Current Report Filing (8-k)

16 December 2022 - 8:02AM

Edgar (US Regulatory)

0001811109

false

0001811109

2022-12-09

2022-12-09

0001811109

AUVI:CommonStockParValue0.0001PerShareMember

2022-12-09

2022-12-09

0001811109

AUVI:Sec10.5SeriesCumulativePerpetualPreferredStockParValue0.0001PerShareMember

2022-12-09

2022-12-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(D)

OF

THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): December 9, 2022

APPLIED

UV, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-39480 |

|

84-4373308 |

| (State

or other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

No.) |

150

N. Macquesten Parkway

Mount

Vernon, NY 10550

(Address

of principal executive offices) (Zip Code)

(914)

665-6100

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.0001 per share |

|

AUVI |

|

The

Nasdaq Stock Market LLC |

| 10.5%

Series A Cumulative Perpetual Preferred Stock, par value $0.0001 per share |

|

AUVIP |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

Growth Company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01. Entry into a Material Definitive Agreement.

On December 9, 2022, Applied

UV, Inc. (the “Company”), SteriLumen, Inc. and MunnWorks, LLC (together with SteriLumen, Inc., the “Subsidiaries”)

entered into that certain Loan and Security Agreement, as amended on December 9 by the First Modification to Loan and Security Agreement

and Loan Documents (the “Loan Agreement”), with Pinnacle Bank (the “Lender”).

The Loan Agreement provides

for a two year $5 million secured revolving credit facility (the “Loan Facility”) that is effect on December 9, 2022 (the

“Effective Date”), of which consists of (i) a maximum advance rate of up to 85% of Net Face Amount of Eligible Accounts, plus

(ii) the least of (A) the sum of 20% of the aggregate Eligible Inventory Value of raw materials Eligible Inventory and 35% of the aggregate

Eligible Inventory Value of finished goods Eligible Inventory, (B) $1 million, (C) 80% of the net orderly liquidation value of raw materials

and finished goods Eligible Inventory as determined by an outside inventory appraisal, or (D) 100% of the aggregate outstanding principal

amount of Advances. In no event shall the aggregate amount of the outstanding Advances under the Loan Facility be greater than $5 million.

The loans under the Loan Facility

bear interest at a rate equal to 1.5% per annum above the greater of: (i) the Prime Rate; and (ii) 4%. The Interest Margin with respect

to that portion of the Daily Balance consisting of Advances against Eligible Inventory shall be at a rate equal to 2% per annum.

On the Effective Date the Company

paid a loan fee of 2% of the amount of the Loan Facility and will be required to pay a loan fee of 1.5% of the amount of the Loan Facility

annually thereafter.

The Loan Agreement contains

customary representations and warranties and customary affirmative and negative covenants applicable to the Company and the Subsidiaries,

including, without limitation, restrictions on liens, indebtedness, fundamental changes, capital expenditures, consignments of inventory

and distributions.

The Loan Agreement contains

customary events of default, including, without limitation, payment defaults, covenant defaults, breaches of certain representations and

warranties, certain events of bankruptcy and insolvency, certain events under ERISA and judgments. If an event of default occurs and is

not cured within any applicable grace period or is not waived, the Lender is entitled to take various actions, including, without limitation,

the acceleration of amounts due thereunder and termination of commitments under the Loan Facility.

Capitalized terms used but

not otherwise defined herein shall have the respective meanings ascribed thereto by the Loan Agreement. The foregoing description of

the Loan Agreement is not intended to be complete and is qualified in its entirety by reference to the full text of the Loan Agreement,

a copy of which is filed as Exhibit 10.1 hereto and Exhibit 10.2 hereto and each is incorporated by reference herein.

Item

2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The Disclosure provided in

Item 1.01 of this Form 8-K is hereby incorporated by reference into this Item 2.03.

Item 9.01.

Financial Statements and Exhibits.

(d)

Exhibits.

| Exhibit No. |

Description |

| 10.1 |

Loan and Security Agreement dated as of December 9, 2022, by and between the Company, SteriLumen, Inc., Munn Works, LLC and Pinnacle Bank |

| 10.2 |

First Modification to Loan and Security Agreement and Loan Documents dated as of December 9, 2022, by and between the Company, SteriLumen, Inc., Munn Works, LLC and Pinnacle Bank |

| 104 |

The cover page from this Current Report on Form 8-K, formatted in Inline XBRL |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

APPLIED

UV, INC. |

| |

|

| Date:

December 15, 2022 |

By: |

/s/

Mike Riccio |

| |

Name: |

Mike

Riccio |

| |

Title: |

Chief

Financial Officer |

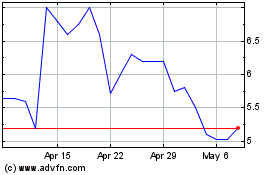

Applied UV (NASDAQ:AUVIP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Applied UV (NASDAQ:AUVIP)

Historical Stock Chart

From Apr 2023 to Apr 2024