0.39 |

|

|

NM |

|

Non-GAAP Net income (loss) |

$ |

(134 |

) |

|

$ |

(434 |

) |

|

NM |

|

$ |

1,230 |

|

|

$ |

1,334 |

|

|

(7.8 |

)% |

|

Non-GAAP Net income (loss) Margin |

|

(0.6 |

)% |

|

|

(2.4 |

)% |

|

n/a |

|

|

1.8 |

% |

|

|

2.4 |

% |

|

n/a |

|

Non-GAAP Net income (loss) per share |

$ |

(0.01 |

) |

|

$ |

(0.02 |

) |

|

NM |

|

$ |

0.06 |

|

|

$ |

0.07 |

|

|

(14.3 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

| EBITDA |

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA |

$ |

1,346 |

|

|

$ |

9,902 |

|

|

NM |

|

$ |

3,831 |

|

|

$ |

20,824 |

|

|

NM |

|

EBITDA Margin |

|

6.1 |

% |

|

|

55.1 |

% |

|

n/a |

|

|

5.8 |

% |

|

|

37.9 |

% |

|

n/a |

|

Adjusted EBITDA |

$ |

2,099 |

|

|

$ |

1,228 |

|

|

70.9 |

% |

|

$ |

7,447 |

|

|

$ |

5,938 |

|

|

25.4 |

% |

|

Adjusted EBITDA Margin |

|

9.6 |

% |

|

|

6.8 |

% |

|

n/a |

|

|

11.2 |

% |

|

|

10.8 |

% |

|

n/a |

- NM indicates Not Meaningful

Information

- Non-GAAP and adjusted financial

measures are reconciled to GAAP in the tables set forth in this

release

Financial Commentary

“Asure’s third quarter results showed strong

double-digit revenue growth of 22% year-over-year with organic

revenues beginning to accelerate as anticipated,” said CFO, John

Pence. “Net loss was $4.5 million, a margin of (21)%, compared to

net income of $5.3 million in the prior period, or a margin of 30%,

a decline of 185% relative to the prior year, as last year’s

results included a $10.5 million gain related to ERTC credits.

EBITDA declined to $1.3 million relative to the prior year’s $9.9

million for the same reason. Adjusted EBITDA, which excludes the

tax credits, rose 71% relative to the prior year to $2.1 million

and adjusted EBITDA margin rose 280 basis points to 9.6%.

“Our revenue guidance for the remainder of 2022

and 2023 contemplates strong momentum with HR Compliance, tax

processing solutions, contribution from revenue streams stemming

from new uses of our installed user’s data in the Integration

Marketplace, and higher investment revenues due to rising interest

rates and larger investible balances. Adjusted EBITDA is expected

to benefit from the additional scale generated by this incremental

revenue growth and the impact of the many efficiency initiatives we

currently have underway.”

Recent Business Highlights

Asure and Equifax Align to Deliver Integrated

Verifications of Employment and Income

- Asure and Equifax® (NYSE: EFX), a

global data, analytics and technology company, announced a new

integration that makes The Work Number from Equifax available to

Asure direct customers and reseller partners. The integration is

designed to provide Asure clients and their employees the benefits

of quicker, more secure verifications of employment and income from

The Work Number within their existing core HCM technology

stacks.

- “Equifax brings deep expertise in

verification services, and through our integration with The Work

Number, we’re delivering significant benefits to our 80,000 small

business customers and reseller partners and their employees,” said

Pat Goepel, Chairman and CEO of Asure. “Employers will no longer

have to spend time manually responding to verification requests,

and their employees will have access to instant, more seamless

verifications in support of important life events.”

- Joe Muchnick, Senior Vice President

of Employer Services and Talent Solutions at Equifax Workforce

Solutions, added, “Equifax and Asure are both dedicated to

deploying technology that helps fuel the growth of our respective

clients. We’re pleased that this new integration supports enhanced

HCM functionality among any sized employer or payroll provider by

delivering the benefits of faster, more secure verifications

through The Work Number from Equifax.”

Asure Expands Tax Filing Capabilities Allowing CPA Firms

and Tax Professionals to Scale in Response to Surging ERTC

Demand

- Developed and implemented a new

technology that automates back-office processes for CPAs and tax

professionals to calculate and prepare amended tax returns for

small businesses claiming ERTC stimulus. Through collaboration with

Asure’s CPA partners, the company has designed technology that

automates the back-office transactional processes of calculating

compliant tax credits and filing the necessary quarterly amended

tax returns for their clients to get ERTC stimulus credits.

- “At Asure, we’re always seeking new

ways for technology to support small businesses and the

organizations that serve them. Our CPA partners were telling us

they couldn’t keep pace with the volume of administrative work

associated with ERTC demand. Our technology automates the

back-office ERTC work so they can focus on high-value client work,”

said Pat Goepel, Chairman and CEO of Asure. “We’re excited about

this new technology’s ability to help drive organic growth as it

allows us to serve even more payroll and non-payroll clients

alike.”

Asure Expands and Streamlines 401(k) Plan Options for

Small Employers with 80+ Provider Integrations and New

Partnership

- Asure payroll systems now feature

direct integration with more than 80 401(k) providers. The time and

expense required to maintain traditional options for providing

employer-sponsored 401(k) plans have been a longtime barrier to

entry for smaller employers. Asure is actively removing that

barrier by making 401(k) plan delivery easier and more accessible

for organizations with limited resources. Asure’s established

integrations enable employers to sync their Asure payroll system

and their 401(k) data to streamline enrollment, eliminate dual

entry, and remain compliant.

- “In today’s job market, prospective

employees have high expectations, even from smaller organizations.

Making it easy to offer 401(k) options for retirement savings is

just one way that Asure is empowering our customers to be more

competitive, while also removing administrative burdens,” said Pat

Goepel, Chairman and CEO of Asure.

Asure Announces Integration with PrismHR

to Deliver Payroll Tax Filing System and Services to PEO and ASO

Markets

- Announced an agreement to be a

preferred provider of payroll tax filing software and services for

PrismHR, a leading provider of HR solutions for PEOs, ASOs and

their clients. The agreement includes integration between Asure’s

FlexTax payroll tax filing engine and PrismHR’s payroll system,

currently in use by more than 80,000 organizations. It also

provides PrismHR customers access to Asure’s Payroll Tax Management

Services, a flexible suite of options that enable customers to

outsource payroll tax filing according to their needs and budget,

with the ability to scale and adapt to other service plans as their

needs change—without changing platforms.

- “This new partnership provides an

opportunity to significantly expand our payroll tax business into

the PEO and ASO markets, while enabling PrismHR to provide an

alternative, standalone tax filing solution that complements their

existing HR portfolio,” said Pat Goepel, Chairman, and CEO of

Asure. “Our deep expertise in the complex landscape of payroll

taxes uniquely positions Asure to deliver not only a user-friendly

software solution to PrismHR’s customers, but also the experienced

counsel and support of a knowledgeable team of payroll tax

experts.”

Fourth Quarter 2022 and Full Year 2023

Guidance

The Company is providing the following guidance

for the fourth quarter and full year 2022 as well as fiscal year

2023 based on third quarter results and its preliminary business

outlook for 2023. Our guidance is offered with the knowledge that

there is a high level of economic uncertainty in 2023 due to recent

inflationary trends and the potential for a recession of unknown

severity.

|

|

Guidance Range |

|

Q4-2022 |

|

2022 |

| |

Revenue |

$ |

23.5M - 24.0M |

$ |

90.0M - 90.5M |

| |

Adjusted EBITDA |

$ |

3.0M - 3.5M |

$ |

10.5M - 11.0M |

| |

Non-GAAP EPS |

$ |

(0.01) - 0.01 |

$ |

0.05 - 0.07 |

|

|

Guidance Range |

|

2023 |

|

| |

Revenue |

$ |

98.0M - 102.0M |

|

| |

Adjusted EBITDA Margin |

|

14% - 16% |

|

Management uses GAAP, non-GAAP and adjusted

measures when planning, monitoring, and evaluating the Company’s

performance. The primary purpose of using non-GAAP and adjusted

measures are to provide supplemental information that may prove

useful to investors and to enable investors to evaluate the

Company’s results in the same way management does.

Management believes that supplementing GAAP

disclosure with non-GAAP and adjusted disclosures provides

investors with a more complete view of the Company’s operational

performance and allows for meaningful period-to-period comparisons

and analysis of trends in the Company’s business. Further, to the

extent that other companies use similar methods in calculating

adjusted financial measures, the provision of supplemental non-GAAP

and adjusted information can allow for a comparison of the

Company’s relative performance against other companies that also

report non-GAAP and adjusted operating results.

Management has not provided a reconciliation of

guidance of GAAP to non-GAAP or adjusted disclosures because

management is unable to predict the nature and materiality of

non-recurring expenses without unreasonable effort.

Conference Call Details

Asure management will host a conference call

Monday, November 7, 2022 at 3:30 pm Central (at 4:30 pm

Eastern). Asure Chairman and CEO Pat Goepel and CFO John Pence will

participate in the conference call followed by a

question-and-answer session. A live webcast of the call will be

available on the “Investor Relations” page of the Company’s

website. To listen to the earnings call by phone, participants must

pre-register.

About Asure Software, Inc.

Asure (Nasdaq: ASUR) is a leading provider of

HCM software solutions. We help small and mid-sized companies grow

by assisting them in building better teams with skills to stay

compliant with ever-changing federal, state, and local tax

jurisdictions and labor laws, and better allocate cash so they can

spend their financial capital on growing their business rather than

back-office overhead expenses. Asure’s Human Capital Management

suite, named Asure HCM, includes cloud-based Payroll, Tax Services,

and Time & Attendance software as well as HR services ranging

from HR projects to completely outsourcing payroll and HR staff. We

also offer these products and services through our network of

reseller partners. Visit us at asuresoftware.com.

Non-GAAP and Adjusted Financial

Measures

This press release includes information about

bookings, non-GAAP gross profit, non-GAAP net income (loss),

non-GAAP net income (loss) per share, EBITDA, EBITDA margin,

adjusted EBITDA, and adjusted EBITDA margin. These non-GAAP and

adjusted financial measures are measurements of financial

performance that are not prepared in accordance with U.S. generally

accepted accounting principles and computational methods may differ

from those used by other companies. Non-GAAP and adjusted financial

measures are not meant to be considered in isolation or as a

substitute for comparable GAAP measures and should be read only in

conjunction with the Company’s Consolidated Financial Statements

prepared in accordance with GAAP. Non-GAAP and adjusted financial

measures are reconciled to GAAP in the tables set forth in this

release and are subject to reclassifications to conform to current

period presentations.

Bookings represent estimated new first year

contracted revenue value for recurring and non-recurring services

sold in the period.

Non-GAAP gross profit differs from gross profit

in that it excludes amortization, share-based compensation, and

one-time items.

Non-GAAP net income (loss) per share differs

from net income (loss) per share in that it excludes items such as

amortization, share-based compensation, and one-time expenses, and

may use basic or diluted share counts in its computation, as

applicable.

EBITDA differs from net income (loss) in that it

excludes items such as interest, income taxes, depreciation, and

amortization. Asure is unable to predict with reasonable certainty

the ultimate outcome of these exclusions without unreasonable

effort.

Adjusted EBITDA differs from EBITDA in that it

excludes share-based compensation, other income (expense), net and

non-recurring expenses. Asure is unable to predict with reasonable

certainty the ultimate outcome of these exclusions without

unreasonable effort.

All adjusted and non-GAAP measures presented as

“margin” are computed by dividing the applicable adjusted financial

measure by total revenue.

Specifically, as applicable to the respective

financial measure, management is adjusting for the following items

when calculating non-GAAP and adjusted financial measures. as

applicable for the periods presented. No additional adjustments

have been made for potential income tax effects of the adjustments

based on the Company’s current and anticipated de minimis effective

federal tax rate, resulting from the Company’s continued losses for

federal tax purposes and its tax net operating loss balances.

Share-Based Compensation

Expenses. The Company’s compensation strategy includes the

use of share-based compensation to attract and retain employees and

executives. It is principally aimed at aligning their interests

with those of our stockholders and at long-term employee retention,

rather than to motivate or reward operational performance for any

particular period. Thus, share-based compensation expense varies

for reasons that are generally unrelated to operational decisions

and performance in any particular period.

Depreciation. The Company

excludes depreciation of fixed assets. Also included in the expense

is the depreciation of capitalized software costs.

Amortization of Purchased

Intangibles. The Company views amortization of

acquisition-related intangible assets, such as the amortization of

the cost associated with an acquired company’s research and

development efforts, trade names, customer lists and customer

relationships, and acquired lease intangibles, as items arising

from pre-acquisition activities determined at the time of an

acquisition. While these intangible assets are continually

evaluated for impairment, amortization of the cost of purchased

intangibles is a static expense, one that is not typically affected

by operations during any particular period.

Interest Expense, Net. The

Company excludes accrued interest expense, the amortization of debt

discounts and deferred financing costs.

Income Taxes. The Company

excludes income taxes, both at the federal and state levels.

One-Time Expenses. The

Company’s adjusted financial measures exclude the following costs

to normalize comparable reporting periods, as these are generally

non-recurring expenses that do not reflect the ongoing operational

results. These items are typically not budgeted and are infrequent

and unusual in nature.

Settlements, Penalties and

Interest. The Company excludes legal settlements,

including separation agreements, penalties and interest that are

generally one-time in nature and not reflective of the operational

results of the business.

Acquisition and Transaction Related

Costs. The Company excludes these expenses as they are

transaction costs and expenses that are generally one-time in

nature and not reflective of the underlying operational results of

our business. Examples of these types of expenses include legal,

accounting, regulatory, other consulting services, severance and

other employee costs.

Other non-recurring Expenses.

The Company excludes these as they are generally non-recurring

items that are not reflective of the underlying operational results

of the business and are generally not anticipated to recur. Some

examples of these types of expenses, historically, have included

write-offs or impairments of assets, costs related to third-party

placement fees, extraordinary employee recognition, demolition of

office space, data retention and cybersecurity consultants.

Other Income, Net. The

Company’s adjusted financial measures exclude Other Income, net

because it includes items that are not reflective of the underlying

operational results of the business, such as loan forgiveness,

adjustments to contingent liabilities and credits earned as part of

the CARES Act, passed by Congress in the wake of the coronavirus

pandemic.

Use of Forward-Looking

Statements

This press release contains forward-looking

statements about our financial results, which may include expected

or projected U.S GAAP and non-U.S. GAAP financial and other

operating and non-operating results, including, by way of example,

revenue, net income, diluted earnings per share, operating cash

flow growth, operating margin improvement, deferred revenue growth,

expected revenue run rate, bookings, expected tax rates,

stock-based compensation expenses, amortization of purchased

intangibles, amortization of debt discount and shares outstanding.

The achievement or success of the matters covered by such

forward-looking statements involves risks, uncertainties and

assumptions, over many of which we have no control. If any

such risks or uncertainties materialize or if any of the

assumptions prove incorrect, the Company’s results could differ

materially from the results expressed or implied by the

forward-looking statements we make.

The risks and uncertainties referred to above

include—but are not limited to—risks associated with possible

fluctuations in the Company’s financial and operating results;

the Company’s rate of growth and anticipated revenue run rate,

including impact of the current environment, the spread of major

pandemics or epidemics (including COVID-19), interruptions to

supply chains and extended shut down of businesses,

political unrest, including the current issues between Russian

and Ukraine, reductions in employment and an increase in business

failures, specifically among our clients, the

Company’s ability to convert deferred revenue and unbilled

deferred revenue into revenue and cash flow, and ability to

maintain continued growth of deferred revenue and unbilled

deferred revenue; errors, interruptions or delays in the

Company’s services or the Company’s Web hosting; breaches of the

Company’s security measures; domestic and

international regulatory developments, including changes to or

applicability to our business of privacy and data securities laws,

money transmitter laws and anti-money laundering laws;

the financial and other impact of any previous and future

acquisitions; the nature of the Company’s business model, including

risks related to government contracts; the Company’s ability

to continue to release, gain customer acceptance of and provide

support for new and improved versions of the Company’s services;

successful customer deployment and utilization of the

Company’s existing and future services; changes in the Company’s

sales cycle; competition; various financial aspects of the

Company’s subscription model; unexpected increases in

attrition or decreases in new business; the Company’s ability to

realize benefits from strategic partnerships and strategic

investments; the emerging markets in which the Company

operates; unique aspects of entering or expanding in international

markets, including the compliance with United States export control

laws, the Company’s ability to hire, retain and motivate

employees and manage the Company’s growth; changes in the Company’s

customer base; technological developments; litigation and any

related claims, negotiations and settlements, including with

respect to intellectual property matters or industry-specific

regulations; unanticipated changes in the Company’s effective

tax rate; regulatory pressures on economic relief enacted as a

result of the COVID-19 pandemic that change or cause different

interpretations with respect to eligibility for such programs;

factors affecting the Company’s term loan; fluctuations in the

number of Company shares outstanding and the price of such shares;

interest rates; collection of receivables; factors affecting

the Company’s deferred tax assets and ability to value and utilize

them; the potential negative impact of indirect tax exposure; the

risks and expenses associated with the Company’s real estate

and office facilities space; and general developments in the

economy, financial markets, credit markets and the impact of

current and future accounting pronouncements and other

financial reporting standards. Please review the Company’s risk

factors in its annual report on Form 10-K filed with the Securities

and Exchange Commission on March 14, 2022.

The forward-looking statements, including the

financial guidance and 2022 and 2023 outlook, contained herein

represent the judgment of the Company as of the date of this press

release, and the Company expressly disclaims any intent, obligation

or undertaking to release publicly any updates or revisions to any

forward-looking statements to reflect any change in the Company’s

expectations with regard thereto or any change in events,

conditions or circumstances on which any such statements are

based.

© 2022 Asure Software, Inc. All rights reserved.

ASURE SOFTWARE,

INC.CONDENSED CONSOLIDATED BALANCE

SHEETS(in thousands)

| |

September 30, 2022 |

|

December 31, 2021 |

| |

| ASSETS |

(unaudited) |

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

10,885 |

|

|

$ |

13,427 |

|

|

Accounts receivable, net |

|

6,821 |

|

|

|

5,308 |

|

|

Inventory |

|

323 |

|

|

|

246 |

|

|

Prepaid expenses and other current assets |

|

10,658 |

|

|

|

13,475 |

|

|

Total current assets before funds held for clients |

|

28,687 |

|

|

|

32,456 |

|

|

Funds held for clients |

|

181,969 |

|

|

|

217,273 |

|

|

Total current assets |

|

210,656 |

|

|

|

249,729 |

|

| Property and equipment,

net |

|

11,364 |

|

|

|

8,945 |

|

| Goodwill |

|

86,011 |

|

|

|

86,011 |

|

| Intangible assets, net |

|

70,238 |

|

|

|

78,573 |

|

| Operating lease assets,

net |

|

7,969 |

|

|

|

5,748 |

|

| Other assets, net |

|

4,886 |

|

|

|

4,136 |

|

|

Total assets |

$ |

391,124 |

|

|

$ |

433,142 |

|

| LIABILITIES AND

STOCKHOLDERS’EQUITY |

|

|

|

| Current liabilities: |

|

|

|

|

Current portion of notes payable |

$ |

3,064 |

|

|

$ |

1,907 |

|

|

Accounts payable |

|

1,322 |

|

|

|

565 |

|

|

Accrued compensation and benefits |

|

4,179 |

|

|

|

3,568 |

|

|

Operating lease liabilities, current |

|

1,686 |

|

|

|

1,551 |

|

|

Other accrued liabilities |

|

4,137 |

|

|

|

2,333 |

|

|

Contingent purchase consideration |

|

2,299 |

|

|

|

1,905 |

|

|

Deferred revenue |

|

4,173 |

|

|

|

3,750 |

|

| Total current liabilities

before client fund obligations |

|

20,860 |

|

|

|

15,579 |

|

|

Client fund obligations |

|

184,617 |

|

|

|

217,144 |

|

| Total current liabilities |

|

205,477 |

|

|

|

232,723 |

|

| Long-term liabilities: |

|

|

|

|

Deferred revenue |

|

252 |

|

|

|

36 |

|

|

Deferred tax liability |

|

1,758 |

|

|

|

1,595 |

|

|

Notes payable, net of current portion |

|

31,367 |

|

|

|

33,120 |

|

|

Operating lease liabilities, noncurrent |

|

6,908 |

|

|

|

4,746 |

|

|

Contingent purchase consideration |

|

670 |

|

|

|

2,424 |

|

|

Other liabilities |

|

130 |

|

|

|

258 |

|

| Total long-term

liabilities |

|

41,085 |

|

|

|

42,179 |

|

| Total liabilities |

|

246,562 |

|

|

|

274,902 |

|

| Commitments |

|

|

|

| Stockholders’ equity: |

|

|

|

|

Preferred stock |

|

— |

|

|

|

— |

|

|

Common stock |

|

205 |

|

|

|

204 |

|

|

Treasury stock at cost |

|

(5,017 |

) |

|

|

(5,017 |

) |

|

Additional paid-in capital |

|

432,445 |

|

|

|

429,912 |

|

|

Accumulated deficit |

|

(280,170 |

) |

|

|

(266,760 |

) |

|

Accumulated other comprehensive income |

|

(2,901 |

) |

|

|

(99 |

) |

| Total stockholders’

equity |

|

144,562 |

|

|

|

158,240 |

|

| Total liabilities and

stockholders’ equity |

$ |

391,124 |

|

|

$ |

433,142 |

|

| |

ASURE SOFTWARE,

INC.CONDENSED CONSOLIDATED STATEMENTS OF

COMPREHENSIVE (LOSS) INCOME(in thousands, except per share

amounts)

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

| |

2022 |

|

2021 |

|

2022 |

|

2021 |

| |

(unaudited) |

|

(unaudited) |

| Revenue: |

|

|

|

|

|

|

|

|

Recurring |

$ |

19,959 |

|

|

$ |

16,374 |

|

|

$ |

61,977 |

|

|

$ |

51,688 |

|

|

Professional services, hardware and other |

|

1,944 |

|

|

|

1,607 |

|

|

|

4,559 |

|

|

|

3,263 |

|

|

Total revenue |

|

21,903 |

|

|

|

17,981 |

|

|

|

66,536 |

|

|

|

54,951 |

|

| Cost of Sales |

|

8,256 |

|

|

|

7,113 |

|

|

|

25,164 |

|

|

|

21,646 |

|

|

Gross profit |

|

13,647 |

|

|

|

10,868 |

|

|

|

41,372 |

|

|

|

33,305 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Sales and marketing |

|

4,752 |

|

|

|

3,897 |

|

|

|

14,238 |

|

|

|

11,130 |

|

|

General and administrative |

|

8,023 |

|

|

|

7,005 |

|

|

|

24,204 |

|

|

|

20,324 |

|

|

Research and development |

|

1,230 |

|

|

|

1,505 |

|

|

|

4,523 |

|

|

|

3,972 |

|

|

Amortization of intangible assets |

|

3,350 |

|

|

|

2,534 |

|

|

|

10,134 |

|

|

|

7,590 |

|

|

Total operating expenses |

|

17,355 |

|

|

|

14,941 |

|

|

|

53,099 |

|

|

|

43,016 |

|

| Loss from operations |

|

(3,708 |

) |

|

|

(4,073 |

) |

|

|

(11,727 |

) |

|

|

(9,711 |

) |

|

Interest expense, net |

|

(1,122 |

) |

|

|

(530 |

) |

|

|

(3,006 |

) |

|

|

(977 |

) |

|

(Loss) gain on extinguishment of debt |

|

— |

|

|

|

(342 |

) |

|

|

180 |

|

|

|

8,312 |

|

|

Employee retention tax credit |

|

— |

|

|

|

10,533 |

|

|

|

— |

|

|

|

10,533 |

|

|

Other income, net |

|

399 |

|

|

|

— |

|

|

|

1,349 |

|

|

|

— |

|

| (Loss) Income from operations

before income taxes |

|

(4,431 |

) |

|

|

5,588 |

|

|

|

(13,204 |

) |

|

|

8,157 |

|

|

Income tax expense |

|

102 |

|

|

|

260 |

|

|

|

206 |

|

|

|

663 |

|

| Net (loss) income |

|

(4,533 |

) |

|

|

5,328 |

|

|

|

(13,410 |

) |

|

|

7,494 |

|

| Other comprehensive loss: |

|

|

|

|

|

|

|

|

Unrealized loss on marketable securities |

|

(1,243 |

) |

|

|

(79 |

) |

|

|

(2,802 |

) |

|

|

(287 |

) |

| Comprehensive (loss)

income |

$ |

(5,776 |

) |

|

$ |

5,249 |

|

|

$ |

(16,212 |

) |

|

$ |

7,207 |

|

| |

|

|

|

|

|

|

|

| Basic and diluted (loss)

earnings per share |

|

|

|

|

|

|

|

|

Basic |

$ |

(0.22 |

) |

|

$ |

0.28 |

|

|

$ |

(0.67 |

) |

|

$ |

0.39 |

|

|

Diluted |

$ |

(0.22 |

) |

|

$ |

0.28 |

|

|

$ |

(0.67 |

) |

|

$ |

0.39 |

|

| |

|

|

|

|

|

|

|

| Weighted average basic and

diluted shares |

|

|

|

|

|

|

|

|

Basic |

|

20,219 |

|

|

|

19,182 |

|

|

|

20,092 |

|

|

|

19,083 |

|

|

Diluted |

|

20,219 |

|

|

|

19,330 |

|

|

|

20,092 |

|

|

|

19,243 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASURE SOFTWARE,

INC.CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS(in thousands)

| |

Nine Months Ended September 30, |

| |

2022 |

|

2021 |

| |

(unaudited) |

| Cash flows from operating

activities: |

|

|

|

|

Net (loss) income |

$ |

(13,410 |

) |

|

$ |

7,494 |

|

|

Adjustments to reconcile (loss) income to net cash provided by

(used in) operations: |

|

|

|

|

Depreciation and amortization |

|

14,018 |

|

|

|

11,690 |

|

|

Amortization of operating lease assets |

|

1,268 |

|

|

|

1,146 |

|

|

Amortization of debt financing costs and discount |

|

531 |

|

|

|

117 |

|

|

Net amortization of premiums and accretion of discounts on

available-for-sale securities |

|

279 |

|

|

|

123 |

|

|

Provision for doubtful accounts |

|

304 |

|

|

|

1 |

|

|

Provision for deferred income taxes |

|

163 |

|

|

|

559 |

|

|

Gain on extinguishment of debt |

|

(180 |

) |

|

|

(8,312 |

) |

|

Net realized gains on sales of available-for-sale securities |

|

(808 |

) |

|

|

(390 |

) |

|

Share-based compensation |

|

2,341 |

|

|

|

2,124 |

|

|

Loss (gain) on disposals of fixed assets |

|

1 |

|

|

|

(32 |

) |

|

Change in fair value of contingent purchase consideration |

|

(1,350 |

) |

|

|

(191 |

) |

|

Adjustment to intangibles |

|

23 |

|

|

|

— |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

Accounts receivable |

|

(1,816 |

) |

|

|

(536 |

) |

|

Inventory |

|

(85 |

) |

|

|

85 |

|

|

Prepaid expenses and other assets |

|

2,855 |

|

|

|

(10,916 |

) |

|

Operating lease right-of-use assets |

|

(3,489 |

) |

|

|

(1,368 |

) |

|

Accounts payable |

|

738 |

|

|

|

11 |

|

|

Accrued expenses and other long-term obligations |

|

2,637 |

|

|

|

111 |

|

|

Operating lease liabilities |

|

2,298 |

|

|

|

116 |

|

|

Deferred revenue |

|

639 |

|

|

|

(2,976 |

) |

|

Net cash provided by (used in) operating activities |

|

6,957 |

|

|

|

(1,144 |

) |

| Cash flows from investing

activities: |

|

|

|

|

Acquisition of intangible asset |

|

(2,289 |

) |

|

|

(25,526 |

) |

|

Purchases of property and equipment |

|

(2,188 |

) |

|

|

(100 |

) |

|

Software capitalization costs |

|

(3,219 |

) |

|

|

(3,152 |

) |

|

Purchases of available-for-sale securities |

|

(33,454 |

) |

|

|

(695 |

) |

|

Proceeds from sales and maturities of available-for-sale

securities |

|

7,159 |

|

|

|

8,431 |

|

| Net cash (used in) provided by

investing activities |

|

(33,991 |

) |

|

|

(21,042 |

) |

| Cash flows from financing

activities: |

|

|

|

|

Proceeds from notes payable |

|

— |

|

|

|

29,425 |

|

|

Payments of notes payable |

|

(1,688 |

) |

|

|

(15,073 |

) |

|

Payments of contingent purchase consideration |

|

(9 |

) |

|

|

(1,784 |

) |

|

Debt financing fees |

|

— |

|

|

|

(878 |

) |

|

Net proceeds from issuance of common stock |

|

192 |

|

|

|

526 |

|

|

Net change in client fund obligations |

|

(32,527 |

) |

|

|

(146,206 |

) |

| Net cash used in financing

activities |

|

(34,032 |

) |

|

|

(133,990 |

) |

| Net decrease in cash and cash

equivalents |

|

(61,066 |

) |

|

|

(156,176 |

) |

| Cash and cash equivalents at

beginning of period |

|

198,641 |

|

|

|

324,985 |

|

| Cash and cash equivalents at

end of period |

$ |

137,575 |

|

|

$ |

168,809 |

|

| |

ASURE SOFTWARE,

INC.CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS (continued)(in thousands)

| |

Nine Months Ended September 30, |

| |

2022 |

|

2021 |

| |

(unaudited) |

| Reconciliation of

cash, cash equivalents, restricted cash, and restricted cash

equivalents to the Condensed Consolidated Balance Sheets |

|

Cash and cash equivalents |

$ |

10,885 |

|

$ |

11,506 |

|

Restricted cash and restricted cash equivalents included in funds

held for clients |

|

126,690 |

|

|

157,303 |

| Total cash, cash equivalents,

restricted cash, and restricted cash equivalents |

$ |

137,575 |

|

$ |

168,809 |

| |

|

|

|

| Supplemental information: |

|

|

|

|

Cash paid for interest |

$ |

2,247 |

|

$ |

722 |

|

Cash paid for income taxes |

$ |

246 |

|

$ |

332 |

|

Net assets added from acquisitions |

$ |

— |

|

$ |

763 |

| |

|

|

|

| Non-cash investing and

financing activities: |

|

|

|

|

Contingent purchase consideration issued for acquisition |

$ |

— |

|

$ |

3,038 |

|

Notes payable issued for acquisitions |

$ |

411 |

|

$ |

4,386 |

|

Stock issuance for acquisitions |

$ |

— |

|

$ |

6,428 |

|

|

|

|

|

|

|

ASURE SOFTWARE,

INC.RECONCILIATION OF NON-GAAP AND ADJUSTED

FINANCIAL MEASURES(in thousands, except per share

amounts)

| |

Q3-22 |

Q2-22 |

Q1-22 |

Q4-21 |

Q3-21 |

Q2-21 |

Q1-21 |

| |

|

|

|

|

|

|

|

|

Revenue |

$ |

21,903 |

|

$ |

20,300 |

|

$ |

24,333 |

|

$ |

21,113 |

|

$ |

17,981 |

|

$ |

17,168 |

|

$ |

19,802 |

|

| |

|

|

|

|

|

|

|

| Gross Profit

to non-GAAP Gross Profit |

|

| Gross

Profit |

$ |

13,647 |

|

$ |

12,261 |

|

$ |

15,464 |

|

$ |

13,259 |

|

$ |

10,868 |

|

$ |

9,945 |

|

$ |

12,492 |

|

| Gross Margin |

|

62.3 |

% |

|

60.4 |

% |

|

63.6 |

% |

|

62.8 |

% |

|

60.4 |

% |

|

57.9 |

% |

|

63.1 |

% |

| |

|

|

|

|

|

|

|

|

Share-based Compensation |

|

38 |

|

|

35 |

|

|

36 |

|

|

46 |

|

|

45 |

|

|

38 |

|

|

23 |

|

|

Depreciation |

|

860 |

|

|

815 |

|

|

857 |

|

|

685 |

|

|

710 |

|

|

973 |

|

|

762 |

|

|

Amortization - intangibles |

|

296 |

|

|

296 |

|

|

296 |

|

|

354 |

|

|

379 |

|

|

379 |

|

|

379 |

|

| Non-GAAP Gross

Profit |

$ |

14,841 |

|

$ |

13,407 |

|

$ |

16,653 |

|

$ |

14,344 |

|

$ |

12,002 |

|

$ |

11,335 |

|

$ |

13,656 |

|

| Non-GAAP Gross Margin |

|

67.8 |

% |

|

66.0 |

% |

|

68.4 |

% |

|

67.9 |

% |

|

66.7 |

% |

|

66.0 |

% |

|

69.0 |

% |

| |

|

|

|

|

|

|

|

| Net (loss)

income to non-GAAP net (loss) income |

| Net (loss)

income |

$ |

(4,533 |

) |

$ |

(5,860 |

) |

$ |

(3,017 |

) |

$ |

(4,301 |

) |

$ |

5,328 |

|

$ |

3,764 |

|

$ |

(1,598 |

) |

| Share Count |

|

20,219 |

|

|

20,105 |

|

|

20,041 |

|

|

19,974 |

|

|

19,182 |

|

|

19,040 |

|

|

19,007 |

|

| EPS |

$ |

(0.22 |

) |

$ |

(0.29 |

) |

$ |

(0.15 |

) |

$ |

(0.22 |

) |

$ |

0.28 |

|

$ |

0.20 |

|

$ |

(0.08 |

) |

| |

|

|

|

|

|

|

|

|

Share-based Compensation |

|

798 |

|

|

814 |

|

|

729 |

|

|

821 |

|

|

784 |

|

|

760 |

|

|

626 |

|

|

Amortization - intangibles |

|

3,646 |

|

|

3,649 |

|

|

3,729 |

|

|

3,711 |

|

|

2,912 |

|

|

2,907 |

|

|

2,907 |

|

|

One-time expenses |

|

|

|

|

|

|

|

|

Settlements, penalties and interest |

|

56 |

|

|

298 |

|

|

138 |

|

|

93 |

|

|

441 |

|

|

401 |

|

|

188 |

|

|

Acquisition and transaction costs |

|

— |

|

|

637 |

|

|

85 |

|

|

35 |

|

|

151 |

|

|

7 |

|

|

14 |

|

|

Other non-recurring expenses |

|

298 |

|

|

793 |

|

|

499 |

|

|

150 |

|

|

141 |

|

|

446 |

|

|

— |

|

|

Other income, net |

|

(399 |

) |

|

(1,130 |

) |

|

— |

|

|

(150 |

) |

|

(10,191 |

) |

|

(8,654 |

) |

|

— |

|

| Non-GAAP net (loss)

income |

$ |

(134 |

) |

$ |

(799 |

) |

$ |

2,163 |

|

$ |

359 |

|

$ |

(434 |

) |

$ |

(369 |

) |

$ |

2,137 |

|

| Share Count |

|

20,219 |

|

|

20,105 |

|

|

20,201 |

|

|

20,133 |

|

|

19,182 |

|

|

19,040 |

|

|

19,200 |

|

| Non-GAAP

EPS |

$ |

(0.01 |

) |

$ |

(0.04 |

) |

$ |

0.11 |

|

$ |

0.02 |

|

$ |

(0.02 |

) |

$ |

(0.02 |

) |

$ |

0.11 |

|

| |

|

|

|

|

|

|

|

| Net income

(loss) to Adjusted EBITDA |

| Net income

(loss) |

$ |

(4,533 |

) |

$ |

(5,860 |

) |

$ |

(3,017 |

) |

$ |

(4,301 |

) |

$ |

5,328 |

|

$ |

3,764 |

|

$ |

(1,598 |

) |

|

Interest expense, net |

|

1,122 |

|

|

1,068 |

|

|

816 |

|

|

1,061 |

|

|

530 |

|

|

223 |

|

|

224 |

|

|

Income taxes |

|

102 |

|

|

74 |

|

|

30 |

|

|

139 |

|

|

260 |

|

|

298 |

|

|

105 |

|

|

Depreciation |

|

1,009 |

|

|

969 |

|

|

1,027 |

|

|

846 |

|

|

872 |

|

|

1,136 |

|

|

956 |

|

|

Amortization - intangibles |

|

3,646 |

|

|

3,649 |

|

|

3,729 |

|

|

3,711 |

|

|

2,912 |

|

|

2,907 |

|

|

2,907 |

|

| EBITDA |

$ |

1,346 |

|

$ |

(100 |

) |

$ |

2,585 |

|

$ |

1,456 |

|

$ |

9,902 |

|

$ |

8,328 |

|

$ |

2,594 |

|

| EBITDA Margin |

|

6.1 |

% |

(0.5)% |

|

10.6 |

% |

|

6.9 |

% |

|

55.1 |

% |

|

48.5 |

% |

|

13.1 |

% |

| |

|

|

|

|

|

|

|

|

Share-based Compensation |

|

798 |

|

|

814 |

|

|

729 |

|

|

821 |

|

|

784 |

|

|

760 |

|

|

626 |

|

|

One Time Expenses |

|

|

|

|

|

|

|

|

Settlements, penalties and interest |

|

56 |

|

|

298 |

|

|

138 |

|

|

93 |

|

|

441 |

|

|

401 |

|

|

188 |

|

|

Acquisition and transaction costs |

|

— |

|

|

637 |

|

|

85 |

|

|

35 |

|

|

151 |

|

|

7 |

|

|

14 |

|

|

Other non-recurring expenses |

|

298 |

|

|

793 |

|

|

499 |

|

|

150 |

|

|

141 |

|

|

446 |

|

|

— |

|

|

Other income, net |

|

(399 |

) |

|

(1,130 |

) |

|

— |

|

|

(150 |

) |

|

(10,191 |

) |

|

(8,654 |

) |

|

— |

|

| Adjusted

EBITDA |

$ |

2,099 |

|

$ |

1,312 |

|

$ |

4,036 |

|

$ |

2,405 |

|

$ |

1,228 |

|

$ |

1,288 |

|

$ |

3,422 |

|

| Adjusted EBITDA Margin |

|

9.6 |

% |

|

6.5 |

% |

|

16.6 |

% |

|

11.4 |

% |

|

6.8 |

% |

|

7.5 |

% |

|

17.3 |

% |

| Investor Relations

Contact |

| Randal Rudniski |

| Vice President, Financial

Planning & Analysis |

| 512-859-3562 |

|

randal.rudniski@asuresoftware.com |

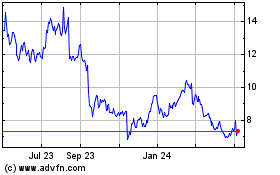

Asure Software (NASDAQ:ASUR)

Historical Stock Chart

From Mar 2024 to Apr 2024

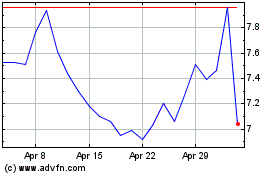

Asure Software (NASDAQ:ASUR)

Historical Stock Chart

From Apr 2023 to Apr 2024