Atrion Reports Third Quarter 2022 Results

09 November 2022 - 8:00AM

Atrion Corporation (NASDAQ: ATRI) today announced its results for

the third quarter ended September 30, 2022.

Revenues for the third quarter of 2022 totaled

$44.6 million compared to $42.9 million for the same period in

2021. For the quarter ended September 30, 2022, operating income

was $9.6 million, up $125 thousand over the comparable 2021 period,

and net income was $8.8 million, up $562 thousand over the same

period in 2021. Third quarter 2022 diluted earnings per share were

$4.94 compared to $4.58 for the third quarter of 2021.

Commenting on the results for the third quarter

of 2022 compared to the prior year period, David Battat, President

and CEO, stated, “Even with the impact of Hurricane Ian, revenues

were up 4%, resulting in the highest revenues of any third quarter

in our history. Net income and earnings per share were up by 7% and

8%, respectively. Continuing manufacturing cost increases lowered

gross profit margins in the quarter from 42% to 40%."

Mr. Battat continued, “Thankfully, our employees

and our Florida facility were not harmed by the hurricane, but $1.7

million in products scheduled for shipment from that facility the

last week of the just ended quarter did not ship until October

because trucking companies did not make scheduled pickups in the

days leading up to the storm. We also incurred costs due to

shutting down that facility for almost three days to ensure the

safety of our employees.”

Updating expectations for the second half of

2022, Mr. Battat stated, “Our international customers are

expressing greater concern about a severe recession in Europe,

especially in light of inflationary pressures from winter energy

prices. These customers have cautioned they may push out orders

previously scheduled to ship at the end of this year into

2023. We expect revenues and operating income will still show

gains, but at lower than previously projected levels.”

Mr. Battat concluded, “Cash and short and long term investments

totaled $58.6 million at September 30, 2022 after our purchase of

8,577 shares of the Company’s stock during the third quarter at an

average price of $593.46. We remain debt free.”

Atrion Corporation develops and manufactures

products primarily for medical applications. The Company’s website

is www.atrioncorp.com.

Statements in this press release that are

forward looking are based upon current expectations and actual

results or future events may differ materially. Such

statements include, but are not limited to, the Company’s

expectations regarding revenues and operating income. Words

such as "expects," "believes," "anticipates," "forecasts,"

"intends," "should", "plans," "will" and variations of such words

and similar expressions are intended to identify such

forward-looking statements. Forward-looking statements contained

herein involve numerous risks and uncertainties, and there are a

number of factors that could cause actual results or future events

to differ materially, including, but not limited to, the following:

the risk that the COVID-19 pandemic continues to lead to material

delays and cancellations of, or reduced demand for, procedures in

which our products are utilized; curtailed or delayed capital

spending by hospitals and other healthcare providers; disruption to

our supply chain; closures of our facilities; delays in training;

delays in gathering clinical evidence; diversion of management and

other resources to respond to the COVID-19 outbreak; the impact of

global and regional economic and credit market conditions on

healthcare spending; the risk that the COVID-19 virus continues to

disrupt local economies and to cause economies in our key markets

to enter prolonged recessions; changing economic, market and

business conditions; acts of war or terrorism; the effects of

governmental regulation; the impact of competition and new

technologies; slower-than-anticipated introduction of new products

or implementation of marketing strategies; implementation of new

manufacturing processes or implementation of new information

systems; our ability to protect our intellectual property; changes

in the prices of raw materials; changes in product mix;

intellectual property and product liability claims and product

recalls; the ability to attract and retain qualified personnel; and

the loss of, or any material reduction in sales to, any significant

customers. In addition, assumptions relating to budgeting,

marketing, product development and other management decisions are

subjective in many respects and thus susceptible to interpretations

and periodic review which may cause us to alter our marketing,

capital expenditures or other budgets, which in turn may affect our

results of operations and financial condition. The foregoing list

of factors is not exclusive, and other factors are set forth in the

Company's filings with the Securities and Exchange Commission. The

forward-looking statements in this press release are made as of the

date hereof, and we do not undertake any obligation, and disclaim

any duty, to supplement, update or revise such statements, whether

as a result of subsequent events, changed expectations or

otherwise, except as required by applicable law.

Contact:

Jeffery

StricklandVice President and

Chief Financial Officer(972)

390-9800

ATRION

CORPORATIONUNAUDITED CONSOLIDATED STATEMENTS OF

INCOME(In thousands, except per share

data)

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| Revenues |

$ |

44,631 |

|

|

$ |

42,855 |

|

|

$ |

140,651 |

|

|

$ |

124,716 |

|

| Cost of goods

sold |

|

26,978 |

|

|

|

25,065 |

|

|

|

82,921 |

|

|

|

72,720 |

|

|

Gross profit |

|

17,653 |

|

|

|

17,790 |

|

|

|

57,730 |

|

|

|

51,996 |

|

| Operating

expenses |

|

8,050 |

|

|

|

8,312 |

|

|

|

26,848 |

|

|

|

23,792 |

|

|

Operating income |

|

9,603 |

|

|

|

9,478 |

|

|

|

30,882 |

|

|

|

28,204 |

|

| |

|

|

|

|

|

|

|

| Interest and dividend

income |

|

210 |

|

|

|

281 |

|

|

|

639 |

|

|

|

680 |

|

| Other investment income

(loss) |

|

764 |

|

|

|

(173 |

) |

|

|

216 |

|

|

|

852 |

|

| Other

income |

|

7 |

|

|

|

-- |

|

|

|

92 |

|

|

|

67 |

|

| Income before income

taxes |

|

10,584 |

|

|

|

9,586 |

|

|

|

31,829 |

|

|

|

29,803 |

|

| Income tax

provision |

|

(1,745 |

) |

|

|

(1,309 |

) |

|

|

(5,143 |

) |

|

|

(4,875 |

) |

|

Net income |

$ |

8,839 |

|

|

$ |

8,277 |

|

|

$ |

26,686 |

|

|

$ |

24,928 |

|

| |

|

|

|

|

|

|

|

| Income per basic

share |

$ |

4.95 |

|

|

$ |

4.59 |

|

|

$ |

14.89 |

|

|

$ |

13.71 |

|

|

|

|

|

|

|

|

|

|

| Weighted average basic

shares outstanding |

|

1,786 |

|

|

|

1,803 |

|

|

|

1,793 |

|

|

|

1,818 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Income per diluted

share |

$ |

4.94 |

|

|

$ |

4.58 |

|

|

$ |

14.86 |

|

|

$ |

13.68 |

|

|

|

|

|

|

|

|

|

|

| Weighted average diluted

shares outstanding |

|

1,788 |

|

|

|

1,806 |

|

|

|

1,796 |

|

|

|

1,822 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ATRION

CORPORATIONCONSOLIDATED BALANCE

SHEETS(In thousands)

| |

Sept. 30, |

|

Dec. 31, |

|

ASSETS |

|

2022 |

|

|

2021 |

| |

(Unaudited) |

|

|

| Current

assets: |

|

|

|

|

Cash and cash equivalents |

$ |

27,125 |

|

$ |

32,264 |

|

Short-term investments |

|

20,296 |

|

|

29,059 |

|

Total cash and short-term investments |

|

47,421 |

|

|

61,323 |

|

Accounts receivable |

|

22,038 |

|

|

21,023 |

|

Inventories |

|

59,624 |

|

|

50,778 |

|

Prepaid expenses and other |

|

3,598 |

|

|

3,447 |

|

Total current assets |

|

132,681 |

|

|

136,571 |

| Long-term

investments |

|

11,133 |

|

|

19,423 |

| Property, plant and

equipment, net |

|

115,113 |

|

|

97,972 |

|

Other assets |

|

13,027 |

|

|

13,298 |

| |

|

|

|

| |

$ |

271,954 |

|

$ |

267,264 |

| |

|

|

|

| |

|

|

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

| |

|

|

|

| Current

liabilities |

|

17,879 |

|

|

13,346 |

| Line of

credit |

|

-- |

|

|

-- |

| Other non-current

liabilities |

|

7,800 |

|

|

9,622 |

| Stockholders’

equity |

|

246,275 |

|

|

244,296 |

| |

|

|

|

| |

$ |

271,954 |

|

$ |

267,264 |

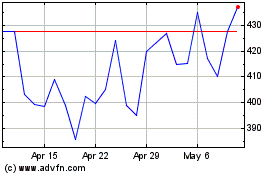

ATRION (NASDAQ:ATRI)

Historical Stock Chart

From Mar 2024 to Apr 2024

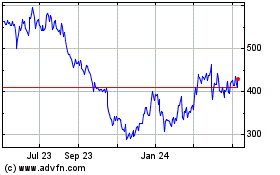

ATRION (NASDAQ:ATRI)

Historical Stock Chart

From Apr 2023 to Apr 2024