- Digital homeownership company has originated more than $100B of

mortgages since its inception in 2016

- Harit Talwar joins as Chairman of the Board

- Proceeds would be used to double down on Better’s mission of

serving customers’ homeownership aspirations

Better HoldCo, Inc. (“Better” or the “Company”), a

leading digital homeownership company, has continued the process to

become a publicly-listed company through a merger with Aurora

Acquisition Corp. (NASDAQ: AURC) (“Aurora”), a publicly

traded special purpose acquisition company (SPAC), when Aurora

submitted amendment No. 6 to its Form S-4 registration statement

with the Securities and Exchange Commission. At closing, the deal

is expected to unlock for the combined company $750 million in new

capital.

“In just six years, Better has helped hundreds of thousands of

Americans invest in themselves and their families by financing or

refinancing their homes,” said Vishal Garg, CEO and Founder of

Better. “For the average American consumer, their home represents

roughly 65% of their net worth. This transaction will enable us to

continue providing a better outcome for folks in search of the

security and opportunity that homeownership brings.”

The digital homeownership company is committed to becoming a

solution for everyday Americans in their homeownership journey by

delivering mortgages and home-related products and services better,

faster, and cheaper. Better would use proceeds to continue

investing in products and features that customers need now more

than ever for a great homeownership financing experience.

“We are guided by a singular obsession with the customer

experience,” said Garg. “Mortgage-focused financial infrastructure

performs one of the most important social functions by providing a

vessel for the savings for those who have capital and empowering

those who can utilize it to improve their lives and their families

and communities well being.”

To remain competitive, the digital homeownership company will

expend resources to enhance and improve Better’s technology,

product offerings, and product lines. The company plans to grow its

purchase business, improve its cross-sell of non-mortgage products

on the platform to enable greater ease and savings for its

customers, and achieve its mission to save every American homeowner

money on their mortgage versus a traditional bank or mortgage

broker.

In the fourth quarter of 2021, the company introduced its Better

Cash Offer program that serves well-qualified, digitally

pre-underwritten prospective homebuyers to make all-cash offers on

their house powered by Tinman, Better’s proprietary mortgage

automation platform. In this challenging refinance market

environment, Better plans to continue innovating for its customers

and driving growth by focusing on less rate-sensitive commoditized

product offerings.

“Tinman learned how to do a rate term refinance mortgage, then

an in-contract purchase, and now we are able to underwrite loans so

fast we can turn regular consumers into cash buyers in a few days.

This has allowed our model to evolve from being a low-cost refi

provider online 24/7 to helping consumers with life’s biggest

transaction in one shot, still 24/7 entirely online. It’s magical

the power of modern technology to change this thousands of years

old business,” shared Vishal Garg.

Better has also implemented organizational changes to continue

improving its culture.

“We at Better remain dedicated to our mission to provide

homeownership opportunities to all and to build a company that we

are proud of through the cycles. To enable that we are focused on

the core business, customer experience, excellent execution, and

talent and teamwork. We also want to be great custodians of our

shareholders’ capital,” said Harit Talwar, Better Chairman of the

Board.

Arnaud Massenet, Chief Executive Officer, and Prabhu Narasimhan,

Chief Investment Officer of Aurora Acquisition Corp. said, “Better

provides a fundamentally different approach to homeownership by

leveraging technology to reduce prices and offer customers the

widest range of appropriate products. Better’s commitment to

continually improving operations and financial discipline gives us

confidence in their business.”

“I’m gratified to my Better colleagues and teammates that even

in a tough economic environment we continue to serve customers and

attract top talent,” concludes Garg.

Highlights

- Harit Talwar joined Better to serve as Chairman of the Board of

Directors in May 2022. He is leading Board oversight of Better’s

strategy and culture and has a strong background in consumer

financial businesses and building public companies. Talwar most

recently served as Chairman of the Consumer Business at Goldman

Sachs from January 2021 to December 2021 and Global Head of the

Consumer Business from May 2015 to January 2021. He has served as a

member of the board for Mastercard Inc. since April 2022.

- CFO Kevin Ryan, who has over 20 years of experience in

financial services investment banking, and Chief Compliance Officer

and General Counsel Paula Tuffin, who has over two decades of

experience in the law including at the Consumer Financial

Protection Bureau, is also playing a key role in the deal.

- Better has won multiple high-profile awards, including being

ranked #1 on LinkedIn’s Top Startups List for 2021 and 2020, #1 on

Fortune’s Best Small and Medium Workplaces in New York, #15 on

CNBC’s Disruptor 50 2020 list, and Forbes FinTech 50 in 2020.

Better was also named to NerdWallet and Forbes Advisor’s Best

Online Mortgage Lenders lists.

- Better has industry-leading partnerships on private label and

co-branded basis for some of the best brands in financial services,

American Express, and Ally Financial.

- Better is currently licensed to operate in all 50 states and

the District of Columbia.

About Better

Founded in 2016, Better is a digital-first homeownership company

whose affiliates provide mortgage, real estate, title, and

homeowners insurance services. In 2021, Better Mortgage funded

approximately $58B in home loans, Better Real Estate completed over

$2B in real estate transaction volume, and Better Cover and Better

Settlement Services provided over $22B in insurance coverage. The

company was ranked #1 on LinkedIn’s Top Startups List for 2021 and

2020, #1 on Fortune’s Best Small and Medium Workplaces in New York,

#15 on CNBC’s Disruptor 50 2020 list, as well as being listed to

Forbes FinTech 50 for 2020, For more information, follow

@betterdotcom.

About Aurora Acquisition Corp.

Aurora Acquisition Corp. is a newly formed blank check company

incorporated for the purpose of effecting a merger, share exchange,

asset acquisition, share purchase, reorganization or similar

business combination with one or more businesses. The Company is

led by Thor Bj�rgólfsson as its Chairman, Arnaud Massenet as its

Chief Executive Officer, and Prabhu Narasimhan as its Chief

Investment Officer.

Through its philosophy of “founders investing in Founders”,

Aurora looks to empower strong management teams and make long term

investments in companies poised for sustained success. Aurora is

sponsored by Novator Capital. Additional information regarding

Aurora Capital may be found at:

https://aurora-acquisition.com/.

DISCLOSURE FOR INVESTORS AND SHAREHOLDERS

Important Information For Investors And Shareholders

This communication may be deemed to relate to a proposed

transaction between Aurora Acquisition Corp. (“Aurora”) and Better

Holdco, Inc. (“Better”). This communication does not constitute an

offer to sell or exchange, or the solicitation of an offer to buy

or exchange, any securities, nor shall there be any sale of

securities in any jurisdiction in which such offer, sale or

exchange would be unlawful prior to registration or qualification

under the securities laws of any such jurisdiction. Aurora has

filed with the U.S. Securities and Exchange Commission (the “SEC”),

a registration statement on Form S-4, which includes a preliminary

proxy statement/prospectus in connection with the proposed

transaction. A definitive proxy statement/prospectus will be sent

to all Aurora shareholders. Aurora also will file other documents

regarding the proposed transaction with the SEC. Before making any

voting decision, investors and security holders of Aurora are urged

to read the registration statement, the proxy statement/prospectus

and all other relevant documents filed or that will be filed with

the SEC in connection with the proposed transaction as they become

available because they will contain important information about the

proposed transaction. Neither the SEC nor any securities commission

or any other U.S. or non-U.S. jurisdiction has approved or

disapproved of the business combination of Aurora and Better (the

“Business Combination”) or information included herein.

Investors and security holders may obtain free copies of the

registration statement, the proxy statement/prospectus and all

other relevant documents filed or that will be filed with the SEC

by Aurora through the website maintained by the SEC at www.sec.gov.

The documents filed by Aurora with the SEC also may be obtained

free of charge at Aurora’s website at

https://aurora-acquisition.com/ or upon written request to Aurora

Acquisition Corp., 20 North Audley Street, London W1K 6LX, United

Kingdom, Attention: Arnaud Massenet, Chief Executive Officer, +44

(0)20 3931 9785.

Participants in the Solicitation

Aurora and its directors and executive officers may be deemed

participants in the solicitation of proxies from Aurora’s

stockholders with respect to the Business Combination. A list of

the names of those directors and executive officers and a

description of their interests in Aurora is contained in Aurora’s

registration statement on Form S-4, which was initially filed with

the SEC on August 3, 2021, as subsequently amended, and is

available free of charge at the SEC’s web site at www.sec.gov, or

by directing a request to Aurora Acquisition Corp., 20 North Audley

Street, London W1K 6LX, United Kingdom, Attention: Arnaud Massenet,

Chief Executive Officer, +44 (0)20 3931 9785.

Better and its directors and executive officers may also be

deemed to be participants in the solicitation of proxies from the

stockholders of Aurora in connection with the Business combination.

A list of the names of such directors and executive officers and

information regarding their interests in the Business combination

is contained in the registration statement.

Forward Looking Statements

This communication only speaks at the date hereof and contains,

and related discussions may contain, “forward- looking statements”

within the meaning of U.S. federal securities laws. These

statements include descriptions regarding the intent, belief,

estimates, assumptions or current expectations of Aurora, Better or

their respective officers with respect to the consolidated results

of operations and financial condition, future events and plans of

Aurora and Better. These forward-looking statements may be

identified by a reference to a future period or by the use of

forward-looking terminology. Forward-looking statements are

typically identified by words such as “expect”, “believe”,

“foresee”, “anticipate”, “intend”, “estimate”, “goal”, “strategy”,

“plan”, “target” and “project” or conditional verbs such as “will”,

“may”, “should”, “could” or “would” or the negative of these terms,

although not all forward-looking statements contain these words.

Forward-looking statements by their nature address matters that

are, to different degrees, uncertain. Forward-looking statements

are not historical facts, and are based upon management’s current

expectations, beliefs, estimates and projections, and various

assumptions, many of which are inherently uncertain and beyond

Aurora’s and Better’s control. Such expectations, beliefs,

estimates and projections are expressed in good faith, and

management believes there is a reasonable basis for them. However,

there can be no assurance that management’s expectations, beliefs,

estimates and projections will be achieved, and actual results may

differ materially from what is expressed in or indicated by the

forward-looking statements. For example, there can be no assurance

that the SEC will declare Aurora’s registration statement

effective, that Aurora shareholders will vote to approve the

transaction or that the Business Combination will close, or that

Better will be able to identify and hire individuals for the roles

that it seeks to fill, nor can there be assurance that the steps

Better expects to take to improve its workplace culture and

organization will have their desired result. Any management or

other changes could be disruptive to Better’s business.

Important factors that could cause actual results to differ

materially from those suggested by the forward-looking statements

include, but are not limited to, Better’s performance,

capabilities, strategy, and outlook; Better’s rapid growth and

subsequent contraction and its ability to manage its growth

effectively and achieve and maintain profitability in the future;

the demand for Better’s solutions and products and services,

including the size of Better’s addressable market, market share,

and market trends; Better’s ability to operate under and maintain

Better’s business model; Better’s ability to develop and protect

its brand; the effect of workforce reductions and associated

negative media coverage on Better’s ability to maintain and

establish third-party relationships (including with business

partners, warehouse lenders and investors), recruit and retain

employees, management and directors and otherwise achieve its

business goals; Better’s ability to maintain morale among its

workforce; Better’s ability to achieve its operational and

financial targets; Better’s ability to set and achieve its business

goals and objectives in the context of recent negative press and

changes to its organizational structure in response; Better’s

estimates regarding expenses, future revenue, capital requirements

and Better’s need for additional financing; the degree of business

and financial risk associated with certain of Better’s loans; the

high volatility in, or any inaccuracies in the estimates of, the

value of Better’s assets; any changes in macro-economic conditions

and in U.S. residential real estate market conditions, including

changes in prevailing interest rates or monetary policies and the

effects of the ongoing COVID-19 pandemic; the impact of elevated

interest rates and inflation on Better’s business including on the

volume of consumers refinancing existing loans and the

corresponding shift in Better’s product mix, Better’s ability to

produce loans, liquidity and employees; Better’s competitive

position; Better’s ability to improve and expand its information

technology and financial infrastructure, security and compliance

requirements and operating and administrative systems; Better’s

future investments in its technology and operations; Better’s

intellectual property position, including its ability to maintain,

protect and enhance Better’s intellectual property; Better’s

ability in general, and its CEO’s ability in particular, to

establish and maintain a larger, more experienced, executive team

in transitioning to public markets; Better’s ability to obtain

additional capital and maintain cash flow or obtain adequate

financing or financing on terms satisfactory to us; the effects of

Better’s existing and future indebtedness on its liquidity and

Better’s ability to operate its business; Better’s plans to adopt

the secured overnight financing rate (“SOFR”); the impact of laws

and regulations and Better’s ability to comply with such laws and

regulations including laws and regulations relating to fair

lending, real estate brokerage matters, title and settlement

services, consumer protection, advertising, tax, title insurance,

loan production and servicing activities, data privacy, and

anti-corruption, as well as the impact of any investigations

related to these or other matters; any changes in certain U.S.

government-sponsored entities and government agencies, including

Fannie Mae, Freddie Mac, Ginnie Mae and the FHA; Aurora’s

expectations regarding the period during which we will qualify as

an emerging growth company under the JOBS Act; the increased

expenses associated with being a public company; and Better’s

anticipated use of existing resources and the proceeds from the

Business Combination.

There may be other risks not presently known to us or that we

presently believe are not material that could also cause actual

results to differ materially. Analysis and opinions contained in

this communication may be based on assumptions that, if altered,

can change the analysis or opinions expressed. In light of the

significant uncertainties inherent in the forward-looking

statements included in this communication, the inclusion of such

forward-looking statements should not be regarded as a

representation by us or any other person that the objectives and

plans set forth in this report will be achieved, and you are

cautioned not to place substantial weight or undue reliance on

these forward-looking statements. These forward-looking statements

speak only as of the date they are made and, Aurora and Better each

disclaims any obligation, except as required by law, to update or

revise forward-looking statements, whether as a result of new

information, future events or otherwise.

No Offer or Solicitation

This communication will not constitute a solicitation of a

proxy, consent or authorization with respect to any securities or

in respect of the Business Combination. This communication will

also not constitute an offer to sell or the solicitation of an

offer to buy any securities, nor will there be any sale of

securities in any states or jurisdictions in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such jurisdiction.

No offering of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the Securities

Act.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220714005445/en/

Media Contact: Better@bevelpr.com Investor

Contact: BetterIR@icrinc.com

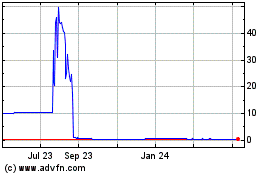

Better Home and Finance (NASDAQ:BETR)

Historical Stock Chart

From Mar 2024 to Apr 2024

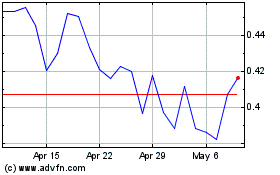

Better Home and Finance (NASDAQ:BETR)

Historical Stock Chart

From Apr 2023 to Apr 2024