Amtech Systems, Inc. ("Amtech") (NASDAQ: ASYS), a manufacturer

of capital equipment, including thermal processing and wafer

polishing, and related consumables used in fabricating

semiconductor devices, such as silicon carbide (SiC) and silicon

power devices, analog and discrete devices, electronic assemblies

and light-emitting diodes (LEDs), today reported results for its

fourth quarter and fiscal year ended September 30, 2022.

Fourth Quarter Fiscal 2022 Financial and Operational

Highlights:

- Net revenue of $32.3 million

- Operating income of $3.9 million

- Net income of $4.2 million

- Net income per diluted share of $0.30

- Customer orders of $20.4 million

- Book to bill ratio of 0.6:1

- Unrestricted cash of $46.9 million

Fiscal 2022 Financial and Operational Highlights:

- Net revenue of $106.3 million

- Operating income of $17.3 million

- Net income of $17.4 million

- Net income per diluted share of $1.22

- Customer orders of $114.0 million

- Book to bill ratio of 1.1:1

- September 30, 2022 backlog of $50.8 million

- Repurchased 434,813 shares for $4.1 million

“Fiscal 2022 was yet another strong year for Amtech, with over

$106 million in revenue, representing a year-over-year growth rate

of 25%. While near-term expectations are tempered by both easing

demand and supply chain limitations, in the mid-term we are well

positioned with increasing alignment to high growth, megatrend end

markets such as electric vehicles. Approximately half of our

current backlog is related to EV capacity expansion,” commented Mr.

Michael Whang, Chief Executive Officer of Amtech. “We are securing

production-scale projects across multiple Amtech product lines and

divisions in diverse applications including Silicon Carbide wafer

polishing and thermal processing for EV sensors, power module

substrates, and battery cooling assemblies, among others,” added

Whang.

GAAP Financial Results

(in millions, except per share

amounts)

Q4 FY

Q3 FY

Q4 FY

12 Months

12 Months

2022

2022

2021

2022

2021

Net revenues

$

32.3

$

20.0

$

24.3

$

106.3

$

85.2

Gross profit

$

12.6

$

5.9

$

9.2

$

39.5

$

34.5

Gross margin

38.8

%

29.6

%

37.8

%

37.2

%

40.5

%

Operating income

$

3.9

$

9.6

$

1.3

$

17.3

$

3.7

Operating margin

12.0

%

47.9

%

5.3

%

16.3

%

4.4

%

Net income

$

4.2

$

10.2

$

0.7

$

17.4

$

1.5

Net income per diluted share

$

0.30

$

0.73

$

0.05

$

1.22

$

0.11

Net revenues increased 62% sequentially and 33% from the fourth

quarter of fiscal 2021, with the sequential increase primarily

attributable to increased shipments of our advanced packaging

equipment and increases in polishing equipment and consumables.

During the third fiscal quarter of 2022, our Shanghai facility was

closed for approximately two months due to the government-mandated

closure relating to its COVID policies. The increase in net

revenues from the fourth quarter of fiscal 2021 was due primarily

to increased shipments across all of our product lines.

Gross margin increased sequentially and from the fourth quarter

of fiscal 2021 due primarily to increased utilization at all our

locations, partial offset by increasing material costs, primarily

in our semiconductor segment.

Selling, General & Administrative (“SG&A”) expenses

increased $0.1 million on a sequential basis and $0.7 million

compared to the prior year period. The increase from the fourth

quarter of fiscal 2021 primarily relates to the timing of external

and internal audit fees.

Research, Development and Engineering decreased $0.3 million

sequentially and was relatively consistent as compared to the same

prior year period.

Operating income was $3.9 million, compared to operating income

of $9.6 million in the third quarter of fiscal 2022 and operating

income of $1.3 million in the same prior year period. Operating

income in the third quarter of fiscal 2022 benefitted from the

pre-tax gain resulting from the sale-leaseback of our building in

Massachusetts.

Income tax provision was $0.6 million for the three months ended

September 30, 2022, compared to a provision of $20,000 in the

preceding quarter and $0.7 million in the same prior year

period.

Net income for the fourth quarter of fiscal 2022 was $4.2

million, or 30 cents per share. This compares to net income of

$10.2 million, or 73 cents per share, for the preceding quarter and

net income of $0.7 million, or 5 cents per share, for the fourth

quarter of fiscal 2021.

Outlook

The Company’s outlook reflects the ongoing logistical impacts

and the related delays for goods shipped to and from China, as well

as supply chain delays we are experiencing in our US business.

Actual results may differ materially in the weeks and months ahead.

Additionally, the semiconductor equipment industries can be

cyclical and inherently impacted by changes in market demand.

Operating results can be significantly impacted, positively or

negatively, by the timing of orders, system shipments, and the

financial results of semiconductor manufacturers.

For the first fiscal quarter ending December 31, 2022, revenues

are expected to be in the range of $21 to $23 million with

operating margin negative.

A portion of Amtech's results is denominated in Renminbis, a

Chinese currency. The outlook provided in this press release is

based on an assumed exchange rate between the United States Dollar

and the Renminbi. Changes in the value of the Renminbi in relation

to the United States Dollar could cause actual results to differ

from expectations.

Conference Call

Amtech Systems will host a conference call today at 5:00 p.m. ET

to discuss our fiscal fourth quarter financial results. The call

will be available to interested parties by dialing 1-877-407-0784.

For international callers, please dial +1-201-689-8560. The

confirmation code is 13734277. A live webcast of the conference

call will be available in the Investor Relations section of

Amtech’s website at:

https://www.amtechsystems.com/investors/events.

A replay of the webcast will be available in the Investor

Relations section of the company’s web site at

http://www.amtechsystems.com/conference.htm shortly after the

conclusion of the call and will remain available for approximately

30 calendar days.

About Amtech Systems, Inc.

Amtech Systems, Inc. is a leading, global manufacturer of

capital equipment, including thermal processing and wafer

polishing, and related consumables used in fabricating

semiconductor devices, such as silicon carbide (SiC) and silicon

power devices, analog and discrete devices, electronic assemblies

and light-emitting diodes (LEDs). We sell these products to

semiconductor device and module manufacturers worldwide,

particularly in Asia, North America and Europe. Our strategic focus

is on semiconductor growth opportunities in power electronics,

sensors and analog devices leveraging our strength in our core

competencies in thermal and substrate processing. We are a market

leader in the high-end power chip market (SiC substrates, 300mm

horizontal thermal reactor, and electronic assemblies used in

power, RF, and other advanced applications), developing and

supplying essential equipment and consumables used in the

semiconductor industry. Amtech's products are recognized under the

leading brand names BTU International, Bruce Technologies™, PR

Hoffman™ and Intersurface Dynamics, Inc.

Cautionary Note Regarding Forward-Looking Statements

Certain information contained in this press release is

forward-looking in nature. All statements in this press release, or

made by management of Amtech Systems, Inc. and its subsidiaries

("Amtech"), other than statements of historical fact, are hereby

identified as "forward-looking statements" (as such term is defined

in Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended, and

the Private Securities Litigation Reform Act of 1995). The

forward-looking statements in this press release relate only to

events or information as of the date on which the statements are

made in this press release. Examples of forward-looking statements

include statements regarding Amtech's future financial results,

operating results, business strategies, projected costs, products

under development, competitive positions, plans and objectives of

Amtech and its management for future operations, efforts to improve

operational efficiencies and effectiveness and profitably grow our

revenue, and enhancements to our technologies and expansion of our

product portfolio. In some cases, forward-looking statements can be

identified by terminology such as "may," "plan," "anticipate,"

"seek," "will," "expect," "intend," "estimate," "believe,"

"continue," "predict," "potential," "project," "should," "would,"

"could", "likely," "future," "target," "forecast," "goal,"

"observe," and "strategy" or the negative of these terms or other

comparable terminology used in this press release or by our

management, which are intended to identify such forward-looking

statements. These statements are not guarantees of future

performance and involve risks, uncertainties and assumptions that

are difficult to predict. The Form 10-K that Amtech filed with the

Securities and Exchange Commission (the "SEC") for the year-ended

September 30, 2021, listed various important factors that could

affect the Company's future operating results and financial

condition and could cause actual results to differ materially from

historical results and expectations based on forward-looking

statements made in this document or elsewhere by Amtech or on its

behalf. These factors can be found under the heading "Risk Factors"

in the Form 10-K and in our subsequently filed Quarterly Reports on

Form 10-Qs, and investors should refer to them. Because it is not

possible to predict or identify all such factors, any such list

cannot be considered a complete set of all potential risks or

uncertainties. Except as required by law, we undertake no

obligation to publicly update forward-looking statements, whether

as a result of new information, future events, or otherwise.

AMTECH SYSTEMS, INC.

(NASDAQ: ASYS)

(Unaudited)

Summary Financial Information

(in thousands, except

percentages)

Three Months Ended

Years Ended September

30,

September 30, 2022

June 30, 2022

September 30, 2021

2022

2021

Amtech Systems, Inc.

Revenues, net of returns and

allowances

$

32,315

$

19,964

$

24,340

$

106,298

$

85,205

Gross profit

$

12,553

$

5,900

$

9,211

$

39,511

$

34,530

Gross margin

39

%

30

%

38

%

37

%

41

%

Operating income

$

3,889

$

9,562

$

1,296

$

17,286

$

3,725

New orders

$

20,365

$

30,145

$

34,188

$

113,953

$

115,444

Backlog

$

50,780

$

62,731

$

44,143

$

50,780

$

44,143

Semiconductor Segment

Revenues, net of returns and

allowances

$

26,498

$

15,135

$

19,891

$

87,982

$

72,086

Gross profit

$

9,373

$

3,590

$

7,732

$

30,880

$

30,336

Gross margin

35

%

24

%

39

%

35

%

42

%

Operating income

$

4,425

$

10,521

$

2,609

$

20,672

$

8,585

New orders

$

16,165

$

24,144

$

30,247

$

94,268

$

101,988

Backlog

$

48,011

$

58,344

$

42,743

$

48,011

$

42,743

Material and Substrate Segment

Revenues, net of returns and

allowances

$

5,817

$

4,829

$

4,449

$

18,316

$

13,119

Gross profit

$

3,180

$

2,310

$

1,479

$

8,631

$

4,194

Gross margin

55

%

48

%

33

%

47

%

32

%

Operating income

$

1,737

$

1,156

$

264

$

3,728

$

278

New orders

$

4,200

$

6,001

$

3,941

$

19,685

$

13,456

Backlog

$

2,769

$

4,387

$

1,400

$

2,769

$

1,400

AMTECH SYSTEMS, INC.

(NASDAQ: ASYS)

(Unaudited)

Consolidated Statements of

Operations

(in thousands, except per share

data)

Three Months Ended September

30,

Years Ended September

30,

2022

2021

2022

2021

Revenue, net

$

32,315

$

24,340

$

106,298

$

85,205

Cost of sales

19,762

15,129

66,787

50,675

Gross profit

12,553

9,211

39,511

34,530

Selling, general and administrative

7,292

6,558

28,300

24,740

Research, development and engineering

1,372

1,342

6,390

5,979

Gain on sale of fixed assets

—

—

(12,465

)

—

Severance expense

—

15

—

86

Operating income

3,889

1,296

17,286

3,725

Interest income (expense) and other,

net

872

46

1,499

(291

)

Income before income tax provision

4,761

1,342

18,785

3,434

Income tax provision

578

676

1,418

1,926

Net income

$

4,183

$

666

$

17,367

$

1,508

Income Per Share:

Net income per basic share

$

0.30

$

0.05

$

1.24

$

0.11

Net income per diluted share

$

0.30

$

0.05

$

1.22

$

0.11

Weighted average shares

outstanding:

Basic

13,933

14,190

14,014

14,189

Diluted

14,080

14,387

14,184

14,340

AMTECH SYSTEMS, INC.

(NASDAQ: ASYS)

(Unaudited)

Consolidated Balance Sheets

(in thousands, except share

data)

September 30, 2022

September 30, 2021

Current Assets

Cash and cash equivalents

$

46,874

$

32,836

Accounts receivable - Net

25,013

22,502

Inventories

25,488

22,075

Income taxes receivable

—

1,046

Other current assets

5,561

2,407

Total current assets

102,936

80,866

Property, Plant and Equipment - Net

6,552

14,083

Right-of-Use Assets - Net

11,258

8,646

Intangible Assets - Net

758

858

Goodwill

11,168

11,168

Deferred Income Taxes - Net

79

631

Other Assets

783

661

Total Assets

$

133,534

$

116,913

Liabilities and Shareholders’

Equity

Current Liabilities

Accounts payable

$

7,301

$

8,229

Accrued compensation and related taxes

4,109

2,881

Accrued warranty expense

871

545

Other accrued liabilities

900

903

Current maturities of finance lease

liabilities and long-term debt

107

396

Current portion of long-term operating

lease liabilities

2,101

531

Contract liabilities

7,231

1,624

Income taxes payable

6

—

Total current liabilities

22,626

15,109

Finance Lease Liabilities and Long-Term

Debt

220

4,402

Long-Term Operating Lease Liabilities

9,395

8,389

Income Taxes Payable

2,849

3,277

Other Long-Term Liabilities

76

102

Total Liabilities

35,166

31,279

Commitments and Contingencies

Shareholders’ Equity

Preferred stock; 100,000,000 shares

authorized; none issued

—

—

Common stock; $0.01 par value; 100,000,000

shares authorized; shares issued and outstanding: 13,994,154 and

14,304,492 in 2022 and 2021, respectively

140

143

Additional paid-in capital

124,458

126,380

Accumulated other comprehensive (loss)

income

(1,767

)

14

Retained deficit

(24,463

)

(40,903

)

Total Shareholders’ Equity

98,368

85,634

Total Liabilities and Shareholders’

Equity

$

133,534

$

116,913

AMTECH SYSTEMS, INC.

(NASDAQ: ASYS)

(Unaudited)

Consolidated Statements of Cash

Flows

(in thousands)

Years Ended September

30,

2022

2021

Operating Activities

Net income (loss)

$

17,367

$

1,508

Adjustments to reconcile net income (loss)

to net cash used in operating activities:

Depreciation and amortization

1,729

1,398

Write-down of inventory

102

544

(Reversal of) provision for allowance for

doubtful accounts

(32

)

44

Deferred income taxes

592

(65

)

Non-cash share-based compensation

expense

543

401

Gain on sale of fixed assets

(12,465

)

—

Other, net

—

43

Changes in operating assets and

liabilities:

Accounts receivable

(2,479

)

(11,023

)

Inventories

(3,684

)

(5,180

)

Contract and other assets

(2,203

)

(686

)

Accounts payable

(1,080

)

5,472

Accrued income taxes

623

353

Accrued and other liabilities

584

829

Contract liabilities

5,607

400

Net cash provided by (used in) operating

activities

5,204

(5,962

)

Investing Activities

Purchases of property, plant and

equipment

(1,135

)

(3,012

)

Proceeds from sale of property, plant and

equipment

19,908

—

Acquisition, net of cash and cash

equivalents acquired

—

(5,082

)

Net cash provided by (used in) investing

activities

18,773

(8,094

)

Financing Activities

Proceeds from the exercise of stock

options

720

1,546

Repurchase of common stock

(4,115

)

—

Payments on long-term debt

(4,872

)

(380

)

Borrowings on long-term debt

Net cash (used in) provided by financing

activities

(8,267

)

1,166

Effect of Exchange Rate Changes on

Cash, Cash Equivalents and Restricted Cash

(1,672

)

656

Net Increase (Decrease) in Cash, Cash

Equivalents and Restricted Cash

14,038

(12,234

)

Cash, Cash Equivalents and Restricted

Cash, Beginning of Year*

32,836

45,070

Cash, Cash Equivalents and Restricted

Cash, End of Year

$

46,874

$

32,836

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221130005979/en/

Amtech Systems, Inc. Lisa D. Gibbs Chief Financial Officer (480)

360-3756 irelations@amtechsystems.com

Sapphire Investor Relations, LLC Erica Mannion and Mike Funari

(617) 542-6180 irelations@amtechsystems.com

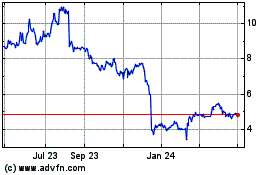

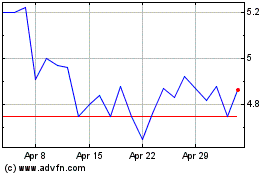

Amtech Systems (NASDAQ:ASYS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amtech Systems (NASDAQ:ASYS)

Historical Stock Chart

From Apr 2023 to Apr 2024