Current Report Filing (8-k)

20 May 2022 - 9:52PM

Edgar (US Regulatory)

0001304492FALSE00013044922022-05-202022-05-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 20, 2022

Anterix Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-36827 | | 33-0745043 |

| (State or other jurisdiction | | (Commission File Number) | | (IRS Employer |

| of incorporation) | | | | Identification No.) |

| | | | | | | | | | | |

| 3 Garret Mountain Plaza | | |

| Suite 401 | | 07424 |

Woodland Park, NJ | | |

| (Address of principal executive offices) | | (Zip Code) |

(973) 771-0300

Registrant’s telephone number, including area code

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12(b))

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol | Name of Each Exchange on which registered |

| Common Stock, $0.0001 par value | ATEX | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

Anterix Inc.’s (the “Company”) preliminary financial results for the fourth quarter and full year ended March 31, 2022 (“Fiscal 2022”) are included below.

Anterix will host an investor conference call on May 20, 2022, at 8:30 am Eastern Time to discuss these preliminary financial results. Interested parties can participate in the call by dialing 888-267-2845 and using the conference code 231489. A replay of the call will be accessible on the Investor Relations section of Anterix’s website at https://www.anterix.com/events/.

The information in this Current Report is being “furnished” pursuant to Item 2.02 of Form 8-K, and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section. Accordingly, the information in this Item 2.02 will not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or under the Exchange Act, unless specifically identified therein as being incorporated therein by reference.

Forward-Looking Statements

Any statements, other than historical information, regarding Anterix Inc. or its business operations, plans, forecasts and opportunities, including its preliminary financial results for Fiscal 2022, constitute forward-looking statements within the meaning of the Federal securities laws. Any such forward-looking statements are based on Anterix’s current expectations and are subject to a number of risks and uncertainties that could cause Anterix’s actual future results or the actual results to differ materially from its current expectations or those implied by the forward-looking statements. These risks and uncertainties include, but are not limited to: (i) Anterix’s preliminary financial results for Fiscal 2022 are subject to material changes and adjustments as the Company completes its financial closing procedures and its financial statements are audited by its outside auditors; (ii) Anterix may not be successful in commercializing its spectrum assets to its targeted utility and critical infrastructure customers, on a timely basis and on favorable terms; (iii) Anterix may be unable to secure broadband licenses from the FCC on a timely and cost-effective basis; (iv) Anterix has a limited operating history with its current business plan, which makes it difficult to evaluate its prospects and future financial results and its business activities, strategic approaches and plans may not be successful; (v) the value of Anterix’s spectrum assets may fluctuate significantly based on supply and demand, as well as technical and regulatory changes; and (vi) Anterix may not be able to repurchase all of the shares anticipated under its proposed share repurchase program. Certain of these and other risk factors that may affect Anterix’s future results of operations are identified and described in more detail in our most recent filings on Form 10-K and 10-Q and in other filings that we make with the SEC from time to time. These documents are available on our website at www.anterix.com under the Investor Relations section and on the SEC’s website at www.sec.gov. Accordingly, you should not rely upon forward-looking statements as predictions of future events. Except as required by applicable law, Anterix undertakes no obligation to update publicly or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise. Forwards-looking statements reflect information and facts only as of the date of this letter.

Anterix Inc.

Consolidated Balance Sheets

March 31, 2022 and 2021

(Unaudited, thousands, except share data)

| | | | | | | | | | | |

| March 31, 2022 | | March 31, 2021 |

| ASSETS |

| Current Assets | | | |

| Cash and cash equivalents | $ | 105,624 | | | $ | 117,538 | |

Accounts receivable, net of allowance for doubtful accounts of $0 and $0, respectively | — | | | 4 | |

| Prepaid expenses and other current assets | 10,147 | | | 3,508 | |

| Total current assets | 115,771 | | | 121,050 | |

| Property and equipment, net | 2,949 | | | 3,574 | |

| Right of use assets, net | 4,047 | | | 5,100 | |

| Intangible assets | 151,169 | | | 122,117 | |

| Equity method investment | — | | | — | |

| Other assets | 4,108 | | | 1,214 | |

| Total assets | $ | 278,044 | | | $ | 253,055 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

| Current liabilities | | | |

| Accounts payable and accrued expenses | $ | 6,526 | | | $ | 6,256 | |

| Due to related parties | 120 | | | 152 | |

| | | |

| Operating lease liabilities | 1,512 | | | 1,470 | |

| Deferred revenue | 1,478 | | | 737 | |

| Total current liabilities | 9,636 | | | 8,615 | |

| Noncurrent liabilities | | | |

| Operating lease liabilities | 4,177 | | | 5,601 | |

| Contingent liability | 20,000 | | | 20,000 | |

| Deferred revenue | 53,200 | | | 2,246 | |

| Deferred income tax | 4,192 | | | 3,209 | |

| Other liabilities | 541 | | | 876 | |

| Total liabilities | 91,746 | | | 40,547 | |

| Commitments and contingencies | | | |

| Stockholders’ equity | | | |

Preferred stock, $0.0001 par value per share, 10,000,000 shares authorized and no shares outstanding at March 31, 2022 and March 31, 2021 | — | | | — | |

Common stock, $0.0001 par value per share, 100,000,000 shares authorized and 18,377,483 shares issued and outstanding at March 31, 2022 and 17,669,905 shares issued and outstanding at March 31, 2021 | 2 | | | 2 | |

| Additional paid-in capital | 500,125 | | | 472,854 | |

| Accumulated deficit | (313,829) | | | (260,348) | |

| Total stockholders’ equity | 186,298 | | | 212,508 | |

| Total liabilities and stockholders’ equity | $ | 278,044 | | | $ | 253,055 | |

Anterix Inc.

Consolidated Statements of Operations

(Unaudited, in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | Year Ended March 31, |

| 2022 | | 2021 | | 2022 | | 2021 |

| Operating revenues | | | | | | | |

| Service revenue | $ | — | | | $ | — | | | $ | — | | | $ | 192 | |

| Spectrum revenue | 335 | | | 181 | | | 1,084 | | | 729 | |

| Total operating revenues | 335 | | | 181 | | | 1,084 | | | 921 | |

| Operating expenses | | | | | | | |

| Direct cost of revenue (exclusive of depreciation and amortization) | — | | | — | | | 5 | | | 1,606 | |

| General and administrative | 9,751 | | | 8,976 | | | 39,525 | | | 39,302 | |

| Sales and support | 1,150 | | | 872 | | | 4,461 | | | 2,942 | |

| Product development | 767 | | | 1,310 | | | 3,593 | | | 4,343 | |

| Depreciation and amortization | 454 | | | 115 | | | 1,450 | | | 3,533 | |

| | | | | | | |

| Impairment of long-lived assets | — | | | 45 | | | — | | | 85 | |

| Operating expenses | 12,122 | | | 11,318 | | | 49,034 | | | 51,811 | |

| (Gain)/loss from disposal of intangible assets, net | (979) | | | — | | | (11,209) | | | 3,849 | |

| Loss from disposal of long-lived assets, net | (4) | | | 76 | | | 107 | | | 70 | |

| Loss from operations | (10,804) | | | (11,213) | | | (36,848) | | | (54,809) | |

| Interest income | 1 | | | 25 | | | 56 | | | 124 | |

| Other income | 59 | | | 82 | | | 256 | | | 414 | |

| Loss on equity method investment | — | | | (16) | | | — | | | (39) | |

| Loss before income taxes | (10,744) | | | (11,122) | | | (36,536) | | | (54,310) | |

| Income tax expense | 273 | | | (187) | | | 983 | | | 124 | |

| Net loss | $ | (11,017) | | | $ | (10,935) | | | $ | (37,519) | | | $ | (54,434) | |

| Net loss per common share basic and diluted | $ | (0.60) | | | $ | (0.62) | | | $ | (2.07) | | | $ | (3.13) | |

| Weighted-average common shares used to compute basic and diluted net loss per share | 18,391,538 | | | 17,602,584 | | | 18,142,828 | | | 17,412,958 | |

Anterix Inc.

Consolidated Statements of Cash Flows

(Unaudited, in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | Year Ended March 31, |

| CASH FLOWS FROM OPERATING ACTIVITIES | 2022 | | 2021 | | 2022 | | 2021 |

| Net loss | $ | (11,017) | | | $ | (10,935) | | | $ | (37,519) | | | $ | (54,434) | |

| Adjustments to reconcile net loss to net cash (used in) provided by operating activities | | | | | | | |

| Depreciation and amortization | 454 | | | 115 | | | 1,450 | | | 3,533 | |

| Non-cash compensation expense attributable to stock awards | 3,578 | | | 2,680 | | | 13,625 | | | 15,925 | |

| Deferred income taxes | 273 | | | (187) | | | 983 | | | 124 | |

| | | | | | | |

| | | | | | | |

| (Gain)/loss from disposal of intangible assets, net | (979) | | | — | | | (11,209) | | | 3,849 | |

| (Gain)/loss from disposal of long-lived assets, net | (4) | | | 76 | | | 107 | | | 70 | |

| | | | | | | |

| Impairment of long-lived assets | — | | | 45 | | | — | | | 85 | |

| Loss on equity method investment | — | | | 16 | | | — | | | 39 | |

| Changes in operating assets and liabilities | | | | | | | |

| Accounts receivable | — | | | 15 | | | 4 | | | 57 | |

| Prepaid expenses and other assets | (682) | | | (106) | | | (797) | | | (745) | |

| Right of use assets | 209 | | | 305 | | | 1,053 | | | 1,407 | |

| Accounts payable and accrued expenses | (258) | | | (1,191) | | | 270 | | | 2,647 | |

| Due to related parties | (40) | | | 31 | | | (32) | | | 42 | |

| Restructuring reserve | — | | | (36) | | | — | | | (636) | |

| Operating lease liabilities | (295) | | | (385) | | | (1,382) | | | (1,674) | |

| Contingent liability | — | | | 20,000 | | | — | | | 20,000 | |

| Deferred revenue | (335) | | | 68 | | | 51,695 | | | (483) | |

| Other liabilities | (28) | | | 199 | | | (335) | | | 235 | |

| Net cash (used in) provided by operating activities | (9,124) | | | 10,710 | | | 17,913 | | | (9,959) | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | | | | | |

| Purchases of intangible assets, including refundable deposits | (10,328) | | | (3,062) | | | (26,358) | | | (13,944) | |

| Purchases of equipment | (801) | | | 4 | | | (1,053) | | | (230) | |

| Net cash used in investing activities | (11,129) | | | (3,058) | | | (27,411) | | | (14,174) | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | | | | | |

| | | | | | | |

| Proceeds from stock option exercises | 1,082 | | | 1,400 | | | 14,004 | | | 4,218 | |

| Repurchase of common stock | (2,969) | | | — | | | (14,962) | | | — | |

| Payments of withholding tax on net issuance of restricted stock | — | | | — | | | (1,458) | | | — | |

| Net cash (used in) provided by financing activities | (1,887) | | | 1,400 | | | (2,416) | | | 4,218 | |

| Net change in cash and cash equivalents | (22,140) | | | 9,052 | | | (11,914) | | | (19,915) | |

| CASH AND CASH EQUIVALENTS | | | | | | | |

| Beginning of the year | 127,764 | | | 108,486 | | | 117,538 | | | 137,453 | |

| End of the year | $ | 105,624 | | | $ | 117,538 | | | $ | 105,624 | | | $ | 117,538 | |

| | | | | | | |

Anterix Inc.

Other Information

(Unaudited, in thousands except per share and county data)

Share Repurchase Program

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | Year Ended March 31, |

| 2022 | | 2021 | | 2022 | | 2021 |

| Number of shares repurchased | 52 | | | — | | | 252 | | | — | |

| Average price paid per share* | $ | 57.35 | | | $ | — | | | $ | 57.50 | | | $ | — | |

| Total cost to repurchase | $ | 2,969 | | | $ | — | | | $ | 14,962 | | | $ | — | |

* Average price paid per share includes costs associated with the repurchases.

90% Broadband Segment Eligibility

The following illustrates the Company’s licensed holdings and licensed holdings under contract by county in the 6 MHz broadband segment created by the Report and Order. This map does not reflect licenses that may meet the protection criteria as that is evaluated on a county basis as each broadband transition plan is prepared.

Item 3.02. Unregistered Sales of Equity Securities.

On May 18, 2022, the Company issued Motorola Solutions, Inc. (“Motorola”) 500,000 shares of its common stock (the “Shares”). Motorola received the Shares by electing to convert 500,000 Class B Units (the “Units”) it held in PDV Spectrum Holding Company, LLC, a subsidiary of the Company (the “Subsidiary”). Motorola acquired the Units in September 2014 in connection with a Spectrum Lease Agreement between Motorola and the Subsidiary. Under the Spectrum Lease Agreement, Motorola leased a portion of the Company’s narrowband spectrum, which was held by the Subsidiary, in consideration for an upfront, fully-paid leasing fee of $7.5 million and a $10.0 million investment in the Units. Motorola had the right at any time to convert its Units into the Shares, representing a conversion price of $20.00 per share. The Shares are currently restricted and may not be resold unless the resale is registered under the federal securities laws, or the Shares are sold in compliance with an exemption from the federal registration requirements.

The sale of the securities described above was exempt from registration under the Securities Act under Section 4(a)(2) of the Securities Act or Regulation D promulgated thereunder as a transaction by an issuer not involving any public offering. The recipient acquired the securities for investment only and not with a view to or for sale in connection with any distribution thereof and appropriate legends were affixed to the securities issued in this transaction. The recipient of securities was an accredited person and had adequate access, through employment, business or other relationships, to information about the registrant.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| | Anterix Inc. |

| | |

| Date: May 20, 2022 | /s/ Tim Gray |

| | Tim Gray |

| | Chief Financial Officer

(Principal Financial and Accounting Officer) |

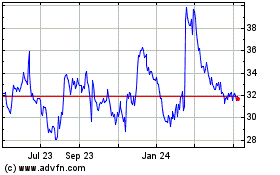

Anterix (NASDAQ:ATEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

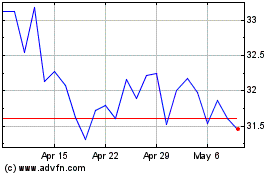

Anterix (NASDAQ:ATEX)

Historical Stock Chart

From Apr 2023 to Apr 2024