Atossa Therapeutics, Inc. (Nasdaq: ATOS), a clinical-stage

biopharmaceutical company seeking to develop innovative proprietary

medicines in oncology and infectious disease with a current focus

on breast cancer and COVID-19, today announces financial results

for the fiscal quarter ended June 30, 2022, and provides an update

on recent company developments.

Key developments from Q2 2022 and to date include:

- Completed dosing in both Part B and Part C (of four parts) of

Phase 1/2a Clinical Trial of AT-H201 in healthy volunteers, which

the Company was developing as an inhalation therapy for moderately

to severely ill hospitalized COVID-19 patients and for “long-haul”

patients with post-infection pulmonary disease.

- Announced plans to shift the development of AT-H201 to more

closely align with its oncology focus by continuing the development

in patients with compromised lung function due to the damaging

effects of cancer treatment.

- Entered into an agreement with a venture-capital backed,

private company based in the United States that is in the

pre-clinical stage of developing novel Chimeric Antigen Receptor

(CAR) T-cell therapies based on technology licensed from a leading

U.S. adult and pediatric cancer treatment and research institution.

The agreement requires that up until November 1, 2022 the CAR-T

company will negotiate exclusively with Atossa for Atossa to

acquire the CAR-T company, and address certain matters related to

personnel, operations and intellectual property.

- Filed an investigational new drug application with the FDA to

initiate a Phase 2 neoadjuvant clinical study of Atossa’s

proprietary Endoxifen in premenopausal women with early-stage

estrogen receptor positive and Human Epidermal Growth Factor

Receptor 2 negative breast cancer in the United States. The FDA has

issued a clinical hold letter requesting additional information

which Atossa plans to submit by the end of the third quarter 2022

and to initiate enrollment in the fourth quarter 2022.

“We continue to make steady progress with our Endoxifen

programs: one to reduce tumor cell activity in breast cancer

patients in the neoadjuvant setting; and another to reduce dense

breast tissue in women. Our work on AT-H201 demonstrated valuable

outcomes, not the least of which was an understanding of how to

pursue its development in the field of oncology. With the

widespread availability of SARS-CoV-2 vaccines and other therapies

now approved to treat COVID-19, we believe that altering the

development pathways for AT-H201 in cancer patients with

compromised lung-function resulting from radiation treatment may

fill a compelling unmet medical need and create additional value

for our stockholders. Lung injury caused by radiation treatment

affects 30-40% of lung cancer patients, and ~35% of esophageal

cancer patients. In non-small cell cancer patients receiving

concurrent chemotherapy and radiation therapy the incidence of lung

injury is estimated to be greater than 60%. As we previously

announced, rather than proceeding with Part D of the AT-H201 study

in COVID-19 patients, we plan to quickly initiate a clinical study

of patients with compromised lung function caused by radiation

treatment and we anticipate announcing next steps in the coming

months,” commented Dr. Steven Quay, Atossa’s President and Chief

Executive Officer.

Quarter Ended June 30, 2022 Financial Results (in

thousands):

As of June 30, 2022, the Company had cash, cash equivalents and

restricted cash of approximately $125,647.

For the quarter ended June 30, 2022, Atossa had no source of

sustainable revenue and no associated cost of revenue.

Operating Expenses: Total operating expenses were

$6,595 for the three months ended June 30, 2022, which is

a decrease of $409 or 6%, from the three

months ended June 30, 2021, of $7,004. Operating expenses for

2022 consisted of research and development (R&D) expenses

of $3,433 and general and administrative (G&A) expenses of

$3,162. Operating expenses for 2021 consisted of R&D

expenses of $3,799, and G&A expenses of $3,205.

Research and Development Expenses: R&D expenses

for the three months ended June 30, 2022, were $3,433,

a decrease of $366 or 10% from total R&D expenses for

the same period in 2021 of $3,799. Clinical and

non-clinical trial costs as well as drug formulation and

analysis for our clinical trials were consistent quarter over

quarter. Total R&D compensation expense increased

primarily due to an increase in stock-based compensation of

$270 and increased salaries, bonus and benefits of $123. In

addition, the Company paid a no-shop fee of $300 to negotiate the

potential acquisition of a company focused on the pre-clinical

stage of developing novel Chimeric Antigen Receptor (CAR) T-cell

therapies based on technology licensed from a leading U.S. cancer

treatment and research institution. Included

in 2021 R&D expenses is an increase of $1,000 attributable

to a one-time fee we paid in June 2021 to a U.S. leading

research institution for the exclusive right to negotiate for

the acquisition of the world-wide rights to two oncology R&D

programs.

General and Administrative Expenses: G&A expenses were

$3,162 for the three months ended June 30, 2022,

a decrease of $43, or 1% from the total G&A expenses for

the three months ended June 30, 2021, of

$3,205. G&A expenses for the three

months ended June 30, 2022, increased $454 primarily due

to an increase in non-cash stock-based compensation expense of

$287 and an increase in other compensation of $167 due to the

addition of a new employee quarter over quarter as well as salary,

bonus and benefits increases. This increase was offset by a

decrease of $533 in professional fees primarily due to a

decrease in proxy costs in 2022.

Six Months Ended June 30, 2022 Financial Results (in

thousands):

For the six months ended June 30, 2022, Atossa had no source of

sustainable revenue and no associated cost of revenue.

Operating Expenses: Total operating expenses were

$11,348 for the six months ended June 30, 2022, which is

an increase of $814 or 8%, from the six months ended

June 30, 2021 of $10,534. Operating expenses for

2022 consisted of R&D expenses of $4,937 and general and

G&A expenses of $6,411. Operating expenses for 2021

consisted of R&D expenses of $5,177, and G&A expenses of

$5,357.

Research and Development Expenses: R&D expenses for

the six months ended June 30, 2022, were $4,937,

a decrease of $240 or 5% from total R&D expenses for

the same period in 2021 of $5,177. R&D expenses

decreased because of a refund of $1,000 from the research

institution that the Company had an exclusive right

to negotiate for the acquisition of the world-wide rights to

two oncology R&D programs. In February 2022, the other party

did not honor its obligation to negotiate with us which lead to a

cancellation of the agreement and refund of the $1,000 previously

paid. Included in 2021 R&D expenses is an increase of

$1,000 attributable the same one-time fee paid in June

2021. Additionally, on June 27, 2022, this decrease was offset

by increased spending on clinical and non-clinical trials of

$434 over the same period in 2021 due to additional drug

manufacturing costs. Stock-based compensation, which is a

non-cash charge, also increased $703 period over

period, and other R&D compensation was up

$202 due to salary, bonus and benefit increases. Professional

expenses also increased $100 during the six months ended June 30,

2022 as compared to the same period in 2021. Finally,

we paid $300 for the exclusive right to negotiate with

a CAR-T Company for us to acquire the company.

General and Administrative Expenses: G&A expenses were

$6,411 for the six months ended June 30, 2022, an

increase of $1,054 or 20% from the total G&A expenses for

the six months ended June 30, 2021, of $5,357. The

increase in G&A expenses for the six months ended

June 30, 2022, is primarily attributable to the increase

in non-cash stock-based compensation expense of $1,020.

Compensation expense also increased $431 due to the addition

of a two new employees year over year as well as salary,

bonus and benefit increases. Legal fees also increased

$147 period over period due to increased patent activity.

These increases are offset by the decrease in professional fees of

$532 due primarily to the reduction of proxy costs

period over period.

About Atossa Therapeutics

Atossa Therapeutics, Inc. is a clinical-stage biopharmaceutical

company seeking to discover and develop innovative medicines in

oncology and infectious diseases with a current focus on breast

cancer and COVID-19. For more information, please visit

www.atossatherapeutics.com.

Forward-Looking Statements

Forward-looking statements in this press release, which Atossa

undertakes no obligation to update, are subject to risks and

uncertainties that may cause actual results to differ materially

from the anticipated or estimated future results, including the

risks and uncertainties associated with any variation between

interim and final clinical results, actions and inactions by the

FDA, the outcome or timing of regulatory approvals needed by Atossa

including those needed to commence studies of AT-H201, AT-301 and

Endoxifen, lower than anticipated rate of patient enrollment,

estimated market size of drugs under development, the safety and

efficacy of Atossa’s products, performance of clinical research

organizations and investigators, obstacles resulting from

proprietary rights held by others such as patent rights, whether

reduction in Ki-67 or any other result from a neoadjuvant study is

an approvable endpoint for oral Endoxifen, whether Atossa can

complete acquisitions, and other risks detailed from time to time

in Atossa’s filings with the Securities and Exchange Commission,

including without limitation its periodic reports on Form 10-K and

10-Q, each as amended and supplemented from time to time.

Company Contact:Atossa Therapeutics, Inc.Kyle Guse CFO and

General CounselOffice: (866) 893-4927kyle.guse@atossainc.com

Investor Relations Contact:Core IROffice: (516)

222-2560ir@atossainc.com

Source: Atossa Therapeutics, Inc.

ATOSSA THERAPEUTICS,

INC.CONDENSED CONSOLIDATED BALANCE

SHEETS(amounts in thousands, except for par

value)

| |

|

As of June 30, |

|

|

|

|

|

| |

|

2022 |

|

|

As of December 31, |

|

| Assets |

|

(Unaudited) |

|

|

2021 |

|

|

Current assets |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

125,537 |

|

|

$ |

136,377 |

|

|

Restricted cash |

|

|

110 |

|

|

|

110 |

|

|

Prepaid expenses |

|

|

5,304 |

|

|

|

2,488 |

|

|

Research and development rebate receivable |

|

|

900 |

|

|

|

1,072 |

|

|

Other current assets |

|

|

1,570 |

|

|

|

1,193 |

|

|

Total current assets |

|

|

133,421 |

|

|

|

141,240 |

|

| |

|

|

|

|

|

|

|

|

|

Other assets |

|

|

627 |

|

|

|

22 |

|

|

Total Assets |

|

$ |

134,048 |

|

|

$ |

141,262 |

|

| |

|

|

|

|

|

|

|

|

| Liabilities and

Stockholders' Equity |

|

|

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

2,052 |

|

|

$ |

1,717 |

|

|

Accrued expenses |

|

|

834 |

|

|

|

204 |

|

|

Payroll liabilities |

|

|

875 |

|

|

|

1,184 |

|

|

Other current liabilities |

|

|

31 |

|

|

|

21 |

|

|

Total current liabilities |

|

|

3,792 |

|

|

|

3,126 |

|

| |

|

|

|

|

|

|

|

|

|

Total Liabilities |

|

|

3,792 |

|

|

|

3,126 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and

contingencies |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Stockholders' equity |

|

|

|

|

|

|

|

|

|

Preferred stock - $0.001 par value; 10,000 shares authorized; 1

share issued and outstanding as of June 30, 2022 and December 31,

2021 |

|

|

- |

|

|

|

- |

|

|

Additional paid-in capital - Series B convertible preferred

stock |

|

|

582 |

|

|

|

582 |

|

|

Common stock - $0.18 par value; 175,000 shares authorized; 126,624

shares issued and outstanding as of June 30, 2022 and December 31,

2021 |

|

|

22,792 |

|

|

|

22,792 |

|

|

Additional paid-in capital - common stock |

|

|

247,573 |

|

|

|

243,996 |

|

|

Accumulated deficit |

|

|

(140,691 |

) |

|

|

(129,234 |

) |

|

Total Stockholders' Equity |

|

|

130,256 |

|

|

|

138,136 |

|

|

Total Liabilities and Stockholders' Equity |

|

$ |

134,048 |

|

|

$ |

141,262 |

|

|

|

|

|

|

|

|

|

|

|

ATOSSA THERAPEUTICS,

INC. CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS(UNAUDITED)(amounts in

thousands, except for per share amounts)

| |

|

For the Three Months Ended June 30, |

|

|

For the Six Months Ended June 30, |

|

| |

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Research and development |

|

$ |

3,433 |

|

|

$ |

3,799 |

|

|

$ |

4,937 |

|

|

$ |

5,177 |

|

| General and

administrative |

|

|

3,162 |

|

|

|

3,205 |

|

|

|

6,411 |

|

|

|

5,357 |

|

|

Total operating expenses |

|

|

6,595 |

|

|

|

7,004 |

|

|

|

11,348 |

|

|

|

10,534 |

|

| Operating loss |

|

|

(6,595 |

) |

|

|

(7,004 |

) |

|

|

(11,348 |

) |

|

|

(10,534 |

) |

| Other expense, net |

|

|

(77 |

) |

|

|

(35 |

) |

|

|

(109 |

) |

|

|

(43 |

) |

| Loss before income taxes |

|

|

(6,672 |

) |

|

|

(7,039 |

) |

|

|

(11,457 |

) |

|

|

(10,577 |

) |

| Income taxes |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Net loss |

|

$ |

(6,672 |

) |

|

$ |

(7,039 |

) |

|

$ |

(11,457 |

) |

|

$ |

(10,577 |

) |

| Loss per common share - basic

and diluted |

|

$ |

(0.05 |

) |

|

$ |

(0.06 |

) |

|

$ |

(0.09 |

) |

|

$ |

(0.10 |

) |

| Weighted average shares

outstanding - basic and diluted |

|

|

126,624 |

|

|

|

121,572 |

|

|

|

126,624 |

|

|

|

107,160 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

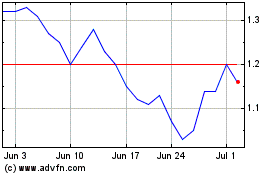

Atossa Therapeutics (NASDAQ:ATOS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Atossa Therapeutics (NASDAQ:ATOS)

Historical Stock Chart

From Apr 2023 to Apr 2024