Statement of Changes in Beneficial Ownership (4)

25 November 2021 - 8:19AM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Averick Robert M |

2. Issuer Name and Ticker or Trading Symbol

AMTECH SYSTEMS INC

[

ASYS

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__X__ Director __X__ 10% Owner

_____ Officer (give title below) _____ Other (specify below)

|

|

(Last)

(First)

(Middle)

C/O KOKINO LLC, 201 TRESSER BOULEVARD, 3RD FLOOR |

3. Date of Earliest Transaction

(MM/DD/YYYY)

11/22/2021 |

|

(Street)

STAMFORD, CT 06901

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Common Stock | | | | | | | | 2250000 (1)(2) | I (1)(2) | See footnote 2 below |

| Common Stock | 11/22/2021 | | P | | 12500 | A | $10.66 (3) | 272500 | D | |

| Common Stock | 11/23/2021 | | P | | 2500 | A | $10.30 | 275000 | D | |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Director Stock Option (Right to Buy) | (4) | | | | | | | (4) | (4) | Common Stock | 36000 | | 36000 (4) | D | |

| Explanation of Responses: |

| (1) | Pursuant to a Schedule 13D filed on January 25, 2016 (as amended on August 24, 2017, December 18, 2017, July 17, 2018 and November 27, 2018) (as further amended from time to time, the "Schedule 13D"), (i) Piton Capital Partners LLC ("Piton"), Cornice Fiduciary Management LLC (as trustee of the Trust (as defined in the Schedule 13D)) and M3C Holdings LLC (collectively, the "Kokino Family Clients"), (ii) Mr. Averick, and (iii) OIH LLC also report beneficial ownership of shares of the Issuer's $.01 par value common stock ("Common Shares"). |

| (2) | Indicates 2,250,000 Common Shares beneficially owned by the Kokino Family Clients. Mr. Averick is a Portfolio Manager at Kokino LLC ("Kokino"). Mr. Averick manages the Kokino Family Clients' investment in the Issuer as a Portfolio Manager of Kokino. Mr. Averick holds an indirect interest in certain Common Shares through his minority ownership of Piton, which is a Kokino Family Client (which ownership may be held through Piton's managing member, Piton Capital Management LLC ("PCM")). Also, Mr. Averick's incentive compensation/allocation as an employee of Kokino and member of Piton, which are generally calculated in Kokino's discretion subject to Piton's and PCM's governing documents, may be based on the performance of Common Shares held by Kokino Family Clients. Such compensation/allocation may be paid or made in cash and/or by way of increasing Mr. Averick's interest in Piton (either directly or indirectly through PCM). Kokino is PCM's managing member. |

| (3) | The reported price in Column 4 regarding the November 22, 2021 is a weighted average price rounded to the nearest hundredth. The shares were purchased in multiple transactions at prices ranging from $10.56 to $10.71 per share. Mr. Averick undertakes to provide to the Issuer, any security holder of the Issuer, or to the staff of the SEC, upon request, full information regarding the number of shares purchased at each separate price within the range set forth in this footnote. |

| (4) | This is the total of all derivative securities, including those with different terms and conditions, held by Mr. Averick as of the filing date of this Form 4. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Averick Robert M

C/O KOKINO LLC

201 TRESSER BOULEVARD, 3RD FLOOR

STAMFORD, CT 06901 | X | X |

|

|

Signatures

|

| /s/ Robert M. Averick | | 11/24/2021 |

| **Signature of Reporting Person | Date |

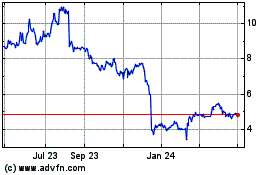

Amtech Systems (NASDAQ:ASYS)

Historical Stock Chart

From Mar 2024 to Apr 2024

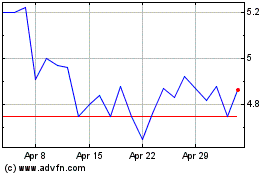

Amtech Systems (NASDAQ:ASYS)

Historical Stock Chart

From Apr 2023 to Apr 2024