Auburn National Bancorporation (Nasdaq: AUBN) reported record

quarterly net earnings of $4.5 million, or $1.27 per share, for the

fourth quarter of 2022, compared to $1.9 million, or $0.53 per

share, for the fourth quarter of 2021. For the full year 2022, the

Company reported record net earnings of $10.3 million, or $2.95 per

share, compared to $8.0 million, or $2.27 per share, for 2021.

“We had record earnings for the fourth quarter and full year

2022 partly due to a couple of notable non-routine items” said

David A. Hedges, President and CEO. “However, we saw strong revenue

growth as our net interest income and margin continued to expand.

In addition to solid loan growth, our net interest margin continued

to benefit from our low-cost core deposit base. While 2023 will

present new opportunities and challenges, we remain confident that

our long-term approach and philosophy of knowing and caring for our

customers, maintaining exceptional asset quality, and supporting

our communities will enable us to continue to generate value for

our shareholders,” said Mr. Hedges.

Total revenue increased by $4.3 million, or 62%, in the fourth

quarter of 2022, compared to the fourth quarter of 2021. This

increase was primarily related to a $3.2 million gain on the sale

of land. Excluding the impact of this gain, total revenue increased

by $1.1 million, or 15%, in the fourth quarter of 2022, compared to

the fourth quarter of 2021.

Net interest income (tax-equivalent) was $7.6 million for the

fourth quarter of 2022, an increase of 23% compared to $6.2 million

for the fourth quarter of 2021. This increase was primarily due to

improvements in the Company’s net interest margin. The Company’s

net interest margin (tax-equivalent) was 3.27% in the fourth

quarter of 2022 compared to 2.45% in the fourth quarter of 2021.

This increase was primarily due to a more favorable asset mix and

higher yields on interest earning assets, while the cost of funds

only increased 7 basis points to 0.43%.

Nonperforming assets were $2.7 million, or 0.27% of total

assets, at December 31, 2022, compared to $0.3 million, or

0.03% of total assets, at September 30, 2022 and $0.8 million, or

0.07% of total assets, at December 31, 2021. The increase in

nonperforming assets was primarily due to the downgrade of one

borrowing relationship with a recorded investment of $2.6 million

at December 31, 2022.

At December 31, 2022, the Company’s allowance for loan losses

was $5.8 million, or 1.14% of total loans, compared to $5.0

million, or 1.05% at September 30, 2022 and $4.9 million, or 1.08%

of total loans, at December 31, 2021. At December 31, 2022, the

Company’s recorded investment in loans considered impaired was $2.6

million with a corresponding valuation allowance (included in the

allowance for loan losses) of $0.5 million, compared to a recorded

investment in loans considered impaired of $0.2 million with no

corresponding valuation allowance at both September 30, 2022 and

December 31, 2021.

The Company recorded a provision for loan losses of $1.0 million

in the fourth quarter of 2022, compared to no provision for loan

losses in the fourth quarter of 2021. The increase in provision for

loan losses was primarily due to loan growth and the downgrade of

one borrowing relationship. Net charge-offs were $0.2 million, or

0.16% of average loans on an annualized basis for the fourth

quarter in both of 2022 and 2021. Net charge-offs recognized in the

fourth quarter of 2022 primarily related to the one borrowing

relationship referenced above.

Noninterest income was $3.9 million in the fourth quarter of

2022 compared to $1.0 million for the fourth quarter of 2021. This

increase was primarily related to a $3.2 million gain on the sale

of land adjacent to Company headquarters. Excluding the impact of

this gain, noninterest income was $0.7 million in the fourth

quarter of 2022, a 3% decrease compared to the fourth quarter of

2021. The decrease in noninterest income was primarily due to a

decrease in mortgage lending income of $0.2 million as refinance

activity slowed in our primary market area related to higher market

interest rates.

Noninterest expense was $4.4 million in the fourth quarter of

2022 compared to $5.1 million for the fourth quarter of 2021. This

decrease was primarily related to the $1.6 million ERC payroll tax

credit recognized in the fourth quarter of 2022. Excluding the

impact of this payroll tax credit, noninterest expense was $6.0

million in the fourth quarter of 2022, a 19% increase compared to

the fourth quarter of 2021. The increase in noninterest expense was

primarily due to increases in net occupancy and equipment expense

of $0.4 million related to the Company’s new headquarters, which

opened in June 2022 and salaries and benefits expense of $0.3

million.

Income tax expense was $1.5 million for the fourth quarter of

2022, compared to $0.1 million during fourth quarter of 2021. The

Company's effective tax rate for the fourth quarter of 2022 was

24.56%, compared to 4.74% in the fourth quarter of 2021. This

increase was primarily due to increased pre-tax earnings in the

fourth quarter of 2022, additional income tax expense of $0.2

million related to the Company’s decision to surrender certain

bank-owned life insurance contracts in the fourth quarter of 2022

and an income tax benefit of $0.4 million realized in the fourth

quarter of 2021 related to a New Markets Tax Credit investment. The

Company’s effective income tax rate is principally impacted by

tax-exempt earnings from the Company’s investments in municipal

securities, bank-owned life insurance, and New Markets Tax

Credits.

At December 31, 2022, the Company’s consolidated stockholders’

equity was $68.0 million, or $19.42 per share, compared to $103.7

million, or 29.46 per share, at December 31, 2021. The decrease

from December 31, 2021 was primarily driven by an other

comprehensive loss due to the change in unrealized gains/losses on

securities available-for-sale, net of tax, during 2022, of $41.8

million. The increase in the unrealized loss on securities was

primarily due to increases in market interest rates. These

unrealized losses do not affect the Bank’s capital for regulatory

capital purposes. At December 31, 2022, the Company’s equity to

total assets ratio was 6.65%, compared to 9.39% at December 31,

2021.

The Company paid cash dividends of $0.265 per share in the

fourth quarter of 2022, an increase of 2% from the same period in

2021. The Company repurchased 17,183 shares for $0.5 million in

2022. At December 31, 2022, the Bank’s regulatory capital ratios

were well above the minimum amounts required to be “well

capitalized” under current regulatory standards.

About Auburn National Bancorporation, Inc.

Auburn National Bancorporation, Inc. (the “Company”) is the

parent company of AuburnBank (the “Bank”), with total assets of

approximately $1.0 billion. The Bank is an Alabama state-chartered

bank that is a member of the Federal Reserve System, which has

operated continuously since 1907. Both the Company and the Bank are

headquartered in Auburn, Alabama. The Bank conducts its business in

East Alabama, including Lee County and surrounding areas. The Bank

operates eight full-service branches in Auburn, Opelika, Valley,

and Notasulga, Alabama. The Bank also operates a loan production

office in Phenix City, Alabama. Additional information about the

Company and the Bank may be found by visiting

www.auburnbank.com.

Cautionary Notice Regarding Forward-Looking

Statements

This press release contains “forward-looking statements” within

the meaning of the Securities Act of 1933 and the Securities

Exchange Act of 1934, including, without limitation, statements

about future financial and operating results, costs and revenues,

the continuing effects

of the COVID-19 pandemic and related

government, Federal Reserve monetary and regulatory actions,

including the continuing effects of pandemic-related economic

stimulus and economic conditions generally and in our markets, loan

demand, mortgage lending activity, changes in the mix of our

earning assets (including those generating tax exempt income or tax

credits) and our deposit and wholesale liabilities, net interest

margin, yields on earning assets, securities valuations and

performance, effects of inflation, including Federal Reserve

tightening in 2022 of monetary policies, including reductions in

the Federal Reserve’s Treasury and mortgage-backed securities

holdings and increases in the Federal Reserve’s target federal

funds rate, interest rates (generally and those applicable to our

assets and liabilities) and changes in asset values as a result of

interest rate changes, noninterest income, loan performance, loan

deferrals and modifications, nonperforming assets, other real

estate owned, provision for loan losses, charge-offs,

other-than-temporary impairments, collateral values, credit

quality, asset sales, insurance claims, and market trends, as well

as statements with respect to our objectives, expectations and

intentions and other statements that are not historical facts.

Actual results may differ from those set forth in the

forward-looking statements.

Forward-looking statements, with respect to our beliefs, plans,

objectives, goals, expectations, anticipations, estimates and

intentions, involve known and unknown risks, uncertainties and

other factors, which may be beyond our control, and which may cause

the actual results, performance, achievements, or financial

condition of the Company or the Bank to be materially different

from future results, performance, achievements, or financial

condition expressed or implied by such forward-looking statements.

You should not expect us to update any forward-looking

statements.

All written or oral forward-looking statements attributable to

us are expressly qualified in their entirety by this cautionary

notice, together with those risks and uncertainties described in

our annual report on Form 10-K for the year

ended December 31, 2021 and otherwise in our other SEC reports

and filings.

Explanation of Certain Unaudited Non-GAAP Financial

Measures

This press release contains financial information determined by

methods other than U.S. generally accepted accounting principles

(“GAAP”). The attached financial highlights include certain

designated net interest income amounts presented

on a tax-equivalent basis, a non-GAAP financial measure,

and the presentation and calculation of the efficiency

ratio, a non-GAAP measure. Management

uses these non-GAAP financial measures in its

analysis of the Company’s performance and believes the presentation

of net interest income

on a tax-equivalent basis provides

comparability of net interest income from both

taxable and tax-exempt sources and facilitates

comparability within the industry. Similarly, the efficiency ratio

is a common measure that facilitates comparability with other

financial institutions. Although the Company

believes these non-GAAP financial measures

enhance investors’ understanding of its business and

performance, these non-GAAP financial measures

should not be considered an alternative to GAAP. Along with the

attached financial highlights, the Company provides reconciliations

between the GAAP financial measures

and these non-GAAP financial measures.

For additional information, contact:David A. HedgesPresident and

CEO(334) 821-9200

| Reports Full

Year and Fourth Quarter Net Earnings |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial Highlights (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quarter ended December 31, |

|

|

|

Years ended December 31, |

|

|

(Dollars in thousands, except per share amounts) |

2022 |

|

2021 |

|

2022 |

|

2021 |

|

|

Results of Operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest income (a) |

$ |

7,588 |

|

|

|

$ |

6,152 |

|

|

|

$ |

27,622 |

|

|

|

$ |

24,460 |

|

|

|

Less: tax-equivalent adjustment |

|

117 |

|

|

|

|

115 |

|

|

|

|

456 |

|

|

|

|

470 |

|

|

|

|

Net interest income (GAAP) |

|

7,471 |

|

|

|

|

6,037 |

|

|

|

|

27,166 |

|

|

|

|

23,990 |

|

|

|

Noninterest income |

|

3,898 |

|

|

|

|

1,000 |

|

|

|

|

6,506 |

|

|

|

|

4,288 |

|

|

|

|

Total revenue |

|

11,369 |

|

|

|

|

7,037 |

|

|

|

|

33,672 |

|

|

|

|

28,278 |

|

|

|

Provision for loan losses |

|

1,000 |

|

|

|

|

— |

|

|

|

|

1,000 |

|

|

|

|

(600 |

) |

|

|

Noninterest expense |

|

4,449 |

|

|

|

|

5,073 |

|

|

|

|

19,823 |

|

|

|

|

19,433 |

|

|

|

Income tax expense |

|

1,454 |

|

|

|

|

93 |

|

|

|

|

2,503 |

|

|

|

|

1,406 |

|

|

|

Net earnings |

$ |

4,466 |

|

|

|

$ |

1,871 |

|

|

|

$ |

10,346 |

|

|

|

$ |

8,039 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Per share data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted net earnings: |

$ |

1.27 |

|

|

|

$ |

0.53 |

|

|

|

$ |

2.95 |

|

|

|

$ |

2.27 |

|

|

|

Cash dividends declared |

$ |

0.265 |

|

|

|

$ |

0.26 |

|

|

|

$ |

1.06 |

|

|

|

$ |

1.04 |

|

|

|

Weighted average shares outstanding: |

|

3,504,344 |

|

|

|

|

3,524,311 |

|

|

|

|

3,510,869 |

|

|

|

|

3,545,310 |

|

|

|

Shares outstanding, at period end |

|

3,503,452 |

|

|

|

|

3,520,485 |

|

|

|

|

3,503,452 |

|

|

|

|

3,520,485 |

|

|

|

Book value |

$ |

19.42 |

|

|

|

$ |

29.46 |

|

|

|

$ |

19.42 |

|

|

|

$ |

29.46 |

|

|

|

Common stock price: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

High |

$ |

24.71 |

|

|

|

$ |

34.79 |

|

|

|

$ |

34.49 |

|

|

|

$ |

48.00 |

|

|

| |

Low |

|

22.07 |

|

|

|

|

31.32 |

|

|

|

|

22.07 |

|

|

|

|

31.32 |

|

|

| |

Period-end |

$ |

23.00 |

|

|

|

$ |

32.30 |

|

|

|

$ |

23.00 |

|

|

|

$ |

32.30 |

|

|

| |

To earnings ratio |

|

7.82 |

|

x |

|

|

14.23 |

|

x |

|

|

7.80 |

|

x |

|

|

14.23 |

|

x |

| |

To book value |

|

118 |

|

% |

|

|

110 |

|

% |

|

|

118 |

|

% |

|

|

110 |

|

% |

|

Performance ratios: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return on average equity (annualized): |

|

28.23 |

|

% |

|

|

7.07 |

|

% |

|

|

12.48 |

|

% |

|

|

7.54 |

|

% |

|

Return on average assets (annualized): |

|

1.75 |

|

% |

|

|

0.70 |

|

% |

|

|

0.96 |

|

% |

|

|

0.78 |

|

% |

|

Dividend payout ratio |

|

20.87 |

|

% |

|

|

49.06 |

|

% |

|

|

35.93 |

|

% |

|

|

45.81 |

|

% |

|

Other financial data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest margin (a) |

|

3.27 |

|

% |

|

|

2.45 |

|

% |

|

|

2.81 |

|

% |

|

|

2.55 |

|

% |

|

Effective income tax rate |

|

24.56 |

|

% |

|

|

4.74 |

|

% |

|

|

19.48 |

|

% |

|

|

14.89 |

|

% |

|

Efficiency ratio (b) |

|

38.73 |

|

% |

|

|

70.93 |

|

% |

|

|

58.08 |

|

% |

|

|

67.60 |

|

% |

|

Asset Quality: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nonperforming assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Nonperforming (nonaccrual) loans |

$ |

2,731 |

|

|

|

$ |

444 |

|

|

|

$ |

2,731 |

|

|

|

$ |

444 |

|

|

|

|

Other real estate owned |

|

— |

|

|

|

|

374 |

|

|

|

|

— |

|

|

|

|

374 |

|

|

|

|

Total nonperforming assets |

$ |

2,731 |

|

|

|

$ |

818 |

|

|

|

$ |

2,731 |

|

|

|

$ |

818 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net charge-offs |

$ |

201 |

|

|

|

$ |

180 |

|

|

|

$ |

174 |

|

|

|

$ |

79 |

|

|

|

Allowance for loan losses as a % of: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Loans |

|

1.14 |

|

% |

|

|

1.08 |

|

% |

|

|

1.14 |

|

% |

|

|

1.08 |

|

% |

| |

Nonperforming loans |

|

211 |

|

% |

|

|

1,112 |

|

% |

|

|

211 |

|

% |

|

|

1,112 |

|

% |

|

Nonperforming assets as a % of: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Loans and

other real estate owned |

|

0.54 |

|

% |

|

|

0.18 |

|

% |

|

|

0.54 |

|

% |

|

|

0.18 |

|

% |

| |

Total

assets |

|

0.27 |

|

% |

|

|

0.07 |

|

% |

|

|

0.27 |

|

% |

|

|

0.07 |

|

% |

|

Nonperforming loans as a % of total loans |

|

0.54 |

|

% |

|

|

0.10 |

|

% |

|

|

0.54 |

|

% |

|

|

0.10 |

|

% |

|

Net charge-offs as a % of average loans |

|

0.16 |

|

% |

|

|

0.16 |

|

% |

|

|

0.04 |

|

% |

|

|

0.02 |

|

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selected average balances: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Securities |

$ |

407,792 |

|

|

|

$ |

414,061 |

|

|

|

$ |

425,620 |

|

|

|

$ |

383,502 |

|

|

|

Loans, net of unearned income |

|

490,163 |

|

|

|

|

455,726 |

|

|

|

|

454,195 |

|

|

|

|

458,087 |

|

|

|

Total assets |

|

1,022,863 |

|

|

|

|

1,073,564 |

|

|

|

|

1,074,735 |

|

|

|

|

1,025,348 |

|

|

|

Total deposits |

|

951,122 |

|

|

|

|

961,544 |

|

|

|

|

985,362 |

|

|

|

|

912,028 |

|

|

|

Total stockholders' equity |

|

63,283 |

|

|

|

|

105,925 |

|

|

|

|

82,925 |

|

|

|

|

106,578 |

|

|

|

Selected period end balances: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Securities |

$ |

405,304 |

|

|

|

$ |

421,891 |

|

|

|

$ |

405,304 |

|

|

|

$ |

421,891 |

|

|

|

Loans, net of unearned income |

|

504,458 |

|

|

|

|

458,364 |

|

|

|

|

504,458 |

|

|

|

|

458,364 |

|

|

|

Allowance for loan losses |

|

5,765 |

|

|

|

|

4,939 |

|

|

|

|

5,765 |

|

|

|

|

4,939 |

|

|

|

Total assets |

|

1,023,888 |

|

|

|

|

1,105,150 |

|

|

|

|

1,023,888 |

|

|

|

|

1,105,150 |

|

|

|

Total deposits |

|

950,337 |

|

|

|

|

994,243 |

|

|

|

|

950,337 |

|

|

|

|

994,243 |

|

|

|

Total stockholders' equity |

|

68,041 |

|

|

|

|

103,726 |

|

|

|

|

68,041 |

|

|

|

|

103,726 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) |

Tax equivalent. See “Explanation of Certain Unaudited Non-GAAP

Financial Measures” and “Reconciliation of GAAP to non-GAAP

Measures (unaudited).” |

|

(b) |

Efficiency ratio is the result of noninterest expense divided by

the sum of noninterest income and tax-equivalent. |

|

Reports Full Year and Fourth Quarter Net

Earnings |

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of GAAP to non-GAAP Measures

(unaudited): |

| |

|

|

|

|

|

|

|

|

| |

|

Quarter ended December 31, |

|

Years ended December 31, |

|

(Dollars in thousands, except per share amounts) |

|

2022 |

|

2021 |

|

2022 |

|

2021 |

|

Net interest income, as reported (GAAP) |

$ |

7.471 |

$ |

6.037 |

$ |

27.166 |

$ |

23.990 |

|

Tax-equivalent adjustment |

|

117 |

|

115 |

|

456 |

|

470 |

|

Net interest income (tax-equivalent) |

$ |

7.588 |

$ |

6.152 |

$ |

27.622 |

$ |

24.460 |

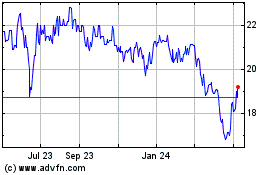

Auburn National Bancorpo... (NASDAQ:AUBN)

Historical Stock Chart

From Mar 2024 to Apr 2024

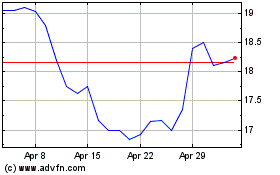

Auburn National Bancorpo... (NASDAQ:AUBN)

Historical Stock Chart

From Apr 2023 to Apr 2024