Aurinia Pharmaceuticals Inc. (NASDAQ: AUPH) today announced

financial results for the three and twelve months ended December

31, 2024 and provided an update on recent corporate progress.

Fourth Quarter 2024 Financial Results

- Total Revenue: For the three months ended December 31,

2024, total revenue was $59.9 million, up 33% from $45.1 million in

the same period of 2023.

– Net Product Sales: For the three

months ended December 31, 2024, net product sales of LUPKYNIS, the

first FDA-approved oral therapy for the treatment of adult patients

with active lupus nephritis, were $57.6 million, up 36% from $42.3

million in the same period of 2023.

– License, Collaboration and Royalty

Revenue: For the three months ended December 31, 2024, license,

collaboration and royalty revenue, which includes manufacturing

services revenue and royalties from Aurinia’s collaboration

partner, Otsuka, was $2.3 million, down 18% from $2.8 million in

the same period of 2023.

- Net Income (Loss): For the three months ended December

31, 2024, net income (loss) was $1.4 million, compared to $(26.9)

million in the same period of 2023.

- Cash Flow Provided by Operating Activities: For the

three months ended December 31, 2024, cash flow provided by

operating activities was $30.1 million, up 110% from $14.3 million

in the same period of 2023.

Full Year 2024 Financial Results

- Total Revenue: For the twelve months ended December 31,

2024, total revenue was $235.1 million, up 34% from $175.5 million

in 2023.

– Net Product Sales: For the twelve

months ended December 31, 2024, net product sales were $216.2

million, up 36% from $158.5 million in 2023.

– License, Collaboration and Royalty

Revenue: For the twelve months ended December 31, 2024,

license, collaboration and royalty revenue, which includes a

milestone payment, manufacturing services revenue and royalties

from Otsuka, was $18.9 million, up 11% from $17.0 million in

2023.

- Net Income (Loss): For the twelve months ended December

31, 2024, net income (loss) was $5.8 million, compared to $(78.0)

million in 2023.

- Cash Flow Provided by (Used in) Operating Activities:

For the twelve months ended December 31, 2024, cash flow provided

by (used in) operating activities was $44.4 million, compared to

$(33.5) million in 2023.

Cash Position

As of December 31, 2024, Aurinia had cash, cash equivalents,

restricted cash and investments of $358.5 million, compared to

$350.7 million at December 31, 2023. For the year ended December

31, 2024, the Company repurchased 6.1 million of its common shares

for $41.0 million.

Full Year 2025 Total Revenue and Net Product Sales

Guidance

For 2025, Aurinia expects total revenue in the range of $250

million to $260 million and net product sales in the range of $240

million to $250 million.

Research and Development Update

In September 2024, Aurinia initiated a Phase 1 study of AUR200,

its potentially best-in-class dual inhibitor of B cell activating

factor (BAFF) and a proliferation inducing ligand (APRIL). BAFF and

APRIL are cytokines that stimulate B cell proliferation and

activity and are upregulated in many autoimmune diseases. In

preclinical studies, AUR200 potently inhibited B cell proliferation

and production of IgA and IgM antibodies and exhibited

pharmacokinetic and pharmacodynamic properties consistent with

once-monthly dosing. Aurinia expects to report initial results from

its Phase 1 study of AUR200 in the second quarter of 2025.

“We are pleased to have delivered strong LUPKYNIS sales growth

in 2024,” stated Peter Greenleaf, President and Chief Executive

Officer of Aurinia. “We expect 2025 to be an exciting year for

Aurinia. We remain focused on increasing LUPKYNIS’s adoption among

the many lupus nephritis patients who could benefit from this

important treatment, while, at the same time, advancing our

important pipeline product, AUR200, which has the potential to

treat a wide range of autoimmune diseases.”

Webcast & Conference Call Details

A webcast and conference call will be hosted today, February

27th, at 8:30 a.m. ET. The link to the audio webcast is available

here. To join the conference call, please dial 877-407-9170/+1

201-493-6756. A replay of the webcast will be available on

Aurinia’s website.

About Aurinia

Aurinia is a biopharmaceutical company focused on delivering

therapies to people living with autoimmune diseases with high unmet

medical needs. In January 2021, the Company introduced LUPKYNIS®

(voclosporin), the first FDA-approved oral therapy for the

treatment of adult patients with active lupus nephritis. Aurinia is

also developing AUR200, a dual inhibitor of B cell activating

factor (BAFF) and a proliferation inducing ligand (APRIL) for the

potential treatment of autoimmune diseases.

Forward-Looking Statements

This press release contains forward-looking information within

the meaning of applicable Canadian securities law and

forward-looking statements within the meaning of applicable U.S.

securities law. We caution investors that forward-looking

statements are based on management’s expectations and assumptions

as of the date of this press release and involve substantial risks

and uncertainties that could cause the actual outcomes to differ

materially from what we currently expect. These risks and

uncertainties include, but are not limited to, those associated

with: LUPKYNIS net product sales, the timing of clinical study

results and other risks and uncertainties identified in our filings

with the U.S. Securities and Exchange Commission. Forward-looking

statements in this press release apply only as of the date made,

and we undertake no obligation to update or revise any

forward-looking statements to reflect subsequent events or

circumstances. Additional information related to Aurinia, including

a detailed list of the risks and uncertainties affecting Aurinia

and its business, can be found in Aurinia’s most recent Annual

Report on Form 10-K and its other public available filings

available by accessing the Canadian Securities Administrators’

System for Electronic Document Analysis and Retrieval (SEDAR)

website at www.sedarplus.ca or the U.S. Securities and Exchange

Commission’s Electronic Document Gathering and Retrieval System

(EDGAR) website at www.sec.gov/edgar, and on Aurinia’s website at

www.auriniapharma.com.

AURINIA PHARMACEUTICALS INC.

AND SUBSIDIARIES

CONSOLIDATED BALANCE

SHEETS

(in thousands)

December 31, 2024

December 31, 2023

ASSETS

Current assets:

Cash, cash equivalents and restricted

cash

$

83,433

$

48,875

Short-term investments

275,043

301,614

Accounts receivable, net

36,544

24,089

Inventory, net

39,228

39,705

Prepaid expenses and deposits

11,219

9,486

Other current assets

1,129

1,031

Total current assets

446,596

424,800

Finance right-of-use lease assets

92,072

108,715

Intangible assets, net

4,355

4,977

Operating right-of-use lease assets

4,068

4,498

Property and equipment, net

2,731

3,354

Long-term investments

—

201

Other noncurrent assets

823

1,517

Total assets

$

550,645

$

548,062

LIABILITIES AND SHAREHOLDERS'

EQUITY

Current liabilities:

Accounts payable

$

5,187

$

4,327

Accrued expenses

64,971

50,062

Finance lease liabilities, current

portion

14,046

14,609

Deferred revenue

11,002

4,813

Operating lease liabilities, current

portion

1,026

989

Other current liabilities

1,531

2,388

Total current liabilities

97,763

77,188

Finance lease liabilities, less current

portion

58,554

75,479

Deferred compensation and other noncurrent

liabilities

11,107

10,911

Operating lease liabilities, less current

portion

5,743

6,530

Total liabilities

173,167

170,108

Shareholders' equity

Common shares - no par value, unlimited

shares authorized, 140,883 and 143,833 shares issued and

outstanding at December 31, 2024 and 2023, respectively

1,187,696

1,200,218

Additional paid-in capital

126,999

120,788

Accumulated other comprehensive loss

(647

)

(730

)

Accumulated deficit

(936,570

)

(942,322

)

Total shareholders' equity

377,478

377,954

Total liabilities and shareholders’

equity

$

550,645

$

548,062

AURINIA PHARMACEUTICALS INC.

AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

OPERATIONS

(in thousands, except per share

data)

Three months ended

Years ended

December 31, 2024

December 31, 2023

December 31, 2024

December 31, 2023

(unaudited)

Revenue

Net product sales

$

57,582

$

42,315

$

216,186

$

158,533

License, collaboration and royalty

revenue

2,285

2,780

18,947

16,980

Total revenue

59,867

45,095

235,133

175,513

Operating expenses

Cost of revenue

5,552

5,395

28,248

14,148

Selling, general and administrative

37,032

50,072

172,028

195,036

Research and development

8,107

10,228

20,785

49,641

Restructuring

15,351

—

23,106

—

Other (income) expense, net

(4,506

)

9,074

(4,347

)

8,379

Total operating expenses

61,536

74,769

239,820

267,204

Loss from operations

(1,669

)

(29,674

)

(4,687

)

(91,691

)

Interest income

3,988

4,568

16,970

16,997

Interest expense

(1,146

)

(1,310

)

(4,835

)

(2,775

)

Net income (loss) before income taxes

1,173

(26,416

)

7,448

(77,469

)

Income tax (benefit) expense

(256

)

459

1,696

551

Net income (loss)

$

1,429

$

(26,875

)

$

5,752

$

(78,020

)

Basic

$

0.01

$

(0.19

)

$

0.04

$

(0.54

)

Diluted

$

0.01

$

(0.19

)

$

0.04

$

(0.54

)

Shares used in computing earnings (loss)

per share

Basic

142,179

142,927

143,057

143,236

Diluted

147,675

142,927

146,194

143,236

AURINIA PHARMACEUTICALS INC.

AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(in thousands)

Years ended December

31,

2024

2023

2022

Cash flows from operating

activities:

Net income (loss)

$

5,752

$

(78,020

)

$

(108,180

)

Adjustments to reconcile consolidated net

income (loss) to net cash provided by (used in) operating

activities:

Share-based compensation

31,596

45,311

32,300

Amortization and depreciation

19,445

11,647

2,706

Foreign exchange (gain) loss on

revaluation of finance lease liability (Monoplant)

(5,910

)

5,949

—

Net amortization of premiums and discounts

on investments

(12,731

)

(12,141

)

(1,572

)

Non-cash write-down of inventory

—

916

3,646

Other, net

788

(1,515

)

(1,612

)

Net changes in operating assets and

liabilities:

Accounts receivable, net

(12,455

)

(10,606

)

1,927

Inventory, net

477

(15,869

)

(9,072

)

Prepaid expenses and other current

assets

(1,834

)

4,399

(2,404

)

Other noncurrent operating assets

31

(16

)

(363

)

Accounts payable

860

1,240

(792

)

Accrued expenses and other liabilities

13,330

12,154

1,491

Deferred revenue

5,789

3,763

3,048

Operating lease liabilities

(750

)

(673

)

(652

)

Net cash provided by (used in) operating

activities

44,388

(33,461

)

(79,529

)

Cash flows from investing

activities:

Proceeds from the sale and maturities of

investments

585,418

529,376

464,316

Purchases of investments

(545,832

)

(523,500

)

(523,993

)

Upfront lease payments

(43

)

(11,864

)

(663

)

Purchases of property, equipment and

intangible assets

(281

)

(718

)

(292

)

Net cash provided by (used in) investing

activities

39,262

(6,706

)

(60,632

)

Cash flows from financing

activities:

Repurchase of common shares

(40,239

)

—

—

Principal portion of finance lease

payments

(11,989

)

(10,025

)

—

Proceeds from issuance of common shares

from exercise of stock options and vesting of RSUs

8,186

5,324

1,561

Proceeds from issuance of common shares

under ESPP

1,084

1,850

1,912

Taxes paid related to net settlement of

exercises of stock options and vesting of RSUs

(6,134

)

(2,279

)

(1,040

)

Net cash (used in) provided by financing

activities

(49,092

)

(5,130

)

2,433

Net increase (decrease) in cash, cash

equivalents and restricted cash

34,558

(45,297

)

(137,728

)

Cash, cash equivalents and restricted

cash, beginning of the period

48,875

94,172

231,900

Cash, cash equivalents and restricted

cash, end of the period

$

83,433

$

48,875

$

94,172

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250227885371/en/

Media and Investor Inquiries: Andrea Christopher

Corporate Communications and Investor Relations Aurinia

Pharmaceuticals Inc. achristopher@auriniapharma.com General

Investor Inquiries ir@auriniapharma.com

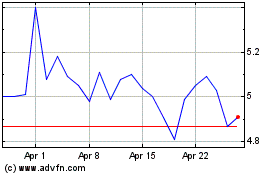

Aurinia Pharmaceuticals (NASDAQ:AUPH)

Historical Stock Chart

From Jan 2025 to Feb 2025

Aurinia Pharmaceuticals (NASDAQ:AUPH)

Historical Stock Chart

From Feb 2024 to Feb 2025