Current Report Filing (8-k)

04 January 2022 - 9:12AM

Edgar (US Regulatory)

0001811109

false

0001811109

2021-12-28

2021-12-28

0001811109

AUVI:CommonStockParValue0.0001PerShareMember

2021-12-28

2021-12-28

0001811109

AUVI:Sec10.5SeriesCumulativePerpetualPreferredStockParValue0.0001PerShareMember

2021-12-28

2021-12-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF

THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported) December 28, 2021

APPLIED

UV, INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

001-39480

|

|

84-4373308

|

(State or other jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification Number)

|

|

150

N. Macquesten Parkway

Mount

Vernon, NY

|

|

10550

|

|

(Address of registrant’s

principal executive office)

|

|

(Zip code)

|

(914)

665-6100

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

symbol(s)

|

|

Name

of each exchange on which

registered

|

|

Common Stock, par value

$0.0001 per share

|

|

AUVI

|

|

The Nasdaq Stock Market

LLC

|

|

10.5% Series A Cumulative

Perpetual Preferred Stock, par value $0.0001 per share

|

|

AUVIP

|

|

The Nasdaq Stock Market

LLC

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01. Entry into a Material Definitive Agreement.

On December 28, 2021, Applied UV, Inc. (the “Company”)

entered into an underwriting agreement (the “Underwriting Agreement”) with EF Hutton, division of Benchmark Investments, LLC

(the “Underwriter”), related to the offering of 2,666,667 shares (the “Shares”) of the Company’s common

stock, par value $0.0001 per share, at a public offering price of $3.00 per share. In addition, the Company granted the Underwriter a

45-day option to purchase up to an additional 400,000 Shares pursuant to its exercise of an overallotment under the terms of the Underwriting

Agreement.

The Shares were offered and sold by the Company pursuant

to the Company’s registration statement on Form S-1 (File No. 333-261892) (the “Registration Statement”) and filed with

the Securities and Exchange Commission (the “Commission”) and the final prospectus filed with the Commission pursuant to Rule

424(b)(4) of the Securities Act of 1933, as amended (the “Securities Act”). The Registration Statement was declared effective

by the Commission on December 28, 2021. The closing of the offering for the Shares took place on December 31, 2021. Aggregate gross proceeds

from the closing will be approximately $8 million before deducting underwriting discounts and commissions and fees and other estimated

offering expenses. The Company intends to use the net proceeds from the offering for general corporate purposes, including new investments

and acquisitions.

The Underwriting Agreement contains customary representations,

warranties and covenants by the Company, customary conditions to closing, indemnification obligations of the Company and the Underwriters,

including for liabilities under the Securities Act, other obligations of the parties and termination provisions. The representations,

warranties and covenants contained in the Underwriting Agreement were made only for purposes of such agreement and as of specific dates,

were solely for the benefit of the parties to such agreement, and may be subject to limitations agreed upon by the contracting parties.

Certain of the Company’s officers and directors

have agreed, subject to certain exceptions, not to offer, issue, sell, contract to sell, encumber, grant any option for the sale of or

otherwise dispose of any shares of our common stock or other securities convertible into or exercisable or exchangeable for shares of

our common stock until June 26, 2022 without the prior written consent of the Underwriter.

The Underwriting Agreement is filed as Exhibit 1.1

to this Current Report on Form 8-K (this “Current Report”) and the description of the material terms of the Underwriting Agreement

is qualified in its entirety by reference to such exhibit.

Item 5.02. Departure of Directors or Certain Officers;

Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

The Company has entered into an Employment Agreement

(the “Employment Agreement”) dated January 1, 2022 with Michael Riccio, its current Chief Financial Officer. The Employment

Agreement has a two year term and automatically renews for additional two year terms unless 90 days prior to the prior to the end of the

current term the Company or Mr. Riccio provides notice to the other that the term will not be extended or the Employment Agreement is

sooner terminated by the Company with or without cause or by Mr. Riccio with good reason or for no reason, in each case as set forth in

the Employment Agreement.

The Employment Agreement provides Mr. Riccio with

a base salary of $300,000, annual performance bonus of up to 100% of base salary based on periodic assesments of Mr. Riccio’s performance

as well as the achievement of specific individual and corporate objectives as determined by the CEO in consultaion with Mr. Riccio; and

equity awards of 50,000 shares of the Compnay’s common stock and a 10 year option to purchase 70,000 shares of the Company’s

common stock at an exercise price of $2.70 per share. Each equity award vests quarterly over a three year period commencing on January

1, 2022 with the first vesting to occur on April 1, 2022. Mr Riccio is also entitled to in the participate the Company-funded healthcare

insurance plan and in all other benefits, perquisites, vacation days, benefit plans or programs of the Company which are available generally

to office employees and other employees of the Company in accordance with the terms of such plans, benefits or programs.

Item 8.01. Other Events.

On December 28, 2021, the Company issued a press release

announcing that it had priced the underwritten public offering described in Item 1.01 of this Current Report. The Company’s press

release is filed as an Exhibit 99.1 to this Current Report and is incorporated herein by reference.

On December 31, 2021, the Company issued a press release

announcing that it had closed its underwritten public offering of 2,666,667 common shares at $3.00 per share and that the Underwriter’s

exercise in full of its overallotment option to purchase 400,000 shares of the Company’s common stock had closed. The Company received

aggregate gross proceeds from both closings of $8 million, before deducting underwriting discounts and commissions and fees and other

estimated offering expenses. The Company’s press release is filed as Exhibit 99.2 to this Current Report and is incorporated herein

by reference.

Item

9.01. Financial Statement and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

Date: January 3, 2022

|

APPLIED

UV, INC.

|

|

|

|

|

|

|

By: /s/

Max Munn

|

|

|

Name: Max Munn

|

|

|

Title: Interim

Chief Executive Officer, President

|

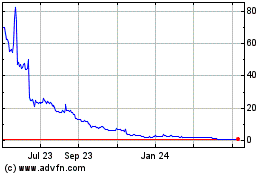

Applied UV (NASDAQ:AUVI)

Historical Stock Chart

From Mar 2024 to Apr 2024

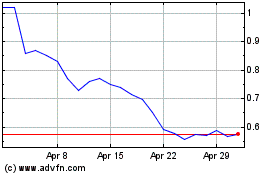

Applied UV (NASDAQ:AUVI)

Historical Stock Chart

From Apr 2023 to Apr 2024