Current Report Filing (8-k)

14 July 2022 - 6:31AM

Edgar (US Regulatory)

0001811109

false

0001811109

2022-07-13

2022-07-13

0001811109

AUVI:CommonStockParValue0.0001PerShareMember

2022-07-13

2022-07-13

0001811109

AUVI:Sec10.5SeriesCumulativePerpetualPreferredStockParValue0.0001PerShareMember

2022-07-13

2022-07-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported)

July 13, 2022

APPLIED UV, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-39480 |

|

84-4373308 |

(State or other jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification Number) |

| |

|

|

|

|

|

150 N. Macquesten Parkway

Mount Vernon, NY |

|

10550 |

| (Address of registrant’s principal executive office) |

|

(Zip code) |

(914) 665-6100

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed since

last report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of

the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which

registered |

| Common Stock, par value $0.0001 per share |

|

AUVI |

|

The Nasdaq Stock Market LLC |

| 10.5% Series A Cumulative Perpetual Preferred Stock, par value $0.0001 per share |

|

AUVIP |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 3.02. Unregistered Sales of Equity Securities.

On January 11, 2022, the Board of Directors of

Applied UV, Inc. (the “Company”) approved the reissuance of 8,000 shares of the Company’s Series X Super Voting Preferred

Stock (the “Super Voting Preferred Stock”) to The Munn Family 2020 Irrevocable Trust, for which Max Munn, the founder, a director

and President of the Company is the trustee, which represent the remainder of the designated but unissued shares of Super Voting Preferred

Stock. The Company has 10,000 shares of preferred stock designated as Super Voting Preferred Stock and after the issuance of the 8,000

shares, Mr. Munn will beneficially own all 10,000 shares of the Super Voting Preferred Stock. Mr. Munn previously held all 10,000 shares

of Super Voting Preferred Stock prior to a reverse stock split that was effected by the Company. In accordance with Nasdaq rules, the

Company will not be able to designate or issue any additional shares of the Super Voting Preferred Stock. The Super Voting Preferred Stock

has no rights other than the right to 1,000 votes per share (voting along with the common stock as a single class on all matters). The

shares of Super Voting Preferred Stock will be issued on July 13, 2022.

Forward-Looking Statements

This report contains forward-looking statements.

All statements that address operating performance, events or developments that we expect or anticipate will occur in the future are forward-looking

statements. These forward-looking statements are based on management’s beliefs and assumptions and on information currently available

to our management. Our management believes that these forward-looking statements are reasonable as and when made. However, you should

not place undue reliance on any such forward-looking statements because such statements speak only as of the date when made. We do not

undertake any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events

or otherwise, except as required by law. In addition, forward-looking statements are subject to certain risks and uncertainties that could

cause actual results, events and developments to differ materially from our historical experience and our present expectations or projections.

These risks and uncertainties include, but are not limited to, those described in “Item 1A. Risk Factors” and elsewhere in

our Annual Report on Form 10-K dated as of and filed with the Securities and Exchange Commission on April 7, 2022 and amended on July

12, 2022 and those described from time to time in other reports which we file with the SEC.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

APPLIED UV, INC. |

| |

|

|

| Date: July 13, 2022 |

By: |

/s/John F. Andrews |

| |

|

John F. Andrews |

| |

|

Chief Executive Officer |

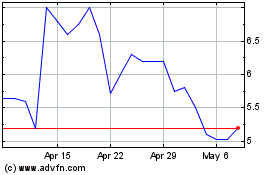

Applied UV (NASDAQ:AUVIP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Applied UV (NASDAQ:AUVIP)

Historical Stock Chart

From Apr 2023 to Apr 2024