Current Report Filing (8-k)

16 November 2022 - 8:12AM

Edgar (US Regulatory)

FALSE000000806300000080632022-11-142022-11-14

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 14, 2022

ASTRONICS CORPORATION

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | | | | |

| New York | 0-7087 | 16-0959303 |

| (State of Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| 130 Commerce Way East Aurora, New York | 14052 | |

| (Address of principal executive offices) | (Zip Code)

| |

Registrant's telephone number, including area code: (716) 805-1599

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, $.01 par value per share | ATRO | NASDAQ Stock Market |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

The disclosure set forth in Item 2.03 below is incorporated in this Item 1.01 by reference.

Item 2.02 Results of Operations and Financial Condition.

On November 15, 2022, Astronics Corporation issued a news release announcing its third quarter financial results for 2022. A copy of the press release is attached as Exhibit 99.1.

The information contained herein and in the accompanying exhibit shall not be incorporated by reference into any filing of the registrant, whether made before or after the date hereof, regardless of any general incorporation language in such filing. The information in this report including the exhibit hereto, shall not be deemed to be “filed” for purpose of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

Astronics Corporation (the “Company”) amended its existing credit facility on November 14, 2022 by entering into Amendment No. 5 (the “Amendment”) to the Fifth Amended and Restated Credit Agreement dated as of February 16, 2018, with HSBC Bank USA, National Association, as Agent, and the lenders signatory thereto. The Amendment extended the scheduled maturity date from August 31, 2023 to November 30, 2023.

The Amendment set the maximum aggregate amount that the Company can borrow under the revolving credit line in the Credit Agreement at $180 million through December 20, 2022. The maximum aggregate amount available for borrowing had been scheduled to decrease to $170 million on November 21, 2022. The decrease to $170 million will now take place on December 21, 2022.

Pursuant to the Amendment, the maximum net leverage ratio was waived for the duration of the facility. The Amendment requires the Company to comply with a minimum EBITDA requirement, set at $15 million as of December 31, 2022 and March 31, 2023, and $25 million as of June 30, 2023 and September 30, 2023. Further, the Company is required to maintain minimum liquidity of at least $10 million as of November 30, 2022 and December 31, 2022, and $15 million at the end of any month thereafter.

Under the terms of the Amendment, the Company will now pay interest on the unpaid principal amount of the amended facility at a rate equal to one-, three- or six-month SOFR (which shall be at least 1.00%) plus 4.50% for ABR loans and 5.50% for SOFR loans from November 14, 2022 through January 16, 2023, and 7.50% for ABR loans and 8.50% for SOFR loans commencing January 17, 2023. In addition, pursuant to the Amendment, the Company will pay a commitment fee in the amount of 10 basis points of the commitment for each lender. The 5 basis point fee that was to be paid upon closing of the proposed refinancing became due and payable on the date of the Amendment.

The above description does not purport to be complete and is qualified in its entirety by reference to the Amendment, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference

Item 9.01 Financial Statements and Exhibits.

| | | | | |

| Exhibit | Description |

| Amendment No. 5 (the “Amendment”) to the Fifth Amended and Restated Credit Agreement dated as of November 14, 2022 |

| Press Release of Astronics Corporation dated November 15, 2022 |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | Astronics Corporation |

| | | |

| Dated: | November 15, 2022 | By: | /s/ David C. Burney |

| | Name: | David C. Burney |

| | | Executive Vice President and Chief Financial Officer |

| | |

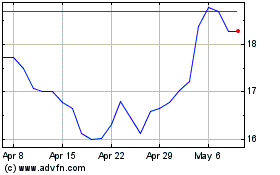

Astronics (NASDAQ:ATRO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Astronics (NASDAQ:ATRO)

Historical Stock Chart

From Apr 2023 to Apr 2024