| | | | | |

| PROSPECTUS SUPPLEMENT NO. 8 | Filed Pursuant to Rule 424(b)(3) |

| (to prospectus dated March 18, 2022) | Registration No. 333-260835 |

903,072,352 Shares of Class A Common Stock

8,900,000 Warrants to Purchase Shares of Class A Common Stock

This prospectus supplement is being filed to update and supplement the information contained in the prospectus dated March 18, 2022 (the “Prospectus”), related to: (1) the issuance and sale by us of an aggregate of (i) 234,560,193 shares of our Class A common stock, par value $0.00001 per share (“Class A Common Stock”), issuable by us upon conversion of our Class B common stock, par value $0.00001 per share (“Class B Common Stock”), held by certain of our stockholders (the “Non-Affiliate Conversion Stock”), (ii) 425,722 shares of Class A Common Stock issuable upon the exercise of certain outstanding options to purchase Class A Common Stock held by individuals who terminated their employment with Aurora Innovation, Inc. prior to the closing of the business combination among Reinvent Technology Partners Y (“RTPY”), Aurora Innovation Holdings, Inc. (formerly Aurora Innovation, Inc.) and RTPY Merger Sub Inc. (the “Former Employee Options”) and (iii) 12,218,750 shares of Class A Common Stock issuable upon the exercise of 12,218,750 warrants, exercisable on December 3, 2021, at a price of $11.50 per share (the “Public Warrants”), (2) the issuance and resale of (i) 246,547,784 shares of Class A Common Stock issuable by us upon conversion of the Class B Common Stock held by certain of our stockholders the (“Affiliate Conversion Stock”), (ii) 951,098 shares of Class A Common Stock issuable upon the exercise of certain outstanding options to purchase Class A Common Stock (the “Affiliate Options”) and vesting of certain restricted stock units for Class A Common Stock held by certain of our affiliates and their affiliated entities (the “Affiliate RSUs” and together with the Affiliate Options, the “Affiliate Equity Stock”) and (iii) 8,900,000 shares of Class A Common Stock issuable upon the exercise of 8,900,000 warrants (the “Private Placement Warrants”) to purchase shares of Class A Common Stock purchased in a private placement in connection with RTPY’s initial public offering of units, consummated on March 18, 2020 (the “RTPY IPO”) and (3) the resale from time to time by the selling securityholders named in the Prospectus or their permitted transferees (the “Selling Securityholders”) of (i) 4,029,344 shares of Class A Common Stock beneficially owned by certain of our affiliates (the “Affiliate Class A Stock”), (ii) 6,883,086 shares of Class A Common Stock beneficially owned by Reinvent Sponsor Y LLC (the “Sponsor Stock”), (iii) 100,000,000 shares of Class A Common Stock purchased at Closing by a number of subscribers pursuant to separate PIPE Subscription Agreements (the “PIPE Shares”), (iv) 288,556,375 shares of Class A Common Stock beneficially owned by certain stockholders who have been granted registration rights (the “Registration Rights Shares”) and (v) 8,900,000 Private Placement Warrants purchased by the Sponsor in connection with the RTPY IPO, with the information contained in the Current Report on Form 8-K, filed with the Securities and Exchange Commission on January 30, 2023 (the “Form 8-K”). Accordingly, we have attached the 8-K to this prospectus supplement.

This prospectus supplement updates and supplements the information in the Prospectus and is not complete without, and may not be delivered or utilized except in combination with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the Prospectus and if there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement.

Our Class A Common Stock is listed on The Nasdaq Global Select Market (“Nasdaq”) under the symbol “AUR,” and the Public Warrants are listed on Nasdaq under the symbol “AUROW.” On January 27, 2023, the last quoted sale price for our Class A Common Stock as reported on Nasdaq was $1.75 per share and the last quoted sale price for our Public Warrants as reported on Nasdaq was $0.27 per warrant.

We are an “emerging growth company,” as defined under the federal securities laws, and, as such, may elect to comply with certain reduced public company reporting requirements for this prospectus and for future filings.

Investing in our securities involves a high degree of risk. Before buying any securities, you should carefully read the discussion of the risks of investing in our securities in “Risk Factors” beginning on page 7 of the Prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is January 30, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): January 30, 2023

AURORA INNOVATION, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-40216 | | 98-1562265 |

(State or other jurisdiction of

incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer

Identification Number) |

| | | | | | | | |

1654 Smallman St, Pittsburgh, PA | | 15222 |

| (Address of principal executive offices) | | (Zip Code) |

(888) 583-9506

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A common stock, par value $0.00001 per share | | AUR | | The Nasdaq Stock Market LLC |

| Redeemable warrants, each whole warrant exercisable for one share of Class A common stock at an exercise price of $11.50 | | AUROW | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On January 30, 2023, Aurora Innovation, Inc. (the “Company”) announced that Ossa F. Fisher has been appointed as President of the Company, effective as of her start date, which is expected to be February 13, 2023. Before joining the Company, Ms. Fisher, age 45, served as the President and Chief Operating Officer of Istation, Inc., an e-learning platform, from 2019 to 2022, and previously served as Istation’s Chief Operating Officer from 2017 to 2018 and Chief Marketing Officer from 2015 to 2017. Prior to joining Istation, Ms. Fisher was the Senior Vice President of Strategy and Analytics at global dating leader, Match.com, where she served since May 2013. Ms. Fisher has a broad range of expertise in technology and media, including more than ten years in the Technology, Media and Telecom practices of both Bain & Company, where she was employed from 2004 to 2013, and Goldman, Sachs & Co., from 1999 to 2002. Ms. Fisher holds a B.A. in Economics from Yale University, an M.A. in Education from Stanford University and an MBA from Stanford Graduate School of Business. Ms. Fisher’s expertise in growth strategy and scaling business operations will play a pivotal role as the Company advances towards commercial launch.

On December 29, 2022, the Company and Ms. Fisher entered into an employment letter agreement (the “Employment Agreement”). Pursuant to the terms of the Employment Agreement, Ms. Fisher will be entitled to an initial annual base salary of $500,000 and an annual target bonus of 40% of annual base salary. Ms. Fisher will also receive a one-time award of 2,000,000 restricted stock units and 2,000,000 stock options, each to vest over a four-year period and subject to a 1-year cliff.

There is no arrangement or understanding between Ms. Fisher and any other person pursuant to which she was selected as President. In addition, there are no familial relationships between Ms. Fisher and any director or executive officer of the Company and Ms. Fisher is not a party to any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K. Effective upon her appointment as President of the Company, Ms. Fisher will be designated as an “officer” as such term is used within the meaning of Section 16 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). Ms. Fisher will execute the Company’s standard form of indemnification agreement prior to the date she commences employment with the Company, a copy of which has been filed as Exhibit 10.14 to the Company’s Registration Statement on Form S-1 (File No. 333- 260835), filed with the SEC on November 5, 2021.

The foregoing description of the terms of the Employment Agreement does not purport to be complete and is qualified in its entirety by the full text of the Employment Agreement, a copy of which is attached to this Current Report on Form 8-K as Exhibit 10.1 and incorporated herein by reference.

In connection with Ms. Fisher’s appointment, Chris Urmson will be stepping down as President, effective as of Ms. Fisher’s start date, but will remain as the Chief Executive Officer of the Company and an officer for purposes of Section 16 of the Exchange Act. The decision was not the result of any dispute or disagreement with the Company, the Company’s management or the Company’s Board of Directors (the “Board”) on any matter relating to the operations, policies or practices of the Company.

A copy of the press release announcing the appointment of Ms. Fisher as President of the Company is attached hereto as Exhibit 99.1.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

EXHIBIT INDEX

| | | | | | | | |

Exhibit

No. | | Description |

| | |

| 10.1 | | Employment Letter between the Company and Ossa F. Fisher, dated December 29, 2022. |

| 99.1 | | Press release dated January 30, 2023. |

| 104 | | Cover Page Interactive Data File. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

Dated: January 30, 2023

| | | | | | | | |

| | |

AURORA INNOVATION, INC. |

| |

| By: | | /s/ Richard Tame |

| Name: | | Richard Tame |

| Title: | | Chief Financial Officer |

Exhibit 10.1

Dec 28, 2022

Ossa F. Fisher

via Aurora Operations, Inc.

Dear Ossa,

It is my pleasure to extend you an offer to join Aurora Operations, Inc. (“Aurora” or “we”) as its President. The remainder of this letter agreement (the “Agreement”), and its attachments, discuss the details of this offer. This Agreement shall be effective as of the date signed below (the “Effective Date”).

1.Title/Position. As noted above, your title will be President, and you will be a full-time employee in our Coppell, Texas office. You will report to Aurora’s Chief Executive Officer and will perform the duties and responsibilities customary for such position and such other related duties as are lawfully assigned. By signing this Agreement, you confirm that you have no contractual commitments or other legal obligations that would prohibit you from performing your duties for Aurora.

2.Base Salary. Your annual base salary will be $500,000, and will be payable, less any applicable withholdings, in accordance with Aurora’s normal payroll practices. Your annual base salary will be subject to review and adjustment from time to time by the Compensation Committee (the “Committee”) of the Board of Directors of Aurora Innovation, Inc., Aurora’s parent (“Parent”), as applicable, in its sole discretion.

3.Annual Bonus. Effective for the annual bonus paid in 2024, you will be eligible to receive a target annual bonus equal to 40% of the base salary you were paid by Aurora during the preceding calendar year. This bonus is payable in the sole discretion of the Committee, and will be determined based on your individual and Aurora’s overall performance. It will be subject to all applicable deductions and withholdings, and to the extent permitted by applicable law, you must be employed by Aurora at the time the bonus is paid in order to be eligible to receive it. Your annual bonus opportunity and the applicable terms and conditions may be adjusted from time to time by the Committee, in its sole discretion.

4.Equity Awards. If you decide to join Aurora, it will be recommended to the Committee following your start date that Parent grant you (a) an award of restricted stock units covering 2,000,000 shares of Aurora’s Class A Common Stock (“RSUs”), plus (b) an option to purchase 2,000,000 shares of Aurora’s Class A Common Stock, at a price per share equal to the closing price of Aurora’s Class A Common Stock on the date of the grant (the “Option” and, together with the RSUs, the “Equity Awards”). The Equity Awards shall be subject to the terms and conditions described on Exhibit A hereto. You will be eligible to receive additional equity awards pursuant to any plans or arrangements Parent may have in effect from time to time. The Committee will determine in its sole discretion whether you will be granted any such equity awards and the terms of any such award in accordance with the terms of any applicable plan or arrangement that may be in effect from time to time.

5.Employee Benefits. You will be eligible to participate in the benefit plans and programs established by Aurora for its employees from time to time, subject to their applicable terms and conditions, including without limitation any eligibility requirements. Aurora reserves the right to modify, amend, suspend or terminate the benefit plans and programs it offers to its employees at any time.

6.Proprietary Agreement. Like all Aurora employees, you will be required to sign Aurora’s standard Proprietary Information and Inventions Agreement (“PIIA”) prior to starting employment at Aurora. A copy of the PIIA is attached to this offer letter.

7.At-Will Employment. Aurora is an “at-will” employer. Your employment with Aurora will be for no specific period of time. Your employment with Aurora will be “at will,” meaning that either you or Aurora may terminate your employment at any time and for any reason, or no reason. Any contrary representations that may have been made to you are hereby superseded. This is the full and complete agreement between you and Aurora on this term. Aurora may modify your job duties, title, compensation and benefits, as well as its personnel policies and procedures from time to time as necessary and in its sole discretion. However, the “at will” nature of your employment may only be changed in an express written agreement signed by you and a duly authorized officer of Aurora (other than you).

8.Miscellaneous.

a.As required by law, your employment with Aurora is contingent upon your providing legal proof of your identity and authorization to work in the United States.

b.Your offer of employment with Aurora is contingent upon the satisfactory completion of a background check.

c.Trade Compliance.

i.Restricted Parties Lists Verification. This offer of employment and your continued employment with Aurora is contingent upon verification that you and, if applicable, your affiliated entity/institution do not appear on any of the Restricted Parties Lists maintained by the United States Government that will prevent Aurora from transacting (including but not limited to financial transactions) or engaging in certain type of activities with you, directly or indirectly.

ii.Export License Determination. If an export control license is required in connection with your employment, this offer is also contingent upon Aurora’s receipt of the necessary export license and any similar government approvals. Your employment with Aurora will commence following receipt of such export license and governmental approvals and is conditioned upon your (a) maintaining your employment with Aurora, and (b) continued compliance with all conditions and limitations imposed by such license and governmental approvals. If, for any reason, such export license and governmental approvals cannot be obtained within a commercially reasonable time from your date of signature on this offer of employment, with such reasonable time to be determined in Aurora’s sole discretion, then this offer will automatically terminate and have no force and effect. Additionally, should an export license become necessary at any point following the commencement of your employment with Aurora, no export-controlled items, information, and/or code will be released to you until such license and any similar government approvals are obtained. Aurora is not obligated to apply for any export license or other government approval that may be required in connection with your employment, and Aurora cannot guarantee that any such license or similar approvals will be granted, if sought.

d.This Agreement, including Exhibit A hereto, together with the PIIA, constitutes the entire agreement between you and Aurora regarding the material terms and conditions of your employment, and they supersede and replace all prior negotiations, representations or agreements between you and Aurora.

e.Except as provided herein, this Agreement may not be amended or modified, except by an express written agreement signed by both you and a duly authorized officer of Aurora (other than you). Any amendment or modification to this Agreement made by you that is not agreed to in an express written agreement signed by a duly authorized officer of Aurora (other than you) after your request for such amendment or modification will render this Agreement and Aurora’s signature hereto null and void.

* * * * *

We’re thrilled to have you join the team!

Very truly yours,

AURORA OPERATIONS, INC.

/s/ Chris Urmson

By: Chris Urmson

Title: Chief Executive Officer

I have read and accept this employment letter, including the terms and conditions attached as Exhibit A, and the PIIA.

Signature of Employee: /s/ Ossa Fisher

Dated: 12/29/2022

Exhibit A

Equity Awards Terms and Conditions

As described in the offer letter to which this Exhibit A is attached (the “Offer Letter”), if you decide to join Aurora, it will be recommended to the Committee following your start date that Parent grant you Equity Awards. Capitalized terms used herein that are not otherwise defined shall have the meanings given to them in the Offer Letter.

1.Vesting Terms.

i.The RSUs will generally vest on 4 specific dates each year: February 20, May 20, August 20 and November 20 (each a “quarterly vesting date”).

ii.Vesting of RSUs is satisfied over a period of 4 years following your Vesting Commencement Date (described below) with a cliff as to 25% of shares time-vesting on the 1-year anniversary of your Vesting Commencement Date, and 1/16 time-vesting quarterly thereafter, in each case, subject to your continued employment.

iii.Twenty-five percent (25)% of the shares subject to the Option shall vest 12 months after the Vesting Commencement Date, subject to your continuing employment with Aurora, and no shares shall vest before such date. The remaining shares shall vest monthly over the next 36 months in equal monthly amounts subject to your continuing employment with Aurora.

iv.Your Vesting Commencement Date will be the first quarterly vesting date after your start date.

2.Other Terms. Your Equity Awards shall be subject to the terms and conditions of Aurora’s Equity Incentive Plan, Restricted Stock Unit Agreement and Stock Option Agreement (as applicable), including vesting requirements. No right to any equity is earned or accrued until such time that vesting occurs, nor does the grant confer any right to continue vesting or employment.

Exhibit 99.1

Aurora Appoints Ossa Fisher as Company President

Fisher joins the company during a pivotal year as Aurora prepares for autonomous trucking commercial launch in 2024

PITTSBURGH - JANUARY 30, 2023 - Aurora Innovation, Inc. (NASDAQ: AUR), a leading autonomous vehicle company, today announced it has appointed Ossa Fisher as the company’s president. Fisher brings more than 20 years of leadership experience to Aurora, spanning strategy, operations, and business functions across a wide variety of technology organizations. As the company focuses on scaling operations and preparing for commercial launch in 2024, Fisher will play a pivotal role in supporting and advancing these critical initiatives.

Fisher is expected to begin in February and will be joining Aurora from Istation, where she has served as president and chief operating officer since 2019 and oversaw a number of the company’s functions including engineering, product, sales, marketing, customer success, and more. Prior to this, Fisher held other leadership roles at the e-learning platform since joining in 2015, including two years as chief marketing officer, before expanding her role and responsibilities. Fisher’s previous roles include serving as a senior vice president of strategy and analytics at Match Group and being named a partner at Bain & Company where she was a leader in the technology, media and telecom practice.

In her role as president, Fisher will report directly to Aurora’s co-founder and Chief Executive Officer Chris Urmson.

“We are on the cusp of an autonomous breakthrough that will transform how people and goods move through the world,” said Fisher. “Aurora’s vision, commitment to safety and world-class partnerships have positioned the company to deliver an autonomous trucking product that will define the industry for years to come. I’m incredibly excited and humbled to join the Aurora team and be part of this journey.”

“This will be a historic year for Aurora as we prepare our autonomous trucking fleet for commercial launch,” said Urmson. “I’m confident Ossa’s experience and leadership will help us unlock greater efficiencies across our operations and further strengthen our existing relationships with industry-leading partners.”

Fisher will be based in Dallas near Aurora’s current center for vehicle operations as the company continues to expand deliveries and shipments for pilot customers between Dallas and Houston as well as between Fort Worth and El Paso. Over the last two years, Aurora’s team in Dallas has expanded at a rapid pace, growing from less than 20 people at the end of 2020 to nearly 120 by the end of 2022 as operations continue to scale for commercial launch.

About Aurora

Aurora (Nasdaq: AUR) is delivering the benefits of self-driving technology safely, quickly, and broadly to make transportation safer, increasingly accessible, and more reliable and efficient than ever before. The Aurora Driver is a self-driving system designed to operate multiple vehicle types, from freight-hauling semi-trucks to ride-hailing passenger vehicles, and underpins Aurora Horizon and Aurora Connect, its driver-as-a-service products for trucking and ride-hailing. Aurora is working with industry leaders across the transportation ecosystem, including Toyota, FedEx, Volvo Trucks, PACCAR, Uber, Uber Freight, U.S. Xpress, Werner, Covenant, Schneider, and Ryder. For Aurora’s latest news, visit aurora.tech and @aurora_inno on Twitter.

Aurora Overview

Aurora Press Kit

Aurora Cautionary Statement Regarding Forward-Looking Statements

This Press Release contains certain forward-looking statements within the meaning of the federal securities laws. All statements contained in this press release that do not relate to matters of historical fact should be considered forward-looking statements, including but not limited, to those statements around Aurora’s operations and the development, commercialization or market impact of Aurora’s products. These statements are based on management’s current assumptions and are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. For factors that could cause actual results to differ materially from the forward-looking statements in this press release, please see the risks and uncertainties identified under the heading “Risk Factors” section of Aurora Innovation, Inc.’s (“Aurora”) Quarterly Report on Form 10-Q for the quarter ended September 30, 2022, filed with the SEC on November 3, 2022, and other documents filed by Aurora from time to time with the SEC, which are accessible on the SEC website at www.sec.gov. All forward-looking statements reflect our beliefs and assumptions only as of the date of this press release. Aurora undertakes no obligation to update forward-looking statements to reflect future events or circumstances.

Investor Relations:

Stacy Feit

ir@aurora.tech

(323) 610-0847

Media:

Khobi Brooklyn

press@aurora.tech

(415) 699-3657

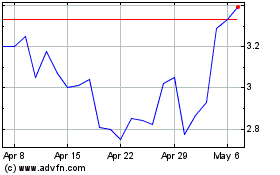

Aurora Innovations (NASDAQ:AUR)

Historical Stock Chart

From Mar 2024 to Apr 2024

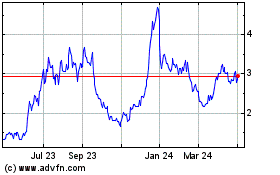

Aurora Innovations (NASDAQ:AUR)

Historical Stock Chart

From Apr 2023 to Apr 2024